Key Insights

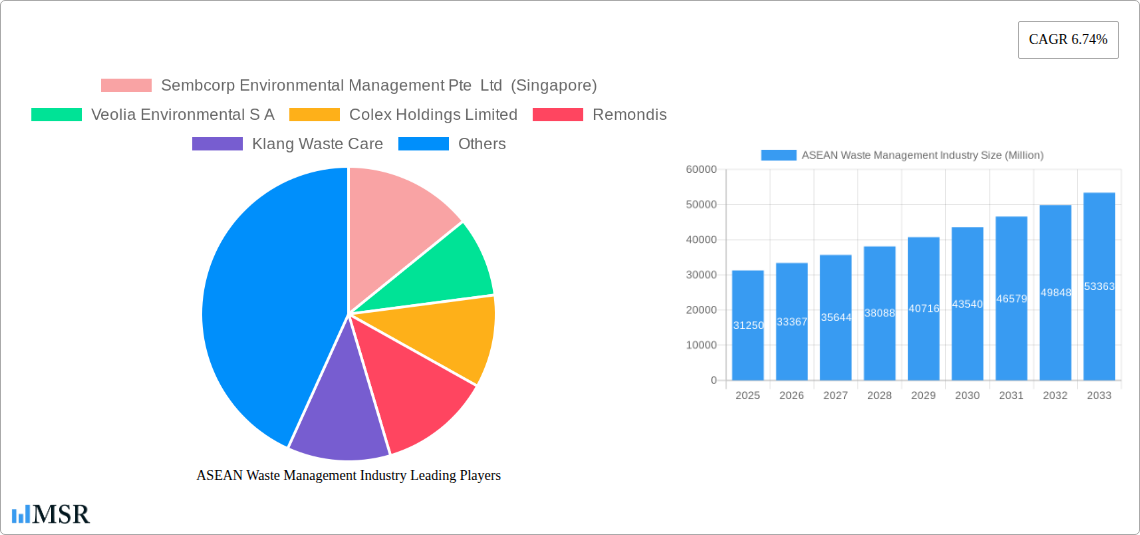

The ASEAN waste management market, valued at $31.25 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental awareness, and stringent government regulations aimed at improving waste management infrastructure. A compound annual growth rate (CAGR) of 6.74% from 2025 to 2033 indicates a significant expansion of this sector. Key drivers include the escalating volume of municipal solid waste generated by rapidly growing populations and industrial activities across the region. Furthermore, the increasing adoption of sustainable waste management practices, such as recycling, composting, and waste-to-energy solutions, is fueling market growth. While challenges remain, including limited infrastructure in some areas and inconsistent waste segregation practices, the market is poised for significant expansion due to increasing private sector investment and government initiatives promoting public-private partnerships to improve waste management capabilities.

ASEAN Waste Management Industry Market Size (In Billion)

The market is segmented by various waste types (organic, recyclable, hazardous), collection methods, and treatment technologies. Leading players such as Sembcorp Environmental Management, Veolia, and Remondis are actively expanding their operations within the ASEAN region, investing in advanced technologies and strategic acquisitions to consolidate their market positions. However, factors such as the high cost of implementing advanced waste management technologies, inconsistent regulatory frameworks across different ASEAN countries, and a lack of skilled workforce can hinder the market’s full potential. Future growth will depend on successful implementation of comprehensive national waste management plans, fostering collaboration between governments and private enterprises, and raising public awareness about sustainable waste disposal methods.

ASEAN Waste Management Industry Company Market Share

ASEAN Waste Management Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN waste management industry, offering crucial insights for investors, industry stakeholders, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities within the rapidly evolving ASEAN waste management landscape. The report covers a market valued at $xx Million in 2025 and projects a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Discover key market dynamics, leading players, emerging opportunities, and challenges shaping the future of waste management across the ASEAN region.

ASEAN Waste Management Industry Market Concentration & Dynamics

The ASEAN waste management market exhibits a moderately concentrated landscape, with a few large multinational corporations and several regional players vying for market share. Market concentration is influenced by factors such as the scale of operations, technological capabilities, and geographic reach. Key players like Sembcorp Environmental Management Pte Ltd, Veolia Environmental S A, and Remondis hold significant market share, driven by their extensive experience and global reach. However, smaller, specialized firms cater to niche markets.

- Market Share: Top 5 players account for approximately xx% of the market in 2025.

- M&A Activity: The number of M&A deals in the ASEAN waste management sector has increased by xx% over the past five years, indicating growing consolidation and a drive for expansion. This trend is expected to continue as larger players look to acquire smaller, specialized firms.

- Innovation Ecosystems: The ASEAN region is witnessing a rise in innovative waste management solutions, such as advanced recycling technologies and waste-to-energy projects, driven by both private companies and research institutions.

- Regulatory Frameworks: Varying national regulations across the ASEAN countries create both opportunities and challenges for waste management companies. Harmonization of regulations could foster greater market efficiency.

- Substitute Products: The emergence of bioplastics and biodegradable materials is creating a degree of substitution within specific waste streams.

- End-User Trends: Growing awareness of environmental sustainability among consumers is driving demand for eco-friendly waste management solutions, influencing the types of services offered by waste management companies.

ASEAN Waste Management Industry Industry Insights & Trends

The ASEAN waste management market is experiencing robust growth, driven by several key factors. Rapid urbanization, rising industrial activity, and increasing environmental awareness are creating significant demand for efficient and sustainable waste management solutions. Technological advancements such as AI-powered waste sorting and waste-to-energy technologies are transforming industry practices. The market is estimated at $xx Million in 2025, poised for significant expansion driven by supportive government policies and increasing private investment. Consumer behaviour is shifting towards conscious consumption and waste reduction, impacting waste generation patterns and the demand for specialized recycling and waste processing solutions. The market's growth is anticipated to be further fueled by increasing governmental initiatives to improve recycling infrastructure and promote sustainable waste management practices across the region. The burgeoning e-commerce sector is generating significant amounts of packaging waste, further contributing to the industry's growth.

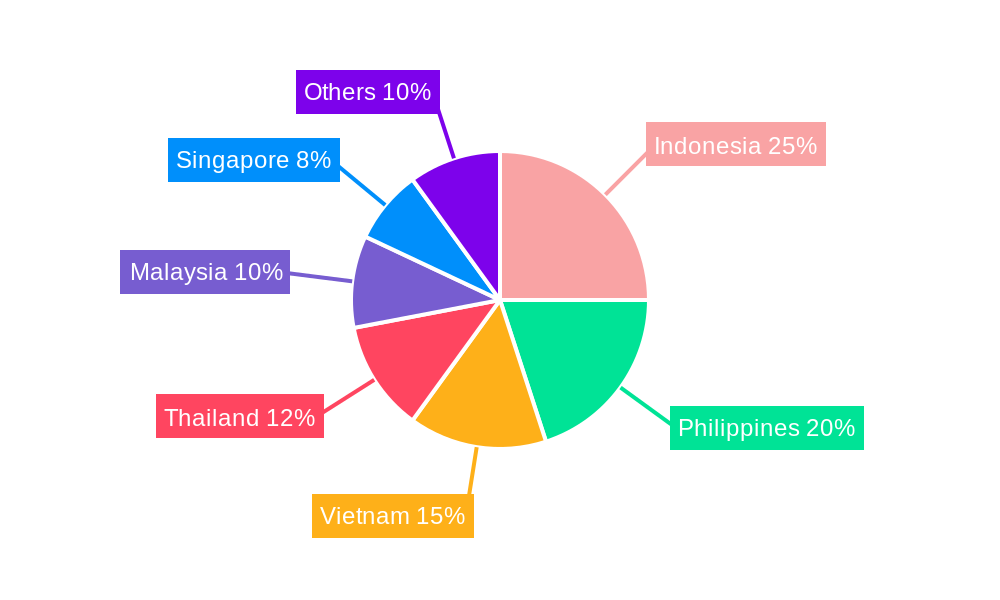

Key Markets & Segments Leading ASEAN Waste Management Industry

While the entire ASEAN region presents significant growth potential, certain markets and segments are exhibiting more pronounced dominance.

- Dominant Region/Country: Indonesia, with its large population and growing economy, currently holds a significant share of the market, followed by Singapore, Malaysia, and Thailand.

- Dominant Segment: The industrial waste management segment demonstrates the highest growth trajectory, propelled by expanding industrial sectors and stringent environmental regulations.

Drivers for Dominant Markets:

- Economic Growth: Rapid economic expansion in several ASEAN countries is generating substantial waste and creating demand for efficient waste management solutions.

- Infrastructure Development: Investments in waste management infrastructure, such as landfills and recycling plants, are crucial for market growth.

- Government Regulations: Stringent environmental regulations and supportive government policies are driving market growth by encouraging investment in the sector.

- Population Growth: Increasing urbanization and population density are intensifying the need for efficient waste collection and disposal systems.

ASEAN Waste Management Industry Product Developments

The ASEAN waste management industry is witnessing significant technological advancements, particularly in waste-to-energy technologies, advanced recycling processes, and smart waste management solutions. These innovations enhance efficiency, reduce environmental impact, and create new revenue streams. The integration of IoT sensors and AI-powered sorting systems is optimizing waste collection and processing, improving resource recovery, and reducing operational costs. Companies are developing specialized solutions for various waste streams, such as e-waste and plastic waste, addressing specific environmental challenges and gaining a competitive edge.

Challenges in the ASEAN Waste Management Industry Market

Several factors impede the growth of the ASEAN waste management market. These include inconsistent waste management regulations across countries, a lack of funding and investment in necessary infrastructure, the high cost of implementing advanced technologies, and supply chain disruptions. Competition is fierce, particularly among larger players, and the informal sector still plays a significant role, creating operational challenges and regulatory compliance issues. These challenges result in a fragmented market, where inconsistent standards and service quality can hamper the sector's overall efficiency and sustainability efforts. The overall impact is an estimated xx% reduction in potential market growth.

Forces Driving ASEAN Waste Management Industry Growth

Several factors are driving significant growth within the ASEAN waste management industry. Firstly, the increasing awareness of environmental issues and the need for sustainable waste management practices is leading to increased government support and investment. Secondly, rapid economic growth and urbanization are driving the generation of waste, creating a need for efficient management solutions. Thirdly, technological innovations, such as waste-to-energy technologies and improved recycling methods, are improving efficiency and reducing environmental impact. Lastly, supportive government policies and regulations are incentivizing investment in the industry and fostering a more sustainable future.

Long-Term Growth Catalysts in the ASEAN Waste Management Industry

Long-term growth will be fueled by continued innovation in waste management technologies, particularly in areas such as waste-to-energy, advanced recycling, and AI-powered waste sorting. Strategic partnerships between public and private sectors will be crucial for infrastructure development and capacity building. Expansion into new markets, such as those with growing economies and underdeveloped waste management systems, will also contribute to sustained growth. These factors will collectively drive long-term expansion and create new opportunities for businesses within this critical sector.

Emerging Opportunities in ASEAN Waste Management Industry

Significant opportunities exist in the development and deployment of advanced recycling technologies, particularly for plastics and e-waste. The circular economy model is gaining traction, creating opportunities for businesses focused on waste reuse and resource recovery. The growing demand for sustainable and eco-friendly waste management solutions presents opportunities for firms that can offer innovative and environmentally conscious services. The expansion into rural areas and underserved communities represents a significant opportunity for growth and expansion of service access.

Leading Players in the ASEAN Waste Management Industry Sector

- Sembcorp Environmental Management Pte Ltd (Singapore)

- Veolia Environmental S A

- Colex Holdings Limited

- Remondis

- Klang Waste Care

- Starpal Pte Ltd

- Blue Planet Environmental Solutions

- Greenway Environmental

- PT Prasadha Pamunah Limbah Industri - PPLI

- Boon Poh Refuse Disposal Pte Ltd

- Suez Environment

- Earth Recycling Services Ltd

- ALBA Group Asia

- Se Cure Waste Management

Key Milestones in ASEAN Waste Management Industry Industry

- June 2022: PT Prasadha Pamunah Waste Industries (PPLI) established a representative office in the Wijayakusuma Industrial Area, Indonesia, signifying expansion into a key market.

- December 2022: The Rebottle initiative, a partnership between Singapore Polytechnic and SembWaste, launched a project to increase PET bottle recycling in Singapore, demonstrating innovation in recycling technologies and a commitment to sustainability.

Strategic Outlook for ASEAN Waste Management Industry Market

The ASEAN waste management market is poised for significant growth, driven by several factors. Continued investments in infrastructure, technological innovation, supportive government policies, and increasing environmental awareness will all contribute to this expansion. Strategic partnerships between public and private entities will be crucial to the successful development of sustainable and efficient waste management solutions throughout the region. The future holds immense potential for companies that can adapt to evolving market dynamics and provide innovative solutions addressing the region's waste management challenges.

ASEAN Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Other Waste types

-

2. Disposal methods

- 2.1. Collection

- 2.2. Landfill

- 2.3. Others

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Malaysia

- 3.4. Singapore

- 3.5. Rest of ASEAN

ASEAN Waste Management Industry Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Malaysia

- 4. Singapore

- 5. Rest of ASEAN

ASEAN Waste Management Industry Regional Market Share

Geographic Coverage of ASEAN Waste Management Industry

ASEAN Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Indonesia Advances Zero-Plastic Waste Ambitions with Public-Private Partnership to Build Waste Management Capacity and Capability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Other Waste types

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Collection

- 5.2.2. Landfill

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Malaysia

- 5.3.4. Singapore

- 5.3.5. Rest of ASEAN

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Malaysia

- 5.4.4. Singapore

- 5.4.5. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Indonesia ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 6.1.1. Industrial waste

- 6.1.2. Municipal solid waste

- 6.1.3. E-waste

- 6.1.4. Other Waste types

- 6.2. Market Analysis, Insights and Forecast - by Disposal methods

- 6.2.1. Collection

- 6.2.2. Landfill

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Malaysia

- 6.3.4. Singapore

- 6.3.5. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 7. Thailand ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 7.1.1. Industrial waste

- 7.1.2. Municipal solid waste

- 7.1.3. E-waste

- 7.1.4. Other Waste types

- 7.2. Market Analysis, Insights and Forecast - by Disposal methods

- 7.2.1. Collection

- 7.2.2. Landfill

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Malaysia

- 7.3.4. Singapore

- 7.3.5. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 8. Malaysia ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 8.1.1. Industrial waste

- 8.1.2. Municipal solid waste

- 8.1.3. E-waste

- 8.1.4. Other Waste types

- 8.2. Market Analysis, Insights and Forecast - by Disposal methods

- 8.2.1. Collection

- 8.2.2. Landfill

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Malaysia

- 8.3.4. Singapore

- 8.3.5. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 9. Singapore ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 9.1.1. Industrial waste

- 9.1.2. Municipal solid waste

- 9.1.3. E-waste

- 9.1.4. Other Waste types

- 9.2. Market Analysis, Insights and Forecast - by Disposal methods

- 9.2.1. Collection

- 9.2.2. Landfill

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Malaysia

- 9.3.4. Singapore

- 9.3.5. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 10. Rest of ASEAN ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 10.1.1. Industrial waste

- 10.1.2. Municipal solid waste

- 10.1.3. E-waste

- 10.1.4. Other Waste types

- 10.2. Market Analysis, Insights and Forecast - by Disposal methods

- 10.2.1. Collection

- 10.2.2. Landfill

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Malaysia

- 10.3.4. Singapore

- 10.3.5. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sembcorp Environmental Management Pte Ltd (Singapore)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Veolia Environmental S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Colex Holdings Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Remondis

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klang Waste Care

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Starpal Pte Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Blue Planet Environmental Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Greenway Environmental

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PT Prasadha Pamunah Limbah Industri - PPLI

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boon Poh Refuse Disposal Pte Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Suez Environment

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Earth Recycling Services Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ALBA Group Asia

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Se Cure Waste Management**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Sembcorp Environmental Management Pte Ltd (Singapore)

List of Figures

- Figure 1: Global ASEAN Waste Management Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global ASEAN Waste Management Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Indonesia ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 4: Indonesia ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 5: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 6: Indonesia ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 7: Indonesia ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 8: Indonesia ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 9: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 10: Indonesia ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 11: Indonesia ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 12: Indonesia ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 13: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 14: Indonesia ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 15: Indonesia ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Indonesia ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 17: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Thailand ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 20: Thailand ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 21: Thailand ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 22: Thailand ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 23: Thailand ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 24: Thailand ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 25: Thailand ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 26: Thailand ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 27: Thailand ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 28: Thailand ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 29: Thailand ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Thailand ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 31: Thailand ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Thailand ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 33: Thailand ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Thailand ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Malaysia ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 36: Malaysia ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 37: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 38: Malaysia ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 39: Malaysia ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 40: Malaysia ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 41: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 42: Malaysia ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 43: Malaysia ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 44: Malaysia ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 45: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Malaysia ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 47: Malaysia ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Malaysia ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Malaysia ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Singapore ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 52: Singapore ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 53: Singapore ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 54: Singapore ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 55: Singapore ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 56: Singapore ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 57: Singapore ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 58: Singapore ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 59: Singapore ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 60: Singapore ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 61: Singapore ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Singapore ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 63: Singapore ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Singapore ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 65: Singapore ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Singapore ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 68: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 69: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 70: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 71: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 72: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 73: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 74: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 75: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 76: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 77: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 79: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 81: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global ASEAN Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global ASEAN Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 10: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 11: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 12: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 13: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 18: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 19: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 20: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 21: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 26: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 27: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 28: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 29: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 34: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 35: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 36: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 37: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 42: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 43: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 44: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 45: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Waste Management Industry?

The projected CAGR is approximately 6.74%.

2. Which companies are prominent players in the ASEAN Waste Management Industry?

Key companies in the market include Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, Colex Holdings Limited, Remondis, Klang Waste Care, Starpal Pte Ltd, Blue Planet Environmental Solutions, Greenway Environmental, PT Prasadha Pamunah Limbah Industri - PPLI, Boon Poh Refuse Disposal Pte Ltd, Suez Environment, Earth Recycling Services Ltd, ALBA Group Asia, Se Cure Waste Management**List Not Exhaustive.

3. What are the main segments of the ASEAN Waste Management Industry?

The market segments include Waste type, Disposal methods, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.25 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Indonesia Advances Zero-Plastic Waste Ambitions with Public-Private Partnership to Build Waste Management Capacity and Capability.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: A cooperative venture called Rebottle between Singapore Polytechnic (SP) and SembWaste, a fully owned subsidiary of Sembcorp Industries (Sembcorp) intends to increase the amount of PET bottles that are recycled in Singapore, beginning with the Punggol Shore area.June 2022: The introduction of a representative office in the Wijayakusuma Industrial Area was conducted on Thursday, June 30, 2022, making it a significant day in the history of PT Prasadha Pamunah Waste Industries (PPLI). The Wijayakusuma Industrial Estate's management, PT KIW, has leased space to the newly established PT PPLI representative office (Persero). Selling land for industrial usage, renting Ready-to-Use Factory Buildings (BPSP), and leasing space for offices are all part of PT KIW's primary business. The PT PPLI-DESI representative office will be opened with the intention of being a dependable partner for businesses, the Indonesian government, and other stakeholders, and contributing to Indonesia's economic and environmental growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Waste Management Industry?

To stay informed about further developments, trends, and reports in the ASEAN Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence