Key Insights

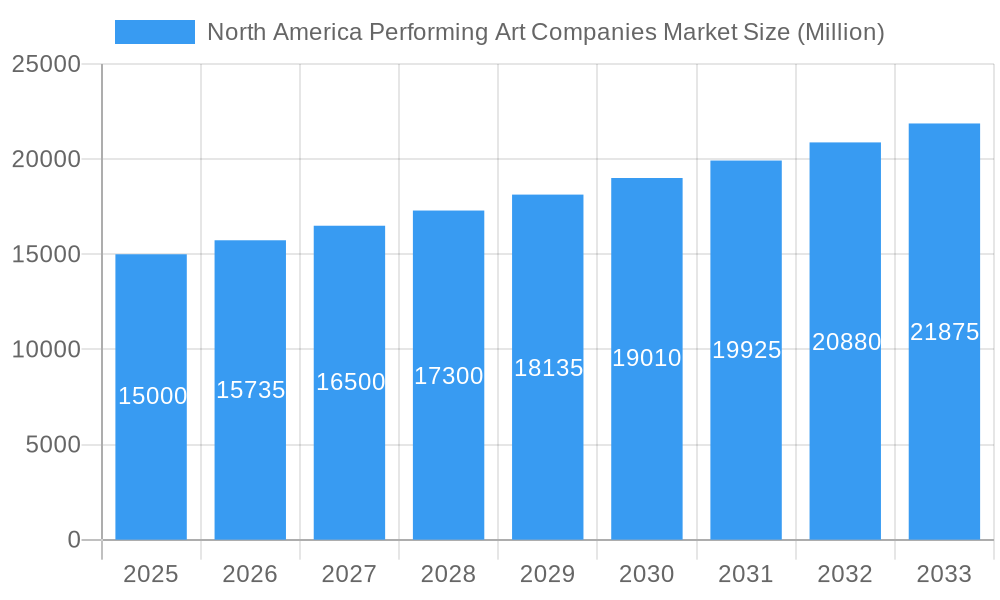

The North America Performing Arts Companies market, projected to reach $193.38 million in 2025, is poised for significant expansion. This growth is propelled by rising disposable incomes, increasing demand for live entertainment, and a growing appreciation for cultural experiences. Technological advancements, including enhanced streaming and virtual reality, are creating new engagement avenues and revenue streams, while also influencing traditional business models. Strategic alliances and collaborations are actively reshaping the industry landscape. Key players such as The Walt Disney Company, Live Nation Entertainment, and Cirque du Soleil continue to lead, capitalizing on their strong brand recognition and extensive distribution. However, competition from independent entities and economic volatility pose potential market restraints. Diverse segments, including Broadway, live music, and independent theater, contribute to the market, each reacting uniquely to evolving trends and economic conditions. While the market is concentrated in major urban centers with established infrastructure, expansion into smaller cities and regional markets is evident. With a projected CAGR of 5.67%, the market is anticipated to reach substantial value by 2033.

North America Performing Art Companies Market Market Size (In Million)

Future market success will depend on adapting to evolving audience preferences and technological disruptions. Innovation, data-driven marketing, and the creation of immersive experiences will be critical for company growth. Social media and digital platforms offer both opportunities and challenges for promotion and audience reach. Balancing ticket affordability with value remains a persistent industry challenge, necessitating strategic segmentation and pricing. External factors, such as economic downturns and unforeseen events, will continue to influence long-term market forecasts. Navigating these challenges while embracing emerging trends is paramount for sustained growth and viability in the North America Performing Arts Companies market.

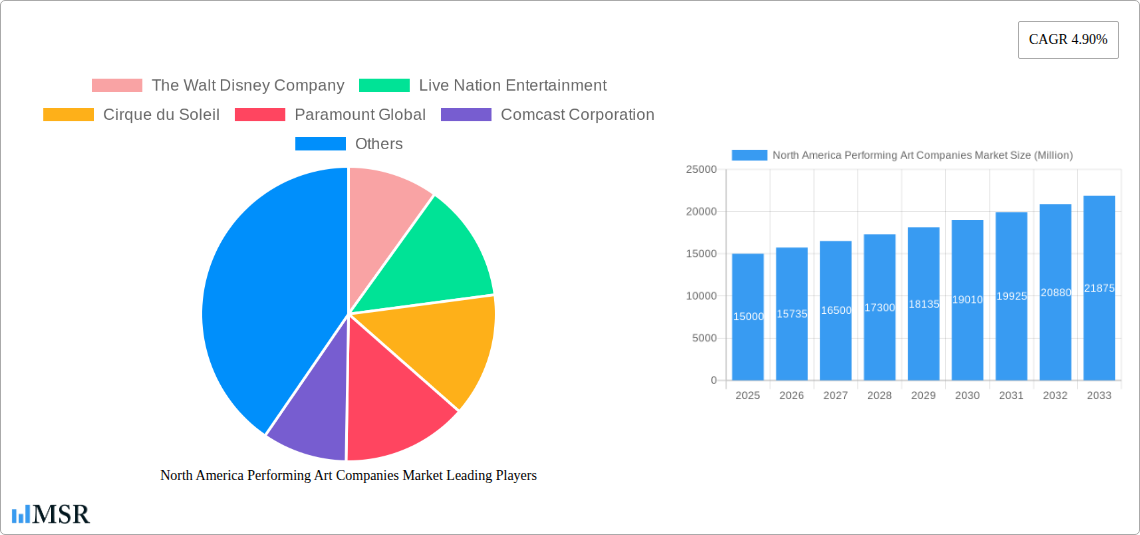

North America Performing Art Companies Market Company Market Share

North America Performing Arts Companies Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Performing Arts Companies Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key trends, and future growth prospects. The report includes detailed analysis of prominent companies including The Walt Disney Company, Live Nation Entertainment, Cirque du Soleil, Paramount Global, Comcast Corporation, The Madison Square Garden Company, Broadway Across America, The Shubert Organization, The Second City, and The Metropolitan Opera (list not exhaustive).

North America Performing Arts Companies Market Concentration & Dynamics

The North American performing arts market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. The Walt Disney Company, for instance, holds a substantial portion due to its diverse portfolio encompassing Broadway productions and theme park shows. Live Nation Entertainment dominates the concert and touring sector, showcasing its considerable influence. However, a multitude of smaller, regional companies and independent artists contribute significantly to the overall market dynamism.

Market Concentration Metrics (Estimated 2025):

- Top 5 players: xx% market share

- Top 10 players: xx% market share

Innovation Ecosystems & Regulatory Frameworks:

The market is characterized by a vibrant innovation ecosystem, driven by technological advancements in stage production, digital distribution (streaming), and audience engagement. Regulatory frameworks, varying by region and encompassing licensing, copyright, and labor laws, influence operational costs and business models.

Substitute Products & End-User Trends:

Substitute products, such as streaming services offering recorded performances and virtual reality experiences, present competitive challenges. However, the inherent appeal of live performances, the social experience, and the unique artistic merit continue to drive demand. End-user trends indicate a growing preference for diverse and inclusive programming, reflecting changing societal values.

M&A Activities:

The historical period (2019-2024) witnessed a moderate level of M&A activity, driven primarily by consolidation efforts amongst mid-sized companies and strategic acquisitions by larger players seeking diversification. The estimated number of M&A deals for this period is xx. This trend is projected to continue, albeit at a similar pace, during the forecast period.

North America Performing Arts Companies Market Industry Insights & Trends

The North American performing arts market experienced a period of disruption during the early 2020s due to the COVID-19 pandemic. However, post-pandemic, the market is demonstrating robust recovery and substantial growth. The market size in 2025 is estimated at $xx Million, reflecting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the pent-up demand for live entertainment, increasing disposable incomes in key demographics, and successful adaptation of digital distribution strategies. The industry is witnessing significant technological disruptions, including the integration of virtual and augmented reality technologies to enhance the audience experience and increase accessibility. Moreover, evolving consumer behavior, driven by a desire for personalized experiences and unique content, is shaping the offerings of performing arts companies.

Key Markets & Segments Leading North America Performing Arts Companies Market

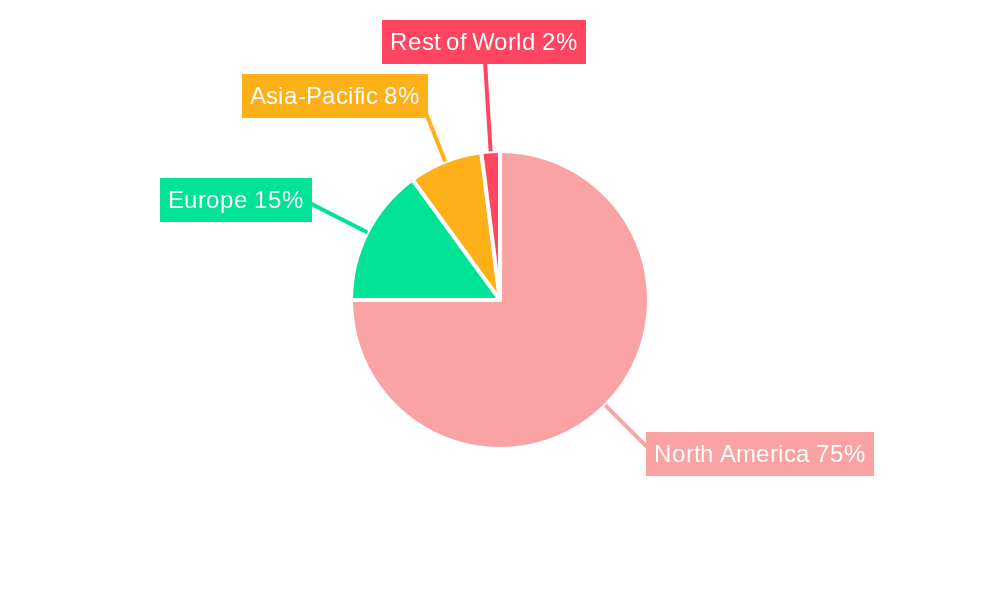

The market is geographically diverse, with significant contributions from major metropolitan areas across the United States and Canada. However, the largest market segments tend to be concentrated in major media hubs like New York City, Los Angeles, and Chicago. These areas benefit from established infrastructure, high population density, and a robust talent pool.

Dominant Regions & Segments (Estimated 2025):

- United States: Holding the largest market share due to its large population and established performing arts infrastructure.

- Canada: A significant contributor, particularly in major cities like Toronto and Montreal.

- Broadway (Theatre): Remains a dominant segment, showcasing enduring appeal and substantial revenue generation.

- Live Music Concerts: A high-growth segment, fueled by a large and diverse audience base.

Drivers for Dominance:

- Robust Infrastructure: Established venues, supporting infrastructure, and skilled professionals contribute to market leadership.

- High Population Density: Concentrated populations in major cities create large potential audience bases.

- Strong Talent Pool: These regions attract a diverse range of talented artists and skilled technical personnel.

- High Disposable Incomes: Affluent populations in major cities contribute to high ticket sales and robust spending on entertainment.

North America Performing Arts Companies Market Product Developments

Recent years have seen notable product innovations, including the expansion of digital distribution platforms for live performances and on-demand access to archived content. Immersive technologies, such as virtual reality and augmented reality, are being integrated to create enhanced audience experiences. Furthermore, companies are developing interactive and participatory performances to engage audiences more directly. These advancements offer competitive advantages by creating unique and engaging entertainment offerings, driving market differentiation and expansion into new markets.

Challenges in the North America Performing Arts Companies Market Market

The industry faces challenges such as high operating costs, including venue rentals, artist fees, and marketing expenses, impacting profitability. The fluctuating availability of talent and supply chain disruptions related to costumes, set designs, and technology can affect production timelines and budgets. Competition from other forms of entertainment, including streaming services and video games, poses a significant challenge for attracting and retaining audiences. These factors may negatively affect the market growth, potentially impacting overall market revenue by xx Million annually.

Forces Driving North America Performing Arts Companies Market Growth

Key growth drivers include the enduring appeal of live performances, increasing disposable incomes, and the growing demand for diverse and inclusive entertainment. Technological advancements are expanding access to performances through digital distribution platforms and creating immersive experiences. Government support for the arts through grants and tax incentives also stimulate growth and investment in the sector. For example, the renewal of the Met: Live in HD series demonstrates the potential for partnerships to expand reach and audience engagement.

Long-Term Growth Catalysts in the North America Performing Arts Companies Market

Long-term growth is projected to be driven by continued innovation in performance technology, strategic partnerships between performing arts organizations and technology companies (e.g. streaming platforms, VR/AR developers), and expansion into new markets. The development of new artistic forms and interactive experiences will broaden appeal and cater to evolving audience preferences.

Emerging Opportunities in North America Performing Arts Companies Market

Emerging opportunities include the integration of immersive technologies, such as augmented and virtual reality, to enhance the audience experience. Furthermore, the development of personalized and interactive performances tailored to specific audience segments represents a significant area of growth. Expanding access to performing arts through affordable ticket programs and digital distribution platforms will broaden market reach and accessibility.

Leading Players in the North America Performing Arts Companies Market Sector

- The Walt Disney Company

- Live Nation Entertainment

- Cirque du Soleil

- Paramount Global

- Comcast Corporation

- The Madison Square Garden Company

- Broadway Across America

- The Shubert Organization

- The Second City

- The Metropolitan Opera

Key Milestones in North America Performing Arts Companies Market Industry

- November 2022: Fathom Events and the Metropolitan Opera renewed their "The Met: Live in HD" series, extending its reach and showcasing the enduring appeal of live performances in a digital age. This signals a successful adaptation to changing consumer preferences.

- February 2023: The North American premiere of Christopher Wheeldon's ballet, "Like Water for Chocolate," at the Segerstrom Center for the Arts highlights the continued innovation and evolution within the performing arts sector. This represents a successful collaboration and demonstrates a focus on bringing new works to audiences.

Strategic Outlook for North America Performing Arts Companies Market Market

The North America Performing Arts Companies Market is poised for continued growth, fueled by technological advancements, evolving consumer preferences, and strategic partnerships. Companies that embrace innovation, adapt to changing market dynamics, and invest in expanding their digital presence will be best positioned to capitalize on future opportunities. The market's resilience and adaptability are key indicators of its strong growth potential throughout the forecast period.

North America Performing Art Companies Market Segmentation

-

1. Type of Performing Arts

- 1.1. Theatre

- 1.2. Music and Opera

- 1.3. Dance

- 1.4. Circus and Other Art Forms

-

2. Venue Type

- 2.1. Concert Halls

- 2.2. Theatres

- 2.3. Stadiums

-

3. Ticket Pricing

- 3.1. Premium

- 3.2. Mid-Range

- 3.3. Economy

North America Performing Art Companies Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Performing Art Companies Market Regional Market Share

Geographic Coverage of North America Performing Art Companies Market

North America Performing Art Companies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rise in the Use of Online Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 5.1.1. Theatre

- 5.1.2. Music and Opera

- 5.1.3. Dance

- 5.1.4. Circus and Other Art Forms

- 5.2. Market Analysis, Insights and Forecast - by Venue Type

- 5.2.1. Concert Halls

- 5.2.2. Theatres

- 5.2.3. Stadiums

- 5.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 5.3.1. Premium

- 5.3.2. Mid-Range

- 5.3.3. Economy

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Walt Disney Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Live Nation Entertainment

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cirque du Soleil

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Paramount Global

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comcast Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Madison Square Garden Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Broadway Across America

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Shubert Organization

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Second City

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Metropolitan Opera**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Walt Disney Company

List of Figures

- Figure 1: North America Performing Art Companies Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Performing Art Companies Market Share (%) by Company 2025

List of Tables

- Table 1: North America Performing Art Companies Market Revenue million Forecast, by Type of Performing Arts 2020 & 2033

- Table 2: North America Performing Art Companies Market Revenue million Forecast, by Venue Type 2020 & 2033

- Table 3: North America Performing Art Companies Market Revenue million Forecast, by Ticket Pricing 2020 & 2033

- Table 4: North America Performing Art Companies Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Performing Art Companies Market Revenue million Forecast, by Type of Performing Arts 2020 & 2033

- Table 6: North America Performing Art Companies Market Revenue million Forecast, by Venue Type 2020 & 2033

- Table 7: North America Performing Art Companies Market Revenue million Forecast, by Ticket Pricing 2020 & 2033

- Table 8: North America Performing Art Companies Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States North America Performing Art Companies Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Performing Art Companies Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Performing Art Companies Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Performing Art Companies Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the North America Performing Art Companies Market?

Key companies in the market include The Walt Disney Company, Live Nation Entertainment, Cirque du Soleil, Paramount Global, Comcast Corporation, The Madison Square Garden Company, Broadway Across America, The Shubert Organization, The Second City, The Metropolitan Opera**List Not Exhaustive.

3. What are the main segments of the North America Performing Art Companies Market?

The market segments include Type of Performing Arts, Venue Type, Ticket Pricing.

4. Can you provide details about the market size?

The market size is estimated to be USD 193.38 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rise in the Use of Online Platforms.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Costa Mesa, CA Segerstrom Center for the Arts presents the North American Premiere of Christopher Wheeldon's latest ballet, Like Water for Chocolate, from American Ballet Theatre for six performances from Wednesday, March 29 through Sunday, April 2. Center audiences will be the first in the country to experience this magical Mexican love story, with the stellar dancers of ABT translating this richly layered story.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Performing Art Companies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Performing Art Companies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Performing Art Companies Market?

To stay informed about further developments, trends, and reports in the North America Performing Art Companies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence