Key Insights

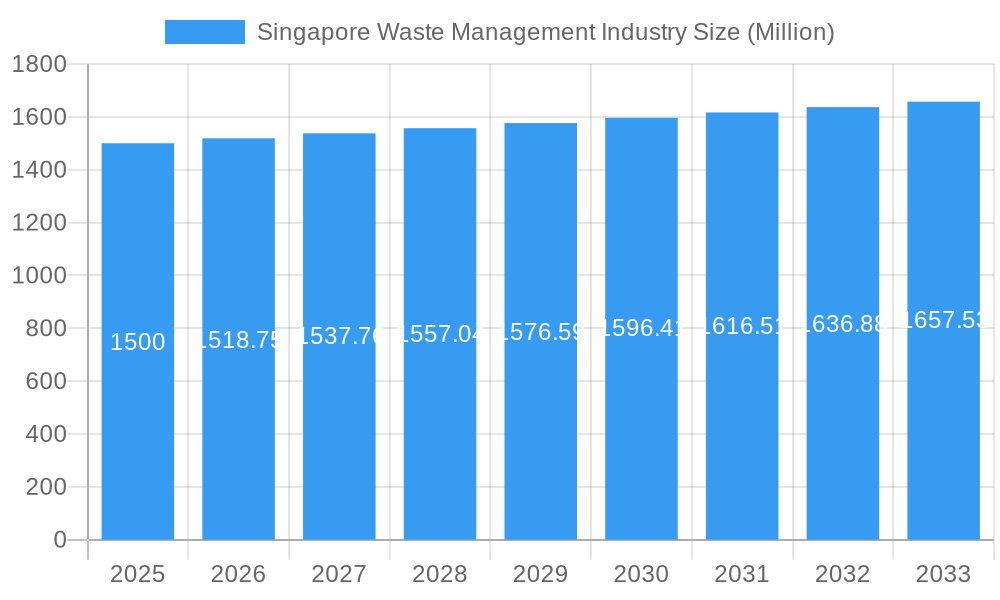

The Singapore waste management market, estimated at $819.26 billion in the base year 2025, is poised for robust expansion, projecting a compound annual growth rate (CAGR) of 6.9% through 2033. This growth is underpinned by several critical drivers. Escalating urbanization and population density in Singapore demand sophisticated waste management strategies to mitigate environmental impact and safeguard public health. The government's unwavering commitment to sustainability, manifested in rigorous waste disposal regulations and ambitious recycling targets, compels industry stakeholders to adopt innovative technologies and eco-conscious methodologies. The proliferation of e-commerce and a burgeoning consumer culture contribute to increased waste generation, consequently driving demand for comprehensive waste management services. Key industry segments encompass waste collection, recycling, treatment, and disposal, with substantial opportunities emerging in advanced recycling technologies and sustainable waste-to-energy solutions.

Singapore Waste Management Industry Market Size (In Billion)

Leading players in the Singapore waste management sector, including Sembcorp Environmental Management, Veolia, and local entities such as ECO Industrial Environmental Engineering, are consistently investing in infrastructure enhancements and technological advancements to boost efficiency and adhere to evolving environmental mandates. Nevertheless, significant challenges persist, notably the substantial cost of land and infrastructure development in Singapore, which can impede expansion and investment. Intensifying competition among established and emerging participants necessitates the adoption of innovative business models and operational optimization for sustained profitability. The industry's future trajectory hinges on continued governmental support, technological innovation, and the effective integration of circular economy principles to expertly manage Singapore's waste streams and attain sustainable development objectives. A strategic emphasis on minimizing landfill dependence and maximizing resource recovery will be paramount for the industry's enduring success.

Singapore Waste Management Industry Company Market Share

Singapore Waste Management Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Singapore waste management industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with a base and estimated year of 2025 and a forecast period spanning 2025-2033. The report leverages data from the historical period (2019-2024) to project future trends and opportunities within the multi-million dollar sector.

Singapore Waste Management Industry Market Concentration & Dynamics

The Singapore waste management market exhibits a moderately concentrated structure, with several key players vying for market share. Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, and CITIC Envirotech Ltd are among the prominent companies shaping the landscape. Market concentration is further influenced by the presence of numerous smaller players, especially in niche segments such as e-waste recycling. The industry witnesses regular M&A activity, with an estimated xx M&A deals occurring in the historical period. This consolidation trend is driven by the need for scale and technological integration. The regulatory framework, while supportive of sustainable waste management practices, also presents complexities for market participants. The introduction of new environmental regulations continues to drive innovation. Substitute products, while limited in scope, are continuously explored as technologies evolve. Finally, end-user trends, particularly among businesses and municipalities, are shifting toward sustainable and technologically advanced waste solutions.

- Market Share (2024 Estimate): Sembcorp Environmental Management: xx%; Veolia Environmental S A: xx%; CITIC Envirotech Ltd: xx%; Others: xx%

- M&A Deal Count (2019-2024): xx deals

- Key Regulatory Frameworks: National Environment Agency (NEA) guidelines, circular economy initiatives.

Singapore Waste Management Industry Industry Insights & Trends

The Singapore waste management industry is experiencing robust growth, driven by several factors. The market size reached approximately $XX Million in 2024, exhibiting a CAGR of xx% during the historical period. Stringent environmental regulations and increasing awareness of sustainability are major growth drivers. Technological advancements such as AI-powered waste sorting systems and advanced recycling technologies are disrupting traditional practices and boosting efficiency. The government’s commitment to a circular economy model further accelerates market growth. Consumer behaviors are also evolving, with increased participation in recycling and waste reduction programs. Challenges such as the rising cost of landfilling and the need for efficient waste-to-energy solutions present both challenges and opportunities for the industry. The industry is also witnessing a notable increase in investment in waste-to-energy and other innovative waste management technologies, leading to overall improved market efficiency and sustainability. The market is expected to further expand in the coming years, reaching an estimated value of $XX Million by 2033.

Key Markets & Segments Leading Singapore Waste Management Industry

The commercial and industrial segments dominate the Singapore waste management market, accounting for a significant portion of the total market volume. This dominance stems from the high volume of waste generated by these sectors and the growing demand for efficient and environmentally sound waste management solutions. The residential segment also holds considerable importance, with ongoing government initiatives promoting greater recycling participation and waste reduction among households. Singapore's highly developed infrastructure, robust economic growth, and stringent environmental regulations further contribute to the strength of this market segment.

- Drivers for Commercial/Industrial Dominance:

- High waste generation volume

- Stringent environmental regulations on industrial waste

- Demand for efficient waste disposal and recycling solutions

- Increasing focus on sustainability among businesses

- Drivers for Residential Segment Growth:

- Government initiatives promoting waste reduction and recycling

- Growing environmental awareness among households

- Improved waste collection and recycling infrastructure

Singapore Waste Management Industry Product Developments

Recent product developments in the Singapore waste management industry are primarily focused on technological advancements. This includes the integration of AI and machine learning in waste sorting and recycling processes, the development of innovative waste-to-energy technologies, and the introduction of advanced recycling techniques to handle various types of waste more efficiently. These innovations are improving efficiency, reducing environmental impact, and creating a competitive advantage for market players.

Challenges in the Singapore Waste Management Industry Market

The Singapore waste management industry faces challenges such as stringent regulatory compliance requirements, the need for continuous technological upgrades to manage evolving waste streams, and intense competition among existing players. Limited landfill space and the need to move towards more sustainable waste management practices, such as waste-to-energy and recycling, further add complexity and cost to the sector. These factors can impact profitability and necessitate strategic investments in innovation and technological advancements. The high initial capital expenditure required for advanced waste treatment technologies can prove to be a barrier for small to medium-sized companies.

Forces Driving Singapore Waste Management Industry Growth

Several factors contribute to the growth of the Singapore waste management industry. These include increasing environmental regulations emphasizing waste reduction and recycling, robust economic growth leading to higher waste generation, and government support for sustainable waste management practices. Furthermore, technological advancements in waste processing and recycling contribute to improved efficiency and reduce environmental impact, thereby driving market growth.

Challenges in the Singapore Waste Management Industry Market

Long-term growth in the Singapore waste management industry depends on sustained government support for sustainable initiatives, ongoing technological advancements, and strategic partnerships between industry players. Expanding into new and emerging waste streams, such as e-waste and medical waste, can also unlock substantial growth opportunities.

Emerging Opportunities in Singapore Waste Management Industry

Emerging opportunities lie in the adoption of advanced technologies like AI-powered waste sorting, expansion into the circular economy by creating value from waste materials, and increased investment in sustainable waste management solutions like anaerobic digestion and waste-to-energy. Further market opportunities also arise from addressing the growing demand for specialized waste management services across different sectors.

Leading Players in the Singapore Waste Management Industry Sector

- Sembcorp Environmental Management Pte Ltd (Singapore)

- Veolia Environmental S A

- Colex Holdings Limited

- ECO Industrial Environmental Engineering Pte Ltd

- Envipure

- RICTEC PTE LTD

- Industrial Wastes Auction

- Recycling Partners Pte Ltd

- CH E-Recycling

- CITIC Envirotech Ltd

- List Not Exhaustive

Key Milestones in Singapore Waste Management Industry Industry

- 2020: Launch of the national “Reduce, Reuse, Recycle” campaign by the NEA.

- 2022: Introduction of stricter regulations on industrial waste disposal.

- 2023: Several M&A activities observed among major players.

- 2024: Successful implementation of new AI-powered waste sorting technology at a major recycling facility.

Strategic Outlook for Singapore Waste Management Industry Market

The future of the Singapore waste management market is bright, with significant opportunities for growth and innovation. The increasing emphasis on sustainability, combined with ongoing technological advancements, will drive demand for efficient and environmentally friendly waste management solutions. Strategic partnerships and investments in advanced technologies will be crucial for market players to maintain a competitive edge and capture a larger share of this rapidly evolving market.

Singapore Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Bio-medical waste

-

2. Disposal methods

- 2.1. Collection

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Recycling

Singapore Waste Management Industry Segmentation By Geography

- 1. Singapore

Singapore Waste Management Industry Regional Market Share

Geographic Coverage of Singapore Waste Management Industry

Singapore Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Recycling is a key trend in the Singaporean waste management industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Collection

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Singapore Waste Management Industry

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Environmental Management Pte Ltd (Singapore)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environmental S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colex Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ECO Industrial Environmental Engineering Pte Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Envipure

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RICTEC PTE LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Indsutrial Wastes Auction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Recycling Partners Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CH E-Recycling

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CITIC Envirotech Ltd**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Singapore Waste Management Industry

List of Figures

- Figure 1: Singapore Waste Management Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 2: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 3: Singapore Waste Management Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 5: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 6: Singapore Waste Management Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Waste Management Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Singapore Waste Management Industry?

Key companies in the market include Singapore Waste Management Industry, Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, Colex Holdings Limited, ECO Industrial Environmental Engineering Pte Ltd, Envipure, RICTEC PTE LTD, Indsutrial Wastes Auction, Recycling Partners Pte Ltd, CH E-Recycling, CITIC Envirotech Ltd**List Not Exhaustive.

3. What are the main segments of the Singapore Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 819.26 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Recycling is a key trend in the Singaporean waste management industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Waste Management Industry?

To stay informed about further developments, trends, and reports in the Singapore Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence