Key Insights

The Financial Advisory Services market is poised for substantial expansion, driven by increasing wealth management demands, growing financial complexity, and technological innovation. High-net-worth individuals and an expanding middle class are fueling demand for expert financial guidance. The intricate landscape of financial instruments and regulations further necessitates professional advisory services. Advancements in robo-advisors and AI analytics are enhancing efficiency and client experience, contributing to market growth. Challenges include regulatory scrutiny and intense competition from established firms and fintech disruptors. The market encompasses wealth management, investment banking, and retirement planning, serving individuals, corporations, and institutions across various geographies. Key players like Bank of America, Goldman Sachs, JP Morgan Chase, Morgan Stanley, and the Big Four accounting firms leverage their expertise to offer integrated solutions. Future trends indicate market consolidation, accelerated technological adoption, and a greater focus on personalized and sustainable investment strategies.

Financial Advisory Services Market Market Size (In Billion)

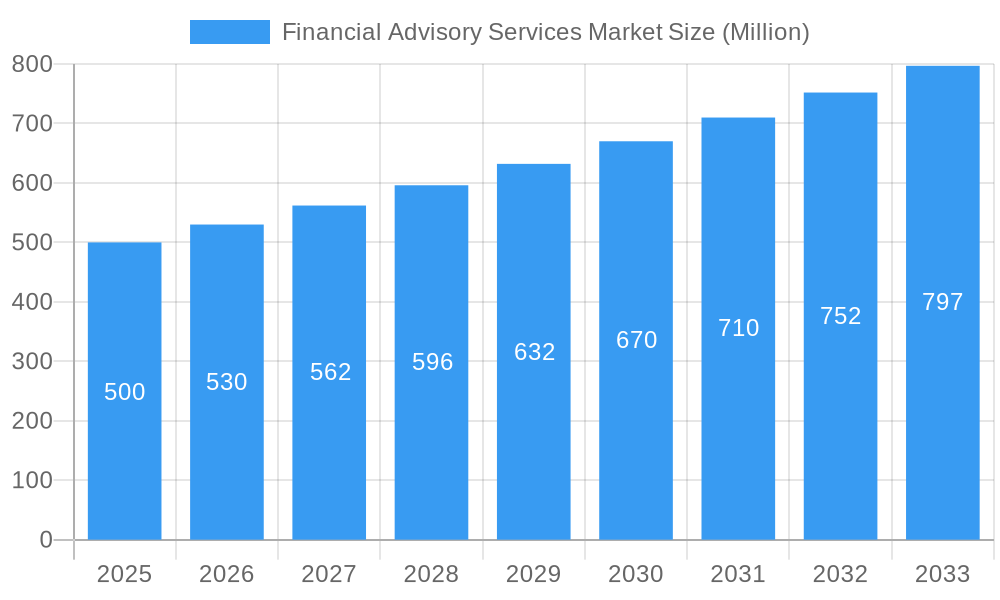

The global Financial Advisory Services market is projected to reach $134.87 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 8.9% from 2025 to 2033. North America and Europe are expected to lead market share, while Asia-Pacific and Latin America will witness accelerated growth due to rising financial literacy and economic development. Intense competition fosters innovation and a commitment to client-centric strategies, requiring continuous investment in technology and talent to sustain a competitive advantage.

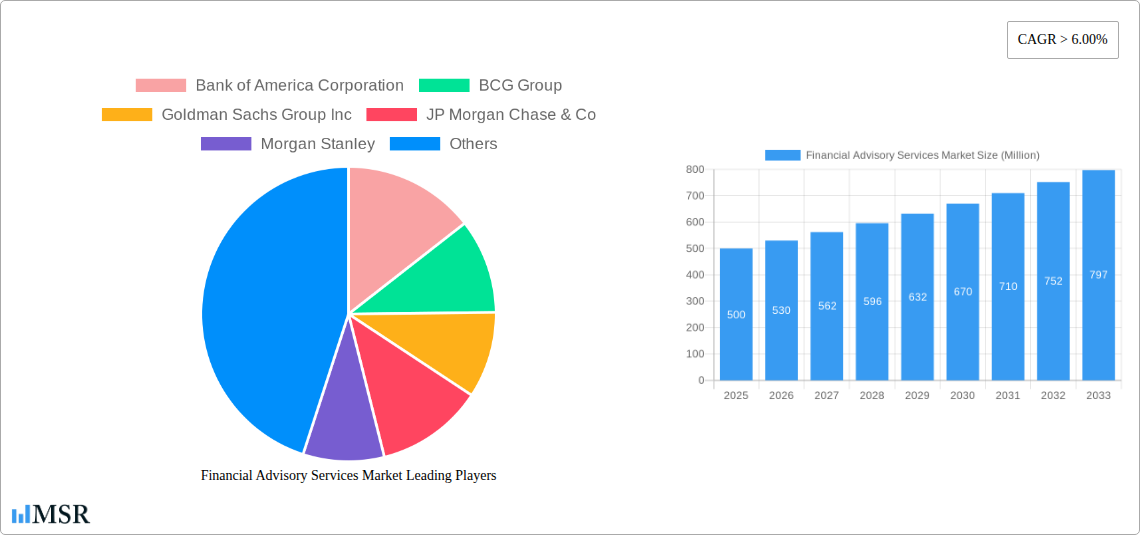

Financial Advisory Services Market Company Market Share

Financial Advisory Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Financial Advisory Services Market, covering market dynamics, industry trends, key players, and future growth prospects from 2019 to 2033. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The report offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate this evolving landscape. The global market size is estimated to be xx Million in 2025, projected to grow at a CAGR of xx% during the forecast period.

Financial Advisory Services Market Concentration & Dynamics

This section analyzes the market concentration, competitive landscape, and key dynamics influencing the Financial Advisory Services Market. The market exhibits a moderately concentrated structure, with several major players holding significant market share. The top ten players – including Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, PwC, and Wells Fargo & Co – account for approximately xx% of the global market (List Not Exhaustive).

Market Concentration Metrics:

- Market Share of Top 10 Players: xx% (Estimated)

- Herfindahl-Hirschman Index (HHI): xx (Estimated)

- Number of M&A Deals (2019-2024): xx

Market Dynamics:

- Innovation Ecosystems: Significant investments in fintech and AI are driving innovation, leading to new advisory platforms and service offerings.

- Regulatory Frameworks: Stringent regulations, particularly regarding data privacy and client protection, are shaping market practices.

- Substitute Products: The rise of robo-advisors presents a competitive threat to traditional financial advisory services.

- End-User Trends: Growing demand for personalized financial planning and wealth management solutions drives market growth.

- M&A Activities: Frequent mergers and acquisitions are reshaping the competitive landscape, leading to consolidation and expansion.

Financial Advisory Services Market Industry Insights & Trends

The Financial Advisory Services Market is experiencing robust growth, driven by several key factors. Increasing affluence, particularly in emerging economies, fuels the demand for professional financial advice. The growing complexity of financial instruments and investment options necessitates expert guidance. Technological advancements, such as AI-powered robo-advisors and sophisticated data analytics tools, are transforming the industry, enabling personalized services and increased efficiency. Changing consumer behavior, with a greater emphasis on online and digital interactions, is also shaping the delivery of financial advisory services. The market is witnessing a shift towards holistic financial planning, encompassing investments, insurance, and tax optimization.

Market Growth Drivers:

- Rising disposable incomes globally.

- Increased awareness of financial planning and wealth management.

- Technological advancements enhancing service delivery and efficiency.

- Growing demand for personalized financial advice.

- Expansion of the middle class in emerging economies.

Market Size & CAGR:

- Market Size (2025): xx Million

- CAGR (2025-2033): xx%

Key Markets & Segments Leading Financial Advisory Services Market

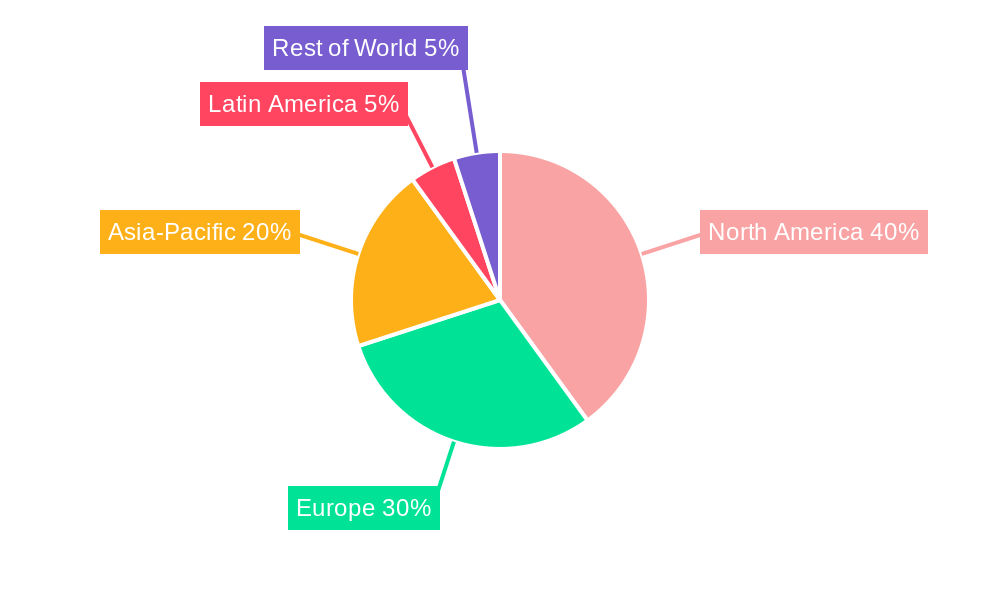

The North American region currently dominates the Financial Advisory Services Market, followed by Europe and Asia-Pacific. However, rapid economic growth and increasing financial literacy in emerging markets are driving significant growth potential in Asia-Pacific and Latin America.

Dominant Region: North America

Drivers for Regional Dominance:

- High levels of disposable income and wealth accumulation.

- Mature financial markets and well-established regulatory frameworks.

- Strong presence of major financial institutions and advisory firms.

- Early adoption of new technologies in the financial sector.

Detailed Dominance Analysis:

The US, with its large and developed financial markets and significant investor base, represents the largest segment within the North American region. The strong regulatory environment and sophisticated financial infrastructure further contribute to its leading position. European countries like the UK and Germany also hold significant market share, driven by their established financial centers and substantial wealth management activities.

Financial Advisory Services Market Product Developments

Recent product innovations include the development of sophisticated AI-powered robo-advisors, offering personalized investment strategies at a lower cost. The integration of advanced data analytics tools enables advisors to provide more comprehensive and insightful financial planning services. These technological advancements are changing the competitive landscape, enabling firms to offer more efficient and client-centric solutions. The market is seeing increased adoption of cloud-based solutions for improved data management and collaboration.

Challenges in the Financial Advisory Services Market Market

The Financial Advisory Services Market faces several challenges, including increasing regulatory scrutiny, cybersecurity risks, and intense competition. The need to comply with ever-evolving regulatory frameworks adds to operational costs and complexity. Data breaches and cyberattacks pose significant security risks. Competition from both established players and new fintech entrants is intense. Maintaining client trust and loyalty in a highly competitive environment is paramount. The fluctuating global economic conditions also affect investment decisions and thus demand for advisory services.

Forces Driving Financial Advisory Services Market Growth

Several key factors are driving the growth of the Financial Advisory Services Market. Technological advancements, such as AI and machine learning, are leading to improved service efficiency and personalization. Favorable economic conditions in certain regions, marked by growth in disposable incomes and wealth creation, boost demand. Changes in regulatory frameworks, which promote financial literacy and consumer protection, also support growth.

Long-Term Growth Catalysts in Financial Advisory Services Market

Long-term growth in the Financial Advisory Services Market will be fueled by continuous innovation in financial technology, strategic partnerships between traditional firms and fintech companies, and expanding into new and untapped markets. The development of sophisticated wealth management tools and the integration of AI and machine learning will provide personalized services, increasing client satisfaction and loyalty. Global expansion and diversification into new geographic regions will generate new revenue streams.

Emerging Opportunities in Financial Advisory Services Market

Emerging opportunities lie in leveraging advanced technologies like AI and blockchain for enhanced security and efficiency. Growing demand for sustainable and ethical investments presents a significant market opportunity. Expansion into underserved markets, particularly in emerging economies, offers substantial growth potential. Personalized financial planning services tailored to specific demographics and life stages are in high demand.

Leading Players in the Financial Advisory Services Market Sector

Key Milestones in Financial Advisory Services Market Industry

February 2023: Morgan Stanley Investment Management received approval from the China Securities Regulatory Commission (CSRC) to take full control of Morgan Stanley Huaxin Funds, expanding its presence in China. This signals increased investment in the Asian market and greater competition within the region.

February 2023: Boston Consulting Group hired Axel Weber, former president of Germany's central bank and UBS chairman, as a senior advisor. This high-profile appointment enhances BCG's expertise in financial markets and regulatory affairs.

Strategic Outlook for Financial Advisory Services Market Market

The Financial Advisory Services Market is poised for sustained growth, driven by technological advancements, increasing wealth, and evolving consumer preferences. Strategic opportunities exist for firms that can leverage technology to enhance service offerings, expand into new markets, and forge strategic partnerships. Firms that embrace innovation and adapt to changing regulatory landscapes will be best positioned for success. The focus will be on personalized, tech-driven solutions and catering to the evolving needs of a diverse clientele.

Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Financial Advisory Services Market Regional Market Share

Geographic Coverage of Financial Advisory Services Market

Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Majority of Revenues generated from United states

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Corporate Finance

- 6.1.2. Accounting Advisory

- 6.1.3. Tax Advisory

- 6.1.4. Transaction Services

- 6.1.5. Risk Management

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large Enterprises

- 6.2.2. Small & Medium-Sized Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. Bfsi

- 6.3.2. It And Telecom

- 6.3.3. Manufacturing

- 6.3.4. Retail And E-Commerce

- 6.3.5. Public Sector

- 6.3.6. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Corporate Finance

- 7.1.2. Accounting Advisory

- 7.1.3. Tax Advisory

- 7.1.4. Transaction Services

- 7.1.5. Risk Management

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large Enterprises

- 7.2.2. Small & Medium-Sized Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. Bfsi

- 7.3.2. It And Telecom

- 7.3.3. Manufacturing

- 7.3.4. Retail And E-Commerce

- 7.3.5. Public Sector

- 7.3.6. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Corporate Finance

- 8.1.2. Accounting Advisory

- 8.1.3. Tax Advisory

- 8.1.4. Transaction Services

- 8.1.5. Risk Management

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large Enterprises

- 8.2.2. Small & Medium-Sized Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. Bfsi

- 8.3.2. It And Telecom

- 8.3.3. Manufacturing

- 8.3.4. Retail And E-Commerce

- 8.3.5. Public Sector

- 8.3.6. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Corporate Finance

- 9.1.2. Accounting Advisory

- 9.1.3. Tax Advisory

- 9.1.4. Transaction Services

- 9.1.5. Risk Management

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large Enterprises

- 9.2.2. Small & Medium-Sized Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. Bfsi

- 9.3.2. It And Telecom

- 9.3.3. Manufacturing

- 9.3.4. Retail And E-Commerce

- 9.3.5. Public Sector

- 9.3.6. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Corporate Finance

- 10.1.2. Accounting Advisory

- 10.1.3. Tax Advisory

- 10.1.4. Transaction Services

- 10.1.5. Risk Management

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large Enterprises

- 10.2.2. Small & Medium-Sized Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. Bfsi

- 10.3.2. It And Telecom

- 10.3.3. Manufacturing

- 10.3.4. Retail And E-Commerce

- 10.3.5. Public Sector

- 10.3.6. Healthcare

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of America Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BCG Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JP Morgan Chase & Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Morgan Stanley

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deloitte

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EY Financial Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KPMG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pwc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wells Fargo & Co**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America Corporation

List of Figures

- Figure 1: Global Financial Advisory Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 5: North America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 7: North America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 8: North America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 13: Europe Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 15: Europe Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 16: Europe Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 23: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 24: Asia Pacific Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 29: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 31: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 32: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 37: South America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: South America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 39: South America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 40: South America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Global Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: USA Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 14: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: UK Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 24: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 25: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Australia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: India Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 34: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 35: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Egypt Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: UAE Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 42: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 43: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Argentina Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Colombia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of South America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial Advisory Services Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Financial Advisory Services Market?

Key companies in the market include Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, Pwc, Wells Fargo & Co**List Not Exhaustive.

3. What are the main segments of the Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.87 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Majority of Revenues generated from United states.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Morgan Stanley Investment Management announced that it had received approval from the China Securities Regulatory Commission (CSRC) to take a full controlling stake in Morgan Stanley Huaxin Funds, marking a key strategic advancement for the company's broader footprint in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence