Key Insights

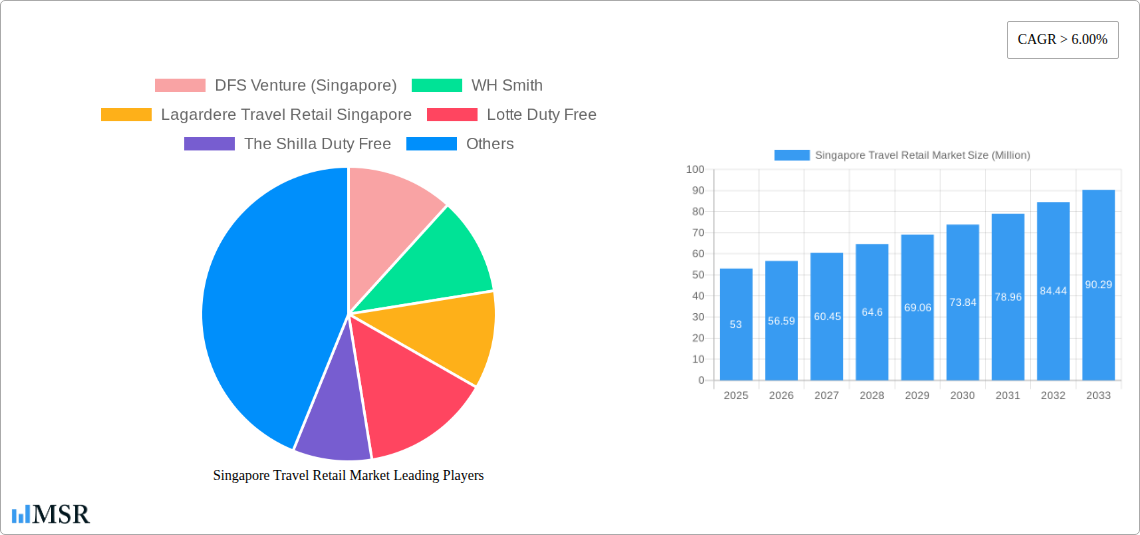

The Singapore travel retail market, valued at approximately $53 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Singapore's strategic location as a major aviation hub and a popular tourist destination drives significant passenger traffic, creating a large potential customer base for duty-free and travel retail products. Secondly, the increasing disposable incomes of both local and international travelers contribute to higher spending on luxury goods and experiences, boosting sales within the sector. The growing popularity of online pre-ordering and personalized shopping experiences also contributes to market expansion. Furthermore, innovative retail strategies employed by major players like DFS Venture, Changi Airport, and Lotte Duty Free, focused on enhancing customer experience and offering exclusive product ranges, further stimulate market growth.

Singapore Travel Retail Market Market Size (In Million)

However, the market faces certain challenges. Fluctuations in global tourism due to geopolitical events or economic downturns can impact passenger numbers and consequently, retail sales. Intense competition among numerous established players, including both international and local brands, necessitates strategic pricing and marketing to maintain market share. Government regulations and policies related to duty-free allowances and product restrictions can also influence the overall market dynamics. Despite these challenges, the long-term outlook for the Singapore travel retail market remains positive, driven by the continuing growth of air travel and the rising demand for premium travel retail experiences. The market segmentation will likely see increasing focus on personalized services and e-commerce integration to cater to evolving consumer preferences and enhance convenience.

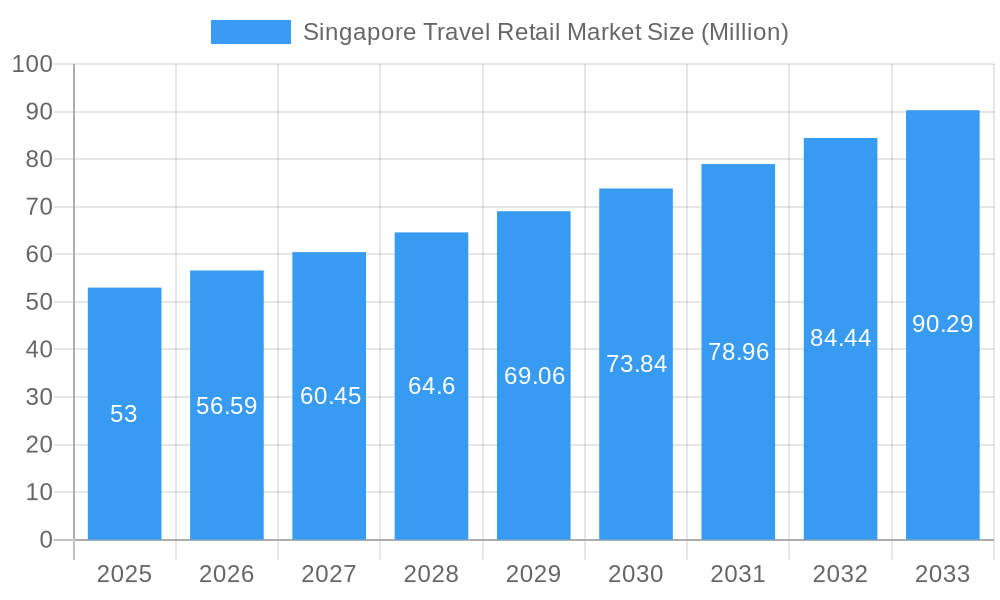

Singapore Travel Retail Market Company Market Share

Singapore Travel Retail Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Singapore travel retail market, offering crucial data and actionable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report is essential for understanding market dynamics, growth drivers, and future opportunities. The report projects a market size of xx Million in 2025, with a CAGR of xx% from 2025 to 2033. This comprehensive study examines key players, emerging trends, and challenges shaping this dynamic sector.

Singapore Travel Retail Market Market Concentration & Dynamics

The Singapore travel retail market exhibits a moderately concentrated landscape, with key players like DFS Venture (Singapore), Lagardere Travel Retail Singapore, and Lotte Duty Free commanding significant market share. However, the presence of numerous smaller players, including 3sixty duty free, Shiseido Travel Retail, and Watsons Personal Care Stores, indicates a competitive environment. The market is driven by factors including:

- Innovation Ecosystems: Continuous innovation in product offerings, technology integration (e.g., AR/AI-powered shopping experiences), and customer service strategies. DFS Group's recent implementation of AR/AI technology exemplifies this.

- Regulatory Frameworks: Government policies and regulations concerning duty-free allowances, import/export restrictions, and consumer protection significantly influence market operations. Changes in these frameworks impact market players’ strategies and profitability.

- Substitute Products: The availability of similar products outside the travel retail channel presents a competitive challenge. Market players need to offer unique value propositions to maintain their edge.

- End-User Trends: Shifting consumer preferences towards personalized experiences, luxury goods, and health-conscious products shape demand. Companies adapt to cater to evolving tastes and expectations.

- M&A Activities: The recent acquisition of Tastes on the Fly by Lagardere Travel Retail showcases the prevalent consolidation trends within the industry. The number of M&A deals in the period 2019-2024 totaled xx, contributing to market restructuring and increased concentration. This trend is projected to continue with xx M&A deals expected during the forecast period (2025-2033).

Singapore Travel Retail Market Industry Insights & Trends

The Singapore travel retail market witnessed significant growth during the historical period (2019-2024), experiencing a fluctuating trajectory impacted by global events like the COVID-19 pandemic. Post-pandemic recovery has been strong, fueled by pent-up travel demand and a resurgence in international tourism. Technological advancements are significantly impacting the industry, creating opportunities for enhanced customer engagement and operational efficiency. This includes the integration of AI for personalized recommendations and AR for immersive shopping experiences. The rising popularity of online pre-ordering and delivery services is also transforming the customer journey. Consumer behavior is evolving with a stronger focus on personalized experiences, convenience, and sustainability. The market's growth is also influenced by factors such as increased disposable income among travelers, the rise of affluent tourists, and the growing popularity of duty-free shopping. The market is expected to reach xx Million in 2025.

Key Markets & Segments Leading Singapore Travel Retail Market

Changi Airport remains the dominant segment within the Singapore travel retail market, owing to its status as a major international air hub. The strong passenger traffic volume directly contributes to increased sales. The high concentration of luxury brands and flagship stores at Changi further enhances its dominance.

- Drivers of Changi Airport's Dominance:

- High Passenger Traffic: Changi Airport consistently ranks among the world's busiest airports.

- World-Class Infrastructure: Excellent facilities, efficient operations, and a wide range of amenities enhance the passenger experience and encourage spending.

- Strategic Location: Singapore's central location in Southeast Asia provides access to a large catchment area.

- Government Support: Government initiatives promoting tourism and infrastructure development further support market growth.

The dominance of Changi Airport is expected to continue throughout the forecast period, although other airports and border crossings may see growth as well. The luxury goods segment currently holds a significant market share and is expected to maintain strong growth due to increasing disposable incomes among high net-worth individuals.

Singapore Travel Retail Market Product Developments

Recent product developments in the Singapore travel retail market highlight the integration of technology, personalized experiences, and sustainable practices. Companies are leveraging AI and AR to create interactive shopping experiences that cater to individual preferences. The introduction of exclusive product lines and collaborations with luxury brands aims to attract affluent travelers. Moreover, the growing focus on sustainability is evident through the introduction of eco-friendly packaging and products. These developments create a competitive landscape that favors those who embrace technological advancements and adapt to evolving consumer needs.

Challenges in the Singapore Travel Retail Market Market

The Singapore travel retail market faces challenges including:

- Intense Competition: A high number of players, both large and small, creates intense competition, requiring companies to differentiate themselves effectively.

- Economic Fluctuations: Global economic downturns and regional instability can impact consumer spending and overall market growth.

- Supply Chain Disruptions: Global supply chain issues can impact product availability and lead to increased costs. This has been amplified in recent years by geopolitical events and pandemics.

- Regulatory Changes: Unexpected changes in government regulations can impact market operations and profitability.

Forces Driving Singapore Travel Retail Market Growth

Several factors are driving growth:

- Increased Tourist Arrivals: The rise in international tourism post-pandemic recovery is directly boosting sales.

- Technological Advancements: AI, AR, and personalized shopping experiences are enhancing customer engagement.

- Economic Growth in Asia: Growing affluence in the region is increasing spending power among travelers.

- Government Support for Tourism: Government initiatives promote tourism and enhance the infrastructure of airports and other travel hubs.

Long-Term Growth Catalysts in the Singapore Travel Retail Market

Long-term growth catalysts include strategic partnerships between retailers and airlines/airports offering bundled deals, investments in innovative technology solutions, and expansion into new product categories like health and wellness, and personalized services. The potential for growth in e-commerce and omnichannel retail strategies is also significant.

Emerging Opportunities in Singapore Travel Retail Market

Emerging opportunities lie in leveraging data analytics for personalized marketing, expanding into niche markets like health and wellness products, developing sustainable and eco-friendly product offerings, and exploring new partnerships with airlines, airports, and other travel-related businesses. The increasing importance of seamless digital integration and online pre-ordering services should also be explored.

Leading Players in the Singapore Travel Retail Market Sector

- DFS Venture (Singapore) [link to website if available]

- WH Smith [link to website if available]

- Lagardere Travel Retail Singapore [link to website if available]

- Lotte Duty Free [link to website if available]

- The Shilla Duty Free [link to website if available]

- Durfy Singapore [link to website if available]

- Heinemann Asia Pacific [link to website if available]

- 3sixty duty free [link to website if available]

- Shiseido Travel Retail [link to website if available]

- Watsons Personal Care Stores [link to website if available]

- SMI Retail [link to website if available]

- Guardian Health & Beauty Singapore [link to website if available]

- Gassan Singapore [link to website if available]

- DFASS (Singapore) [link to website if available]

- Candy Empire [link to website if available]

- iShopChangi [link to website if available]

Key Milestones in Singapore Travel Retail Market Industry

- September 2023: Lagardere Travel Retail acquired Tastes on the Fly, expanding its food and beverage offerings and strengthening its position in the travel retail market.

- July 2023: DFS Group launched a series of exclusive experiences using AR and AI technology, enhancing the customer journey and offering personalized shopping journeys.

Strategic Outlook for Singapore Travel Retail Market Market

The future of the Singapore travel retail market is promising, with significant growth potential driven by increasing tourist arrivals, technological innovation, and strategic partnerships. Companies that adapt to changing consumer preferences, embrace technological advancements, and focus on providing unique and personalized experiences will be best positioned to capture market share and drive future growth. The market is poised for continued expansion, driven by an increase in both domestic and international tourism.

Singapore Travel Retail Market Segmentation

-

1. Product Type

- 1.1. Beauty and Personal Care

- 1.2. Wines and Spirits

- 1.3. Tobacco

- 1.4. Eatables

- 1.5. Fashion Accessories and Hard Luxury

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels

Singapore Travel Retail Market Segmentation By Geography

- 1. Singapore

Singapore Travel Retail Market Regional Market Share

Geographic Coverage of Singapore Travel Retail Market

Singapore Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Across The Globe; Growing Airport Infrasturcture

- 3.3. Market Restrains

- 3.3.1. Growing Tourism Across The Globe; Growing Airport Infrasturcture

- 3.4. Market Trends

- 3.4.1. Tourist Arrivals in Singapore is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beauty and Personal Care

- 5.1.2. Wines and Spirits

- 5.1.3. Tobacco

- 5.1.4. Eatables

- 5.1.5. Fashion Accessories and Hard Luxury

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DFS Venture (Singapore)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WH Smith

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lagardere Travel Retail Singapore

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lotte Duty Free

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Shilla Duty Free

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durfy Singapore

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Heinemann Asia Pacific

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3sixty duty free

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shiseido Travel Retail

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Watsons Personal Care Stores

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SMI Retail

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Guardian Health & Beauty Singapore

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Gassan Singapore

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DFASS (Singapore)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Candy Empire

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 iShopChangi**List Not Exhaustive

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 DFS Venture (Singapore)

List of Figures

- Figure 1: Singapore Travel Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Travel Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Singapore Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Singapore Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Singapore Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Singapore Travel Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Singapore Travel Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Singapore Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Singapore Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Singapore Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Singapore Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Singapore Travel Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Singapore Travel Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Travel Retail Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Singapore Travel Retail Market?

Key companies in the market include DFS Venture (Singapore), WH Smith, Lagardere Travel Retail Singapore, Lotte Duty Free, The Shilla Duty Free, Durfy Singapore, Heinemann Asia Pacific, 3sixty duty free, Shiseido Travel Retail, Watsons Personal Care Stores, SMI Retail, Guardian Health & Beauty Singapore, Gassan Singapore, DFASS (Singapore), Candy Empire, iShopChangi**List Not Exhaustive.

3. What are the main segments of the Singapore Travel Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Across The Globe; Growing Airport Infrasturcture.

6. What are the notable trends driving market growth?

Tourist Arrivals in Singapore is Driving the Market.

7. Are there any restraints impacting market growth?

Growing Tourism Across The Globe; Growing Airport Infrasturcture.

8. Can you provide examples of recent developments in the market?

September 2023: Lagardere Travel Retail acquired Tastes on the Fly, which operates restaurants and food and beverage concepts. The acquisition helps Lagardère to grow its food service expertise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Travel Retail Market?

To stay informed about further developments, trends, and reports in the Singapore Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence