Key Insights

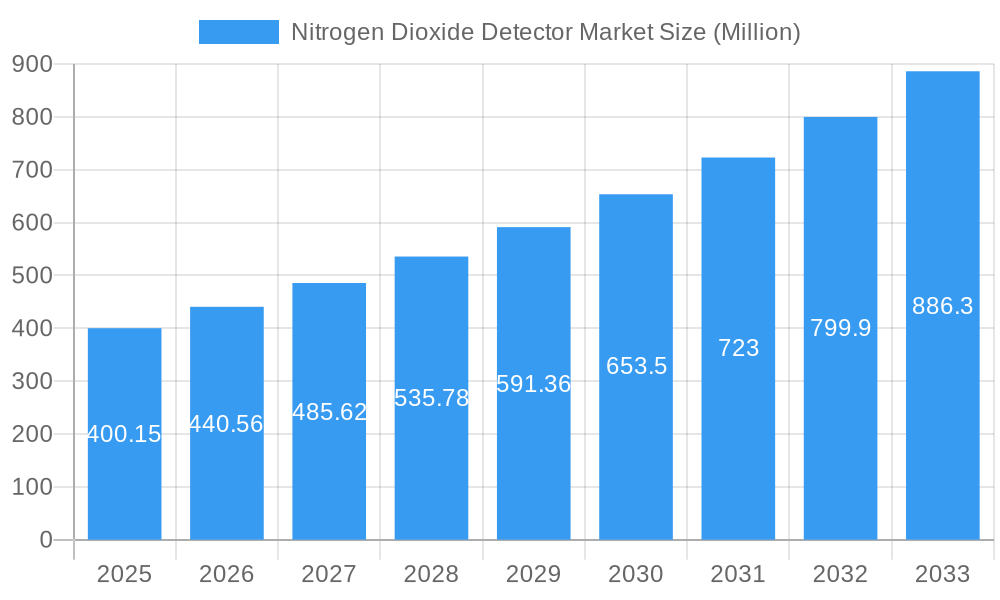

The Nitrogen Dioxide (NO2) Detector Market is experiencing robust growth, projected to reach \$400.15 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.21% from 2025 to 2033. This expansion is driven by increasing regulatory stringency concerning air quality, particularly in densely populated urban areas and industrial zones. Growing awareness of the health risks associated with NO2 exposure, including respiratory illnesses and cardiovascular problems, further fuels demand for accurate and reliable detection technologies. The market is segmented by detector type (e.g., electrochemical, infrared, chemiluminescence), application (industrial monitoring, environmental monitoring, automotive), and end-user (government agencies, industrial facilities, research institutions). Technological advancements, such as the development of smaller, more portable, and cost-effective detectors, are also contributing to market growth. However, factors like high initial investment costs for advanced detection systems and the need for skilled personnel for operation and maintenance can act as restraints.

Nitrogen Dioxide Detector Market Market Size (In Million)

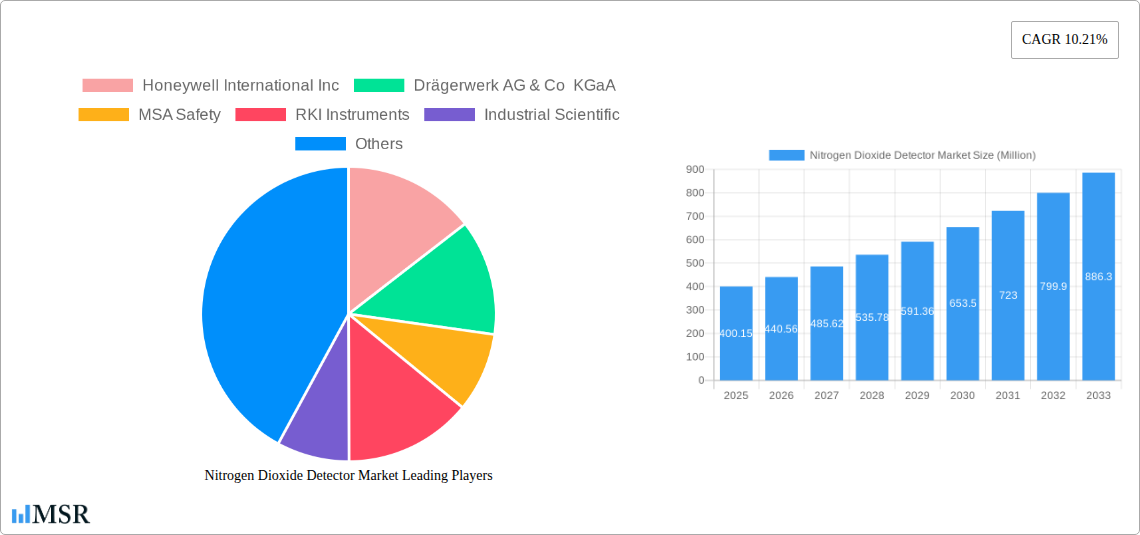

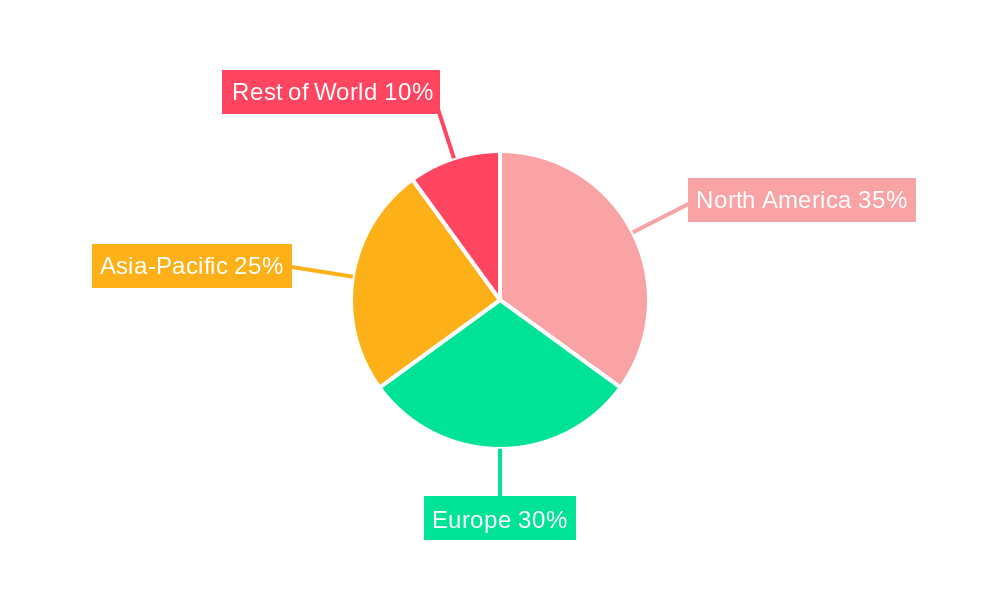

Major players like Honeywell International Inc., Drägerwerk AG & Co KGaA, and MSA Safety are actively shaping the market through product innovation, strategic partnerships, and geographical expansion. The competitive landscape is characterized by both established players and emerging companies offering diverse product portfolios to cater to specific application needs. The market exhibits significant regional variations, with North America and Europe currently holding substantial market share due to stringent environmental regulations and a robust industrial base. However, the Asia-Pacific region is poised for substantial growth, driven by rapid industrialization and increasing urbanization. The forecast period (2025-2033) suggests continued expansion, largely contingent on evolving environmental regulations, technological breakthroughs, and economic growth in key regions.

Nitrogen Dioxide Detector Market Company Market Share

Nitrogen Dioxide Detector Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Nitrogen Dioxide (NO2) Detector market, offering valuable insights for industry stakeholders, investors, and researchers. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report covers market size, growth drivers, technological advancements, competitive landscape, and emerging opportunities, providing actionable intelligence to navigate this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Nitrogen Dioxide Detector Market Market Concentration & Dynamics

The Nitrogen Dioxide Detector market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Major companies like Honeywell International Inc, Drägerwerk AG & Co KGaA, MSA Safety, and RKI Instruments dominate the market, leveraging their established brand reputation and technological expertise. However, the market also features a number of smaller, specialized players, often focusing on niche applications or innovative technologies.

Market Concentration Metrics:

- Market share of top 5 players: xx% (2025)

- Market share of top 10 players: xx% (2025)

- Herfindahl-Hirschman Index (HHI): xx (2025)

Market Dynamics:

- Innovation Ecosystems: Significant R&D investments are driving innovation in sensor technology, leading to the development of more sensitive, cost-effective, and portable NO2 detectors. The emergence of new materials like metal-organic frameworks (MOFs) is revolutionizing detection capabilities.

- Regulatory Frameworks: Stringent environmental regulations, particularly concerning air quality, are a key driver of market growth. Governments worldwide are implementing stricter emission standards, prompting increased demand for NO2 detection solutions. For example, South Korea's stringent 30 ppb annual average NO2 limit is a prime example.

- Substitute Products: While no direct substitutes exist for NO2 detectors, alternative monitoring methods, such as remote sensing technologies, are being explored and may influence market growth in the long term.

- End-User Trends: The demand for NO2 detectors is driven by various end-user segments, including industrial facilities, environmental monitoring agencies, research institutions, and automotive manufacturers. Growing awareness of air pollution and its health impacts is fuelling demand across these sectors.

- M&A Activities: The market has witnessed several mergers and acquisitions in recent years, with larger players seeking to expand their product portfolios and market reach. The number of M&A deals in the past five years is estimated at xx.

Nitrogen Dioxide Detector Market Industry Insights & Trends

The global Nitrogen Dioxide Detector market is experiencing significant growth, propelled by several key factors. Rising concerns about air quality and the detrimental health effects of NO2 are driving demand for accurate and reliable detection systems. Stringent environmental regulations in various countries are further boosting market expansion. The market is also witnessing a surge in technological advancements, with the development of more sensitive, portable, and cost-effective detectors. This is further fueled by increased demand from various sectors, including industrial monitoring, environmental protection, and automotive emissions control. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, indicating robust growth. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%.

Technological disruptions are reshaping the industry, particularly in sensor technology, with the introduction of improved materials and miniaturization techniques. Consumer behavior is also changing, with increased awareness of air quality and the adoption of smart devices influencing demand. The market is also seeing an increasing adoption of cloud-based data analytics platforms, enabling remote monitoring and enhanced data management capabilities.

Key Markets & Segments Leading Nitrogen Dioxide Detector Market

The Asia-Pacific region is currently the dominant market for NO2 detectors, driven by rapid industrialization, urbanization, and increasing environmental concerns. This region's strong economic growth, coupled with expanding infrastructure projects and rising investments in environmental monitoring programs, are propelling demand.

Drivers for Dominance in Asia-Pacific:

- Rapid industrialization and urbanization leading to increased air pollution.

- Stringent government regulations aimed at improving air quality.

- Growing awareness among consumers regarding air pollution's health impacts.

- Significant investments in environmental monitoring infrastructure.

- High population density and associated health concerns.

Detailed analysis reveals that China and India are currently the leading countries in the Asia-Pacific market, due to their large populations, high levels of industrial activity, and increasing government focus on environmental protection. However, other countries in the region, like South Korea (driven by stringent NO2 regulations), are exhibiting strong growth potential.

Nitrogen Dioxide Detector Market Product Developments

Recent years have witnessed significant advancements in NO2 detector technology. The emergence of highly sensitive electrochemical sensors and advanced optical techniques has led to the development of more accurate, reliable, and cost-effective devices. These advancements cater to a broader range of applications, from industrial process monitoring to personal safety and environmental monitoring. Miniaturization of sensors and the integration of wireless communication capabilities have also increased their portability and ease of use, enhancing their market relevance. These technological leaps provide companies with a significant competitive edge.

Challenges in the Nitrogen Dioxide Detector Market Market

Several challenges hinder the growth of the NO2 detector market. These include the high cost of advanced sensor technologies, particularly for high-sensitivity devices, limiting market penetration in price-sensitive segments. Supply chain disruptions, exacerbated by geopolitical events and material scarcity, can also negatively impact production and availability. Intense competition among established players and the emergence of new entrants create pressure on pricing and profit margins, impacting market dynamics. Furthermore, regulatory complexities and varying standards across different regions pose challenges for manufacturers in terms of product compliance and market access. The combined impact of these factors is estimated to reduce market growth by approximately xx% in 2025.

Forces Driving Nitrogen Dioxide Detector Market Growth

Several key factors are driving the growth of the NO2 detector market. Stringent environmental regulations worldwide are mandating the use of NO2 detection systems in various industrial and environmental settings. Growing awareness about the health hazards associated with NO2 exposure is influencing consumer behavior, leading to increased demand for personal monitoring devices. Technological advancements, such as the development of more sensitive and cost-effective sensors, are also expanding market applications. Furthermore, the increasing adoption of smart technologies and IoT (Internet of Things) integration in environmental monitoring systems is boosting market expansion.

Long-Term Growth Catalysts in the Nitrogen Dioxide Detector Market

Long-term growth will be fuelled by continuous innovations in sensor technology, leading to more accurate and portable detectors. Strategic partnerships between sensor manufacturers and technology providers will play a crucial role in integrating NO2 detection systems into wider environmental monitoring networks. The expansion into new markets, especially in developing economies experiencing rapid industrialization, will also contribute significantly. The ongoing development of advanced analytics capabilities for NO2 data will further enhance the value proposition and adoption of these detectors.

Emerging Opportunities in Nitrogen Dioxide Detector Market

Emerging opportunities lie in the development of integrated, multi-gas detection systems, providing comprehensive environmental monitoring capabilities. The integration of NO2 detectors into wearable technologies and smart homes presents a significant growth avenue. Furthermore, the exploration of new applications in sectors such as agriculture and healthcare offers further expansion opportunities. The increasing demand for real-time, remote monitoring capabilities, using cloud-based platforms, presents another avenue for market growth.

Leading Players in the Nitrogen Dioxide Detector Market Sector

- Honeywell International Inc

- Drägerwerk AG & Co KGaA

- MSA Safety

- RKI Instruments

- Industrial Scientific

- Crowcon Detection Instruments Ltd

- GAO Tek & GAO Group Inc

- Calibration Technologies LLC

- Greystone Energy Systems Inc

- Evikon MCI OÜ

- CO2Meter

- Teledyne Gas and Flame Detection *List Not Exhaustive

Key Milestones in Nitrogen Dioxide Detector Market Industry

January 2024: Researchers at the Korea Research Institute of Standards and Science unveiled a highly sensitive room-temperature NO2 sensor, enhancing detection capabilities, particularly at low concentrations. This advancement directly impacts the market by offering a competitive alternative with high sensitivity and low power consumption.

May 2024: MIT researchers introduced a cost-effective NO2 detector using a MOF-polymer composite, showcasing improved sensitivity compared to existing technologies. This breakthrough has the potential to significantly disrupt the market by offering a more affordable and sensitive detection solution.

Strategic Outlook for Nitrogen Dioxide Detector Market Market

The future of the NO2 detector market looks promising, driven by increasing environmental regulations, technological advancements, and rising awareness about air quality. Strategic opportunities exist for companies to focus on developing highly sensitive, portable, and cost-effective detectors, targeting diverse market segments. Investing in R&D to develop innovative sensor technologies, expanding into new geographical markets, and establishing strategic partnerships will be crucial for achieving long-term growth and success in this dynamic market. The market is poised for continued expansion, fueled by both technological progress and the urgent global need for effective air pollution monitoring and control.

Nitrogen Dioxide Detector Market Segmentation

-

1. Type

- 1.1. Fixed Detectors

- 1.2. Portable Detectors

-

2. End-User

- 2.1. Chemicals

- 2.2. Food and Beverage

- 2.3. Paper and Pulp

- 2.4. Energy and Utilities

- 2.5. Others

Nitrogen Dioxide Detector Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Nitrogen Dioxide Detector Market Regional Market Share

Geographic Coverage of Nitrogen Dioxide Detector Market

Nitrogen Dioxide Detector Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Environmental Regulations Owing to Growing Health Concerns; Increasing Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations Owing to Growing Health Concerns; Increasing Technological Advancements

- 3.4. Market Trends

- 3.4.1. Chemicals Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nitrogen Dioxide Detector Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Detectors

- 5.1.2. Portable Detectors

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Chemicals

- 5.2.2. Food and Beverage

- 5.2.3. Paper and Pulp

- 5.2.4. Energy and Utilities

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Nitrogen Dioxide Detector Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed Detectors

- 6.1.2. Portable Detectors

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Chemicals

- 6.2.2. Food and Beverage

- 6.2.3. Paper and Pulp

- 6.2.4. Energy and Utilities

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Nitrogen Dioxide Detector Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed Detectors

- 7.1.2. Portable Detectors

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Chemicals

- 7.2.2. Food and Beverage

- 7.2.3. Paper and Pulp

- 7.2.4. Energy and Utilities

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Nitrogen Dioxide Detector Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed Detectors

- 8.1.2. Portable Detectors

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Chemicals

- 8.2.2. Food and Beverage

- 8.2.3. Paper and Pulp

- 8.2.4. Energy and Utilities

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Nitrogen Dioxide Detector Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed Detectors

- 9.1.2. Portable Detectors

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Chemicals

- 9.2.2. Food and Beverage

- 9.2.3. Paper and Pulp

- 9.2.4. Energy and Utilities

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Nitrogen Dioxide Detector Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed Detectors

- 10.1.2. Portable Detectors

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Chemicals

- 10.2.2. Food and Beverage

- 10.2.3. Paper and Pulp

- 10.2.4. Energy and Utilities

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Nitrogen Dioxide Detector Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Fixed Detectors

- 11.1.2. Portable Detectors

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Chemicals

- 11.2.2. Food and Beverage

- 11.2.3. Paper and Pulp

- 11.2.4. Energy and Utilities

- 11.2.5. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Drägerwerk AG & Co KGaA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 MSA Safety

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 RKI Instruments

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Industrial Scientific

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Crowcon Detection Instruments Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GAO Tek & GAO Group Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Calibration Technologies LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Greystone Energy Systems Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Evikon MCI OÜ

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 CO2Meter

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Teledyne Gas and Flame Detection*List Not Exhaustive

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Nitrogen Dioxide Detector Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Nitrogen Dioxide Detector Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America Nitrogen Dioxide Detector Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Nitrogen Dioxide Detector Market Volume (Million), by Type 2025 & 2033

- Figure 5: North America Nitrogen Dioxide Detector Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Nitrogen Dioxide Detector Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Nitrogen Dioxide Detector Market Revenue (Million), by End-User 2025 & 2033

- Figure 8: North America Nitrogen Dioxide Detector Market Volume (Million), by End-User 2025 & 2033

- Figure 9: North America Nitrogen Dioxide Detector Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Nitrogen Dioxide Detector Market Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Nitrogen Dioxide Detector Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Nitrogen Dioxide Detector Market Volume (Million), by Country 2025 & 2033

- Figure 13: North America Nitrogen Dioxide Detector Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Nitrogen Dioxide Detector Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Nitrogen Dioxide Detector Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Nitrogen Dioxide Detector Market Volume (Million), by Type 2025 & 2033

- Figure 17: Europe Nitrogen Dioxide Detector Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Nitrogen Dioxide Detector Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Nitrogen Dioxide Detector Market Revenue (Million), by End-User 2025 & 2033

- Figure 20: Europe Nitrogen Dioxide Detector Market Volume (Million), by End-User 2025 & 2033

- Figure 21: Europe Nitrogen Dioxide Detector Market Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Europe Nitrogen Dioxide Detector Market Volume Share (%), by End-User 2025 & 2033

- Figure 23: Europe Nitrogen Dioxide Detector Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Nitrogen Dioxide Detector Market Volume (Million), by Country 2025 & 2033

- Figure 25: Europe Nitrogen Dioxide Detector Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Nitrogen Dioxide Detector Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Nitrogen Dioxide Detector Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Nitrogen Dioxide Detector Market Volume (Million), by Type 2025 & 2033

- Figure 29: Asia Nitrogen Dioxide Detector Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Nitrogen Dioxide Detector Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Nitrogen Dioxide Detector Market Revenue (Million), by End-User 2025 & 2033

- Figure 32: Asia Nitrogen Dioxide Detector Market Volume (Million), by End-User 2025 & 2033

- Figure 33: Asia Nitrogen Dioxide Detector Market Revenue Share (%), by End-User 2025 & 2033

- Figure 34: Asia Nitrogen Dioxide Detector Market Volume Share (%), by End-User 2025 & 2033

- Figure 35: Asia Nitrogen Dioxide Detector Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Nitrogen Dioxide Detector Market Volume (Million), by Country 2025 & 2033

- Figure 37: Asia Nitrogen Dioxide Detector Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Nitrogen Dioxide Detector Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Nitrogen Dioxide Detector Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Australia and New Zealand Nitrogen Dioxide Detector Market Volume (Million), by Type 2025 & 2033

- Figure 41: Australia and New Zealand Nitrogen Dioxide Detector Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Australia and New Zealand Nitrogen Dioxide Detector Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Australia and New Zealand Nitrogen Dioxide Detector Market Revenue (Million), by End-User 2025 & 2033

- Figure 44: Australia and New Zealand Nitrogen Dioxide Detector Market Volume (Million), by End-User 2025 & 2033

- Figure 45: Australia and New Zealand Nitrogen Dioxide Detector Market Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Australia and New Zealand Nitrogen Dioxide Detector Market Volume Share (%), by End-User 2025 & 2033

- Figure 47: Australia and New Zealand Nitrogen Dioxide Detector Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Nitrogen Dioxide Detector Market Volume (Million), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Nitrogen Dioxide Detector Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Nitrogen Dioxide Detector Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Nitrogen Dioxide Detector Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Latin America Nitrogen Dioxide Detector Market Volume (Million), by Type 2025 & 2033

- Figure 53: Latin America Nitrogen Dioxide Detector Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Latin America Nitrogen Dioxide Detector Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Latin America Nitrogen Dioxide Detector Market Revenue (Million), by End-User 2025 & 2033

- Figure 56: Latin America Nitrogen Dioxide Detector Market Volume (Million), by End-User 2025 & 2033

- Figure 57: Latin America Nitrogen Dioxide Detector Market Revenue Share (%), by End-User 2025 & 2033

- Figure 58: Latin America Nitrogen Dioxide Detector Market Volume Share (%), by End-User 2025 & 2033

- Figure 59: Latin America Nitrogen Dioxide Detector Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Nitrogen Dioxide Detector Market Volume (Million), by Country 2025 & 2033

- Figure 61: Latin America Nitrogen Dioxide Detector Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Nitrogen Dioxide Detector Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Nitrogen Dioxide Detector Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Middle East and Africa Nitrogen Dioxide Detector Market Volume (Million), by Type 2025 & 2033

- Figure 65: Middle East and Africa Nitrogen Dioxide Detector Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Middle East and Africa Nitrogen Dioxide Detector Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Middle East and Africa Nitrogen Dioxide Detector Market Revenue (Million), by End-User 2025 & 2033

- Figure 68: Middle East and Africa Nitrogen Dioxide Detector Market Volume (Million), by End-User 2025 & 2033

- Figure 69: Middle East and Africa Nitrogen Dioxide Detector Market Revenue Share (%), by End-User 2025 & 2033

- Figure 70: Middle East and Africa Nitrogen Dioxide Detector Market Volume Share (%), by End-User 2025 & 2033

- Figure 71: Middle East and Africa Nitrogen Dioxide Detector Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Nitrogen Dioxide Detector Market Volume (Million), by Country 2025 & 2033

- Figure 73: Middle East and Africa Nitrogen Dioxide Detector Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Nitrogen Dioxide Detector Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by End-User 2020 & 2033

- Table 5: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Type 2020 & 2033

- Table 9: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by End-User 2020 & 2033

- Table 11: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Type 2020 & 2033

- Table 15: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by End-User 2020 & 2033

- Table 17: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Country 2020 & 2033

- Table 19: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Type 2020 & 2033

- Table 21: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 22: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by End-User 2020 & 2033

- Table 23: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Country 2020 & 2033

- Table 25: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Type 2020 & 2033

- Table 27: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 28: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by End-User 2020 & 2033

- Table 29: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Country 2020 & 2033

- Table 31: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Type 2020 & 2033

- Table 33: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 34: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by End-User 2020 & 2033

- Table 35: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Country 2020 & 2033

- Table 37: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Type 2020 & 2033

- Table 39: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 40: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by End-User 2020 & 2033

- Table 41: Global Nitrogen Dioxide Detector Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Nitrogen Dioxide Detector Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nitrogen Dioxide Detector Market?

The projected CAGR is approximately 10.21%.

2. Which companies are prominent players in the Nitrogen Dioxide Detector Market?

Key companies in the market include Honeywell International Inc, Drägerwerk AG & Co KGaA, MSA Safety, RKI Instruments, Industrial Scientific, Crowcon Detection Instruments Ltd, GAO Tek & GAO Group Inc, Calibration Technologies LLC, Greystone Energy Systems Inc, Evikon MCI OÜ, CO2Meter, Teledyne Gas and Flame Detection*List Not Exhaustive.

3. What are the main segments of the Nitrogen Dioxide Detector Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 400.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Environmental Regulations Owing to Growing Health Concerns; Increasing Technological Advancements.

6. What are the notable trends driving market growth?

Chemicals Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations Owing to Growing Health Concerns; Increasing Technological Advancements.

8. Can you provide examples of recent developments in the market?

May 2024: Researchers at MIT have unveiled a cost-effective detector capable of continuously monitoring specific gases. This innovative system merges two established technologies. The team utilized a metal-organic framework (MOF). However, MOFs face a challenge: their performance diminishes rapidly. To counter this, the team integrated the MOF with a polymer material. While the polymer boasts durability and ease of processing, it lacks the sensitivity of the MOF. The researchers dissolved the polymers in a liquid solution, mixed in the powdered MOF, and then applied this blend onto a substrate. Once dried, it formed a consistent, thin coating. When gas molecules get temporarily trapped within this material, they induce a change in electrical resistance. These resistance fluctuations can be monitored over time by simply connecting an ohmmeter. The team showcased the composite material's prowess in detecting nitrogen dioxide, noting its superior sensitivity to most current nitrogen dioxide detectors.January 2024: Researchers at the Korea Research Institute of Standards and Science have unveiled a highly sensitive toxic gas sensor that competes with leading devices in the market. Operating at room temperature, this sensor boasts ultra-high sensitivity and minimal power consumption, allowing it to accurately detect nitrogen dioxide (NO2), a harmful atmospheric chemical. Its versatility spans various fields, from pinpointing residual gases in semiconductor manufacturing to analyzing electrolysis catalysts. NO2, primarily emitted from high-temperature fossil fuel combustion, automotive exhaust, and industrial smoke, significantly contributes to air pollution-related mortality. In South Korea, a presidential mandate caps the annual average NO2 concentration in the air at 30 ppb. This stringent limit underscores the need for advanced sensors capable of detecting gases at such minute concentrations. Furthermore, as high-tech sectors like semiconductor production expand, the associated rise in hazardous gas usage amplifies the potential risks to human health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nitrogen Dioxide Detector Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nitrogen Dioxide Detector Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nitrogen Dioxide Detector Market?

To stay informed about further developments, trends, and reports in the Nitrogen Dioxide Detector Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence