Key Insights

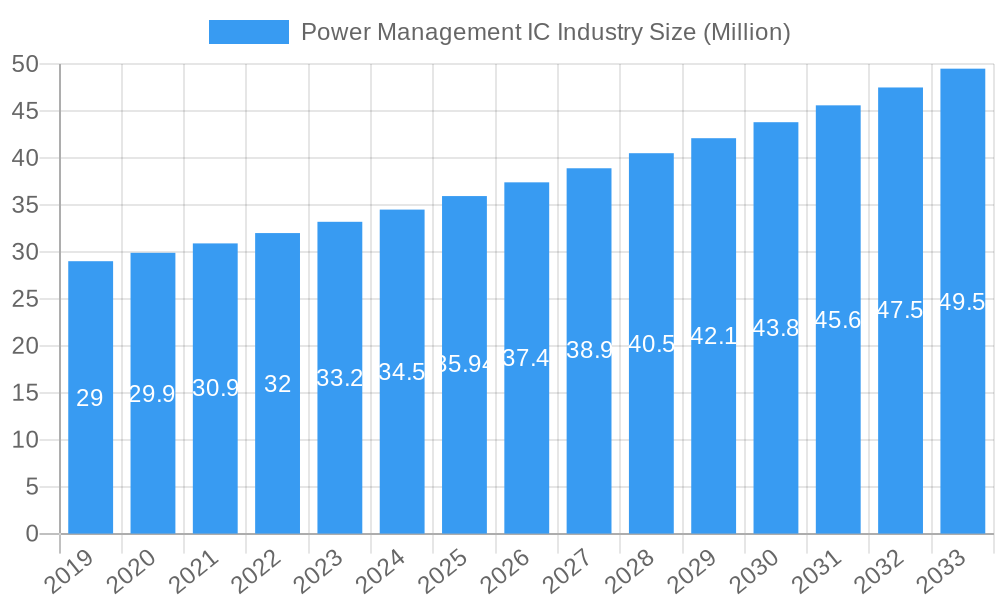

The global Power Management Integrated Circuit (PMIC) market is poised for robust expansion, projected to reach $35.94 million by 2025 with a Compound Annual Growth Rate (CAGR) of 4.16%. This growth is fundamentally driven by the escalating demand for energy-efficient solutions across a wide spectrum of electronic devices. The increasing prevalence of smart devices, Internet of Things (IoT) applications, and advanced automotive systems, all of which rely heavily on optimized power consumption, are key catalysts. Specifically, the automotive sector is a significant contributor, fueled by the burgeoning electric vehicle (EV) market and the integration of sophisticated electronic control units (ECUs) for safety, infotainment, and autonomous driving features. Consumer electronics, with their relentless innovation cycle and demand for longer battery life, also represent a substantial growth avenue for PMICs.

Power Management IC Industry Market Size (In Million)

The market's trajectory is further shaped by key trends such as the miniaturization of components, the development of higher power density PMICs, and the integration of advanced functionalities like artificial intelligence for predictive power management. Emerging technologies like 5G infrastructure and advanced computing systems are also creating new opportunities. However, challenges persist, including the intense price competition among manufacturers and the complexities associated with developing highly integrated PMICs that meet diverse application requirements. Nonetheless, the overarching need for efficient power delivery and management in an increasingly electrified and connected world ensures a positive outlook for the PMIC market, with companies like Texas Instruments, Analog Devices, and Infineon Technologies at the forefront of innovation.

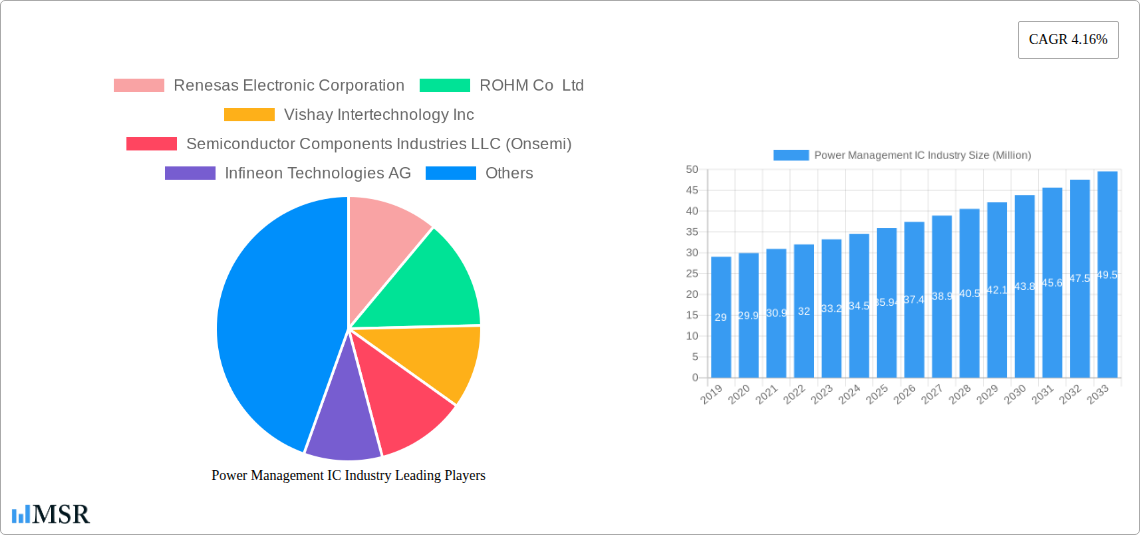

Power Management IC Industry Company Market Share

Unlock critical insights into the dynamic Power Management Integrated Circuit (PMIC) market. This in-depth report, covering the historical period of 2019-2024 and a robust forecast period from 2025-2033, provides a definitive guide for stakeholders seeking to understand market concentration, emerging trends, key growth drivers, and strategic opportunities within the global PMIC landscape. With a base year of 2025, this analysis leverages detailed segment breakdowns across products (Voltage Regulators, Motor Control ICs, Battery Management ICs, Multi-channel PMICs, Other Products) and end-users (Automotive, Consumer Electronics, Industrial, Communication, Computing, Other End-Users).

Power Management IC Industry Market Concentration & Dynamics

The Power Management IC (PMIC) market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Leading companies are investing heavily in R&D to foster innovation ecosystems, driving advancements in energy efficiency, miniaturization, and integrated functionality. Regulatory frameworks, particularly concerning energy consumption standards and environmental impact, are increasingly shaping product development and market entry strategies. The threat of substitute products, while present in specific niche applications, remains limited for core PMIC functionalities, especially in high-performance sectors. End-user demand for advanced features, extended battery life, and smaller form factors continuously fuels market evolution. Merger and acquisition (M&A) activities, though subject to specific industry cycles, remain a strategic tool for companies to expand their product portfolios, gain access to new technologies, and consolidate market positions. For instance, recent M&A activities have focused on acquiring companies with specialized expertise in areas like advanced battery management and high-power density solutions.

Power Management IC Industry Industry Insights & Trends

The global Power Management IC (PMIC) market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer behaviors, and a growing demand for energy-efficient electronic devices. The projected market size for 2025 is estimated at USD XXX Million, with a robust Compound Annual Growth Rate (CAGR) of XX% projected for the forecast period 2025-2033. Key growth drivers include the proliferation of the Internet of Things (IoT) ecosystem, requiring highly integrated and efficient power solutions for a vast array of connected devices, from smart home appliances to industrial sensors. The escalating demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) is another critical catalyst, necessitating sophisticated battery management systems (BMS) and high-power conversion ICs to optimize charging, range, and overall vehicle performance. Furthermore, the relentless pursuit of miniaturization and extended battery life in consumer electronics, such as smartphones, wearables, and portable gaming devices, is pushing the boundaries of PMIC innovation, leading to the development of ultra-low-power and highly efficient solutions. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in various applications also contributes to market growth, as these technologies often require specialized power management strategies to handle complex processing demands efficiently. The industrial sector’s push towards automation, smart manufacturing, and the Industrial Internet of Things (IIoT) further amplifies the need for reliable and efficient power management solutions for robots, control systems, and networked machinery. The communication sector, with the ongoing rollout of 5G infrastructure and the increasing demand for data processing, is also a significant contributor to PMIC market growth, requiring high-performance power solutions for base stations and network equipment. The computing segment, driven by the demand for high-performance laptops, servers, and data centers, also relies heavily on advanced PMICs for efficient power delivery and thermal management.

Key Markets & Segments Leading Power Management IC Industry

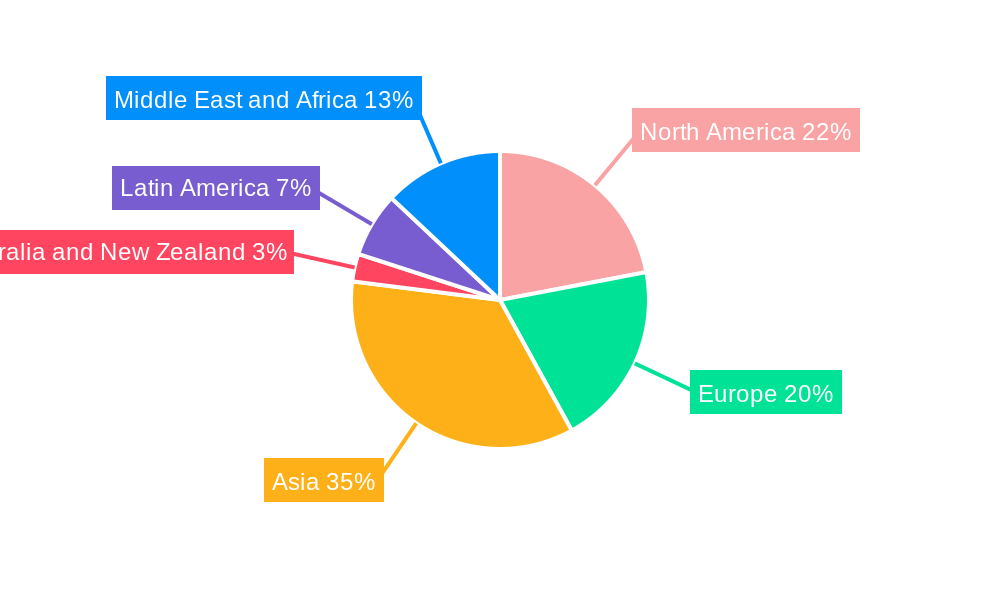

The Power Management IC (PMIC) market's dominance is shaped by vibrant regional economies, technological adoption rates, and critical end-user demands.

- Dominant Region: North America and Asia-Pacific are currently the leading regions, driven by robust innovation hubs, significant manufacturing capabilities, and high consumer electronics penetration.

- North America: Fueled by substantial R&D investments in automotive electrification, advanced communication networks, and industrial automation, North America showcases strong demand for sophisticated PMICs. Economic growth and government initiatives promoting technological adoption further bolster this segment.

- Asia-Pacific: This region emerges as a powerhouse due to its extensive electronics manufacturing base, particularly in China, South Korea, and Taiwan, coupled with a rapidly expanding middle class driving consumer electronics sales. The surge in 5G deployment and the burgeoning electric vehicle market are significant growth accelerators.

- Dominant Segments:

- Product: Battery Management ICs: The exponential growth of the electric vehicle market and the ubiquitous demand for longer-lasting portable electronics position Battery Management ICs as a high-growth segment. Their critical role in optimizing battery performance, safety, and lifespan is paramount.

- Drivers: Increasing EV adoption, demand for longer battery life in consumer devices, growth in energy storage solutions.

- End-User: Automotive: The automotive industry is a prime driver of PMIC innovation, propelled by the electrification trend, the increasing complexity of in-car electronics, and the integration of advanced driver-assistance systems (ADAS).

- Drivers: Electrification of vehicles, increasing number of electronic control units (ECUs), adoption of ADAS and infotainment systems.

- End-User: Consumer Electronics: This segment continues to be a foundational pillar for PMIC demand, encompassing smartphones, wearables, tablets, and other portable devices where power efficiency and miniaturization are key differentiators.

- Drivers: Growing demand for smart devices, miniaturization trends, increasing consumer expectations for battery life.

- End-User: Industrial: The Industrial Internet of Things (IIoT), smart manufacturing, and the need for robust power solutions in harsh environments are fueling significant growth in industrial PMIC applications.

- Drivers: Automation in manufacturing, IIoT adoption, energy efficiency initiatives in industrial settings.

- Product: Battery Management ICs: The exponential growth of the electric vehicle market and the ubiquitous demand for longer-lasting portable electronics position Battery Management ICs as a high-growth segment. Their critical role in optimizing battery performance, safety, and lifespan is paramount.

Power Management IC Industry Product Developments

Recent product developments in the Power Management IC industry showcase a strong emphasis on energy efficiency, increased integration, and enhanced performance. Innovations are geared towards addressing the evolving demands of applications like advanced driver-assistance systems (ADAS) in automotive, the burgeoning IoT ecosystem, and the need for longer battery life in consumer electronics. Companies are actively developing new families of integrated circuits that offer superior power conversion efficiency, reduced quiescent current, and sophisticated protection features, thereby enabling smaller form factors and more sustainable electronic designs. This relentless pursuit of technological advancement creates competitive advantages and addresses critical market needs.

Challenges in the Power Management IC Industry Market

The Power Management IC market, while robust, faces several critical challenges.

- Supply Chain Disruptions: Geopolitical tensions, natural disasters, and logistical bottlenecks can severely impact the availability of raw materials and the timely delivery of finished goods, leading to production delays and increased costs.

- Intensifying Competition: The market is characterized by fierce competition among established players and emerging startups, leading to price pressures and the need for continuous innovation to maintain market share.

- Stringent Regulatory Compliance: Evolving environmental regulations regarding energy efficiency and hazardous materials add complexity and cost to product development and manufacturing processes.

- Talent Shortage: A persistent shortage of skilled engineers and researchers in the semiconductor industry can hinder the pace of innovation and product development.

- Technological Obsolescence: The rapid pace of technological change necessitates significant and ongoing investment in R&D to avoid products becoming obsolete, impacting profitability.

Forces Driving Power Management IC Industry Growth

Several powerful forces are propelling the growth of the Power Management IC industry. The relentless demand for energy-efficient solutions across all sectors, from consumer electronics to industrial automation and electric vehicles, is a primary driver. The proliferation of connected devices in the Internet of Things (IoT) ecosystem necessitates highly integrated and low-power PMICs for their operation. Furthermore, the ongoing digital transformation and the increasing adoption of artificial intelligence (AI) require sophisticated power management strategies to handle computational demands efficiently. Government initiatives promoting sustainable energy and reducing carbon footprints are also indirectly boosting the demand for PMICs that enhance energy efficiency.

Challenges in the Power Management IC Industry Market

Long-term growth catalysts for the Power Management IC industry are intrinsically linked to ongoing technological advancements and strategic market expansions. The continuous drive towards miniaturization and higher power density will necessitate the development of novel packaging technologies and advanced semiconductor materials. Furthermore, the increasing complexity of electronic systems, particularly in the automotive and communication sectors, will create demand for highly integrated multi-channel PMICs with advanced functionalities. Strategic partnerships and collaborations between semiconductor manufacturers and device OEMs will be crucial for co-developing tailored power solutions that meet specific application requirements. The expansion into emerging markets and the development of PMICs for nascent technologies, such as advanced robotics and augmented reality, will also present significant long-term growth opportunities.

Emerging Opportunities in Power Management IC Industry

Emerging opportunities in the Power Management IC industry are abundant, driven by technological innovation and shifting consumer preferences. The rapid expansion of the 5G infrastructure and the development of edge computing applications present a substantial demand for high-performance, efficient PMICs. The growing adoption of renewable energy sources and energy storage systems, such as advanced battery technologies, will create new avenues for specialized battery management and power conversion ICs. Furthermore, the increasing focus on sustainable and eco-friendly electronics is driving demand for ultra-low-power PMICs and solutions that minimize energy waste throughout the product lifecycle. The burgeoning market for electric vertical takeoff and landing (eVTOL) aircraft and other advanced mobility solutions also represents a significant future growth area for high-power density and highly reliable PMICs.

Leading Players in the Power Management IC Industry Sector

- Renesas Electronic Corporation

- ROHM Co Ltd

- Vishay Intertechnology Inc

- Semiconductor Components Industries LLC (Onsemi)

- Infineon Technologies AG

- NXP Semiconductors N V

- Qualcomm Incorporated

- Texas Instruments Incorporated

- Analog Devices Inc

- STMicroelectronics N V

Key Milestones in Power Management IC Industry Industry

- July 2023: Analog Devices Inc. revealed a significant investment exceeding USD 1 billion in expanding its semiconductor facilities located in Oregon. This ambitious expansion project is geared towards boosting production capacity, allowing the company to better cater to critical sectors such as communications, healthcare, industrial, automotive, and consumer electronics. Additionally, this endeavor is expected to generate hundreds of new, permanent job opportunities in the region.

- March 2023: Texas Instruments (TXN) introduced a new family of electromagnetic interference (EMI) filter integrated circuits (ICs) as part of its analog product offerings. This innovative IC family includes the TPSF12C1, TPSF12C3, TPSF12C1-Q1, and TPSF12C3-Q1, establishing them as the industry's pioneering stand-alone active EMI filter ICs.

Strategic Outlook for Power Management IC Industry Market

The strategic outlook for the Power Management IC industry is exceptionally positive, driven by sustained innovation and increasing demand from critical growth sectors. Future market potential lies in developing highly integrated solutions that combine advanced power management with other functionalities, catering to the increasingly complex needs of AI-powered devices and sophisticated automotive systems. Strategic opportunities include focusing on ultra-low-power PMICs for the expanding IoT market, developing high-efficiency power solutions for renewable energy and energy storage, and capitalizing on the growing demand for automotive electrification. Companies that prioritize R&D, forge strong partnerships, and adapt to evolving regulatory landscapes will be well-positioned for significant growth and market leadership in the coming years.

Power Management IC Industry Segmentation

-

1. Product

- 1.1. Voltage Regulators

- 1.2. Motor Control ICs

- 1.3. Battery Management ICs

- 1.4. Multi-channel PMIC

- 1.5. Other Products

-

2. End-User

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. Industrial

- 2.4. Communication

- 2.5. Computing

- 2.6. Other End-Users

Power Management IC Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Power Management IC Industry Regional Market Share

Geographic Coverage of Power Management IC Industry

Power Management IC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Energy-efficient Battery-powered Devices; Electrification Trend in the Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Design Complexity and Performance Limitations in High-power Applications

- 3.4. Market Trends

- 3.4.1. Automotive to be the Fastest Growing End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Management IC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Voltage Regulators

- 5.1.2. Motor Control ICs

- 5.1.3. Battery Management ICs

- 5.1.4. Multi-channel PMIC

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. Industrial

- 5.2.4. Communication

- 5.2.5. Computing

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Power Management IC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Voltage Regulators

- 6.1.2. Motor Control ICs

- 6.1.3. Battery Management ICs

- 6.1.4. Multi-channel PMIC

- 6.1.5. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics

- 6.2.3. Industrial

- 6.2.4. Communication

- 6.2.5. Computing

- 6.2.6. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Power Management IC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Voltage Regulators

- 7.1.2. Motor Control ICs

- 7.1.3. Battery Management ICs

- 7.1.4. Multi-channel PMIC

- 7.1.5. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics

- 7.2.3. Industrial

- 7.2.4. Communication

- 7.2.5. Computing

- 7.2.6. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Power Management IC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Voltage Regulators

- 8.1.2. Motor Control ICs

- 8.1.3. Battery Management ICs

- 8.1.4. Multi-channel PMIC

- 8.1.5. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics

- 8.2.3. Industrial

- 8.2.4. Communication

- 8.2.5. Computing

- 8.2.6. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia and New Zealand Power Management IC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Voltage Regulators

- 9.1.2. Motor Control ICs

- 9.1.3. Battery Management ICs

- 9.1.4. Multi-channel PMIC

- 9.1.5. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics

- 9.2.3. Industrial

- 9.2.4. Communication

- 9.2.5. Computing

- 9.2.6. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Latin America Power Management IC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Voltage Regulators

- 10.1.2. Motor Control ICs

- 10.1.3. Battery Management ICs

- 10.1.4. Multi-channel PMIC

- 10.1.5. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Automotive

- 10.2.2. Consumer Electronics

- 10.2.3. Industrial

- 10.2.4. Communication

- 10.2.5. Computing

- 10.2.6. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Middle East and Africa Power Management IC Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Voltage Regulators

- 11.1.2. Motor Control ICs

- 11.1.3. Battery Management ICs

- 11.1.4. Multi-channel PMIC

- 11.1.5. Other Products

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Automotive

- 11.2.2. Consumer Electronics

- 11.2.3. Industrial

- 11.2.4. Communication

- 11.2.5. Computing

- 11.2.6. Other End-Users

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Renesas Electronic Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ROHM Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vishay Intertechnology Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Semiconductor Components Industries LLC (Onsemi)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Infineon Technologies AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NXP Semiconductors N V

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Qualcomm Incorporated

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Texas Instruments Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Analog Devices Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 STMicroelectronics N V *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Renesas Electronic Corporation

List of Figures

- Figure 1: Global Power Management IC Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Power Management IC Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Power Management IC Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Power Management IC Industry Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Power Management IC Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Power Management IC Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Power Management IC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Power Management IC Industry Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Power Management IC Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Power Management IC Industry Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe Power Management IC Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Power Management IC Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Power Management IC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Power Management IC Industry Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Power Management IC Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Power Management IC Industry Revenue (Million), by End-User 2025 & 2033

- Figure 17: Asia Power Management IC Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Power Management IC Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Power Management IC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Power Management IC Industry Revenue (Million), by Product 2025 & 2033

- Figure 21: Australia and New Zealand Power Management IC Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Australia and New Zealand Power Management IC Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Australia and New Zealand Power Management IC Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Australia and New Zealand Power Management IC Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Power Management IC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Power Management IC Industry Revenue (Million), by Product 2025 & 2033

- Figure 27: Latin America Power Management IC Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Latin America Power Management IC Industry Revenue (Million), by End-User 2025 & 2033

- Figure 29: Latin America Power Management IC Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Latin America Power Management IC Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Power Management IC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Power Management IC Industry Revenue (Million), by Product 2025 & 2033

- Figure 33: Middle East and Africa Power Management IC Industry Revenue Share (%), by Product 2025 & 2033

- Figure 34: Middle East and Africa Power Management IC Industry Revenue (Million), by End-User 2025 & 2033

- Figure 35: Middle East and Africa Power Management IC Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 36: Middle East and Africa Power Management IC Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Power Management IC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Power Management IC Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Power Management IC Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Power Management IC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Power Management IC Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Power Management IC Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Power Management IC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Power Management IC Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Power Management IC Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 9: Global Power Management IC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Power Management IC Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Power Management IC Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Power Management IC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Power Management IC Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Global Power Management IC Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Power Management IC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Power Management IC Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Power Management IC Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global Power Management IC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Power Management IC Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Power Management IC Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 21: Global Power Management IC Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Management IC Industry?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the Power Management IC Industry?

Key companies in the market include Renesas Electronic Corporation, ROHM Co Ltd, Vishay Intertechnology Inc, Semiconductor Components Industries LLC (Onsemi), Infineon Technologies AG, NXP Semiconductors N V, Qualcomm Incorporated, Texas Instruments Incorporated, Analog Devices Inc, STMicroelectronics N V *List Not Exhaustive.

3. What are the main segments of the Power Management IC Industry?

The market segments include Product, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Energy-efficient Battery-powered Devices; Electrification Trend in the Automotive Sector.

6. What are the notable trends driving market growth?

Automotive to be the Fastest Growing End-user Industry.

7. Are there any restraints impacting market growth?

Design Complexity and Performance Limitations in High-power Applications.

8. Can you provide examples of recent developments in the market?

July 2023: Analog Devices Inc. revealed a significant investment exceeding USD 1 billion in expanding its semiconductor facilities located in Oregon. This ambitious expansion project is geared towards boosting production capacity, allowing the company to better cater to critical sectors such as communications, healthcare, industrial, automotive, and consumer electronics. Additionally, this endeavor is expected to generate hundreds of new, permanent job opportunities in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Management IC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Management IC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Management IC Industry?

To stay informed about further developments, trends, and reports in the Power Management IC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence