Key Insights

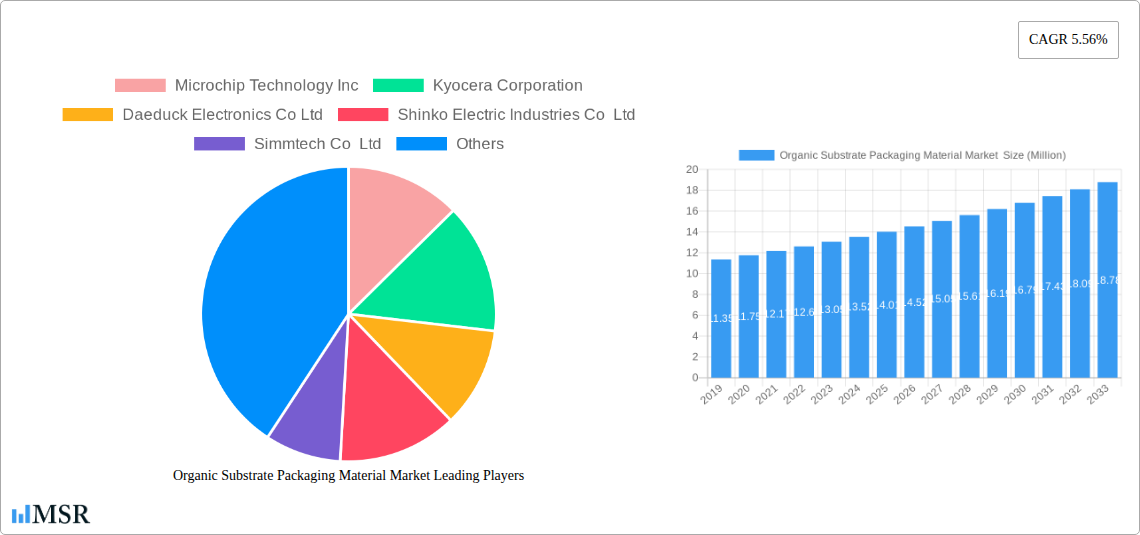

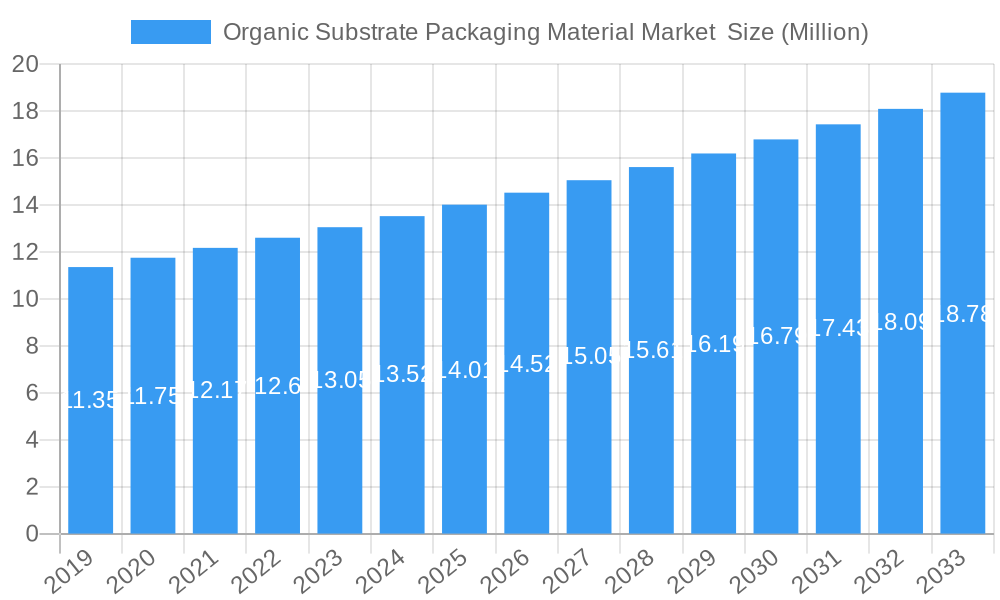

The global Organic Substrate Packaging Material Market is poised for substantial growth, projected to reach a market size of $14.64 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.56%. This expansion is fueled by the escalating demand for advanced semiconductor packaging solutions across a multitude of industries. Consumer electronics, including smartphones, wearables, and high-performance computing devices, are at the forefront of this surge, requiring smaller, thinner, and more efficient packaging to accommodate miniaturization and enhanced functionality. The automotive sector is another significant driver, with the increasing integration of electronic control units (ECUs) for advanced driver-assistance systems (ADAS), infotainment, and electric vehicle (EV) powertrains necessitating sophisticated and reliable organic substrates. Furthermore, the industrial and manufacturing segments are benefiting from the adoption of smart technologies and the Internet of Things (IoT), which rely heavily on embedded systems and robust packaging for harsh environments.

Organic Substrate Packaging Material Market Market Size (In Million)

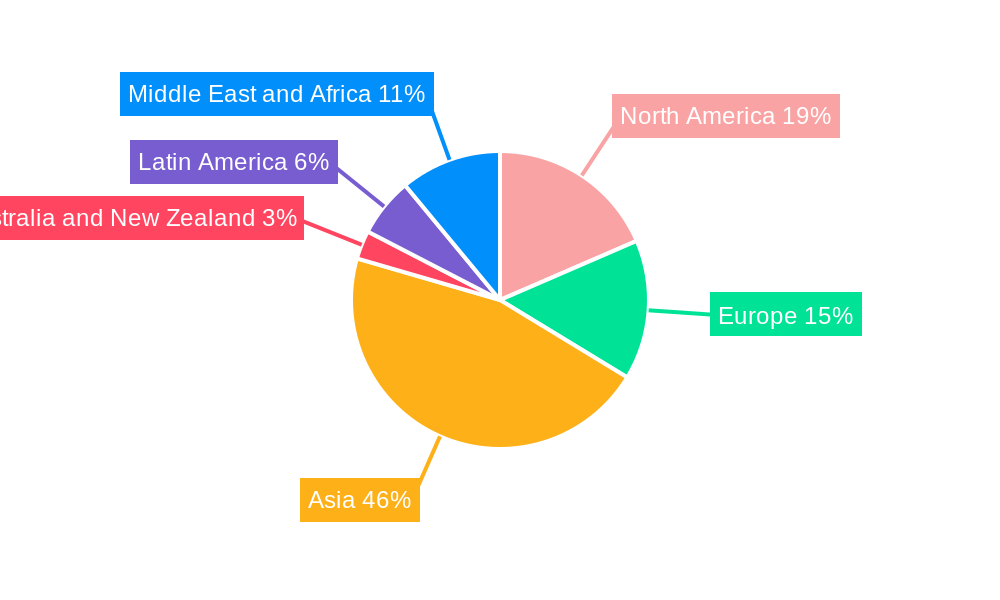

The market's growth trajectory is further shaped by key trends such as the increasing adoption of Fan-Out Wafer Level Packaging (FOWLP) and advanced substrate technologies like Embedded Wafer Level Ball Grid Array (eWLB) and Substrate-Embedded Packages (SEP). These innovations enable higher density interconnects, improved thermal management, and reduced form factors, catering to the relentless pursuit of performance and efficiency. While the market exhibits strong growth potential, certain restraints need to be navigated. The complexity and cost associated with advanced manufacturing processes, coupled with the stringent quality control required for high-reliability applications, can present challenges. However, ongoing research and development in materials science and manufacturing techniques are actively addressing these limitations. Geographically, Asia is anticipated to lead the market, owing to its dominant position in semiconductor manufacturing and the presence of major electronics producers. North America and Europe are also expected to witness significant growth, driven by innovation in automotive electronics and industrial automation.

Organic Substrate Packaging Material Market Company Market Share

Unlock critical insights into the burgeoning Organic Substrate Packaging Material Market with this comprehensive report. Analyze market dynamics, identify key growth drivers, and explore emerging opportunities in a sector poised for exponential expansion. This report provides in-depth analysis of the global market size, market share, and CAGR, offering actionable intelligence for stakeholders navigating the complex landscape of semiconductor packaging.

Study Period: 2019–2033 | Base Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

This report delves into the future of advanced electronic packaging, exploring the innovative organic substrate materials that are revolutionizing semiconductor packaging for applications spanning consumer electronics, automotive, manufacturing, industrial, and healthcare sectors. Discover how technologies like Small Thin Outline Packages (SOP), Pin Grid Array (PGA) Packages, Flat no-leads Packages (e.g., QFN), Quad Flat Package (QFP), and Dual inline Package (DIP) are being empowered by cutting-edge organic substrate solutions.

The Organic Substrate Packaging Material Market is experiencing significant growth, driven by the relentless demand for higher performance, miniaturization, and cost-effectiveness in electronic devices. This report offers a detailed examination of market trends, competitive landscapes, and strategic outlooks, providing a vital resource for semiconductor manufacturers, material suppliers, equipment providers, and investors seeking to capitalize on this dynamic market.

Organic Substrate Packaging Material Market Concentration & Dynamics

The Organic Substrate Packaging Material Market exhibits a moderately concentrated landscape, with key players actively investing in research and development to drive innovation in advanced packaging materials. The innovation ecosystem is robust, fueled by collaborations between material suppliers and semiconductor manufacturers to develop next-generation organic substrates that meet the stringent requirements of high-performance computing, AI, and 5G technologies. Regulatory frameworks are evolving to ensure environmental sustainability and material safety, influencing manufacturing processes and material choices. Substitute products, while present, are continuously challenged by the superior performance and cost-effectiveness offered by advanced organic substrates. End-user trends are heavily influenced by the increasing demand for smaller, more powerful, and energy-efficient electronic devices. Mergers and acquisitions (M&A) activities are strategic maneuvers by leading companies to expand their product portfolios, gain market share, and secure access to critical technologies. The market share is influenced by the technological capabilities and production capacities of major players. M&A deal counts are expected to rise as companies seek to consolidate their positions and address emerging market needs.

Organic Substrate Packaging Material Market Industry Insights & Trends

The Organic Substrate Packaging Material Market is witnessing a significant surge in growth, projected to reach a market size of approximately USD 25 Billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period of 2025–2033. This expansion is primarily driven by the escalating demand for sophisticated semiconductor packaging solutions across diverse end-user industries. The relentless miniaturization of electronic components, coupled with the increasing complexity of integrated circuits (ICs), necessitates the development of advanced organic substrate materials that offer superior electrical performance, thermal management, and mechanical robustness.

Key growth drivers include the proliferation of 5G technology, the exponential growth of the Internet of Things (IoT) ecosystem, and the increasing adoption of artificial intelligence (AI) and machine learning (ML) in various applications. The automotive sector, with its increasing electrification and adoption of advanced driver-assistance systems (ADAS), is a significant contributor, demanding high-reliability organic substrates for power modules and sensor packaging. Similarly, the consumer electronics market, driven by the demand for smartphones, wearables, and high-performance computing devices, continues to fuel the need for smaller, thinner, and more capable semiconductor packages.

Technological disruptions are at the forefront, with continuous innovation in organic substrate materials such as epoxy molding compounds (EMCs), liquid encapsulants, and advanced resin formulations. These advancements enable finer pitch interconnects, improved thermal dissipation, and enhanced reliability under extreme operating conditions. Evolving consumer behaviors, characterized by a preference for sleeker designs, longer battery life, and seamless connectivity, are indirectly pushing the boundaries of organic substrate packaging material development. The integration of novel materials and advanced manufacturing techniques is crucial for meeting these ever-increasing performance expectations and miniaturization goals.

Key Markets & Segments Leading Organic Substrate Packaging Material Market

The Organic Substrate Packaging Material Market is led by the Asia-Pacific region, driven by its robust semiconductor manufacturing ecosystem, particularly in countries like South Korea, Taiwan, and China. This dominance is further amplified by the strong presence of leading semiconductor packaging companies and their continuous investment in advanced technologies.

- Technology Dominance:

- Flat no-leads Packages (e.g., QFN): This segment is experiencing substantial growth due to its excellent thermal performance, small footprint, and cost-effectiveness, making it ideal for a wide range of consumer electronics and IoT devices. Economic growth in emerging markets and the demand for compact devices are key drivers.

- Small Thin Outline Packages (SOP): While a mature technology, SOPs continue to be crucial for many standard applications, supported by their established manufacturing processes and reliability.

- Other Technologies: Emerging packaging technologies, including advanced fan-out wafer-level packaging (FOWLP) and 2.5D/3D packaging, are increasingly relying on high-performance organic substrates, indicating a strong future growth trajectory for this sub-segment.

- Application Dominance:

- Consumer Electronics: This remains the largest and fastest-growing application segment, propelled by the insatiable demand for smartphones, tablets, laptops, gaming consoles, and wearable devices. Economic growth and increasing disposable incomes globally are significant drivers.

- Automotive: The automotive sector is a rapidly expanding market for organic substrate packaging materials. The surge in electric vehicles (EVs), autonomous driving technologies, and advanced infotainment systems requires highly reliable and high-performance packaging solutions for power electronics, sensors, and processors. Government initiatives promoting EVs and stricter safety regulations are key drivers.

- Industrial and Manufacturing: The Industry 4.0 revolution, with its emphasis on automation, smart factories, and industrial IoT, is creating significant demand for robust and reliable organic substrate packaging for control systems, sensors, and communication modules. Infrastructure development and digital transformation initiatives are major drivers.

- Healthcare: The growing demand for advanced medical devices, including wearables for health monitoring, diagnostic equipment, and implantable devices, is creating niche but high-value opportunities for specialized organic substrate packaging solutions that offer biocompatibility and miniaturization. Aging populations and advancements in medical technology are key drivers.

The dominance of these segments and regions is underpinned by factors such as technological advancements, robust supply chains, favorable government policies, and the increasing integration of semiconductors into everyday life.

Organic Substrate Packaging Material Market Product Developments

Recent product developments in the Organic Substrate Packaging Material Market highlight a focus on enhanced thermal management, increased density, and improved electrical performance. Companies are innovating with novel resin formulations and composite materials to create substrates capable of handling higher power densities and operating temperatures, crucial for advanced applications like AI accelerators and high-performance computing. The development of thinner and more flexible organic substrates is also a key trend, enabling the creation of smaller and more integrated electronic devices, particularly in the consumer electronics and wearable technology sectors. These advancements aim to provide a competitive edge by offering superior reliability, reduced signal loss, and greater design freedom for semiconductor manufacturers.

Challenges in the Organic Substrate Packaging Material Market Market

The Organic Substrate Packaging Material Market faces several challenges that could temper its growth trajectory. Regulatory hurdles related to environmental compliance and material safety, particularly concerning certain chemical compositions, can lead to increased development costs and production complexities. Supply chain disruptions, exacerbated by geopolitical factors and material scarcity, pose a significant risk to consistent production and timely delivery. Furthermore, intense competitive pressures among established players and emerging entrants can lead to price erosion and necessitate continuous investment in innovation to maintain market share. The cost of raw materials and the development of new, advanced materials can also present a significant barrier for smaller manufacturers.

Forces Driving Organic Substrate Packaging Material Market Growth

Several powerful forces are propelling the Organic Substrate Packaging Material Market forward. The relentless demand for smaller, faster, and more powerful electronic devices across all sectors is a primary driver. The rapid adoption of 5G technology and the expansion of the Internet of Things (IoT) ecosystem require advanced semiconductor packaging solutions that organic substrates are uniquely positioned to provide. Furthermore, the increasing sophistication of artificial intelligence (AI) and machine learning (ML) applications necessitates packaging that can handle higher processing power and data throughput. Government initiatives promoting digital transformation and technological innovation in various countries also provide a conducive environment for market growth.

Challenges in the Organic Substrate Packaging Material Market Market

Long-term growth in the Organic Substrate Packaging Material Market is significantly influenced by ongoing technological advancements and strategic market expansions. Continuous innovation in material science to develop substrates with superior dielectric properties, thermal conductivity, and mechanical strength is crucial. The development of environmentally friendly and sustainable organic substrate materials is also becoming increasingly important, driven by global environmental consciousness and regulatory pressures. Strategic partnerships and collaborations between organic substrate manufacturers and leading semiconductor foundries and integrated device manufacturers (IDMs) are essential for co-developing next-generation packaging solutions and securing long-term supply agreements. Market expansions into emerging economies with growing electronics manufacturing sectors will also contribute to sustained growth.

Emerging Opportunities in Organic Substrate Packaging Material Market

Emerging opportunities in the Organic Substrate Packaging Material Market are vast and diverse. The burgeoning electric vehicle (EV) market presents a significant opportunity for high-reliability organic substrates in power modules and battery management systems. The increasing demand for advanced medical devices, including implantable sensors and diagnostic tools, opens avenues for biocompatible and miniaturized organic substrate solutions. The continued growth of the cloud computing and data center infrastructure necessitates high-performance packaging for advanced processors and memory chips, driving innovation in organic substrate materials. Furthermore, the development of novel applications in areas such as augmented reality (AR), virtual reality (VR), and advanced sensing technologies will create new demands for specialized organic substrate packaging.

Leading Players in the Organic Substrate Packaging Material Market Sector

- Microchip Technology Inc

- Kyocera Corporation

- Daeduck Electronics Co Ltd

- Shinko Electric Industries Co Ltd

- Simmtech Co Ltd

- LG Innotek Co Ltd

- ASE Kaohsiung

- Texas Instruments Incorporated

- Amkor Technology Inc

- At&s

Key Milestones in Organic Substrate Packaging Material Market Industry

- July 2023: Samsung Electronics initiated mass production of flip-chip ball grid array (FC-BGA) in its factory located in Thai Nguyen province, in northern Vietnam, signaling expansion and increased capacity for advanced packaging.

- February 2023: LG Innotek announced its intention to commence production of flip-chip ball grid array (FC-BGA) components in October of the same year. LG Innotek is projected to achieve a monthly FC-BGA production capacity of 7.3 million units in 2023, with plans to expand it to 15 million units by 2026. Furthermore, LG Innotek disclosed its commitment to invest 413 billion won (approximately USD 311.58 million) to kickstart FC-BGA production, indicating significant investment in advanced substrate technologies.

- September 2022: Onsemi introduced a series of silicon carbide (SiC) based power modules utilizing transfer molded technology, designed for use in onboard charging and high voltage (HV) DCDC conversion in electric vehicles (EVs). The APM32 series represents a pioneering development as it incorporates SiC technology into a transfer molded package, enhancing efficiency and reducing the charging time of xEVs. These modules are specifically engineered for high-power 11-22kW onboard chargers (OBC) in EVs, highlighting advancements in substrate materials for the rapidly growing electric vehicle market.

Strategic Outlook for Organic Substrate Packaging Material Market Market

The strategic outlook for the Organic Substrate Packaging Material Market is highly optimistic, with growth accelerators centered around technological innovation, strategic partnerships, and market expansion. The increasing demand for higher performance and miniaturization in semiconductor devices will continue to drive the development of advanced organic substrate materials. Companies that invest in R&D for next-generation substrates with superior electrical, thermal, and mechanical properties will gain a significant competitive advantage. Furthermore, forging strong collaborations with leading semiconductor manufacturers and end-users will be crucial for aligning product development with market needs and securing long-term contracts. Expanding into emerging geographical markets with growing electronics manufacturing capabilities will also be a key strategy for sustained growth and market penetration.

Organic Substrate Packaging Material Market Segmentation

-

1. Technology

- 1.1. Small Thin Outline Packages

- 1.2. Pin Grid Array (PGA) Packages

- 1.3. Flat no-leads Packages

- 1.4. Quad Flat Package (QFP)

- 1.5. Dual inline Package (DIP)

- 1.6. Other Technologies

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Manufacturing

- 2.4. Industrial

- 2.5. Healthcare

- 2.6. Other Applications

Organic Substrate Packaging Material Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Organic Substrate Packaging Material Market Regional Market Share

Geographic Coverage of Organic Substrate Packaging Material Market

Organic Substrate Packaging Material Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Self-Driving Vehicles; Increasing Use of Portable Devices

- 3.3. Market Restrains

- 3.3.1. Market Consolidation affecting Overall Profitability

- 3.4. Market Trends

- 3.4.1. Consumer Electronics holds Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Substrate Packaging Material Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Small Thin Outline Packages

- 5.1.2. Pin Grid Array (PGA) Packages

- 5.1.3. Flat no-leads Packages

- 5.1.4. Quad Flat Package (QFP)

- 5.1.5. Dual inline Package (DIP)

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Manufacturing

- 5.2.4. Industrial

- 5.2.5. Healthcare

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Organic Substrate Packaging Material Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Small Thin Outline Packages

- 6.1.2. Pin Grid Array (PGA) Packages

- 6.1.3. Flat no-leads Packages

- 6.1.4. Quad Flat Package (QFP)

- 6.1.5. Dual inline Package (DIP)

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. Manufacturing

- 6.2.4. Industrial

- 6.2.5. Healthcare

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Organic Substrate Packaging Material Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Small Thin Outline Packages

- 7.1.2. Pin Grid Array (PGA) Packages

- 7.1.3. Flat no-leads Packages

- 7.1.4. Quad Flat Package (QFP)

- 7.1.5. Dual inline Package (DIP)

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. Manufacturing

- 7.2.4. Industrial

- 7.2.5. Healthcare

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Organic Substrate Packaging Material Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Small Thin Outline Packages

- 8.1.2. Pin Grid Array (PGA) Packages

- 8.1.3. Flat no-leads Packages

- 8.1.4. Quad Flat Package (QFP)

- 8.1.5. Dual inline Package (DIP)

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. Manufacturing

- 8.2.4. Industrial

- 8.2.5. Healthcare

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand Organic Substrate Packaging Material Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Small Thin Outline Packages

- 9.1.2. Pin Grid Array (PGA) Packages

- 9.1.3. Flat no-leads Packages

- 9.1.4. Quad Flat Package (QFP)

- 9.1.5. Dual inline Package (DIP)

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. Manufacturing

- 9.2.4. Industrial

- 9.2.5. Healthcare

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America Organic Substrate Packaging Material Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Small Thin Outline Packages

- 10.1.2. Pin Grid Array (PGA) Packages

- 10.1.3. Flat no-leads Packages

- 10.1.4. Quad Flat Package (QFP)

- 10.1.5. Dual inline Package (DIP)

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Consumer Electronics

- 10.2.2. Automotive

- 10.2.3. Manufacturing

- 10.2.4. Industrial

- 10.2.5. Healthcare

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East and Africa Organic Substrate Packaging Material Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Small Thin Outline Packages

- 11.1.2. Pin Grid Array (PGA) Packages

- 11.1.3. Flat no-leads Packages

- 11.1.4. Quad Flat Package (QFP)

- 11.1.5. Dual inline Package (DIP)

- 11.1.6. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Consumer Electronics

- 11.2.2. Automotive

- 11.2.3. Manufacturing

- 11.2.4. Industrial

- 11.2.5. Healthcare

- 11.2.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Microchip Technology Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kyocera Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Daeduck Electronics Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Shinko Electric Industries Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Simmtech Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 LG Innotek Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ASE Kaohsiung

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Texas Instruments Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Amkor Technology Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 At&s

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Microchip Technology Inc

List of Figures

- Figure 1: Global Organic Substrate Packaging Material Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Organic Substrate Packaging Material Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Organic Substrate Packaging Material Market Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America Organic Substrate Packaging Material Market Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America Organic Substrate Packaging Material Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Organic Substrate Packaging Material Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Organic Substrate Packaging Material Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Organic Substrate Packaging Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Organic Substrate Packaging Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Organic Substrate Packaging Material Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Organic Substrate Packaging Material Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Organic Substrate Packaging Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Organic Substrate Packaging Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Organic Substrate Packaging Material Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Organic Substrate Packaging Material Market Revenue (Million), by Technology 2025 & 2033

- Figure 16: Europe Organic Substrate Packaging Material Market Volume (K Unit), by Technology 2025 & 2033

- Figure 17: Europe Organic Substrate Packaging Material Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Organic Substrate Packaging Material Market Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe Organic Substrate Packaging Material Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Organic Substrate Packaging Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Organic Substrate Packaging Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Organic Substrate Packaging Material Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Organic Substrate Packaging Material Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Organic Substrate Packaging Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Organic Substrate Packaging Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Organic Substrate Packaging Material Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Organic Substrate Packaging Material Market Revenue (Million), by Technology 2025 & 2033

- Figure 28: Asia Organic Substrate Packaging Material Market Volume (K Unit), by Technology 2025 & 2033

- Figure 29: Asia Organic Substrate Packaging Material Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Organic Substrate Packaging Material Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia Organic Substrate Packaging Material Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Organic Substrate Packaging Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Organic Substrate Packaging Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Organic Substrate Packaging Material Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Organic Substrate Packaging Material Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Organic Substrate Packaging Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Organic Substrate Packaging Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Organic Substrate Packaging Material Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Organic Substrate Packaging Material Market Revenue (Million), by Technology 2025 & 2033

- Figure 40: Australia and New Zealand Organic Substrate Packaging Material Market Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Australia and New Zealand Organic Substrate Packaging Material Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Australia and New Zealand Organic Substrate Packaging Material Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Australia and New Zealand Organic Substrate Packaging Material Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Australia and New Zealand Organic Substrate Packaging Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Australia and New Zealand Organic Substrate Packaging Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Australia and New Zealand Organic Substrate Packaging Material Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Australia and New Zealand Organic Substrate Packaging Material Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Organic Substrate Packaging Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Organic Substrate Packaging Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Organic Substrate Packaging Material Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Organic Substrate Packaging Material Market Revenue (Million), by Technology 2025 & 2033

- Figure 52: Latin America Organic Substrate Packaging Material Market Volume (K Unit), by Technology 2025 & 2033

- Figure 53: Latin America Organic Substrate Packaging Material Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Latin America Organic Substrate Packaging Material Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Latin America Organic Substrate Packaging Material Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Latin America Organic Substrate Packaging Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Latin America Organic Substrate Packaging Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Latin America Organic Substrate Packaging Material Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Latin America Organic Substrate Packaging Material Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Organic Substrate Packaging Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Organic Substrate Packaging Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Organic Substrate Packaging Material Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Organic Substrate Packaging Material Market Revenue (Million), by Technology 2025 & 2033

- Figure 64: Middle East and Africa Organic Substrate Packaging Material Market Volume (K Unit), by Technology 2025 & 2033

- Figure 65: Middle East and Africa Organic Substrate Packaging Material Market Revenue Share (%), by Technology 2025 & 2033

- Figure 66: Middle East and Africa Organic Substrate Packaging Material Market Volume Share (%), by Technology 2025 & 2033

- Figure 67: Middle East and Africa Organic Substrate Packaging Material Market Revenue (Million), by Application 2025 & 2033

- Figure 68: Middle East and Africa Organic Substrate Packaging Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 69: Middle East and Africa Organic Substrate Packaging Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East and Africa Organic Substrate Packaging Material Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East and Africa Organic Substrate Packaging Material Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Organic Substrate Packaging Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Organic Substrate Packaging Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Organic Substrate Packaging Material Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 9: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 15: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 32: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 33: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 38: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 39: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Organic Substrate Packaging Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Organic Substrate Packaging Material Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Substrate Packaging Material Market ?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the Organic Substrate Packaging Material Market ?

Key companies in the market include Microchip Technology Inc, Kyocera Corporation, Daeduck Electronics Co Ltd, Shinko Electric Industries Co Ltd, Simmtech Co Ltd, LG Innotek Co Ltd, ASE Kaohsiung, Texas Instruments Incorporated, Amkor Technology Inc, At&s.

3. What are the main segments of the Organic Substrate Packaging Material Market ?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Self-Driving Vehicles; Increasing Use of Portable Devices.

6. What are the notable trends driving market growth?

Consumer Electronics holds Significant Share in the Market.

7. Are there any restraints impacting market growth?

Market Consolidation affecting Overall Profitability.

8. Can you provide examples of recent developments in the market?

July 2023: Samsung Electronics initiated mass production of flip-chip ball grid array (FC-BGA) in its factory located in Thai Nguyen province, in northern Vietnam.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Substrate Packaging Material Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Substrate Packaging Material Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Substrate Packaging Material Market ?

To stay informed about further developments, trends, and reports in the Organic Substrate Packaging Material Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence