Key Insights

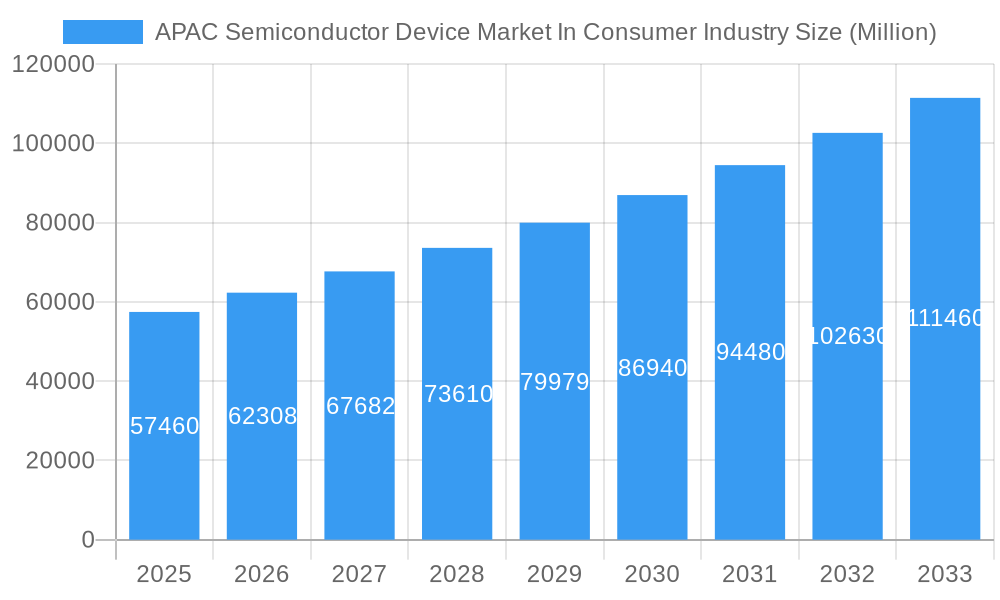

The APAC semiconductor device market within the consumer industry is experiencing robust growth, projected to reach a market size of $57.46 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning demand for smartphones, wearables, and other consumer electronics in rapidly developing economies like China and India is a primary catalyst. Furthermore, the increasing integration of semiconductors in innovative consumer products, such as smart home devices and advanced automotive systems, is significantly boosting market demand. Technological advancements, particularly in miniaturization and energy efficiency of semiconductor devices, are also contributing to market growth. While potential restraints such as geopolitical uncertainties and supply chain disruptions exist, the overall positive trajectory suggests a sustained period of expansion for the foreseeable future. The market is segmented by device type (discrete semiconductors, optoelectronics, sensors, and integrated circuits) and by semiconductor type (microprocessors, microcontrollers, and digital signal processors), providing diverse avenues for growth within specific niches. Major players like Infineon, NXP, Toshiba, and Samsung are leveraging their established expertise and market presence to capitalize on this expanding market. Regional variations in growth are expected, with China and India anticipated to be major contributors given their large and rapidly growing consumer bases. The consistent demand for improved processing power, data storage, and connectivity in consumer electronics will continue to propel this market’s growth trajectory.

APAC Semiconductor Device Market In Consumer Industry Market Size (In Billion)

The diverse range of applications for semiconductor devices across various consumer electronic segments ensures continued market dynamism. Companies are investing heavily in research and development to improve performance, reduce power consumption, and enhance the functionality of these devices. This innovation, coupled with the expanding consumer base in the APAC region, particularly the increasing adoption of advanced technologies in emerging markets, ensures the long-term viability and growth potential of this market segment. The ongoing development of 5G technology and the Internet of Things (IoT) are further strengthening market prospects, driving the need for more sophisticated and integrated semiconductor solutions in consumer devices. While challenges related to raw material costs and global economic conditions may influence growth rates, the underlying market fundamentals remain robust and supportive of continued expansion.

APAC Semiconductor Device Market In Consumer Industry Company Market Share

APAC Semiconductor Device Market in Consumer Industry: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) semiconductor device market within the consumer industry, covering the period from 2019 to 2033. It delves into market dynamics, key segments, leading players, and emerging trends, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. The report leverages meticulous data analysis and expert insights to forecast market growth and identify lucrative opportunities. Key players like Infineon Technologies AG, NXP Semiconductors NV, and TSMC are analyzed, providing a strategic competitive landscape. This report is essential for investors, industry professionals, and strategic decision-makers seeking actionable intelligence.

APAC Semiconductor Device Market In Consumer Industry Market Concentration & Dynamics

The APAC semiconductor device market in the consumer industry exhibits a moderately concentrated landscape, with a few major players commanding significant market share. Infineon Technologies AG, NXP Semiconductors NV, and Samsung Electronics Co Ltd are among the leading players, collectively accounting for an estimated xx% of the market in 2025. The market is characterized by a dynamic innovation ecosystem, driven by continuous advancements in semiconductor technology and rising consumer demand for sophisticated electronic devices. Regulatory frameworks, particularly concerning data privacy and product safety, significantly impact market operations. Substitute products, such as alternative energy sources for electronics, pose a potential challenge. End-user trends, including the growing adoption of smart devices and IoT applications, are driving market growth. Furthermore, the industry experiences considerable M&A activity, with an estimated xx deals recorded between 2019 and 2024, indicating strategic consolidation and expansion efforts.

- Market Share (2025): Top 3 players – xx%

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: (Specific regulations impacting the market will be detailed in the full report)

- Substitute Products: (Specific substitute products and their market impact will be detailed in the full report)

APAC Semiconductor Device Market In Consumer Industry Industry Insights & Trends

The APAC semiconductor device market in the consumer industry is experiencing robust growth, driven by several factors. The market size reached an estimated xx Million in 2025 and is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, including the proliferation of 5G technology, the rise of Artificial Intelligence (AI), and the increasing sophistication of consumer electronics, are key drivers. Evolving consumer behaviors, such as the growing preference for smart, connected devices and the increasing adoption of online services, further propel market expansion. The market is witnessing significant disruptions from the introduction of new materials and manufacturing techniques, improving efficiency and performance. The integration of semiconductors into diverse consumer applications also contributes to market expansion. The shift towards miniaturization, enhanced energy efficiency, and improved performance are defining industry trends.

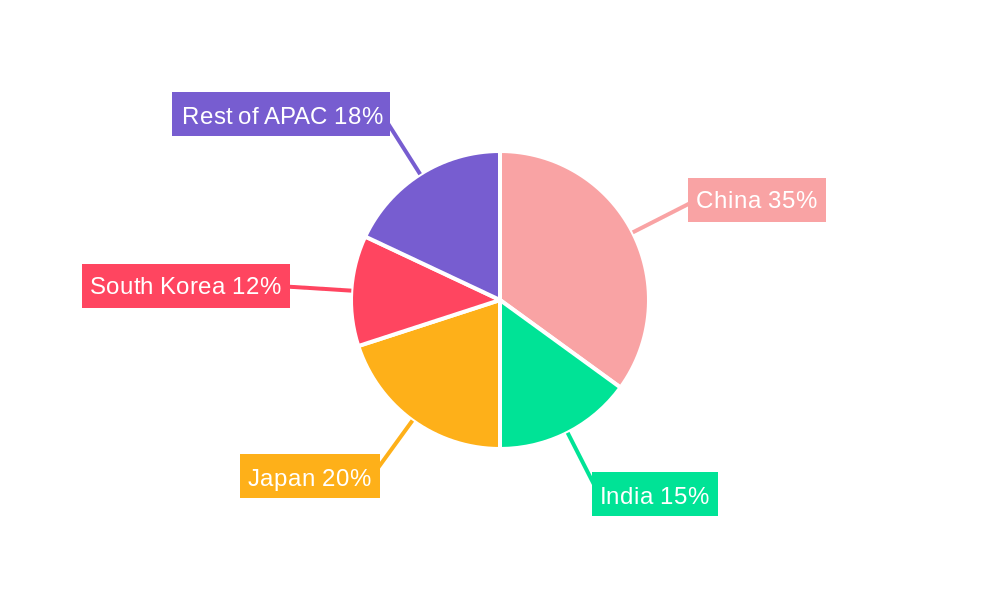

Key Markets & Segments Leading APAC Semiconductor Industry

The report identifies key markets and segments within the APAC semiconductor device market for consumer applications. China and India emerge as dominant markets, driven by strong economic growth, expanding middle classes, and rising consumer spending on electronics. Integrated Circuits (ICs) represent the largest segment, followed by sensors and optoelectronics. The detailed market breakdown is presented below:

Dominant Regions/Countries:

- China: Strong economic growth, large consumer base, and government support for technological advancement.

- India: Rapidly growing economy, increasing smartphone penetration, and expanding digital infrastructure.

- Others: South Korea, Japan, Taiwan, and other APAC countries contribute significantly, driving growth.

Dominant Segments:

- By Device Type: Integrated Circuits (ICs), holding the largest market share driven by the wide application in electronics, followed by Sensors (growth fueled by IoT and wearable devices) and Optoelectronics (due to increasing demand in displays and consumer lighting).

- By Micro: Microprocessors (MPUs) and Microcontrollers (MCUs) are key segments, driven by the demand for advanced computing power in consumer electronics and IoT devices. Digital Signal Processors (DSPs) show steady growth, fueled by the need for signal processing in audio-visual applications.

Drivers for Key Segments:

- Integrated Circuits: Growth is fueled by increasing demand for smartphones, wearables, and other sophisticated consumer electronics.

- Sensors: The burgeoning Internet of Things (IoT) and the rise of wearable technology drive substantial growth.

- Optoelectronics: Growth is boosted by the demand for advanced displays, lighting solutions, and optical communication systems.

- Microprocessors (MPUs): The demand is primarily driven by the need for powerful processing capabilities in smartphones, tablets, and other high-performance consumer electronics.

- Microcontrollers (MCUs): The demand is driven by the expanding IoT market and the increasing use of embedded systems in various consumer products.

- Digital Signal Processors (DSPs): Growth stems from their use in audio-visual applications, including high-definition TVs and digital cameras.

APAC Semiconductor Device Market In Consumer Industry Product Developments

Significant product innovations are reshaping the APAC semiconductor device market. The emergence of advanced ICs, incorporating Artificial Intelligence (AI) capabilities and enhanced energy efficiency, is a major trend. Miniaturization continues to drive progress, resulting in smaller, more powerful devices that consume less energy. New materials and manufacturing processes are delivering improved performance and reduced costs. These innovations are providing manufacturers with a competitive edge, driving market growth, and expanding product applications in diverse consumer segments.

Challenges in the APAC Semiconductor Device Market In Consumer Industry Market

The APAC semiconductor device market faces several challenges. Stringent regulatory requirements relating to environmental standards and product safety can increase production costs and complexity. Global supply chain disruptions, particularly related to raw materials and manufacturing capacity, represent a major risk. Intense competition among established players and the emergence of new entrants create price pressures and necessitate ongoing innovation. These factors, if not managed effectively, can impact market growth and profitability. For example, disruptions in the supply of specific materials caused a xx% increase in production costs in 2023.

Forces Driving APAC Semiconductor Device Market In Consumer Industry Growth

Several factors contribute to the continued growth of the APAC semiconductor device market in the consumer industry. Technological advancements, particularly in 5G, AI, and IoT, are major drivers. The expanding middle class in key APAC countries fuels increasing consumer spending on electronics. Government initiatives to promote technological innovation and infrastructure development further enhance market growth. These combined forces drive a continuous need for more sophisticated and feature-rich devices, fostering a steady expansion of the market.

Long-Term Growth Catalysts in the APAC Semiconductor Device Market

Long-term growth will be driven by advancements in semiconductor technology, focusing on higher integration, lower power consumption, and improved performance. Strategic partnerships and collaborations between device manufacturers and consumer electronics companies will streamline innovation and product development. Expanding into new markets and customer segments will unlock further growth opportunities. These factors will ensure the APAC semiconductor device market continues its upward trajectory in the long term.

Emerging Opportunities in APAC Semiconductor Device Market In Consumer Industry

Emerging opportunities lie in the adoption of new technologies, including AI-powered devices, advanced sensor technology for wearables, and high-bandwidth communication solutions. The expansion of the Internet of Things (IoT) and the increasing demand for smart home and connected car applications open avenues for significant market growth. Focusing on environmentally sustainable designs and reducing the carbon footprint of semiconductor production will also be a key area for future opportunities.

Leading Players in the APAC Semiconductor Device Market In Consumer Industry Sector

Key Milestones in APAC Semiconductor Device Market In Consumer Industry Industry

- May 2024: Toshiba completed a 300-millimeter wafer fabrication facility for power semiconductors in Ishikawa Prefecture, Japan, significantly boosting its production capacity and impacting the power semiconductor segment.

- Feb 2024: TSMC announced expansion plans in Kumamoto, Japan, focusing on logic chip production for CMOS camera sensors and automotive applications. This strategic move, supported by significant government investment, underscores the growing importance of the APAC region in semiconductor manufacturing and its impact on the overall market.

Strategic Outlook for APAC Semiconductor Device Market In Consumer Industry Market

The APAC semiconductor device market in the consumer industry presents a significant growth opportunity. Continued technological advancements, coupled with strong economic growth in key markets and government support, are set to drive further expansion. Companies that can effectively leverage technological innovations, manage supply chain complexities, and cater to evolving consumer preferences will be best positioned to capitalize on this dynamic market's potential. Strategic investments in R&D, strategic partnerships, and efficient manufacturing processes will be crucial to maintaining a competitive edge.

APAC Semiconductor Device Market In Consumer Industry Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessors (MPU)

- 1.4.4.2. Microcontrollers (MCU)

- 1.4.4.3. Digital Signal Processors

-

2. Geography

- 2.1. Japan

- 2.2. China

- 2.3. India

- 2.4. South Korea

APAC Semiconductor Device Market In Consumer Industry Segmentation By Geography

- 1. Japan

- 2. China

- 3. India

- 4. South Korea

APAC Semiconductor Device Market In Consumer Industry Regional Market Share

Geographic Coverage of APAC Semiconductor Device Market In Consumer Industry

APAC Semiconductor Device Market In Consumer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Emergence of new technologies like AI

- 3.2.2 and IoT; Increased Deployment of 5G and Rising Demand for 5G Smartphones; Increasing demand for smartphones and the introduction of budget friendly smartphones

- 3.3. Market Restrains

- 3.3.1. Low Demand Due to Impact of COVID-; Competitive Prices Led to Stiff Profit Margins

- 3.4. Market Trends

- 3.4.1. The Integrated Circuits Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessors (MPU)

- 5.1.4.4.2. Microcontrollers (MCU)

- 5.1.4.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Japan

- 5.2.2. China

- 5.2.3. India

- 5.2.4. South Korea

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. India

- 5.3.4. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Japan APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Discrete Semiconductors

- 6.1.2. Optoelectronics

- 6.1.3. Sensors

- 6.1.4. Integrated Circuits

- 6.1.4.1. Analog

- 6.1.4.2. Logic

- 6.1.4.3. Memory

- 6.1.4.4. Micro

- 6.1.4.4.1. Microprocessors (MPU)

- 6.1.4.4.2. Microcontrollers (MCU)

- 6.1.4.4.3. Digital Signal Processors

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Japan

- 6.2.2. China

- 6.2.3. India

- 6.2.4. South Korea

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. China APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Discrete Semiconductors

- 7.1.2. Optoelectronics

- 7.1.3. Sensors

- 7.1.4. Integrated Circuits

- 7.1.4.1. Analog

- 7.1.4.2. Logic

- 7.1.4.3. Memory

- 7.1.4.4. Micro

- 7.1.4.4.1. Microprocessors (MPU)

- 7.1.4.4.2. Microcontrollers (MCU)

- 7.1.4.4.3. Digital Signal Processors

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Japan

- 7.2.2. China

- 7.2.3. India

- 7.2.4. South Korea

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. India APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Discrete Semiconductors

- 8.1.2. Optoelectronics

- 8.1.3. Sensors

- 8.1.4. Integrated Circuits

- 8.1.4.1. Analog

- 8.1.4.2. Logic

- 8.1.4.3. Memory

- 8.1.4.4. Micro

- 8.1.4.4.1. Microprocessors (MPU)

- 8.1.4.4.2. Microcontrollers (MCU)

- 8.1.4.4.3. Digital Signal Processors

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Japan

- 8.2.2. China

- 8.2.3. India

- 8.2.4. South Korea

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. South Korea APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Discrete Semiconductors

- 9.1.2. Optoelectronics

- 9.1.3. Sensors

- 9.1.4. Integrated Circuits

- 9.1.4.1. Analog

- 9.1.4.2. Logic

- 9.1.4.3. Memory

- 9.1.4.4. Micro

- 9.1.4.4.1. Microprocessors (MPU)

- 9.1.4.4.2. Microcontrollers (MCU)

- 9.1.4.4.3. Digital Signal Processors

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Japan

- 9.2.2. China

- 9.2.3. India

- 9.2.4. South Korea

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kyocera Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Broadcom Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Renesas Electronics Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SK Hynix Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Intel Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Fujitsu Semiconductor Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: APAC Semiconductor Device Market In Consumer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: APAC Semiconductor Device Market In Consumer Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 11: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Semiconductor Device Market In Consumer Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the APAC Semiconductor Device Market In Consumer Industry?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors NV, Toshiba Corporation, Kyocera Corporation, Samsung Electronics Co Ltd, Broadcom Inc, STMicroelectronics NV, Renesas Electronics Corporation, SK Hynix Inc, Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Intel Corporation, Fujitsu Semiconductor Ltd.

3. What are the main segments of the APAC Semiconductor Device Market In Consumer Industry?

The market segments include Device Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of new technologies like AI. and IoT; Increased Deployment of 5G and Rising Demand for 5G Smartphones; Increasing demand for smartphones and the introduction of budget friendly smartphones.

6. What are the notable trends driving market growth?

The Integrated Circuits Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Low Demand Due to Impact of COVID-; Competitive Prices Led to Stiff Profit Margins.

8. Can you provide examples of recent developments in the market?

May 2024: Toshiba finished 300-millimeter wafer fabrication facility for power semiconductors and an office building at KagaToshiba Electronics Corporation in Ishikawa Prefecture, Japan, one of Toshiba’s key group companies. Toshiba will now proceed with equipment installation, aiming to start mass production in the second half of fiscal year 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Semiconductor Device Market In Consumer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Semiconductor Device Market In Consumer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Semiconductor Device Market In Consumer Industry?

To stay informed about further developments, trends, and reports in the APAC Semiconductor Device Market In Consumer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence