Key Insights

The global Plasma Etching Equipment market is projected for significant expansion, with an estimated market size of $8.03 billion in 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 14.58% through 2033. This growth is driven by increasing demand for advanced semiconductor devices in consumer electronics, healthcare, and industrial applications. The miniaturization of electronic components and the complexity of integrated circuits necessitate sophisticated plasma etching for precise patterning of next-generation chips. The adoption of 5G, AI, and IoT technologies further fuels the need for high-performance, compact semiconductor devices, directly increasing demand for advanced plasma etching equipment.

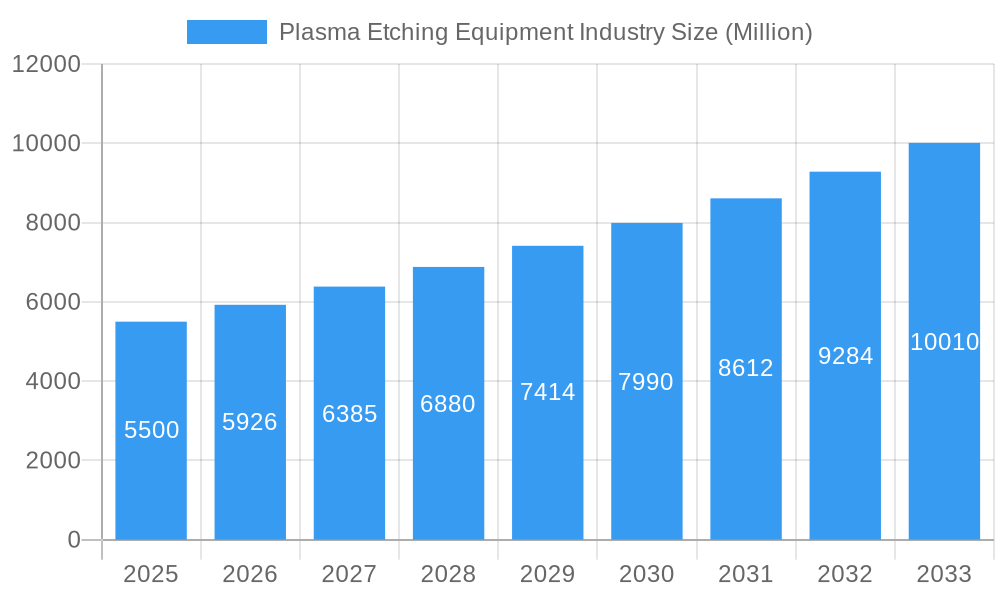

Plasma Etching Equipment Industry Market Size (In Billion)

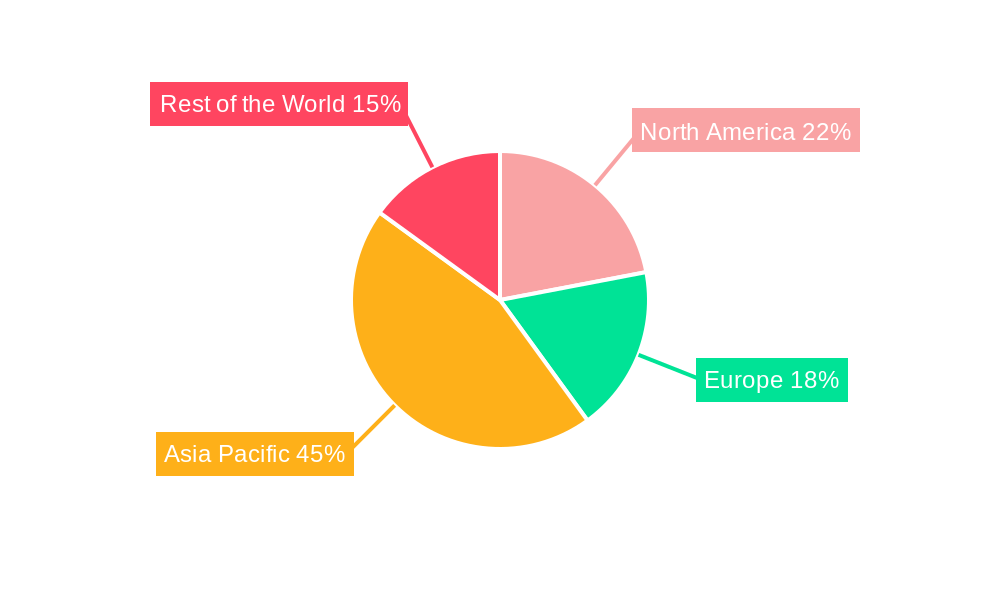

Key market trends include the growing adoption of Inductively Coupled Plasma (ICP) etching for superior plasma uniformity and control, vital for high-aspect-ratio etching. Deep Reactive Ion Etching (DRIE) is gaining traction for MEMS fabrication and advanced packaging, enabling specialized microstructures. While demand is strong, high capital investment for advanced systems and global semiconductor supply chain challenges may pose restraints. Continuous innovation in etching technology, focusing on throughput, precision, and reduced process variations, alongside strategic collaborations, is expected to overcome these challenges. Asia Pacific is anticipated to lead market growth, owing to its semiconductor manufacturing dominance and investments in advanced technology.

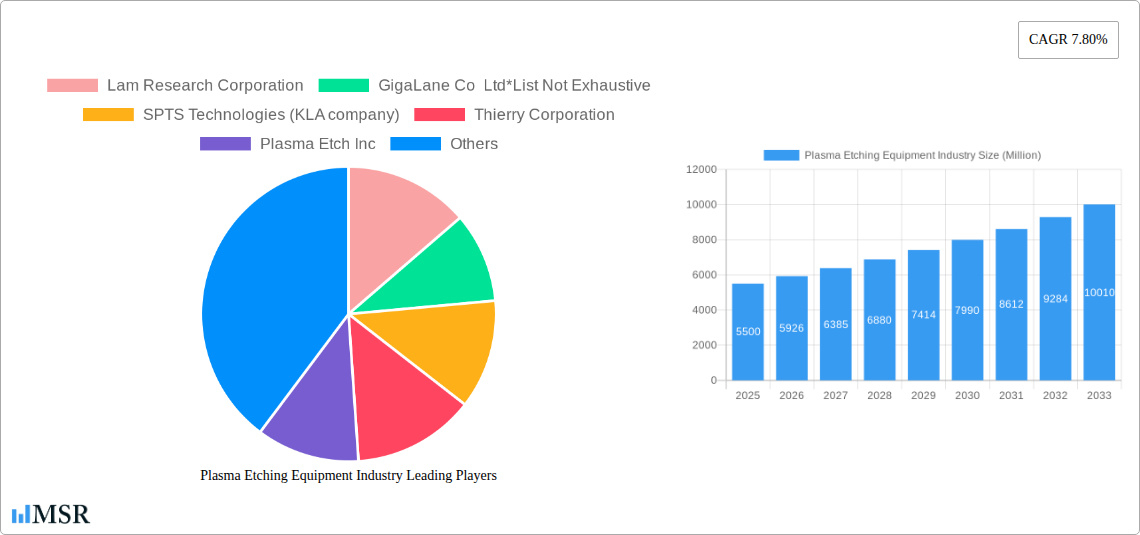

Plasma Etching Equipment Industry Company Market Share

Plasma Etching Equipment Industry Market Report: Unlocking the Future of Semiconductor Manufacturing

This comprehensive report delves into the intricate dynamics of the global Plasma Etching Equipment industry, providing critical insights for stakeholders seeking to navigate this rapidly evolving sector. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis offers a robust understanding of market trends, technological advancements, and competitive landscapes. Discover key growth drivers, emerging opportunities, and strategic imperatives shaping the future of semiconductor fabrication.

Plasma Etching Equipment Industry Market Concentration & Dynamics

The plasma etching equipment industry exhibits a moderate to high market concentration, primarily dominated by a few key players who command significant market share through continuous innovation and strategic acquisitions. The innovation ecosystem is vibrant, driven by the relentless demand for miniaturization and enhanced performance in semiconductor devices. Regulatory frameworks, particularly concerning environmental impact and safety standards, are evolving, influencing manufacturing processes and equipment design. Substitute products, such as wet etching or other advanced patterning techniques, exist but often lack the precision and scalability offered by plasma etching for critical fabrication steps. End-user trends are heavily influenced by the consumer electronics sector, with increasing demand for sophisticated smartphones, wearables, and advanced computing solutions fueling the need for cutting-edge etching capabilities. Mergers and acquisitions (M&A) are a significant aspect of market dynamics, allowing larger players to expand their product portfolios and geographical reach. For instance, KLA's acquisition of SPTS Technologies underscores this trend, consolidating expertise in critical process steps. M&A deal counts have been consistent over the historical period, indicating a strategic consolidation phase. Market share distribution, while dynamic, sees companies like Applied Materials, Tokyo Electron, and Lam Research holding substantial portions due to their extensive research and development investments and broad product offerings.

Plasma Etching Equipment Industry Industry Insights & Trends

The global Plasma Etching Equipment industry is poised for substantial growth, driven by the relentless demand for advanced semiconductor devices across various end-use sectors. The market size is projected to reach over $10 Billion by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. Key growth drivers include the burgeoning consumer electronics market, with the proliferation of 5G-enabled devices, artificial intelligence, and the Internet of Things (IoT) necessitating more powerful and efficient microchips. The automotive industry's increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies, both heavily reliant on sophisticated semiconductor components, also presents a significant demand catalyst. Furthermore, the expansion of data centers and cloud computing infrastructure, coupled with advancements in the medical applications sector, particularly in implantable devices and advanced diagnostics, are contributing to sustained market expansion. Technological disruptions, such as the development of Deep Reactive Ion Etching (DRIE) for 3D NAND flash memory and advanced packaging solutions, are reshaping the competitive landscape. The continuous pursuit of smaller feature sizes and higher yields in chip manufacturing fuels ongoing innovation in plasma etching technologies, leading to the development of more precise, efficient, and cost-effective equipment. Evolving consumer behaviors, particularly the demand for more personalized and interconnected devices, indirectly stimulate the need for customized and high-performance semiconductor solutions, further bolstering the plasma etching equipment market. The transition to next-generation manufacturing processes, including EUV lithography, requires complementary advancements in etching techniques, creating a synergistic growth environment. The Industrial Applications segment, encompassing automation and smart manufacturing, is also a significant contributor to the industry's upward trajectory. The historical period (2019–2024) has witnessed steady growth, setting a strong foundation for the projected expansion.

Key Markets & Segments Leading Plasma Etching Equipment Industry

The Asia Pacific region is the dominant market for plasma etching equipment, driven by its status as the global hub for semiconductor manufacturing. Countries like South Korea, Taiwan, and China are at the forefront, housing major foundries and fabless semiconductor companies that heavily invest in advanced etching technologies. This dominance is further amplified by substantial government initiatives aimed at boosting domestic semiconductor production capabilities.

Within the Type segment, Deep Reactive Ion Etching (DRIE) is experiencing significant growth, primarily due to its critical role in fabricating high-aspect-ratio structures required for advanced memory devices, MEMS (Micro-Electro-Mechanical Systems), and power devices. The increasing demand for 3D NAND flash memory and advanced packaging solutions directly translates to a higher demand for DRIE equipment.

- DRIE Drivers:

- Exponential growth in demand for high-density memory storage solutions.

- Advancements in MEMS technology for sensors and actuators.

- Development of next-generation power semiconductors for EVs and renewable energy.

- Need for intricate 3D structures in advanced packaging.

In terms of Application, Consumer Electronics remains the largest and most influential segment. The insatiable demand for smartphones, tablets, laptops, gaming consoles, and wearable devices, all powered by increasingly complex semiconductor chips, directly fuels the market for plasma etching equipment. The rapid pace of innovation in this sector necessitates continuous upgrades and acquisitions of state-of-the-art etching tools to achieve smaller feature sizes, improved performance, and enhanced power efficiency.

- Consumer Electronics Drivers:

- Rapid product cycles and feature upgrades in smartphones and other consumer gadgets.

- The growing adoption of IoT devices and smart home technologies.

- Increased consumer spending on premium electronics.

- Demand for higher processing power and graphics capabilities.

While Consumer Electronics leads, Industrial Applications are also a significant and growing segment. This includes semiconductor devices used in automation, robotics, industrial control systems, and the burgeoning smart manufacturing sector. The Industry 4.0 revolution, characterized by increased automation and data-driven processes, relies heavily on advanced semiconductor components that are enabled by precise plasma etching. The Medical Applications segment, though smaller, is poised for robust growth, driven by advancements in medical imaging, diagnostics, implantable devices, and personalized medicine, all of which require sophisticated microelectronics fabricated using advanced etching techniques.

Plasma Etching Equipment Industry Product Developments

Recent product developments in the plasma etching equipment industry highlight a strong focus on enhancing precision, throughput, and versatility. Companies are introducing tools capable of handling larger wafer sizes and enabling more complex etching processes. Innovations in plasma source design and control systems allow for finer control over ion and radical distributions, crucial for achieving atomic-level etch profiles and minimizing damage. For instance, the introduction of new chambers designed for high-resolution processes on larger glass substrates demonstrates the industry's commitment to supporting next-generation display technologies. Furthermore, advancements in plasma uniformity and etch selectivity are enabling the fabrication of advanced power devices and integrated circuits with improved performance and reliability. These developments are driven by the relentless pursuit of miniaturization and the demand for higher performance in semiconductor devices across all applications.

Challenges in the Plasma Etching Equipment Industry Market

The plasma etching equipment industry faces several challenges that can impact growth. High capital investment required for state-of-the-art equipment presents a significant barrier for smaller manufacturers and research institutions. Supply chain complexities, particularly for specialized components and raw materials, can lead to production delays and increased costs. Intensifying competition from established players and emerging regional manufacturers necessitates continuous innovation and cost optimization. Furthermore, evolving environmental regulations related to the use of specific gases and waste disposal can add to operational complexities and costs. The long lead times for developing and qualifying new etching processes also pose a challenge, as market demands can shift rapidly.

Forces Driving Plasma Etching Equipment Industry Growth

Several key forces are propelling the growth of the plasma etching equipment industry. The fundamental driver is the ever-increasing demand for advanced semiconductor devices, fueled by the expansion of the digital economy, artificial intelligence, 5G, and the IoT. Technological advancements in lithography, such as EUV lithography, directly necessitate complementary advancements in etching technologies for achieving higher resolutions and more complex 3D structures. Growing investments in research and development by leading semiconductor manufacturers to push the boundaries of Moore's Law and explore novel architectures are creating a continuous demand for cutting-edge etching solutions. Additionally, government initiatives and subsidies in various regions to bolster domestic semiconductor manufacturing capabilities are significantly boosting market expansion. The expanding applications in automotive electronics and medical devices further diversify and strengthen the demand for plasma etching.

Challenges in the Plasma Etching Equipment Industry Market

Long-term growth catalysts for the plasma etching equipment industry are rooted in continued innovation in advanced materials and device architectures. The development of new etching chemistries and plasma generation techniques will be crucial for enabling the fabrication of next-generation transistors, memory cells, and quantum computing components. Strategic partnerships and collaborations between equipment manufacturers, semiconductor foundries, and research institutions will foster a more integrated approach to problem-solving and accelerate the development of novel etching solutions. Furthermore, expansion into emerging markets with nascent semiconductor industries presents significant long-term growth opportunities. The increasing need for specialized etching processes for advanced packaging technologies, such as heterogeneous integration, will also serve as a sustained growth driver.

Emerging Opportunities in Plasma Etching Equipment Industry

Emerging opportunities within the plasma etching equipment industry are abundant, driven by cutting-edge technological advancements and evolving market demands. The burgeoning field of quantum computing requires highly precise etching for fabricating qubits and associated control circuitry, presenting a nascent but high-potential market. The continued growth of advanced packaging solutions, including chiplets and 3D stacking, opens avenues for specialized etching equipment designed for intricate interconnections and wafer-level processing. The increasing focus on sustainability is also creating opportunities for developing more energy-efficient and environmentally friendly plasma etching processes and equipment. Furthermore, the expansion of semiconductor manufacturing in new geographical regions and the growing demand for specialized etching in sectors like biotechnology and advanced sensors offer significant avenues for market diversification and growth.

Leading Players in the Plasma Etching Equipment Industry Sector

- Lam Research Corporation

- GigaLane Co Ltd

- SPTS Technologies (KLA company)

- Thierry Corporation

- Plasma Etch Inc

- Applied Materials Inc

- Plasma-Therm LLC

- Tokyo Electron Limited

- Oxford Instruments PLC

- Samco Inc

- Sentech Instruments GmbH

- Advanced Micro-Fabrication Equipment Inc

Key Milestones in Plasma Etching Equipment Industry Industry

- February 2022: Lam Research Corporation announced the Syndion GP, a new product designed to enable chipmakers to develop next-generation power management integrated circuits and power devices using deep silicon etch technology. According to the company, Syndion GP can provide good control of the plasma across the wafer by controlling the distribution of ions and radicals for the deep silicon etch (DRIE) process.

- December 2021: Tokyo Electron launched Impressio 2400 PICP Pro, a plasma etch system for processing 8th generation glass substrates featuring the new PICP Pro chamber for high-resolution processes.

Strategic Outlook for Plasma Etching Equipment Industry Market

The strategic outlook for the Plasma Etching Equipment industry market is exceptionally positive, characterized by sustained growth accelerators. The primary growth accelerator is the unwavering demand for increasingly sophisticated semiconductor devices, driven by megatrends such as AI, 5G, autonomous driving, and the expansion of the IoT. Future market potential lies in the continuous evolution of etching technologies to meet the demands of sub-nanometer process nodes and novel device architectures. Strategic opportunities include developing specialized etching solutions for advanced packaging, quantum computing, and neuromorphic computing. Furthermore, expanding service and support offerings globally, and focusing on developing more sustainable and energy-efficient etching processes will be crucial for long-term competitive advantage. Companies that invest heavily in R&D, foster strategic partnerships, and adapt to the dynamic demands of the semiconductor landscape will be best positioned for success.

Plasma Etching Equipment Industry Segmentation

-

1. Type

- 1.1. Reactive Ion Etching (RIE)

- 1.2. Inductively Coupled Plasma Etching (ICP)

- 1.3. Deep Reactive Ion Etching (DRIE)

- 1.4. Other Types

-

2. Application

- 2.1. Industrial Applications

- 2.2. Medical Applications

- 2.3. Consumer Electronics

- 2.4. Other Applications

Plasma Etching Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Plasma Etching Equipment Industry Regional Market Share

Geographic Coverage of Plasma Etching Equipment Industry

Plasma Etching Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Semiconductor Industry; Rising Demand for Compact and Energy Efficient Electronic Devices

- 3.3. Market Restrains

- 3.3.1. Growing Complexities Related to Miniaturized Structures of Circuits

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Reactive Ion Etching (RIE)

- 5.1.2. Inductively Coupled Plasma Etching (ICP)

- 5.1.3. Deep Reactive Ion Etching (DRIE)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial Applications

- 5.2.2. Medical Applications

- 5.2.3. Consumer Electronics

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Reactive Ion Etching (RIE)

- 6.1.2. Inductively Coupled Plasma Etching (ICP)

- 6.1.3. Deep Reactive Ion Etching (DRIE)

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial Applications

- 6.2.2. Medical Applications

- 6.2.3. Consumer Electronics

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Reactive Ion Etching (RIE)

- 7.1.2. Inductively Coupled Plasma Etching (ICP)

- 7.1.3. Deep Reactive Ion Etching (DRIE)

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial Applications

- 7.2.2. Medical Applications

- 7.2.3. Consumer Electronics

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Reactive Ion Etching (RIE)

- 8.1.2. Inductively Coupled Plasma Etching (ICP)

- 8.1.3. Deep Reactive Ion Etching (DRIE)

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial Applications

- 8.2.2. Medical Applications

- 8.2.3. Consumer Electronics

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Reactive Ion Etching (RIE)

- 9.1.2. Inductively Coupled Plasma Etching (ICP)

- 9.1.3. Deep Reactive Ion Etching (DRIE)

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial Applications

- 9.2.2. Medical Applications

- 9.2.3. Consumer Electronics

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lam Research Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 GigaLane Co Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPTS Technologies (KLA company)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thierry Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Plasma Etch Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Applied Materials Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Plasma-Therm LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tokyo Electron Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Oxford Instruments PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Samco Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sentech Instruments GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Advanced Micro-Fabrication Equipment Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Lam Research Corporation

List of Figures

- Figure 1: Global Plasma Etching Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plasma Etching Equipment Industry?

The projected CAGR is approximately 14.58%.

2. Which companies are prominent players in the Plasma Etching Equipment Industry?

Key companies in the market include Lam Research Corporation, GigaLane Co Ltd*List Not Exhaustive, SPTS Technologies (KLA company), Thierry Corporation, Plasma Etch Inc, Applied Materials Inc, Plasma-Therm LLC, Tokyo Electron Limited, Oxford Instruments PLC, Samco Inc, Sentech Instruments GmbH, Advanced Micro-Fabrication Equipment Inc.

3. What are the main segments of the Plasma Etching Equipment Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.03 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Semiconductor Industry; Rising Demand for Compact and Energy Efficient Electronic Devices.

6. What are the notable trends driving market growth?

Consumer Electronics Segment to Drive the Demand.

7. Are there any restraints impacting market growth?

Growing Complexities Related to Miniaturized Structures of Circuits.

8. Can you provide examples of recent developments in the market?

February 2022 - Lam Research Corporation, a plasma etch and deposition tool manufacturer, announced the Syndion GP, a new product designed to enable chipmakers to develop next-generation power management integrated circuits and power devices using deep silicon etch technology. According to the company, Syndion GP can provide good control of the plasma across the wafer by controlling the distribution of ions and radicals for the deep silicon etch (DRIE) process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plasma Etching Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plasma Etching Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plasma Etching Equipment Industry?

To stay informed about further developments, trends, and reports in the Plasma Etching Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence