Key Insights

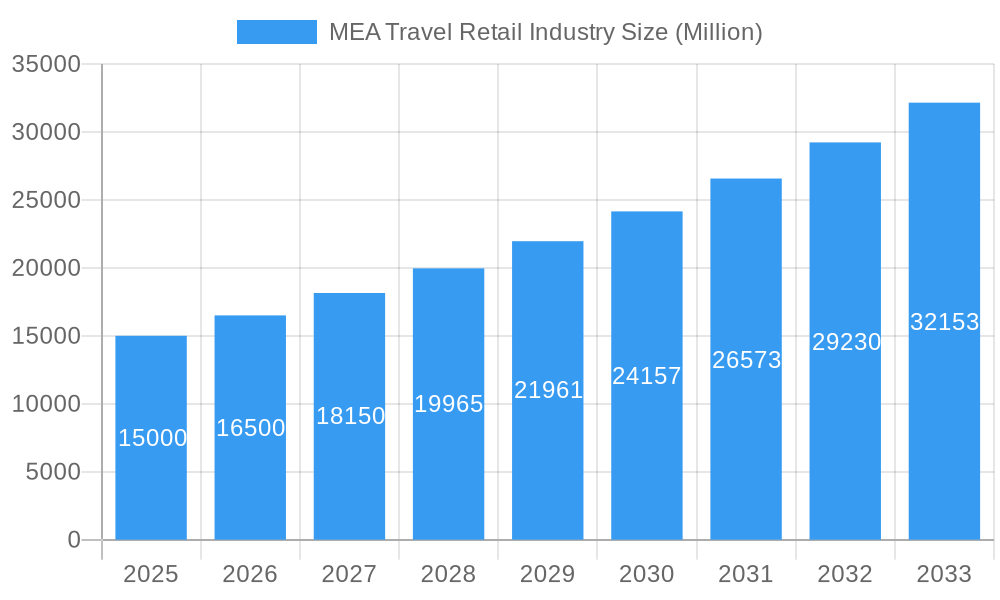

The Middle East and Africa (MEA) travel retail market is projected for significant expansion, propelled by escalating air passenger volumes, rising disposable incomes, and heightened demand for premium goods and experiences among travelers. The market is anticipated to achieve a CAGR of 5.4% from 2025 to 2030. Key growth drivers include the region's pivotal role as a global aviation hub, substantial investments in airport infrastructure development, and an increasing influx of tourists. The proliferation of airport duty-free outlets offering comprehensive product selections further stimulates market growth. Technological advancements, such as online pre-ordering and mobile payment solutions, are enhancing customer engagement and contributing to sales uplift.

MEA Travel Retail Industry Market Size (In Billion)

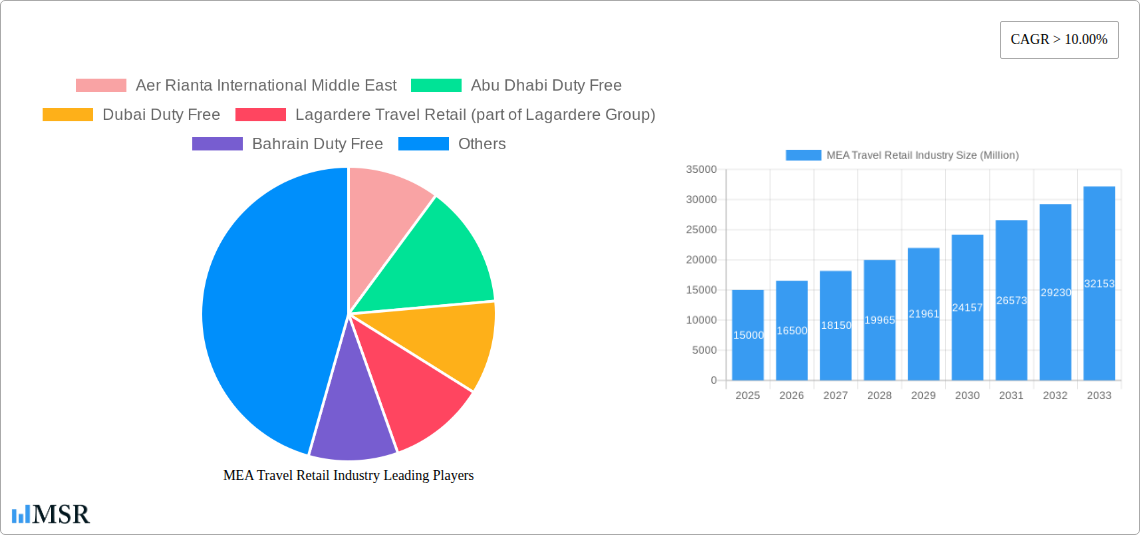

The MEA travel retail market is segmented across diverse product categories including perfumes & cosmetics, liquor & tobacco, confectionery, and fashion accessories. Leading operators such as Dufry AG, Aer Rianta International Middle East, and Dubai Duty Free hold substantial market share, capitalizing on strong brand equity and extensive retail footprints. Emerging regional entities are also capturing market share by offering distinctive product assortments and localized retail concepts. Prospective challenges encompass currency fluctuations, regional geopolitical dynamics, and potential global economic downturns. Sustained growth necessitates adaptation to evolving consumer preferences, adoption of innovative retail strategies, and efficient management of operational complexities. Emphasis on personalized offerings, omnichannel integration, and sustainability initiatives will be crucial for future market success. The estimated market size for 2025 is $72.57 billion.

MEA Travel Retail Industry Company Market Share

MEA Travel Retail Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) travel retail industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The MEA travel retail market is expected to reach $XX Million by 2033, presenting significant potential for growth and investment. This report covers key players such as Aer Rianta International Middle East, Abu Dhabi Duty Free, Dubai Duty Free, and Dufry AG, among others.

MEA Travel Retail Industry Market Concentration & Dynamics

The MEA travel retail market exhibits a moderately concentrated landscape, dominated by a few major players like Dubai Duty Free and Dufry AG, holding significant market share. However, the presence of numerous smaller, regional operators fosters competition. Market share dynamics are influenced by factors such as strategic partnerships, M&A activity, and the success of new product introductions. The regulatory environment, while generally supportive of industry growth, varies across different MEA countries. Innovation ecosystems are developing, with a focus on enhancing the customer experience through technology and personalized offerings. Substitute products, such as online retail and local shopping, pose a challenge, necessitating constant innovation and value-added services within the travel retail sector. End-user trends show a growing preference for luxury goods, personalized experiences, and sustainable products.

- Market Concentration: Dubai Duty Free and Dufry AG hold approximately XX% and YY% market share, respectively (2024 estimate).

- M&A Activity: An estimated XX M&A deals occurred between 2019 and 2024, primarily focused on consolidating market share and expanding regional presence.

MEA Travel Retail Industry Industry Insights & Trends

The MEA travel retail market is experiencing robust growth, driven primarily by increasing passenger traffic at major airports, rising disposable incomes, and a surge in tourism. The market size reached $XX Million in 2024 and is projected to grow at a CAGR of XX% from 2025 to 2033. Technological disruptions, such as the adoption of mobile payment systems and personalized marketing campaigns, are transforming the consumer experience. Evolving consumer behaviors, including a greater preference for premium brands and omnichannel shopping experiences, are shaping the industry's trajectory. Furthermore, the increasing focus on sustainability and ethical sourcing is influencing product selection and brand choices.

Key Markets & Segments Leading MEA Travel Retail Industry

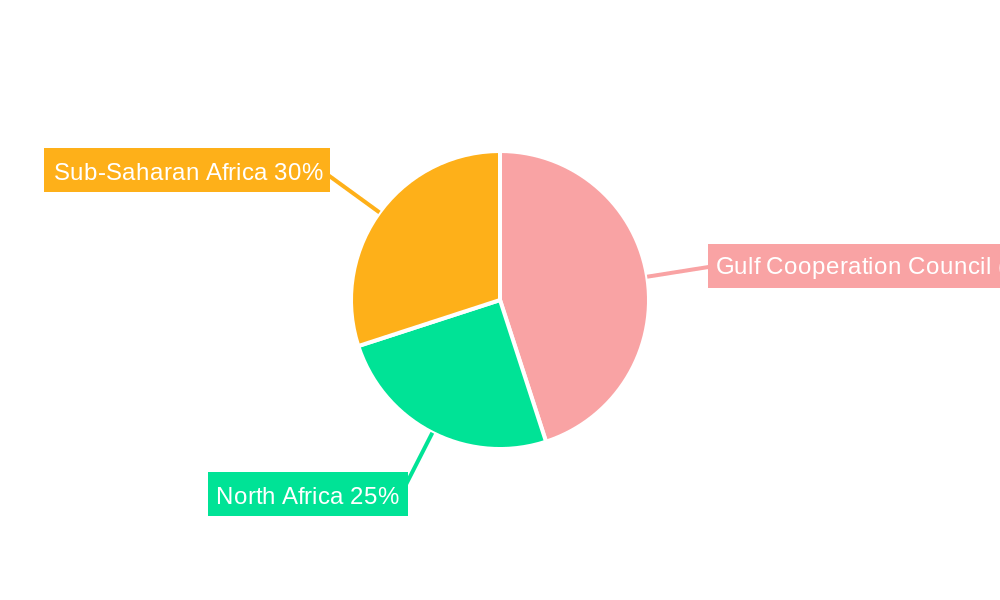

Dubai International Airport (DXB) and other major airports in the UAE, such as Abu Dhabi International Airport, remain dominant in the MEA travel retail market. The UAE accounts for approximately XX% of the total market revenue (2024 estimate). Other significant markets include those in Saudi Arabia, Qatar, and South Africa. The luxury goods segment constitutes a major portion of the overall market, reflecting the high spending power of international travelers.

- Key Market Drivers:

- Rapid economic growth in several MEA countries.

- Increasing tourism and air passenger traffic.

- Development of advanced airport infrastructure.

- Rising disposable incomes and a growing middle class.

MEA Travel Retail Industry Product Developments

The MEA travel retail industry witnesses constant product innovation, with an emphasis on offering unique and exclusive products unavailable in local markets. Technological advancements, like interactive displays and personalized recommendations, enhance the shopping experience. Competition compels brands to constantly develop new product lines and collaborations to capture market share. This focus on premium goods, particularly in the luxury and beauty segments, is paramount to success.

Challenges in the MEA Travel Retail Industry Market

The MEA travel retail sector faces challenges such as fluctuating currency exchange rates, geopolitical instability in certain regions, and supply chain disruptions impacting product availability and prices. Stringent regulatory frameworks and varying import/export regulations across countries present logistical complexities. Furthermore, intense competition among established players and the emergence of new entrants necessitate continuous innovation and adaptation. The impact of these factors is estimated to result in a XX% reduction in projected revenue in specific years, according to our analysis.

Forces Driving MEA Travel Retail Industry Growth

Several factors drive the growth of the MEA travel retail market. The increasing number of international tourists visiting the region, coupled with improved airport infrastructure and expanding connectivity, contributes significantly. Economic growth in several key markets boosts consumer spending, while innovative marketing strategies and technological advancements enhance the shopping experience. Supportive government policies and investment in airport infrastructure further stimulate growth.

Challenges in the MEA Travel Retail Industry Market

Long-term growth will depend on maintaining strong partnerships with key airport operators and airlines, coupled with strategic investments in technology and customer experience improvements. Expansion into new markets within the MEA region and exploring untapped consumer segments will also be crucial. Sustaining competitive advantages through product differentiation and personalized marketing initiatives will contribute significantly to growth.

Emerging Opportunities in MEA Travel Retail Industry

Emerging opportunities include the growth of e-commerce platforms for pre-ordering and delivery of products, the expansion of duty-free shopping into new airport locations, and the increasing demand for personalized travel retail experiences. Targeting the millennial and Gen Z demographics with tailored products and promotions presents significant potential. Leveraging data analytics to understand consumer preferences and optimize product offerings can enhance competitiveness.

Leading Players in the MEA Travel Retail Industry Sector

- Aer Rianta International Middle East

- Abu Dhabi Duty Free

- Dubai Duty Free

- Lagardere Travel Retail (part of Lagardere Group)

- Bahrain Duty Free

- Beirut Duty Free

- Big Five Duty Free Stores

- Hamila Duty Free

- Kreol Travel Retail

- Pernod Ricard Global Travel Retail

- Dufry AG

- EgyptAir for Tourism (El Karnak) and Duty Free Shops Company (EADFS)

Key Milestones in MEA Travel Retail Industry Industry

- June 2021: Leading French luxury brand Louis Vuitton announced plans to open a boutique at Dubai International (DXB) in partnership with Dubai Duty-Free, signaling the growing importance of luxury brands in the MEA travel retail market.

- June 2021: Dubai Duty Free launched the "Plant a Tree, Plant A Legacy" initiative, demonstrating a growing commitment to sustainability within the industry.

Strategic Outlook for MEA Travel Retail Industry Market

The MEA travel retail market is poised for significant growth over the next decade. Continued investments in airport infrastructure, the expansion of air travel, and the rising disposable incomes in several key markets will drive this growth. By focusing on delivering exceptional customer experiences, leveraging technological advancements, and embracing sustainable practices, companies can secure a leading position in this dynamic market. Strategic partnerships and mergers and acquisitions will continue to shape the competitive landscape.

MEA Travel Retail Industry Segmentation

-

1. Product Type

- 1.1. Fashion and Accessories

- 1.2. Jewellery and Watches

- 1.3. Wine and Spirits

- 1.4. Food and Confectionary

- 1.5. Fragnances and Cosmetics

- 1.6. Tobacco

- 1.7. Others (Stationery, Electronics, etc.)

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Others (Railway Stations, Border, Downtown)

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Rest of Middle East and Africa

MEA Travel Retail Industry Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

MEA Travel Retail Industry Regional Market Share

Geographic Coverage of MEA Travel Retail Industry

MEA Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The UAE has been Playing a Key Role in Attracting More Customers and thus Recording Year-on-Year Revenues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewellery and Watches

- 5.1.3. Wine and Spirits

- 5.1.4. Food and Confectionary

- 5.1.5. Fragnances and Cosmetics

- 5.1.6. Tobacco

- 5.1.7. Others (Stationery, Electronics, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Others (Railway Stations, Border, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Arab Emirates MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fashion and Accessories

- 6.1.2. Jewellery and Watches

- 6.1.3. Wine and Spirits

- 6.1.4. Food and Confectionary

- 6.1.5. Fragnances and Cosmetics

- 6.1.6. Tobacco

- 6.1.7. Others (Stationery, Electronics, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Airports

- 6.2.2. Airlines

- 6.2.3. Ferries

- 6.2.4. Others (Railway Stations, Border, Downtown)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fashion and Accessories

- 7.1.2. Jewellery and Watches

- 7.1.3. Wine and Spirits

- 7.1.4. Food and Confectionary

- 7.1.5. Fragnances and Cosmetics

- 7.1.6. Tobacco

- 7.1.7. Others (Stationery, Electronics, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Airports

- 7.2.2. Airlines

- 7.2.3. Ferries

- 7.2.4. Others (Railway Stations, Border, Downtown)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. South Africa MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fashion and Accessories

- 8.1.2. Jewellery and Watches

- 8.1.3. Wine and Spirits

- 8.1.4. Food and Confectionary

- 8.1.5. Fragnances and Cosmetics

- 8.1.6. Tobacco

- 8.1.7. Others (Stationery, Electronics, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Airports

- 8.2.2. Airlines

- 8.2.3. Ferries

- 8.2.4. Others (Railway Stations, Border, Downtown)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa MEA Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fashion and Accessories

- 9.1.2. Jewellery and Watches

- 9.1.3. Wine and Spirits

- 9.1.4. Food and Confectionary

- 9.1.5. Fragnances and Cosmetics

- 9.1.6. Tobacco

- 9.1.7. Others (Stationery, Electronics, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Airports

- 9.2.2. Airlines

- 9.2.3. Ferries

- 9.2.4. Others (Railway Stations, Border, Downtown)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Aer Rianta International Middle East

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Abu Dhabi Duty Free

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dubai Duty Free

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lagardere Travel Retail (part of Lagardere Group)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bahrain Duty Free

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Beirut Duty Free

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Big Five Duty Free Stores

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hamila Duty Free

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kreol Travel Retail

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pernod Ricard Global Travel Retail

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dufry AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 EgyptAir for Tourism (El Karnak) and Duty Free Shops Company (EADFS)**List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Aer Rianta International Middle East

List of Figures

- Figure 1: Global MEA Travel Retail Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United Arab Emirates MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: United Arab Emirates MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Saudi Arabia MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Saudi Arabia MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South Africa MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: South Africa MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: South Africa MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: South Africa MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South Africa MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: South Africa MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: South Africa MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South Africa MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Middle East and Africa MEA Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Middle East and Africa MEA Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global MEA Travel Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global MEA Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global MEA Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global MEA Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global MEA Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Travel Retail Industry?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the MEA Travel Retail Industry?

Key companies in the market include Aer Rianta International Middle East, Abu Dhabi Duty Free, Dubai Duty Free, Lagardere Travel Retail (part of Lagardere Group), Bahrain Duty Free, Beirut Duty Free, Big Five Duty Free Stores, Hamila Duty Free, Kreol Travel Retail, Pernod Ricard Global Travel Retail, Dufry AG, EgyptAir for Tourism (El Karnak) and Duty Free Shops Company (EADFS)**List Not Exhaustive.

3. What are the main segments of the MEA Travel Retail Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.57 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The UAE has been Playing a Key Role in Attracting More Customers and thus Recording Year-on-Year Revenues.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2021, Leading French luxury brand Louis Vuitton announced plans to open a boutique at Dubai International (DXB) by the end of 2021 in partnership with Dubai Duty-Free.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Travel Retail Industry?

To stay informed about further developments, trends, and reports in the MEA Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence