Key Insights

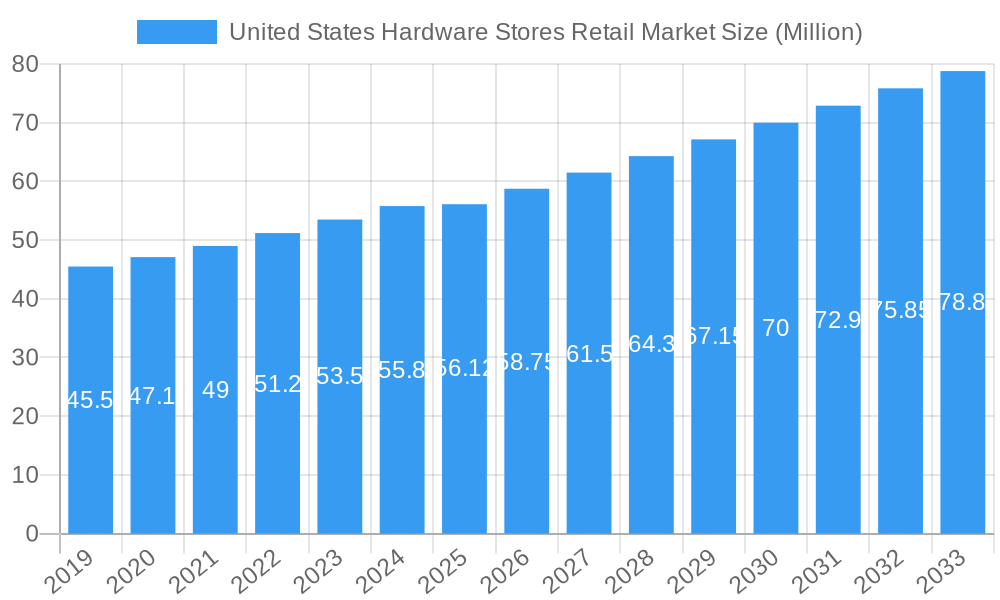

The United States Hardware Stores Retail Market is poised for steady expansion, projected to reach an estimated value of $56.12 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 4.89% between 2019 and 2033, indicating sustained momentum in the sector. The market's vitality is driven by several key factors, including the ongoing trend of home improvement and renovation projects undertaken by a significant portion of the U.S. population, particularly in an era where homeowners are investing more in their living spaces. Furthermore, the robust construction industry, both residential and commercial, continues to fuel demand for hardware products. The increasing adoption of DIY culture, amplified by accessible online tutorials and readily available products, also plays a crucial role. E-commerce penetration within the hardware retail space is also a significant driver, offering consumers greater convenience and wider product selection.

United States Hardware Stores Retail Market Market Size (In Million)

While the market benefits from these drivers, certain restraints warrant consideration. Economic fluctuations and potential downturns can impact consumer spending on non-essential home improvements. Rising raw material costs for manufacturing hardware products can also put pressure on profit margins for retailers and potentially lead to price increases for consumers. Additionally, intense competition among established players and the emergence of new online retailers necessitate continuous innovation in product offerings and customer service strategies. The market is segmented across various product types, including essential Door Hardware, diverse Building Materials, functional Kitchen and Toilet Products, and a range of Other Product Types, catering to a broad spectrum of consumer needs. Distribution channels are primarily split between traditional Offline retail and increasingly influential Online platforms, reflecting evolving consumer purchasing habits. Key companies dominating this landscape include Home Depot Inc., Lowe's Companies Inc., Menard Inc., Ace Hardware, and True Value Hardware, alongside other notable players contributing to the market's competitive dynamics.

United States Hardware Stores Retail Market Company Market Share

Unlock comprehensive insights into the dynamic United States hardware stores retail market with this indispensable report. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this analysis delivers critical data for industry stakeholders. Discover market size, growth drivers, trends, challenges, and opportunities shaping the future of DIY home improvement, building materials retail, and home services. This report meticulously examines key players like Home Depot Inc, Lowe's Companies Inc, Menard Inc, Ace Hardware, True Value Hardware, 84 Lumber, Handy Andy Home Improvement Centers Inc, Hippo Hardware and Trading Company, Orchard Supply Hardware, and Harbor Freight Tools. Explore segment-specific data for Door Hardware, Building Materials, Kitchen and Toilet Products, and Other Product Types, along with distribution channel analysis of Offline and Online sales.

United States Hardware Stores Retail Market Market Concentration & Dynamics

The United States hardware stores retail market exhibits a moderate to high level of concentration, with a few major players dominating the landscape. Home Depot Inc and Lowe's Companies Inc command significant market share, driving innovation and setting industry standards. The market is characterized by a robust innovation ecosystem, with continuous product development and the integration of new technologies to enhance customer experience. Regulatory frameworks, while generally supportive of retail operations, can influence product safety standards and environmental compliance. Substitute products, such as direct-to-consumer online retailers and specialized service providers, present competitive challenges. End-user trends indicate a growing demand for sustainable products, smart home integration, and professional installation services. Mergers and acquisitions (M&A) activities, though less frequent among the top-tier players, are crucial for market consolidation and expansion, particularly among smaller regional chains and specialized service providers. For instance, recent M&A activities have focused on acquiring specialized home services to bolster omnichannel offerings.

United States Hardware Stores Retail Market Industry Insights & Trends

The United States hardware stores retail market is poised for substantial growth, projected to reach an estimated USD XX Billion in 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by several key market growth drivers. The persistent demand for home renovation and remodeling projects, driven by an aging housing stock and increased homeowner equity, continues to be a primary catalyst. Furthermore, the DIY culture remains strong, encouraged by accessible online tutorials and readily available product information. Technological disruptions are profoundly reshaping the industry, with the increasing adoption of e-commerce platforms and the integration of Artificial Intelligence (AI) for personalized recommendations and inventory management. The rise of smart home technology also presents significant opportunities, with consumers seeking integrated solutions for security, energy efficiency, and convenience. Evolving consumer behaviors are characterized by a preference for convenient shopping experiences, encompassing both online retail and in-store services. Customers are increasingly seeking expert advice and professional installation services, blurring the lines between retail and service provision. The trend towards sustainability is also gaining traction, with a growing demand for eco-friendly products and materials. The market's resilience is further bolstered by its essential nature, serving both professional contractors and individual consumers for everyday needs and project-based purchases. The continuous need for repairs, maintenance, and upgrades ensures a steady revenue stream, even in fluctuating economic conditions.

Key Markets & Segments Leading United States Hardware Stores Retail Market

The United States hardware stores retail market is led by the Building Materials segment, which consistently represents the largest share due to the ongoing demand for construction, renovation, and repair projects across residential and commercial sectors. This dominance is driven by factors such as infrastructure development initiatives, new housing starts, and the inherent need for foundational and finishing materials. The Offline distribution channel remains the primary driver of revenue, accounting for a significant portion of sales, owing to the tangible nature of many hardware products and the preference of many consumers for in-person product selection and immediate availability. However, the Online distribution channel is experiencing rapid growth, fueled by convenience, a wider product selection, and the ability to compare prices easily, especially for smaller items and repeat purchases.

Product Type Dominance:

- Building Materials: The consistent demand for lumber, drywall, roofing, insulation, and concrete materials underpins the leadership of this segment. Economic growth, interest rates affecting new construction, and repair needs directly influence its performance.

- Door Hardware: While a smaller segment, its steady demand for replacement and new installations, coupled with aesthetic upgrades, contributes significantly.

- Kitchen and Toilet Products: This segment benefits from renovation trends and the essential nature of these fixtures, experiencing cyclical upturns during periods of increased home improvement activity.

- Other Product Types: This broad category, encompassing tools, paint, garden supplies, and fasteners, benefits from the diverse needs of both DIY enthusiasts and professionals.

Distribution Channel Dominance:

- Offline: The established store networks of major players provide a significant advantage. The ability to offer expert advice, immediate product availability, and the experience of browsing physical products ensures its continued relevance, particularly for large or complex purchases.

- Online: The burgeoning e-commerce landscape allows for broader market reach, catering to a younger demographic and those prioritizing convenience. Click-and-collect services are increasingly bridging the gap between online and offline experiences.

United States Hardware Stores Retail Market Product Developments

Product innovation within the United States hardware stores retail market is centered on enhancing efficiency, sustainability, and user experience. Advances in power tools incorporate lighter materials and longer-lasting battery technology. Sustainable building materials, such as recycled content insulation and low-VOC paints, are gaining prominence. The integration of smart technology into home hardware, including smart locks and smart lighting systems, is a key trend, offering consumers enhanced control and connectivity. These developments are driven by a focus on creating products that are not only functional but also environmentally responsible and technologically advanced, providing a competitive edge to manufacturers and retailers.

Challenges in the United States Hardware Stores Retail Market Market

The United States hardware stores retail market faces several significant challenges. Intense competition from online retailers and big-box stores puts pressure on pricing and margins. Supply chain disruptions, including raw material shortages and increased shipping costs, can impact product availability and profitability. Regulatory hurdles related to environmental standards and product safety add complexity. Furthermore, the skilled labor shortage in the construction and home services sector can affect demand for certain product categories and the availability of installation services, creating an indirect restraint on market growth.

Forces Driving United States Hardware Stores Retail Market Growth

Several powerful forces are propelling the United States hardware stores retail market forward. The ongoing trend of homeownership and the desire for personalized living spaces fuel continuous demand for renovation and DIY projects. Technological advancements, particularly in e-commerce and digital marketing, expand reach and enhance customer engagement. Government initiatives supporting infrastructure development and home improvement tax credits can also stimulate growth. Additionally, the increasing focus on energy efficiency and sustainability in housing is driving demand for related products, creating a robust market for eco-friendly alternatives.

Challenges in the United States Hardware Stores Retail Market Market

Long-term growth catalysts for the United States hardware stores retail market lie in strategic adaptation and market expansion. Continued investment in omnichannel strategies that seamlessly integrate online and offline experiences will be crucial. Expanding service offerings, such as professional installation and maintenance packages, will cater to evolving consumer preferences and capture higher value. The development and promotion of sustainable and smart home product lines will tap into growing consumer demand. Furthermore, strategic partnerships with home builders, real estate agencies, and service providers can create new avenues for market penetration and customer acquisition.

Emerging Opportunities in United States Hardware Stores Retail Market

Emerging opportunities in the United States hardware stores retail market are abundant. The growing demand for smart home integration presents a significant growth area, with opportunities in connected devices, security systems, and energy management solutions. The increasing focus on aging-in-place solutions for the elderly population offers potential for specialized products and services. The expansion of services, including plumbing, electrical, and HVAC repair, through partnerships or in-house offerings, can create recurring revenue streams. Furthermore, the growing interest in urban gardening and sustainable living is driving demand for related products, opening new niche markets.

Leading Players in the United States Hardware Stores Retail Market Sector

- Home Depot Inc

- Lowe's Companies Inc

- Menard Inc

- Ace Hardware

- True Value Hardware

- 84 Lumber

- Handy Andy Home Improvement Centers Inc

- Hippo Hardware and Trading Company

- Orchard Supply Hardware

- Harbor Freight Tools

Key Milestones in United States Hardware Stores Retail Market Industry

- September 2023: Lowe declared the extension of its multi-year agreement with the NFL for the current year's season. The collaboration will commence with a comprehensive marketing campaign, including a national television commercial, an updated lineup of Lowe's Home Team players, and the introduction of a limited-edition DIY Wrist Coach accessory.

- June 2023: Ace Hardware purchased 12 independent heating and air, plumbing, and electrical home services companies from Unique Indoor Comfort's portfolio, which was owned by the Atlanta-based private equity firm Grove Mountain.

Strategic Outlook for United States Hardware Stores Retail Market Market

The strategic outlook for the United States hardware stores retail market is optimistic, driven by ongoing consumer demand for home improvement and the industry's ability to adapt to technological advancements. Key growth accelerators include the expansion of e-commerce capabilities, the enhancement of in-store customer experiences, and the diversification of product and service offerings. The focus on sustainability and smart home technology will continue to be a significant driver of innovation and market penetration. Retailers that effectively integrate online and offline channels, leverage data analytics for personalized customer engagement, and invest in skilled service personnel will be best positioned for long-term success and sustained market leadership.

United States Hardware Stores Retail Market Segmentation

-

1. Product Type

- 1.1. Door Hardware

- 1.2. Building Materials

- 1.3. Kitchen and Toilet Products

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Offline

- 2.2. Online

United States Hardware Stores Retail Market Segmentation By Geography

- 1. United States

United States Hardware Stores Retail Market Regional Market Share

Geographic Coverage of United States Hardware Stores Retail Market

United States Hardware Stores Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Home Improvement and Renovation Projects

- 3.3. Market Restrains

- 3.3.1. Rise in Home Improvement and Renovation Projects

- 3.4. Market Trends

- 3.4.1. Increased Focus on Home Improvement and Renovation Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hardware Stores Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Door Hardware

- 5.1.2. Building Materials

- 5.1.3. Kitchen and Toilet Products

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Home Depot Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lowe's Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Menard Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ace Hardware

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 True Value Hardware

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 84 Lumber

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Handy Andy Home Improvement Centers Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hippo Hardware and Trading Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orchard Supply Hardware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Harbor Freight Tools

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Home Depot Inc

List of Figures

- Figure 1: United States Hardware Stores Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Hardware Stores Retail Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: United States Hardware Stores Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Hardware Stores Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: United States Hardware Stores Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Hardware Stores Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hardware Stores Retail Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the United States Hardware Stores Retail Market?

Key companies in the market include Home Depot Inc, Lowe's Companies Inc, Menard Inc, Ace Hardware, True Value Hardware, 84 Lumber, Handy Andy Home Improvement Centers Inc, Hippo Hardware and Trading Company, Orchard Supply Hardware, Harbor Freight Tools.

3. What are the main segments of the United States Hardware Stores Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Home Improvement and Renovation Projects.

6. What are the notable trends driving market growth?

Increased Focus on Home Improvement and Renovation Projects.

7. Are there any restraints impacting market growth?

Rise in Home Improvement and Renovation Projects.

8. Can you provide examples of recent developments in the market?

September 2023: Lowe declared the extension of its multi-year agreement with the NFL for the current year's season. The collaboration will commence with a comprehensive marketing campaign, including a national television commercial, an updated lineup of Lowe's Home Team players, and the introduction of a limited-edition DIY Wrist Coach accessory.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hardware Stores Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hardware Stores Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hardware Stores Retail Market?

To stay informed about further developments, trends, and reports in the United States Hardware Stores Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence