Key Insights

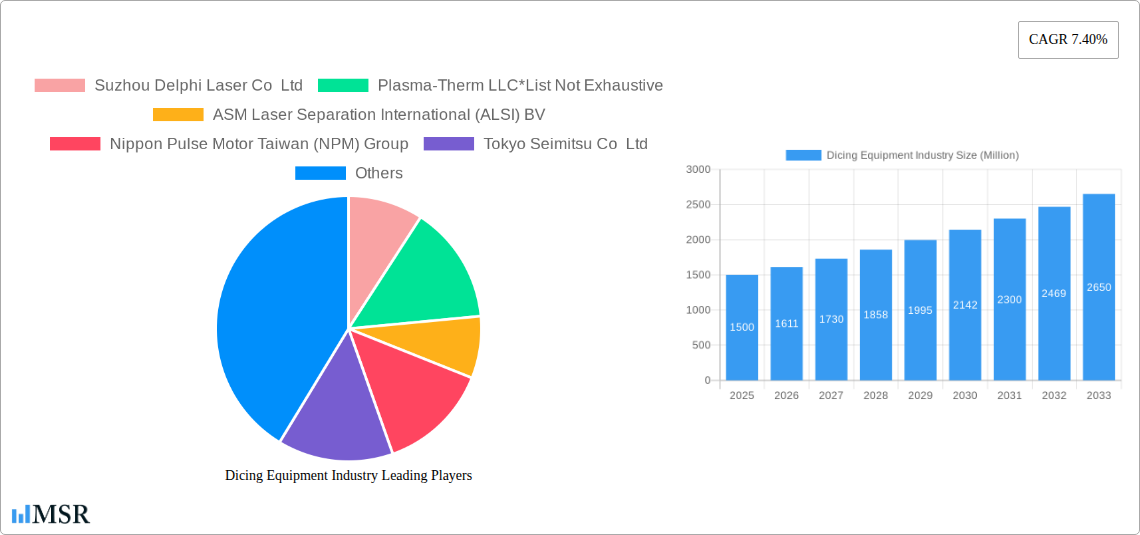

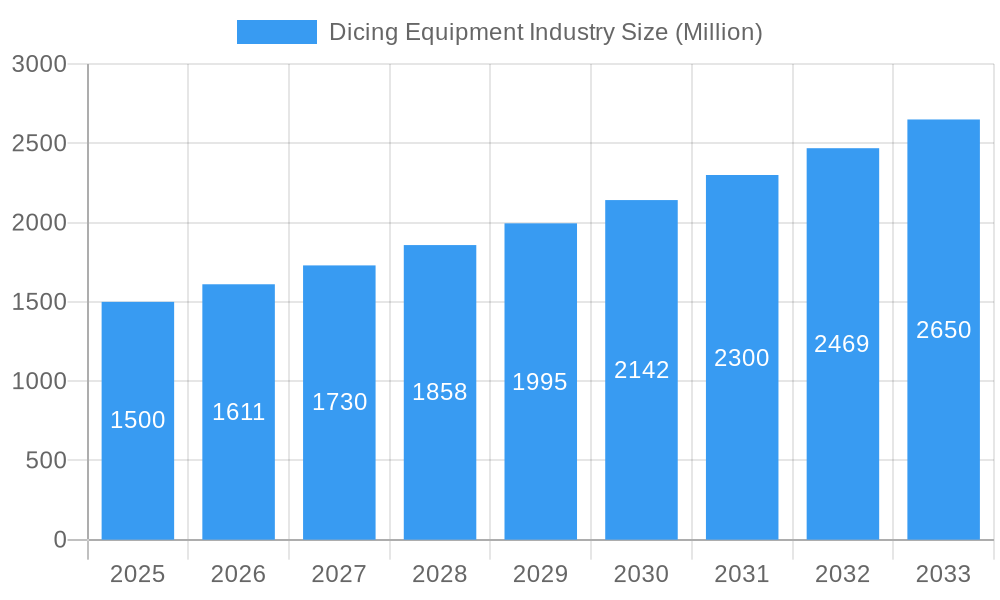

The global dicing equipment market is projected for significant expansion, with a projected market size of 459.6 million in the base year 2025. This market is anticipated to grow at a compound annual growth rate (CAGR) of 7.2% from 2025 to 2033. Key growth drivers include the expanding semiconductor industry, propelled by escalating demand for advanced electronics across automotive, consumer electronics, and healthcare sectors. Miniaturization trends in semiconductor packaging and the widespread adoption of technologies like 5G and AI are accelerating the need for precise dicing solutions. Moreover, the shift towards advanced packaging techniques, such as 3D stacking and System-in-Package (SiP), is creating new avenues for dicing equipment manufacturers. Increased automation in manufacturing processes also contributes to market growth by enhancing productivity and reducing operational expenses. Intense competition among key players, including Suzhou Delphi Laser Co Ltd, Plasma-Therm LLC, and ASM Laser Separation International, is fostering innovation and cost optimization for end-users.

Dicing Equipment Industry Market Size (In Million)

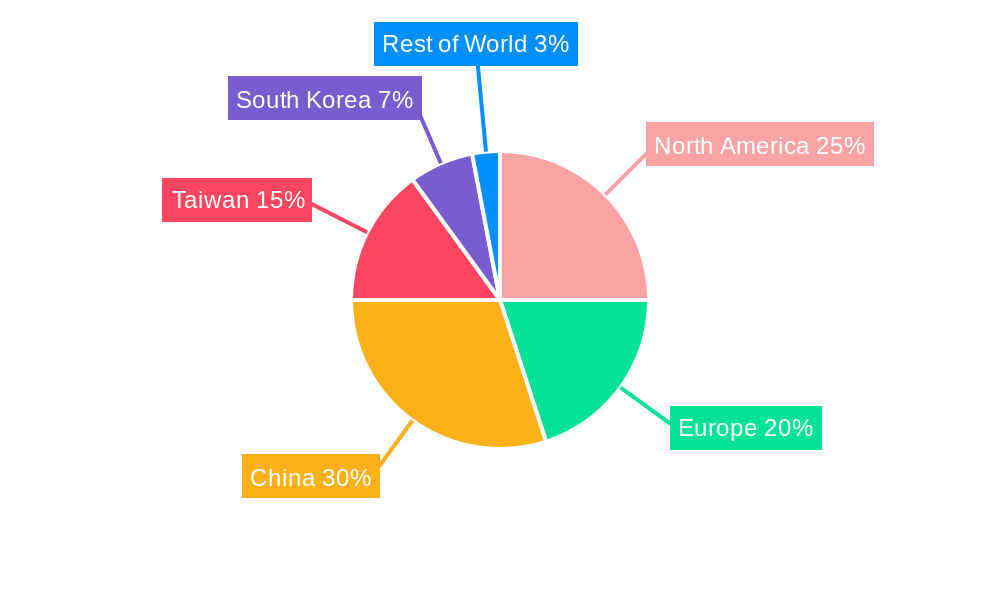

Despite the positive outlook, the market encounters certain challenges. The substantial initial investment required for advanced dicing equipment may impede adoption by smaller enterprises. Rapid technological advancements necessitate continuous research and development investments for manufacturers to maintain competitiveness. Furthermore, volatility in the global semiconductor market and geopolitical influences can affect overall demand. Nevertheless, the long-term forecast for the dicing equipment market remains optimistic, driven by the persistent demand for smaller, more powerful, and energy-efficient electronic devices. Within market segments, laser ablation dicing technology is expected to experience considerable growth due to its precision and versatility. The logic & memory segment is poised to lead in applications, driven by high-volume production requirements. Key growth regions are anticipated to be China, Taiwan, and South Korea, owing to their robust semiconductor manufacturing capabilities.

Dicing Equipment Industry Company Market Share

Dicing Equipment Industry Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global dicing equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, technological advancements, and future growth opportunities. The global dicing equipment market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Dicing Equipment Industry Market Concentration & Dynamics

The global dicing equipment market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. While precise market share figures for individual companies are proprietary, key players such as SPTS Technologies Limited (KLA Tencor Corporation), Panasonic Corporation, and Tokyo Seimitsu Co Ltd. command substantial portions of the market. The industry's innovation ecosystem is driven by continuous advancements in dicing technologies, necessitating significant R&D investment. Regulatory frameworks, particularly those concerning environmental compliance and safety standards, play a vital role in shaping industry practices. Substitute products, while limited, include alternative wafer separation methods, but they often lack the precision and efficiency of dicing. End-user trends toward miniaturization and higher integration density in semiconductors fuel demand for advanced dicing equipment.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- M&A Activity: A moderate number of M&A deals (xx) occurred during the historical period (2019-2024), primarily driven by consolidation efforts and expansion into new markets.

- Innovation Ecosystem: Highly dynamic, characterized by continuous technological improvements in blade dicing, laser ablation, and plasma dicing techniques.

- Regulatory Framework: Subject to environmental and safety regulations impacting material usage and waste management.

- Substitute Products: Limited, offering alternative wafer separation solutions but often lacking in precision.

- End-User Trends: Strong demand driven by the need for miniaturized and high-integration density semiconductor devices.

Dicing Equipment Industry Insights & Trends

The global dicing equipment market experienced robust growth during the historical period (2019-2024), primarily fueled by the increasing demand for advanced semiconductor devices across various applications. The market size in 2024 was estimated at xx Million. Technological disruptions, such as advancements in laser ablation and plasma dicing techniques, continue to reshape the competitive landscape. Evolving consumer behaviors, particularly the preference for smaller, faster, and more energy-efficient electronic devices, are driving demand for high-precision dicing equipment. This trend is expected to persist throughout the forecast period, leading to a significant expansion of the market. Growth is further propelled by the increasing adoption of automation in semiconductor manufacturing processes and the development of advanced materials requiring specialized dicing techniques. The market's growth trajectory indicates a positive outlook for the industry, with continued expansion anticipated in the coming years.

Key Markets & Segments Leading Dicing Equipment Industry

The Asia-Pacific region, specifically countries like Taiwan, South Korea, and China, represents a dominant market for dicing equipment due to the concentration of semiconductor manufacturing facilities.

- By Dicing Technology:

- Laser Ablation: Experiencing high growth due to its precision and minimal kerf loss, particularly in advanced semiconductor applications.

- Blade Dicing: Remains a significant segment, offering cost-effectiveness for certain applications.

- Plasma Dicing: Shows promising growth potential, driven by its ability to handle delicate and brittle materials.

- By Application:

- Logic & Memory: The largest application segment, driven by the massive demand for memory chips and logic ICs.

- MEMS Devices: A significant and rapidly growing segment, driven by the proliferation of MEMS-based sensors and actuators.

- Power Devices: Growing steadily due to the increasing demand for energy-efficient electronic devices.

- CMOS Image Sensor: A significant segment driven by the increasing demand for high-resolution imaging in various applications.

- RFID: A growing segment driven by the increasing adoption of RFID technology in various industries.

- Regional Dominance: The Asia-Pacific region demonstrates the strongest growth owing to the concentration of major semiconductor manufacturers. Strong economic growth and substantial investments in semiconductor infrastructure further solidify this region's dominance.

Dicing Equipment Industry Product Developments

Recent years have witnessed significant product innovations, focusing on enhancing precision, throughput, and cost-effectiveness. Advancements in laser ablation technologies, such as ultrafast lasers, allow for smaller kerf sizes and improved edge quality. Plasma dicing systems have also witnessed improvements, offering enhanced control and reduced damage to delicate wafers. These innovations directly translate into improved yields and reduced manufacturing costs for semiconductor manufacturers, strengthening the market relevance of these advanced technologies.

Challenges in the Dicing Equipment Industry Market

The dicing equipment market faces challenges such as stringent regulatory compliance requirements, potentially increasing manufacturing costs. Supply chain disruptions can impact component availability and lead times. Intense competition among established players and emerging entrants further complicates market dynamics. These factors can collectively impact the overall profitability and market growth trajectory.

Forces Driving Dicing Equipment Industry Growth

Several factors drive the dicing equipment market's growth: the continued miniaturization of electronic devices necessitates more precise dicing technologies. The rising adoption of automation in semiconductor manufacturing processes boosts demand for automated dicing systems. Government initiatives promoting the semiconductor industry, combined with technological advancements and increased research and development efforts, fuel continuous innovation in dicing technologies.

Long-Term Growth Catalysts in the Dicing Equipment Industry

Long-term growth will be fueled by innovations in dicing technologies, such as the development of more efficient and precise laser and plasma dicing systems. Strategic partnerships between equipment manufacturers and semiconductor companies are also expected to foster innovation and market expansion. The exploration of new materials and applications for semiconductor devices further presents opportunities for growth in the long term.

Emerging Opportunities in Dicing Equipment Industry

Emerging trends point towards increased demand for dicing equipment in advanced packaging technologies, such as 3D stacking and heterogeneous integration. The adoption of artificial intelligence (AI) and machine learning (ML) in dicing processes holds significant potential for optimizing throughput and yield. The expansion into new markets, particularly in emerging economies, represents a key opportunity for growth.

Leading Players in the Dicing Equipment Industry Sector

- Suzhou Delphi Laser Co Ltd

- Plasma-Therm LLC

- ASM Laser Separation International (ALSI) BV

- Nippon Pulse Motor Taiwan (NPM) Group

- Tokyo Seimitsu Co Ltd

- SPTS Technologies Limited (KLA Tencor Corporation)

- Panasonic Corporation

- Neon Tech Co Ltd

Key Milestones in Dicing Equipment Industry

- January 2022: Corning launched a new dicing technology, enhancing laser microfabrication processes for semiconductors, leading to higher throughput, lower kerf loss, and improved edge strength. This innovation significantly impacts cost reduction and efficiency within the semiconductor industry.

Strategic Outlook for Dicing Equipment Industry Market

The dicing equipment market holds substantial growth potential driven by ongoing advancements in semiconductor technology, the increasing demand for high-performance electronics, and the expansion of applications across various industries. Strategic investments in R&D, strategic partnerships, and a focus on providing customized solutions will be critical for companies aiming to capitalize on emerging opportunities and maintain a competitive edge in this dynamic market.

Dicing Equipment Industry Segmentation

-

1. Dicing Technology

- 1.1. Blade Dicing

- 1.2. Laser Ablation

- 1.3. Plasma Dicing

-

2. Application

- 2.1. Logic & Memory

- 2.2. MEMS Devices

- 2.3. Power Devices

- 2.4. CMOS Image Sensor

- 2.5. RFID

Dicing Equipment Industry Segmentation By Geography

- 1. China

- 2. Taiwan

- 3. South Korea

- 4. North America

- 5. Europe

- 6. Rest of the World

Dicing Equipment Industry Regional Market Share

Geographic Coverage of Dicing Equipment Industry

Dicing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Technological Advancements

- 3.2.2 and Evolution of Next Generation Devices

- 3.3. Market Restrains

- 3.3.1. Performance Constraint of Cryocoolers

- 3.4. Market Trends

- 3.4.1. Blade Dicing to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dicing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 5.1.1. Blade Dicing

- 5.1.2. Laser Ablation

- 5.1.3. Plasma Dicing

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Logic & Memory

- 5.2.2. MEMS Devices

- 5.2.3. Power Devices

- 5.2.4. CMOS Image Sensor

- 5.2.5. RFID

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Taiwan

- 5.3.3. South Korea

- 5.3.4. North America

- 5.3.5. Europe

- 5.3.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 6. China Dicing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 6.1.1. Blade Dicing

- 6.1.2. Laser Ablation

- 6.1.3. Plasma Dicing

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Logic & Memory

- 6.2.2. MEMS Devices

- 6.2.3. Power Devices

- 6.2.4. CMOS Image Sensor

- 6.2.5. RFID

- 6.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 7. Taiwan Dicing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 7.1.1. Blade Dicing

- 7.1.2. Laser Ablation

- 7.1.3. Plasma Dicing

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Logic & Memory

- 7.2.2. MEMS Devices

- 7.2.3. Power Devices

- 7.2.4. CMOS Image Sensor

- 7.2.5. RFID

- 7.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 8. South Korea Dicing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 8.1.1. Blade Dicing

- 8.1.2. Laser Ablation

- 8.1.3. Plasma Dicing

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Logic & Memory

- 8.2.2. MEMS Devices

- 8.2.3. Power Devices

- 8.2.4. CMOS Image Sensor

- 8.2.5. RFID

- 8.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 9. North America Dicing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 9.1.1. Blade Dicing

- 9.1.2. Laser Ablation

- 9.1.3. Plasma Dicing

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Logic & Memory

- 9.2.2. MEMS Devices

- 9.2.3. Power Devices

- 9.2.4. CMOS Image Sensor

- 9.2.5. RFID

- 9.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 10. Europe Dicing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 10.1.1. Blade Dicing

- 10.1.2. Laser Ablation

- 10.1.3. Plasma Dicing

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Logic & Memory

- 10.2.2. MEMS Devices

- 10.2.3. Power Devices

- 10.2.4. CMOS Image Sensor

- 10.2.5. RFID

- 10.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 11. Rest of the World Dicing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 11.1.1. Blade Dicing

- 11.1.2. Laser Ablation

- 11.1.3. Plasma Dicing

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Logic & Memory

- 11.2.2. MEMS Devices

- 11.2.3. Power Devices

- 11.2.4. CMOS Image Sensor

- 11.2.5. RFID

- 11.1. Market Analysis, Insights and Forecast - by Dicing Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Suzhou Delphi Laser Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Plasma-Therm LLC*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ASM Laser Separation International (ALSI) BV

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nippon Pulse Motor Taiwan (NPM) Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Tokyo Seimitsu Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SPTS Technologies Limited (KLA Tencor Corporation)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Panasonic Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Neon Tech Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Suzhou Delphi Laser Co Ltd

List of Figures

- Figure 1: Global Dicing Equipment Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: China Dicing Equipment Industry Revenue (million), by Dicing Technology 2025 & 2033

- Figure 3: China Dicing Equipment Industry Revenue Share (%), by Dicing Technology 2025 & 2033

- Figure 4: China Dicing Equipment Industry Revenue (million), by Application 2025 & 2033

- Figure 5: China Dicing Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: China Dicing Equipment Industry Revenue (million), by Country 2025 & 2033

- Figure 7: China Dicing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Taiwan Dicing Equipment Industry Revenue (million), by Dicing Technology 2025 & 2033

- Figure 9: Taiwan Dicing Equipment Industry Revenue Share (%), by Dicing Technology 2025 & 2033

- Figure 10: Taiwan Dicing Equipment Industry Revenue (million), by Application 2025 & 2033

- Figure 11: Taiwan Dicing Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Taiwan Dicing Equipment Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Taiwan Dicing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South Korea Dicing Equipment Industry Revenue (million), by Dicing Technology 2025 & 2033

- Figure 15: South Korea Dicing Equipment Industry Revenue Share (%), by Dicing Technology 2025 & 2033

- Figure 16: South Korea Dicing Equipment Industry Revenue (million), by Application 2025 & 2033

- Figure 17: South Korea Dicing Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: South Korea Dicing Equipment Industry Revenue (million), by Country 2025 & 2033

- Figure 19: South Korea Dicing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: North America Dicing Equipment Industry Revenue (million), by Dicing Technology 2025 & 2033

- Figure 21: North America Dicing Equipment Industry Revenue Share (%), by Dicing Technology 2025 & 2033

- Figure 22: North America Dicing Equipment Industry Revenue (million), by Application 2025 & 2033

- Figure 23: North America Dicing Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: North America Dicing Equipment Industry Revenue (million), by Country 2025 & 2033

- Figure 25: North America Dicing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Dicing Equipment Industry Revenue (million), by Dicing Technology 2025 & 2033

- Figure 27: Europe Dicing Equipment Industry Revenue Share (%), by Dicing Technology 2025 & 2033

- Figure 28: Europe Dicing Equipment Industry Revenue (million), by Application 2025 & 2033

- Figure 29: Europe Dicing Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Dicing Equipment Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Europe Dicing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Dicing Equipment Industry Revenue (million), by Dicing Technology 2025 & 2033

- Figure 33: Rest of the World Dicing Equipment Industry Revenue Share (%), by Dicing Technology 2025 & 2033

- Figure 34: Rest of the World Dicing Equipment Industry Revenue (million), by Application 2025 & 2033

- Figure 35: Rest of the World Dicing Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Rest of the World Dicing Equipment Industry Revenue (million), by Country 2025 & 2033

- Figure 37: Rest of the World Dicing Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dicing Equipment Industry Revenue million Forecast, by Dicing Technology 2020 & 2033

- Table 2: Global Dicing Equipment Industry Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Dicing Equipment Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Dicing Equipment Industry Revenue million Forecast, by Dicing Technology 2020 & 2033

- Table 5: Global Dicing Equipment Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Dicing Equipment Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global Dicing Equipment Industry Revenue million Forecast, by Dicing Technology 2020 & 2033

- Table 8: Global Dicing Equipment Industry Revenue million Forecast, by Application 2020 & 2033

- Table 9: Global Dicing Equipment Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Global Dicing Equipment Industry Revenue million Forecast, by Dicing Technology 2020 & 2033

- Table 11: Global Dicing Equipment Industry Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Dicing Equipment Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Dicing Equipment Industry Revenue million Forecast, by Dicing Technology 2020 & 2033

- Table 14: Global Dicing Equipment Industry Revenue million Forecast, by Application 2020 & 2033

- Table 15: Global Dicing Equipment Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Dicing Equipment Industry Revenue million Forecast, by Dicing Technology 2020 & 2033

- Table 17: Global Dicing Equipment Industry Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global Dicing Equipment Industry Revenue million Forecast, by Country 2020 & 2033

- Table 19: Global Dicing Equipment Industry Revenue million Forecast, by Dicing Technology 2020 & 2033

- Table 20: Global Dicing Equipment Industry Revenue million Forecast, by Application 2020 & 2033

- Table 21: Global Dicing Equipment Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dicing Equipment Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Dicing Equipment Industry?

Key companies in the market include Suzhou Delphi Laser Co Ltd, Plasma-Therm LLC*List Not Exhaustive, ASM Laser Separation International (ALSI) BV, Nippon Pulse Motor Taiwan (NPM) Group, Tokyo Seimitsu Co Ltd, SPTS Technologies Limited (KLA Tencor Corporation), Panasonic Corporation, Neon Tech Co Ltd.

3. What are the main segments of the Dicing Equipment Industry?

The market segments include Dicing Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 459.6 million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements. and Evolution of Next Generation Devices.

6. What are the notable trends driving market growth?

Blade Dicing to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Performance Constraint of Cryocoolers.

8. Can you provide examples of recent developments in the market?

January 2022: Corning launched a dicing technology, enabling the company's laser technologies business to focus further on microfabrication processes in the semiconductor application space. According to the company, the new technology would allow customers to drive lower costs through higher throughput and achieve lower kerf loss and high edge strength through an inherently clean process to eliminate subsequent cleaning steps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dicing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dicing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dicing Equipment Industry?

To stay informed about further developments, trends, and reports in the Dicing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence