Key Insights

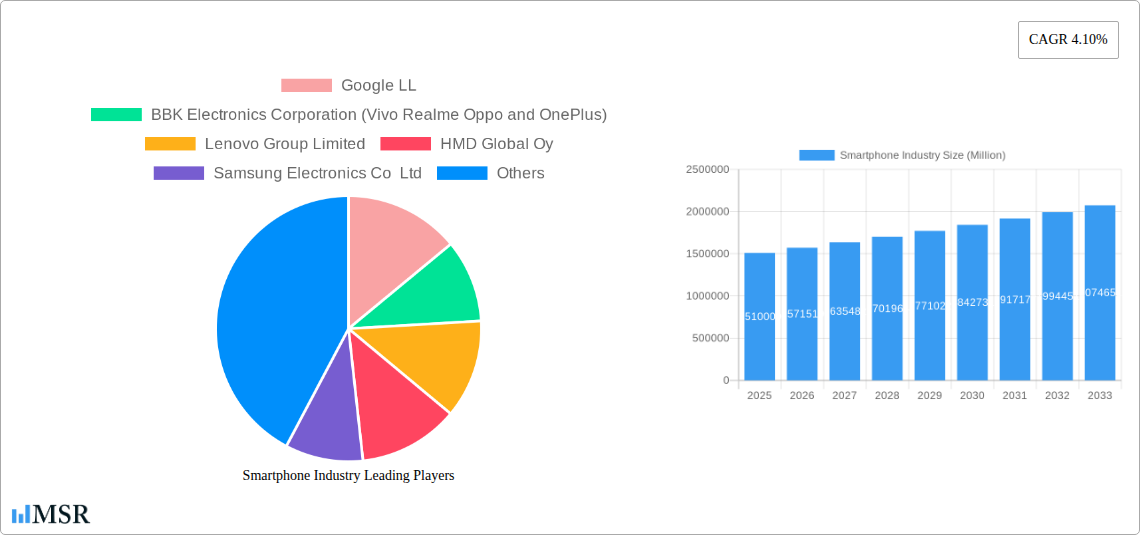

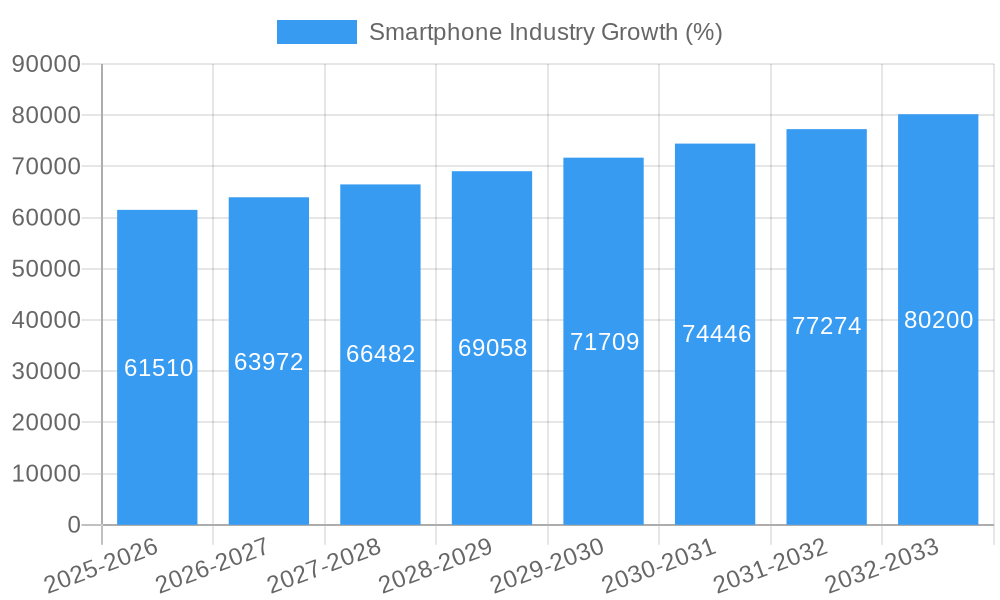

The global smartphone market, valued at $1.51 trillion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This growth is driven by several key factors. Firstly, the continuous innovation in smartphone technology, including advancements in camera capabilities, processing power, and display technology, fuels consumer demand for upgrades. Secondly, the expanding global middle class, particularly in emerging markets like Asia and Africa, contributes significantly to increased smartphone adoption. Furthermore, the rising penetration of high-speed internet and affordable data plans enables wider access to mobile applications and services, further driving market expansion. Competition among major players like Apple, Samsung, Xiaomi, and Google fuels innovation and keeps prices competitive, benefiting consumers. However, market saturation in developed regions like North America and Europe, coupled with lengthening replacement cycles, presents a challenge to sustained high growth. The market segmentation by operating system (Android and iOS) reveals Android's dominance in terms of market share, although iOS retains a strong presence in the premium segment. The regional breakdown suggests significant growth potential in developing economies, while mature markets are expected to see more moderate expansion. Factors like increasing manufacturing costs and geopolitical uncertainties could also influence the trajectory of market growth in the coming years.

The smartphone industry's future hinges on several key trends. The increasing adoption of 5G technology will lead to faster data speeds and improved user experience, fueling demand for 5G-enabled smartphones. The growing popularity of foldable smartphones and other innovative form factors represents a potential growth avenue. The integration of Artificial Intelligence (AI) and advanced features like improved camera image processing, enhanced security, and personalized user interfaces further enhances consumer appeal. Sustainable manufacturing practices and initiatives aimed at extending product lifecycles are gaining importance in response to growing environmental concerns. The competitive landscape remains dynamic, with companies continuously striving for technological leadership and innovative business models. To maintain competitiveness, brands are focusing on value-added services and premium experiences beyond hardware specifications, emphasizing factors such as software updates and customer support.

Smartphone Industry Report: 2019-2033 - A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the global smartphone industry from 2019 to 2033, offering actionable insights for industry stakeholders. The study covers market dynamics, key players, technological advancements, and future growth opportunities, providing a detailed overview of a market valued at $xx Million in 2025 and projected to reach $xx Million by 2033, achieving a CAGR of xx%. This report is crucial for understanding the competitive landscape, identifying emerging trends, and making informed business decisions in this rapidly evolving sector.

Smartphone Industry Market Concentration & Dynamics

The global smartphone market exhibits a high degree of concentration, dominated by a few key players. In 2025, Samsung Electronics Co Ltd, Apple Inc, and BBK Electronics Corporation (Vivo, Realme, Oppo, and OnePlus) hold the largest market share, collectively accounting for approximately xx% of the total market. The market is characterized by intense competition, driven by continuous product innovation and aggressive marketing strategies.

- Market Share (2025 Estimate): Samsung: xx%; Apple: xx%; BBK: xx%; Xiaomi: xx%; Others: xx%.

- M&A Activity: The historical period (2019-2024) witnessed xx major M&A deals, primarily focused on enhancing technology portfolios and expanding market reach. The forecast period (2025-2033) is expected to see xx more deals, further consolidating the market.

- Innovation Ecosystems: The industry relies heavily on robust innovation ecosystems, including collaborations with component suppliers, software developers, and research institutions.

- Regulatory Frameworks: Government regulations concerning data privacy, cybersecurity, and antitrust issues significantly influence market dynamics.

- Substitute Products: The rise of smartwatches and other wearable devices poses a potential threat to traditional smartphone sales.

- End-User Trends: Increasing demand for 5G-enabled devices, foldable smartphones, and enhanced camera features are driving market growth.

Smartphone Industry Industry Insights & Trends

The global smartphone market experienced significant growth during the historical period (2019-2024), driven by factors such as rising smartphone adoption rates in emerging markets, increasing affordability, and technological advancements. The market size in 2024 was estimated at $xx Million. The market is expected to continue its growth trajectory during the forecast period (2025-2033), although at a potentially slower pace compared to previous years. Technological disruptions, such as the introduction of foldable phones and advancements in AI and 5G connectivity, are reshaping the competitive landscape. Changing consumer behavior, with a greater emphasis on premium features and personalized experiences, also influences market trends. This is further fueled by the expansion of e-commerce and the growing adoption of mobile payments. The overall market value is expected to reach $xx Million by 2033, fueled primarily by growth in emerging economies and increased demand for high-end devices.

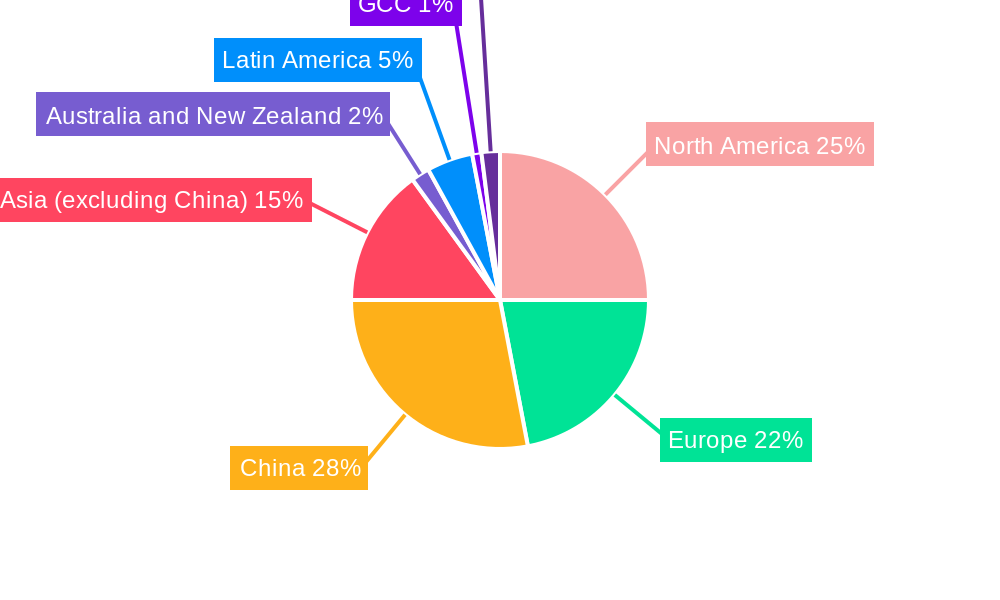

Key Markets & Segments Leading Smartphone Industry

The Asia-Pacific region remains the dominant market for smartphones, driven by high population density, strong economic growth, and increasing smartphone penetration. China, India, and other Southeast Asian nations are key contributors to this dominance.

Drivers for Dominance:

- High Population Growth: Rapid population growth in several Asian countries creates a vast potential consumer base.

- Rising Disposable Incomes: Increasing disposable incomes enable more consumers to afford smartphones.

- Robust Infrastructure Development: Investment in telecommunications infrastructure enhances smartphone connectivity.

- Government Initiatives: Government policies promoting digital inclusion and technological advancements further stimulate the market.

Segment Analysis:

- Android: Android holds a significant majority market share globally, fueled by its open-source nature and the availability of a wide range of affordable devices.

- iOS: While holding a smaller market share compared to Android, iOS maintains a strong premium segment presence, known for its user-friendly interface, robust ecosystem, and strong brand loyalty. The iOS segment tends to command higher average selling prices.

The detailed dominance analysis reveals that while Android dominates the overall market in terms of units sold, iOS consistently outperforms Android in terms of average revenue per unit due to the premium pricing of Apple devices.

Smartphone Industry Product Developments

Recent product innovations focus on improved camera technology (e.g., high-resolution sensors, advanced image processing), enhanced processing power fueled by more powerful chipsets, more durable designs, and innovative form factors such as foldable screens. These advancements contribute to enhanced user experience and create competitive differentiation for leading brands. The integration of AI and 5G connectivity provides further opportunities for enhanced functionality and improved application performance.

Challenges in the Smartphone Industry Market

The smartphone industry faces several challenges, including intensifying competition, supply chain disruptions, and increasing regulatory scrutiny. These factors combined can significantly impact profitability and market growth. The impact is quantifiable in terms of reduced sales, increased production costs, and legal expenses. For example, supply chain issues during 2021-2022 led to a $xx Million decrease in global smartphone production.

Forces Driving Smartphone Industry Growth

Key growth drivers include advancements in 5G technology, increasing demand for premium features (e.g., advanced cameras, improved battery life), and the expansion of smartphone adoption in developing countries. Economic growth, particularly in emerging markets, contributes significantly to the rising demand for smartphones. Furthermore, supportive government policies aimed at improving digital infrastructure are boosting the market.

Challenges in the Smartphone Industry Market

Long-term growth hinges on continuous innovation in areas such as foldable displays, improved battery technology, and artificial intelligence integration. Strategic partnerships to leverage technology and expand market reach are essential. Expanding into new markets, particularly in underpenetrated regions, will be vital for sustained long-term growth.

Emerging Opportunities in Smartphone Industry

Emerging opportunities include the growth of the Internet of Things (IoT), the expansion of augmented reality (AR) and virtual reality (VR) applications, and the increasing demand for specialized smartphones for various industries (e.g., healthcare, manufacturing). The rising adoption of 5G technology presents significant opportunities for new services and applications. Furthermore, personalized mobile experiences and advanced security features are driving further growth.

Leading Players in the Smartphone Industry Sector

- Google LL

- BBK Electronics Corporation (Vivo, Realme, Oppo, and OnePlus)

- Lenovo Group Limited

- HMD Global Oy

- Samsung Electronics Co Ltd

- Xiaomi Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Apple Inc

- HTC Corporation

- Sony Corporation

Key Milestones in Smartphone Industry Industry

- 2019: Launch of the first commercially available 5G smartphones.

- 2020: Increased focus on foldable phone technology.

- 2021: Significant supply chain disruptions impacting global production.

- 2022: Growth of AI-powered smartphone features.

- 2023: Continued adoption of 5G smartphones across various regions.

- 2024: Increased focus on sustainability and eco-friendly smartphone design.

Strategic Outlook for Smartphone Industry Market

The future of the smartphone market rests on continued innovation and adaptation. Focusing on advanced technologies like AI, improved camera systems, and enhanced battery life will be key to attracting consumers. Strategic partnerships to expand into new markets and cater to diverse customer segments will be crucial for long-term success. The market’s potential for growth remains significant, particularly in emerging markets with increasing smartphone adoption rates.

Smartphone Industry Segmentation

-

1. Operating Segment

- 1.1. Android

- 1.2. iOS

Smartphone Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. China

- 4. Asia

- 5. Australia and New Zealand

- 6. Latin America

- 7. GCC

- 8. Africa

Smartphone Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Launch of 5G Devices

- 3.2.2 Services

- 3.2.3 and Technologies; Increasing Demand in the Emerging Markets

- 3.3. Market Restrains

- 3.3.1. Stagnating Demand

- 3.4. Market Trends

- 3.4.1. Android Operating System is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating Segment

- 5.1.1. Android

- 5.1.2. iOS

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. China

- 5.2.4. Asia

- 5.2.5. Australia and New Zealand

- 5.2.6. Latin America

- 5.2.7. GCC

- 5.2.8. Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating Segment

- 6. North America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Operating Segment

- 6.1.1. Android

- 6.1.2. iOS

- 6.1. Market Analysis, Insights and Forecast - by Operating Segment

- 7. Europe Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Operating Segment

- 7.1.1. Android

- 7.1.2. iOS

- 7.1. Market Analysis, Insights and Forecast - by Operating Segment

- 8. China Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Operating Segment

- 8.1.1. Android

- 8.1.2. iOS

- 8.1. Market Analysis, Insights and Forecast - by Operating Segment

- 9. Asia Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Operating Segment

- 9.1.1. Android

- 9.1.2. iOS

- 9.1. Market Analysis, Insights and Forecast - by Operating Segment

- 10. Australia and New Zealand Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Operating Segment

- 10.1.1. Android

- 10.1.2. iOS

- 10.1. Market Analysis, Insights and Forecast - by Operating Segment

- 11. Latin America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Operating Segment

- 11.1.1. Android

- 11.1.2. iOS

- 11.1. Market Analysis, Insights and Forecast - by Operating Segment

- 12. GCC Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Operating Segment

- 12.1.1. Android

- 12.1.2. iOS

- 12.1. Market Analysis, Insights and Forecast - by Operating Segment

- 13. Africa Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Operating Segment

- 13.1.1. Android

- 13.1.2. iOS

- 13.1. Market Analysis, Insights and Forecast - by Operating Segment

- 14. North America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Europe Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. China Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Asia Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Australia and New Zealand Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1.

- 19. Latin America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1.

- 20. GCC Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 20.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 20.1.1.

- 21. Africa Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 21.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 21.1.1.

- 22. Competitive Analysis

- 22.1. Market Share Analysis 2024

- 22.2. Company Profiles

- 22.2.1 Google LL

- 22.2.1.1. Overview

- 22.2.1.2. Products

- 22.2.1.3. SWOT Analysis

- 22.2.1.4. Recent Developments

- 22.2.1.5. Financials (Based on Availability)

- 22.2.2 BBK Electronics Corporation (Vivo Realme Oppo and OnePlus)

- 22.2.2.1. Overview

- 22.2.2.2. Products

- 22.2.2.3. SWOT Analysis

- 22.2.2.4. Recent Developments

- 22.2.2.5. Financials (Based on Availability)

- 22.2.3 Lenovo Group Limited

- 22.2.3.1. Overview

- 22.2.3.2. Products

- 22.2.3.3. SWOT Analysis

- 22.2.3.4. Recent Developments

- 22.2.3.5. Financials (Based on Availability)

- 22.2.4 HMD Global Oy

- 22.2.4.1. Overview

- 22.2.4.2. Products

- 22.2.4.3. SWOT Analysis

- 22.2.4.4. Recent Developments

- 22.2.4.5. Financials (Based on Availability)

- 22.2.5 Samsung Electronics Co Ltd

- 22.2.5.1. Overview

- 22.2.5.2. Products

- 22.2.5.3. SWOT Analysis

- 22.2.5.4. Recent Developments

- 22.2.5.5. Financials (Based on Availability)

- 22.2.6 Xiaomi Corporation

- 22.2.6.1. Overview

- 22.2.6.2. Products

- 22.2.6.3. SWOT Analysis

- 22.2.6.4. Recent Developments

- 22.2.6.5. Financials (Based on Availability)

- 22.2.7 Huawei Technologies Co Ltd

- 22.2.7.1. Overview

- 22.2.7.2. Products

- 22.2.7.3. SWOT Analysis

- 22.2.7.4. Recent Developments

- 22.2.7.5. Financials (Based on Availability)

- 22.2.8 ZTE Corporation

- 22.2.8.1. Overview

- 22.2.8.2. Products

- 22.2.8.3. SWOT Analysis

- 22.2.8.4. Recent Developments

- 22.2.8.5. Financials (Based on Availability)

- 22.2.9 Apple Inc

- 22.2.9.1. Overview

- 22.2.9.2. Products

- 22.2.9.3. SWOT Analysis

- 22.2.9.4. Recent Developments

- 22.2.9.5. Financials (Based on Availability)

- 22.2.10 HTC Corporation

- 22.2.10.1. Overview

- 22.2.10.2. Products

- 22.2.10.3. SWOT Analysis

- 22.2.10.4. Recent Developments

- 22.2.10.5. Financials (Based on Availability)

- 22.2.11 Sony Corporation

- 22.2.11.1. Overview

- 22.2.11.2. Products

- 22.2.11.3. SWOT Analysis

- 22.2.11.4. Recent Developments

- 22.2.11.5. Financials (Based on Availability)

- 22.2.1 Google LL

List of Figures

- Figure 1: Smartphone Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Smartphone Industry Share (%) by Company 2024

List of Tables

- Table 1: Smartphone Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 3: Smartphone Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 21: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 23: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 25: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 27: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 29: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 31: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 33: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 35: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smartphone Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Smartphone Industry?

Key companies in the market include Google LL, BBK Electronics Corporation (Vivo Realme Oppo and OnePlus), Lenovo Group Limited, HMD Global Oy, Samsung Electronics Co Ltd, Xiaomi Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Apple Inc, HTC Corporation, Sony Corporation.

3. What are the main segments of the Smartphone Industry?

The market segments include Operating Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Launch of 5G Devices. Services. and Technologies; Increasing Demand in the Emerging Markets.

6. What are the notable trends driving market growth?

Android Operating System is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Stagnating Demand.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smartphone Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smartphone Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smartphone Industry?

To stay informed about further developments, trends, and reports in the Smartphone Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence