Key Insights

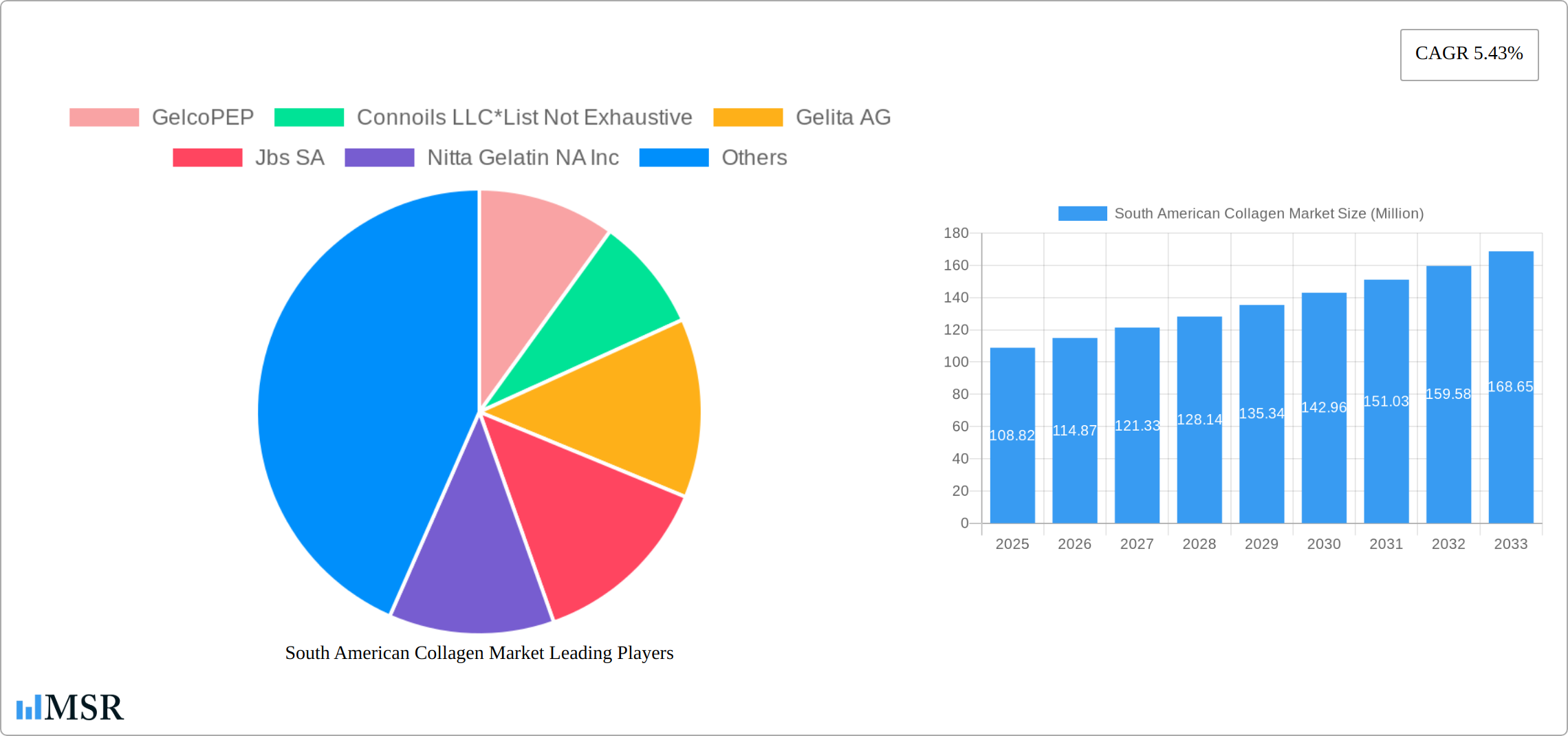

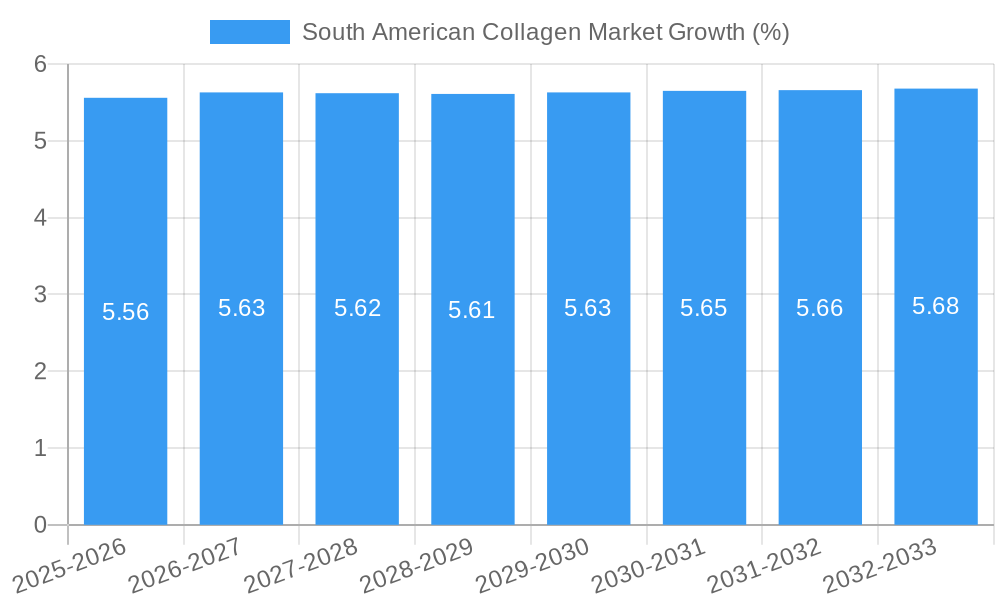

The South American collagen market, valued at $108.82 million in 2025, is projected to experience robust growth, driven by increasing demand from the dietary supplements, food and beverage, and cosmetics and personal care sectors. The rising consumer awareness of collagen's health benefits, particularly its role in skin health, joint mobility, and gut health, fuels this demand. Brazil and Argentina, the largest economies in South America, are key contributors to market growth, spurred by a burgeoning middle class with increased disposable income and a growing preference for natural and functional ingredients. The market's expansion is further propelled by technological advancements in collagen extraction and processing, leading to higher-quality and more cost-effective products. While the availability of animal-based collagen currently dominates the market, the increasing popularity of plant-based alternatives presents both an opportunity and a challenge. The market will likely see innovation in sustainable sourcing and processing techniques to meet growing environmental concerns. Competitive landscape is shaped by both international and regional players, highlighting opportunities for consolidation and partnerships. The forecast period of 2025-2033 anticipates continued growth, driven by sustained consumer demand and innovative product development.

The 5.43% CAGR projected for the South American collagen market indicates a steady and predictable expansion trajectory. Growth is expected to be more pronounced in the food and beverage sector, due to increasing incorporation of collagen in functional foods and beverages aimed at health-conscious consumers. The cosmetics and personal care sector will also demonstrate strong growth, driven by the incorporation of collagen in anti-aging skincare products. While challenges remain in ensuring consistent supply of high-quality raw materials and navigating regulatory landscapes, the overall outlook for the South American collagen market remains optimistic, suggesting significant investment opportunities for businesses operating in this sector. Further segmentation by specific collagen types (e.g., Type I, Type II) and detailed regional breakdowns (beyond Brazil and Argentina) would provide a more comprehensive market analysis.

Unlocking the Potential: A Comprehensive Analysis of the South American Collagen Market (2019-2033)

This in-depth report provides a comprehensive analysis of the South American collagen market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on the year 2025, this report meticulously examines market size, growth drivers, key players, and emerging trends. The study period encompasses historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). The report's findings are supported by rigorous data analysis and provide actionable intelligence for strategic decision-making. Expect detailed analysis across key segments including animal-based collagen, marine-based collagen, and applications such as dietary supplements, meat processing, food and beverage, cosmetics and personal care, and other applications.

South American Collagen Market Market Concentration & Dynamics

The South American collagen market exhibits a moderately concentrated landscape, with key players like Gelita AG, JBS SA, and Rousselot holding significant market share. However, the presence of several smaller, regional players indicates a competitive environment. Innovation within the ecosystem is driven by investments in advanced extraction technologies and the development of specialized collagen products tailored to specific applications. Regulatory frameworks, while generally supportive of the industry, vary across countries, impacting market access and product approvals. Substitute products, such as plant-based proteins, present a competitive challenge but haven't significantly impacted market dominance yet. Consumer trends favouring natural and health-conscious products fuel collagen's demand, creating a robust growth environment. The past few years have witnessed significant M&A activity.

- Market Share Concentration: The top 5 players control approximately xx% of the market in 2025.

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024, signaling consolidation trends and significant investments.

- Innovation Ecosystem: Significant R&D investments are being observed focusing on improved extraction and specialized collagen types.

- Regulatory Landscape: Varied regulatory hurdles across South American nations influence market access and product approval processes.

- Substitute Products: Plant-based alternatives are gaining some traction but currently hold a relatively small market share at approximately xx% as of 2025.

South American Collagen Market Industry Insights & Trends

The South American collagen market is experiencing robust growth, driven by a confluence of factors. The market size reached USD xx Million in 2024 and is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements in extraction methods and product formulations are enhancing product quality and expanding application possibilities. The growing demand for collagen-based products across various sectors—notably dietary supplements, cosmetics, and food and beverage—fuels market expansion. Changing consumer preferences towards natural ingredients and functional foods further bolster market growth. However, challenges such as price volatility of raw materials and fluctuations in currency exchange rates can influence market dynamics.

Key Markets & Segments Leading South American Collagen Market

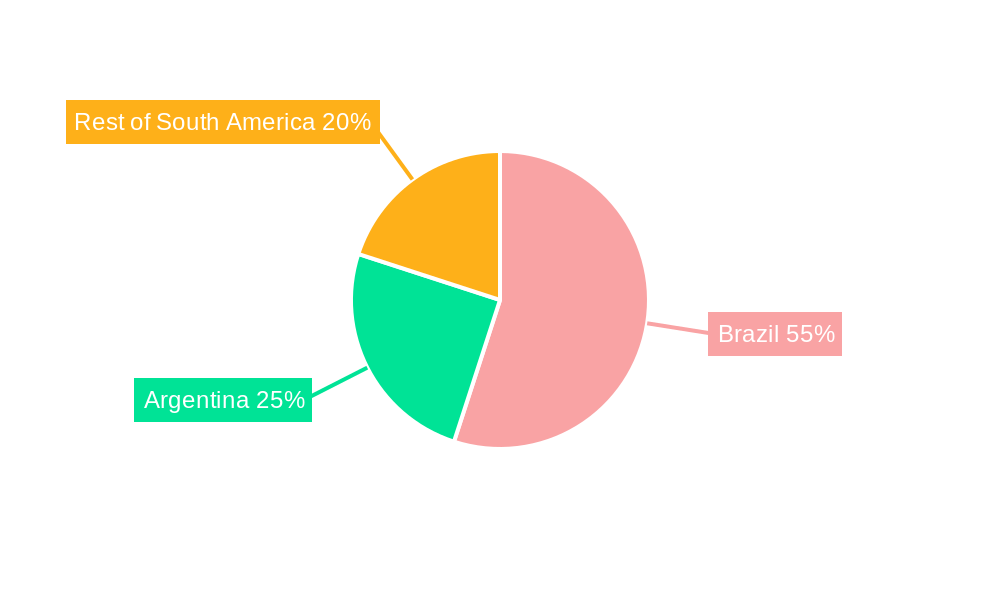

Brazil currently dominates the South American collagen market, driven by strong economic growth and a large and increasingly health-conscious population. Argentina and Colombia are also significant markets, exhibiting considerable growth potential.

Dominant Segments:

- Application: Dietary supplements represent the largest segment, driven by the growing awareness of collagen's benefits for joint health and skin elasticity. Food and beverage applications are also experiencing significant growth.

- Source: Animal-based collagen currently holds the majority market share due to cost-effectiveness and established supply chains. However, marine-based collagen is gaining traction due to increased consumer demand for sustainable and ethically sourced ingredients.

Drivers:

- Economic Growth: Robust economic growth in key South American countries fuels increased consumer spending on health and wellness products.

- Infrastructure Development: Improved infrastructure facilitates efficient transportation and distribution of collagen products across the region.

- Growing Health Awareness: Rising health consciousness among consumers is boosting the demand for collagen-enriched products.

South American Collagen Market Product Developments

Recent years have witnessed significant product innovations in the South American collagen market, focusing on enhanced bioavailability, improved functionality, and specialized applications. Companies are investing in advanced extraction techniques to ensure high-quality, standardized collagen products. Technological advancements such as enzymatic hydrolysis are being utilized to produce collagen peptides with superior solubility and absorption rates. These innovations are driving competitive differentiation and opening up new market opportunities.

Challenges in the South American Collagen Market Market

The South American collagen market faces several challenges, including regulatory inconsistencies across different countries, which create hurdles for market entry and product registration. Fluctuations in raw material prices pose a significant risk, impacting profitability and making pricing strategies complex. Intense competition from both established players and emerging companies adds pressure on margins. Supply chain complexities, particularly related to sourcing raw materials and efficient distribution networks, also present operational hurdles.

Forces Driving South American Collagen Market Growth

The South American collagen market is propelled by several key factors: rising consumer demand for health and wellness products, driven by health awareness campaigns, and increased disposable incomes fuel purchases of premium health and beauty products. Technological innovations in extraction methods and product development lead to superior quality and varied applications. Favorable government policies encouraging the growth of the food processing and cosmetic industries further stimulate the market's expansion.

Long-Term Growth Catalysts in the South American Collagen Market

The long-term growth of the South American collagen market hinges on ongoing innovation in product formulation, targeted at specific health and beauty benefits, expanding partnerships between collagen producers and companies in other related industries will allow access to wider distribution networks and customer bases. Further geographical expansion into less-penetrated markets within South America will help the industry to mature.

Emerging Opportunities in South American Collagen Market

Significant opportunities exist in expanding into niche markets focusing on specialized collagen types for targeted applications, such as sports nutrition or medical devices. Growing consumer demand for sustainable and ethically sourced collagen presents opportunities for companies offering marine-based collagen products. Collaborations with research institutions and universities can create significant product advancements, driving growth.

Leading Players in the South American Collagen Market Sector

- GelcoPEP

- Connoils LLC

- Gelita AG

- JBS SA

- Nitta Gelatin NA Inc

- Gelnex Industria

- Rousselot

- Novaprom

- PB Leiner

- Bioiberica

Key Milestones in South American Collagen Market Industry

- August 2022: JBS SA invested approximately USD 78.1 Million in a new collagen processing facility in Brazil, significantly expanding its capacity to supply the food and beverage industry. This indicates a focus on high-volume production to meet the increasing demand.

- September 2022: Darling Ingredients acquired five facilities in South America, adding 46,000 metric tons of gelatin and collagen production capacity. This acquisition significantly increases their market presence and production capacity in the region.

- November 2022: Acquion Food Tech, a new Brazilian venture, announced a BRL 250 million (USD 46.6 million) investment plan over four years to produce collagen and gelatin. This signifies new market entry and substantial investment in the sector's future.

Strategic Outlook for South American Collagen Market Market

The South American collagen market holds significant long-term growth potential, driven by favorable demographic trends, increasing health consciousness, and continuous product innovation. Strategic opportunities lie in expanding into new applications, developing sustainable sourcing practices, and strengthening supply chains. Companies that can effectively navigate regulatory landscapes and adapt to evolving consumer preferences are poised for considerable success in this burgeoning market.

South American Collagen Market Segmentation

-

1. Source

- 1.1. Animal-based Collagen

- 1.2. Marine-based Collagen

-

2. Application

- 2.1. Dietary Supplements

- 2.2. Meat Processing

- 2.3. Food and Beverage

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Rest of South America

South American Collagen Market Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Rest of South America

South American Collagen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing applications of collagen in meat processing; Growing collagen application in food and beverage industry

- 3.3. Market Restrains

- 3.3.1. Availability of potential alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand for Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal-based Collagen

- 5.1.2. Marine-based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dietary Supplements

- 5.2.2. Meat Processing

- 5.2.3. Food and Beverage

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Brazil South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Animal-based Collagen

- 6.1.2. Marine-based Collagen

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dietary Supplements

- 6.2.2. Meat Processing

- 6.2.3. Food and Beverage

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Colombia South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Animal-based Collagen

- 7.1.2. Marine-based Collagen

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dietary Supplements

- 7.2.2. Meat Processing

- 7.2.3. Food and Beverage

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Rest of South America South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Animal-based Collagen

- 8.1.2. Marine-based Collagen

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dietary Supplements

- 8.2.2. Meat Processing

- 8.2.3. Food and Beverage

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Brazil South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South American Collagen Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 GelcoPEP

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Connoils LLC*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gelita AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jbs SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nitta Gelatin NA Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Gelnex Industria

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rousselot

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Novaprom

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 PB Leiner

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Bioiberica

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 GelcoPEP

List of Figures

- Figure 1: South American Collagen Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South American Collagen Market Share (%) by Company 2024

List of Tables

- Table 1: South American Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South American Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South American Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South American Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South American Collagen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 11: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 15: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South American Collagen Market Revenue Million Forecast, by Source 2019 & 2032

- Table 19: South American Collagen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South American Collagen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South American Collagen Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South American Collagen Market?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the South American Collagen Market?

Key companies in the market include GelcoPEP, Connoils LLC*List Not Exhaustive, Gelita AG, Jbs SA, Nitta Gelatin NA Inc, Gelnex Industria, Rousselot, Novaprom, PB Leiner, Bioiberica.

3. What are the main segments of the South American Collagen Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing applications of collagen in meat processing; Growing collagen application in food and beverage industry.

6. What are the notable trends driving market growth?

Growing Demand for Dietary Supplements.

7. Are there any restraints impacting market growth?

Availability of potential alternatives.

8. Can you provide examples of recent developments in the market?

November 2022: Acquion Food Tech, a new Brazilian venture led by entrepreneur André Albuquerque, begins operations with a plan to invest BRL 250 million (USD 46.6 million) over the next four years to produce collagen and gelatin for the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South American Collagen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South American Collagen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South American Collagen Market?

To stay informed about further developments, trends, and reports in the South American Collagen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence