Key Insights

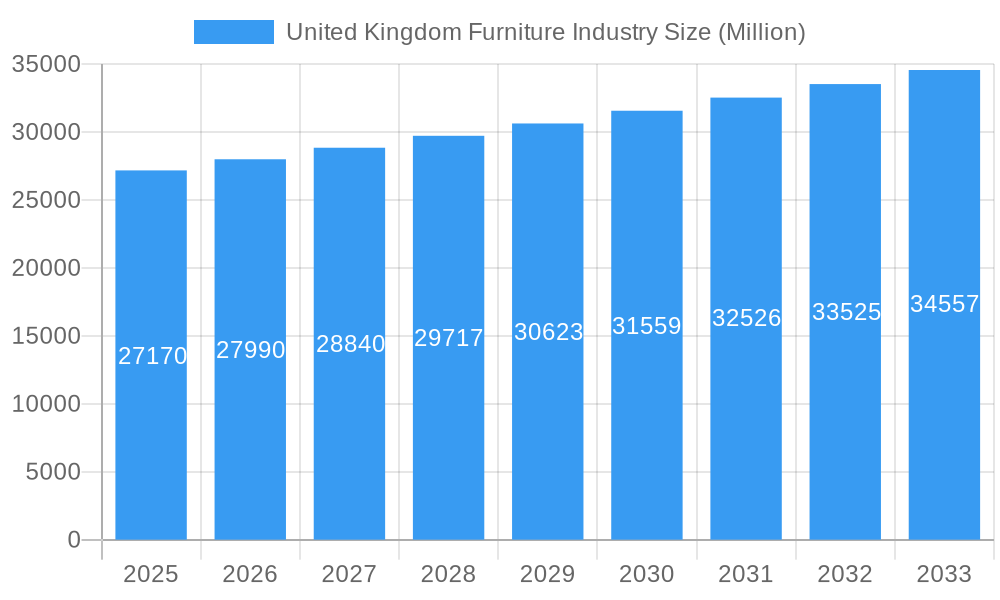

The United Kingdom furniture industry, valued at approximately £27.17 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.02% from 2025 to 2033. This growth is driven by several key factors. Rising disposable incomes and a growing emphasis on home improvement are boosting demand, particularly within the home furniture segment. The increasing popularity of online furniture retail channels provides greater convenience and accessibility for consumers, further stimulating market expansion. Furthermore, the hospitality sector's recovery post-pandemic contributes to increased demand for commercial furniture. However, challenges remain. Supply chain disruptions and fluctuating material costs, particularly for wood and metal, present ongoing restraints. The industry's segmentation reveals a diverse landscape: wood remains a dominant material, but plastic and other materials are gaining traction. Supermarkets and specialty stores are major distribution channels, while online sales continue their robust growth. Key players like IKEA, Modus Furniture, and smaller specialist retailers compete in this dynamic market, each catering to distinct consumer preferences and price points. The industry's future hinges on successfully navigating these challenges while capitalizing on the opportunities presented by evolving consumer trends and technological advancements.

United Kingdom Furniture Industry Market Size (In Billion)

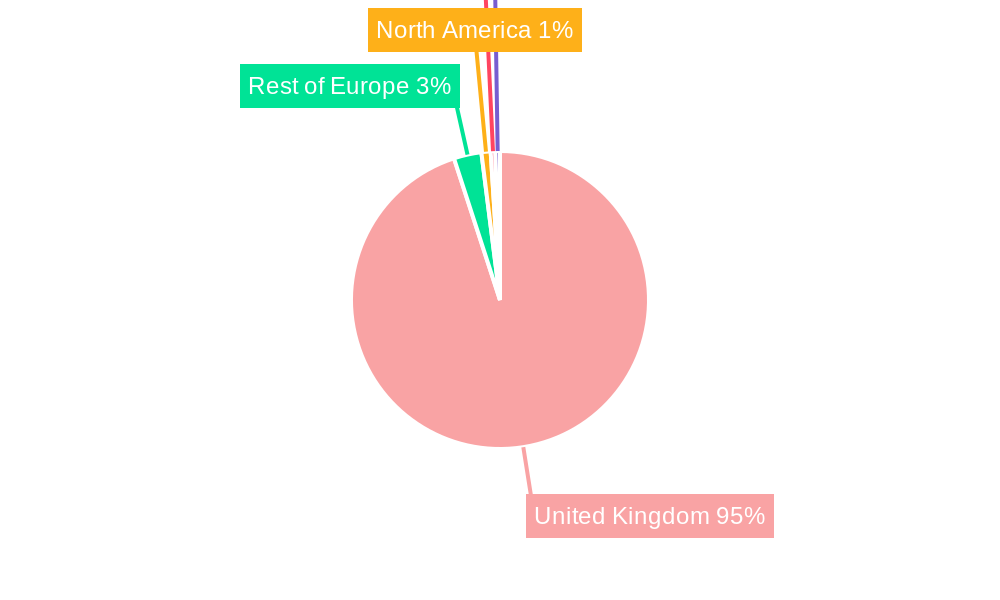

The regional breakdown of the UK furniture market isn't explicitly provided, but considering the UK's economic structure and population density, it's reasonable to assume a high concentration of market activity within the UK itself. While international companies such as IKEA significantly contribute, the majority of revenue likely comes from domestic sales and production. This suggests a strong focus on internal market dynamics, including consumer preferences for design, sustainability, and affordability, as well as the competitive landscape between established and emerging brands. Future growth will depend on continued investment in innovative designs, sustainable sourcing practices, and a strategic adaptation to changing consumer behaviours, including the integration of technology in the buying process and delivery models.

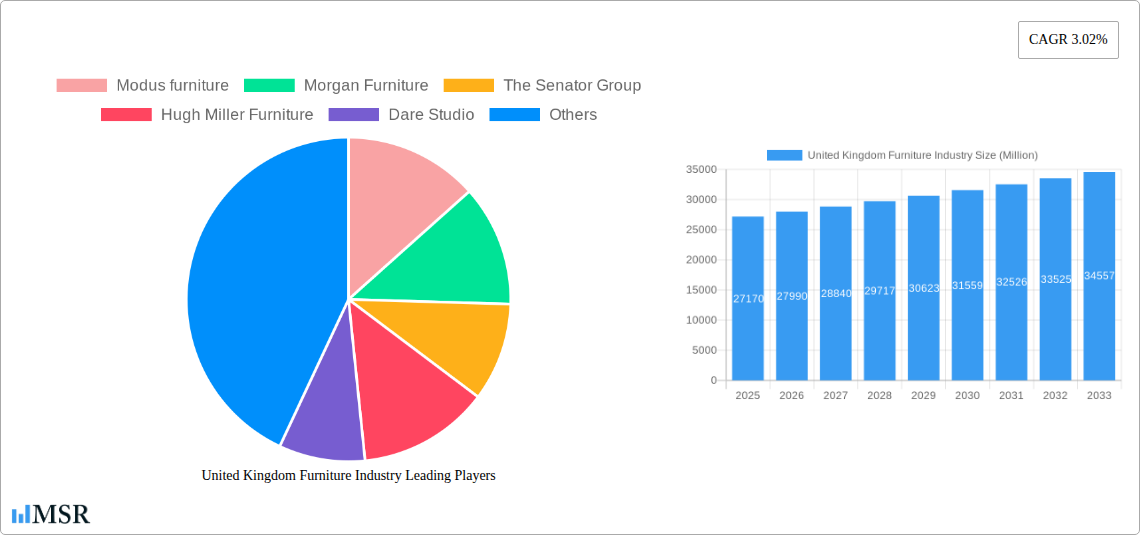

United Kingdom Furniture Industry Company Market Share

United Kingdom Furniture Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the United Kingdom furniture industry, offering invaluable insights for stakeholders, investors, and businesses operating within this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, segmentation, key players, and future growth potential. The UK furniture market, valued at £XX Million in 2024, is projected to reach £XX Million by 2033, exhibiting a CAGR of XX%.

United Kingdom Furniture Industry Market Concentration & Dynamics

The UK furniture market demonstrates a moderately concentrated structure, with a few large players like IKEA and Furniture Village holding significant market share alongside numerous smaller, specialized businesses. Market share data reveals that IKEA commands approximately XX% of the market, followed by Furniture Village at approximately XX%. The remaining market share is distributed amongst a multitude of players, including Modus furniture, Morgan Furniture, The Senator Group, Hugh Miller Furniture, Dare Studio, On & On Designs, Benchmark, Staverton, The Bisley Group, Williams Ridout, and Case Furniture. This fragmented landscape fosters competition, encouraging innovation and diversification.

The regulatory framework, encompassing product safety standards and environmental regulations, significantly influences market dynamics. Substitute products, such as repurposed or vintage furniture, present a growing challenge, particularly within the environmentally conscious consumer segment. End-user trends towards sustainability and minimalist design are shaping product development and marketing strategies. M&A activity within the sector remains relatively modest, with approximately XX deals recorded between 2019 and 2024. However, strategic partnerships and collaborations are increasingly common, facilitating market expansion and technological advancements.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller firms.

- Innovation Ecosystem: Moderate level of innovation, driven by both established and emerging players.

- Regulatory Framework: Stringent product safety and environmental regulations in place.

- Substitute Products: Increasingly popular repurposed and vintage furniture presents competition.

- End-User Trends: Growing demand for sustainable and minimalist designs.

- M&A Activity: Relatively low M&A activity, with approximately XX deals between 2019 and 2024.

United Kingdom Furniture Industry Industry Insights & Trends

The UK furniture industry's growth is propelled by several key factors. Rising disposable incomes and an improving housing market stimulate demand for home furniture. Furthermore, the expansion of the hospitality sector fuels growth in the commercial furniture segment. Technological disruptions, including the rise of e-commerce and the adoption of advanced manufacturing techniques, are reshaping the industry landscape. Evolving consumer behaviors, such as a growing preference for online shopping and personalized furniture solutions, are creating new opportunities for businesses that can adapt effectively. The market size is projected to increase significantly, driven by strong economic growth, population increase and consumer spending.

Key Markets & Segments Leading United Kingdom Furniture Industry

The home furniture segment dominates the UK market, accounting for approximately XX% of total revenue in 2024. Within the material segment, wood remains the most popular choice, followed by metal and plastic. Online distribution channels are experiencing rapid growth, fueled by increased internet penetration and consumer preference for convenience. London and other major cities lead regional market shares.

Drivers:

- Economic Growth: Rising disposable incomes drive demand for higher-quality furniture.

- Infrastructure Development: New housing projects and commercial developments stimulate demand.

- Population Growth: Increasing population fuels demand for both residential and commercial furniture.

- Tourism: Growth in tourism increases demand for furniture in hotels and other hospitality establishments.

Dominance Analysis:

The home furniture segment demonstrates robust growth potential due to sustained demand from a population that embraces home improvement projects. Wood remains the dominant material due to its perceived quality and versatility. The rise of online shopping is revolutionizing the distribution channel landscape, significantly increasing market accessibility for consumers while providing an additional avenue for growth to manufacturers. London continues to be the key regional market, driven by high population density and robust consumer spending.

United Kingdom Furniture Industry Product Developments

Recent years have witnessed significant advancements in furniture design and manufacturing. Smart furniture incorporating technological features like integrated lighting and charging ports is gaining traction. Sustainable materials and manufacturing processes are increasingly adopted to meet growing environmental concerns. Modular and customizable furniture solutions cater to the rising demand for personalized living spaces. These innovations enhance the competitiveness of UK furniture manufacturers.

Challenges in the United Kingdom Furniture Industry Market

The UK furniture industry faces several challenges, including fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions, exacerbated by Brexit and global events, lead to delays and increased expenses. Intense competition from both domestic and international players puts pressure on margins. Additionally, stringent environmental regulations and evolving consumer preferences create new challenges for manufacturers.

Forces Driving United Kingdom Furniture Industry Growth

Several factors fuel the growth of the UK furniture industry. Economic expansion drives consumer spending and investment in home improvement projects. Technological advancements, such as automation and 3D printing, enhance efficiency and reduce production costs. Government initiatives promoting sustainable practices and investment in infrastructure indirectly support industry growth.

Challenges in the United Kingdom Furniture Industry Market

Long-term growth depends on the industry's ability to adapt to evolving consumer preferences and maintain competitiveness in a global market. Sustainable sourcing, innovative designs, and efficient supply chain management are essential for long-term success. Strategic partnerships and collaborations can also provide access to new markets and technologies.

Emerging Opportunities in United Kingdom Furniture Industry

Emerging trends such as increasing demand for bespoke furniture and the growth of the rental furniture market present significant opportunities. The integration of technology in furniture design, like smart home automation systems, and the focus on circular economy models offers avenues for innovation. The growth of eco-conscious and ethically sourced products is also creating new market niches.

Leading Players in the United Kingdom Furniture Industry Sector

- Modus furniture

- Morgan Furniture

- The Senator Group

- Hugh Miller Furniture

- Dare Studio

- Furniture Village

- On & On Designs

- Benchmark

- IKEA

- Staverton

- The Bisley Group

- Williams Ridout

- Case Furniture

Key Milestones in United Kingdom Furniture Industry Industry

- December 2022: Furniture Village opened a new store in Colchester, expanding its retail presence.

- February 2023: IKEA launched three new home and furniture collections (Vivid Wonderland, Glorious Green, and Simple Serenity), showcasing commitment to design innovation.

Strategic Outlook for United Kingdom Furniture Industry Market

The UK furniture industry is poised for continued growth, driven by a combination of economic factors, evolving consumer preferences, and technological advancements. Companies that embrace sustainable practices, prioritize innovation, and effectively leverage digital channels will be best positioned for success. The market presents compelling opportunities for both established players and new entrants to capitalize on growing demand and emerging trends.

United Kingdom Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Distribution Channel

- 2.1. Supermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. Application

- 3.1. Home Furniture

- 3.2. Office Furniture

- 3.3. Hospitality

- 3.4. Other Furniture

United Kingdom Furniture Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Furniture Industry Regional Market Share

Geographic Coverage of United Kingdom Furniture Industry

United Kingdom Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market

- 3.3. Market Restrains

- 3.3.1. Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Real-Estate Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Home Furniture

- 5.3.2. Office Furniture

- 5.3.3. Hospitality

- 5.3.4. Other Furniture

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Modus furniture

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Morgan Furniture

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Senator Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hugh Miller Furniture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dare Studio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Furniture Village

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On & On Designs

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Benchmark

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IKEA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Staverton**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Bisley Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Williams Ridout

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Case Furniture

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Modus furniture

List of Figures

- Figure 1: United Kingdom Furniture Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: United Kingdom Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: United Kingdom Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United Kingdom Furniture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: United Kingdom Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: United Kingdom Furniture Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: United Kingdom Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Furniture Industry?

The projected CAGR is approximately 3.02%.

2. Which companies are prominent players in the United Kingdom Furniture Industry?

Key companies in the market include Modus furniture, Morgan Furniture, The Senator Group, Hugh Miller Furniture, Dare Studio, Furniture Village, On & On Designs, Benchmark, IKEA, Staverton**List Not Exhaustive, The Bisley Group, Williams Ridout, Case Furniture.

3. What are the main segments of the United Kingdom Furniture Industry?

The market segments include Material, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market.

6. What are the notable trends driving market growth?

Increasing Real-Estate Industry is Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: IKEA launched three new home and furniture collections. These collections are named Vivid Wonderland, Glorious Green, and Simple Serenity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Furniture Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence