Key Insights

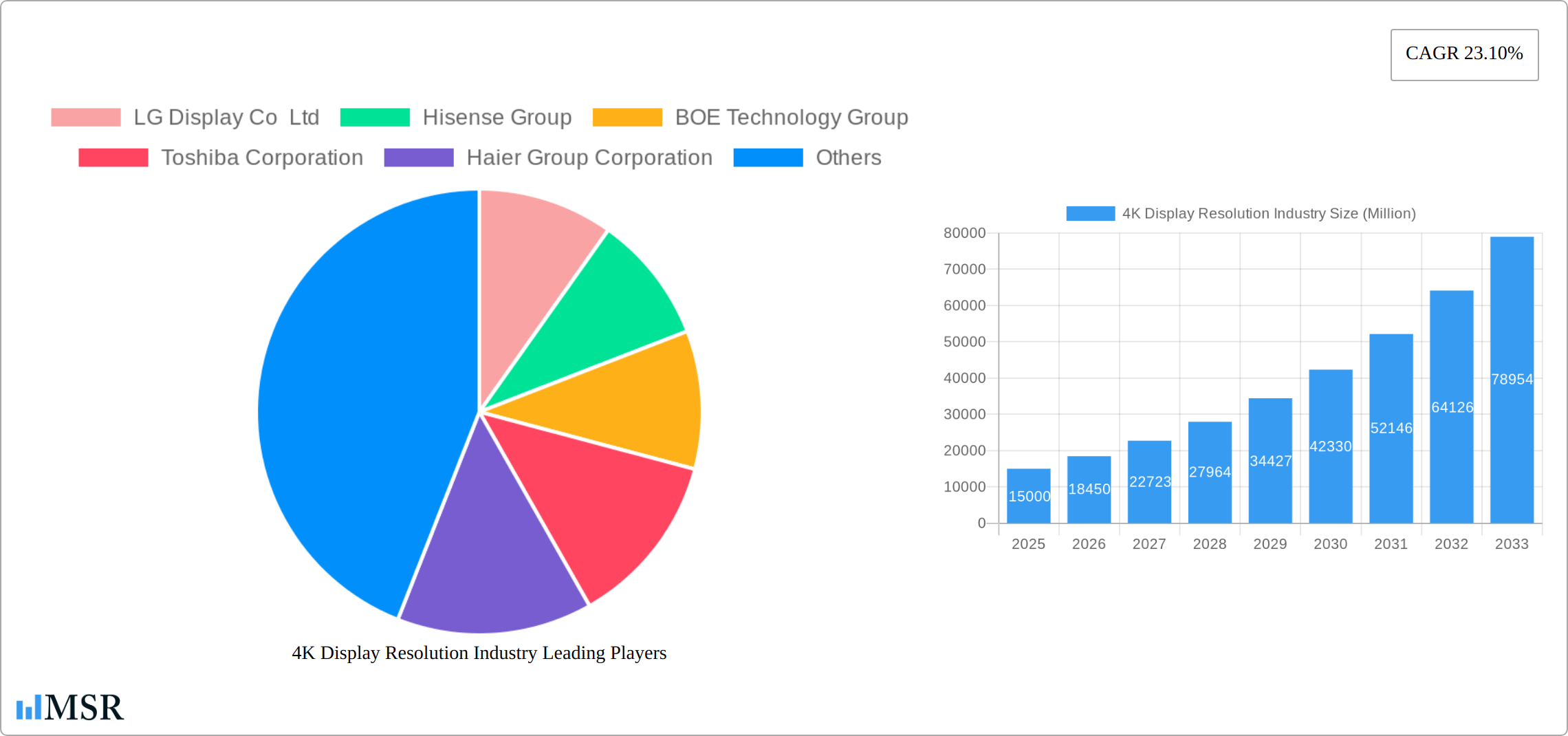

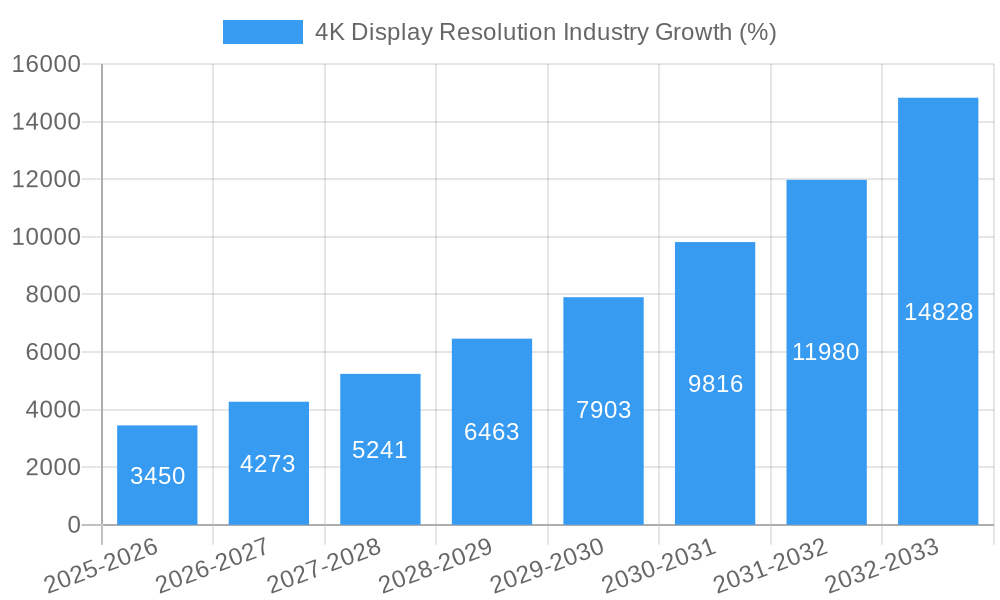

The 4K display resolution market is experiencing robust growth, driven by increasing demand for high-resolution visuals across various sectors. The market, valued at approximately $XX million in 2025 (assuming a logical value based on the provided CAGR of 23.10% and a reasonable starting point in 2019), is projected to witness a Compound Annual Growth Rate (CAGR) of 23.10% from 2025 to 2033. This expansion is fueled by several key factors. The proliferation of streaming services and the rise of 4K content creation are major catalysts, pushing consumers and businesses alike to upgrade their display technologies. Furthermore, advancements in display panel technology, leading to cost reductions and improved picture quality, are making 4K displays increasingly accessible. The gaming industry's shift towards higher resolutions and the expanding adoption of 4K displays in professional settings, such as aerospace and defense simulations and high-end education facilities, contribute significantly to this growth. Segment-wise, Smart TVs currently dominate the market, followed by monitors and smartphones, with each segment experiencing a proportionate growth trajectory mirroring the overall market expansion.

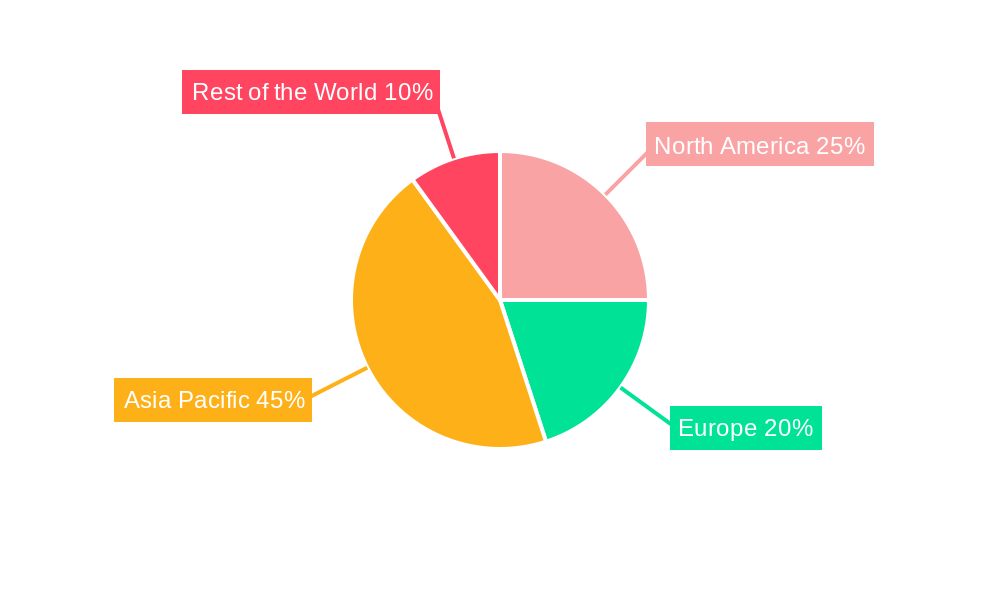

However, several restraining factors could moderate the market's growth. These include the relatively higher cost of 4K displays compared to lower-resolution alternatives, particularly in developing economies. Additionally, technological limitations regarding the availability of high-bandwidth content and the energy consumption associated with higher resolutions could present challenges. Nevertheless, ongoing technological innovation and the sustained demand for superior visual experiences across various applications suggest that the long-term outlook for the 4K display resolution market remains highly positive, with substantial growth expected throughout the forecast period. Key players like LG Display, Samsung, and BOE Technology are actively shaping the market with their ongoing investments in R&D and production capabilities. The Asia-Pacific region is anticipated to be the largest market due to the high growth of electronic consumption and manufacturing in the region.

4K Display Resolution Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the 4K display resolution industry, encompassing market dynamics, key segments, leading players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for industry stakeholders, investors, and anyone seeking to understand this rapidly evolving market. The global 4K display resolution market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

4K Display Resolution Industry Market Concentration & Dynamics

The 4K display resolution market is characterized by a moderately concentrated competitive landscape, with a handful of dominant players controlling a significant market share. Key players like Samsung Electronics Co Ltd, LG Display Co Ltd, BOE Technology Group, and others compete fiercely on price, technology, and features. The market is highly dynamic, influenced by technological advancements, evolving consumer preferences, and strategic mergers and acquisitions (M&A) activities. Innovation ecosystems are thriving, driven by continuous improvements in display technologies like mini-LED and OLED. However, regulatory frameworks concerning energy efficiency and environmental standards can impact the industry. The presence of substitute products like 8K displays and advancements in other display technologies pose competitive pressure. End-user trends indicate growing demand from entertainment and media, with the adoption of large-screen 4K TVs driving market growth.

- Market Share: Samsung Electronics Co Ltd and LG Display Co Ltd hold a combined market share estimated at xx%, with BOE Technology Group and other key players controlling the remaining share.

- M&A Activities: Over the historical period (2019-2024), approximately xx M&A deals were recorded in the industry, mostly focused on consolidation and expansion of supply chains. The projected number of deals for the forecast period is xx.

4K Display Resolution Industry Industry Insights & Trends

The 4K display resolution industry is experiencing robust growth, fueled by several key factors. The increasing affordability of 4K displays, coupled with rising disposable incomes in developing economies, significantly boosts market expansion. Technological advancements, particularly in mini-LED and OLED technologies, offering enhanced picture quality and energy efficiency, are driving market demand. Evolving consumer behavior, emphasizing high-resolution screens for entertainment, gaming, and professional applications, also contributes to growth. The market size reached xx Million in 2024 and is projected to reach xx Million by 2025. The growing demand for high-resolution displays in various end-user verticals is expected to drive the market’s growth during the forecast period. The market is expected to witness significant growth in emerging economies due to increasing consumer spending and rising smartphone and television adoption.

Key Markets & Segments Leading 4K Display Resolution Industry

The Asia-Pacific region currently dominates the 4K display resolution market, driven by robust economic growth and high consumer electronics adoption. China and South Korea are key contributors to this regional dominance. Within the segment breakdown:

By End-user Vertical:

- Entertainment and Media: This segment holds the largest market share due to the increasing popularity of 4K content and the widespread adoption of 4K TVs. Drivers include rising disposable incomes and increasing penetration of streaming services.

- Business and Education: Growth is fueled by the need for high-resolution displays in corporate settings and educational institutions for improved productivity and enhanced visual learning experiences.

- Retail and Advertisement: The segment is growing due to the adoption of high-resolution displays for digital signage and advertising applications.

By Product Type:

- Smart TVs: This segment constitutes the largest share, driven by falling prices and increasing demand for large-screen displays.

- Monitors: The monitor segment displays steady growth, fueled by the demand for high-resolution displays for professional use.

Drivers:

- Strong economic growth in several regions.

- Increasing disposable incomes.

- Growing adoption of streaming services and 4K content.

- Advancement in display technologies

4K Display Resolution Industry Product Developments

Recent product innovations focus on enhancing picture quality, energy efficiency, and size. Mini-LED technology is gaining traction, offering superior contrast and brightness compared to traditional LED backlights. OLED technology continues to improve, providing deeper blacks and wider color gamuts. The introduction of 4K displays in niche applications, such as medical surgical monitors, showcases the versatility of the technology. This continuous innovation keeps the industry competitive and fuels market growth.

Challenges in the 4K Display Resolution Industry Market

The 4K display resolution market faces challenges like fluctuating raw material prices impacting production costs, stringent environmental regulations, and intense competition from other display technologies (e.g., 8K). Supply chain disruptions can also impact production and delivery timelines. The increasing prevalence of counterfeit products and intellectual property rights violations also presents significant challenges. The estimated quantifiable impact of these challenges on overall market growth is about xx% for the forecast period.

Forces Driving 4K Display Resolution Industry Growth

Several factors are driving market growth: technological advancements (mini-LED, OLED), increasing demand for high-resolution displays across various sectors (gaming, entertainment, business), and favorable economic conditions in several regions. Government initiatives promoting digitalization further contribute to the growth. For instance, the increasing adoption of 5G and high-speed internet is creating significant opportunities.

Long-Term Growth Catalysts in the 4K Display Resolution Industry

Long-term growth is fueled by innovations in display technologies, strategic partnerships between display manufacturers and content providers, and expansion into new markets (e.g., automotive, wearable devices). The development of more sustainable and energy-efficient display solutions also contributes to long-term growth prospects.

Emerging Opportunities in 4K Display Resolution Industry

Emerging opportunities include the integration of 4K displays into augmented reality (AR) and virtual reality (VR) devices, growing adoption in the automotive industry for infotainment systems, and the increasing demand for foldable and flexible 4K displays. Furthermore, the use of 4K in specialized applications, such as medical imaging, presents a substantial avenue for growth.

Leading Players in the 4K Display Resolution Industry Sector

- LG Display Co Ltd

- Hisense Group

- BOE Technology Group

- Toshiba Corporation

- Haier Group Corporation

- Samsung Electronics Co Ltd

- AU Optronics

- Innolux Corporation

- Koninklijke Philips NV

- Sharp Corporation

- Panasonic Corporation

- Sony Corporation

Key Milestones in 4K Display Resolution Industry Industry

- November 2022: LG introduced its first 27-inch, 4K surgical monitor with mini-LED technology, showcasing the technology's expansion into specialized markets.

- August 2022: Sony India launched its 85-inch BRAVIA XR X95K Mini LED TV, highlighting the continued focus on premium large-screen 4K displays.

Strategic Outlook for 4K Display Resolution Industry Market

The future of the 4K display resolution market looks bright. Continued technological advancements, coupled with rising demand across diverse sectors and the expansion into new application areas, point towards significant growth potential. Strategic partnerships and investments in research and development will play a crucial role in shaping the market’s future trajectory. The market is poised for sustained expansion as the adoption of 4K technology continues to rise globally.

4K Display Resolution Industry Segmentation

-

1. Product Type

- 1.1. Monitor

- 1.2. Smart TV

- 1.3. Smartphone

- 1.4. Other Product Types

-

2. End-user Vertical

- 2.1. Aerospace and Defence

- 2.2. Business and Education

- 2.3. Entertainment and Media

- 2.4. Retail and Advertisement

- 2.5. Other End-user Verticals

4K Display Resolution Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

4K Display Resolution Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for High-resolution Display Products; Affordable Manufacturing of 4K Display Products

- 3.3. Market Restrains

- 3.3.1. The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution

- 3.4. Market Trends

- 3.4.1. Entertainment and Media Segment to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Monitor

- 5.1.2. Smart TV

- 5.1.3. Smartphone

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Aerospace and Defence

- 5.2.2. Business and Education

- 5.2.3. Entertainment and Media

- 5.2.4. Retail and Advertisement

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Monitor

- 6.1.2. Smart TV

- 6.1.3. Smartphone

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Aerospace and Defence

- 6.2.2. Business and Education

- 6.2.3. Entertainment and Media

- 6.2.4. Retail and Advertisement

- 6.2.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Monitor

- 7.1.2. Smart TV

- 7.1.3. Smartphone

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Aerospace and Defence

- 7.2.2. Business and Education

- 7.2.3. Entertainment and Media

- 7.2.4. Retail and Advertisement

- 7.2.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Monitor

- 8.1.2. Smart TV

- 8.1.3. Smartphone

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Aerospace and Defence

- 8.2.2. Business and Education

- 8.2.3. Entertainment and Media

- 8.2.4. Retail and Advertisement

- 8.2.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Monitor

- 9.1.2. Smart TV

- 9.1.3. Smartphone

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Aerospace and Defence

- 9.2.2. Business and Education

- 9.2.3. Entertainment and Media

- 9.2.4. Retail and Advertisement

- 9.2.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. North America 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World 4K Display Resolution Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 LG Display Co Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Hisense Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 BOE Technology Group

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Toshiba Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Haier Group Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Samsung Electronics Co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 AU Optronics*List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Innolux Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Koninklijke Philips NV

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Sharp Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Panasonic Corporation

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Sony Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 LG Display Co Ltd

List of Figures

- Figure 1: Global 4K Display Resolution Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America 4K Display Resolution Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 11: North America 4K Display Resolution Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: North America 4K Display Resolution Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 13: North America 4K Display Resolution Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 14: North America 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe 4K Display Resolution Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe 4K Display Resolution Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe 4K Display Resolution Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 19: Europe 4K Display Resolution Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 20: Europe 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific 4K Display Resolution Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Asia Pacific 4K Display Resolution Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Asia Pacific 4K Display Resolution Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 25: Asia Pacific 4K Display Resolution Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 26: Asia Pacific 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World 4K Display Resolution Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Rest of the World 4K Display Resolution Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Rest of the World 4K Display Resolution Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 31: Rest of the World 4K Display Resolution Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 32: Rest of the World 4K Display Resolution Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World 4K Display Resolution Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 4K Display Resolution Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global 4K Display Resolution Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global 4K Display Resolution Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global 4K Display Resolution Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: 4K Display Resolution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: 4K Display Resolution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: 4K Display Resolution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: 4K Display Resolution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global 4K Display Resolution Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Global 4K Display Resolution Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 15: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global 4K Display Resolution Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Global 4K Display Resolution Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 18: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global 4K Display Resolution Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global 4K Display Resolution Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 21: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global 4K Display Resolution Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Global 4K Display Resolution Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 24: Global 4K Display Resolution Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 4K Display Resolution Industry?

The projected CAGR is approximately 23.10%.

2. Which companies are prominent players in the 4K Display Resolution Industry?

Key companies in the market include LG Display Co Ltd, Hisense Group, BOE Technology Group, Toshiba Corporation, Haier Group Corporation, Samsung Electronics Co Ltd, AU Optronics*List Not Exhaustive, Innolux Corporation, Koninklijke Philips NV, Sharp Corporation, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the 4K Display Resolution Industry?

The market segments include Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for High-resolution Display Products; Affordable Manufacturing of 4K Display Products.

6. What are the notable trends driving market growth?

Entertainment and Media Segment to Hold Major Share.

7. Are there any restraints impacting market growth?

The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution.

8. Can you provide examples of recent developments in the market?

November 2022: LG introduced its first 27-inch, 4K surgical monitor with mini-LED technology at MEDICA 2022 (the international tradeshow for the medical sector in Düsseldorf, Germany). According to the company, the 4K mini-LED surgical monitor boasts exceptional picture quality courtesy of the company's mini-LED technology, which provides clear, precise images.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "4K Display Resolution Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 4K Display Resolution Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 4K Display Resolution Industry?

To stay informed about further developments, trends, and reports in the 4K Display Resolution Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence