Key Insights

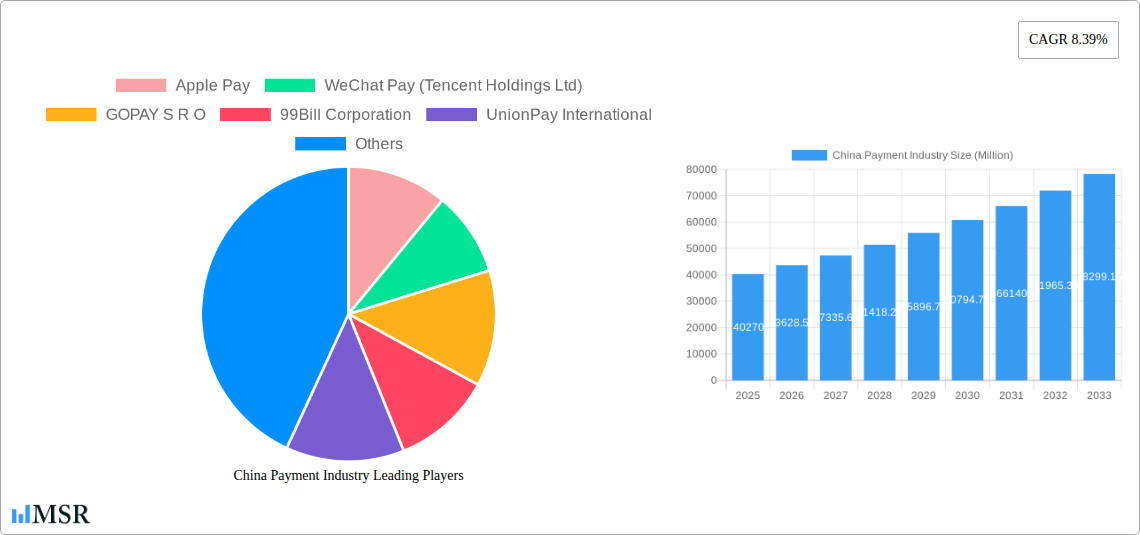

The China payment industry, a rapidly expanding market, is projected to reach \$40.27 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.39% from 2019 to 2033. This phenomenal growth is fueled by several key drivers. The widespread adoption of smartphones and mobile internet access has created a fertile ground for digital payment solutions. Increasing e-commerce activity and a burgeoning middle class with rising disposable incomes further contribute to this expansion. Government initiatives promoting digitalization and financial inclusion also play a significant role. Furthermore, the increasing preference for contactless payments, driven by hygiene concerns and convenience, is accelerating the shift away from traditional cash transactions. The industry is segmented by payment mode (Point of Sale and Online Sale) and end-user industry (Retail, Entertainment, Healthcare, Hospitality, and Others). Major players like Alipay, WeChat Pay, and UnionPay dominate the market, leveraging extensive user bases and sophisticated technological infrastructure. While the market faces challenges such as cybersecurity concerns and the need for robust regulatory frameworks, the overall outlook remains overwhelmingly positive, projecting substantial growth throughout the forecast period.

China Payment Industry Market Size (In Billion)

The competitive landscape is characterized by intense rivalry among established players and emerging fintech companies. Companies are continuously innovating to enhance user experience, expand their service offerings, and penetrate new market segments. This includes integrating AI and machine learning for fraud detection and personalized services. The expansion into less-penetrated regions and rural areas presents a significant opportunity for further growth. While challenges like maintaining data security and ensuring regulatory compliance remain crucial, strategic partnerships and mergers and acquisitions are likely to further shape the industry's trajectory. The continued development of robust infrastructure and the government's ongoing support for digitalization will be vital in sustaining the industry's impressive growth trajectory. The focus on enhancing security measures and addressing consumer concerns will further solidify the confidence in these payment solutions and drive continued market expansion.

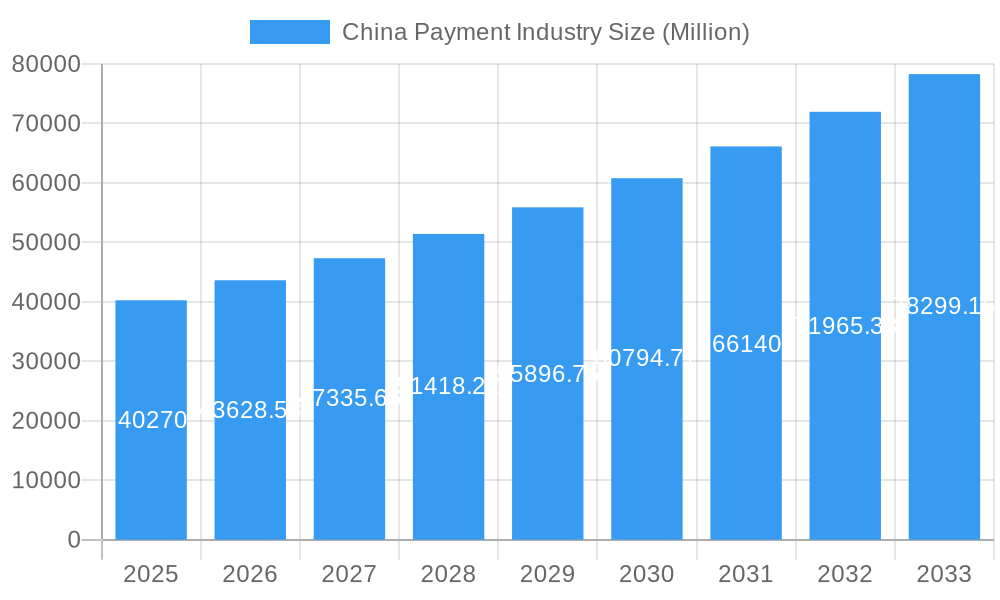

China Payment Industry Company Market Share

China Payment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China payment industry, covering market size, key players, emerging trends, and future growth prospects from 2019 to 2033. With a focus on key segments like Point of Sale and Online Sale, across Retail, Entertainment, Healthcare, and Hospitality end-user industries, this report is essential reading for investors, industry stakeholders, and anyone seeking to understand this rapidly evolving market. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

China Payment Industry Market Concentration & Dynamics

The China payment industry is characterized by high concentration, with dominant players like Alipay and WeChat Pay commanding significant market share. The market exhibits a vibrant innovation ecosystem, fueled by technological advancements and intense competition. Regulatory frameworks, while evolving, play a crucial role in shaping industry dynamics. Substitute products, such as cash and other digital wallets, exert some competitive pressure. End-user trends, particularly among young consumers embracing digital payment options, significantly influence market growth. M&A activity has been relatively high, with xx major deals recorded between 2019 and 2024, indicating consolidation and strategic expansion within the sector.

- Market Share: Alipay and WeChat Pay collectively hold over xx% of the market share in 2024.

- M&A Deal Counts: xx major M&A deals occurred between 2019 and 2024.

- Regulatory Framework: The evolving regulatory landscape influences the adoption of new technologies and payment methods.

- Innovation Ecosystem: Constant innovation in mobile payment technologies and Fintech drives market growth.

China Payment Industry Industry Insights & Trends

The China payment industry experienced significant growth during the historical period (2019-2024), with the market size reaching xx Million in 2024. This robust growth is projected to continue throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. Several factors drive this expansion, including the increasing penetration of smartphones, rising e-commerce adoption, and a growing preference for cashless transactions. Technological disruptions, such as the emergence of digital yuan and innovative payment solutions, are transforming the industry landscape. Evolving consumer behaviors, particularly the adoption of super-apps and mobile wallets by younger demographics, contribute significantly to market expansion.

Key Markets & Segments Leading China Payment Industry

The Chinese market dominates the region, driven by factors such as robust economic growth, widespread smartphone penetration, and supportive government policies. The Point of Sale (POS) segment represents a significant share of the market, benefiting from the extensive adoption of digital payment terminals in retail establishments. The online sales segment also exhibits strong growth, fueled by the booming e-commerce sector.

By Mode of Payment:

- Point of Sale: Dominated by Alipay and WeChat Pay, benefiting from high retail adoption.

- Online Sale: Rapid growth driven by e-commerce expansion and mobile payment convenience.

By End-user Industry:

- Retail: The largest segment, driven by high consumer spending and widespread adoption of digital payments.

- Entertainment: Strong growth fueled by online ticketing, streaming services, and in-app purchases.

- Healthcare: Growing segment driven by increasing digitalization of healthcare services.

- Hospitality: Significant growth driven by mobile payments in hotels, restaurants, and tourist attractions.

- Other End-user Industries: This segment includes sectors such as education, transportation, and utilities, which are gradually adopting digital payment methods.

China Payment Industry Product Developments

Significant product innovations have shaped the competitive landscape. The integration of digital yuan into popular platforms like WeChat signifies a major advancement. Developments in biometric authentication, NFC technology, and AI-powered fraud detection enhance security and user experience. These innovations offer enhanced security, convenience, and personalized services, creating competitive advantages for leading players.

Challenges in the China Payment Industry Market

The China payment industry faces several challenges. Regulatory hurdles, including licensing requirements and data privacy regulations, can impact market entry and operations. Supply chain disruptions, particularly concerning hardware components for POS terminals, can create operational inefficiencies. Intense competition among numerous players necessitates continuous innovation and strategic partnerships to maintain market share. These factors, though significant, are being addressed through strategic planning and regulatory adaptations.

Forces Driving China Payment Industry Growth

Several factors fuel the industry's growth. Technological advancements such as the development of the digital yuan and improved mobile payment infrastructure significantly boost adoption. The robust economic growth in China increases consumer spending and expands the market for digital payment solutions. Supportive government policies promoting cashless transactions contribute to market expansion. Furthermore, the increasing adoption of super-apps incorporating payment functionalities further accelerates the market's growth.

Long-Term Growth Catalysts in the China Payment Industry

Long-term growth will be driven by ongoing technological innovation, strategic partnerships between payment providers and other industry players, and expansion into new markets both domestically and potentially internationally. The continuous development of more sophisticated and user-friendly payment solutions will be key to attracting new customers and increasing overall market penetration.

Emerging Opportunities in China Payment Industry

Emerging opportunities lie in the expansion of mobile payment services into underserved areas, the integration of payment solutions with IoT devices, and the development of innovative payment solutions catering to specific consumer needs and preferences. The growing demand for cross-border payment solutions represents a key opportunity for expansion. Increased focus on financial inclusion through accessible payment options will further fuel growth.

Leading Players in the China Payment Industry Sector

- Apple Pay

- WeChat Pay (Tencent Holdings Ltd)

- GOPAY S R O

- 99Bill Corporation

- UnionPay International

- Huawei Pay (Huawei Device Co Ltd)

- Orange Finance (China Telecom BestPay Co Ltd)

- Mastercard Inc

- JDPay com(JD com)

- AliPay (Alibaba Group)

Key Milestones in China Payment Industry Industry

- April 2022: Integration of Digital Yuan into WeChat.

- June 2022: Launch of BOC Chill Card by Bank of China and Mastercard.

Strategic Outlook for China Payment Industry Market

The future of the China payment industry looks promising. Continued technological innovation, expanding consumer adoption, and supportive government policies will drive substantial growth. Strategic partnerships and market expansion into new sectors and geographies present lucrative opportunities for market players. The industry's trajectory points toward further consolidation, with leading players continually innovating to maintain their market leadership and shape the future of digital payments in China.

China Payment Industry Segmentation

-

1. Mode of Payment

- 1.1. Point of Sale (Card Pay)

- 1.2. Digital Wallet (includes Mobile Wallets)

- 1.3. Cash

- 1.4. Others

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

China Payment Industry Segmentation By Geography

- 1. China

China Payment Industry Regional Market Share

Geographic Coverage of China Payment Industry

China Payment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Adoption of E-commerce Supported by M-commerce in China; Mobile Payments to Drive the Payments Market; Growth of Real-time Payments

- 3.2.2 especially Buy Now Pay Later in China

- 3.3. Market Restrains

- 3.3.1. Internet Breakdown and Bandwidth Limitation

- 3.4. Market Trends

- 3.4.1. Mobile Payments to Drive the Payments Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Payment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale (Card Pay)

- 5.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.3. Cash

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Apple Pay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WeChat Pay (Tencent Holdings Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GOPAY S R O

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 99Bill Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UnionPay International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Pay (Huawei Device Co Ltd)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orange Finance (China Telecom BestPay Co Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mastercard Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JDPay com(JD com)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AliPay (Alibaba Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Apple Pay

List of Figures

- Figure 1: China Payment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Payment Industry Share (%) by Company 2025

List of Tables

- Table 1: China Payment Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: China Payment Industry Volume K Unit Forecast, by Mode of Payment 2020 & 2033

- Table 3: China Payment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: China Payment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: China Payment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Payment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: China Payment Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 8: China Payment Industry Volume K Unit Forecast, by Mode of Payment 2020 & 2033

- Table 9: China Payment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: China Payment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: China Payment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Payment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Payment Industry?

The projected CAGR is approximately 8.39%.

2. Which companies are prominent players in the China Payment Industry?

Key companies in the market include Apple Pay, WeChat Pay (Tencent Holdings Ltd), GOPAY S R O, 99Bill Corporation, UnionPay International, Huawei Pay (Huawei Device Co Ltd), Orange Finance (China Telecom BestPay Co Ltd), Mastercard Inc, JDPay com(JD com), AliPay (Alibaba Group).

3. What are the main segments of the China Payment Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of E-commerce Supported by M-commerce in China; Mobile Payments to Drive the Payments Market; Growth of Real-time Payments. especially Buy Now Pay Later in China.

6. What are the notable trends driving market growth?

Mobile Payments to Drive the Payments Market.

7. Are there any restraints impacting market growth?

Internet Breakdown and Bandwidth Limitation.

8. Can you provide examples of recent developments in the market?

June 2022: BOC Chill Card, the bank's first environmentally friendly credit card, was officially launched by the Bank of China and Mastercard. The card aims to give young consumers who enjoy entertainment, leisure, and environmentally sustainable consumption a "Chill" lifestyle. Young consumers may avail advantage of various cash incentives and a flexible Pay Later payment solution to fit their spending habits and lifestyles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Payment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Payment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Payment Industry?

To stay informed about further developments, trends, and reports in the China Payment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence