Key Insights

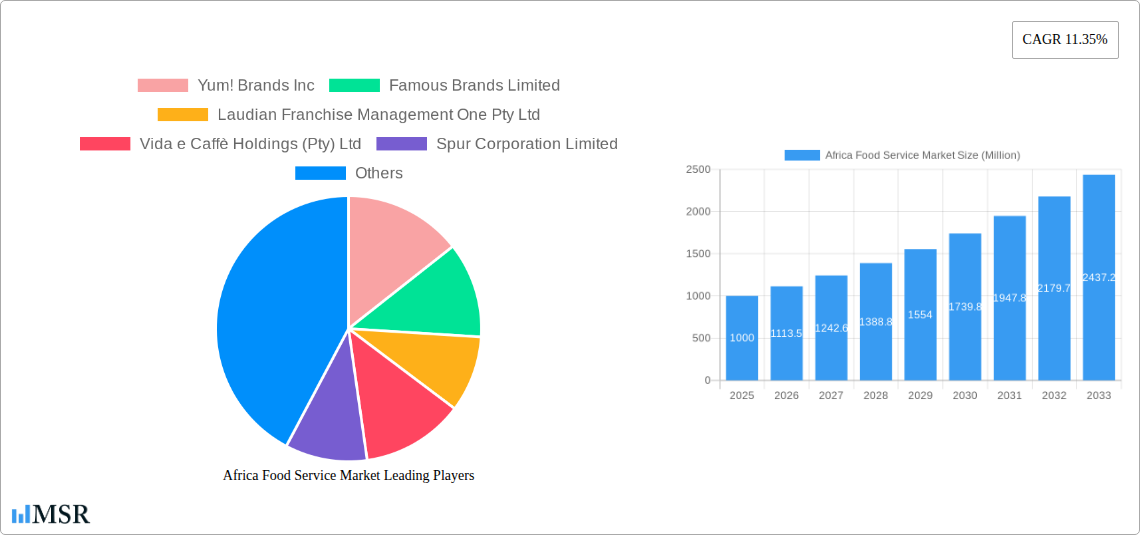

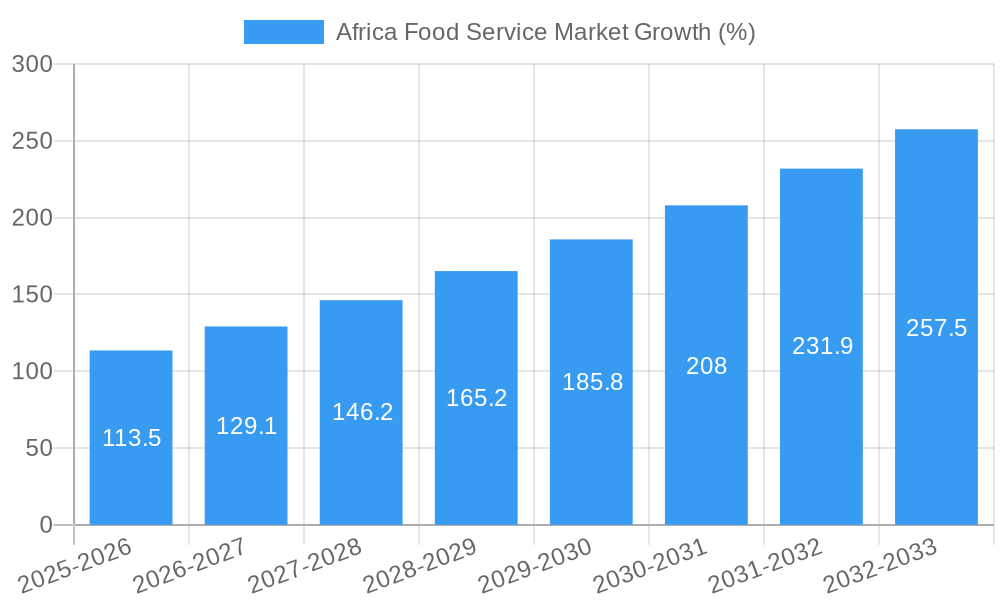

The African food service market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 11.35% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increasing disposable incomes is driving demand for convenient and diverse food options. Rapid urbanization in major African cities like Nairobi, Lagos, and Cape Town is leading to a concentration of consumers and increased opportunities for food service businesses. The rising popularity of quick-service restaurants (QSRs) and international food chains, alongside the growth of local culinary brands, contributes significantly to market dynamism. Furthermore, tourism's increasing contribution to many African economies boosts the demand for food service offerings, especially within the leisure and lodging sectors. However, challenges remain. Infrastructure limitations in some regions, fluctuating food prices, and competition from informal street food vendors pose constraints on market growth. The market is segmented by food service type (cafes & bars, other QSR cuisines), outlet type (chained and independent outlets), and location (leisure, lodging, retail, standalone, travel). Key players like Yum! Brands, Famous Brands, and McDonald's are strategically investing in the region to capitalize on the growth potential.

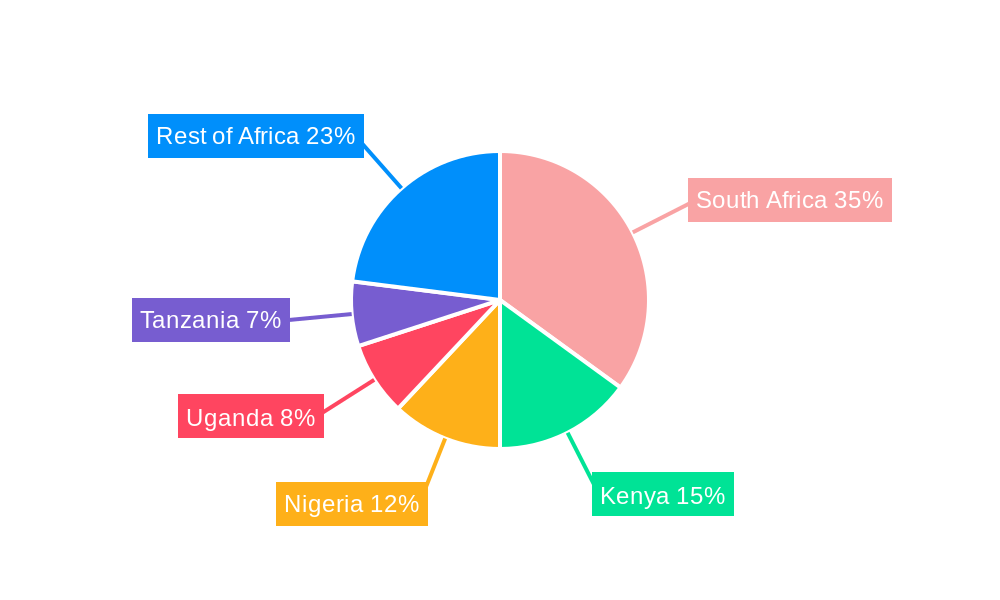

The market's segmentation reveals opportunities across different segments. The QSR segment is particularly vibrant, with significant potential for growth driven by the demand for convenience and affordability. Chained outlets benefit from brand recognition and economies of scale, while independent outlets offer localized menus and personalized experiences. Growth in the tourism sector fuels the demand for food service establishments in leisure and lodging locations. Geographic variations are notable, with South Africa, Kenya, and other economically stronger nations driving the majority of market growth. However, untapped potential remains in less developed regions, which will benefit from improved infrastructure and economic development in the coming years. This dynamic interplay of drivers, restraints, and segment-specific opportunities presents a complex yet promising landscape for investors and businesses operating within the African food service sector. A focused strategy on adapting to local tastes while leveraging international best practices will be crucial for success.

Unlock the Untapped Potential: A Comprehensive Analysis of the Africa Food Service Market (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Africa Food Service Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report meticulously examines market dynamics, trends, and future opportunities across various segments. The report uses the latest data available to predict future values and trends.

Africa Food Service Market Concentration & Dynamics

The Africa Food Service Market exhibits a dynamic landscape characterized by a mix of established international players and rapidly growing local businesses. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller players contribute to the overall market vibrancy. Innovation is driven by technological advancements, changing consumer preferences, and the emergence of diverse culinary offerings. Regulatory frameworks vary across the continent, influencing market access and operational standards. Substitute products, including home-cooked meals and informal street food, compete for consumer spending. End-user trends reflect a growing preference for convenience, affordability, and diverse culinary experiences. Mergers and acquisitions (M&A) activity is on the rise, with an estimated xx M&A deals recorded between 2019 and 2024. Key players are leveraging strategic acquisitions to expand their market footprint and product offerings.

- Market Share: Dominant players hold approximately xx% of the market share collectively, with the remaining share dispersed among numerous smaller players.

- M&A Activity: An estimated xx M&A deals were recorded from 2019 to 2024, indicating increased consolidation within the sector.

- Regulatory Landscape: Varying regulatory environments across different African countries pose both challenges and opportunities for market expansion.

- Innovation Ecosystem: Technological advancements in online ordering, delivery platforms, and kitchen automation are driving significant innovation within the sector.

Africa Food Service Market Industry Insights & Trends

The Africa Food Service Market is experiencing robust growth, fueled by a burgeoning young population, rising disposable incomes, and urbanization. The market size in 2025 is estimated at $xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Technological disruptions, such as online ordering platforms and mobile payment solutions, are reshaping consumer behavior and market dynamics. Evolving consumer preferences, such as demand for healthier food options, international cuisines, and personalized experiences, are driving innovation and product diversification. The market is also witnessing the rise of quick-service restaurants (QSRs) offering convenience and affordability. Key growth drivers include a rise in tourism, expanding middle class, and increased adoption of technology in the sector. Several factors contribute to the growth of this market, including the increasing adoption of e-commerce and online food delivery platforms.

Key Markets & Segments Leading Africa Food Service Market

The Africa Food Service Market exhibits diverse growth across various segments. While the exact dominance is difficult to definitively state without further specific market data, potential analysis suggests:

- Dominant Region/Country: South Africa, Nigeria, and Kenya are likely the leading markets due to their large populations, robust economies, and relatively developed infrastructure. However, other regions are exhibiting rapid growth.

- Dominant Foodservice Type: The QSR segment (including both chained and independent outlets) is likely to be dominant due to its affordability and convenience.

- Dominant Outlet Type: Chained outlets benefit from economies of scale and brand recognition, while independent outlets often cater to localized tastes and preferences.

- Dominant Location: Retail and standalone locations are likely prevalent, reflecting consumer convenience preferences. However, lodging and travel segments are showing potential for expansion.

Drivers of Growth (for key segments):

- Economic Growth: Rising disposable incomes fuel increased spending on food services.

- Urbanization: Increased concentration of populations in urban areas creates higher demand.

- Tourism: Growing tourist numbers support demand for diverse dining experiences.

- Infrastructure Development: Improved infrastructure (roads, internet access) enhances access and convenience.

Africa Food Service Market Product Developments

The Africa Food Service Market is witnessing significant product innovation, with a focus on enhancing convenience, health, and customization. Technological advancements such as self-service kiosks, mobile ordering apps, and kitchen automation are improving efficiency and enhancing customer experience. Restaurants are expanding their menu offerings to cater to diverse dietary needs and preferences, incorporating healthier options and global cuisines. This drive towards innovation is creating competitive advantages and attracting more customer base.

Challenges in the Africa Food Service Market

The Africa Food Service Market faces several challenges, including:

- Regulatory Hurdles: Inconsistent regulatory frameworks across different countries create complexities for businesses.

- Supply Chain Issues: Logistics and infrastructure limitations can affect the availability and cost of ingredients.

- Competitive Pressures: Intense competition among existing players, both local and international, necessitates strategic positioning.

- Economic Volatility: Fluctuations in economic conditions may impact consumer spending and profitability.

Forces Driving Africa Food Service Market Growth

Several factors are driving the growth of the Africa Food Service Market:

- Technological Advancements: Online ordering, delivery platforms, and digital payment systems are revolutionizing consumer access.

- Economic Expansion: Growth in disposable income fuels higher spending on food services.

- Favorable Government Policies: Supportive policies aimed at promoting the sector contribute to market growth.

- Changing Consumer Preferences: Demand for convenience, international cuisines, and healthier options fuels innovation.

Long-Term Growth Catalysts in Africa Food Service Market

Long-term growth will be propelled by continued innovation in food technology, strategic partnerships, and expansion into new markets. The development of sustainable and locally sourced food supply chains will be crucial. Expansion into underserved regions and exploring new culinary concepts will create further opportunities.

Emerging Opportunities in Africa Food Service Market

Emerging opportunities include:

- Healthier Food Options: Growing demand for healthy and nutritious food presents significant opportunities.

- Technology Integration: Leveraging technology for efficient operations and enhanced customer experience.

- Expansion into Underserved Markets: Targeting less developed regions with accessible food service options.

- Focus on Local Flavors: Showcasing and promoting regional cuisines to attract broader consumer appeal.

Leading Players in the Africa Food Service Market Sector

- Yum! Brands Inc

- Famous Brands Limited

- Laudian Franchise Management One Pty Ltd

- Vida e Caffè Holdings (Pty) Ltd

- Spur Corporation Limited

- Domino's Pizza Inc

- Restaurant Brands International Inc

- Roman's Pizza

- McDonald's Corporation

Key Milestones in Africa Food Service Market Industry

- June 2021: Spur Corporation opened its first Drive Thru in Pretoria, South Africa.

- July 2022: Spur Corporation announced plans to open 32 new restaurants in South Africa and nine internationally by June 30, 2023.

- July 2022: KFC opened a technologically advanced outlet in Pinelands, Western Cape, featuring digital menu boards, self-service kiosks, and a dedicated delivery window.

Strategic Outlook for Africa Food Service Market

The Africa Food Service Market presents significant long-term growth potential. Strategic opportunities exist for companies that can adapt to evolving consumer preferences, leverage technological advancements, and navigate the complexities of the diverse regulatory landscape. Focus on building robust supply chains, investing in technology, and tailoring offerings to local tastes will be key to success in this dynamic market. The continued growth of the middle class and ongoing urbanization will ensure sustained demand for food services across the continent.

Africa Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Africa Food Service Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. The rising popularity of food delivery platforms like Mr.D and Uber Eats is boosting the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. South Africa Africa Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Food Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Food Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Yum! Brands Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Famous Brands Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Laudian Franchise Management One Pty Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Vida e Caffè Holdings (Pty) Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Spur Corporation Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Domino's Pizza Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Restaurant Brands International Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Roman's Pizza

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 McDonald's Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Yum! Brands Inc

List of Figures

- Figure 1: Africa Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Africa Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Africa Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Africa Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 14: Africa Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 15: Africa Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 16: Africa Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Food Service Market?

The projected CAGR is approximately 11.35%.

2. Which companies are prominent players in the Africa Food Service Market?

Key companies in the market include Yum! Brands Inc, Famous Brands Limited, Laudian Franchise Management One Pty Ltd, Vida e Caffè Holdings (Pty) Ltd, Spur Corporation Limited, Domino's Pizza Inc, Restaurant Brands International Inc, Roman's Pizza, McDonald's Corporation.

3. What are the main segments of the Africa Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

The rising popularity of food delivery platforms like Mr.D and Uber Eats is boosting the market growth.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

July 2022: Spur Corporation planned to open 32 new restaurants in South Africa and nine stores internationally by June 30, 2023.July 2022: KFC opened a new outlet in Pinelands, Western Cape, which is ultra-modern and features some of the latest restaurant technology. The store features digital menu boards in each of the dual-lane drive-thru. It also boasts dedicated self-service kiosks for walk-in customers, a dedicated window for delivery drivers, and digital menu boards.June 2021: Spur Corporation opened its first Drive Thru at Heinrich Ave, Karenpark, Pretoria, to provide easy access to customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Food Service Market?

To stay informed about further developments, trends, and reports in the Africa Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence