Key Insights

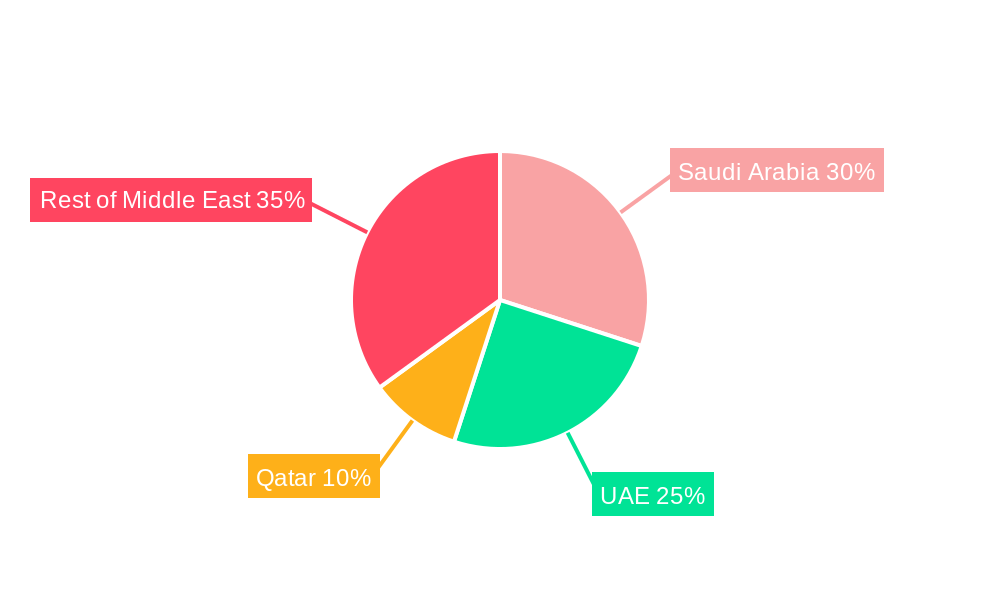

The Middle East ready-to-drink (RTD) coffee market is experiencing robust growth, driven by several key factors. A rising young population with a penchant for Westernized beverages and increasing disposable incomes are fueling demand for convenient and premium coffee options. The region's burgeoning cafe culture and a growing awareness of coffee's health benefits (particularly cold brew and iced coffee) are further stimulating market expansion. The dominance of established players like Nestle and Coca-Cola, alongside the emergence of local brands like Almarai, highlights a competitive landscape marked by both international and regional competition. The preference for convenient packaging formats like PET bottles and cans caters to the fast-paced lifestyle of urban consumers, while the on-trade (cafes, restaurants) and off-trade (supermarkets, convenience stores) channels are both contributing significantly to market sales. While the market faces some restraints such as fluctuating raw material prices and intense competition, the overall trend points to continued growth. The projected CAGR of 6.10% suggests a substantial market expansion over the forecast period (2025-2033), with significant opportunities for companies that successfully target specific consumer segments with tailored product offerings and marketing strategies. The segmentation by soft drink type (cold brew, iced coffee, etc.) and packaging type indicates the need for diverse product portfolios to capture the varied consumer preferences in the region. Saudi Arabia, the UAE, and Qatar are expected to remain the key revenue generators, fueled by their larger populations and greater per capita income compared to other Middle Eastern countries.

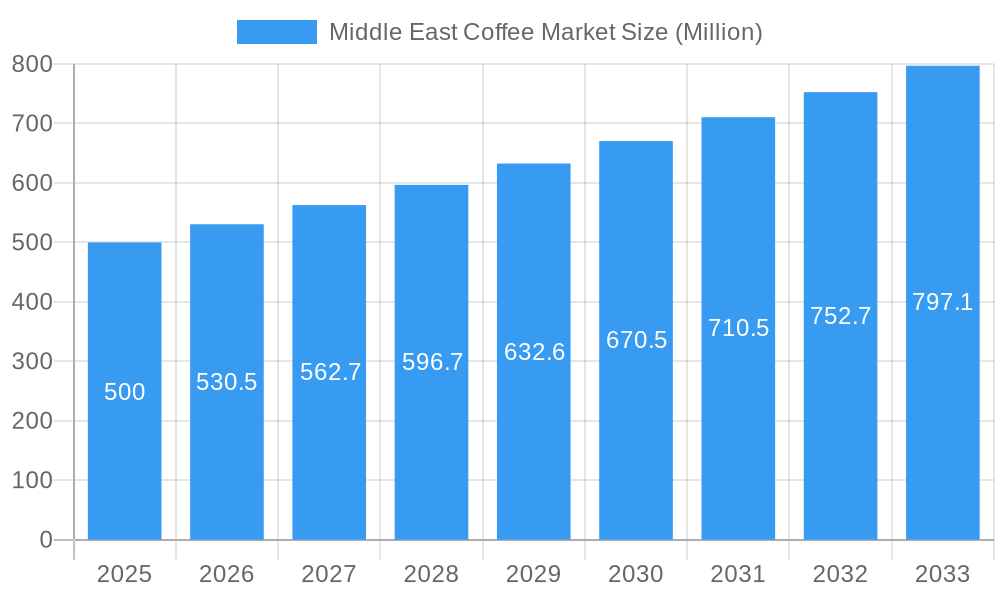

Middle East Coffee Market Market Size (In Million)

Considering the given 6.10% CAGR and a base year of 2025, with an estimated market size of (let's assume) $500 million, we can project reasonable market growth. Different segments like cold brew coffee, iced coffee, and various packaging types will likely exhibit varied growth rates depending on consumer preferences and marketing efforts. The distribution channel (on-trade vs. off-trade) will also influence market dynamics. Further market expansion is possible with the introduction of innovative products, strategic partnerships, and efficient supply chain management in response to shifting consumer preferences and preferences for sustainability. The continued expansion of cafe culture and the increasing adoption of online and mobile ordering systems will also significantly impact future growth. The diverse range of companies operating in this market highlights both the competitive landscape and the diverse opportunities available for both established players and new entrants.

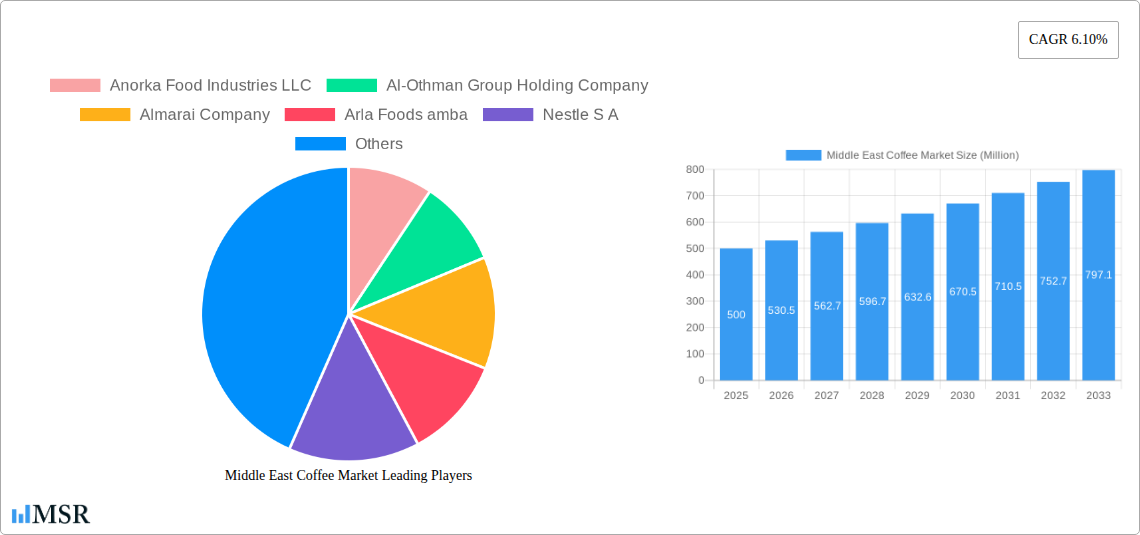

Middle East Coffee Market Company Market Share

Middle East Coffee Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East coffee market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, and future projections, empowering you to navigate this rapidly evolving landscape. The report leverages extensive data analysis, including market sizing and CAGR projections, to present actionable intelligence for informed strategic planning. Key segments analyzed include Ready-to-Drink (RTD) coffee (Cold Brew Coffee, Iced Coffee, Other RTD Coffee), distribution channels (On-trade, Off-trade), packaging types (Aseptic packages, Glass Bottles, Metal Can, PET Bottles), and major countries within the Middle East (Qatar, Saudi Arabia, United Arab Emirates, Rest of Middle East). Leading players like Nestle S.A., Starbucks, and Almarai Company are profiled, highlighting their market strategies and contributions to the industry's growth.

Middle East Coffee Market Concentration & Dynamics

The Middle East coffee market exhibits a moderately concentrated structure, with several multinational giants and regional players vying for market share. The market share held by the top five players is estimated at xx%, demonstrating a competitive yet consolidated landscape. Innovation is driven by both established brands and emerging startups focusing on product diversification (e.g., cold brew, flavored coffees) and sustainable packaging options. Regulatory frameworks, particularly concerning food safety and labeling, play a significant role, impacting product development and market access. Substitute products, such as tea and energy drinks, present competition, while consumer preferences shift towards healthier and more convenient options. The historical period (2019-2024) saw a moderate number of M&A activities (xx deals), primarily focusing on expanding distribution networks and strengthening market presence. The forecast period (2025-2033) is anticipated to see a rise in strategic partnerships and acquisitions driven by the increasing market demand and consumer preferences.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation: Focus on RTD coffee variations, sustainable packaging.

- Regulatory Landscape: Stringent food safety and labeling regulations.

- Substitute Products: Competition from tea and energy drinks.

- M&A Activity: xx deals (2019-2024), expected increase in 2025-2033.

Middle East Coffee Market Industry Insights & Trends

The Middle East coffee market is experiencing robust growth, driven by increasing disposable incomes, changing lifestyles, and a rising young population with a preference for premium coffee experiences. The market size in 2025 is estimated at $xx Million, projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements in brewing techniques, packaging, and distribution are significantly impacting market dynamics. Consumers are increasingly seeking convenient, high-quality, and ethically sourced coffee options. The rising popularity of cold brew and iced coffee reflects evolving consumer preferences for refreshing and convenient beverages. Furthermore, the increasing adoption of online and mobile ordering and delivery services is shaping the market's growth trajectory. The impact of external factors like fluctuating coffee bean prices and regional political and economic events cannot be ignored.

Key Markets & Segments Leading Middle East Coffee Market

The United Arab Emirates (UAE) and Saudi Arabia dominate the Middle East coffee market, driven by strong economic growth, high consumer spending, and developed retail infrastructure. Other key markets include Qatar and the Rest of the Middle East, exhibiting varying growth trajectories based on their respective economic landscapes. Within segments, Ready-to-Drink (RTD) coffee, particularly cold brew and iced coffee, is experiencing rapid growth. The off-trade distribution channel (supermarkets, convenience stores) holds a larger market share than the on-trade (cafes, restaurants). Packaging preferences vary across segments and countries, but PET bottles and aseptic packages are gaining popularity due to convenience and extended shelf life.

Growth Drivers:

- Strong Economic Growth: High disposable incomes in the UAE and Saudi Arabia.

- Developed Retail Infrastructure: Extensive supermarket and convenience store networks.

- Evolving Consumer Preferences: Growing demand for RTD coffee and premium offerings.

- Tourism: Increased tourist traffic fueling demand in key cities.

Middle East Coffee Market Product Developments

Recent product innovations focus on premiumization, convenience, and health-conscious options. The introduction of new RTD coffee variants, such as cold brew and flavored iced coffees, caters to changing consumer preferences. Technological advancements in packaging, such as aseptic cartons for extended shelf life and sustainable alternatives, enhance product appeal. Companies are also focusing on creating unique coffee blends and flavor profiles to differentiate their offerings and enhance the consumer experience. Starbucks' Oleato launch in May 2023, combining arabica coffee and olive oil, exemplifies this trend of innovation and premiumization.

Challenges in the Middle East Coffee Market Market

The Middle East coffee market faces challenges such as fluctuating coffee bean prices, impacting profitability. Supply chain disruptions and logistical hurdles can also affect product availability and pricing. Intense competition from established players and new entrants creates pressure on pricing and market share. Furthermore, varying regulatory frameworks across different countries can create complexities for market entry and expansion. These challenges need to be addressed for sustainable market growth.

Forces Driving Middle East Coffee Market Growth

Several factors are driving the growth of the Middle East coffee market. Rising disposable incomes and a burgeoning young population create a significant consumer base for coffee. The increasing popularity of cafes and coffee shops contributes to higher consumption rates. Technological advancements in coffee brewing and packaging provide consumers with more convenient and enjoyable experiences. Government initiatives supporting the food and beverage industry also promote market expansion.

Challenges in the Middle East Coffee Market Market

Long-term growth will depend on addressing challenges such as maintaining product quality and consistency in the face of fluctuating input costs. Strategic partnerships and collaborations can foster innovation and market expansion. Investing in sustainable packaging solutions and responsible sourcing practices will enhance brand reputation and attract environmentally conscious consumers.

Emerging Opportunities in Middle East Coffee Market

Emerging opportunities lie in expanding into less-penetrated markets within the Middle East. Specializing in niche coffee varieties (e.g., organic, fair-trade) targets the growing consumer demand for ethical and sustainable products. Leveraging digital channels for marketing and direct-to-consumer sales expands market reach and improves customer engagement.

Leading Players in the Middle East Coffee Market Sector

- Anorka Food Industries LLC

- Al-Othman Group Holding Company

- Almarai Company

- Arla Foods amba

- Nestle S.A. [Nestle Website]

- National Food Industries Company Ltd

- Rauch Fruchtsäfte GmbH & Co OG

- The Kuwaiti Danish Dairy Company

- The Coca-Cola Company [Coca-Cola Website]

- The Savola Group

- Sapporo Holdings Limited

Key Milestones in Middle East Coffee Market Industry

- September 2020: Chef Middle East partners with Arla Foods to distribute Starbucks RTD coffee.

- February 2022: Starbucks opens its 1000th store in the Middle East.

- May 2023: Starbucks launches Oleato coffee line with olive oil.

Strategic Outlook for Middle East Coffee Market Market

The Middle East coffee market presents significant growth potential driven by evolving consumer preferences and technological innovations. Strategic opportunities exist in product diversification, sustainable packaging, and targeted marketing campaigns. Companies focusing on premiumization, convenience, and ethical sourcing will be well-positioned to capitalize on the market's growth trajectory. Expansion into new markets and strategic partnerships will further enhance market penetration and long-term success.

Middle East Coffee Market Segmentation

-

1. Soft Drink Type

- 1.1. Cold Brew Coffee

- 1.2. Iced coffee

- 1.3. Other RTD Coffee

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Specialty Stores

- 3.1.4. Supermarket/Hypermarket

- 3.1.5. Others

- 3.2. On-trade

-

3.1. Off-trade

Middle East Coffee Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Coffee Market Regional Market Share

Geographic Coverage of Middle East Coffee Market

Middle East Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Cold Brew Coffee

- 5.1.2. Iced coffee

- 5.1.3. Other RTD Coffee

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Specialty Stores

- 5.3.1.4. Supermarket/Hypermarket

- 5.3.1.5. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Anorka Food Industries LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al-Othman Group Holding Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Almarai Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arla Foods amba

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nestle S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Food Industries Company Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rauch Fruchtsäfte GmbH & Co OG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Kuwaiti Danish Dairy Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Coca-Cola Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Savola Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sapporo Holdings Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Anorka Food Industries LLC

List of Figures

- Figure 1: Middle East Coffee Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Coffee Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Middle East Coffee Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Middle East Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East Coffee Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East Coffee Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Middle East Coffee Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Middle East Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Middle East Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Coffee Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Middle East Coffee Market?

Key companies in the market include Anorka Food Industries LLC, Al-Othman Group Holding Company, Almarai Company, Arla Foods amba, Nestle S A, National Food Industries Company Ltd, Rauch Fruchtsäfte GmbH & Co OG, The Kuwaiti Danish Dairy Company, The Coca-Cola Company, The Savola Grou, Sapporo Holdings Limited.

3. What are the main segments of the Middle East Coffee Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

May 2023: Starbucks introduced Oleato, a line of beverages that combine arabica coffee with extra virgin olive oil featuring such varieties as latte, expresso, cold brew, and iced cortado offering a velvety smooth, deliciously lush new coffee experience.February 2022: Starbucks has opened its 1,000th store in the Middle East region. The milestone opening took place on Bluewaters Island in Dubai, as it continued its expansion across 14 markets in the region.September 2020: Chef Middle East has extended its partnership and collaboration with Arla Foods to include the Starbucks ‘Ready-to-drink’ range to its already vast existing portfolio of products to distribute to its food service customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Coffee Market?

To stay informed about further developments, trends, and reports in the Middle East Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence