Key Insights

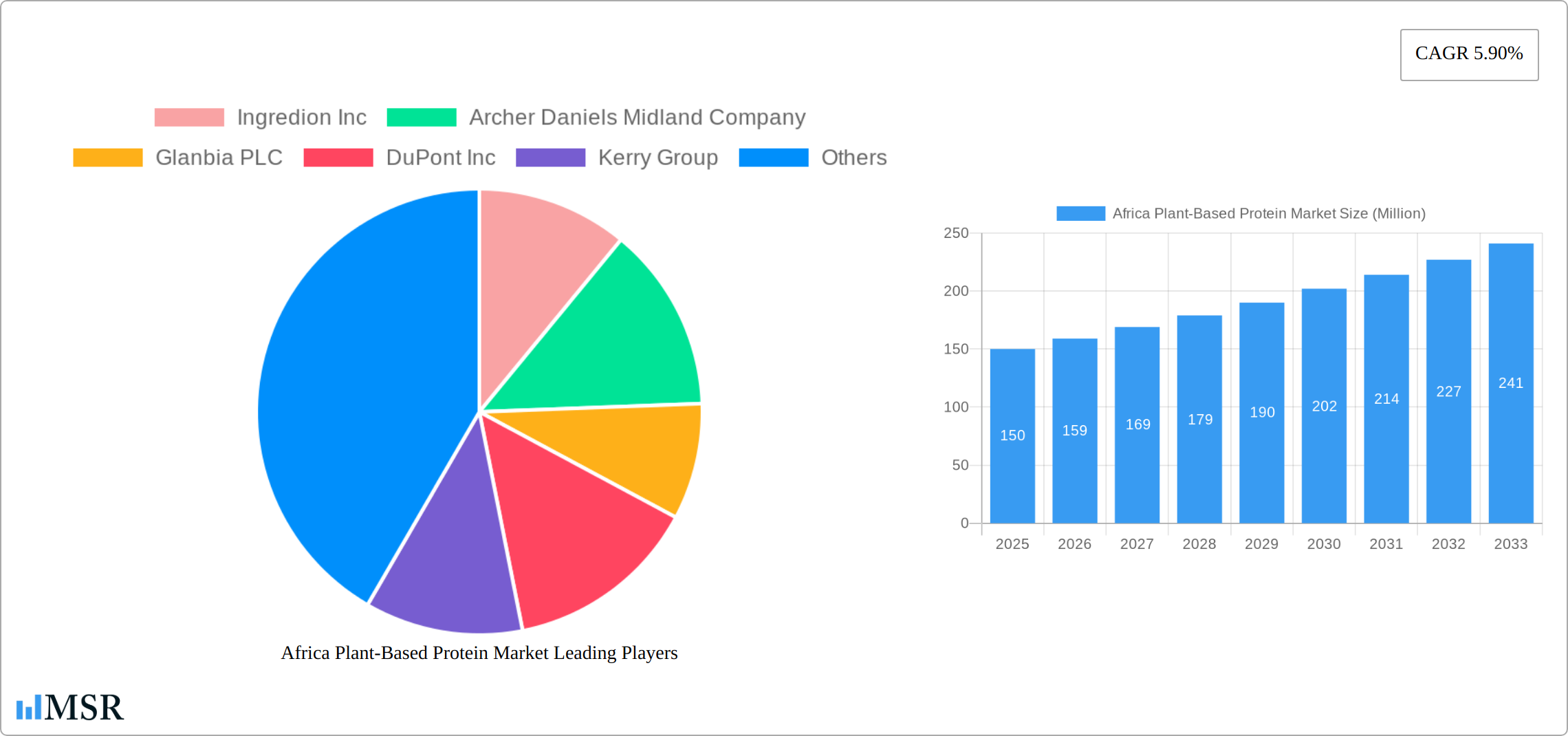

The African plant-based protein market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing health consciousness among consumers is driving demand for protein-rich, plant-based alternatives to traditional animal protein sources. Growing awareness of the environmental benefits of plant-based diets, coupled with rising concerns about food security and sustainability, further bolsters market growth. The rising prevalence of vegetarianism and veganism, particularly among younger demographics in urban centers across Africa, is also significantly contributing to the market's upward trajectory. Government initiatives promoting sustainable agriculture and diversification of food sources further support this trend.

However, market growth is not without its challenges. Limited processing infrastructure and technological advancements in some regions hinder large-scale production and may limit the availability of diverse plant-based protein products. Furthermore, the relatively high cost of some plant-based proteins compared to conventional animal protein sources remains a barrier to wider adoption, particularly among lower-income consumers. Overcoming these restraints through investments in infrastructure and technological advancements, along with initiatives to reduce production costs, will be crucial for realizing the market's full potential. The market segmentation reveals strong demand across various product types (wheat, soy, pea, and other proteins), forms (isolates, concentrates, textured proteins), and applications (bakery, meat alternatives, dietary supplements, beverages, snacks). South Africa, Sudan, Uganda, Tanzania, and Kenya represent key regional markets within Africa, each presenting unique opportunities and challenges based on local dietary habits and economic factors. The forecast period (2025-2033) promises significant expansion as these factors continue to shape the landscape of the African plant-based protein market.

Africa Plant-Based Protein Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the burgeoning Africa Plant-Based Protein Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, key segments, leading players, and future opportunities. Unlock actionable strategies with in-depth data and forecasts on market size, CAGR, and segment-specific trends.

Africa Plant-Based Protein Market Market Concentration & Dynamics

This section delves into the competitive landscape of the African plant-based protein market, assessing market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and M&A activity. The market is characterized by a mix of established multinational corporations and emerging local players.

Market Concentration: While precise market share data for individual companies is unavailable at this time, the market exhibits a moderately concentrated structure, with a few dominant players like Cargill, Ingredion, and DuPont holding significant shares. However, numerous smaller, regional players also contribute significantly to the overall market. xx% of the market is controlled by the top five players as of 2025.

Innovation Ecosystem: The market showcases a dynamic innovation ecosystem driven by the rising demand for plant-based alternatives and technological advancements in protein extraction and formulation. This is evident in the continuous introduction of novel protein sources and improved processing techniques.

Regulatory Frameworks: Regulatory frameworks concerning food safety and labeling vary across African nations. Harmonization of these regulations could foster further market growth. The impact of inconsistent regulatory landscapes is estimated to reduce market growth by xx% annually.

Substitute Products: Animal-based proteins remain the primary substitutes, though consumer awareness of health and sustainability is increasingly driving the shift towards plant-based options.

End-User Trends: The growing health-conscious population, coupled with increasing disposable incomes in several African countries, fuels the demand for plant-based protein products.

M&A Activities: The number of mergers and acquisitions in the African plant-based protein sector remains relatively low compared to more established markets. However, recent activity suggests an increase in consolidation as larger players seek to expand their presence. A total of xx M&A deals have been recorded between 2019 and 2024.

Africa Plant-Based Protein Market Industry Insights & Trends

This section analyzes the market's growth drivers, technological disruptions, and evolving consumer behaviors. The African plant-based protein market is projected to experience significant growth, driven by increasing consumer demand for healthier and more sustainable food options.

The market size in 2025 is estimated at $XX Million, and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). Key growth drivers include:

- Rising consumer awareness of health benefits: Plant-based proteins are increasingly perceived as healthier alternatives to animal-based proteins, driving demand.

- Growing preference for sustainable food choices: The growing environmental awareness among consumers is fueling the adoption of plant-based alternatives.

- Expanding food processing and manufacturing capabilities: Investment in local food processing facilities expands access to plant-based proteins.

- Government initiatives promoting plant-based foods: Several African governments are actively promoting plant-based foods through various initiatives.

- Technological advancements improving protein extraction and processing: Innovations in protein extraction techniques are lowering costs and increasing efficiency, making plant-based proteins more accessible.

Key Markets & Segments Leading Africa Plant-Based Protein Market

This section identifies the dominant regions, countries, and segments within the Africa Plant-based protein market. While data on precise market share for each segment is limited, the following observations can be made:

Dominant Segments:

Product Type: Soy protein and pea protein are expected to dominate the product type segment, owing to their relatively lower cost and wide applicability.

Form: Protein isolates and concentrates are likely to hold the largest share of the form segment due to their versatility in various food applications.

Application: Meat extenders and substitutes, bakery products, and beverages are anticipated to be the leading application segments.

Regional Dominance: South Africa and Nigeria, owing to their larger populations and relatively developed food processing industries, are expected to be the leading regional markets.

Drivers for Segment Dominance:

- Economic growth and rising disposable incomes: Increased purchasing power fuels demand for diverse food choices.

- Growing urbanization and changing lifestyles: Urbanization and changing lifestyles are driving demand for convenient and readily available food options.

- Improved infrastructure and distribution networks: Efficient supply chains are crucial for ensuring the availability of plant-based proteins across the continent.

Africa Plant-Based Protein Market Product Developments

Recent years have witnessed significant innovations in plant-based protein products, driven by the need to enhance taste, texture, and functionality. Cargill's launch of RadiPure pea protein in 2022 exemplifies this trend, highlighting the focus on improving the solubility and flavor profile of plant-based proteins to meet consumer expectations. Furthermore, the development of web-based tools, like Kerry's Radicle Solution Finder, facilitates formulation innovation, accelerating the creation of new plant-based products.

Challenges in the Africa Plant-Based Protein Market Market

The African plant-based protein market faces several challenges, including:

Limited access to technology and infrastructure: Many parts of Africa lack the advanced food processing technology needed to efficiently process plant-based proteins. This leads to higher production costs and limited scalability.

Supply chain constraints: Inefficient supply chains and inadequate storage facilities can cause significant losses and limit the availability of raw materials and finished products. This challenge is estimated to impact annual market growth by approximately xx%.

High production costs: These can hinder market expansion, especially in price-sensitive regions.

Competition from animal-based proteins: Consumer preference for traditional animal-based proteins remains a barrier to complete market penetration.

Forces Driving Africa Plant-Based Protein Market Growth

Several key factors are propelling the growth of the Africa plant-based protein market:

- Rising health consciousness: Consumers are increasingly seeking healthier dietary options.

- Growing environmental awareness: Sustainability concerns are driving demand for plant-based proteins as a more environmentally friendly alternative.

- Technological advancements: Innovations in production and processing technologies are leading to more affordable and better-tasting plant-based products.

- Government support and initiatives: Government policies promoting sustainable agriculture and plant-based diets are providing crucial support.

Long-Term Growth Catalysts in Africa Plant-Based Protein Market

Long-term growth in the African plant-based protein market will be fueled by:

Further advancements in protein extraction and formulation will improve the sensory attributes and nutritional value of plant-based proteins, thereby boosting consumer acceptance. Strategic partnerships between established food companies and local producers will leverage existing market infrastructure and expertise, facilitating expansion. Investment in research and development for new and improved plant-based protein products will cater to evolving consumer preferences and market demands.

Emerging Opportunities in Africa Plant-Based Protein Market

Emerging opportunities include tapping into underserved markets in rural areas, developing novel plant-based protein products tailored to local tastes and preferences, exploring new protein sources native to the region, and leveraging technology to optimize supply chains and reduce waste.

Leading Players in the Africa Plant-Based Protein Sector

- Ingredion Inc

- Archer Daniels Midland Company

- Glanbia PLC

- DuPont Inc

- Kerry Group

- Cargill Inc

- Tate & Lyle PLC

- Philafrica Foods

Key Milestones in Africa Plant-Based Protein Industry

- April 2022: Cargill launches RadiPure pea protein, highlighting plant-based innovation in META (Middle East, Turkey, Africa, and India).

- February 2021: DuPont's Nutrition & Biosciences merges with IFF, strengthening the combined company's position in soy protein.

- January 2021: Kerry introduces Radicle Solution Finder, a web-based tool assisting in plant-based formulation development.

Strategic Outlook for Africa Plant-Based Protein Market Market

The Africa plant-based protein market holds immense potential for future growth. Strategic partnerships, investments in research and development, and improvements in infrastructure will be crucial for realizing this potential. The focus should be on developing locally relevant products, improving affordability, and building strong supply chains to fully tap into this burgeoning market.

Africa Plant-Based Protein Market Segmentation

-

1. Product Type

- 1.1. Wheat Protein

- 1.2. Soy Protein

- 1.3. Pea Protein

- 1.4. Other Products

-

2. Form

- 2.1. Protein Isolate

- 2.2. Protein Concentrate

- 2.3. Textured Proteins

-

3. Application

- 3.1. Bakery

- 3.2. Meat Extenders and Substitutes

- 3.3. Dietary Supplements

- 3.4. Beverages

- 3.5. Snacks

- 3.6. Other Applications

-

4. Geography

- 4.1. South Africa

- 4.2. Nigeria

- 4.3. Kenya

- 4.4. Rest of Africa

Africa Plant-Based Protein Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Kenya

- 4. Rest of Africa

Africa Plant-Based Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. Higher Production Cost of Fat Replacers

- 3.4. Market Trends

- 3.4.1. Soy Protein Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wheat Protein

- 5.1.2. Soy Protein

- 5.1.3. Pea Protein

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Protein Isolate

- 5.2.2. Protein Concentrate

- 5.2.3. Textured Proteins

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Meat Extenders and Substitutes

- 5.3.3. Dietary Supplements

- 5.3.4. Beverages

- 5.3.5. Snacks

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Kenya

- 5.4.4. Rest of Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Nigeria

- 5.5.3. Kenya

- 5.5.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Wheat Protein

- 6.1.2. Soy Protein

- 6.1.3. Pea Protein

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Protein Isolate

- 6.2.2. Protein Concentrate

- 6.2.3. Textured Proteins

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bakery

- 6.3.2. Meat Extenders and Substitutes

- 6.3.3. Dietary Supplements

- 6.3.4. Beverages

- 6.3.5. Snacks

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Nigeria

- 6.4.3. Kenya

- 6.4.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Nigeria Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Wheat Protein

- 7.1.2. Soy Protein

- 7.1.3. Pea Protein

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Protein Isolate

- 7.2.2. Protein Concentrate

- 7.2.3. Textured Proteins

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bakery

- 7.3.2. Meat Extenders and Substitutes

- 7.3.3. Dietary Supplements

- 7.3.4. Beverages

- 7.3.5. Snacks

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Nigeria

- 7.4.3. Kenya

- 7.4.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Kenya Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Wheat Protein

- 8.1.2. Soy Protein

- 8.1.3. Pea Protein

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Protein Isolate

- 8.2.2. Protein Concentrate

- 8.2.3. Textured Proteins

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bakery

- 8.3.2. Meat Extenders and Substitutes

- 8.3.3. Dietary Supplements

- 8.3.4. Beverages

- 8.3.5. Snacks

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Nigeria

- 8.4.3. Kenya

- 8.4.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Wheat Protein

- 9.1.2. Soy Protein

- 9.1.3. Pea Protein

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Protein Isolate

- 9.2.2. Protein Concentrate

- 9.2.3. Textured Proteins

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bakery

- 9.3.2. Meat Extenders and Substitutes

- 9.3.3. Dietary Supplements

- 9.3.4. Beverages

- 9.3.5. Snacks

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. South Africa

- 9.4.2. Nigeria

- 9.4.3. Kenya

- 9.4.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa Plant-Based Protein Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ingredion Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Archer Daniels Midland Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Glanbia PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DuPont Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kerry Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cargill Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Tate & Lyle PLC*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Philafrica Foods

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Ingredion Inc

List of Figures

- Figure 1: Africa Plant-Based Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Plant-Based Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Plant-Based Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Africa Plant-Based Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Africa Plant-Based Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 16: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 21: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 26: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Africa Plant-Based Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Africa Plant-Based Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 31: Africa Plant-Based Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Africa Plant-Based Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Africa Plant-Based Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Plant-Based Protein Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Africa Plant-Based Protein Market?

Key companies in the market include Ingredion Inc, Archer Daniels Midland Company, Glanbia PLC, DuPont Inc, Kerry Group, Cargill Inc, Tate & Lyle PLC*List Not Exhaustive, Philafrica Foods.

3. What are the main segments of the Africa Plant-Based Protein Market?

The market segments include Product Type, Form, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Soy Protein Dominates the Market.

7. Are there any restraints impacting market growth?

Higher Production Cost of Fat Replacers.

8. Can you provide examples of recent developments in the market?

In April 2022, with the launch of RadiPure pea protein, Cargill promoted plant-based innovations in META (Middle East, Turkey, Africa, and India). The solubility and flavor profile that clients require for the creation of food applications is provided by RadiPure pea protein. Pea protein is claimed to be an excellent substitute for a variety of applications due to such advantages and its emulsifying, viscosifying, and gelation qualities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Plant-Based Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Plant-Based Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Plant-Based Protein Market?

To stay informed about further developments, trends, and reports in the Africa Plant-Based Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence