Key Insights

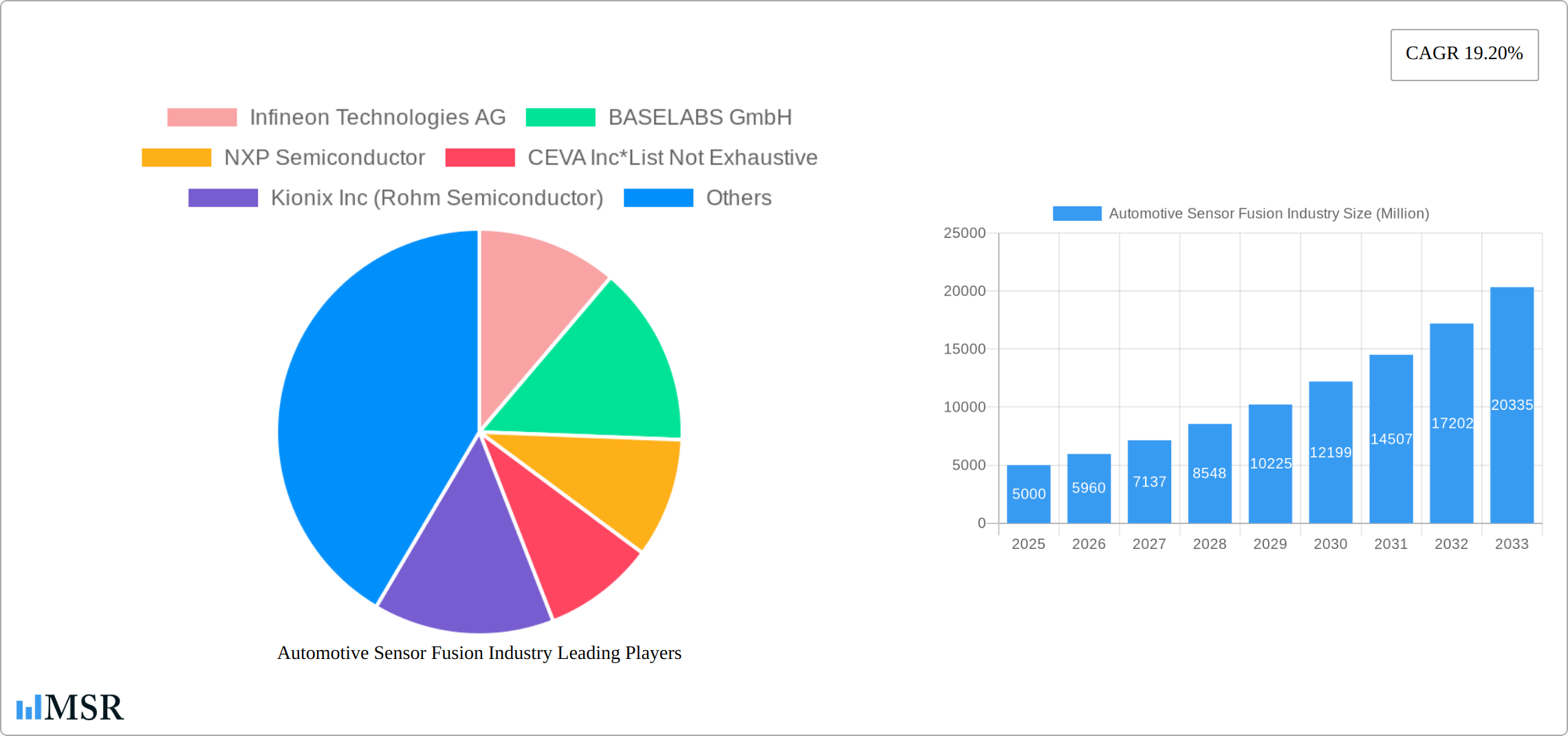

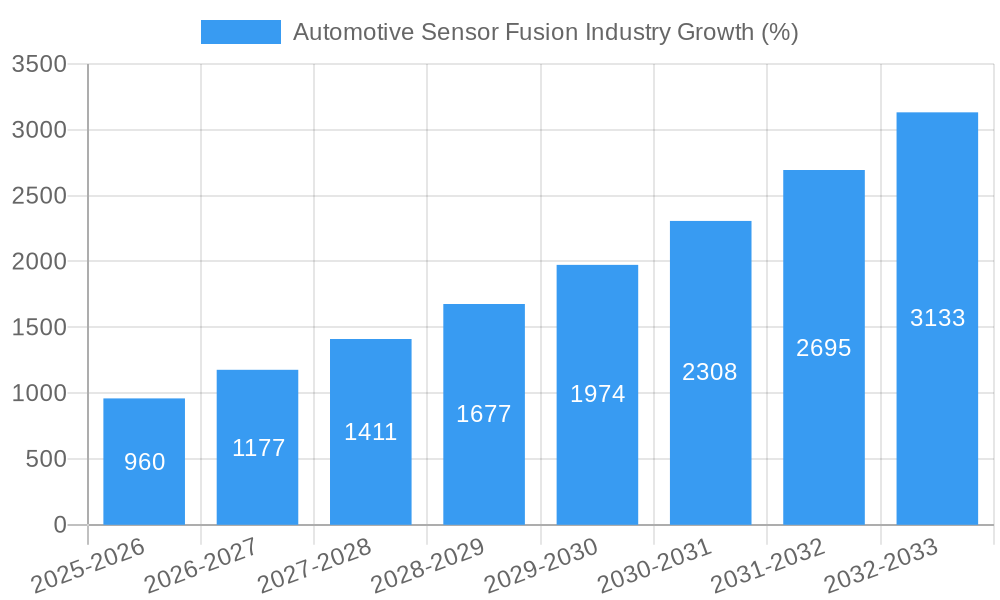

The automotive sensor fusion market is experiencing robust growth, driven by the increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicles. A compound annual growth rate (CAGR) of 19.20% from 2019 to 2024 suggests a significant market expansion. This growth is fueled by several key factors. Firstly, the rising adoption of ADAS features, such as adaptive cruise control, lane departure warning, and automatic emergency braking, necessitates the integration of multiple sensor types for enhanced safety and performance. Secondly, the ongoing development and deployment of autonomous driving technologies are creating substantial demand for sophisticated sensor fusion algorithms and hardware. This requires the seamless integration of data from various sensors, including cameras, radar, lidar, and ultrasonic sensors, to create a comprehensive and reliable understanding of the vehicle's surroundings. Finally, advancements in sensor technology, such as improved accuracy, reduced cost, and smaller form factors, are further accelerating market growth. The market segmentation reveals a strong contribution from passenger cars, followed by light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs), with other autonomous vehicles representing a growing segment. Key players like Infineon Technologies, Bosch, and NXP Semiconductor are driving innovation and competition within this rapidly evolving landscape.

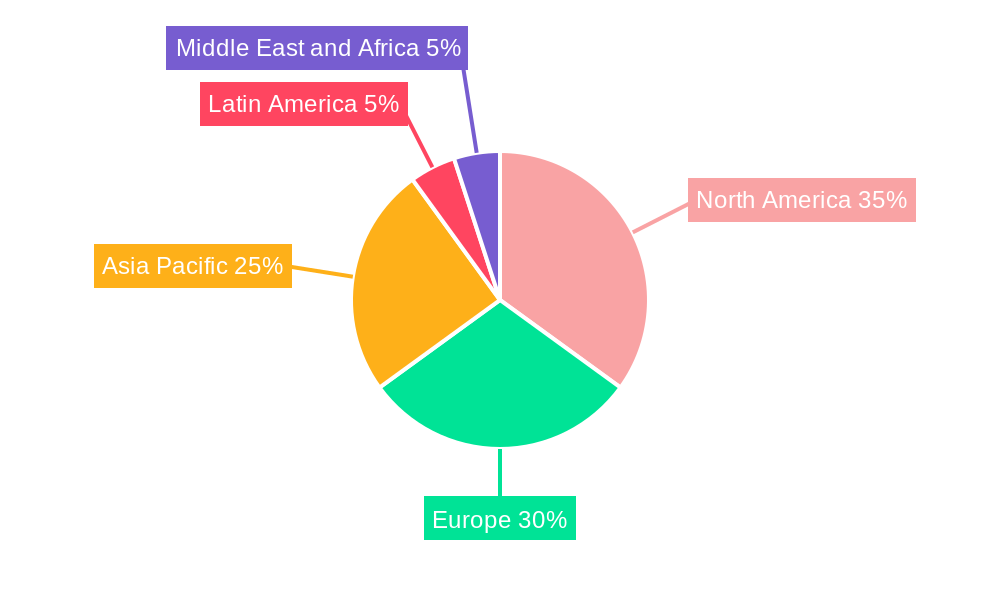

The geographic distribution of the market is likely to reflect established automotive manufacturing hubs and emerging economies adopting advanced technologies. North America and Europe are expected to hold significant market share initially, driven by early adoption of ADAS and autonomous vehicle technologies. However, the Asia-Pacific region is anticipated to witness rapid growth, fueled by increasing vehicle production and government initiatives promoting technological advancement in the automotive sector. This growth is expected to continue throughout the forecast period (2025-2033), with the market size exceeding [Estimate based on CAGR and a plausible 2025 market size. For example, if the 2025 market size is estimated at $5 billion, and assuming consistent CAGR, the market could reach approximately $20 billion by 2033]. Restraints on growth could include high initial investment costs for sensor fusion technologies, along with challenges related to data processing power and computational complexity, and ensuring cybersecurity within the systems. However, technological advancements and cost reductions are projected to mitigate these challenges in the coming years.

Automotive Sensor Fusion Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Sensor Fusion Industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The global market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Automotive Sensor Fusion Industry Market Concentration & Dynamics

The Automotive Sensor Fusion market is characterized by a moderate level of concentration, with several key players holding significant market share. Infineon Technologies AG, Robert Bosch GmbH, and NXP Semiconductor are among the leading companies, collectively commanding an estimated xx% of the market in 2025. However, the market also features numerous smaller players and startups, fostering a dynamic competitive landscape.

Innovation is a key driver, with companies continuously developing advanced sensor fusion technologies leveraging machine learning (ML) and artificial intelligence (AI) for improved accuracy and performance. Stringent safety regulations governing autonomous driving are shaping the industry, pushing for higher levels of sensor fusion integration and reliability. Substitute products, such as radar-only systems or less sophisticated sensor combinations, present a competitive challenge, but the increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicles is expected to drive the adoption of sensor fusion technology.

End-user trends are heavily influenced by increasing consumer demand for safety and convenience features in vehicles. The growth of the electric vehicle (EV) market also fuels demand, as sensor fusion is crucial for advanced driver-assistance systems in EVs. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, indicating strategic consolidation within the sector.

Automotive Sensor Fusion Industry Industry Insights & Trends

The Automotive Sensor Fusion market is experiencing robust growth, driven by the increasing adoption of ADAS and autonomous driving technologies. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2025, reflecting the significant investment in the development and integration of sophisticated sensor fusion systems in vehicles. Technological advancements, including the integration of AI and ML algorithms, are enhancing the capabilities of sensor fusion systems, resulting in improved accuracy, reliability, and functionality. Evolving consumer preferences towards safer and more technologically advanced vehicles are further driving the market's growth. The global market is expected to witness considerable growth, reaching xx Million by 2033, driven by factors such as increasing demand for enhanced safety features and the rise of autonomous vehicles.

Key Markets & Segments Leading Automotive Sensor Fusion Industry

The passenger car segment is currently the largest contributor to the automotive sensor fusion market, holding a significant market share of approximately xx% in 2025. This dominance is attributed to the high volume of passenger car production and the increasing incorporation of ADAS features in new vehicles.

- Drivers of Passenger Car Segment Growth:

- High demand for safety and comfort features.

- Increasing adoption of ADAS and autonomous driving technologies.

- Rising disposable incomes and automotive sales in key markets.

- Government regulations mandating advanced safety features.

The light commercial vehicle (LCV) and heavy commercial vehicle (HCV) segments are also exhibiting significant growth potential, driven by the increasing demand for safety and efficiency improvements in commercial vehicles. The other autonomous vehicles segment is expected to experience exponential growth in the coming years, with advancements in autonomous driving technology paving the way for wider adoption. The significant growth of the market can be attributed to the increasing demand for higher levels of automation and safety in the automotive industry, driven by the increasing popularity of autonomous vehicles.

Automotive Sensor Fusion Industry Product Developments

The automotive sensor fusion industry is experiencing rapid advancements, driven by the increasing demand for enhanced safety and autonomous driving capabilities. Recent product developments focus on improving accuracy, reducing latency, lowering power consumption, and seamlessly integrating with existing vehicle architectures. This includes the development of sophisticated sensor fusion chips like CEVA's FSP201, a high-performance, low-power sensor hub MCU for precise motion tracking and orientation detection, and Rutronik's RAB1 adapter board, enabling machine learning-based sensor fusion. These advancements are not only improving the performance and reliability of Advanced Driver-Assistance Systems (ADAS) and autonomous driving systems but also driving down costs and enabling smaller form factors. This enhanced efficiency and accuracy provide a substantial competitive advantage for automotive manufacturers and sensor suppliers alike, fueling the industry's growth trajectory.

Challenges in the Automotive Sensor Fusion Industry Market

Despite its significant potential, the automotive sensor fusion industry faces considerable hurdles. The high cost of development and integration of advanced sensor fusion systems remains a significant barrier to entry for many companies. Supply chain vulnerabilities, particularly concerning the availability of specialized semiconductors, continue to pose a threat to production timelines and overall market stability. The complexity of data processing and algorithm development necessitates significant expertise in areas like artificial intelligence and machine learning, demanding substantial investments in research and development. Moreover, the intense competition among established industry giants and emerging technology companies creates a highly dynamic and challenging market environment. Effectively navigating these challenges is critical for sustainable growth and success within this sector.

Forces Driving Automotive Sensor Fusion Industry Growth

The automotive sensor fusion market is fueled by several factors, notably the increasing demand for ADAS and autonomous driving capabilities. Government regulations mandating advanced safety features in vehicles significantly boost adoption. The rapid advancements in sensor technologies, such as LiDAR and radar, improve accuracy and reliability. The automotive industry's substantial investment in research and development further propels the market's expansion. These factors synergistically contribute to sustained growth.

Challenges in the Automotive Sensor Fusion Industry Market

Despite its significant potential, the automotive sensor fusion industry faces considerable hurdles. The high cost of development and integration of advanced sensor fusion systems remains a significant barrier to entry for many companies. Supply chain vulnerabilities, particularly concerning the availability of specialized semiconductors, continue to pose a threat to production timelines and overall market stability. The complexity of data processing and algorithm development necessitates significant expertise in areas like artificial intelligence and machine learning, demanding substantial investments in research and development. Moreover, the intense competition among established industry giants and emerging technology companies creates a highly dynamic and challenging market environment. Effectively navigating these challenges is critical for sustainable growth and success within this sector.

Emerging Opportunities in Automotive Sensor Fusion Industry

Emerging opportunities abound in the automotive sensor fusion industry, particularly in the areas of improved sensor integration with machine learning algorithms. The development of highly reliable and low-power consumption sensor fusion systems for various applications, including parking assistance, lane keeping assist, and adaptive cruise control, holds immense promise. The emergence of new applications in emerging markets like the commercial vehicle sector and in areas such as improved navigation systems and connected cars provides lucrative growth pathways.

Leading Players in the Automotive Sensor Fusion Industry Sector

- Infineon Technologies AG

- BASELABS GmbH

- NXP Semiconductor

- CEVA Inc

- Kionix Inc (Rohm Semiconductor)

- Memsic Inc

- STMicroelectronics NV

- Continental AG

- Robert Bosch GmbH

- TDK Corporation

Key Milestones in Automotive Sensor Fusion Industry Industry

- June 2022: CEVA launched the FSP201, a high-performance, low-power sensor hub MCU for precise sensor fusion in motion tracking and orientation detection. This signifies a step toward more efficient and accurate sensor fusion systems.

- September 2022: Rutronik System Solutions introduced the RAB1 adapter board, enabling machine learning-based sensor fusion, marking a significant advancement in AI-powered sensor integration for diverse applications.

Strategic Outlook for Automotive Sensor Fusion Industry Market

The future of the automotive sensor fusion market is bright, driven by continued advancements in sensor technologies and artificial intelligence. Strategic opportunities lie in developing innovative sensor fusion solutions for emerging markets and applications, such as autonomous driving and enhanced safety features in commercial vehicles. Companies that prioritize innovation, strategic partnerships, and efficient supply chain management will be well-positioned to capitalize on the significant growth potential of this dynamic industry.

Automotive Sensor Fusion Industry Segmentation

-

1. Type of Vehicles

- 1.1. Passenger Cars

- 1.2. Light Commercial Vehicle (LCV)

- 1.3. Heavy Commercial Vehicle (HCV)

- 1.4. Other Autonomous Vehicles

Automotive Sensor Fusion Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automotive Sensor Fusion Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Miniaturization in Automotive Electronics; Increasing Demand for ADAS system and Autonomous Vehicle

- 3.3. Market Restrains

- 3.3.1. Absence of Standardization in Sensor Fusion System

- 3.4. Market Trends

- 3.4.1. Growing Technological Trends in Automotive Sector to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 5.1.1. Passenger Cars

- 5.1.2. Light Commercial Vehicle (LCV)

- 5.1.3. Heavy Commercial Vehicle (HCV)

- 5.1.4. Other Autonomous Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 6. North America Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 6.1.1. Passenger Cars

- 6.1.2. Light Commercial Vehicle (LCV)

- 6.1.3. Heavy Commercial Vehicle (HCV)

- 6.1.4. Other Autonomous Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 7. Europe Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 7.1.1. Passenger Cars

- 7.1.2. Light Commercial Vehicle (LCV)

- 7.1.3. Heavy Commercial Vehicle (HCV)

- 7.1.4. Other Autonomous Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 8. Asia Pacific Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 8.1.1. Passenger Cars

- 8.1.2. Light Commercial Vehicle (LCV)

- 8.1.3. Heavy Commercial Vehicle (HCV)

- 8.1.4. Other Autonomous Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 9. Latin America Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 9.1.1. Passenger Cars

- 9.1.2. Light Commercial Vehicle (LCV)

- 9.1.3. Heavy Commercial Vehicle (HCV)

- 9.1.4. Other Autonomous Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 10. Middle East and Africa Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 10.1.1. Passenger Cars

- 10.1.2. Light Commercial Vehicle (LCV)

- 10.1.3. Heavy Commercial Vehicle (HCV)

- 10.1.4. Other Autonomous Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 11. North America Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Infineon Technologies AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 BASELABS GmbH

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 NXP Semiconductor

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 CEVA Inc*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kionix Inc (Rohm Semiconductor)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Memsic Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 STMicroelectronics NV

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Continental AG

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Robert Bosch GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 TDK Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Automotive Sensor Fusion Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Automotive Sensor Fusion Industry Revenue (Million), by Type of Vehicles 2024 & 2032

- Figure 13: North America Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2024 & 2032

- Figure 14: North America Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Automotive Sensor Fusion Industry Revenue (Million), by Type of Vehicles 2024 & 2032

- Figure 17: Europe Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2024 & 2032

- Figure 18: Europe Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Automotive Sensor Fusion Industry Revenue (Million), by Type of Vehicles 2024 & 2032

- Figure 21: Asia Pacific Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2024 & 2032

- Figure 22: Asia Pacific Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Automotive Sensor Fusion Industry Revenue (Million), by Type of Vehicles 2024 & 2032

- Figure 25: Latin America Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2024 & 2032

- Figure 26: Latin America Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Automotive Sensor Fusion Industry Revenue (Million), by Type of Vehicles 2024 & 2032

- Figure 29: Middle East and Africa Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2024 & 2032

- Figure 30: Middle East and Africa Automotive Sensor Fusion Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Automotive Sensor Fusion Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Type of Vehicles 2019 & 2032

- Table 3: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Automotive Sensor Fusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Automotive Sensor Fusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Automotive Sensor Fusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Automotive Sensor Fusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Automotive Sensor Fusion Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Type of Vehicles 2019 & 2032

- Table 15: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Type of Vehicles 2019 & 2032

- Table 17: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Type of Vehicles 2019 & 2032

- Table 19: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Type of Vehicles 2019 & 2032

- Table 21: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Type of Vehicles 2019 & 2032

- Table 23: Global Automotive Sensor Fusion Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Sensor Fusion Industry?

The projected CAGR is approximately 19.20%.

2. Which companies are prominent players in the Automotive Sensor Fusion Industry?

Key companies in the market include Infineon Technologies AG, BASELABS GmbH, NXP Semiconductor, CEVA Inc*List Not Exhaustive, Kionix Inc (Rohm Semiconductor), Memsic Inc, STMicroelectronics NV, Continental AG, Robert Bosch GmbH, TDK Corporation.

3. What are the main segments of the Automotive Sensor Fusion Industry?

The market segments include Type of Vehicles.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Miniaturization in Automotive Electronics; Increasing Demand for ADAS system and Autonomous Vehicle.

6. What are the notable trends driving market growth?

Growing Technological Trends in Automotive Sector to Boost the Market Growth.

7. Are there any restraints impacting market growth?

Absence of Standardization in Sensor Fusion System.

8. Can you provide examples of recent developments in the market?

September 2022 - Rutronik System Solutions launched its latest state-of-the-art sensor fusion solution with the Rutronik Adapter Board RAB1. According to the company, the adapter board offers its own platform, allowing machine learning (ML) based sensor fusion that forms the basis and the future of artificial intelligence (AI). Equipped with the highest performance sensors from Bosch, Infineon, and Sensirion, the board is ideal for a wide range of sensor fusion applications, like smoke and gas detectors or air quality measurements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Sensor Fusion Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Sensor Fusion Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Sensor Fusion Industry?

To stay informed about further developments, trends, and reports in the Automotive Sensor Fusion Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence