Key Insights

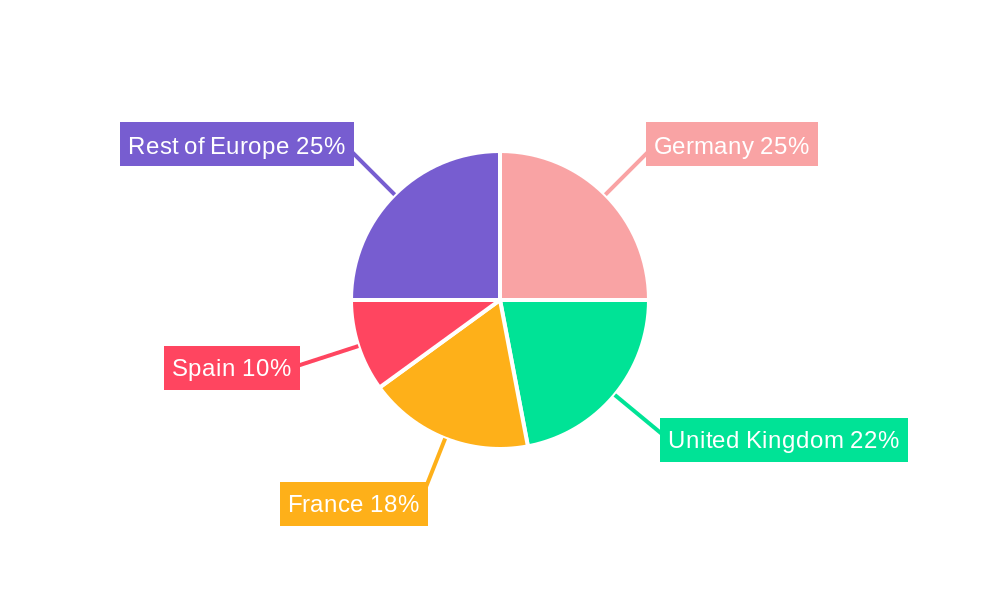

The European online grocery delivery market is experiencing robust growth, fueled by several key factors. The market, valued at approximately €XX million in 2025 (assuming a logical estimation based on the provided CAGR of 17.20% and a given value unit of millions), is projected to reach €YY million by 2033. This significant expansion is driven by increasing consumer preference for convenience, particularly among younger demographics and busy urban populations. The rising adoption of smartphones and internet penetration further accelerates this trend, allowing seamless access to online grocery platforms. Quick commerce (Q-commerce) models, offering rapid delivery within minutes or hours, are a significant growth driver, attracting consumers seeking immediate gratification. However, the market also faces challenges such as high operational costs, including logistics and last-mile delivery, and intense competition among established players and emerging startups. Furthermore, maintaining consistent product quality and freshness during delivery remains a crucial concern for both businesses and consumers. The market is segmented by product type (retail delivery, quick commerce, meal kit delivery) and geographically (United Kingdom, Germany, France, Spain, Eastern Europe, Rest of Europe), with Germany, the UK, and France representing the largest national markets.

Different business models are competing for market share. Established supermarket chains like Rewe are integrating online offerings with their physical stores, while dedicated delivery-only services like Gorillas and Flink are focused on rapid delivery. International players like Doordash, Just Eat, Delivery Hero, and Uber Eats are expanding their grocery delivery services, adding another layer of competition. Amazon, with its existing logistics infrastructure, also poses a significant threat. The market's future growth will depend on the ability of companies to innovate, improve logistics efficiency, manage costs effectively, and meet the evolving demands of consumers regarding speed, convenience, and sustainability. The continued development of technological advancements, like AI-powered optimization of delivery routes and improved cold-chain logistics, will be crucial for long-term market success. Expansion into less penetrated Eastern European markets also offers significant potential for growth.

Europe Online Grocery Delivery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the rapidly evolving Europe online grocery delivery market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state and future trajectory. We examine key segments, including Retail Delivery, Quick Commerce, and Meal Kit Delivery, across major European countries like the United Kingdom, Germany, France, Spain, Eastern Europe, and the Rest of Europe. Leading players such as Doordash, Gorillas, Rewe, Just Eat, Delivery Hero, Uber Eats, Flink, Amazon.com Inc, Zomato, and Getir are analyzed to provide a holistic view of the competitive landscape. The report's projected market size for 2025 is valued at xx Million and boasts a CAGR of xx% during the forecast period.

Europe Online Grocery Delivery Market Concentration & Dynamics

The European online grocery delivery market is characterized by a dynamic interplay of factors influencing its concentration and overall dynamics. Market concentration is currently moderate, with a few dominant players vying for market share alongside numerous smaller, specialized firms. The market exhibits a high degree of innovation, fueled by technological advancements in logistics, mobile applications, and AI-powered personalization. Regulatory frameworks, particularly concerning data privacy and food safety, significantly impact market operations. Substitute products, such as traditional brick-and-mortar grocery stores and local farmers' markets, continue to pose competitive challenges. Consumer trends toward convenience, health-conscious choices, and sustainable practices are shaping demand.

- Market Share: Amazon.com Inc and Delivery Hero hold a significant portion, estimated at xx% and xx% respectively in 2024. Other major players such as Just Eat and Uber Eats hold smaller but substantial shares. The remaining market share is distributed among regional and niche players.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, indicating a high level of consolidation and expansion within the market. This activity is expected to continue, driving further market concentration in the coming years.

- Innovation Ecosystem: Significant investments in technology, particularly in AI-powered route optimization and automated warehouses, are transforming operational efficiency and customer experience.

- Regulatory Frameworks: Varying regulations across European countries regarding data protection, food handling, and delivery worker rights impact operational costs and market entry barriers.

Europe Online Grocery Delivery Market Industry Insights & Trends

The European online grocery delivery market experienced robust growth during the historical period (2019-2024), driven by increasing internet penetration, smartphone adoption, and changing consumer lifestyles. The market size in 2024 reached xx Million. Technological disruptions, particularly the rise of quick commerce (Q-commerce) platforms offering ultra-fast delivery, fundamentally reshaped the market. Evolving consumer behaviors, including a preference for convenience, personalized shopping experiences, and contactless deliveries, further propelled market expansion. The market is expected to continue its strong growth trajectory throughout the forecast period (2025-2033), with significant opportunities in emerging areas like sustainable packaging and personalized meal planning services.

Key Markets & Segments Leading Europe Online Grocery Delivery Market

The United Kingdom currently holds the largest market share within Europe, followed by Germany and France. This dominance is driven by several factors:

- United Kingdom: High internet penetration, established e-commerce infrastructure, and a relatively high disposable income per capita.

- Germany: Large population, well-developed logistics networks, and a strong presence of both international and domestic online grocery players.

- France: Growing consumer adoption of online grocery shopping and significant investments in technological improvements for delivery services.

By Product Type:

- Quick Commerce: This segment exhibits the fastest growth, driven by consumer demand for immediate gratification and the increasing availability of hyperlocal delivery options.

- Retail Delivery: Remains a significant segment, offering a broader range of products and potentially higher order values.

- Meal Kit Delivery: While a smaller segment, meal kit delivery is witnessing steady growth, appealing to health-conscious consumers seeking convenient and healthy meal options.

Europe Online Grocery Delivery Market Product Developments

Recent product innovations include the integration of AI-powered recommendation engines, personalized shopping experiences, subscription services, and automated warehouse technologies. These enhancements offer enhanced customer convenience, streamlined operations, and improved cost efficiency, creating a competitive edge for market players. The focus on sustainable packaging options and eco-friendly delivery methods further enhances customer loyalty and brand image.

Challenges in the Europe Online Grocery Delivery Market Market

The European online grocery delivery market faces several challenges, impacting profitability and growth. High operational costs, including last-mile delivery expenses and warehouse management, remain a significant hurdle. Intense competition, particularly from established players and new entrants, puts pressure on pricing and profit margins. Regulatory complexities and cross-border regulations add further complexity to operations. The unpredictable nature of food supply chains adds to operational challenges, affecting stock availability and delivery times. These challenges collectively impact the overall market growth and profitability for numerous market participants.

Forces Driving Europe Online Grocery Delivery Market Growth

Several factors are propelling the growth of the European online grocery delivery market. Technological advancements in logistics and automation are enhancing efficiency and reducing costs. Growing consumer preference for convenience and time-saving solutions fuels demand for online grocery deliveries. Increased internet and smartphone penetration are expanding the market's potential consumer base. Supportive government policies encouraging e-commerce adoption also contribute to market expansion.

Challenges in the Europe Online Grocery Delivery Market Market

Long-term growth hinges on overcoming existing challenges, fostering innovation, and strategically adapting to changing consumer preferences. Sustainable and efficient logistics solutions are critical to reducing costs and environmental impact. Strategic partnerships with retailers and technology providers can unlock new opportunities for growth. Expansion into underserved markets and the development of niche offerings will open new avenues for market expansion.

Emerging Opportunities in Europe Online Grocery Delivery Market

Emerging opportunities lie in the expansion of quick commerce into smaller towns and cities. Integrating personalized shopping experiences through AI and data analytics will enhance customer satisfaction and loyalty. The development of sustainable delivery options and eco-friendly packaging will appeal to environmentally conscious consumers. Focus on specific dietary needs and personalized meal plans are also growing areas of opportunity.

Leading Players in the Europe Online Grocery Delivery Market Sector

Key Milestones in Europe Online Grocery Delivery Market Industry

February 2022: Rohlik Group expands its Knusper.de service to the Rhine-Main Metropolitan Region in Germany, offering over 9,000 products, with a significant proportion from local suppliers. This expansion signifies the growing interest in regional and local sourcing within the online grocery sector.

January 2023: Sainsbury's partners with Just Eat Takeaway to offer 30-minute grocery delivery across the UK. This collaboration demonstrates the increasing integration between established supermarket chains and established online delivery platforms to enhance customer convenience and speed. The potential market impact is significant, given Sainsbury’s position as the UK's largest supermarket chain.

Strategic Outlook for Europe Online Grocery Delivery Market Market

The future of the European online grocery delivery market holds immense potential. Continued technological advancements, coupled with evolving consumer preferences, will drive further market expansion. Strategic partnerships and acquisitions will reshape the competitive landscape, resulting in increased consolidation. Companies that successfully adapt to evolving consumer demands for convenience, sustainability, and personalized experiences will gain a competitive advantage. The market is poised for continued growth, with significant opportunities for innovation and expansion.

Europe Online Grocery Delivery Market Segmentation

-

1. Product Type

- 1.1. Retail Delivery

- 1.2. Quick Commerce

- 1.3. Meal Kit Delivery

Europe Online Grocery Delivery Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Grocery Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Attractive Offers and Payment Flexibility to Boost the Demand of the Market

- 3.3. Market Restrains

- 3.3.1. High-priced products and additional delivery charges; Inconsistency in product quality

- 3.4. Market Trends

- 3.4.1. Attractive Offers and Payment Flexibility to Boost the Demand of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Retail Delivery

- 5.1.2. Quick Commerce

- 5.1.3. Meal Kit Delivery

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Doordash

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Gorillas

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Rewe

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Just Eat

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Delivery Hero

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Uber Eats

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Flink

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Amazon com Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Zomato

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Getir

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Doordash

List of Figures

- Figure 1: Europe Online Grocery Delivery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Online Grocery Delivery Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Online Grocery Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Online Grocery Delivery Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Online Grocery Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Online Grocery Delivery Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Europe Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Grocery Delivery Market?

The projected CAGR is approximately 17.20%.

2. Which companies are prominent players in the Europe Online Grocery Delivery Market?

Key companies in the market include Doordash, Gorillas, Rewe, Just Eat, Delivery Hero, Uber Eats, Flink, Amazon com Inc, Zomato, Getir.

3. What are the main segments of the Europe Online Grocery Delivery Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Attractive Offers and Payment Flexibility to Boost the Demand of the Market.

6. What are the notable trends driving market growth?

Attractive Offers and Payment Flexibility to Boost the Demand of the Market.

7. Are there any restraints impacting market growth?

High-priced products and additional delivery charges; Inconsistency in product quality.

8. Can you provide examples of recent developments in the market?

January 2023: Sainsbury's, the UK's largest supermarket chain, has partnered with online meal ordering and delivery service Eat Takeaway to provide speedier home delivery for groceries across the country. Customers can order things from Sainsbury's for delivery in under 30 minutes using the Just Eat app. The cooperation will begin with more than 175 stores by the end of February, with a nationwide rollout planned for 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Grocery Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Grocery Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Grocery Delivery Market?

To stay informed about further developments, trends, and reports in the Europe Online Grocery Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence