Key Insights

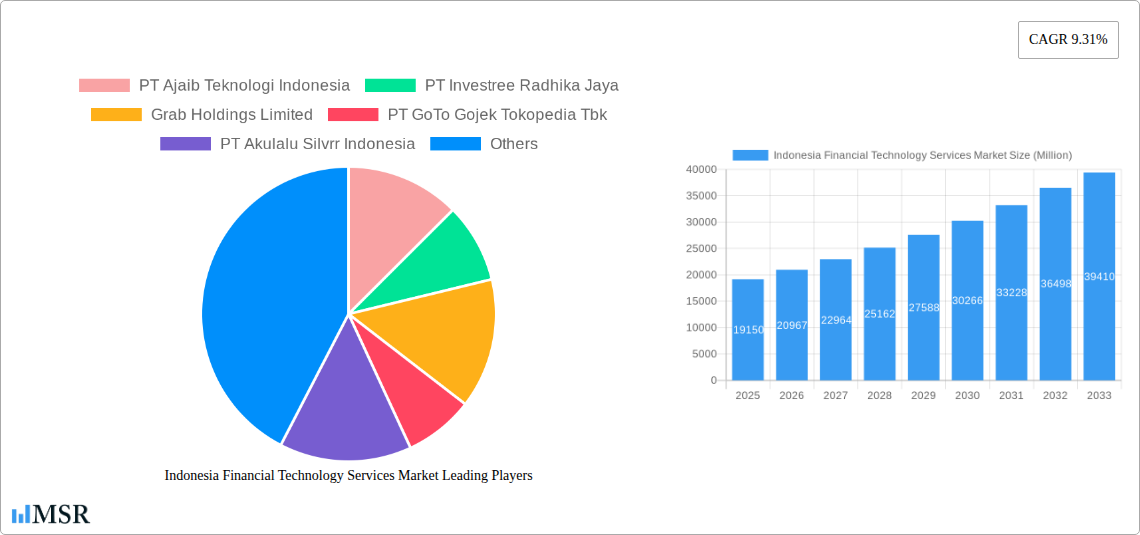

The Indonesian Financial Technology (FinTech) Services market, valued at $19.15 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.31% from 2025 to 2033. This surge is driven by several factors. Increasing smartphone penetration and internet access across Indonesia's vast archipelago are creating a fertile ground for FinTech adoption. A young and digitally savvy population readily embraces mobile banking, e-wallets, and online lending platforms, fueling demand for convenient and accessible financial services. Government initiatives promoting financial inclusion and digitalization further accelerate market expansion. The rise of super apps, integrating various financial services into a single platform, also plays a significant role, offering a one-stop shop for users. Competition is fierce, with established players like GoPay and OVO alongside newer entrants vying for market share. This competitive landscape fosters innovation and drives down costs, ultimately benefiting consumers. While regulatory challenges and cybersecurity concerns present some restraints, the overall outlook remains positive, indicating substantial growth potential in the coming years.

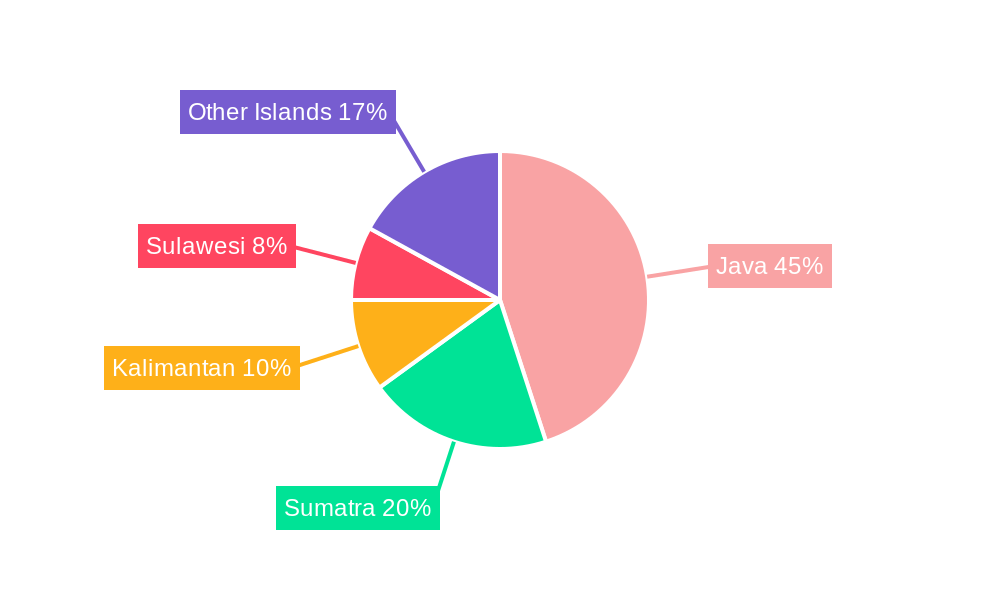

The market's segmentation, while not explicitly detailed, likely encompasses key areas such as mobile payments, digital lending, investment platforms, and insurance technology. The prominent companies listed—including GoTo, Grab, Ajaib, and Kredivo—represent a cross-section of these segments, highlighting the breadth and depth of the Indonesian FinTech landscape. Regional variations in adoption rates are anticipated, with more densely populated and digitally advanced areas exhibiting faster growth compared to less developed regions. However, ongoing infrastructure development and government initiatives are bridging this gap, fostering broader FinTech penetration across the country. The forecast period of 2025-2033 suggests continued market expansion driven by sustained digital adoption and the ongoing development of innovative financial products and services tailored to the specific needs of the Indonesian market.

Indonesia Financial Technology Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Indonesia Financial Technology Services Market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The Indonesian fintech landscape is ripe with opportunity, and this report provides the crucial data and analysis you need to navigate it successfully.

Indonesia Financial Technology Services Market Concentration & Dynamics

The Indonesian fintech market is experiencing rapid growth, characterized by both high competition and significant consolidation. While a few dominant players hold substantial market share, numerous smaller fintech companies are also vying for a position. Market concentration is moderate, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025, indicating a competitive yet consolidating environment.

Innovation Ecosystems: Indonesia boasts a vibrant startup ecosystem, supported by government initiatives and foreign investment. This fuels innovation across various fintech segments, from digital payments to lending and investment platforms.

Regulatory Frameworks: The Indonesian government's regulatory approach is evolving, aiming to balance innovation with consumer protection and financial stability. This regulatory landscape presents both opportunities and challenges for fintech companies. Navigating these regulations effectively is crucial for success.

Substitute Products: Traditional financial institutions still hold a significant market share, representing a key challenge to fintech’s growth. However, the increasing convenience and accessibility of fintech solutions are gradually shifting consumer preferences.

End-User Trends: Indonesian consumers, particularly the younger generation, are rapidly adopting digital financial services. The high smartphone penetration and increasing internet accessibility are key drivers of this trend.

M&A Activities: The Indonesian fintech market has witnessed a surge in mergers and acquisitions (M&A) activity in recent years. The number of deals concluded reached xx in 2024, suggesting a trend of consolidation amongst companies seeking to achieve scale and expand market reach. Major players are strategically acquiring smaller companies to broaden their service offerings and strengthen their market position. This consolidation is expected to continue throughout the forecast period.

Indonesia Financial Technology Services Market Industry Insights & Trends

The Indonesian Financial Technology Services Market is experiencing exponential growth, driven by several factors. The market size reached xx Million in 2024 and is projected to reach xx Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is fueled by several key trends.

The rising adoption of smartphones and increased internet penetration across the archipelago are transforming financial inclusion. A significant portion of the population previously excluded from traditional banking services are now accessing financial products and services through fintech platforms. The government's initiatives promoting digitalization and financial inclusion further accelerate market expansion. Technological advancements, such as artificial intelligence (AI) and machine learning (ML), are improving efficiency and enhancing the customer experience. The rise of e-commerce and the growing digital economy has created a substantial demand for seamless and secure digital payment solutions. These trends are creating a favorable environment for fintech companies to flourish and expand their operations within Indonesia. The shift towards cashless transactions is another major factor shaping this market.

Key Markets & Segments Leading Indonesia Financial Technology Services Market

The Indonesian fintech market is geographically diverse, with significant growth observed across major urban centers and increasingly in rural areas. Java, as the most populous island, dominates the market, accounting for approximately xx% of the total market value in 2025. However, significant growth opportunities exist in other regions as internet penetration and digital literacy expand.

- Drivers of Dominance in Java:

- High population density and concentration of businesses.

- Advanced infrastructure supporting digital services.

- Higher levels of internet and smartphone penetration.

- Strong presence of major fintech players and their headquarters.

The digital payments segment holds a leading position in the market, driven by the increasing preference for cashless transactions. Digital lending is another rapidly growing segment, catering to the needs of both individuals and small and medium-sized enterprises (SMEs). Investment platforms and other fintech solutions are also witnessing substantial growth, demonstrating the market's dynamism. This growth is further fueled by a young and tech-savvy population eager to embrace new financial technologies. The government's continuous support for digital financial inclusion is creating a supportive ecosystem for the sector's further expansion.

Indonesia Financial Technology Services Market Product Developments

Fintech product innovation in Indonesia is rapid, focusing on enhancing user experience, improving security, and broadening accessibility. Innovations include AI-powered credit scoring, embedded finance solutions, and super apps integrating multiple financial services. These advancements are enabling fintech companies to offer personalized services, reduce costs, and compete effectively with traditional financial institutions. The increasing adoption of open banking APIs is also fostering collaboration and innovation within the ecosystem.

Challenges in the Indonesia Financial Technology Services Market

The Indonesian fintech market faces several challenges, including regulatory uncertainty, cybersecurity risks, and the need for improved financial literacy among the population. Data privacy concerns and the potential for fraud also pose significant hurdles. Competition from both established players and new entrants intensifies pressure on profit margins. These challenges require companies to adopt robust security measures, invest in consumer education, and actively engage with regulators to build a sustainable and trustworthy market. The high cost of acquiring customers, especially in less-developed regions, also presents a challenge to many fintech players.

Forces Driving Indonesia Financial Technology Services Market Growth

Several factors are driving the growth of the Indonesian fintech market. These include government initiatives promoting financial inclusion, rising smartphone penetration and internet access, and a young, tech-savvy population eager to adopt digital financial services. The flourishing e-commerce sector and the increasing demand for seamless payment solutions further propel this growth. The government's focus on digital transformation is creating a conducive regulatory environment for fintech companies. Technological innovation, such as AI and blockchain, continuously improves the efficiency and security of financial services.

Long-Term Growth Catalysts in Indonesia Financial Technology Services Market

Long-term growth will be driven by continuous innovation in areas like AI-powered financial products, the expansion of financial services into underserved rural areas, and strategic partnerships between fintech companies and traditional financial institutions. The increasing adoption of blockchain technology for secure transactions and the development of more sophisticated risk management systems will also contribute significantly to the market's sustained expansion. Government support for digital infrastructure and financial literacy initiatives will be critical to fostering long-term growth.

Emerging Opportunities in Indonesia Financial Technology Services Market

Emerging opportunities include the expansion of financial services to the unbanked and underbanked population in rural areas through mobile-first solutions. The growing demand for embedded finance offers significant potential for integrating financial services into non-financial platforms. The use of blockchain technology for secure and transparent transactions presents an exciting avenue for innovation. The development of personalized financial products tailored to the unique needs of different customer segments will also create considerable market opportunities.

Leading Players in the Indonesia Financial Technology Services Market Sector

- PT Ajaib Teknologi Indonesia

- PT Investree Radhika Jaya

- Grab Holdings Limited

- PT GoTo Gojek Tokopedia Tbk

- PT Akulalu Silvrr Indonesia

- PT Dompet Anak Bangsa (GoPay)

- Jenius (PT Bank Tabungan Pensiunan Nasional Tbk)

- Kredivo Group Ltd

- DANA (PT Espay Debit Indonesia Koe)

- Xendit (PT Sinar Digital Terdepan)

- List Not Exhaustive

Key Milestones in Indonesia Financial Technology Services Market Industry

June 2024: Amartha, an Indonesian microfinance technology company, secured a USD 17.5 Million equity investment from the Accion Digital Transformation Fund. This investment highlights the growing interest in fintech solutions targeting underserved communities and the increasing adoption of AI and data-driven approaches in the industry.

November 2023: Finfra, a leading lending infrastructure provider in Indonesia, partnered with Xendit to leverage advanced payment gateways. This collaboration streamlines revenue-based financing collections for SMEs, emphasizing the market's increasing demand for efficient and scalable financial technology solutions.

Strategic Outlook for Indonesia Financial Technology Services Market

The future of the Indonesian fintech market is bright, driven by ongoing technological advancements, supportive government policies, and the expanding digital economy. Strategic opportunities lie in leveraging AI and data analytics to personalize financial products, expanding into underserved markets, and fostering strategic collaborations to build a robust and inclusive financial ecosystem. Fintech companies that can adapt to the evolving regulatory landscape, prioritize security, and focus on user experience will be best positioned to capture significant market share and achieve sustainable growth in the years to come.

Indonesia Financial Technology Services Market Segmentation

-

1. Type

-

1.1. Digital Capital Raising

- 1.1.1. Crowd investing

- 1.1.2. Crowd Lending

- 1.1.3. Marketplace Lending

-

1.2. Digital Payments

- 1.2.1. Digital Commerce

- 1.2.2. Digital Remittances

- 1.2.3. Mobile PoS Payments

- 1.3. Neobanking

-

1.1. Digital Capital Raising

Indonesia Financial Technology Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Financial Technology Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth in Low-cost

- 3.2.2 Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs

- 3.3. Market Restrains

- 3.3.1 Growth in Low-cost

- 3.3.2 Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs

- 3.4. Market Trends

- 3.4.1. Digital Payments Contribute Significantly to Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Financial Technology Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Digital Capital Raising

- 5.1.1.1. Crowd investing

- 5.1.1.2. Crowd Lending

- 5.1.1.3. Marketplace Lending

- 5.1.2. Digital Payments

- 5.1.2.1. Digital Commerce

- 5.1.2.2. Digital Remittances

- 5.1.2.3. Mobile PoS Payments

- 5.1.3. Neobanking

- 5.1.1. Digital Capital Raising

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PT Ajaib Teknologi Indonesia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Investree Radhika Jaya

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grab Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT GoTo Gojek Tokopedia Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Akulalu Silvrr Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Dompet Anak Bangsa (GoPay)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jenius (PT Bank Tabungan Pensiunan Nasional Tbk)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kredivo Group Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DANA (PT Espay Debit Indonesia Koe)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xendit (PT Sinar Digital Terdepan)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Ajaib Teknologi Indonesia

List of Figures

- Figure 1: Indonesia Financial Technology Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Financial Technology Services Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Financial Technology Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Financial Technology Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Indonesia Financial Technology Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Indonesia Financial Technology Services Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Indonesia Financial Technology Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Indonesia Financial Technology Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Indonesia Financial Technology Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Indonesia Financial Technology Services Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: Indonesia Financial Technology Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Indonesia Financial Technology Services Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Financial Technology Services Market?

The projected CAGR is approximately 9.31%.

2. Which companies are prominent players in the Indonesia Financial Technology Services Market?

Key companies in the market include PT Ajaib Teknologi Indonesia, PT Investree Radhika Jaya, Grab Holdings Limited, PT GoTo Gojek Tokopedia Tbk, PT Akulalu Silvrr Indonesia, PT Dompet Anak Bangsa (GoPay), Jenius (PT Bank Tabungan Pensiunan Nasional Tbk), Kredivo Group Ltd, DANA (PT Espay Debit Indonesia Koe), Xendit (PT Sinar Digital Terdepan)*List Not Exhaustive.

3. What are the main segments of the Indonesia Financial Technology Services Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Low-cost. Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs.

6. What are the notable trends driving market growth?

Digital Payments Contribute Significantly to Growth.

7. Are there any restraints impacting market growth?

Growth in Low-cost. Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs.

8. Can you provide examples of recent developments in the market?

June 2024: Indonesian microfinance technology company Amartha received a USD 17.5 million equity investment from the Accion Digital Transformation Fund to enhance Amartha’s platform, which provides financial products and services to underserved women-led small businesses in rural areas across Indonesia, leveraging data and AI, showing the increasing demand for technology integrated financial services in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Financial Technology Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Financial Technology Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Financial Technology Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Financial Technology Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence