Key Insights

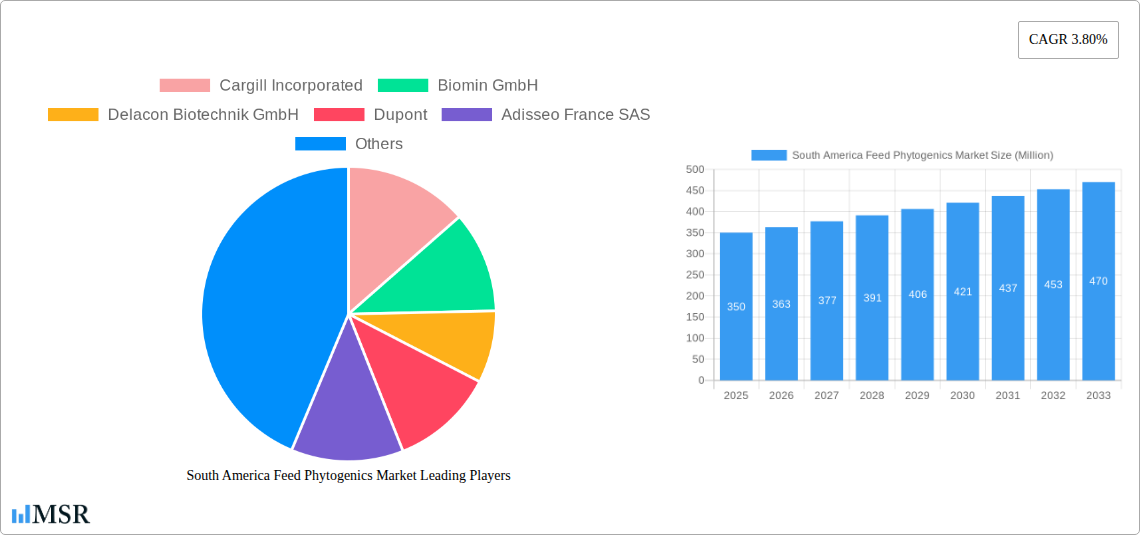

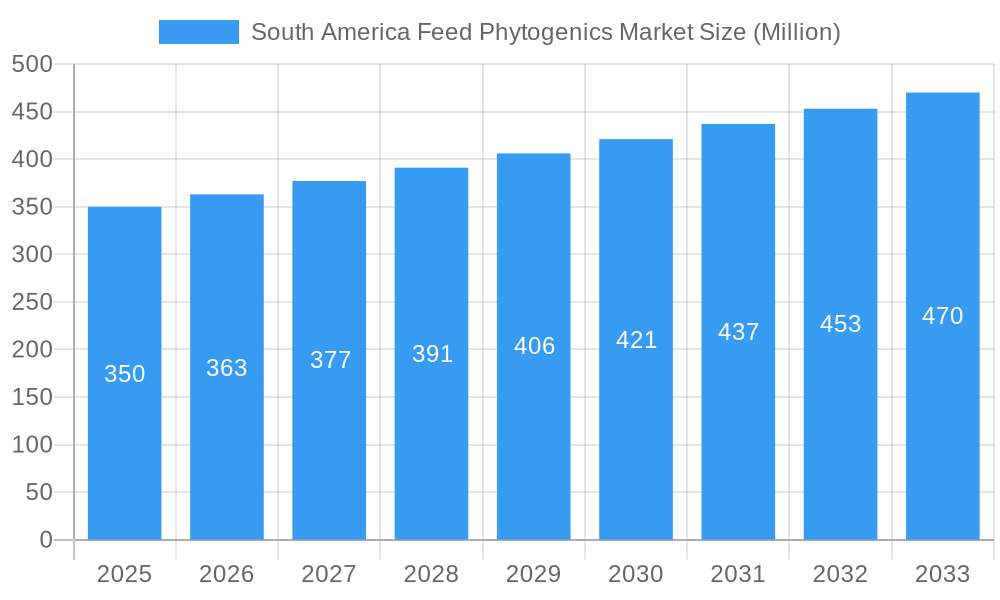

The South America Feed Phytogenics Market is poised for steady expansion, projected to reach an estimated market size of approximately $350 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.80% expected to drive its trajectory through 2033. This growth is largely propelled by an increasing demand for natural and sustainable alternatives to traditional antibiotic growth promoters in animal feed. Key market drivers include the rising global consumer preference for meat and animal products, coupled with growing awareness of the health benefits associated with phytogenic feed additives. These natural compounds, derived from herbs and spices, offer advantages such as improved feed intake and digestibility, enhanced flavor and aroma profiles, and potential antimicrobial properties, contributing to healthier livestock and reduced reliance on synthetic additives. The market's evolution is also influenced by stringent regulations on antibiotic use in animal agriculture across various South American nations, further bolstering the adoption of phytogenic solutions.

South America Feed Phytogenics Market Market Size (In Million)

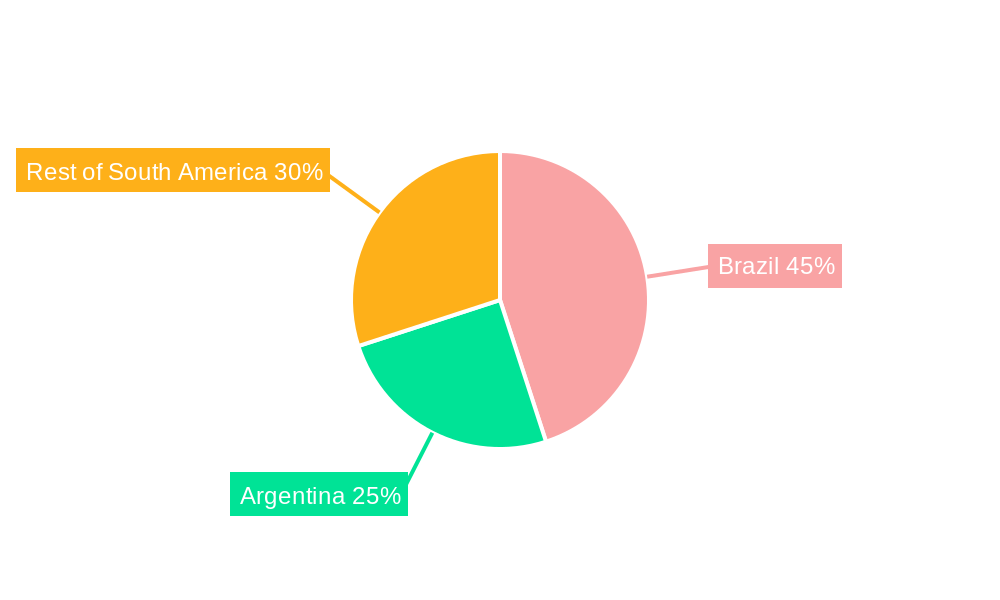

The market segmentation reveals a diverse landscape, with "Herbs and Spices" and "Essential Oils" emerging as dominant ingredient categories within the feed phytogenics sector. In terms of application, "Feed Intake and Digestibility" and "Flavoring and Aroma" represent significant growth areas, directly impacting animal performance and product quality. Poultry and Ruminant segments are expected to be the primary consumers of these additives, reflecting the substantial scale of these animal types in South American agriculture. Geographically, Brazil stands out as the leading market, supported by its robust animal husbandry industry and proactive approach to adopting innovative feed solutions. Argentina and the Rest of South America are also anticipated to witness considerable growth, driven by similar market dynamics and a rising emphasis on sustainable and ethical animal farming practices. Major industry players like Cargill Incorporated, Biomin GmbH, and Dupont are actively investing in research and development to expand their product portfolios and cater to the evolving needs of the South American feed industry.

South America Feed Phytogenics Market Company Market Share

South America Feed Phytogenics Market: Comprehensive Report and Growth Analysis (2019-2033)

Unlock the potential of the South America Feed Phytogenics Market with this in-depth analysis. Discover key growth drivers, emerging trends, and competitive landscapes shaping the future of animal nutrition. This report provides actionable insights for stakeholders seeking to capitalize on the booming demand for natural, effective feed additives in the region. Investigate market dynamics, technological advancements, and segment-specific opportunities to inform your strategic decisions.

South America Feed Phytogenics Market Market Concentration & Dynamics

The South America Feed Phytogenics Market exhibits a moderately concentrated landscape, with several key players vying for market share. Major companies like Cargill Incorporated, Biomin GmbH, Delacon Biotechnik GmbH, Dupont, Adisseo France SAS, Kemin Industries Inc, Pancosma, and Natural Remedie are actively involved in product innovation, strategic partnerships, and market expansion. The innovation ecosystem is characterized by increasing research and development in novel phytogenic compounds and their applications in animal feed. Regulatory frameworks are evolving, with a growing emphasis on natural and sustainable feed additives, presenting both opportunities and challenges. Substitute products, such as synthetic growth promoters and antibiotics, are facing increasing scrutiny, driving the adoption of phytogenics. End-user trends indicate a strong preference for products that enhance animal health, improve feed efficiency, and contribute to food safety. Merger and acquisition (M&A) activities are anticipated to rise as companies seek to consolidate their market position and acquire innovative technologies. For instance, the market has witnessed approximately 5 M&A deals in the historical period, highlighting consolidation efforts.

South America Feed Phytogenics Market Industry Insights & Trends

The South America Feed Phytogenics Market is poised for significant expansion, driven by a confluence of escalating demand for animal protein, heightened awareness of animal welfare, and the global push towards sustainable agricultural practices. The market size is projected to reach an estimated $850 Million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period of 2025–2033. This growth is underpinned by increasing consumer preference for meat and dairy products with a lower environmental footprint, directly translating into a demand for natural and effective feed additives. Phytogenics, derived from plants, are emerging as a preferred alternative to antibiotic growth promoters (AGPs) due to growing concerns over antimicrobial resistance (AMR) and stringent regulations restricting AGP usage in many South American nations. Technological disruptions are playing a pivotal role, with advancements in extraction, formulation, and delivery systems enhancing the efficacy and bioavailability of phytogenic compounds. The industry is witnessing a surge in research focused on synergistic combinations of different plant-derived ingredients to achieve broader spectrum benefits, including improved gut health, enhanced nutrient digestibility, reduced inflammatory responses, and better overall animal performance. Furthermore, the inherent antimicrobial and antioxidant properties of many phytogenics contribute to disease prevention and stress reduction in livestock, leading to improved animal welfare and reduced medication costs. The economic growth in key South American countries, coupled with increasing investments in the livestock sector, further fuels the demand for advanced feed solutions. The focus on traceability and food safety throughout the supply chain also propels the adoption of naturally sourced feed ingredients. The historical period (2019–2024) has laid a strong foundation for this market, with consistent growth observed as the benefits of phytogenics become more widely recognized by feed manufacturers and livestock producers.

Key Markets & Segments Leading South America Feed Phytogenics Market

Brazil currently stands as the dominant force in the South America Feed Phytogenics Market, driven by its colossal livestock industry, particularly in poultry and swine production. The sheer scale of agricultural operations in Brazil, coupled with government initiatives promoting sustainable farming practices and a growing awareness of the benefits of natural feed additives, positions it as a primary growth engine. Argentina also presents a significant market, with a strong presence in ruminant and swine farming.

Dominant Geography: Brazil

- Economic Growth: Robust economic development in Brazil translates to increased disposable income, driving higher demand for animal protein products.

- Infrastructure Development: Advancements in logistics and supply chain infrastructure facilitate the wider distribution of feed phytogenics across the country.

- Livestock Sector Dominance: Brazil is a global powerhouse in poultry and swine production, creating a massive captive market for feed additives.

- Regulatory Support: Evolving regulations that favor natural and sustainable feed solutions are encouraging the adoption of phytogenics.

Dominant Animal Type: Poultry

- Poultry farming's intensive nature and the high volume of feed consumed make it a prime target for phytogenic solutions aimed at improving feed conversion ratio and gut health. The rapid growth cycles and susceptibility to diseases in poultry also make them highly responsive to the beneficial effects of phytogenics.

Dominant Application: Feed Intake and Digestibility

- The primary driver for phytogenic adoption in animal feed is the enhancement of feed intake and digestibility. Phytogenics can stimulate appetite, improve nutrient absorption, and optimize gut microbiota, leading to more efficient feed utilization and reduced waste. This directly impacts profitability for livestock producers.

Dominant Ingredient: Herbs and Spices

- Herbs and spices, with their well-documented bioactive compounds, are the most widely utilized ingredients in the South American feed phytogenics market. Their established efficacy in improving palatability, stimulating digestive enzymes, and providing antimicrobial benefits makes them a go-to choice for formulators. Essential oils, derived from these plants, are also gaining traction due to their concentrated potency.

South America Feed Phytogenics Market Product Developments

Product innovation in the South America Feed Phytogenics Market is characterized by the development of novel formulations, synergistic blends, and advanced delivery systems designed to maximize efficacy and ease of use. Companies are investing in R&D to isolate and concentrate specific bioactive compounds, such as polyphenols, flavonoids, and essential oil constituents, known for their antioxidant, anti-inflammatory, and antimicrobial properties. The focus is on creating targeted solutions for specific animal types and production challenges, such as improving gut health in poultry, enhancing feed efficiency in swine, and supporting immune function in ruminants. Microencapsulation technologies are emerging as a key area of development, protecting active compounds from degradation during feed processing and ensuring their effective release in the animal's digestive tract.

Challenges in the South America Feed Phytogenics Market Market

The South America Feed Phytogenics Market faces several challenges that could impede its growth trajectory.

- Regulatory Harmonization: Inconsistent regulatory approvals and varying standards across different South American countries can create hurdles for market entry and product registration.

- Supply Chain Volatility: Fluctuations in the availability and pricing of raw botanical materials, influenced by weather patterns and agricultural yields, can impact product consistency and cost-effectiveness.

- Perception and Education: Some segments of the market may still require further education on the scientific backing and economic benefits of phytogenic feed additives compared to traditional products.

- Cost Competitiveness: In certain applications, the initial cost of high-quality phytogenic formulations may be higher than that of synthetic alternatives, requiring a strong demonstration of ROI.

Forces Driving South America Feed Phytogenics Market Growth

Several powerful forces are propelling the growth of the South America Feed Phytogenics Market. The escalating global demand for animal protein necessitates more efficient and sustainable livestock production methods. This, in turn, fuels the demand for feed additives that can improve animal health and performance without the concerns associated with antibiotic residues. Growing consumer awareness regarding food safety and the welfare of farm animals is a significant driver, pushing producers towards natural and humane farming practices. Furthermore, increasing regulatory pressure on the use of antibiotic growth promoters (AGPs) in many countries is creating a substantial void that phytogenics are effectively filling. Technological advancements in extraction, formulation, and delivery mechanisms are enhancing the efficacy and bioavailability of phytogenic compounds, making them more attractive to feed manufacturers.

Challenges in the South America Feed Phytogenics Market Market

The long-term growth catalysts for the South America Feed Phytogenics Market lie in continuous innovation and strategic market penetration. Ongoing research into new botanical sources and the synergistic effects of compound combinations will unlock novel applications and enhance efficacy. The increasing demand for transparency and traceability in the food supply chain will further favor naturally sourced ingredients like phytogenics. Partnerships between phytogenic manufacturers and feed producers, as well as academic institutions, will accelerate product development and market adoption. Expansion into emerging markets within South America and a focus on providing tailored solutions for diverse production systems will be crucial for sustained growth.

Emerging Opportunities in South America Feed Phytogenics Market

Emerging opportunities in the South America Feed Phytogenics Market are diverse and promising. The growing trend towards reduced antibiotic use in animal agriculture presents a significant opportunity for phytogenics to replace synthetic growth promoters and therapeutic antibiotics. The increasing consumer demand for "clean label" products, free from artificial additives, is creating a pull for naturally sourced feed ingredients. Advancements in precision livestock farming offer opportunities for developing targeted phytogenic solutions based on real-time animal health monitoring. Furthermore, the exploration of underutilized plant species and the development of sustainable cultivation practices for raw materials can unlock new product lines and enhance supply chain resilience. The growing aquaculture sector in South America also presents a largely untapped market for phytogenic feed additives.

Leading Players in the South America Feed Phytogenics Market Sector

- Cargill Incorporated

- Biomin GmbH

- Delacon Biotechnik GmbH

- Dupont

- Adisseo France SAS

- Kemin Industries Inc

- Pancosma

- Natural Remedie

Key Milestones in South America Feed Phytogenics Market Industry

- 2019: Increased regulatory scrutiny on antibiotic use in livestock globally, boosting interest in phytogenic alternatives.

- 2020: Key players intensified R&D efforts, leading to the launch of enhanced phytogenic formulations with improved bioavailability.

- 2021: Several South American countries began implementing stricter regulations on antibiotic growth promoters, creating a more favorable market for phytogenics.

- 2022: Significant investment in sustainable sourcing and production of botanical raw materials by leading companies.

- 2023: Growing adoption of phytogenics in aquaculture due to concerns over antibiotic resistance in aquatic environments.

- 2024: Increased collaborations between research institutions and industry players to validate the efficacy of novel phytogenic compounds.

Strategic Outlook for South America Feed Phytogenics Market Market

The strategic outlook for the South America Feed Phytogenics Market is exceptionally bright, driven by a sustained shift towards natural, sustainable, and antibiotic-free animal production. Key growth accelerators include continued innovation in product development, focusing on synergistic blends and advanced delivery systems that offer superior efficacy and cost-effectiveness. Strategic partnerships with feed manufacturers and livestock producers will be crucial for market penetration and the establishment of strong distribution networks. Companies that can effectively address the evolving regulatory landscape and educate stakeholders on the scientific and economic benefits of their phytogenic solutions will gain a competitive edge. Furthermore, a focus on sustainable sourcing and transparent supply chains will resonate with increasingly conscious consumers, further solidifying the market's long-term growth potential. The increasing integration of digital technologies in animal agriculture also presents opportunities for developing data-driven phytogenic solutions.

South America Feed Phytogenics Market Segmentation

-

1. Ingredients

- 1.1. Herbs and Spices

- 1.2. Essential Oils

- 1.3. Others

-

2. Application

- 2.1. Feed Intake and Digestibility

- 2.2. Flavoring and Aroma

- 2.3. Others

-

3. Animal Type

- 3.1. Ruminant

- 3.2. Poultry

- 3.3. Swine

- 3.4. Aquaculture

- 3.5. Others

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Feed Phytogenics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Phytogenics Market Regional Market Share

Geographic Coverage of South America Feed Phytogenics Market

South America Feed Phytogenics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Production of Animal Feed Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Herbs and Spices

- 5.1.2. Essential Oils

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Feed Intake and Digestibility

- 5.2.2. Flavoring and Aroma

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Ruminant

- 5.3.2. Poultry

- 5.3.3. Swine

- 5.3.4. Aquaculture

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. Brazil South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Herbs and Spices

- 6.1.2. Essential Oils

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Feed Intake and Digestibility

- 6.2.2. Flavoring and Aroma

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Animal Type

- 6.3.1. Ruminant

- 6.3.2. Poultry

- 6.3.3. Swine

- 6.3.4. Aquaculture

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. Argentina South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Herbs and Spices

- 7.1.2. Essential Oils

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Feed Intake and Digestibility

- 7.2.2. Flavoring and Aroma

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Animal Type

- 7.3.1. Ruminant

- 7.3.2. Poultry

- 7.3.3. Swine

- 7.3.4. Aquaculture

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Rest of South America South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Herbs and Spices

- 8.1.2. Essential Oils

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Feed Intake and Digestibility

- 8.2.2. Flavoring and Aroma

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Animal Type

- 8.3.1. Ruminant

- 8.3.2. Poultry

- 8.3.3. Swine

- 8.3.4. Aquaculture

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cargill Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Biomin GmbH

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Delacon Biotechnik GmbH

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Dupont

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Adisseo France SAS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Kemin Industries Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Pancosma

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Natural Remedie

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Cargill Incorporated

List of Figures

- Figure 1: South America Feed Phytogenics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Feed Phytogenics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 2: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 4: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: South America Feed Phytogenics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 7: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 9: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 12: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 14: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 17: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Phytogenics Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the South America Feed Phytogenics Market?

Key companies in the market include Cargill Incorporated, Biomin GmbH, Delacon Biotechnik GmbH, Dupont, Adisseo France SAS, Kemin Industries Inc, Pancosma, Natural Remedie.

3. What are the main segments of the South America Feed Phytogenics Market?

The market segments include Ingredients, Application, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Production of Animal Feed Driving the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Phytogenics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Phytogenics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Phytogenics Market?

To stay informed about further developments, trends, and reports in the South America Feed Phytogenics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence