Key Insights

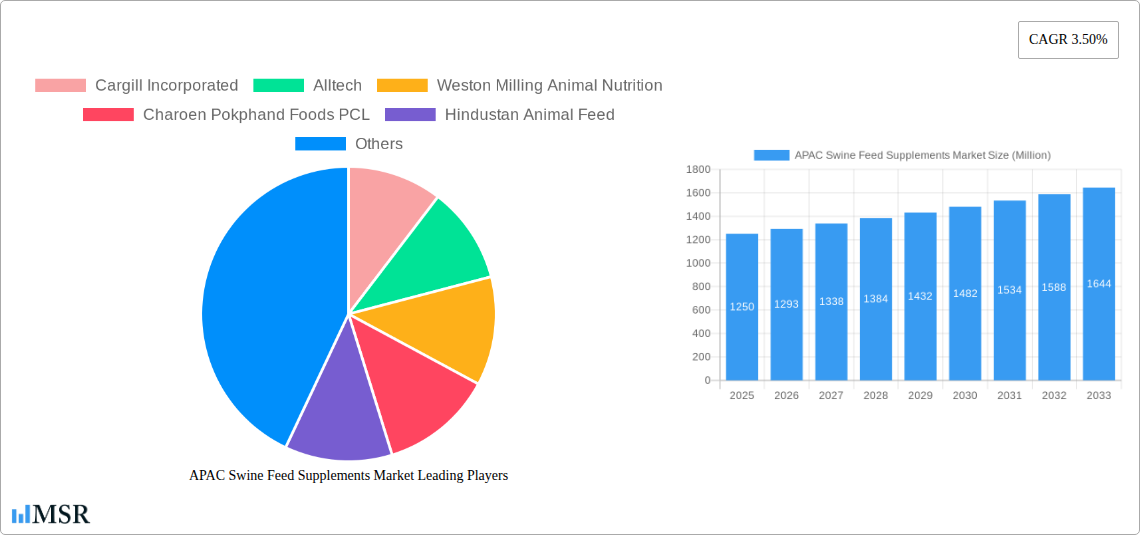

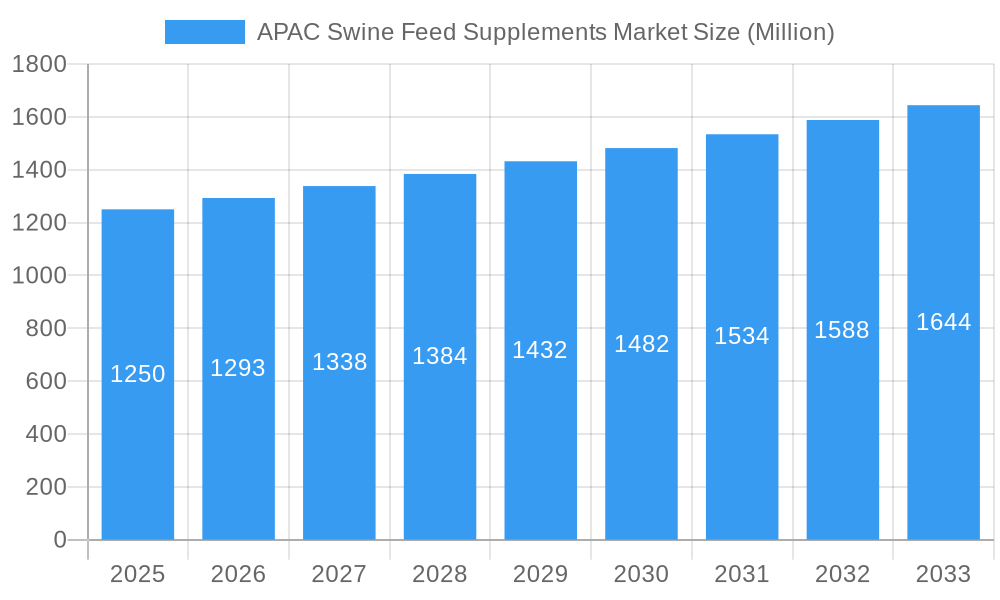

The Asia-Pacific (APAC) Swine Feed Supplements market is poised for robust growth, projected to reach approximately USD 1,250 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 3.50% through 2033. This expansion is primarily fueled by the burgeoning demand for high-quality pork products across the region, driven by a growing population and increasing disposable incomes. Key market drivers include the continuous need to enhance swine health and productivity, minimize disease outbreaks, and improve feed conversion ratios. The rising adoption of advanced animal husbandry practices and the growing awareness among farmers about the benefits of specialized feed supplements are also significant contributors. The market is segmented across various ingredients such as cereals, oilseed meals, and vital supplements like antibiotics, vitamins, and enzymes, each playing a crucial role in optimizing animal nutrition and overall farm profitability. China and India are expected to lead this growth trajectory, owing to their vast swine populations and expanding agricultural sectors.

APAC Swine Feed Supplements Market Market Size (In Billion)

The competitive landscape features prominent global and regional players like Cargill Incorporated, Alltech, and New Hope Group, actively innovating and expanding their product portfolios to cater to diverse market needs. Emerging trends include the increasing demand for natural and organic feed additives, such as probiotics and prebiotics, driven by consumer preferences for antibiotic-free pork. Furthermore, the development of customized supplement formulations tailored to specific life stages and health conditions of swine is gaining traction. However, the market faces certain restraints, including fluctuating raw material prices, stringent regulatory frameworks in some countries, and the potential for the emergence of antibiotic resistance, which necessitates careful management and alternative solutions. Despite these challenges, the APAC Swine Feed Supplements market demonstrates a strong upward trajectory, supported by ongoing technological advancements and a commitment to sustainable and efficient animal agriculture.

APAC Swine Feed Supplements Market Company Market Share

This in-depth market research report provides a definitive analysis of the APAC Swine Feed Supplements Market. Covering the historical period of 2019–2024, the base and estimated year of 2025, and a robust forecast period from 2025 to 2033, this study is your essential guide to understanding market dynamics, growth drivers, and future opportunities. Delve into the intricate landscape of swine nutrition across Asia-Pacific, driven by increasing demand for high-quality pork and advancements in animal husbandry.

APAC Swine Feed Supplements Market Market Concentration & Dynamics

The APAC Swine Feed Supplements Market exhibits a moderate to high concentration, with key players like Cargill Incorporated, Alltech, New Hope Group, and ADM Animal Nutrition holding significant market shares. Innovation is a critical differentiator, with companies investing heavily in R&D for novel feed additives that enhance animal health, growth, and feed conversion efficiency. The innovation ecosystem is characterized by collaborations between feed manufacturers, research institutions, and technology providers. Regulatory frameworks vary across the region, with China and India implementing stricter guidelines on feed additive usage, influencing market access and product development. Substitute products, such as improved farming practices and alternative protein sources, pose a mild threat. End-user trends indicate a growing preference for natural and sustainable feed supplements. Mergers and acquisitions (M&A) are a notable dynamic, with an estimated XX M&A deal count in the historical period, aimed at consolidating market presence and expanding product portfolios. Hindustan Animal Feed and ShivShakti Agro are key regional players contributing to the market's diverse landscape.

APAC Swine Feed Supplements Market Industry Insights & Trends

The APAC Swine Feed Supplements Market is projected to reach an estimated value of $XXX Million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This impressive growth is primarily fueled by the escalating global demand for pork, driven by a burgeoning population and rising disposable incomes across key APAC nations. The increasing adoption of modern animal husbandry practices, coupled with a heightened awareness among farmers regarding the critical role of nutrition in improving pig health, growth rates, and overall productivity, are significant market drivers. Technological disruptions, including advancements in precision nutrition, the development of novel feed enzymes, and the integration of biotechnological solutions, are transforming the feed supplement landscape. The trend towards antibiotic reduction in animal feed also presents a substantial opportunity for alternative feed additives like probiotics, prebiotics, and organic acids. Evolving consumer behaviors, leaning towards safer and healthier meat products, are indirectly influencing the demand for high-quality feed supplements that contribute to superior animal welfare and meat quality. The market is also witnessing increased R&D investments into scientifically-backed formulations that offer enhanced gut health, immune support, and nutrient absorption.

Key Markets & Segments Leading APAC Swine Feed Supplements Market

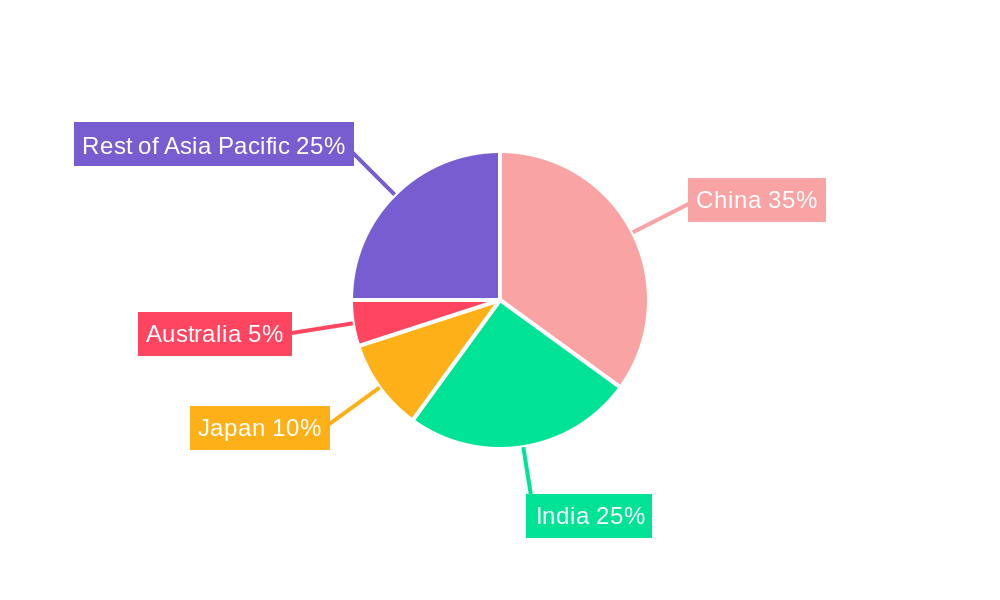

China stands out as the dominant geography in the APAC Swine Feed Supplements Market, driven by its colossal swine population and substantial pork consumption. Economic growth and significant investments in modernizing its agricultural sector have further propelled China's leadership. Within the Ingredients segment, Oil Seed Meal and Cereals are paramount, forming the foundational components of swine diets and necessitating the supplementation for optimal nutrient profiles. The Rest of Asia-Pacific, encompassing countries with rapidly developing agricultural sectors like Vietnam and Thailand, also presents significant growth potential due to increasing swine farming intensity.

Among Supplements, Antibiotics have historically held a substantial share due to their efficacy in disease prevention and growth promotion. However, a strong regulatory push towards antibiotic reduction is driving the rapid expansion of Vitamins, Amino Acids, and Enzymes. These categories are crucial for enhancing nutrient utilization, improving gut health, and bolstering the immune system, aligning with the industry's shift towards sustainable and responsible farming.

Dominance of China:

- The sheer size of its swine herd, exceeding XX million heads, translates to unparalleled demand for feed.

- Government initiatives promoting agricultural modernization and food security reinforce this dominance.

- Rising middle-class populations contribute to sustained high pork consumption.

Key Ingredient Segments:

- Oil Seed Meal: A primary source of protein, its demand is directly linked to the volume of feed produced.

- Cereals: Providing essential energy, their availability and cost significantly influence feed formulation.

Emerging Supplement Trends:

- Amino Acids: Crucial for precise nutrient formulation and reducing reliance on protein meals.

- Enzymes: Enhance digestibility of feed ingredients, leading to improved feed conversion ratios and reduced environmental impact.

- Vitamins: Essential for overall animal health and performance, their demand is steadily increasing.

APAC Swine Feed Supplements Market Product Developments

Product innovation in the APAC Swine Feed Supplements Market is characterized by a focus on enhancing animal health and performance while adhering to stringent regulatory requirements and consumer preferences for natural ingredients. Companies are actively developing probiotic and prebiotic formulations to improve gut microbiome health and reduce the need for antibiotics. Advancements in enzyme technology are leading to more effective digestion of complex feed ingredients, boosting nutrient absorption and reducing waste. The market is also witnessing a surge in antioxidant supplements, aimed at combating oxidative stress in pigs and improving meat quality. These developments underscore a strategic shift towards sustainable, efficient, and healthier swine farming practices, driven by scientific research and a growing demand for premium feed additives.

Challenges in the APAC Swine Feed Supplements Market Market

Navigating the APAC Swine Feed Supplements Market presents several challenges. Stringent and evolving regulatory landscapes across different countries create complexities for market entry and product compliance, impacting the speed of innovation adoption. Volatile raw material prices for key ingredients like cereals and oil seed meal directly affect production costs and profit margins for feed supplement manufacturers. Supply chain disruptions, exacerbated by geopolitical events and logistical hurdles, can impede the consistent availability of essential components. Furthermore, intense competitive pressures from both global giants and local players necessitate continuous product innovation and cost-effective solutions. The estimated impact of these challenges on market growth is a reduction in the forecast CAGR by approximately XX%.

Forces Driving APAC Swine Feed Supplements Market Growth

The APAC Swine Feed Supplements Market is propelled by a confluence of powerful growth forces. The increasing global demand for protein, particularly pork, due to population growth and rising disposable incomes in emerging economies, serves as a fundamental driver. Significant technological advancements in animal nutrition and feed formulation are leading to the development of more efficacious and specialized supplements. Government initiatives aimed at improving livestock productivity and ensuring food security also play a crucial role. Furthermore, a growing awareness among farmers about the economic benefits of enhanced pig health and feed conversion efficiency through optimal supplementation is fostering greater adoption of these products. The projected market size growth due to these forces is estimated at XX% annually.

Challenges in the APAC Swine Feed Supplements Market Market

Long-term growth catalysts for the APAC Swine Feed Supplements Market are deeply rooted in innovation and market expansion. The ongoing research and development in next-generation feed additives, such as targeted nutrient delivery systems and immune modulators, promise to unlock new levels of animal performance. Strategic partnerships and collaborations between feed manufacturers, ingredient suppliers, and research institutions are accelerating the development and commercialization of novel solutions. Expanding into underserved rural markets within key APAC countries and adapting product offerings to local farming conditions represent significant avenues for sustained growth. Furthermore, the increasing focus on sustainability and environmental impact reduction in animal agriculture is creating demand for feed supplements that minimize nutrient excretion and improve resource utilization.

Emerging Opportunities in APAC Swine Feed Supplements Market

Emerging opportunities in the APAC Swine Feed Supplements Market are diverse and lucrative. The growing consumer demand for "antibiotic-free" pork is creating a significant market for natural alternatives like probiotics, prebiotics, and essential oils. Precision nutrition solutions, leveraging data analytics and advanced formulation techniques to deliver tailored supplements based on specific pig life stages and health needs, present a rapidly expanding frontier. The development of bio-based feed additives derived from sustainable sources aligns with the global shift towards eco-friendly agriculture. Furthermore, the increasing adoption of digital technologies in farming, such as smart feeding systems and health monitoring, offers opportunities for integrated feed supplement solutions.

Leading Players in the APAC Swine Feed Supplements Market Sector

- Cargill Incorporated

- Alltech

- Weston Milling Animal Nutrition

- Charoen Pokphand Foods PCL

- Hindustan Animal Feed

- ShivShakti Agro

- Feedone Co Ltd

- New Hope Group

- ADM Animal Nutrition

Key Milestones in APAC Swine Feed Supplements Market Industry

- 2019: Launch of a novel enzyme blend by Alltech to improve nutrient digestibility.

- 2020: Cargill expands its swine nutrition R&D center in China to focus on gut health solutions.

- 2021: New Hope Group announces strategic investment in a sustainable feed additive technology.

- 2022: ADM Animal Nutrition introduces a new range of amino acid supplements for growing pigs.

- 2023: Charoen Pokphand Foods PCL implements advanced traceability systems for its feed ingredients.

- 2024: Hindustan Animal Feed launches a new line of vitamin premixes catering to specific regional needs.

Strategic Outlook for APAC Swine Feed Supplements Market Market

The strategic outlook for the APAC Swine Feed Supplements Market is exceptionally positive, driven by sustained demand and a relentless pursuit of innovation. Growth accelerators will primarily focus on developing and marketing next-generation, science-backed feed additives that enhance animal welfare, improve feed efficiency, and contribute to the production of healthier pork. Strategic opportunities lie in expanding market reach into developing Asian economies, tailoring product portfolios to meet local needs, and fostering strong distribution networks. Furthermore, companies that can effectively leverage digital technologies and data analytics to offer precision nutrition solutions will gain a significant competitive edge. The emphasis on sustainability and reduced antibiotic usage will continue to shape product development and market strategies, presenting a lucrative landscape for agile and forward-thinking players.

APAC Swine Feed Supplements Market Segmentation

-

1. Ingredients

- 1.1. Cereals

- 1.2. Cereals by products

- 1.3. Oil Seed Meal

- 1.4. Oils

- 1.5. Molasses

- 1.6. Others

-

2. Supplements

- 2.1. Antibiotics

- 2.2. Vitamins

- 2.3. Antioxidants

- 2.4. Amino Acids

- 2.5. Enzymes

- 2.6. Acidifiers

- 2.7. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

APAC Swine Feed Supplements Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

APAC Swine Feed Supplements Market Regional Market Share

Geographic Coverage of APAC Swine Feed Supplements Market

APAC Swine Feed Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Pork Meat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Swine Feed Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Cereals

- 5.1.2. Cereals by products

- 5.1.3. Oil Seed Meal

- 5.1.4. Oils

- 5.1.5. Molasses

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Supplements

- 5.2.1. Antibiotics

- 5.2.2. Vitamins

- 5.2.3. Antioxidants

- 5.2.4. Amino Acids

- 5.2.5. Enzymes

- 5.2.6. Acidifiers

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. China APAC Swine Feed Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Cereals

- 6.1.2. Cereals by products

- 6.1.3. Oil Seed Meal

- 6.1.4. Oils

- 6.1.5. Molasses

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Supplements

- 6.2.1. Antibiotics

- 6.2.2. Vitamins

- 6.2.3. Antioxidants

- 6.2.4. Amino Acids

- 6.2.5. Enzymes

- 6.2.6. Acidifiers

- 6.2.7. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. India APAC Swine Feed Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Cereals

- 7.1.2. Cereals by products

- 7.1.3. Oil Seed Meal

- 7.1.4. Oils

- 7.1.5. Molasses

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Supplements

- 7.2.1. Antibiotics

- 7.2.2. Vitamins

- 7.2.3. Antioxidants

- 7.2.4. Amino Acids

- 7.2.5. Enzymes

- 7.2.6. Acidifiers

- 7.2.7. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Japan APAC Swine Feed Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Cereals

- 8.1.2. Cereals by products

- 8.1.3. Oil Seed Meal

- 8.1.4. Oils

- 8.1.5. Molasses

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Supplements

- 8.2.1. Antibiotics

- 8.2.2. Vitamins

- 8.2.3. Antioxidants

- 8.2.4. Amino Acids

- 8.2.5. Enzymes

- 8.2.6. Acidifiers

- 8.2.7. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. Australia APAC Swine Feed Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 9.1.1. Cereals

- 9.1.2. Cereals by products

- 9.1.3. Oil Seed Meal

- 9.1.4. Oils

- 9.1.5. Molasses

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Supplements

- 9.2.1. Antibiotics

- 9.2.2. Vitamins

- 9.2.3. Antioxidants

- 9.2.4. Amino Acids

- 9.2.5. Enzymes

- 9.2.6. Acidifiers

- 9.2.7. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 10. Rest of Asia Pacific APAC Swine Feed Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 10.1.1. Cereals

- 10.1.2. Cereals by products

- 10.1.3. Oil Seed Meal

- 10.1.4. Oils

- 10.1.5. Molasses

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Supplements

- 10.2.1. Antibiotics

- 10.2.2. Vitamins

- 10.2.3. Antioxidants

- 10.2.4. Amino Acids

- 10.2.5. Enzymes

- 10.2.6. Acidifiers

- 10.2.7. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alltech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Weston Milling Animal Nutrition

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Charoen Pokphand Foods PCL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hindustan Animal Feed

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ShivShakti Agro

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Feedone Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 New Hope Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ADM Animal Nutrition

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global APAC Swine Feed Supplements Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China APAC Swine Feed Supplements Market Revenue (undefined), by Ingredients 2025 & 2033

- Figure 3: China APAC Swine Feed Supplements Market Revenue Share (%), by Ingredients 2025 & 2033

- Figure 4: China APAC Swine Feed Supplements Market Revenue (undefined), by Supplements 2025 & 2033

- Figure 5: China APAC Swine Feed Supplements Market Revenue Share (%), by Supplements 2025 & 2033

- Figure 6: China APAC Swine Feed Supplements Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China APAC Swine Feed Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Swine Feed Supplements Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: China APAC Swine Feed Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India APAC Swine Feed Supplements Market Revenue (undefined), by Ingredients 2025 & 2033

- Figure 11: India APAC Swine Feed Supplements Market Revenue Share (%), by Ingredients 2025 & 2033

- Figure 12: India APAC Swine Feed Supplements Market Revenue (undefined), by Supplements 2025 & 2033

- Figure 13: India APAC Swine Feed Supplements Market Revenue Share (%), by Supplements 2025 & 2033

- Figure 14: India APAC Swine Feed Supplements Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: India APAC Swine Feed Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India APAC Swine Feed Supplements Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: India APAC Swine Feed Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan APAC Swine Feed Supplements Market Revenue (undefined), by Ingredients 2025 & 2033

- Figure 19: Japan APAC Swine Feed Supplements Market Revenue Share (%), by Ingredients 2025 & 2033

- Figure 20: Japan APAC Swine Feed Supplements Market Revenue (undefined), by Supplements 2025 & 2033

- Figure 21: Japan APAC Swine Feed Supplements Market Revenue Share (%), by Supplements 2025 & 2033

- Figure 22: Japan APAC Swine Feed Supplements Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Japan APAC Swine Feed Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan APAC Swine Feed Supplements Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Japan APAC Swine Feed Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia APAC Swine Feed Supplements Market Revenue (undefined), by Ingredients 2025 & 2033

- Figure 27: Australia APAC Swine Feed Supplements Market Revenue Share (%), by Ingredients 2025 & 2033

- Figure 28: Australia APAC Swine Feed Supplements Market Revenue (undefined), by Supplements 2025 & 2033

- Figure 29: Australia APAC Swine Feed Supplements Market Revenue Share (%), by Supplements 2025 & 2033

- Figure 30: Australia APAC Swine Feed Supplements Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Australia APAC Swine Feed Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Australia APAC Swine Feed Supplements Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Australia APAC Swine Feed Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue (undefined), by Ingredients 2025 & 2033

- Figure 35: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue Share (%), by Ingredients 2025 & 2033

- Figure 36: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue (undefined), by Supplements 2025 & 2033

- Figure 37: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue Share (%), by Supplements 2025 & 2033

- Figure 38: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of Asia Pacific APAC Swine Feed Supplements Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 2: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 3: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 6: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 7: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 10: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 11: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 14: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 15: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 18: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 19: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 22: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 23: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Swine Feed Supplements Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Swine Feed Supplements Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the APAC Swine Feed Supplements Market?

Key companies in the market include Cargill Incorporated, Alltech, Weston Milling Animal Nutrition, Charoen Pokphand Foods PCL, Hindustan Animal Feed, ShivShakti Agro, Feedone Co Ltd, New Hope Group, ADM Animal Nutrition.

3. What are the main segments of the APAC Swine Feed Supplements Market?

The market segments include Ingredients, Supplements, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

Increasing Demand for Pork Meat.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Swine Feed Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Swine Feed Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Swine Feed Supplements Market?

To stay informed about further developments, trends, and reports in the APAC Swine Feed Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence