Key Insights

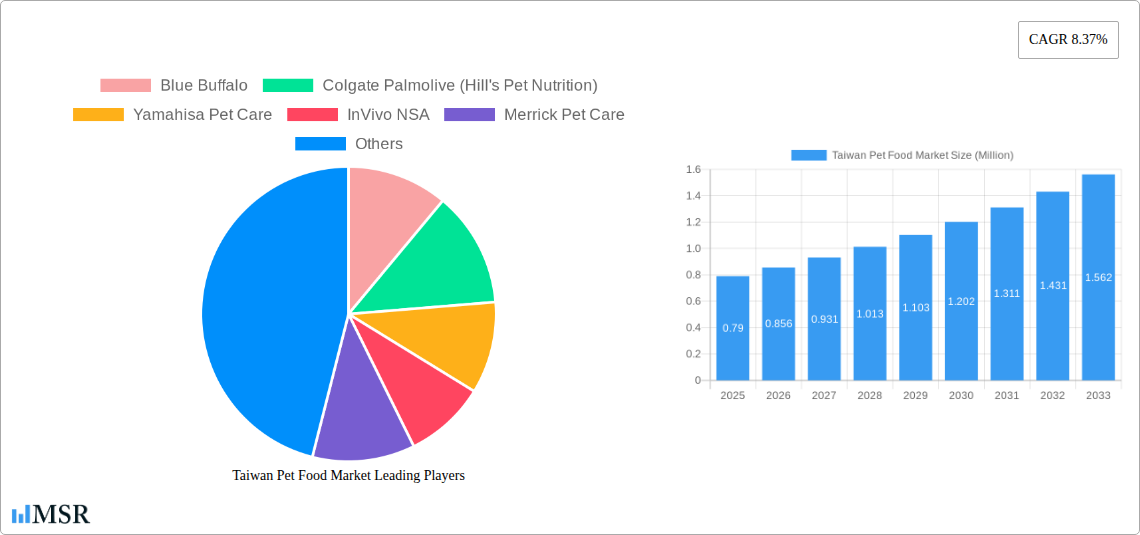

The Taiwan pet food market is poised for significant growth, projected to expand from an estimated USD 0.79 million in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 8.37% through 2033. This burgeoning market is fueled by increasing pet ownership, a growing humanization trend where pets are treated as family members, and a rising disposable income among Taiwanese consumers, leading to higher spending on premium and specialized pet nutrition. Key product segments like dry pet food and wet pet food are expected to dominate, catering to the daily nutritional needs of a growing canine and feline population. Furthermore, the increasing demand for veterinary diets and specialized treats reflects a more informed pet owner base prioritizing health and well-being.

Taiwan Pet Food Market Market Size (In Million)

The market's expansion is also supported by evolving sales channels. While specialized pet shops have traditionally held sway, the surge in internet sales and e-commerce platforms is significantly reshaping how pet food is purchased, offering convenience and wider product selection. This shift is expected to further democratize access to a diverse range of pet food options. Ingredient innovation, with a focus on animal-derived and plant-derived components, is another crucial trend, as owners seek healthier, more natural, and ethically sourced options for their pets. Despite the generally positive outlook, potential restraints could include fluctuations in raw material costs and increasing competition among established global brands and emerging local players. However, the underlying demand for high-quality pet food, coupled with a culture that increasingly values pet companionship, positions Taiwan as a dynamic and promising market within the global pet food industry.

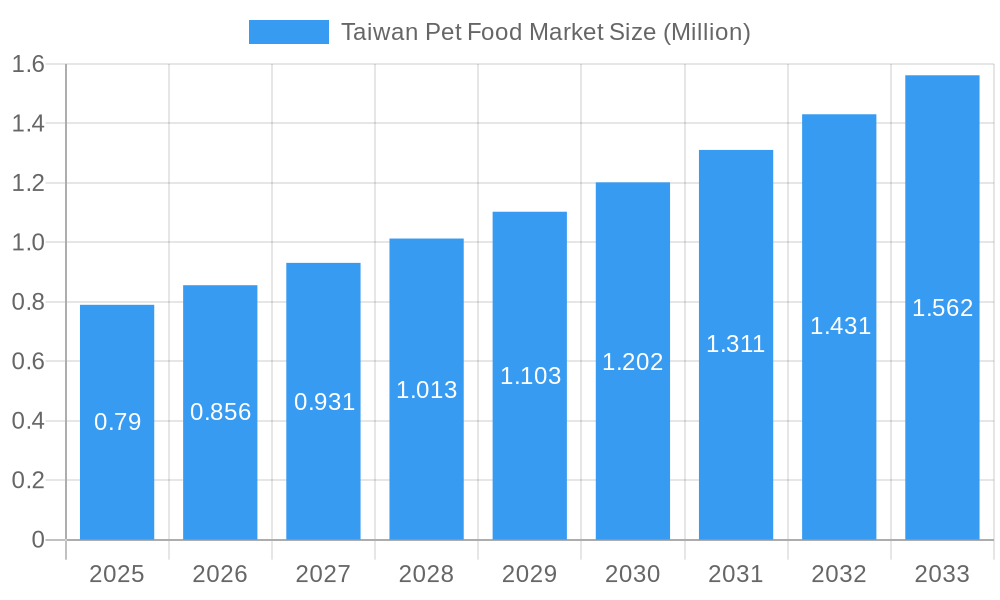

Taiwan Pet Food Market Company Market Share

Taiwan Pet Food Market: In-Depth Analysis & Forecast 2019–2033

This comprehensive report delves into the dynamic Taiwan pet food market, offering a detailed analysis from 2019 to 2033, with a base and estimated year of 2025. Uncover critical market insights, growth drivers, emerging trends, and competitive landscapes shaping the future of pet nutrition in Taiwan. Gain actionable intelligence on product types, animal categories, ingredient preferences, and sales channels, alongside strategic recommendations for industry stakeholders.

Taiwan Pet Food Market Market Concentration & Dynamics

The Taiwan pet food market exhibits a moderate level of concentration, with key players like Mars Inc. and Nestlé SA (Purina) holding significant market shares. The innovation ecosystem is thriving, fueled by increasing pet humanization and a demand for premium and specialized pet food options. Regulatory frameworks are evolving to support pet welfare, as evidenced by the April 2022 launch of a new government department dedicated to pet affairs, overseeing everything from pet food to insurance. Substitute products, such as homemade pet food, are present but represent a smaller segment. End-user trends highlight a growing preference for high-quality, natural, and functional pet food. Merger and acquisition (M&A) activities, while not extensive, are indicative of consolidation and strategic expansion within the market. For instance, a predicted xx number of M&A deals are anticipated within the forecast period, indicating strategic moves by established companies to acquire innovative startups or expand their product portfolios.

Taiwan Pet Food Market Industry Insights & Trends

The Taiwan pet food market is poised for significant growth, projected to reach a market size of approximately $1,500 Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This expansion is primarily driven by escalating pet ownership, a burgeoning middle class with increased disposable income, and a societal shift towards viewing pets as integral family members. Technological advancements are influencing product development, with a focus on scientifically formulated diets, personalized nutrition, and the integration of functional ingredients. Evolving consumer behaviors are characterized by a premiumization trend, with pet owners prioritizing health, wellness, and sustainability in their purchasing decisions. The demand for natural, organic, and grain-free pet foods is on the rise, mirroring global trends. Furthermore, the convenience offered by online sales channels is contributing to market accessibility and growth. The market is expected to experience substantial momentum due to these factors, making it an attractive landscape for both domestic and international players seeking to tap into the burgeoning Taiwanese pet care industry.

Key Markets & Segments Leading Taiwan Pet Food Market

Product Type Dominance

- Dry Pet Food: Expected to remain the largest segment, driven by its convenience, shelf-stability, and cost-effectiveness. Economic growth and increasing pet adoption are key drivers.

- Wet Pet Food: Experiencing robust growth due to its palatability and perceived nutritional benefits.

- Veterinary Diet: A high-value segment driven by increasing awareness of pet health issues and the availability of specialized therapeutic diets.

- Treats/Snacks: Continues to be a strong performer, fueled by the humanization of pets and the desire to reward and bond with them.

Animal Type Dominance

- Dog: The largest animal segment, representing a substantial portion of the pet food market. Rising pet ownership and the popularity of various dog breeds contribute to this dominance.

- Cat: The second-largest segment, with a growing number of cat owners seeking high-quality, specialized food options.

- Bird & Other Animal Types: Smaller but growing segments, catering to niche markets and specialized pet needs.

Ingredient Type Dominance

- Animal-derived: Remains the dominant ingredient type, reflecting the natural dietary needs of pets.

- Plant-derived & Cereals and Cereal Derivatives: Growing in popularity as consumers seek healthier, more sustainable, and allergen-friendly options.

Sales Channel Dominance

- Specialized Pet Shops: Continue to be a significant channel, offering expert advice and a curated selection of premium products.

- Internet Sales: Rapidly gaining market share due to convenience, wider product availability, and competitive pricing.

- Hypermarkets: Offer a broader range of products, catering to a wider consumer base seeking value and convenience.

Taiwan Pet Food Market Product Developments

Product innovations in the Taiwan pet food market are increasingly focused on health and wellness. Brands are launching products with functional ingredients like probiotics, prebiotics, and omega-3 fatty acids to support pet digestion, immune health, and skin and coat condition. The trend towards natural, organic, and limited-ingredient diets is prominent, addressing concerns about allergies and sensitivities. Innovations in wet pet food formulations, including gourmet recipes and grain-free options, are enhancing palatability and meeting evolving consumer preferences. The January 2022 launch of Royal Canin's specialized cat and dog food for specific sensitivities, addressing issues like insatiable appetite and stress, exemplifies this trend towards targeted nutritional solutions that offer tangible benefits.

Challenges in the Taiwan Pet Food Market Market

Key challenges in the Taiwan pet food market include the rising cost of high-quality ingredients, impacting production expenses and retail prices. Supply chain disruptions, influenced by global events, can lead to stock shortages and increased logistics costs. Intense competition among established brands and emerging players necessitates continuous innovation and effective marketing strategies to maintain market share. Furthermore, navigating evolving regulatory landscapes and ensuring compliance with food safety standards requires ongoing diligence and investment. The market also faces the challenge of educating consumers about the benefits of premium and specialized pet food, particularly in price-sensitive segments.

Forces Driving Taiwan Pet Food Market Growth

Several forces are propelling the Taiwan pet food market forward. The deepening humanization of pets, leading to owners treating them as family members, drives demand for premium and specialized nutrition. Growing disposable incomes enable pet owners to invest more in their pets' health and well-being. The increasing adoption rate of pets, particularly dogs and cats, directly expands the consumer base. Furthermore, government initiatives aimed at promoting pet welfare and industry standards create a more supportive environment for market expansion and innovation. The availability of advanced e-commerce platforms also enhances accessibility and convenience for consumers.

Challenges in the Taiwan Pet Food Market Market

Long-term growth catalysts in the Taiwan pet food market are rooted in continued innovation and strategic market expansion. The development of novel functional ingredients and personalized nutrition solutions will cater to specific health needs and preferences. Partnerships between pet food manufacturers and veterinary professionals can foster trust and promote scientifically backed products. Exploring untapped segments, such as specialized food for exotic pets or senior animals, presents significant growth potential. Furthermore, a focus on sustainable sourcing and production practices will resonate with an increasingly environmentally conscious consumer base, solidifying brand loyalty and market leadership.

Emerging Opportunities in Taiwan Pet Food Market

Emerging opportunities in the Taiwan pet food market lie in the burgeoning demand for personalized nutrition plans, leveraging pet data and AI to create bespoke diets. The growth of the "pet wellness" trend presents avenues for functional foods targeting specific health benefits like joint health, cognitive function, and stress reduction. The increasing adoption of smaller pets and "pocket pets" opens up new niche markets for specialized food formulations. Furthermore, the expansion of direct-to-consumer (DTC) sales models, coupled with subscription services, offers enhanced convenience and customer engagement. Opportunities also exist in developing sustainable and eco-friendly packaging solutions to meet growing environmental consciousness.

Leading Players in the Taiwan Pet Food Market Sector

- Blue Buffalo

- Colgate Palmolive (Hill's Pet Nutrition)

- Yamahisa Pet Care

- InVivo NSA

- Merrick Pet Care

- Wellpet

- Sunshine Mills

- Deuerer

- Nestle SA (Purina)

- Mogiana Alimentos SA

- Agrolimen SA

- Diamond Pet Foods

- Ainsworth Pet Nutrition

- Debifu Pet Products Co Lt

- Mars Inc

- J M Smucker (Big Heart)

- Heristo AG

Key Milestones in Taiwan Pet Food Market Industry

- April 2022: Taiwan launched a new government department for pets. This new section in the country's council of agriculture will manage all aspects of a pet's life, from pet food to grooming, training, pet-sitting, and pet insurance. This initiative signifies a commitment to enhancing pet welfare and regulating the industry, potentially leading to new standards and opportunities.

- January 2022: Royal Canin, a brand of Mars, launched a new product for specific sensitivities of cats and dogs. Among the innovations, the brand brings new foods with proven results to control the insatiable appetite of cats and help dogs feel more relaxed during times of stress. This product launch highlights the growing trend of specialized and functional pet nutrition addressing specific health concerns.

Strategic Outlook for Taiwan Pet Food Market Market

The strategic outlook for the Taiwan pet food market is characterized by sustained growth driven by increasing pet humanization and a demand for premium, health-focused products. Companies should focus on innovation in functional ingredients, personalized nutrition, and sustainable practices to capture market share. Expanding online sales channels and leveraging data analytics for targeted marketing will be crucial. Partnerships with veterinary professionals and a commitment to transparency in ingredient sourcing will build consumer trust. Exploring niche segments and offering specialized diets for various life stages and health conditions will further accelerate growth and solidify competitive positioning in this dynamic market.

Taiwan Pet Food Market Segmentation

-

1. Product Type

- 1.1. Dry Pet Food

- 1.2. Wet Pet Food

- 1.3. Veterinary Diet

- 1.4. Treats/Snacks

- 1.5. Other Product Types

-

2. Animal Type

- 2.1. Dog

- 2.2. Cat

- 2.3. Bird

- 2.4. Other Animal Types

-

3. Ingredient Type

- 3.1. Animal-derived

- 3.2. Plant-derived

- 3.3. Cereals and Cereal Derivatives

- 3.4. Other Ingredient Types

-

4. Sales Channel

- 4.1. Specialized Pet Shops

- 4.2. Internet Sales

- 4.3. Hypermarkets

- 4.4. Other Sales Channels

Taiwan Pet Food Market Segmentation By Geography

- 1. Taiwan

Taiwan Pet Food Market Regional Market Share

Geographic Coverage of Taiwan Pet Food Market

Taiwan Pet Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed

- 3.3. Market Restrains

- 3.3.1. High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves

- 3.4. Market Trends

- 3.4.1. Demand for Premium Quality Pet Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Pet Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dry Pet Food

- 5.1.2. Wet Pet Food

- 5.1.3. Veterinary Diet

- 5.1.4. Treats/Snacks

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dog

- 5.2.2. Cat

- 5.2.3. Bird

- 5.2.4. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.3.1. Animal-derived

- 5.3.2. Plant-derived

- 5.3.3. Cereals and Cereal Derivatives

- 5.3.4. Other Ingredient Types

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Specialized Pet Shops

- 5.4.2. Internet Sales

- 5.4.3. Hypermarkets

- 5.4.4. Other Sales Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Blue Buffalo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colgate Palmolive (Hill's Pet Nutrition)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yamahisa Pet Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 InVivo NSA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merrick Pet Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wellpet

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunshine Mills

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deuerer

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nestle SA (Purina)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mogiana Alimentos SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Agrolimen SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Diamond Pet Foods

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Ainsworth Pet Nutrition

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Debifu Pet Products Co Lt

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mars Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 J M Smucker (Big Heart)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Heristo AG

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Blue Buffalo

List of Figures

- Figure 1: Taiwan Pet Food Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Taiwan Pet Food Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Pet Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Taiwan Pet Food Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Taiwan Pet Food Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 4: Taiwan Pet Food Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: Taiwan Pet Food Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Taiwan Pet Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Taiwan Pet Food Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Taiwan Pet Food Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 9: Taiwan Pet Food Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: Taiwan Pet Food Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Pet Food Market?

The projected CAGR is approximately 8.37%.

2. Which companies are prominent players in the Taiwan Pet Food Market?

Key companies in the market include Blue Buffalo, Colgate Palmolive (Hill's Pet Nutrition), Yamahisa Pet Care, InVivo NSA, Merrick Pet Care, Wellpet, Sunshine Mills, Deuerer, Nestle SA (Purina), Mogiana Alimentos SA, Agrolimen SA, Diamond Pet Foods, Ainsworth Pet Nutrition, Debifu Pet Products Co Lt, Mars Inc, J M Smucker (Big Heart), Heristo AG.

3. What are the main segments of the Taiwan Pet Food Market?

The market segments include Product Type, Animal Type, Ingredient Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed.

6. What are the notable trends driving market growth?

Demand for Premium Quality Pet Food.

7. Are there any restraints impacting market growth?

High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves.

8. Can you provide examples of recent developments in the market?

April 2022: Taiwan launched a new government department for pets. This new section in the country's council of agriculture will manage all aspects of a pet's life, from pet food to grooming, training, pet-sitting, and pet insurance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Pet Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Pet Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Pet Food Market?

To stay informed about further developments, trends, and reports in the Taiwan Pet Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence