Key Insights

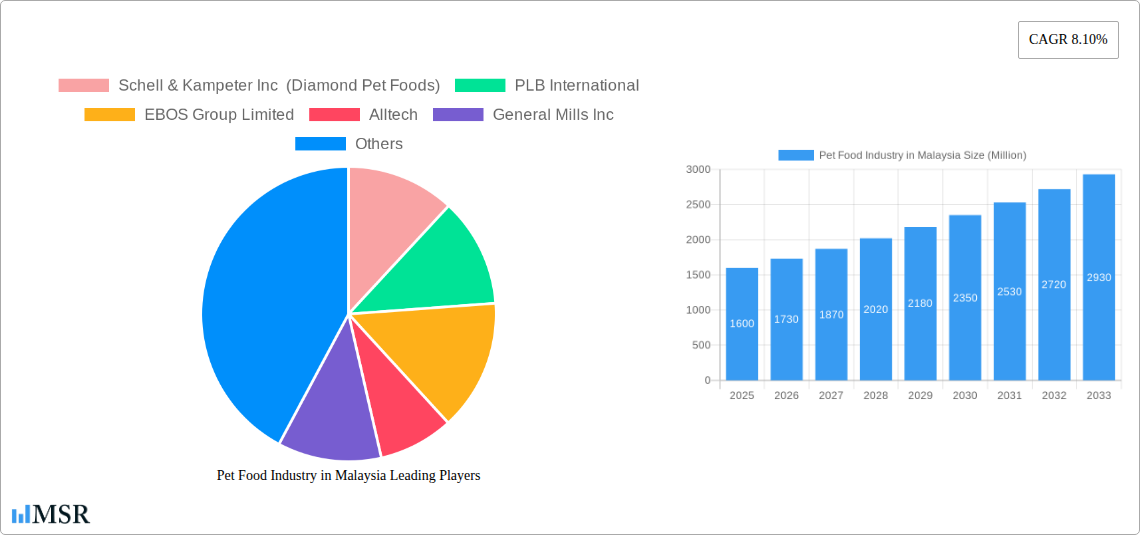

The Malaysian pet food market is projected for significant expansion, driven by a 6.87% CAGR from 2025 to 2033. Key growth catalysts include escalating pet ownership, with owners increasingly treating pets as family, thereby boosting demand for premium and specialized diets. The expanding middle class and rising disposable incomes further fuel this trend. E-commerce's growing convenience and accessibility are also critical contributors, offering a wider product selection to consumers. The market size is estimated at 340.3 million in the base year 2025. This projection considers the rising adoption of premium products and sustained e-commerce growth. The market is segmented by pet type (cats, dogs, others), distribution channels (online, specialty stores, supermarkets, convenience stores), and food type (dry, wet, treats, veterinary diets). Intense competition from global leaders like Mars and Nestlé (Purina), alongside local brands, spurs continuous product innovation and marketing strategies.

Pet Food Industry in Malaysia Market Size (In Million)

Despite a positive outlook, challenges persist. Volatile raw material prices, particularly for imported components, may affect profitability. Educating consumers on pet food nutrition remains a priority. Balancing affordability with the increasing demand for premium options is vital for sustained success. The forecast period of 2025-2033 indicates continued market growth, propelled by pet humanization and a preference for healthier, specialized pet food. This trajectory presents substantial opportunities for both established companies and new entrants in the region.

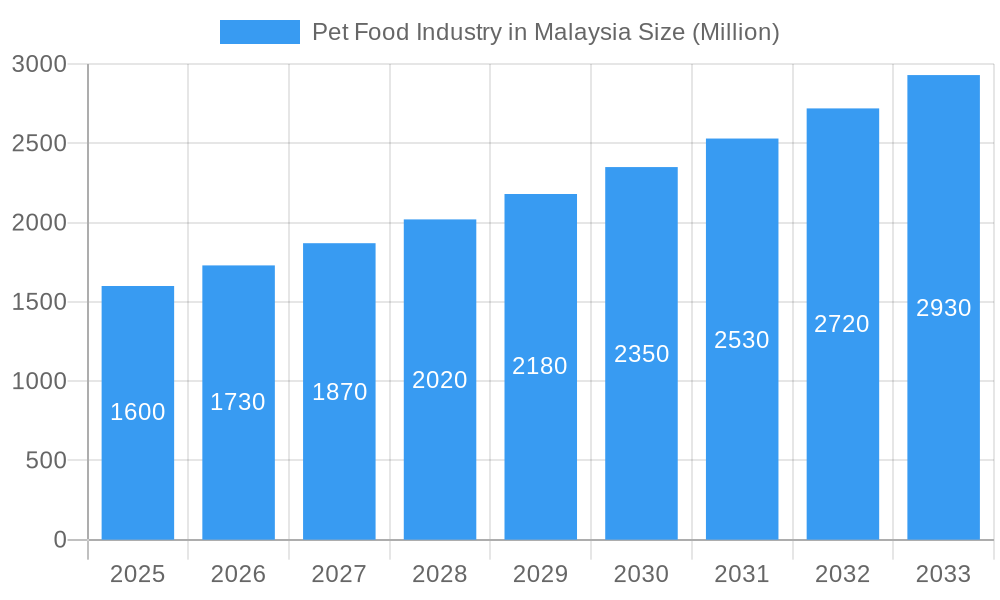

Pet Food Industry in Malaysia Company Market Share

Malaysia Pet Food Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Malaysian pet food market, offering crucial insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The Malaysian pet food market, valued at xx Million in 2025, is projected to experience significant growth, reaching xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%.

Pet Food Industry in Malaysia Market Concentration & Dynamics

The Malaysian pet food market exhibits a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as brand recognition, distribution networks, and product innovation. The innovation ecosystem is developing, with increasing investments in research and development focused on natural ingredients, functional foods, and specialized diets. Regulatory frameworks, while generally supportive of industry growth, are subject to evolving standards for pet food safety and labeling. Substitute products, such as homemade pet food, pose a competitive threat, particularly within certain price-sensitive segments. End-user trends reflect a rising preference for premium and specialized pet foods catering to specific dietary needs and life stages. Mergers and acquisitions (M&A) activity in the Malaysian pet food sector has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024. Key players are focusing on strategic acquisitions to expand their product portfolios and market reach.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Deal Count (2019-2024): xx deals

- Key Regulatory Frameworks: [Insert relevant Malaysian regulations on pet food safety and labeling]

Pet Food Industry in Malaysia Industry Insights & Trends

The Malaysian pet food market is experiencing significant growth fueled by several factors. Increasing pet ownership, rising disposable incomes, and a growing awareness of pet health and nutrition are key drivers. The market size has expanded significantly, from xx Million in 2019 to xx Million in 2024, demonstrating the robust growth trajectory. Technological disruptions, such as the rise of e-commerce and online pet food delivery services, are reshaping distribution channels and consumer behavior. Evolving consumer preferences are driving demand for premium, specialized, and natural pet food products, emphasizing functionality and health benefits. This shift necessitates continuous innovation in product formulation and marketing strategies for manufacturers.

Key Markets & Segments Leading Pet Food Industry in Malaysia

The Malaysian pet food market is dominated by the dog segment, followed by the cat segment. The supermarkets/hypermarkets channel currently holds the largest market share in terms of distribution, followed by specialty stores. However, the online channel is exhibiting the fastest growth rate.

Key Drivers by Segment:

- Dogs: High pet ownership rates, increasing disposable incomes.

- Cats: Growing popularity of cats as pets, rising demand for premium cat food.

- Supermarkets/Hypermarkets: Wide reach, established distribution networks.

- Online Channel: Convenience, wider product selection, competitive pricing.

Dominance Analysis: The dominance of the dog food segment and supermarket/hypermarket channel is driven by factors such as established brand presence, widespread availability, and competitive pricing. However, the rapid growth of the online channel indicates a potential shift in market dynamics in the coming years. The "Other Pets" segment presents a niche market with growth potential.

Pet Food Industry in Malaysia Product Developments

Recent product innovations focus on addressing specific pet health needs, including sensitive stomachs, skin allergies, and joint health. Technological advancements are driving the development of novel pet food formulations incorporating functional ingredients, such as probiotics and prebiotics, and sustainable and ethically sourced ingredients. Companies are increasingly emphasizing transparency and traceability in their supply chains. This focus on premiumization and specialized diets contributes to a more competitive landscape.

Challenges in the Pet Food Industry in Malaysia Market

The Malaysian pet food industry faces several challenges, including fluctuating raw material prices, increasing competition, and the need to comply with stringent regulatory requirements. Supply chain disruptions, potentially impacting ingredient availability and cost, pose a significant risk. Maintaining competitiveness in a market with both established and emerging players is crucial for long-term success. The influence of these challenges on profitability is estimated at xx Million annually.

Forces Driving Pet Food Industry in Malaysia Growth

The Malaysian pet food market's growth is propelled by factors such as rising pet ownership, increasing disposable incomes, and the growing humanization of pets. Technological advancements in pet food formulation and processing, coupled with enhanced distribution channels, contribute to market expansion. Favorable government regulations supporting the pet industry further stimulate growth. These factors collectively drive increased demand for diverse and high-quality pet food products.

Challenges in the Pet Food Industry in Malaysia Market

Long-term growth in the Malaysian pet food market hinges on addressing challenges such as evolving consumer preferences, ensuring sustainable sourcing of raw materials, and maintaining competitiveness. Strategic partnerships, innovation in product formulation, and expansion into new market segments are crucial for sustained success. Investments in research and development are essential for meeting evolving consumer demands and maintaining a competitive edge.

Emerging Opportunities in Pet Food Industry in Malaysia

The Malaysian pet food market presents several emerging opportunities, including growth in the premium and specialized pet food segments, expanding e-commerce channels, and increasing demand for sustainable and ethically sourced products. There's significant potential in catering to the needs of specific pet demographics, such as senior pets or pets with dietary restrictions. Innovation in pet food technology and packaging also presents attractive growth opportunities.

Leading Players in the Pet Food Industry in Malaysia Sector

- Schell & Kampeter Inc (Diamond Pet Foods)

- PLB International

- EBOS Group Limited

- Alltech

- General Mills Inc

- FARMINA PET FOODS

- Mars Incorporated

- Nestle (Purina)

- Vafo Praha s r o

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

Key Milestones in Pet Food Industry in Malaysia Industry

- May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand.

- May 2023: Vafo Praha, s.r.o. launched its new range of Brit RAW Freeze-dried treats and toppers for dogs.

- July 2023: Hill's Pet Nutrition introduced its new MSC (Marine Stewardship Council) certified pollock and insect protein products.

Strategic Outlook for Pet Food Industry in Malaysia Market

The Malaysian pet food market holds substantial growth potential, driven by increasing pet ownership, rising disposable incomes, and evolving consumer preferences. Strategic opportunities lie in focusing on premiumization, specialization, and sustainable practices. Companies need to invest in research and development, strengthen distribution networks, and adopt innovative marketing strategies to capture market share and capitalize on the growth trajectory.

Pet Food Industry in Malaysia Segmentation

-

1. Pet Food Product

-

1.1. By Sub Product

-

1.1.1. Dry Pet Food

-

1.1.1.1. By Sub Dry Pet Food

- 1.1.1.1.1. Kibbles

- 1.1.1.1.2. Other Dry Pet Food

-

1.1.1.1. By Sub Dry Pet Food

- 1.1.2. Wet Pet Food

-

1.1.1. Dry Pet Food

-

1.2. Pet Nutraceuticals/Supplements

- 1.2.1. Milk Bioactives

- 1.2.2. Omega-3 Fatty Acids

- 1.2.3. Probiotics

- 1.2.4. Proteins and Peptides

- 1.2.5. Vitamins and Minerals

- 1.2.6. Other Nutraceuticals

-

1.3. Pet Treats

- 1.3.1. Crunchy Treats

- 1.3.2. Dental Treats

- 1.3.3. Freeze-dried and Jerky Treats

- 1.3.4. Soft & Chewy Treats

- 1.3.5. Other Treats

-

1.4. Pet Veterinary Diets

- 1.4.1. Diabetes

- 1.4.2. Digestive Sensitivity

- 1.4.3. Oral Care Diets

- 1.4.4. Renal

- 1.4.5. Urinary tract disease

- 1.4.6. Other Veterinary Diets

-

1.1. By Sub Product

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Pet Food Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pet Food Industry in Malaysia Regional Market Share

Geographic Coverage of Pet Food Industry in Malaysia

Pet Food Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Food Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 5.1.1. By Sub Product

- 5.1.1.1. Dry Pet Food

- 5.1.1.1.1. By Sub Dry Pet Food

- 5.1.1.1.1.1. Kibbles

- 5.1.1.1.1.2. Other Dry Pet Food

- 5.1.1.1.1. By Sub Dry Pet Food

- 5.1.1.2. Wet Pet Food

- 5.1.1.1. Dry Pet Food

- 5.1.2. Pet Nutraceuticals/Supplements

- 5.1.2.1. Milk Bioactives

- 5.1.2.2. Omega-3 Fatty Acids

- 5.1.2.3. Probiotics

- 5.1.2.4. Proteins and Peptides

- 5.1.2.5. Vitamins and Minerals

- 5.1.2.6. Other Nutraceuticals

- 5.1.3. Pet Treats

- 5.1.3.1. Crunchy Treats

- 5.1.3.2. Dental Treats

- 5.1.3.3. Freeze-dried and Jerky Treats

- 5.1.3.4. Soft & Chewy Treats

- 5.1.3.5. Other Treats

- 5.1.4. Pet Veterinary Diets

- 5.1.4.1. Diabetes

- 5.1.4.2. Digestive Sensitivity

- 5.1.4.3. Oral Care Diets

- 5.1.4.4. Renal

- 5.1.4.5. Urinary tract disease

- 5.1.4.6. Other Veterinary Diets

- 5.1.1. By Sub Product

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 6. North America Pet Food Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 6.1.1. By Sub Product

- 6.1.1.1. Dry Pet Food

- 6.1.1.1.1. By Sub Dry Pet Food

- 6.1.1.1.1.1. Kibbles

- 6.1.1.1.1.2. Other Dry Pet Food

- 6.1.1.1.1. By Sub Dry Pet Food

- 6.1.1.2. Wet Pet Food

- 6.1.1.1. Dry Pet Food

- 6.1.2. Pet Nutraceuticals/Supplements

- 6.1.2.1. Milk Bioactives

- 6.1.2.2. Omega-3 Fatty Acids

- 6.1.2.3. Probiotics

- 6.1.2.4. Proteins and Peptides

- 6.1.2.5. Vitamins and Minerals

- 6.1.2.6. Other Nutraceuticals

- 6.1.3. Pet Treats

- 6.1.3.1. Crunchy Treats

- 6.1.3.2. Dental Treats

- 6.1.3.3. Freeze-dried and Jerky Treats

- 6.1.3.4. Soft & Chewy Treats

- 6.1.3.5. Other Treats

- 6.1.4. Pet Veterinary Diets

- 6.1.4.1. Diabetes

- 6.1.4.2. Digestive Sensitivity

- 6.1.4.3. Oral Care Diets

- 6.1.4.4. Renal

- 6.1.4.5. Urinary tract disease

- 6.1.4.6. Other Veterinary Diets

- 6.1.1. By Sub Product

- 6.2. Market Analysis, Insights and Forecast - by Pets

- 6.2.1. Cats

- 6.2.2. Dogs

- 6.2.3. Other Pets

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Channel

- 6.3.3. Specialty Stores

- 6.3.4. Supermarkets/Hypermarkets

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 7. South America Pet Food Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 7.1.1. By Sub Product

- 7.1.1.1. Dry Pet Food

- 7.1.1.1.1. By Sub Dry Pet Food

- 7.1.1.1.1.1. Kibbles

- 7.1.1.1.1.2. Other Dry Pet Food

- 7.1.1.1.1. By Sub Dry Pet Food

- 7.1.1.2. Wet Pet Food

- 7.1.1.1. Dry Pet Food

- 7.1.2. Pet Nutraceuticals/Supplements

- 7.1.2.1. Milk Bioactives

- 7.1.2.2. Omega-3 Fatty Acids

- 7.1.2.3. Probiotics

- 7.1.2.4. Proteins and Peptides

- 7.1.2.5. Vitamins and Minerals

- 7.1.2.6. Other Nutraceuticals

- 7.1.3. Pet Treats

- 7.1.3.1. Crunchy Treats

- 7.1.3.2. Dental Treats

- 7.1.3.3. Freeze-dried and Jerky Treats

- 7.1.3.4. Soft & Chewy Treats

- 7.1.3.5. Other Treats

- 7.1.4. Pet Veterinary Diets

- 7.1.4.1. Diabetes

- 7.1.4.2. Digestive Sensitivity

- 7.1.4.3. Oral Care Diets

- 7.1.4.4. Renal

- 7.1.4.5. Urinary tract disease

- 7.1.4.6. Other Veterinary Diets

- 7.1.1. By Sub Product

- 7.2. Market Analysis, Insights and Forecast - by Pets

- 7.2.1. Cats

- 7.2.2. Dogs

- 7.2.3. Other Pets

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Channel

- 7.3.3. Specialty Stores

- 7.3.4. Supermarkets/Hypermarkets

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 8. Europe Pet Food Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 8.1.1. By Sub Product

- 8.1.1.1. Dry Pet Food

- 8.1.1.1.1. By Sub Dry Pet Food

- 8.1.1.1.1.1. Kibbles

- 8.1.1.1.1.2. Other Dry Pet Food

- 8.1.1.1.1. By Sub Dry Pet Food

- 8.1.1.2. Wet Pet Food

- 8.1.1.1. Dry Pet Food

- 8.1.2. Pet Nutraceuticals/Supplements

- 8.1.2.1. Milk Bioactives

- 8.1.2.2. Omega-3 Fatty Acids

- 8.1.2.3. Probiotics

- 8.1.2.4. Proteins and Peptides

- 8.1.2.5. Vitamins and Minerals

- 8.1.2.6. Other Nutraceuticals

- 8.1.3. Pet Treats

- 8.1.3.1. Crunchy Treats

- 8.1.3.2. Dental Treats

- 8.1.3.3. Freeze-dried and Jerky Treats

- 8.1.3.4. Soft & Chewy Treats

- 8.1.3.5. Other Treats

- 8.1.4. Pet Veterinary Diets

- 8.1.4.1. Diabetes

- 8.1.4.2. Digestive Sensitivity

- 8.1.4.3. Oral Care Diets

- 8.1.4.4. Renal

- 8.1.4.5. Urinary tract disease

- 8.1.4.6. Other Veterinary Diets

- 8.1.1. By Sub Product

- 8.2. Market Analysis, Insights and Forecast - by Pets

- 8.2.1. Cats

- 8.2.2. Dogs

- 8.2.3. Other Pets

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Channel

- 8.3.3. Specialty Stores

- 8.3.4. Supermarkets/Hypermarkets

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 9. Middle East & Africa Pet Food Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 9.1.1. By Sub Product

- 9.1.1.1. Dry Pet Food

- 9.1.1.1.1. By Sub Dry Pet Food

- 9.1.1.1.1.1. Kibbles

- 9.1.1.1.1.2. Other Dry Pet Food

- 9.1.1.1.1. By Sub Dry Pet Food

- 9.1.1.2. Wet Pet Food

- 9.1.1.1. Dry Pet Food

- 9.1.2. Pet Nutraceuticals/Supplements

- 9.1.2.1. Milk Bioactives

- 9.1.2.2. Omega-3 Fatty Acids

- 9.1.2.3. Probiotics

- 9.1.2.4. Proteins and Peptides

- 9.1.2.5. Vitamins and Minerals

- 9.1.2.6. Other Nutraceuticals

- 9.1.3. Pet Treats

- 9.1.3.1. Crunchy Treats

- 9.1.3.2. Dental Treats

- 9.1.3.3. Freeze-dried and Jerky Treats

- 9.1.3.4. Soft & Chewy Treats

- 9.1.3.5. Other Treats

- 9.1.4. Pet Veterinary Diets

- 9.1.4.1. Diabetes

- 9.1.4.2. Digestive Sensitivity

- 9.1.4.3. Oral Care Diets

- 9.1.4.4. Renal

- 9.1.4.5. Urinary tract disease

- 9.1.4.6. Other Veterinary Diets

- 9.1.1. By Sub Product

- 9.2. Market Analysis, Insights and Forecast - by Pets

- 9.2.1. Cats

- 9.2.2. Dogs

- 9.2.3. Other Pets

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Channel

- 9.3.3. Specialty Stores

- 9.3.4. Supermarkets/Hypermarkets

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 10. Asia Pacific Pet Food Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 10.1.1. By Sub Product

- 10.1.1.1. Dry Pet Food

- 10.1.1.1.1. By Sub Dry Pet Food

- 10.1.1.1.1.1. Kibbles

- 10.1.1.1.1.2. Other Dry Pet Food

- 10.1.1.1.1. By Sub Dry Pet Food

- 10.1.1.2. Wet Pet Food

- 10.1.1.1. Dry Pet Food

- 10.1.2. Pet Nutraceuticals/Supplements

- 10.1.2.1. Milk Bioactives

- 10.1.2.2. Omega-3 Fatty Acids

- 10.1.2.3. Probiotics

- 10.1.2.4. Proteins and Peptides

- 10.1.2.5. Vitamins and Minerals

- 10.1.2.6. Other Nutraceuticals

- 10.1.3. Pet Treats

- 10.1.3.1. Crunchy Treats

- 10.1.3.2. Dental Treats

- 10.1.3.3. Freeze-dried and Jerky Treats

- 10.1.3.4. Soft & Chewy Treats

- 10.1.3.5. Other Treats

- 10.1.4. Pet Veterinary Diets

- 10.1.4.1. Diabetes

- 10.1.4.2. Digestive Sensitivity

- 10.1.4.3. Oral Care Diets

- 10.1.4.4. Renal

- 10.1.4.5. Urinary tract disease

- 10.1.4.6. Other Veterinary Diets

- 10.1.1. By Sub Product

- 10.2. Market Analysis, Insights and Forecast - by Pets

- 10.2.1. Cats

- 10.2.2. Dogs

- 10.2.3. Other Pets

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Channel

- 10.3.3. Specialty Stores

- 10.3.4. Supermarkets/Hypermarkets

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Schell & Kampeter Inc (Diamond Pet Foods)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PLB International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EBOS Group Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alltech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FARMINA PET FOODS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mars Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nestle (Purina)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vafo Praha s r o

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Schell & Kampeter Inc (Diamond Pet Foods)

List of Figures

- Figure 1: Global Pet Food Industry in Malaysia Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Pet Food Industry in Malaysia Revenue (million), by Pet Food Product 2025 & 2033

- Figure 3: North America Pet Food Industry in Malaysia Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 4: North America Pet Food Industry in Malaysia Revenue (million), by Pets 2025 & 2033

- Figure 5: North America Pet Food Industry in Malaysia Revenue Share (%), by Pets 2025 & 2033

- Figure 6: North America Pet Food Industry in Malaysia Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: North America Pet Food Industry in Malaysia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Pet Food Industry in Malaysia Revenue (million), by Country 2025 & 2033

- Figure 9: North America Pet Food Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Pet Food Industry in Malaysia Revenue (million), by Pet Food Product 2025 & 2033

- Figure 11: South America Pet Food Industry in Malaysia Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 12: South America Pet Food Industry in Malaysia Revenue (million), by Pets 2025 & 2033

- Figure 13: South America Pet Food Industry in Malaysia Revenue Share (%), by Pets 2025 & 2033

- Figure 14: South America Pet Food Industry in Malaysia Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: South America Pet Food Industry in Malaysia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Pet Food Industry in Malaysia Revenue (million), by Country 2025 & 2033

- Figure 17: South America Pet Food Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Pet Food Industry in Malaysia Revenue (million), by Pet Food Product 2025 & 2033

- Figure 19: Europe Pet Food Industry in Malaysia Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 20: Europe Pet Food Industry in Malaysia Revenue (million), by Pets 2025 & 2033

- Figure 21: Europe Pet Food Industry in Malaysia Revenue Share (%), by Pets 2025 & 2033

- Figure 22: Europe Pet Food Industry in Malaysia Revenue (million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Pet Food Industry in Malaysia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Pet Food Industry in Malaysia Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Pet Food Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Pet Food Industry in Malaysia Revenue (million), by Pet Food Product 2025 & 2033

- Figure 27: Middle East & Africa Pet Food Industry in Malaysia Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 28: Middle East & Africa Pet Food Industry in Malaysia Revenue (million), by Pets 2025 & 2033

- Figure 29: Middle East & Africa Pet Food Industry in Malaysia Revenue Share (%), by Pets 2025 & 2033

- Figure 30: Middle East & Africa Pet Food Industry in Malaysia Revenue (million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Pet Food Industry in Malaysia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Pet Food Industry in Malaysia Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Pet Food Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Pet Food Industry in Malaysia Revenue (million), by Pet Food Product 2025 & 2033

- Figure 35: Asia Pacific Pet Food Industry in Malaysia Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 36: Asia Pacific Pet Food Industry in Malaysia Revenue (million), by Pets 2025 & 2033

- Figure 37: Asia Pacific Pet Food Industry in Malaysia Revenue Share (%), by Pets 2025 & 2033

- Figure 38: Asia Pacific Pet Food Industry in Malaysia Revenue (million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Pet Food Industry in Malaysia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Pet Food Industry in Malaysia Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Pet Food Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 2: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pets 2020 & 2033

- Table 3: Global Pet Food Industry in Malaysia Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Pet Food Industry in Malaysia Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 6: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pets 2020 & 2033

- Table 7: Global Pet Food Industry in Malaysia Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Pet Food Industry in Malaysia Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 13: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pets 2020 & 2033

- Table 14: Global Pet Food Industry in Malaysia Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Pet Food Industry in Malaysia Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 20: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pets 2020 & 2033

- Table 21: Global Pet Food Industry in Malaysia Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Pet Food Industry in Malaysia Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 33: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pets 2020 & 2033

- Table 34: Global Pet Food Industry in Malaysia Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Pet Food Industry in Malaysia Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 43: Global Pet Food Industry in Malaysia Revenue million Forecast, by Pets 2020 & 2033

- Table 44: Global Pet Food Industry in Malaysia Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Pet Food Industry in Malaysia Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Pet Food Industry in Malaysia Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Food Industry in Malaysia?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the Pet Food Industry in Malaysia?

Key companies in the market include Schell & Kampeter Inc (Diamond Pet Foods), PLB International, EBOS Group Limited, Alltech, General Mills Inc, FARMINA PET FOODS, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, Colgate-Palmolive Company (Hill's Pet Nutrition Inc ).

3. What are the main segments of the Pet Food Industry in Malaysia?

The market segments include Pet Food Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 340.3 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

July 2023: Hill's Pet Nutrition introduced its new MSC (Marine Stewardship Council) certified pollock and insect protein products for pets with sensitive stomachs and skin lines. They contain vitamins, omega-3 fatty acids, and antioxidants.May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.May 2023: Vafo Praha, s.r.o. launched its new range of Brit RAW Freeze-dried treats and toppers for dogs. These products are made up of high-quality proteins and minimally processed ingredients for potential health benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Food Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Food Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Food Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Pet Food Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence