Key Insights

The European Feed Antibiotics Market is projected for robust expansion, with an estimated market size of $18.98 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 3.2% through 2033. This growth is propelled by escalating global demand for animal protein, driven by population increases and evolving dietary preferences. The imperative to enhance animal health, optimize feed utilization, and mitigate disease outbreaks across livestock, poultry, and aquaculture sectors significantly influences this market. Key drivers include the widespread adoption of scientifically formulated animal feeds for improved growth and reduced mortality, alongside heightened farmer awareness of the economic advantages of proactive health management. Tetracyclines and Penicillins are expected to retain market dominance due to their broad-spectrum efficacy, while Macrolides and Cephalosporins are anticipated to see growth driven by increased regulatory oversight and the rise of antibiotic resistance, necessitating more targeted and effective solutions.

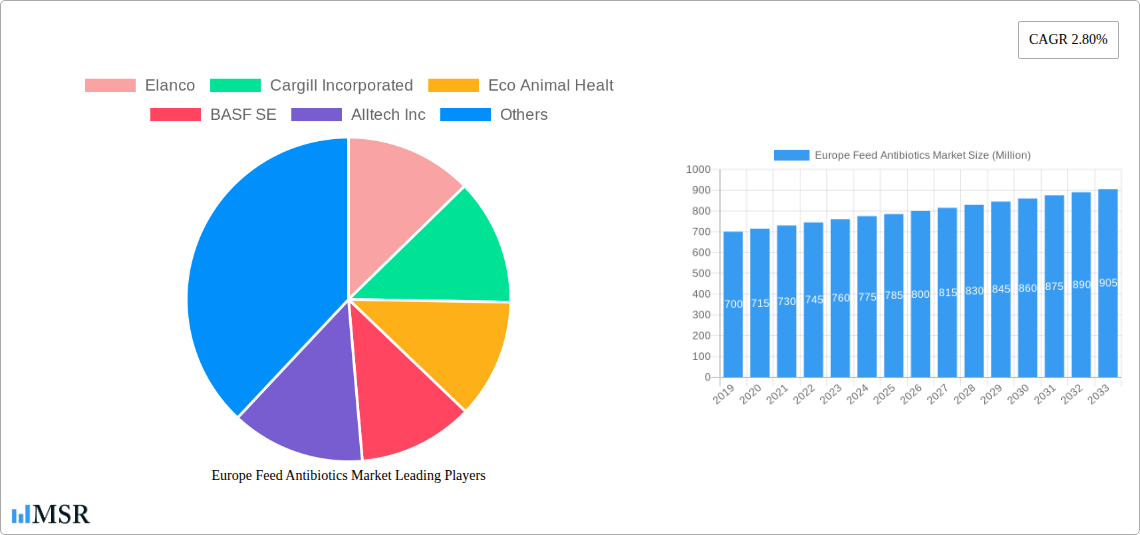

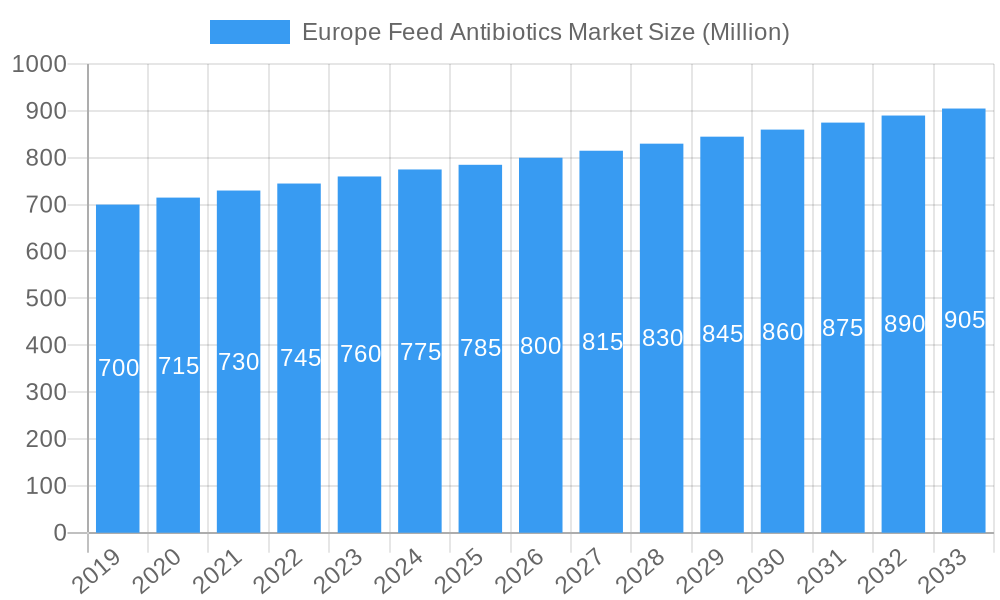

Europe Feed Antibiotics Market Market Size (In Billion)

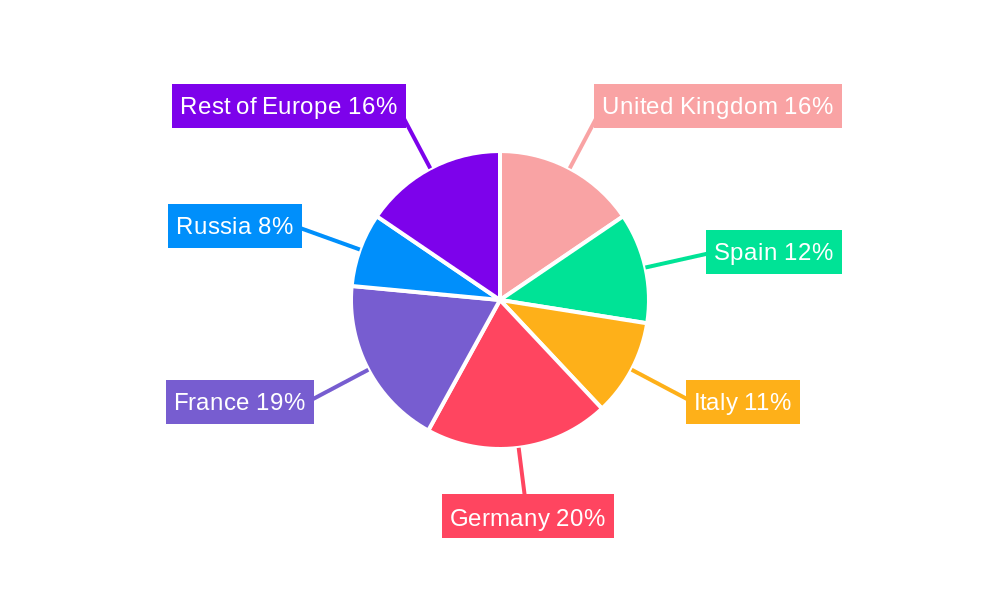

However, the market faces notable constraints. Growing concerns regarding human and animal antibiotic resistance, coupled with stringent regulations from governmental bodies and the European Union aimed at reducing antibiotic use in animal agriculture, are expected to temper market growth. This has catalyzed a significant shift towards exploring and implementing antibiotic alternatives, such as probiotics, prebiotics, and organic acids, which are gaining increasing adoption. The market will witness intensified research and development focused on creating safer and more sustainable animal health solutions. Geographically, Germany, France, and the United Kingdom are expected to lead the European market due to their advanced animal husbandry practices and substantial livestock populations. Conversely, the "Rest of Europe" region presents considerable growth opportunities, supported by expanding agricultural sectors in emerging economies. Key industry players, including Elanco, BASF SE, and Boehringer Ingelheim Denmark A/S, are anticipated to play crucial roles, either through innovation in traditional antibiotic segments or significant investment in alternative solutions.

Europe Feed Antibiotics Market Company Market Share

Europe Feed Antibiotics Market Analysis: Driving Sustainable Animal Health and Productivity (2019-2033)

This comprehensive report offers a deep dive into the Europe Feed Antibiotics Market, a vital sector for ensuring animal health, productivity, and food safety across the continent. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report provides critical insights into historical trends, current dynamics, and future market trajectories. Explore veterinary antibiotics, feed additives, and animal growth promoters within the evolving European landscape.

Europe Feed Antibiotics Market Market Concentration & Dynamics

The Europe Feed Antibiotics Market exhibits a moderately concentrated structure, influenced by stringent regulations and the presence of established global players alongside emerging regional specialists. Innovation ecosystems are driven by significant R&D investments from key companies, focusing on developing targeted solutions that balance efficacy with reduced resistance concerns. Regulatory frameworks, particularly those from the European Medicines Agency (EMA), play a pivotal role in shaping market access and product development, leading to a greater emphasis on judicious use and alternatives. The threat of substitute products, such as probiotics, prebiotics, and organic acids, is steadily increasing, forcing incumbents to innovate. End-user trends are characterized by a growing demand for animal welfare and sustainably produced animal protein, influencing product preferences and usage patterns. Merger and acquisition (M&A) activities, while present, are often strategic and focused on expanding product portfolios or geographical reach, rather than outright consolidation. The market share distribution is dynamic, with major players holding significant but not absolute dominance. M&A deal counts have seen a steady flow, indicating ongoing strategic realignment within the sector.

- Regulatory Impact: EU regulations are a primary driver of market dynamics, pushing for reduced reliance on antibiotics and promoting alternatives.

- Innovation Focus: Companies are investing in novel feed additive formulations and targeted therapeutic solutions.

- Market Share Dynamics: Key players maintain substantial shares, but the market remains open to strategic acquisitions and partnerships.

- M&A Activity: A consistent, though selective, pattern of M&A transactions signals a maturing market seeking to enhance capabilities.

Europe Feed Antibiotics Market Industry Insights & Trends

The Europe Feed Antibiotics Market is poised for significant evolution, driven by a confluence of factors that are reshaping the agricultural landscape. The estimated market size for 2025 is valued at $XXX Million, projected to grow at a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period (2025-2033). Growth drivers are multifaceted, encompassing the persistent need for effective disease prevention and treatment in livestock to meet escalating protein demands from a growing population. Technological disruptions are at the forefront, with advancements in precision farming, gut health management, and the development of novel antimicrobial compounds offering new avenues for growth. Evolving consumer behaviors, particularly the heightened awareness regarding food safety, antibiotic resistance, and animal welfare, are compelling producers to seek out healthier and more sustainable animal husbandry practices. This shift is directly impacting the demand for feed antibiotics, prompting a more nuanced approach to their application.

The historical period (2019-2024) saw a steady demand for feed antibiotics, with Tetracyclines and Penicillins dominating the market share. However, increasing regulatory scrutiny and public pressure began to influence usage patterns, paving the way for alternative solutions. The base year of 2025 marks a pivotal point where market participants are actively adapting to these changing dynamics. The market is characterized by an ongoing debate between the necessity of antibiotics for animal health and productivity, and the imperative to mitigate the development of antimicrobial resistance (AMR). This has led to a dual focus: optimizing the use of essential antibiotics while simultaneously investing in research and development of non-antibiotic alternatives.

Key trends include the rise of gut health modulation strategies, including the use of probiotics, prebiotics, and synbiotics, which are gaining traction as viable replacements or complements to traditional antibiotics. The development of vaccines and improved biosecurity measures also plays a crucial role in reducing the incidence of infections, thereby lowering the reliance on antibiotic treatments. Furthermore, advancements in feed formulation technologies are enabling the incorporation of functional ingredients that enhance animal immunity and nutrient utilization, contributing to overall herd health. The aquaculture segment, in particular, presents a significant growth opportunity, driven by the increasing global demand for seafood and the unique challenges associated with disease management in farmed aquatic species. The swine and poultry sectors, being high-volume production systems, will continue to be major consumers of feed antibiotics, although the type and dosage will likely be subject to stricter control.

The strategic imperative for manufacturers is to navigate this complex regulatory and consumer-driven environment by offering a portfolio of solutions that addresses both immediate animal health needs and long-term sustainability goals. This includes developing data-driven insights into disease patterns, providing educational resources to farmers on responsible antibiotic use, and investing in the development of next-generation feed additives that can deliver comparable or superior outcomes without contributing to AMR. The Europe Feed Antibiotics Market is thus at a crossroads, where innovation, regulatory compliance, and market adaptation will be key determinants of success.

Key Markets & Segments Leading Europe Feed Antibiotics Market

The Europe Feed Antibiotics Market is significantly influenced by regional demand patterns and segment-specific applications. Among the types of antibiotics, Tetracyclines continue to hold a substantial market share due to their broad-spectrum efficacy and cost-effectiveness in treating a range of bacterial infections in livestock. However, Macrolides are witnessing increasing adoption, particularly in poultry and swine, owing to their improved safety profile and efficacy against specific respiratory and enteric pathogens. The Penicillins segment also remains relevant, especially for prophylaxis and treatment of certain infections.

Dominant Animal Type:

- Poultry: This segment consistently leads the market due to the high density of production and the susceptibility of poultry to various bacterial diseases. The intensive nature of poultry farming necessitates effective disease management strategies, making feed antibiotics a crucial component of their diet. Economic growth and the consistent demand for poultry meat globally further bolster this segment's importance.

- Swine: The swine sector is another major contributor to the Europe Feed Antibiotics Market. Similar to poultry, the high throughput and susceptibility to enteric and respiratory diseases make feed antibiotics essential for maintaining herd health and optimizing growth rates. Infrastructure development in animal husbandry facilities and advancements in feed technology further support the dominance of this segment.

Dominant Type:

- Tetracyclines: Despite increasing regulatory scrutiny, Tetracyclines remain a cornerstone in the Europe Feed Antibiotics Market. Their broad-spectrum activity and cost-effectiveness make them a go-to choice for a wide array of bacterial infections across different animal types. Economic growth in the agricultural sector directly correlates with the demand for effective and affordable treatments like Tetracyclines.

- Macrolides: Emerging as a strong contender, Macrolides are gaining significant traction, particularly in poultry and swine. Their targeted action against specific pathogens and perceived better safety profiles compared to some older antibiotic classes are driving their increased use. Technological advancements in drug delivery and formulation are enhancing their efficacy and market penetration.

Key Geographical Markets:

- Germany: As one of Europe's largest agricultural economies, Germany represents a significant market for feed antibiotics. High production volumes in its poultry and swine industries, coupled with a strong emphasis on animal health and productivity, drive substantial demand. Investments in modern farming practices and research into animal nutrition further contribute to its leading position.

- France: France's robust livestock sector, particularly in beef and dairy, makes it a key market. The country's agricultural policies and focus on animal welfare influence the types of feed antibiotics used, encouraging a balance between efficacy and responsible application. Economic stability and a consistent demand for animal protein underpin its market strength.

- The Netherlands: Renowned for its intensive agricultural practices and export-oriented food industry, the Netherlands is a critical market. High production densities in its poultry and swine sectors, along with a proactive approach to disease prevention, ensure consistent demand for feed additives, including antibiotics. Its strategic location and well-developed logistics infrastructure facilitate the distribution of these products across Europe.

The interplay of these segments and markets, driven by factors such as economic growth, infrastructure advancements, and evolving disease patterns, dictates the overall trajectory of the Europe Feed Antibiotics Market.

Europe Feed Antibiotics Market Product Developments

Product developments in the Europe Feed Antibiotics Market are increasingly focused on enhancing efficacy while minimizing resistance. Innovations include novel formulations of established antibiotic classes like Tetracyclines and Macrolides for improved bioavailability and targeted delivery. There's a growing emphasis on combination therapies and synergistic formulations to combat multi-drug resistant pathogens. Furthermore, companies are investing in the development of new antimicrobial molecules with novel mechanisms of action. The market relevance of these developments lies in their ability to address emerging disease challenges, meet stricter regulatory demands for reduced antibiotic usage, and support the growing consumer demand for sustainably produced animal protein, offering competitive advantages to early adopters.

Challenges in the Europe Feed Antibiotics Market Market

The Europe Feed Antibiotics Market faces significant challenges that are reshaping its landscape. A primary restraint is the increasingly stringent regulatory environment across Europe, with bans or severe restrictions on the prophylactic use of antibiotics in animal feed. This directly impacts market volume and necessitates a shift in product development and marketing strategies. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of raw materials, influencing production and pricing. Furthermore, the growing public concern over antimicrobial resistance (AMR) and its potential impact on human health creates significant pressure on the industry to reduce antibiotic dependence. Competitive pressures are also intense, with a growing number of alternative products and solutions vying for market share. These factors collectively contribute to a complex and dynamic market environment.

Forces Driving Europe Feed Antibiotics Market Growth

The Europe Feed Antibiotics Market is propelled by several key growth drivers. The fundamental need to ensure animal health and prevent disease outbreaks in intensive livestock farming remains a primary force. Economic growth across European nations directly translates to increased demand for animal protein, thus sustaining the need for effective animal husbandry practices. Technological advancements in veterinary medicine and animal nutrition are leading to the development of more targeted and efficient feed antibiotic formulations. Furthermore, evolving regulatory frameworks, while presenting challenges, also drive innovation towards safer and more sustainable antimicrobial solutions, creating new market opportunities for companies that can adapt and comply.

Challenges in the Europe Feed Antibiotics Market Market

The long-term growth catalysts for the Europe Feed Antibiotics Market are intrinsically linked to innovation and strategic adaptation. The continuous development of novel antimicrobial compounds with unique mechanisms of action is crucial for staying ahead of evolving pathogens and addressing resistance concerns. Strategic partnerships between feed additive manufacturers, pharmaceutical companies, and research institutions are essential for accelerating R&D and bringing innovative solutions to market faster. Moreover, expanding into new geographical markets within Europe that may have less stringent regulations or a higher demand for specific antibiotic types can also serve as a long-term growth engine. The focus on developing integrated animal health solutions, beyond just antibiotics, will also play a vital role in future market expansion.

Emerging Opportunities in Europe Feed Antibiotics Market

Emerging opportunities in the Europe Feed Antibiotics Market are concentrated around sustainable solutions and technological advancements. The growing demand for antibiotic-free animal production presents a significant opportunity for companies offering effective alternatives like probiotics, prebiotics, organic acids, and essential oils. Innovations in precision animal farming and digital health solutions, enabling better monitoring of animal health and more targeted antibiotic interventions, are also creating new avenues. The aquaculture sector, with its unique disease challenges, offers substantial untapped potential for specialized feed antibiotic formulations. Furthermore, a heightened consumer preference for transparent and ethically produced animal products is driving demand for feed additives that can demonstrably improve animal welfare and reduce the environmental footprint of livestock farming.

Leading Players in the Europe Feed Antibiotics Market Sector

- Elanco

- Cargill Incorporated

- Eco Animal Health

- BASF SE

- Alltech Inc

- Zeotis

- Boehringer Ingelheim Denmark A / S

- Borregaard AS

Key Milestones in Europe Feed Antibiotics Market Industry

- 2019: Increased regulatory scrutiny on antibiotic usage in animal feed across several EU member states, leading to early discussions on restrictions.

- 2020: Launch of new generation fluoroquinolone antibiotics with improved safety profiles, targeting specific bacterial infections in livestock.

- 2021: Major acquisition of a leading European animal health company by a global pharmaceutical giant, signaling consolidation and strategic investment.

- 2022: Introduction of novel probiotic strains designed to improve gut health in poultry, offering an alternative to antibiotic growth promoters.

- 2023: Significant R&D investment announced by a key player to develop bacteriophage-based therapies for livestock, marking a shift towards non-antibiotic solutions.

- 2024: Publication of comprehensive guidelines by the European Food Safety Authority (EFSA) on the responsible use of antibiotics in animal agriculture, influencing future market strategies.

Strategic Outlook for Europe Feed Antibiotics Market Market

The strategic outlook for the Europe Feed Antibiotics Market is characterized by a dual approach: optimizing the judicious use of existing antibiotics and aggressively investing in the development and commercialization of sustainable alternatives. Growth accelerators will include leveraging technological advancements in diagnostics and precision farming to enable targeted interventions, thus reducing overall antibiotic reliance. Strategic partnerships and collaborations will be crucial for innovation and market penetration, particularly in the burgeoning field of microbiome management and functional feed ingredients. Companies that can demonstrate clear value propositions in terms of animal health, productivity, and compliance with evolving regulatory and consumer demands will be best positioned for sustained growth and market leadership in this dynamic sector.

Europe Feed Antibiotics Market Segmentation

-

1. Type

- 1.1. Tetracyclines

- 1.2. Penicillins

- 1.3. Sulfonamides

- 1.4. Macrolides

- 1.5. Aminoglycosides

- 1.6. Cephalosporins

- 1.7. Others

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

Europe Feed Antibiotics Market Segmentation By Geography

- 1. United Kingdom

- 2. Spain

- 3. Italy

- 4. Germany

- 5. France

- 6. Russia

- 7. Rest of Europe

Europe Feed Antibiotics Market Regional Market Share

Geographic Coverage of Europe Feed Antibiotics Market

Europe Feed Antibiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Animal Sourced Proteins

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tetracyclines

- 5.1.2. Penicillins

- 5.1.3. Sulfonamides

- 5.1.4. Macrolides

- 5.1.5. Aminoglycosides

- 5.1.6. Cephalosporins

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Spain

- 5.3.3. Italy

- 5.3.4. Germany

- 5.3.5. France

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tetracyclines

- 6.1.2. Penicillins

- 6.1.3. Sulfonamides

- 6.1.4. Macrolides

- 6.1.5. Aminoglycosides

- 6.1.6. Cephalosporins

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Spain Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tetracyclines

- 7.1.2. Penicillins

- 7.1.3. Sulfonamides

- 7.1.4. Macrolides

- 7.1.5. Aminoglycosides

- 7.1.6. Cephalosporins

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Italy Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tetracyclines

- 8.1.2. Penicillins

- 8.1.3. Sulfonamides

- 8.1.4. Macrolides

- 8.1.5. Aminoglycosides

- 8.1.6. Cephalosporins

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Germany Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tetracyclines

- 9.1.2. Penicillins

- 9.1.3. Sulfonamides

- 9.1.4. Macrolides

- 9.1.5. Aminoglycosides

- 9.1.6. Cephalosporins

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. France Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Tetracyclines

- 10.1.2. Penicillins

- 10.1.3. Sulfonamides

- 10.1.4. Macrolides

- 10.1.5. Aminoglycosides

- 10.1.6. Cephalosporins

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminants

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Tetracyclines

- 11.1.2. Penicillins

- 11.1.3. Sulfonamides

- 11.1.4. Macrolides

- 11.1.5. Aminoglycosides

- 11.1.6. Cephalosporins

- 11.1.7. Others

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Ruminants

- 11.2.2. Poultry

- 11.2.3. Swine

- 11.2.4. Aquaculture

- 11.2.5. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Tetracyclines

- 12.1.2. Penicillins

- 12.1.3. Sulfonamides

- 12.1.4. Macrolides

- 12.1.5. Aminoglycosides

- 12.1.6. Cephalosporins

- 12.1.7. Others

- 12.2. Market Analysis, Insights and Forecast - by Animal Type

- 12.2.1. Ruminants

- 12.2.2. Poultry

- 12.2.3. Swine

- 12.2.4. Aquaculture

- 12.2.5. Others

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Elanco

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cargill Incorporated

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Eco Animal Healt

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BASF SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Alltech Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Zeotis

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Boehringer Ingelheim Denmark A / S

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Borregaard AS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Elanco

List of Figures

- Figure 1: Europe Feed Antibiotics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Feed Antibiotics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Europe Feed Antibiotics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 6: Europe Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 9: Europe Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 12: Europe Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: Europe Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 18: Europe Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 21: Europe Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 24: Europe Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Feed Antibiotics Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Europe Feed Antibiotics Market?

Key companies in the market include Elanco, Cargill Incorporated, Eco Animal Healt, BASF SE, Alltech Inc, Zeotis, Boehringer Ingelheim Denmark A / S, Borregaard AS.

3. What are the main segments of the Europe Feed Antibiotics Market?

The market segments include Type, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Demand for Animal Sourced Proteins.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Feed Antibiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Feed Antibiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Feed Antibiotics Market?

To stay informed about further developments, trends, and reports in the Europe Feed Antibiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence