Key Insights

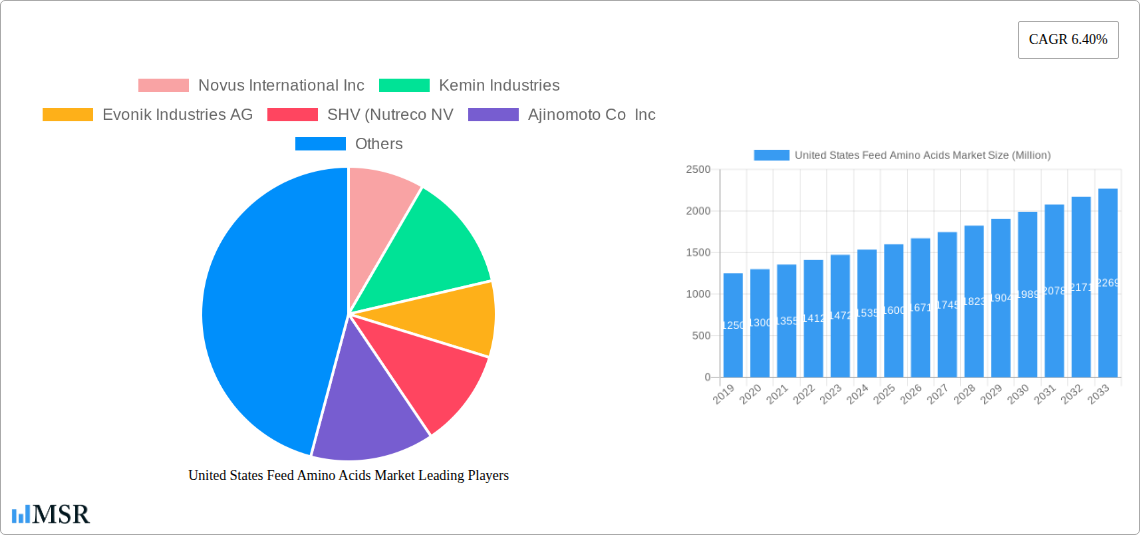

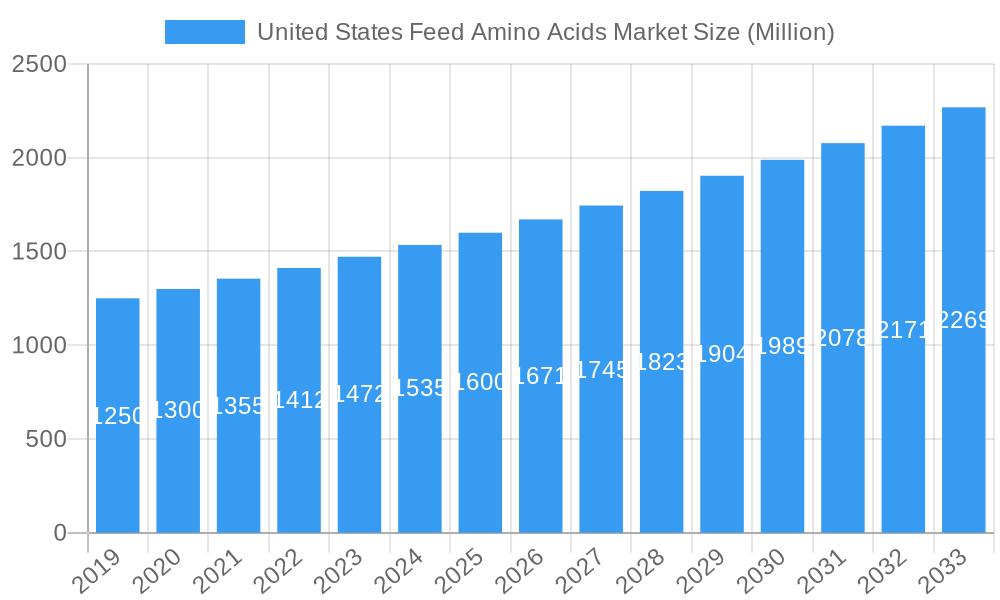

The United States feed amino acids market is poised for robust expansion, driven by the increasing demand for high-quality animal protein and the growing awareness of the nutritional benefits of supplementing animal feed. With an estimated market size of USD 1,500 million in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.40% through 2033. This growth is primarily fueled by the expanding livestock and aquaculture industries, where amino acids play a critical role in optimizing animal growth, feed efficiency, and overall health. The poultry sector, particularly broilers and layers, represents a significant segment due to its high protein requirements and efficient conversion rates. Similarly, the aquaculture industry, encompassing fish and shrimp farming, is increasingly adopting feed amino acid solutions to enhance yield and disease resistance. The market is further propelled by advancements in animal nutrition research and the development of innovative feed additives that improve digestibility and bioavailability of essential amino acids like Lysine, Methionine, Threonine, and Tryptophan.

United States Feed Amino Acids Market Market Size (In Billion)

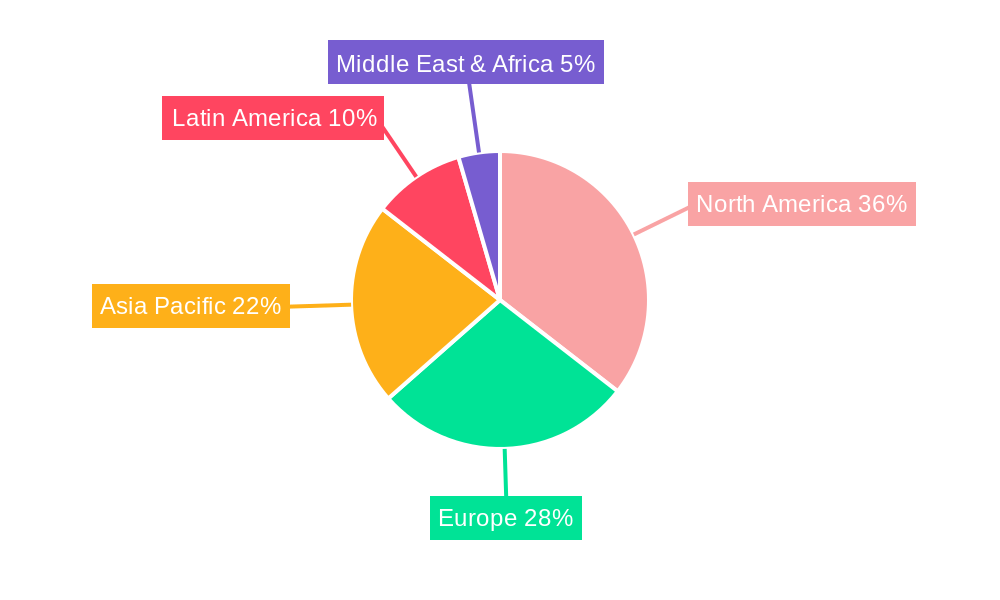

Despite the strong growth trajectory, the market faces certain restraints, including fluctuating raw material prices and increasing regulatory scrutiny concerning the use of feed additives. However, the adoption of precision nutrition strategies and the development of cost-effective production methods for amino acids are expected to mitigate these challenges. Key industry players such as Novus International Inc., Kemin Industries, Evonik Industries AG, and SHV (Nutreco NV) are actively investing in research and development to introduce novel products and expand their market reach. The North American region, with the United States as a dominant force, is anticipated to maintain its leadership position, supported by a well-established animal agriculture infrastructure and a strong focus on sustainable farming practices. The continuous innovation in sub-additives and the expansion into niche animal segments will further shape the market landscape, underscoring the strategic importance of feed amino acids in modern animal husbandry.

United States Feed Amino Acids Market Company Market Share

Unlock the Future of Animal Nutrition: United States Feed Amino Acids Market Analysis 2025-2033

Gain unparalleled insights into the dynamic United States feed amino acids market, a critical segment for optimizing animal health, feed efficiency, and sustainability in the US animal feed industry. This comprehensive report delves into the intricate market landscape, forecasting a robust growth trajectory from 2025 to 2033, with a base year of 2025. Leveraging historical data from 2019-2024, we provide a definitive analysis of market size, CAGR, and key growth drivers that are shaping the future of feed additives.

Explore the dominance of key amino acids such as Lysine, Methionine, Threonine, and Tryptophan, and understand their pivotal role in various animal segments, including poultry (broiler, layer), swine, ruminants (beef cattle, dairy cattle), and aquaculture (fish, shrimp). Our in-depth analysis covers market concentration, innovation ecosystems, regulatory frameworks, and substitute products, offering actionable intelligence for feed manufacturers, nutritionists, animal producers, and ingredient suppliers. Discover the impact of industry developments, strategic partnerships, and M&A activities, including Novus International's acquisition of Agrivida and Evonik's strategic collaborations.

This report is your essential guide to navigating the challenges and capitalizing on the emerging opportunities within the United States feed amino acids market. Understand the competitive forces, technological disruptions, and evolving consumer behaviors that are driving innovation and market expansion.

United States Feed Amino Acids Market Market Concentration & Dynamics

The United States feed amino acids market exhibits a moderately concentrated landscape, characterized by the significant presence of global players and a few strong domestic entities. The innovation ecosystem is driven by continuous research and development in optimizing amino acid production, delivery methods, and efficacy for various animal species. Key companies are investing in sustainable sourcing and production technologies to meet environmental regulations and consumer demands for ethically produced animal protein. The regulatory framework governing feed additives, overseen by agencies like the FDA, plays a crucial role in market entry and product development, ensuring safety and efficacy. Substitute products, primarily protein meals, are constantly evaluated against the cost-effectiveness and nutritional precision offered by synthesized amino acids. End-user trends are heavily influenced by the drive for enhanced animal welfare, reduced environmental impact from livestock farming, and improved feed conversion ratios to lower production costs. Mergers and acquisitions (M&A) are sporadic but impactful, aimed at consolidating market share, acquiring new technologies, and expanding product portfolios. For instance, the acquisition of Agrivida by Novus International signifies a strategic move towards integrating biotechnology for novel feed additive development. M&A deal counts in the broader feed additives sector have seen a steady, albeit conservative, pace, reflecting the strategic importance of specialized acquisitions. The market share of leading players is a dynamic metric, influenced by product innovation and global supply chain dynamics, with major players like Evonik and Adisseo holding substantial portions of the methionine and lysine markets respectively.

United States Feed Amino Acids Market Industry Insights & Trends

The United States feed amino acids market is poised for significant expansion, driven by a confluence of factors that underscore the increasing demand for precision nutrition in animal agriculture. The estimated market size for 2025 is projected to be $X,XXX Million, with a projected Compound Annual Growth Rate (CAGR) of X.X% from 2025 to 2033. This growth is propelled by several key market drivers. Firstly, the relentless pursuit of improved feed efficiency and reduced production costs within the US animal feed industry is a primary catalyst. Amino acids, when precisely supplemented, enable a reduction in crude protein content of diets, leading to significant cost savings and a minimized environmental footprint through reduced nitrogen excretion. Secondly, the growing global population and the ensuing demand for animal protein products necessitate higher yields and better animal health. Feed amino acids play an indispensable role in optimizing growth rates, reproductive performance, and disease resistance in poultry, swine, ruminants, and aquaculture.

Technological disruptions are continually reshaping the market. Advancements in biotechnology, including fermentation processes for amino acid production, are enhancing sustainability and reducing reliance on traditional, more resource-intensive methods. For example, the development of more efficient microbial strains for methionine and lysine production is lowering manufacturing costs and improving product purity. Digital solutions are also emerging, as seen in Evonik and BASF's partnership on OpteinicsTM, which aims to improve comprehension and reduce the environmental impact of the animal protein and feed industries by providing data-driven insights. Evolving consumer behaviors are indirectly influencing the market. Increased consumer awareness regarding animal welfare, antibiotic use, and the environmental impact of food production is pushing the industry towards more sustainable and efficient practices. This translates to a greater demand for feed additives that enhance animal health naturally and reduce the need for medical interventions. Furthermore, the shift towards alternative protein sources and the need to maximize the nutritional value of conventional feed ingredients also bolster the demand for targeted amino acid supplementation. The historical period of 2019-2024 has laid the groundwork for this growth, with consistent advancements in production technologies and increasing adoption rates of essential amino acids across various animal sectors. The United States' strong agricultural base and its position as a major producer of poultry, beef, pork, and seafood further solidify its status as a key market for feed amino acids.

Key Markets & Segments Leading United States Feed Amino Acids Market

The United States feed amino acids market is led by the poultry segment, which consistently drives demand due to its high production volumes and rapid growth cycles. Within poultry, broilers represent the largest sub-segment, owing to the immense scale of industrial broiler production and the critical need for optimized feed formulations to ensure rapid weight gain and feed conversion efficiency. Layers also contribute significantly, as amino acid supplementation is vital for consistent egg production, shell quality, and overall hen health. The swine segment is another dominant force, with grower-finisher pigs requiring precise amino acid profiles to maximize lean meat deposition and minimize wastage. The increasing focus on reducing environmental impact from swine operations further elevates the importance of amino acid supplementation, as it allows for lower crude protein diets and consequently, reduced nitrogen excretion.

The aquaculture segment, particularly fish and shrimp farming, is exhibiting substantial growth and is projected to become an increasingly significant contributor. As aquaculture intensifies to meet global seafood demand, the need for scientifically formulated feeds containing essential amino acids becomes paramount for promoting rapid growth, disease resistance, and optimal flesh quality. The ruminant segment, encompassing beef cattle and dairy cattle, is also an important market, though its growth trajectory for feed amino acids is more nuanced. While essential for optimizing milk production and quality in dairy cows, and for growth and carcass quality in beef cattle, the ruminant digestive system's ability to synthesize certain amino acids necessitates different supplementation strategies compared to monogastric animals. However, specific amino acids like methionine and lysine are increasingly being supplemented to overcome dietary limitations and improve performance.

Dominance Drivers in Poultry:

- Economic Growth: Robust consumer demand for poultry products directly fuels production, necessitating efficient feed.

- Technological Advancements: Continuous improvements in genetics and husbandry practices require precise nutritional support.

- Cost-Effectiveness: Amino acid supplementation offers a proven method to reduce feed costs while maintaining performance.

- Disease Management: Optimized nutrition enhances immune function, reducing reliance on antibiotics.

Dominance Drivers in Swine:

- Lean Meat Production: Amino acids are crucial for maximizing lean muscle development and improving carcass quality.

- Environmental Regulations: Reduction of nitrogen excretion through lower crude protein diets is a key regulatory driver.

- Feed Conversion Efficiency: Optimizing amino acid profiles directly improves feed conversion ratios, lowering costs.

Emerging Dominance Drivers in Aquaculture:

- Growing Seafood Demand: Intensification of aquaculture practices requires sophisticated feed solutions.

- Sustainability Initiatives: Amino acid supplementation contributes to more sustainable aquaculture feed formulations.

The United States' leading position in these animal production sectors, coupled with its advanced agricultural research and adoption of innovative feed technologies, solidifies these segments as the primary drivers of the feed amino acids market. The sub-additive methionine and lysine are particularly dominant across these key animal segments due to their status as first and second limiting amino acids in common feed ingredients.

United States Feed Amino Acids Market Product Developments

Product development in the United States feed amino acids market is characterized by a focus on enhanced bioavailability, stability, and targeted delivery mechanisms. Companies are innovating through the development of novel formulations, such as coated or encapsulated amino acids, which ensure their survival through the upper digestive tract and release in the small intestine, maximizing absorption and efficacy. Furthermore, advancements in precision fermentation and biotechnology are leading to the production of more sustainable and cost-effective amino acids, including L-threonine and L-tryptophan. Research into the synergistic effects of different amino acids and their impact on gut health and immune function is also driving innovation, leading to more comprehensive nutritional solutions for animal feed. These advancements are critical for maintaining a competitive edge and meeting the evolving demands for efficient and sustainable animal nutrition.

Challenges in the United States Feed Amino Acids Market Market

The United States feed amino acids market faces several significant challenges. Regulatory hurdles for new product approvals can be lengthy and costly, potentially delaying market entry for innovative solutions. Supply chain volatility, exacerbated by global events and raw material price fluctuations, poses a constant threat to consistent production and competitive pricing. Intensifying competition among established global players and emerging regional producers also exerts downward pressure on margins. Furthermore, volatility in raw material costs, particularly for petrochemical-derived precursors used in amino acid synthesis, can impact profitability. Quantifiable impacts include potential delays in product launches, leading to missed market opportunities, and increased operational costs that affect the affordability of feed additives for end-users.

Forces Driving United States Feed Amino Acids Market Growth

Several powerful forces are driving the growth of the United States feed amino acids market. Technological advancements in biotechnology and fermentation are enabling more efficient and sustainable production of essential amino acids, lowering costs and expanding availability. Economic factors, such as the increasing global demand for animal protein and the need for cost-effective animal production, are compelling feed manufacturers to adopt precision nutrition strategies. Regulatory pressures focused on reducing environmental impact, particularly concerning nitrogen and phosphorus excretion from livestock, incentivize the use of amino acid-supplemented low-protein diets. Furthermore, growing consumer awareness regarding animal welfare and sustainable food production practices indirectly supports the adoption of feed additives that improve animal health and reduce the need for antibiotics. The continuous drive for improved feed conversion ratios across all animal species remains a fundamental economic imperative, directly benefiting the feed amino acids sector.

Challenges in the United States Feed Amino Acids Market Market

Long-term growth catalysts in the United States feed amino acids market are being forged through continued innovation and strategic market expansion. The development of next-generation amino acid products with enhanced bioavailability and specific functionalities, such as improved gut health support or immune modulation, will be critical. Partnerships between amino acid producers and feed formulators, as well as animal nutrition researchers, are essential for optimizing product application and demonstrating their value. Expanding the application of amino acids beyond traditional livestock into emerging areas like pet food and specialized aquaculture feeds presents significant growth potential. Furthermore, investments in sustainable production methods and the exploration of alternative, bio-based feedstocks for amino acid synthesis will not only address environmental concerns but also secure long-term supply chain resilience. Strategic market expansions into underserved regions or niche animal segments within the US will also contribute to sustained growth.

Emerging Opportunities in United States Feed Amino Acids Market

Emerging opportunities in the United States feed amino acids market are abundant and diverse. The increasing focus on sustainable aquaculture presents a significant avenue for growth, as the demand for scientifically formulated feeds for fish and shrimp intensifies. Innovations in precision livestock farming, utilizing data analytics to tailor amino acid supplementation at the individual animal level, offer a pathway to unprecedented efficiency gains. The growing pet food industry also presents a burgeoning opportunity, with owners increasingly seeking high-quality, nutritionally balanced diets for their pets, driving demand for premium amino acid ingredients. Furthermore, the development of functional amino acids that offer benefits beyond basic nutrition, such as enhanced immune response or stress reduction, is a key area for future growth and differentiation. Consumer demand for antibiotic-free meat and dairy products creates a strong impetus for feed solutions that bolster animal health naturally, making amino acids a crucial component of such strategies.

Leading Players in the United States Feed Amino Acids Market Sector

- Novus International Inc

- Kemin Industries

- Evonik Industries AG

- SHV (Nutreco NV)

- Ajinomoto Co Inc

- Land O'Lakes

- Archer Daniel Midland Co

- Alltech Inc

- IFF (Danisco Animal Nutrition)

- Adisseo

Key Milestones in United States Feed Amino Acids Market Industry

- January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives, signaling a strategic investment in biotechnology for enhanced animal nutrition solutions.

- October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries, highlighting a move towards digital solutions for sustainability.

- March 2022: Evonik extended its methyl mercaptan plant in Alabama, the United States. Methyl mercaptan is currently obtained from outside sources and used as an intermediate in the production of DL-methionine, indicating an effort to strengthen domestic supply chains for key amino acid precursors.

Strategic Outlook for United States Feed Amino Acids Market Market

The strategic outlook for the United States feed amino acids market is exceptionally strong, driven by an intensified focus on efficiency, sustainability, and animal well-being. Growth accelerators will include continued innovation in product development, such as the creation of slow-release amino acids and those with added health benefits, directly addressing the demand for improved animal performance and reduced environmental impact. Strategic partnerships between technology providers, ingredient manufacturers, and end-users will be crucial for optimizing the application of these additives and demonstrating their economic and ecological value. Furthermore, the market will benefit from the expanding reach of precision nutrition principles across all animal sectors, supported by advanced analytics and data-driven insights. Investments in sustainable production methods and the exploration of novel feed ingredients will also bolster market resilience and cater to evolving consumer preferences, ensuring sustained long-term growth and profitability in this vital segment of the animal nutrition industry.

United States Feed Amino Acids Market Segmentation

-

1. Sub Additive

- 1.1. Lysine

- 1.2. Methionine

- 1.3. Threonine

- 1.4. Tryptophan

- 1.5. Other Amino Acids

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

United States Feed Amino Acids Market Segmentation By Geography

- 1. United States

United States Feed Amino Acids Market Regional Market Share

Geographic Coverage of United States Feed Amino Acids Market

United States Feed Amino Acids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Feed Amino Acids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Lysine

- 5.1.2. Methionine

- 5.1.3. Threonine

- 5.1.4. Tryptophan

- 5.1.5. Other Amino Acids

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novus International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kemin Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Evonik Industries AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SHV (Nutreco NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Co Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Land O'Lakes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniel Midland Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alltech Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Novus International Inc

List of Figures

- Figure 1: United States Feed Amino Acids Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Feed Amino Acids Market Share (%) by Company 2025

List of Tables

- Table 1: United States Feed Amino Acids Market Revenue undefined Forecast, by Sub Additive 2020 & 2033

- Table 2: United States Feed Amino Acids Market Revenue undefined Forecast, by Animal 2020 & 2033

- Table 3: United States Feed Amino Acids Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Feed Amino Acids Market Revenue undefined Forecast, by Sub Additive 2020 & 2033

- Table 5: United States Feed Amino Acids Market Revenue undefined Forecast, by Animal 2020 & 2033

- Table 6: United States Feed Amino Acids Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Feed Amino Acids Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the United States Feed Amino Acids Market?

Key companies in the market include Novus International Inc, Kemin Industries, Evonik Industries AG, SHV (Nutreco NV, Ajinomoto Co Inc, Land O'Lakes, Archer Daniel Midland Co, Alltech Inc, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the United States Feed Amino Acids Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives.October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.March 2022: Evonik extended its methyl mercaptan plant in Alabama, the United States. Methyl mercaptan is currently obtained from outside sources and used as an intermediate in the production of DL-methionine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Feed Amino Acids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Feed Amino Acids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Feed Amino Acids Market?

To stay informed about further developments, trends, and reports in the United States Feed Amino Acids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence