Key Insights

The European Feed Antioxidants Market is forecast for robust expansion, projecting a market size of $371.38 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.18% from 2025 to 2033. This growth is propelled by escalating demand for premium animal feed, influenced by a rising European population and increased meat and dairy consumption. Primary growth drivers include the necessity to bolster animal health and productivity through the mitigation of oxidative stress and the extension of feed shelf-life, consequently minimizing spoilage-related economic losses. The poultry and swine sectors are anticipated to spearhead this growth, given their substantial role in the European animal protein supply chain and the critical need for optimized feed formulations. The aquaculture segment is also emerging as a significant contributor, driven by the expanding aquaculture industry's requirement for specialized feed solutions.

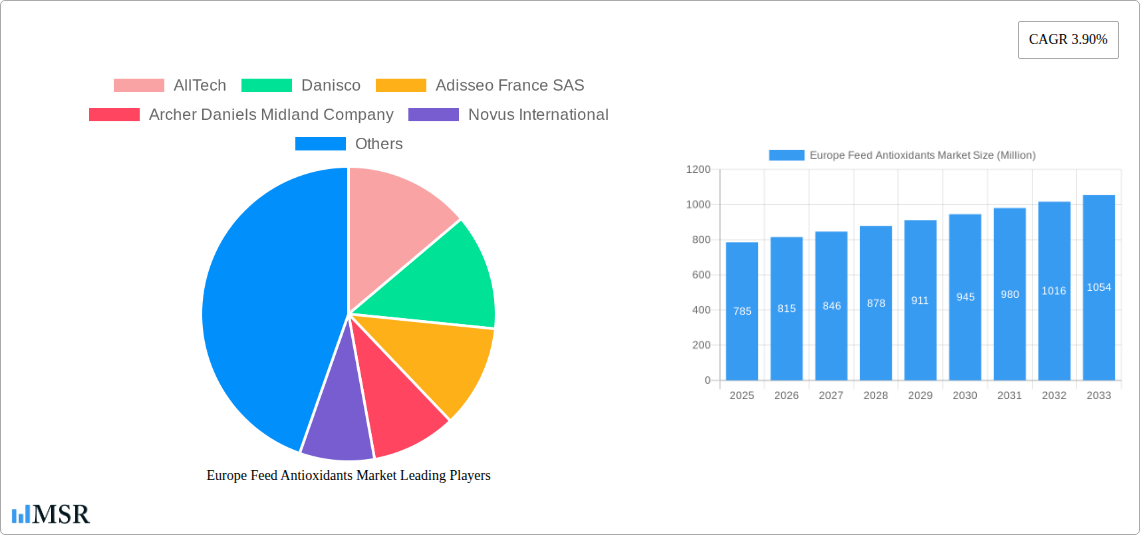

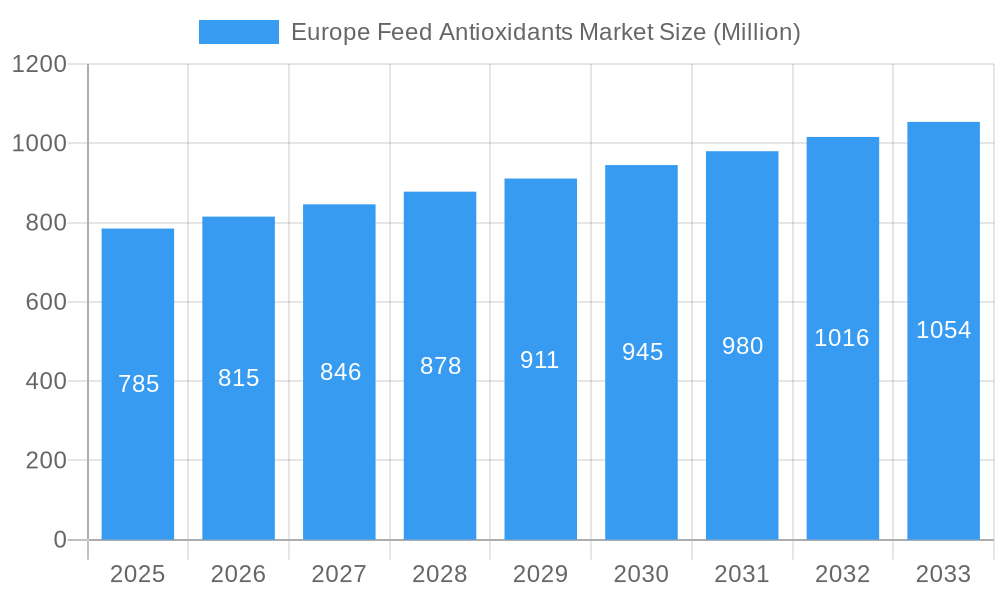

Europe Feed Antioxidants Market Market Size (In Million)

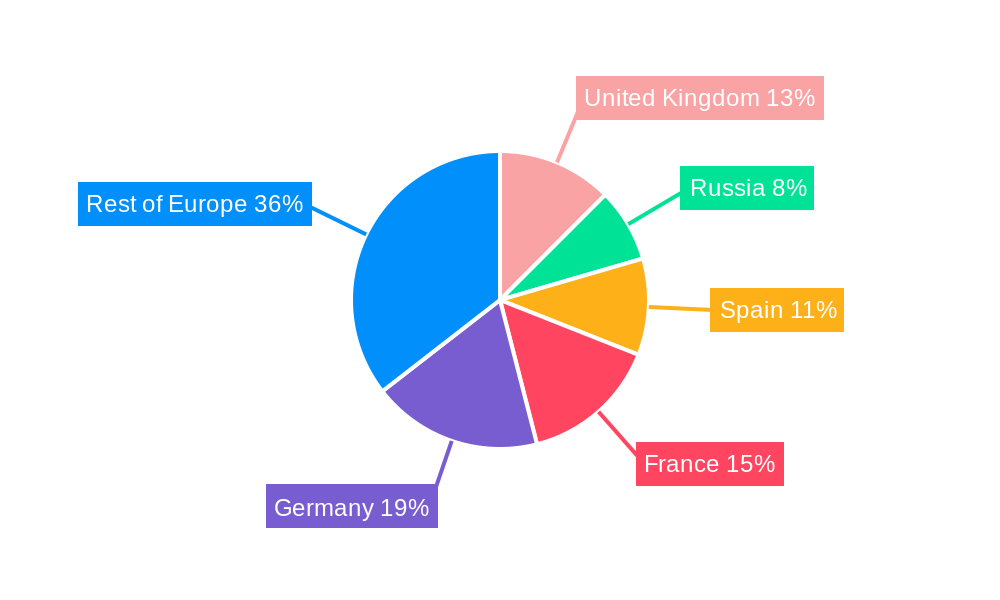

A prominent trend in the market is the increasing adoption of natural antioxidants, fueled by growing concerns regarding synthetic additives. This is driving innovation towards alternatives to traditional options. However, regulatory frameworks for feed additives and volatile raw material pricing pose key challenges. Despite these hurdles, leading companies are actively investing in research and development to launch innovative, sustainable, and efficacious antioxidant solutions. Germany, France, and the United Kingdom are expected to lead the European market, reflecting strong livestock production and stringent animal feed quality standards. The forecast period (2025-2033) anticipates sustained market growth as the industry prioritizes animal welfare and feed efficiency.

Europe Feed Antioxidants Market Company Market Share

Europe Feed Antioxidants Market: Comprehensive Market Research Report 2024-2033

Unlock growth opportunities in the dynamic Europe Feed Antioxidants Market. This in-depth report provides critical insights into market trends, competitive landscapes, and future projections. Essential for stakeholders seeking to capitalize on the surging demand for animal nutrition and feed preservation.

This report delves into the Europe Feed Antioxidants Market, analyzing its present state and future trajectory from 2019 to 2033. With a base year of 2025, our comprehensive study offers an estimated market size of $XXX Million and a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Covering the historical period of 2019–2024, this research provides a holistic understanding of market dynamics, including segmentation by Animal Type (Ruminant, Poultry, Swine, Aquaculture, Other Animal Types) and Type (BHA, BHT, Ethoxyquin, Others).

Europe Feed Antioxidants Market Market Concentration & Dynamics

The Europe Feed Antioxidants Market exhibits a moderate to high concentration, with key players such as AllTech, Danisco, Adisseo France SAS, Archer Daniels Midland Company, Novus International, DSM, Cargill Inc, Kemin Europa, Nutreco N V holding significant market share. Innovation ecosystems are driven by ongoing research and development into more effective and natural antioxidant solutions. Regulatory frameworks, while stringent, are evolving to accommodate novel feed additives. The presence of substitute products, including natural extracts, presents a competitive challenge. End-user trends are increasingly focused on animal health, welfare, and the reduction of oxidative stress, driving demand for high-quality feed antioxidants. Merger and acquisition (M&A) activities have been instrumental in consolidating market share and expanding product portfolios, with approximately XX significant M&A deals recorded between 2019 and 2024.

Europe Feed Antioxidants Market Industry Insights & Trends

The Europe Feed Antioxidants Market is experiencing robust growth, fueled by a confluence of factors critical to the animal feed industry. The increasing global population and rising demand for animal protein are fundamentally driving the expansion of the livestock sector, necessitating advanced feed solutions to ensure animal health and productivity. Feed antioxidants play a pivotal role in preserving the nutritional quality of animal feed, preventing the degradation of essential fatty acids and vitamins, thereby enhancing feed palatability and digestibility. This directly translates to improved animal growth rates, better feed conversion ratios, and a reduction in mortality rates, making antioxidants indispensable for modern animal husbandry.

Technological disruptions are continuously reshaping the market. There is a growing emphasis on the development and adoption of synthetic antioxidants like BHA and BHT, which offer cost-effectiveness and consistent performance. However, an equally significant trend is the burgeoning demand for natural antioxidants, driven by consumer preference for “clean label” products and concerns about the potential health impacts of synthetic additives. This has spurred innovation in the extraction and application of natural antioxidants from sources such as rosemary, green tea, and grape seeds. Companies are investing heavily in research to identify novel natural compounds with superior antioxidant properties and to develop cost-effective production methods for these alternatives.

Evolving consumer behaviors in the European Union, particularly concerning food safety and animal welfare, are indirectly impacting the feed antioxidants market. Consumers are increasingly aware of the link between animal feed quality and the healthfulness of the final animal products. This heightened awareness is compelling feed manufacturers and livestock producers to prioritize ingredients that promote animal health and reduce the need for antibiotics. Feed antioxidants contribute significantly to this goal by bolstering animal immune systems and mitigating stress-related issues, which can lead to antibiotic use. Furthermore, the growing interest in sustainable agriculture and eco-friendly feed additives is encouraging the development of biodegradable and naturally sourced antioxidants. The market is also witnessing a rise in demand for customized antioxidant solutions tailored to specific animal types and dietary requirements, reflecting a more sophisticated approach to animal nutrition. The estimated market size for Europe Feed Antioxidants Market was $XXX Million in 2025, with a projected CAGR of XX% during the forecast period.

Key Markets & Segments Leading Europe Feed Antioxidants Market

The Poultry segment is the dominant force within the Europe Feed Antioxidants Market. This leadership is underpinned by several key drivers. The sheer scale of poultry production across Europe, coupled with its relatively shorter production cycles and high feed intake, creates a consistent and substantial demand for feed antioxidants. Poultry, with its high metabolism, is particularly susceptible to oxidative stress, making antioxidants crucial for maintaining bird health, improving growth performance, and ensuring the quality of meat and eggs.

- Economic Growth: The robust economic growth in key European nations directly supports the expansion of the animal protein industry, with poultry consistently being a cost-effective and popular choice for consumers, thereby fueling demand for feed additives.

- Infrastructure: Advanced agricultural infrastructure, including state-of-the-art feed mills and livestock farms, facilitates the efficient integration and application of feed antioxidants.

- Technological Advancements: Continuous innovation in poultry farming practices, including improved genetics and feed formulations, necessitates the use of sophisticated feed additives like antioxidants to maximize performance and minimize losses.

Within the types of feed antioxidants, Ethoxyquin has historically held a significant market share due to its efficacy and cost-effectiveness in preventing lipid peroxidation in animal feeds. However, growing regulatory scrutiny and consumer preferences for natural alternatives are gradually shifting the landscape. The Others category, encompassing natural antioxidants like tocopherols, carotenoids, and plant extracts, is experiencing rapid growth. This surge is driven by the increasing demand for ‘natural’ and ‘clean label’ products throughout the food value chain, prompting feed manufacturers to incorporate these naturally derived compounds to meet consumer expectations and comply with evolving regulatory guidelines.

Geographically, Western Europe, encompassing countries like Germany, France, the UK, and the Netherlands, represents the largest market for feed antioxidants in Europe. This dominance is attributed to the region's established and highly industrialized animal agriculture sector, a strong consumer demand for high-quality animal products, and stringent regulations that encourage the use of feed additives to ensure animal health and food safety. The presence of leading animal nutrition companies and research institutions in this region also contributes to market leadership through continuous product development and adoption of innovative solutions.

Europe Feed Antioxidants Market Product Developments

Product development in the Europe Feed Antioxidants Market is characterized by a dual focus on enhancing the efficacy of synthetic antioxidants and pioneering novel natural alternatives. Companies are investing in advanced encapsulation technologies to improve the stability and delivery of antioxidants within feed matrices. This includes the development of microencapsulated synthetic antioxidants that offer controlled release, protecting them from degradation during feed processing and ensuring optimal absorption by animals. Simultaneously, significant strides are being made in the extraction and application of natural antioxidants from a variety of botanical sources. Innovations include identifying synergistic blends of natural compounds to achieve antioxidant performance comparable to or exceeding synthetic options. The market relevance of these developments lies in their ability to address evolving regulatory demands, growing consumer preference for natural ingredients, and the increasing need for sustainable feed solutions.

Challenges in the Europe Feed Antioxidants Market Market

The Europe Feed Antioxidants Market faces several significant challenges. Regulatory Hurdles are a primary concern, with ongoing reviews and potential restrictions on certain synthetic antioxidants like Ethoxyquin creating uncertainty and necessitating investment in alternative solutions. Supply Chain Volatility for natural antioxidant sources, influenced by agricultural yields and geopolitical factors, can impact availability and pricing. Furthermore, Competitive Pressures from both established players and emerging companies offering innovative formulations drive down margins. The Cost of Natural Alternatives remains a barrier for widespread adoption, especially for smaller producers, compared to the often more economical synthetic options.

Forces Driving Europe Feed Antioxidants Market Growth

Several forces are propelling the growth of the Europe Feed Antioxidants Market. The increasing global demand for animal protein, driven by a growing population and rising disposable incomes, directly translates to higher volumes of animal feed produced, thereby boosting the demand for feed antioxidants. Growing awareness among livestock producers regarding animal health and welfare is a significant driver, as antioxidants play a crucial role in mitigating oxidative stress, improving immune function, and reducing the incidence of disease. Technological advancements in feed processing and formulation enable the more effective incorporation and utilization of antioxidants. Moreover, evolving regulatory landscapes that prioritize food safety and animal well-being indirectly encourage the adoption of high-quality feed additives that enhance feed stability and animal health.

Challenges in the Europe Feed Antioxidants Market Market

Long-term growth catalysts for the Europe Feed Antioxidants Market are intrinsically linked to innovation and strategic market adaptation. The ongoing drive towards sustainable and environmentally friendly animal agriculture presents a substantial opportunity for naturally derived and biodegradable antioxidants. Increased investment in research and development (R&D) to uncover novel antioxidant compounds with enhanced efficacy and broader applicability across different animal species will be crucial. Strategic partnerships and collaborations between feed additive manufacturers, research institutions, and livestock producers can accelerate the adoption of new technologies and products. Furthermore, expansion into emerging animal types and niche markets within Europe, such as organic farming or specialized aquaculture, can unlock new revenue streams and diversify market reliance.

Emerging Opportunities in Europe Feed Antioxidants Market

Emerging opportunities within the Europe Feed Antioxidants Market are diverse and promising. The increasing consumer demand for "healthier" animal products is a key trend, driving the need for feed additives that contribute to the well-being of livestock and ultimately, the quality of food. This includes a growing preference for natural and plant-based antioxidants, creating a significant market for ingredients derived from sources like herbs, spices, and fruits. Furthermore, advancements in precision nutrition offer opportunities for developing customized antioxidant formulations tailored to the specific dietary needs and life stages of different animal types, optimizing performance and health outcomes. The growing focus on reducing food waste also presents an opportunity, as antioxidants help preserve the quality and shelf-life of animal feed, minimizing spoilage.

Leading Players in the Europe Feed Antioxidants Market Sector

- AllTech

- Danisco

- Adisseo France SAS

- Archer Daniels Midland Company

- Novus International

- DSM

- Cargill Inc

- Kemin Europa

- Nutreco N V

Key Milestones in Europe Feed Antioxidants Market Industry

- 2019: Increased investment in R&D for natural antioxidant alternatives from major players like DSM and Cargill.

- 2020: Launch of new microencapsulated synthetic antioxidant products by Novus International to improve stability during feed processing.

- 2021: European Food Safety Authority (EFSA) review of Ethoxyquin’s use, leading to increased market uncertainty and a shift towards alternatives.

- 2022: Kemin Europa announces expansion of its natural antioxidant portfolio, focusing on botanical extracts for poultry and swine.

- 2023: AllTech introduces a novel antioxidant blend derived from algae for aquaculture applications, addressing specific industry needs.

- 2024: Adisseo France SAS acquires a key player in the natural antioxidant market, strengthening its position in this growing segment.

Strategic Outlook for Europe Feed Antioxidants Market Market

The strategic outlook for the Europe Feed Antioxidants Market is characterized by a strong emphasis on innovation, sustainability, and regulatory compliance. Growth will be accelerated by the continued transition towards natural and plant-based antioxidant solutions, driven by consumer preferences and evolving regulatory frameworks. Companies that invest in R&D to develop highly effective and cost-competitive natural alternatives, coupled with robust supply chain management, will be well-positioned for success. Strategic partnerships and collaborations will be crucial for market penetration and product diversification. The market is expected to witness further consolidation through mergers and acquisitions as companies seek to expand their product portfolios and geographic reach.

This report is a definitive guide for understanding the Europe Feed Antioxidants Market. Leveraging advanced analytical methodologies, it provides actionable intelligence for manufacturers, suppliers, distributors, and investors to navigate this complex and evolving industry. Essential for strategic planning and market entry.

Europe Feed Antioxidants Market Segmentation

-

1. Animal Type

- 1.1. Ruminant

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Type

- 2.1. BHA

- 2.2. BHT

- 2.3. Ethoxyquin

- 2.4. Others

Europe Feed Antioxidants Market Segmentation By Geography

- 1. United Kingdom

- 2. Russia

- 3. Spain

- 4. France

- 5. Germany

- 6. Rest of Europe

Europe Feed Antioxidants Market Regional Market Share

Geographic Coverage of Europe Feed Antioxidants Market

Europe Feed Antioxidants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. Increased Demand Due to Decreasing Livestock Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminant

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. BHA

- 5.2.2. BHT

- 5.2.3. Ethoxyquin

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Russia

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Germany

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United Kingdom Europe Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminant

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. BHA

- 6.2.2. BHT

- 6.2.3. Ethoxyquin

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Russia Europe Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminant

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. BHA

- 7.2.2. BHT

- 7.2.3. Ethoxyquin

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Spain Europe Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminant

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. BHA

- 8.2.2. BHT

- 8.2.3. Ethoxyquin

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. France Europe Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminant

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. BHA

- 9.2.2. BHT

- 9.2.3. Ethoxyquin

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Germany Europe Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminant

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. BHA

- 10.2.2. BHT

- 10.2.3. Ethoxyquin

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Rest of Europe Europe Feed Antioxidants Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Ruminant

- 11.1.2. Poultry

- 11.1.3. Swine

- 11.1.4. Aquaculture

- 11.1.5. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. BHA

- 11.2.2. BHT

- 11.2.3. Ethoxyquin

- 11.2.4. Others

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 AllTech

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Danisco

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Adisseo France SAS

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Archer Daniels Midland Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Novus International

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DSM

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cargill Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kemin Europa

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nutreco N V

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 AllTech

List of Figures

- Figure 1: Europe Feed Antioxidants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Feed Antioxidants Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 2: Europe Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Europe Feed Antioxidants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 5: Europe Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Europe Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Europe Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 8: Europe Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 9: Europe Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Europe Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 11: Europe Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: Europe Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Europe Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 14: Europe Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 15: Europe Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Europe Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 17: Europe Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: Europe Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: Europe Feed Antioxidants Market Revenue million Forecast, by Animal Type 2020 & 2033

- Table 20: Europe Feed Antioxidants Market Revenue million Forecast, by Type 2020 & 2033

- Table 21: Europe Feed Antioxidants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Feed Antioxidants Market?

The projected CAGR is approximately 5.18%.

2. Which companies are prominent players in the Europe Feed Antioxidants Market?

Key companies in the market include AllTech, Danisco, Adisseo France SAS, Archer Daniels Midland Company, Novus International, DSM, Cargill Inc, Kemin Europa, Nutreco N V.

3. What are the main segments of the Europe Feed Antioxidants Market?

The market segments include Animal Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 371.38 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

Increased Demand Due to Decreasing Livestock Population.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Feed Antioxidants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Feed Antioxidants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Feed Antioxidants Market?

To stay informed about further developments, trends, and reports in the Europe Feed Antioxidants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence