Key Insights

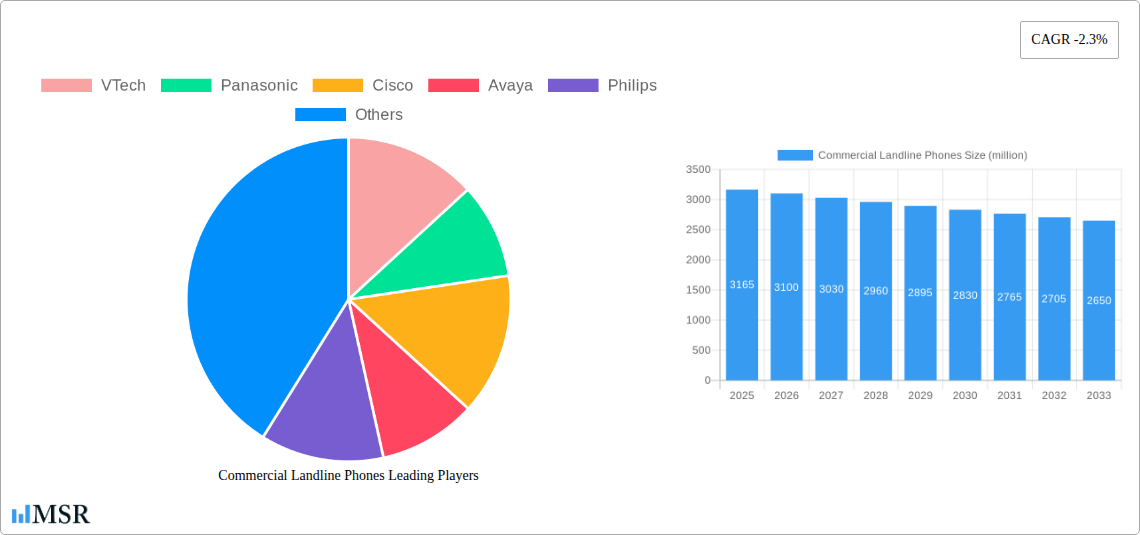

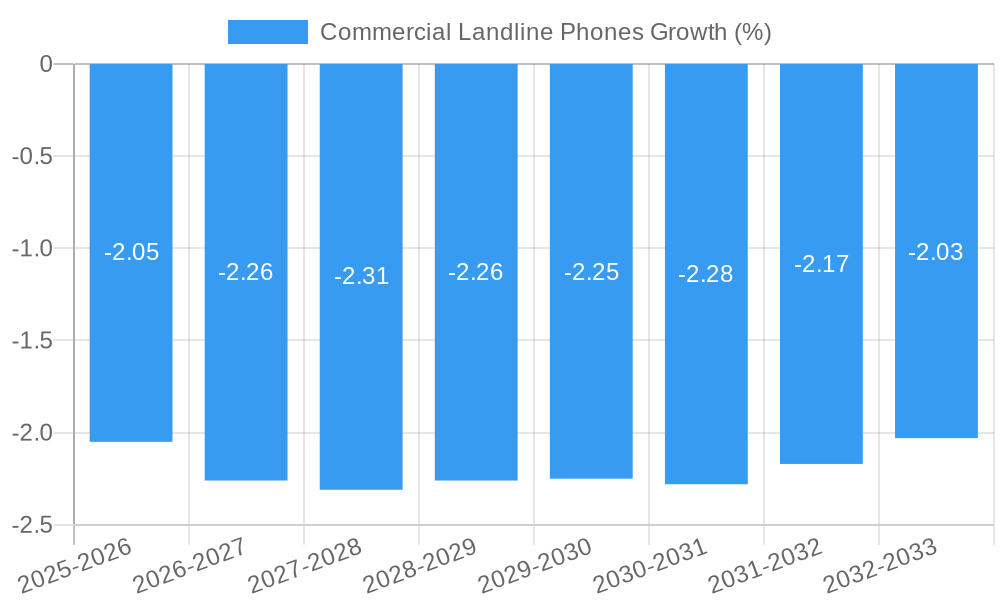

The global commercial landline phone market, valued at an estimated USD 3165 million in 2025, is projected to experience a slight contraction with a Compound Annual Growth Rate (CAGR) of -2.3% during the forecast period of 2025-2033. This declining trend is primarily attributed to the widespread adoption of mobile devices, Voice over Internet Protocol (VoIP) solutions, and unified communications platforms that offer greater flexibility and advanced features. Businesses are increasingly investing in integrated communication systems that consolidate voice, video, and messaging, rendering traditional landline phones less essential for many operational needs. Consequently, the market's value is expected to diminish as organizations streamline their communication infrastructure and embrace more modern, cost-effective alternatives.

Despite the overall market decline, specific segments and applications will continue to exhibit resilience. Office buildings and government agencies, which often maintain legacy systems or have specific regulatory requirements, are likely to remain significant consumers of commercial landline phones. However, the waning demand from sectors like shopping malls and hotels, which are more agile in adopting new technologies, will exert downward pressure on the market. Key players like VTech, Panasonic, and Cisco are adapting by diversifying their product portfolios to include advanced IP phones and integrated communication solutions, aiming to offset the declining revenue from traditional landline devices. The market's future will be shaped by the strategic pivots of these companies and the slow, yet steady, digital transformation across various business verticals.

Sure, here is an SEO-optimized, engaging report description for Commercial Landline Phones, embedding high-ranking keywords and following all your specified requirements.

Commercial Landline Phones Market Concentration & Dynamics

The global commercial landline phones market is characterized by a moderate to high concentration, with key players like VTech, Panasonic, Cisco, Avaya, Philips, Gigaset, Polycom, Mitel, Alcatel-Lucent, Yealink, Motorola, TCL, and AT&T dominating market share. These companies consistently invest in R&D to foster innovation ecosystems, bringing advanced features and connectivity solutions to various business environments. Regulatory frameworks worldwide play a crucial role in shaping market access and product standards, influencing competitive landscapes. While the rise of VoIP solutions and mobile communication presents substitute products, the inherent reliability and security of traditional landline systems continue to ensure their relevance, particularly in critical sectors. End-user trends indicate a demand for integrated communication platforms that offer both landline stability and modern features. Merger and acquisition (M&A) activities, while not as prevalent as in some tech sectors, are strategic moves aimed at consolidating market presence and expanding product portfolios. The market anticipates a steady flow of M&A deals focused on niche technologies and regional dominance, with an estimated XX million worth of transactions in the historical period. Market share for top players is estimated to hover around XX% collectively, with individual company shares ranging from XX% to XX%. Innovation hubs are emerging in regions with strong manufacturing capabilities and a skilled workforce, fostering a dynamic environment for new product development.

Commercial Landline Phones Industry Insights & Trends

The commercial landline phones market is poised for steady growth, projected to reach a market size of XX million by 2033. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. The industry is witnessing significant technological disruptions, with advancements in features like HD voice, enhanced security protocols, and seamless integration with cloud-based services. Evolving consumer behaviors, particularly among businesses, are driving demand for communication solutions that offer greater flexibility, scalability, and cost-effectiveness without compromising on the reliability of traditional landlines. The integration of AI-powered features for call management and analytics is becoming a key differentiator, attracting businesses seeking to optimize their communication workflows. The market is also experiencing a shift towards more user-friendly interfaces and robust hardware designed for demanding commercial environments. The historical period (2019–2024) saw a market size of XX million in 2019, demonstrating a resilient performance despite the rise of alternative technologies. The base year (2025) is estimated to have a market size of XX million, serving as a crucial benchmark for future projections. The study period (2019–2033) encompasses a comprehensive analysis of market evolution, from pre-pandemic trends to the post-digital transformation era. Industry analysts predict that investments in upgrading existing business communication infrastructure will continue to be a significant growth catalyst. Furthermore, the increasing adoption of smart office technologies will further embed the necessity of reliable landline connectivity. The market's ability to adapt to emerging communication paradigms while retaining its core strengths will be pivotal to its sustained expansion. The integration of advanced encryption standards and remote management capabilities are also contributing to the market's resilience, particularly for sectors with stringent data security requirements. The ongoing digital transformation across industries is creating new avenues for commercial landline phones that can seamlessly coexist with and complement newer communication technologies.

Key Markets & Segments Leading Commercial Landline Phones

The commercial landline phones market is witnessing significant dominance in specific regions and segments, driven by a confluence of economic growth, robust infrastructure, and specific industry needs. The Office Building segment, in particular, is a leading contributor, fueled by the continuous need for reliable on-site communication for employees, clients, and administrative functions. The increasing establishment of new office spaces and the renovation of existing ones necessitate the installation and upgrading of comprehensive landline systems. Furthermore, the Government Agency segment demonstrates consistent demand due to the critical nature of their operations, where uninterrupted communication is paramount for public safety, administration, and inter-agency coordination. These agencies often prioritize security and reliability, making traditional landlines a preferred choice.

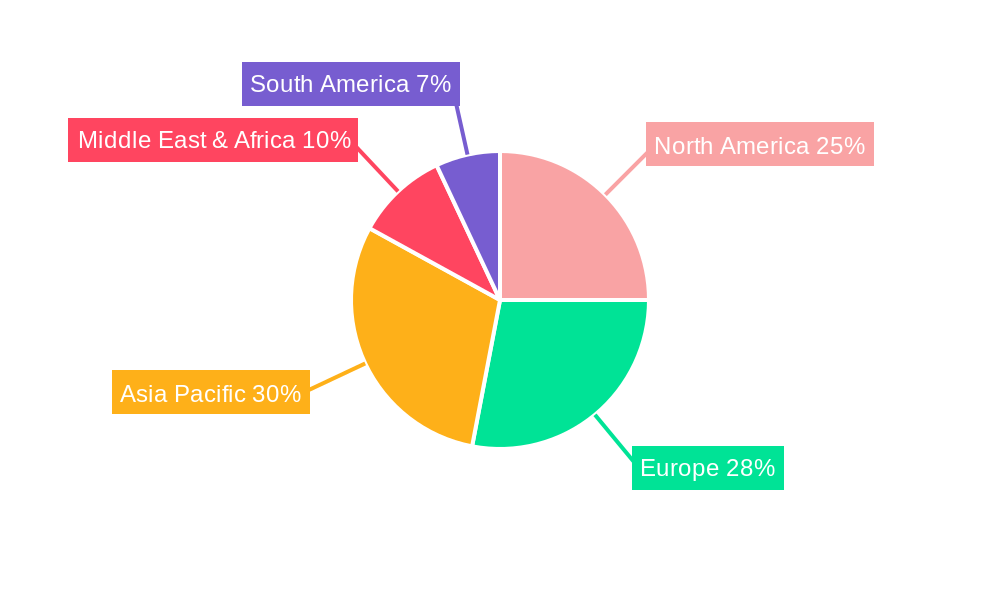

Dominant Regions and Countries:

- North America: Driven by a mature business landscape and a strong emphasis on corporate communication infrastructure.

- Europe: Benefiting from established business practices and significant investments in enterprise communication upgrades.

- Asia Pacific: Experiencing rapid growth due to expanding economies, increasing digitalization, and a surge in new business establishments.

Leading Application Segments:

- Office Building: High adoption rates due to the fundamental requirement for internal and external communication.

- Drivers: New business setup, office infrastructure upgrades, employee productivity focus.

- Government Agency: Sustained demand driven by critical communication needs and stringent security requirements.

- Drivers: National security, public service delivery, inter-departmental communication needs.

- Hotel: Essential for guest services, front desk operations, and in-room communication.

- Drivers: Tourism growth, guest experience enhancement, operational efficiency.

- Shopping Mall: Facilitates customer service, security, and vendor communication.

- Drivers: Retail sector expansion, customer engagement strategies.

Dominant Types:

- Cordless Telephones: Offer flexibility and mobility within office spaces, enhancing user convenience.

- Drivers: Ease of use, desk decluttering, enhanced employee mobility.

- Corded Telephones: Valued for their robustness, reliability, and often superior audio quality in noisy environments.

- Drivers: Durability, plug-and-play simplicity, preferred by certain professions.

The economic growth in emerging markets, coupled with ongoing infrastructure development, further bolsters the demand for commercial landline phones. The need for dependable communication in sectors like hospitality and retail, where seamless customer interaction is key, also contributes to the market's expansion. The Other application segment, encompassing healthcare facilities, educational institutions, and manufacturing plants, also represents a substantial and growing market. These sectors rely on the consistent and secure communication capabilities that landlines provide, especially for critical operations and emergency response. The evolution of these applications towards more integrated systems also creates opportunities for advanced landline solutions.

Commercial Landline Phones Product Developments

Recent product developments in commercial landline phones focus on enhancing user experience and integration capabilities. Innovations include crystal-clear HD voice technology for superior call quality, advanced noise-cancellation features, and improved security protocols to safeguard sensitive business communications. Many new models now offer seamless integration with VoIP systems and cloud-based communication platforms, bridging the gap between traditional and modern telephony. Features such as intuitive touchscreen interfaces, programmable speed-dial buttons, and built-in conference call capabilities are becoming standard. The market relevance is maintained through durable designs built for demanding office environments and energy-efficient operation. Companies like Yealink and Cisco are leading in offering feature-rich IP-based landline phones that support a wide array of business applications and unified communications.

Challenges in the Commercial Landline Phones Market

The commercial landline phones market faces several challenges, including the persistent and rapid adoption of Voice over Internet Protocol (VoIP) and mobile communication, which offer perceived cost savings and greater flexibility. The XX% year-over-year decline in traditional landline subscriptions in some developed markets highlights this competitive pressure. Additionally, supply chain disruptions, exacerbated by global events, can impact component availability and lead times, potentially increasing costs by XX% for manufacturers. Regulatory hurdles related to network infrastructure upgrades and sunsetting of older copper networks can also pose significant obstacles.

Forces Driving Commercial Landline Phones Growth

Several forces are driving the sustained growth of commercial landline phones. The inherent reliability and stability of landline networks, particularly in situations where internet connectivity may be intermittent, remains a critical factor for many businesses. Enhanced security features are increasingly important, as landlines are often perceived as more secure for sensitive business calls than some internet-based alternatives. The continued need for robust and dedicated communication channels in specific sectors like government and emergency services ensures a baseline demand. Furthermore, the integration of advanced functionalities such as HD voice and compatibility with emerging unified communications platforms is making landline solutions more attractive.

Challenges in the Commercial Landline Phones Market

Long-term growth catalysts for the commercial landline phones market lie in its ability to innovate and adapt. Strategic partnerships between landline providers and cloud communication specialists can lead to hybrid solutions that offer the best of both worlds – the reliability of landlines coupled with the scalability and feature-richness of IP-based systems. Market expansion into regions with less developed digital infrastructure, where traditional landlines still form the backbone of communication, presents significant opportunities. Furthermore, developing next-generation landline technologies that are more energy-efficient and incorporate AI-driven call management features will be crucial for retaining market relevance and attracting new business users.

Emerging Opportunities in Commercial Landline Phones

Emerging opportunities in the commercial landline phones market are centered around specialized applications and niche markets. The increasing demand for secure communication in sectors like healthcare (for patient consultations and internal communication) and legal services (for client confidentiality) presents a significant avenue for growth. The development of integrated communication hubs that combine landline functionality with advanced IoT device management and smart office controls can unlock new revenue streams. Furthermore, the "last mile" connectivity solutions in areas still relying on older infrastructure can be leveraged by offering modern, feature-rich landline devices that are easy to install and manage, thereby capturing a segment resistant to full IP migration.

Leading Players in the Commercial Landline Phones Sector

- VTech

- Panasonic

- Cisco

- Avaya

- Philips

- Gigaset

- Polycom

- Mitel

- Alcatel-Lucent

- Yealink

- Motorola

- TCL

- AT&T

Key Milestones in Commercial Landline Phones Industry

- 2019: Introduction of advanced noise cancellation technology in cordless business phones.

- 2020: Increased focus on secure communication features amidst growing cybersecurity concerns.

- 2021: Enhanced integration capabilities with VoIP and cloud-based platforms by leading manufacturers.

- 2022: Rollout of energy-efficient models, responding to corporate sustainability initiatives.

- 2023: Significant product launches featuring AI-driven call management and analytics.

- 2024: Growing emphasis on ruggedized and durable designs for industrial and high-usage environments.

Strategic Outlook for Commercial Landline Phones Market

The strategic outlook for the commercial landline phones market is one of targeted growth and integration. Future success hinges on the ability of manufacturers and service providers to offer hybrid solutions that seamlessly blend the reliability of traditional landlines with the advanced functionalities of modern digital communication. Strategic investments in R&D for enhanced security, AI integration, and improved user interfaces will be crucial for capturing new market segments and retaining existing customers. Furthermore, forging strong partnerships with IT service providers and focusing on delivering comprehensive communication solutions rather than just hardware will accelerate market penetration and revenue growth.

Commercial Landline Phones Segmentation

-

1. Application

- 1.1. Office Building

- 1.2. Government Agency

- 1.3. Shopping Mall

- 1.4. Hotel

- 1.5. Other

-

2. Types

- 2.1. Cordless Telephones

- 2.2. Corded Telephones

Commercial Landline Phones Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commercial Landline Phones REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of -2.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Landline Phones Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Office Building

- 5.1.2. Government Agency

- 5.1.3. Shopping Mall

- 5.1.4. Hotel

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cordless Telephones

- 5.2.2. Corded Telephones

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Landline Phones Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Office Building

- 6.1.2. Government Agency

- 6.1.3. Shopping Mall

- 6.1.4. Hotel

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cordless Telephones

- 6.2.2. Corded Telephones

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Commercial Landline Phones Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Office Building

- 7.1.2. Government Agency

- 7.1.3. Shopping Mall

- 7.1.4. Hotel

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cordless Telephones

- 7.2.2. Corded Telephones

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Commercial Landline Phones Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Office Building

- 8.1.2. Government Agency

- 8.1.3. Shopping Mall

- 8.1.4. Hotel

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cordless Telephones

- 8.2.2. Corded Telephones

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Commercial Landline Phones Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Office Building

- 9.1.2. Government Agency

- 9.1.3. Shopping Mall

- 9.1.4. Hotel

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cordless Telephones

- 9.2.2. Corded Telephones

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Commercial Landline Phones Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Office Building

- 10.1.2. Government Agency

- 10.1.3. Shopping Mall

- 10.1.4. Hotel

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cordless Telephones

- 10.2.2. Corded Telephones

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VTech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Panasonic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cisco

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Avaya

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Philips

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gigaset

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Polycom

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mitel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alcatel-Lucent

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yealink

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Motorola

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TCL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AT&T

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 VTech

List of Figures

- Figure 1: Global Commercial Landline Phones Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Commercial Landline Phones Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Commercial Landline Phones Revenue (million), by Application 2024 & 2032

- Figure 4: North America Commercial Landline Phones Volume (K), by Application 2024 & 2032

- Figure 5: North America Commercial Landline Phones Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Commercial Landline Phones Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Commercial Landline Phones Revenue (million), by Types 2024 & 2032

- Figure 8: North America Commercial Landline Phones Volume (K), by Types 2024 & 2032

- Figure 9: North America Commercial Landline Phones Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Commercial Landline Phones Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Commercial Landline Phones Revenue (million), by Country 2024 & 2032

- Figure 12: North America Commercial Landline Phones Volume (K), by Country 2024 & 2032

- Figure 13: North America Commercial Landline Phones Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Commercial Landline Phones Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Commercial Landline Phones Revenue (million), by Application 2024 & 2032

- Figure 16: South America Commercial Landline Phones Volume (K), by Application 2024 & 2032

- Figure 17: South America Commercial Landline Phones Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Commercial Landline Phones Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Commercial Landline Phones Revenue (million), by Types 2024 & 2032

- Figure 20: South America Commercial Landline Phones Volume (K), by Types 2024 & 2032

- Figure 21: South America Commercial Landline Phones Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Commercial Landline Phones Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Commercial Landline Phones Revenue (million), by Country 2024 & 2032

- Figure 24: South America Commercial Landline Phones Volume (K), by Country 2024 & 2032

- Figure 25: South America Commercial Landline Phones Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Commercial Landline Phones Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Commercial Landline Phones Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Commercial Landline Phones Volume (K), by Application 2024 & 2032

- Figure 29: Europe Commercial Landline Phones Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Commercial Landline Phones Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Commercial Landline Phones Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Commercial Landline Phones Volume (K), by Types 2024 & 2032

- Figure 33: Europe Commercial Landline Phones Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Commercial Landline Phones Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Commercial Landline Phones Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Commercial Landline Phones Volume (K), by Country 2024 & 2032

- Figure 37: Europe Commercial Landline Phones Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Commercial Landline Phones Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Commercial Landline Phones Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Commercial Landline Phones Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Commercial Landline Phones Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Commercial Landline Phones Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Commercial Landline Phones Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Commercial Landline Phones Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Commercial Landline Phones Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Commercial Landline Phones Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Commercial Landline Phones Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Commercial Landline Phones Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Commercial Landline Phones Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Commercial Landline Phones Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Commercial Landline Phones Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Commercial Landline Phones Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Commercial Landline Phones Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Commercial Landline Phones Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Commercial Landline Phones Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Commercial Landline Phones Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Commercial Landline Phones Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Commercial Landline Phones Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Commercial Landline Phones Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Commercial Landline Phones Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Commercial Landline Phones Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Commercial Landline Phones Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Commercial Landline Phones Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Commercial Landline Phones Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Commercial Landline Phones Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Commercial Landline Phones Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Commercial Landline Phones Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Commercial Landline Phones Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Commercial Landline Phones Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Commercial Landline Phones Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Commercial Landline Phones Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Commercial Landline Phones Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Commercial Landline Phones Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Commercial Landline Phones Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Commercial Landline Phones Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Commercial Landline Phones Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Commercial Landline Phones Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Commercial Landline Phones Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Commercial Landline Phones Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Commercial Landline Phones Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Commercial Landline Phones Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Commercial Landline Phones Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Commercial Landline Phones Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Commercial Landline Phones Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Commercial Landline Phones Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Commercial Landline Phones Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Commercial Landline Phones Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Commercial Landline Phones Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Commercial Landline Phones Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Commercial Landline Phones Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Commercial Landline Phones Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Commercial Landline Phones Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Commercial Landline Phones Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Commercial Landline Phones Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Commercial Landline Phones Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Commercial Landline Phones Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Commercial Landline Phones Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Commercial Landline Phones Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Commercial Landline Phones Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Commercial Landline Phones Volume K Forecast, by Country 2019 & 2032

- Table 81: China Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Commercial Landline Phones Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Commercial Landline Phones Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Landline Phones?

The projected CAGR is approximately -2.3%.

2. Which companies are prominent players in the Commercial Landline Phones?

Key companies in the market include VTech, Panasonic, Cisco, Avaya, Philips, Gigaset, Polycom, Mitel, Alcatel-Lucent, Yealink, Motorola, TCL, AT&T.

3. What are the main segments of the Commercial Landline Phones?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 3165 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Landline Phones," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Landline Phones report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Landline Phones?

To stay informed about further developments, trends, and reports in the Commercial Landline Phones, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence