Key Insights

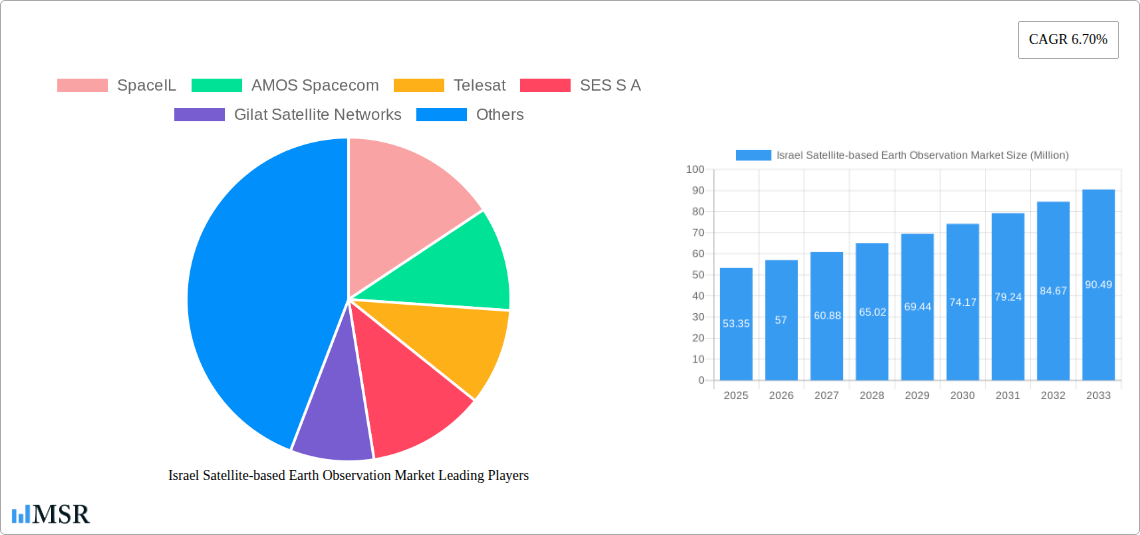

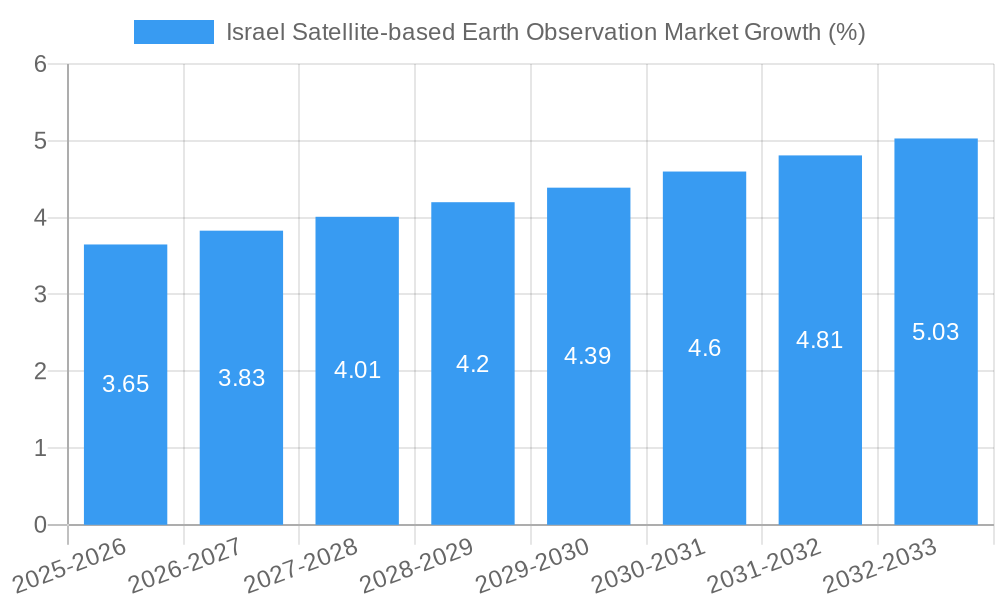

The Israeli satellite-based Earth observation market, valued at $53.35 million in 2025, is projected to experience robust growth, driven by increasing government investments in advanced technologies and a rising demand for precise geospatial data across various sectors. This growth is further fueled by the country's strategic location and its established expertise in aerospace and technology. The market's expansion is largely attributed to the increasing adoption of Earth observation data for precision agriculture, enhancing infrastructure planning and management (particularly in urban development and cultural heritage preservation), facilitating climate change monitoring and mitigation strategies, and improving resource management in the energy and raw materials sectors. The market is segmented by type (Earth Observation Data and Value-Added Services), satellite orbit (Low Earth Orbit, Medium Earth Orbit, and Geostationary Orbit), and end-use (Urban Development and Cultural Heritage, Agriculture, Climate Services, Energy and Raw Materials, and Infrastructure). Key players like SpaceIL, AMOS Spacecom, and others are actively contributing to this market growth through innovative solutions and technological advancements. The consistent CAGR of 6.70% indicates a sustained upward trajectory throughout the forecast period (2025-2033), signifying a promising investment opportunity. While challenges like high initial investment costs and data processing complexities might exist, the substantial benefits derived from utilizing satellite-based Earth observation data are expected to outweigh these restraints.

The competitive landscape is characterized by a mix of established players and emerging companies, fostering innovation and collaboration. The market’s future growth will likely be influenced by factors such as advancements in satellite technology, increasing accessibility of data analytics tools, and the development of new applications for Earth observation data. The government's continued support for research and development in the space sector and the country's strong entrepreneurial ecosystem will further propel the growth of the Israeli satellite-based Earth observation market. The development of advanced analytics capabilities and the increasing integration of AI and machine learning in data processing are also expected to drive market expansion. The focus on data security and the establishment of robust regulatory frameworks will play a significant role in ensuring sustainable growth in the years to come.

Israel Satellite-based Earth Observation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Israel satellite-based Earth observation market, projecting significant growth from 2025 to 2033. The study covers market dynamics, industry trends, key segments, leading players, and emerging opportunities, offering invaluable insights for stakeholders, investors, and industry professionals. The report utilizes data from 2019-2024 (Historical Period), with 2025 as the Base Year and Estimated Year, and forecasts extending to 2033 (Forecast Period). Market values are expressed in Millions.

Israel Satellite-based Earth Observation Market Market Concentration & Dynamics

The Israeli satellite-based Earth observation market exhibits a moderately concentrated landscape, with a few dominant players alongside a growing number of smaller, specialized firms. Market share analysis reveals that the top 5 players account for approximately xx% of the total market revenue in 2025, indicative of a competitive yet consolidated sector. Innovation thrives within a robust ecosystem encompassing government support, academic research, and private investment, fostering the development of advanced technologies and applications. The regulatory framework, while generally supportive, faces ongoing adjustments to address emerging challenges related to data privacy, security, and international collaborations. Substitute products, such as aerial photography and ground-based sensors, exist but generally lack the scale, coverage, and temporal resolution of satellite-based solutions. End-user trends showcase an increasing demand for high-resolution imagery and value-added services across diverse sectors. M&A activity in the period 2019-2024 involved xx deals, primarily focused on consolidating technologies and expanding market reach. Future consolidation is anticipated, driven by the need to scale operations and enhance service offerings.

- Market Share: Top 5 players: xx% (2025)

- M&A Activity (2019-2024): xx deals

Israel Satellite-based Earth Observation Market Industry Insights & Trends

The Israeli satellite-based Earth observation market is poised for robust growth, driven by several key factors. The market size is estimated at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of xx%. Government initiatives promoting technological advancement and space-related industries play a crucial role, coupled with rising private sector investments. Technological disruptions, including the development of miniaturized satellites and advanced sensor technologies, are significantly reducing costs and improving data acquisition capabilities. This leads to the increased adoption across various sectors. Consumer behavior is evolving towards a preference for readily accessible, high-quality, and easily-analyzable data, driving demand for value-added services. The market is characterized by increasing competition, prompting innovation and the development of specialized solutions tailored to specific end-user requirements.

Key Markets & Segments Leading Israel Satellite-based Earth Observation Market

The Israeli satellite-based Earth observation market is characterized by diverse segments and applications. While the exact market share for each segment is currently under development, the following observations are made:

By Type:

- Earth Observation Data: This segment holds a significant share, reflecting the fundamental nature of raw data as the foundation for various applications.

- Value-Added Services: This segment is growing rapidly, driven by increasing demand for processed and interpreted data products.

By Satellite Orbit:

- Low Earth Orbit (LEO): LEO satellites offer high-resolution imagery, making them popular for various applications. The decreasing launch costs contribute to market expansion in this segment.

- Medium Earth Orbit (MEO): MEO satellites provide a balance between coverage and resolution, suitable for various purposes.

- Geostationary Orbit (GEO): GEO satellites, offering continuous coverage, are primarily utilized for monitoring purposes and specific applications requiring consistent coverage.

By End-Use:

- Agriculture: Precision agriculture, crop monitoring, and yield prediction are driving demand for satellite-based data in this sector.

- Urban Development and Cultural Heritage: Monitoring urban sprawl, managing infrastructure, and preserving historical sites are key applications.

- Climate Services: Climate change monitoring and environmental impact assessment contribute to the significant growth of this market segment.

- Energy and Raw Materials: Exploration, extraction, and management of resources leverage satellite-based earth observation technology.

- Infrastructure: Monitoring infrastructure, particularly transportation and utility networks, is crucial for effective management.

- Other End-Use: This segment includes a range of applications utilizing satellite data.

Drivers:

- Strong government support for space technologies and R&D

- Increasing adoption of precision agriculture techniques

- Growing need for efficient urban planning and resource management

- Demand for accurate and timely climate change monitoring data

- Investments in infrastructure development and monitoring

Israel Satellite-based Earth Observation Market Product Developments

Recent advancements in sensor technology, particularly in high-resolution multi-spectral and hyperspectral imaging, are revolutionizing the capabilities of satellite-based Earth observation. The launch of the RUNNER-1 satellite by ImageSat International in June 2023, showcasing sub-meter resolution multi-spectral imaging and color video capabilities, highlights this progress. The introduction of advanced analytics tools and AI-powered platforms is further enhancing the value proposition of these data sets. Companies are investing in developing user-friendly software and platforms to make these advanced tools accessible.

Challenges in the Israel Satellite-based Earth Observation Market Market

The market faces challenges, including regulatory complexities surrounding data access and usage, potential supply chain disruptions affecting satellite manufacturing and launch schedules, and intense competition among providers. These factors may constrain market growth in the short to medium term. High initial investment costs, especially for larger satellite projects, pose a significant barrier to entry for new players.

Forces Driving Israel Satellite-based Earth Observation Market Growth

Technological advancements, such as miniaturization of satellites and improved sensor technology, are lowering costs and increasing data accessibility, fueling market expansion. Economic growth across various sectors, coupled with government initiatives supporting space technology, creates favorable conditions for market growth. The supportive regulatory framework in Israel fosters innovation and attracts investment in the space sector.

Challenges in the Israel Satellite-based Earth Observation Market Market

Long-term growth hinges on sustained technological advancements, collaborative partnerships between public and private sectors to address shared challenges, and expanding market applications across various sectors. Successful expansion into new international markets will be crucial to maximize long-term potential.

Emerging Opportunities in Israel Satellite-based Earth Observation Market

The integration of AI and machine learning for data analysis, the rise of the New Space industry with its focus on cost-effective launch solutions, and the growing demand for real-time data services are creating significant market opportunities. Expansion into new applications, such as environmental monitoring and disaster management, offers further potential for growth.

Leading Players in the Israel Satellite-based Earth Observation Market Sector

- SpaceIL

- AMOS Spacecom

- Telesat

- SES S.A.

- Gilat Satellite Networks

- Inmarsat global limited

- Orbit Communication Systems Ltd

- Iridium Communications Inc

- *List Not Exhaustive

Key Milestones in Israel Satellite-based Earth Observation Market Industry

- June 2023: Launch of RUNNER-1 satellite by ImageSat International, enhancing high-resolution multi-spectral imaging capabilities.

- March 2023: Launch of a new Ofek series spy satellite, offering unique radar observation capabilities and improved intelligence gathering.

Strategic Outlook for Israel Satellite-based Earth Observation Market Market

The future of the Israeli satellite-based Earth observation market is bright, driven by ongoing technological innovation, increasing private and public investment, and a growing awareness of the value of geospatial data across various sectors. Strategic partnerships and expansion into new markets are expected to fuel further growth, solidifying Israel's position as a key player in the global Earth observation industry.

Israel Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-Use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Other End-Use

Israel Satellite-based Earth Observation Market Segmentation By Geography

- 1. Israel

Israel Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Requirement of Earth Observation Satellite in the Defence Sector; Increasing Use of Earth Observation Satellite in Commercial Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Deploying and Launching Satellite

- 3.4. Market Trends

- 3.4.1. Increasing Use of Earth Observation Satellite in Commercial Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-Use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Other End-Use

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SpaceIL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AMOS Spacecom

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Telesat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SES S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gilat Satellite Networks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inmarsat global limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orbit Communication Systems Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Iridium Communications Inc *List Not Exhaustive 7 2 *List Not Exhaustiv

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 SpaceIL

List of Figures

- Figure 1: Israel Satellite-based Earth Observation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Israel Satellite-based Earth Observation Market Share (%) by Company 2024

List of Tables

- Table 1: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 4: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 5: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 9: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 10: Israel Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Satellite-based Earth Observation Market?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Israel Satellite-based Earth Observation Market?

Key companies in the market include SpaceIL, AMOS Spacecom, Telesat, SES S A, Gilat Satellite Networks, Inmarsat global limited, Orbit Communication Systems Ltd, Iridium Communications Inc *List Not Exhaustive 7 2 *List Not Exhaustiv.

3. What are the main segments of the Israel Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Requirement of Earth Observation Satellite in the Defence Sector; Increasing Use of Earth Observation Satellite in Commercial Sector.

6. What are the notable trends driving market growth?

Increasing Use of Earth Observation Satellite in Commercial Sector.

7. Are there any restraints impacting market growth?

High Cost of Deploying and Launching Satellite.

8. Can you provide examples of recent developments in the market?

June 2023: ImageSat International Ltd., a space company in Israel, launched the RUNNER-1 satellite. This satellite was developed in collaboration with ISI and Terran Orbital and is a multi-purpose remote sensing satellite capable of sub-meter high-resolution multi-spectral imaging and color video.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the Israel Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence