Key Insights

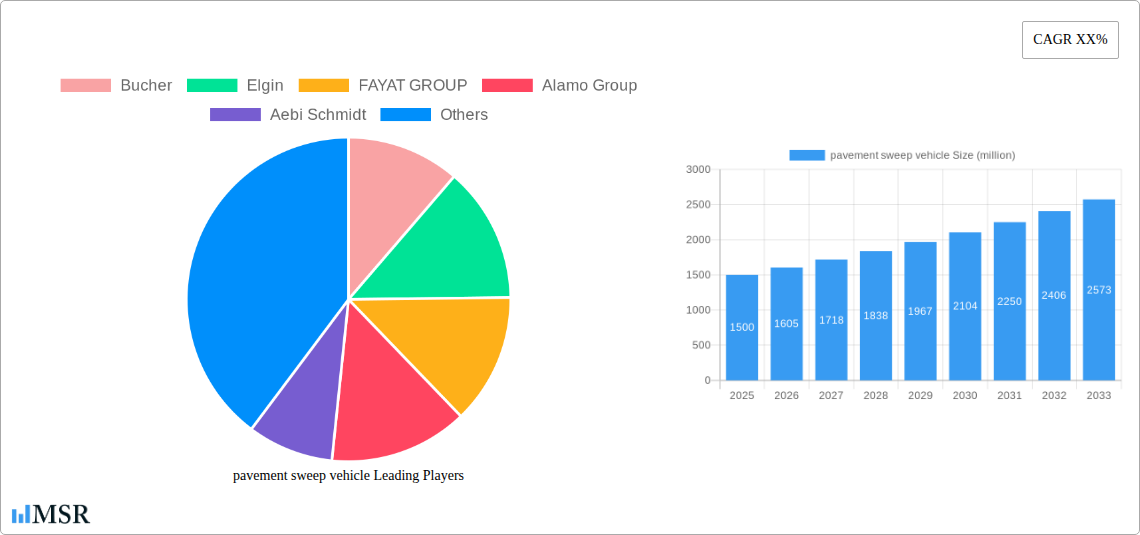

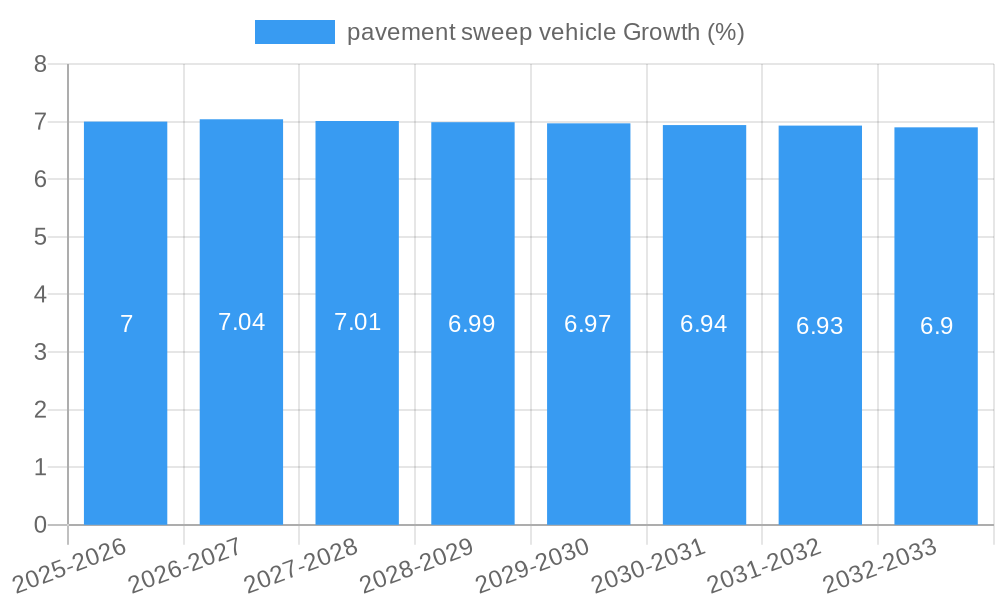

The global pavement sweep vehicle market is poised for significant expansion, driven by increasing urbanization and the growing need for efficient infrastructure maintenance. With a current market size estimated at approximately $1.5 billion and a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033, the industry is set to reach an estimated value of $2.8 billion by the forecast year. This robust growth is primarily fueled by escalating investments in road construction and rehabilitation across both developed and developing economies, coupled with a heightened emphasis on environmental regulations mandating cleaner urban air quality. The demand for advanced sweeping solutions that offer superior efficiency, reduced emissions, and enhanced operator safety is a key trend shaping product development and market strategies.

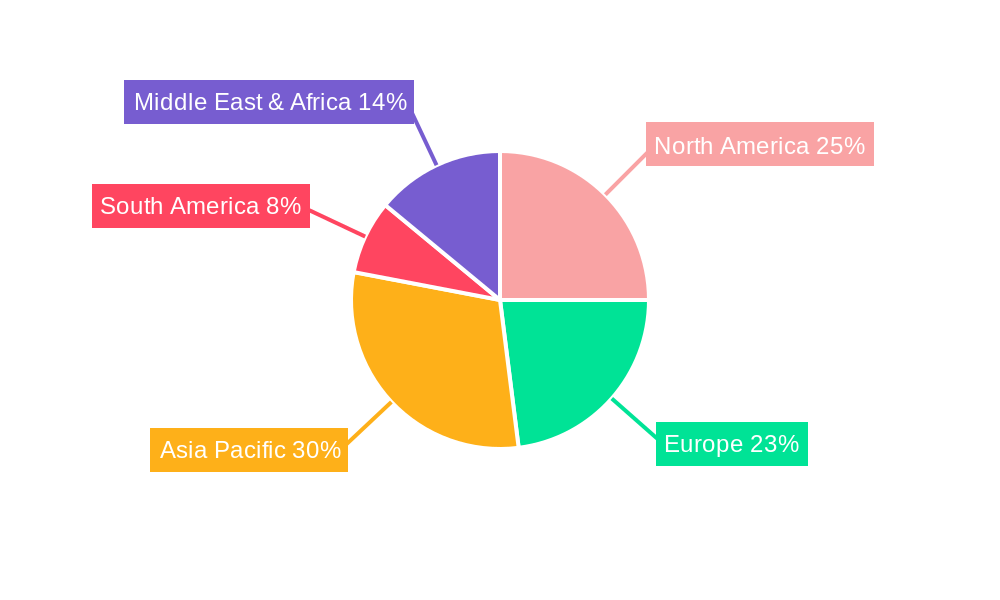

Furthermore, the market is experiencing a notable shift towards technologically advanced and environmentally friendly solutions. Pure electric pavement sweep vehicles are gaining considerable traction, driven by stringent emission standards and a growing corporate commitment to sustainability. While traditional fuel-powered vehicles still hold a significant share, the long-term outlook favors electric alternatives, supported by advancements in battery technology and charging infrastructure. Geographically, Asia Pacific, led by China and India, is emerging as a powerhouse, owing to rapid infrastructure development and a large, expanding urban population. North America and Europe, characterized by mature markets and established infrastructure, continue to drive demand through fleet modernization and a focus on smart city initiatives. Key players are actively engaged in strategic partnerships, product innovation, and geographical expansion to capitalize on these evolving market dynamics.

This comprehensive report delivers unparalleled insights into the global pavement sweep vehicle market, a critical sector supporting infrastructure maintenance and urban cleanliness. Spanning the historical period of 2019-2024, base year 2025, and extending through a forecast period of 2025-2033, this analysis provides actionable intelligence for industry stakeholders. Leveraging cutting-edge market intelligence and expert analysis, this report unveils growth trajectories, technological advancements, and key opportunities within the road sweeper vehicle industry.

pavement sweep vehicle Market Concentration & Dynamics

The global pavement sweep vehicle market exhibits a moderately concentrated landscape, with a few key players dominating market share. Leading manufacturers such as Bucher, Elgin, FAYAT GROUP, Alamo Group, and Aebi Schmidt have established significant presences through strategic product portfolios and robust distribution networks. Innovation ecosystems are burgeoning, driven by a growing emphasis on pure electric vehicle technology and advanced digital solutions for fleet management. Regulatory frameworks, particularly concerning emissions standards and operational efficiency, are increasingly shaping market dynamics. Substitute products, while limited in direct function, include manual sweeping services and smaller, specialized cleaning equipment. End-user trends indicate a strong demand for fuel-efficient and environmentally friendly road sweepers, with a growing preference for autonomous and semi-autonomous capabilities. Mergers and acquisitions (M&A) activities, estimated at a count of over 20 significant deals throughout the study period (2019-2033), highlight the industry's drive for consolidation and enhanced market reach. Leading companies like FAUN and Alfred Karcher have been instrumental in shaping these dynamics through strategic acquisitions, aiming to expand their product offerings and geographical footprints. The overall market share distribution suggests that the top five players collectively command approximately 65% of the global market, with emerging players gaining traction in niche segments.

pavement sweep vehicle Industry Insights & Trends

The pavement sweep vehicle market is poised for substantial growth, projected to reach a market size exceeding 5,000 million by the end of the forecast period (2033). This expansion is underpinned by a remarkable Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year 2025. Key growth drivers include escalating urbanization, leading to increased demand for effective urban roads maintenance and waste management. Government initiatives promoting cleaner urban environments and sustainable infrastructure development are further fueling market expansion. Technological disruptions are revolutionizing the sector, with a significant shift towards pure electric vehicle sweepers that offer reduced emissions and lower operational costs. Advancements in sensor technology, GPS integration, and artificial intelligence are paving the way for more efficient route optimization and enhanced operational capabilities. Evolving consumer behaviors, particularly the growing public awareness and demand for eco-friendly solutions, are compelling manufacturers to invest heavily in green technologies. The increasing use of sweepers in construction plants and airport & seaport applications, where stringent cleanliness and safety standards are paramount, also contributes significantly to market growth. The historical period (2019-2024) witnessed a steady demand, with a notable acceleration in adoption rates for electric variants in the latter half, setting a strong foundation for future expansion. The market is also seeing increased investments in smart city infrastructure, which inherently requires sophisticated sweeping solutions for maintaining public spaces.

Key Markets & Segments Leading pavement sweep Vehicle

The pavement sweep vehicle market is witnessing robust growth across various applications and vehicle types. The Urban Roads segment stands out as the dominant force, driven by the ever-increasing need for efficient waste and debris removal in densely populated areas. Economic growth and infrastructure development in emerging economies are significant drivers in this segment.

Urban Roads:

- Drivers: Rapid urbanization, rising public health concerns, government mandates for clean cities, and increasing road network expansion.

- Dominance Analysis: Municipalities and city councils are the primary end-users, investing heavily in advanced sweeping solutions to manage public spaces, pedestrian zones, and transportation arteries. The sheer volume of road networks and the continuous need for maintenance make this segment the largest contributor to market revenue, projected to account for over 40% of the total market value by 2033. The demand for high-capacity and versatile sweepers capable of handling diverse debris types is a key characteristic of this segment.

Construction Plants:

- Drivers: Increased construction activity globally, stringent safety regulations on construction sites, and the need to prevent dust and debris pollution.

- Dominance Analysis: This segment is experiencing steady growth, fueled by infrastructure projects and real estate development. Companies operating in this sector require robust and specialized sweepers that can efficiently clear construction sites, ensuring compliance with environmental and safety standards. The market value for this segment is estimated to reach approximately 1,000 million by 2033.

Airport & Seaport:

- Drivers: Strict hygiene and safety requirements, high operational tempo, and the need for specialized equipment for tarmac and apron cleaning.

- Dominance Analysis: Airports and seaports represent a high-value niche market. The specialized nature of sweeping in these environments, which requires machines capable of handling fuel spills, de-icing residues, and fine dust, drives demand for advanced and reliable equipment. This segment is expected to contribute around 700 million to the market by 2033, characterized by high-performance and durable sweeping solutions.

Others:

- Drivers: Industrial facilities, mining operations, and large commercial complexes requiring specialized cleaning.

- Dominance Analysis: This segment, while smaller, offers significant growth potential for customized solutions. Industrial parks and large manufacturing facilities are increasingly adopting specialized sweeping vehicles for maintaining operational efficiency and adhering to environmental regulations.

In terms of vehicle types:

Pure Electric Vehicle:

- Drivers: Growing environmental consciousness, government incentives for electric mobility, and reduced operational costs (fuel and maintenance).

- Dominance Analysis: The adoption of pure electric vehicle sweepers is a major trend, projected to capture over 60% of the market share by 2033. Their silent operation and zero tailpipe emissions make them ideal for urban environments and sensitive areas. Leading manufacturers like Hako and Tennant are at the forefront of this technological shift.

Fuel Vehicle:

- Drivers: Established infrastructure, longer range capabilities for extensive operations, and lower initial purchase costs.

- Dominance Analysis: While electric variants are gaining dominance, fuel vehicle sweepers will continue to hold a significant market share, particularly in regions with less developed charging infrastructure or for operations requiring extended range. This segment is expected to represent approximately 35% of the market by 2033, with ongoing improvements in fuel efficiency and emissions control.

pavement sweep vehicle Product Developments

Recent pavement sweep vehicle product developments are significantly enhancing operational efficiency and environmental sustainability. Innovations focus on advanced dust suppression systems, improved water management for reduced consumption, and the integration of intelligent route planning software. The emergence of compact and highly maneuverable sweepers for tight urban spaces, alongside larger, heavy-duty machines for industrial applications, reflects a diversified product strategy. Manufacturers like Madvac Exprolink and TYMCO are pioneering new designs that optimize debris collection and minimize downtime. The market relevance is amplified by the growing demand for vehicles that meet increasingly stringent emission standards and offer lower total cost of ownership.

Challenges in the pavement sweep vehicle Market

The pavement sweep vehicle market faces several challenges. High initial purchase costs for advanced pure electric vehicle models can be a barrier for smaller municipalities and private contractors. Stringent regulatory compliance, particularly regarding noise pollution and emissions, necessitates continuous investment in research and development, adding to production costs. Supply chain disruptions for specialized components, especially in the wake of global events, can lead to production delays and increased lead times, impacting market availability. Competitive pressures from numerous players, including established giants and emerging manufacturers like ZOOMLION and CLW Group, often lead to price wars, squeezing profit margins. The estimated impact of these challenges on market growth can be a reduction of approximately 5-10% in projected CAGR if not addressed proactively.

Forces Driving pavement sweep vehicle Growth

Several forces are driving the growth of the pavement sweep vehicle market. Technological advancements, particularly in electrification and autonomous driving capabilities, are creating a demand for more efficient and environmentally friendly solutions. Economic growth and increased government spending on infrastructure development and urban renewal projects are directly contributing to the need for effective road maintenance. Regulatory mandates pushing for cleaner air and reduced noise pollution are compelling municipalities and private entities to adopt advanced sweeping technologies. The growing global emphasis on sustainability and smart city initiatives further bolsters the demand for innovative road sweeper vehicles.

Challenges in the pavement Sweep Vehicle Market

Long-term growth catalysts in the pavement sweep vehicle market are rooted in continuous innovation and strategic market expansion. The development of next-generation electric powertrains offering extended range and faster charging times will be crucial. Furthermore, the integration of AI and IoT for predictive maintenance and real-time operational data analysis will unlock new levels of efficiency. Strategic partnerships between vehicle manufacturers and smart city technology providers, along with collaborations with end-users for customized solution development, will foster sustained growth. Market expansion into developing economies, where infrastructure development is rapidly progressing, presents significant untapped potential.

Emerging Opportunities in pavement sweep vehicle

Emerging opportunities in the pavement sweep vehicle market lie in the burgeoning demand for specialized sweepers designed for unique environments such as tunnels, railways, and industrial complexes. The increasing adoption of IoT-enabled fleet management systems and data analytics offers significant opportunities for service-based business models. The development of modular sweeper designs that can be adapted for various tasks presents a versatile solution for diverse user needs. Furthermore, the growing focus on circular economy principles presents an opportunity for manufacturers to develop sweepers utilizing recycled materials and promoting the recyclability of components at the end of their lifecycle.

Leading Players in the pavement sweep vehicle Sector

- Bucher

- Elgin

- FAYAT GROUP

- Alamo Group

- Aebi Schmidt

- Madvac Exprolink

- Hako

- Tennant

- FAUN

- Alfred Karcher

- Boschung

- Dulevo

- Global Sweeper

- TYMCO

- KATO

- ZOOMLION

- CLW Group

- Ceksan Sweepers

- Infore Environment

- Airuite New Energy Special Purpose Vehicle

Key Milestones in pavement sweep vehicle Industry

- 2019: Increased adoption of GPS tracking for optimized route management in fleet operations.

- 2020: Significant investments in R&D for electric sweeper technologies by major manufacturers.

- 2021 (Q3): Launch of advanced dust suppression systems by Elgin, improving air quality.

- 2022 (Q1): FAYAT GROUP announces strategic acquisition to expand its market presence in Asia.

- 2022 (Q4): Introduction of AI-powered route optimization software by Tennant for enhanced efficiency.

- 2023 (Q2): Madvac Exprolink unveils a new generation of compact electric sweepers for urban mobility.

- 2024 (Q1): Alamo Group expands its portfolio with the acquisition of a specialized sweeper component manufacturer.

- 2024 (Q3): FAUN introduces a new hydrogen fuel cell sweeper prototype, signaling future trends.

Strategic Outlook for pavement sweep vehicle Market

- 2019: Increased adoption of GPS tracking for optimized route management in fleet operations.

- 2020: Significant investments in R&D for electric sweeper technologies by major manufacturers.

- 2021 (Q3): Launch of advanced dust suppression systems by Elgin, improving air quality.

- 2022 (Q1): FAYAT GROUP announces strategic acquisition to expand its market presence in Asia.

- 2022 (Q4): Introduction of AI-powered route optimization software by Tennant for enhanced efficiency.

- 2023 (Q2): Madvac Exprolink unveils a new generation of compact electric sweepers for urban mobility.

- 2024 (Q1): Alamo Group expands its portfolio with the acquisition of a specialized sweeper component manufacturer.

- 2024 (Q3): FAUN introduces a new hydrogen fuel cell sweeper prototype, signaling future trends.

Strategic Outlook for pavement sweep vehicle Market

The strategic outlook for the pavement sweep vehicle market is highly positive, driven by a confluence of technological innovation, environmental consciousness, and robust infrastructure investment. Growth accelerators include the continued transition towards pure electric vehicle sweepers, advancements in smart city integration, and the expansion of services beyond simple equipment sales. Manufacturers focusing on delivering sustainable, efficient, and data-driven sweeping solutions will be best positioned for success. Strategic opportunities lie in penetrating emerging markets, fostering collaborations for technological advancements, and developing product portfolios that cater to the diverse needs of urban roads, construction plants, and airport & seaport applications. The market's future potential is immense, promising a cleaner and more efficient urban landscape.

pavement sweep vehicle Segmentation

-

1. Application

- 1.1. Urban Roads

- 1.2. Construction Plants

- 1.3. Airport & Seaport

- 1.4. Others

-

2. Types

- 2.1. Pure Electric Vehicle

- 2.2. Fuel Vehicle

pavement sweep vehicle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

pavement sweep vehicle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global pavement sweep vehicle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Urban Roads

- 5.1.2. Construction Plants

- 5.1.3. Airport & Seaport

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pure Electric Vehicle

- 5.2.2. Fuel Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America pavement sweep vehicle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Urban Roads

- 6.1.2. Construction Plants

- 6.1.3. Airport & Seaport

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pure Electric Vehicle

- 6.2.2. Fuel Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America pavement sweep vehicle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Urban Roads

- 7.1.2. Construction Plants

- 7.1.3. Airport & Seaport

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pure Electric Vehicle

- 7.2.2. Fuel Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe pavement sweep vehicle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Urban Roads

- 8.1.2. Construction Plants

- 8.1.3. Airport & Seaport

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pure Electric Vehicle

- 8.2.2. Fuel Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa pavement sweep vehicle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Urban Roads

- 9.1.2. Construction Plants

- 9.1.3. Airport & Seaport

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pure Electric Vehicle

- 9.2.2. Fuel Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific pavement sweep vehicle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Urban Roads

- 10.1.2. Construction Plants

- 10.1.3. Airport & Seaport

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pure Electric Vehicle

- 10.2.2. Fuel Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bucher

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elgin

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FAYAT GROUP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alamo Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aebi Schmidt

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Madvac Exprolink

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hako

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tennant

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FAUN

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alfred Karcher

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Boschung

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dulevo

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Global Sweeper

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TYMCO

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 KATO

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ZOOMLION

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 CLW Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ceksan Sweepers

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Infore Environment

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Airuite New Energy Special Purpose Vehicle

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Bucher

List of Figures

- Figure 1: Global pavement sweep vehicle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global pavement sweep vehicle Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America pavement sweep vehicle Revenue (million), by Application 2024 & 2032

- Figure 4: North America pavement sweep vehicle Volume (K), by Application 2024 & 2032

- Figure 5: North America pavement sweep vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America pavement sweep vehicle Volume Share (%), by Application 2024 & 2032

- Figure 7: North America pavement sweep vehicle Revenue (million), by Types 2024 & 2032

- Figure 8: North America pavement sweep vehicle Volume (K), by Types 2024 & 2032

- Figure 9: North America pavement sweep vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America pavement sweep vehicle Volume Share (%), by Types 2024 & 2032

- Figure 11: North America pavement sweep vehicle Revenue (million), by Country 2024 & 2032

- Figure 12: North America pavement sweep vehicle Volume (K), by Country 2024 & 2032

- Figure 13: North America pavement sweep vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America pavement sweep vehicle Volume Share (%), by Country 2024 & 2032

- Figure 15: South America pavement sweep vehicle Revenue (million), by Application 2024 & 2032

- Figure 16: South America pavement sweep vehicle Volume (K), by Application 2024 & 2032

- Figure 17: South America pavement sweep vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America pavement sweep vehicle Volume Share (%), by Application 2024 & 2032

- Figure 19: South America pavement sweep vehicle Revenue (million), by Types 2024 & 2032

- Figure 20: South America pavement sweep vehicle Volume (K), by Types 2024 & 2032

- Figure 21: South America pavement sweep vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America pavement sweep vehicle Volume Share (%), by Types 2024 & 2032

- Figure 23: South America pavement sweep vehicle Revenue (million), by Country 2024 & 2032

- Figure 24: South America pavement sweep vehicle Volume (K), by Country 2024 & 2032

- Figure 25: South America pavement sweep vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America pavement sweep vehicle Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe pavement sweep vehicle Revenue (million), by Application 2024 & 2032

- Figure 28: Europe pavement sweep vehicle Volume (K), by Application 2024 & 2032

- Figure 29: Europe pavement sweep vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe pavement sweep vehicle Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe pavement sweep vehicle Revenue (million), by Types 2024 & 2032

- Figure 32: Europe pavement sweep vehicle Volume (K), by Types 2024 & 2032

- Figure 33: Europe pavement sweep vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe pavement sweep vehicle Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe pavement sweep vehicle Revenue (million), by Country 2024 & 2032

- Figure 36: Europe pavement sweep vehicle Volume (K), by Country 2024 & 2032

- Figure 37: Europe pavement sweep vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe pavement sweep vehicle Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa pavement sweep vehicle Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa pavement sweep vehicle Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa pavement sweep vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa pavement sweep vehicle Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa pavement sweep vehicle Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa pavement sweep vehicle Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa pavement sweep vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa pavement sweep vehicle Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa pavement sweep vehicle Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa pavement sweep vehicle Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa pavement sweep vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa pavement sweep vehicle Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific pavement sweep vehicle Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific pavement sweep vehicle Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific pavement sweep vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific pavement sweep vehicle Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific pavement sweep vehicle Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific pavement sweep vehicle Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific pavement sweep vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific pavement sweep vehicle Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific pavement sweep vehicle Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific pavement sweep vehicle Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific pavement sweep vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific pavement sweep vehicle Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global pavement sweep vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global pavement sweep vehicle Volume K Forecast, by Region 2019 & 2032

- Table 3: Global pavement sweep vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global pavement sweep vehicle Volume K Forecast, by Application 2019 & 2032

- Table 5: Global pavement sweep vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global pavement sweep vehicle Volume K Forecast, by Types 2019 & 2032

- Table 7: Global pavement sweep vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global pavement sweep vehicle Volume K Forecast, by Region 2019 & 2032

- Table 9: Global pavement sweep vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global pavement sweep vehicle Volume K Forecast, by Application 2019 & 2032

- Table 11: Global pavement sweep vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global pavement sweep vehicle Volume K Forecast, by Types 2019 & 2032

- Table 13: Global pavement sweep vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global pavement sweep vehicle Volume K Forecast, by Country 2019 & 2032

- Table 15: United States pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global pavement sweep vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global pavement sweep vehicle Volume K Forecast, by Application 2019 & 2032

- Table 23: Global pavement sweep vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global pavement sweep vehicle Volume K Forecast, by Types 2019 & 2032

- Table 25: Global pavement sweep vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global pavement sweep vehicle Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global pavement sweep vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global pavement sweep vehicle Volume K Forecast, by Application 2019 & 2032

- Table 35: Global pavement sweep vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global pavement sweep vehicle Volume K Forecast, by Types 2019 & 2032

- Table 37: Global pavement sweep vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global pavement sweep vehicle Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global pavement sweep vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global pavement sweep vehicle Volume K Forecast, by Application 2019 & 2032

- Table 59: Global pavement sweep vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global pavement sweep vehicle Volume K Forecast, by Types 2019 & 2032

- Table 61: Global pavement sweep vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global pavement sweep vehicle Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global pavement sweep vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global pavement sweep vehicle Volume K Forecast, by Application 2019 & 2032

- Table 77: Global pavement sweep vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global pavement sweep vehicle Volume K Forecast, by Types 2019 & 2032

- Table 79: Global pavement sweep vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global pavement sweep vehicle Volume K Forecast, by Country 2019 & 2032

- Table 81: China pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific pavement sweep vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific pavement sweep vehicle Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the pavement sweep vehicle?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the pavement sweep vehicle?

Key companies in the market include Bucher, Elgin, FAYAT GROUP, Alamo Group, Aebi Schmidt, Madvac Exprolink, Hako, Tennant, FAUN, Alfred Karcher, Boschung, Dulevo, Global Sweeper, TYMCO, KATO, ZOOMLION, CLW Group, Ceksan Sweepers, Infore Environment, Airuite New Energy Special Purpose Vehicle.

3. What are the main segments of the pavement sweep vehicle?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "pavement sweep vehicle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the pavement sweep vehicle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the pavement sweep vehicle?

To stay informed about further developments, trends, and reports in the pavement sweep vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence