Key Insights

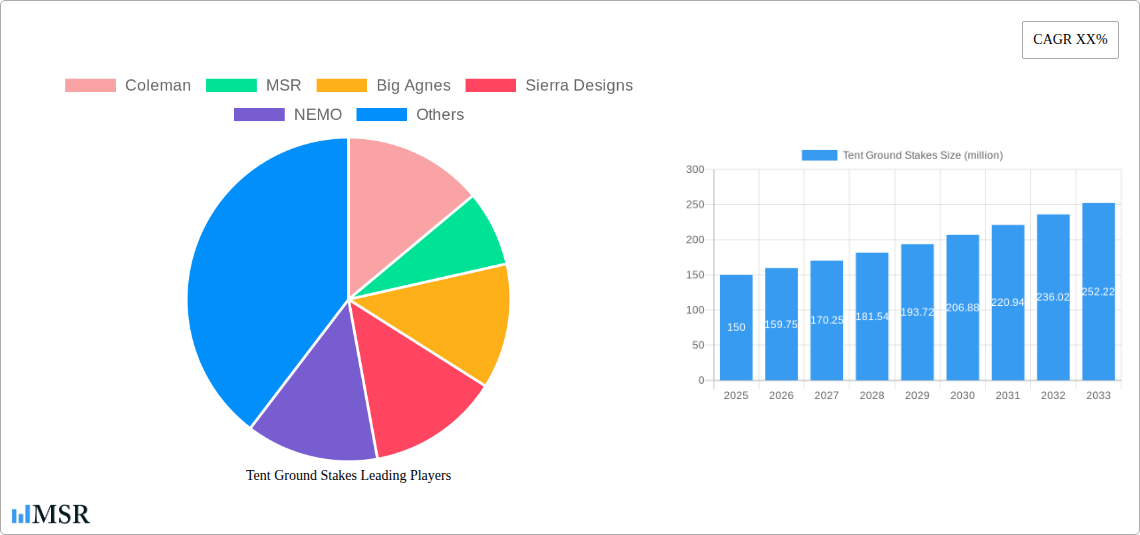

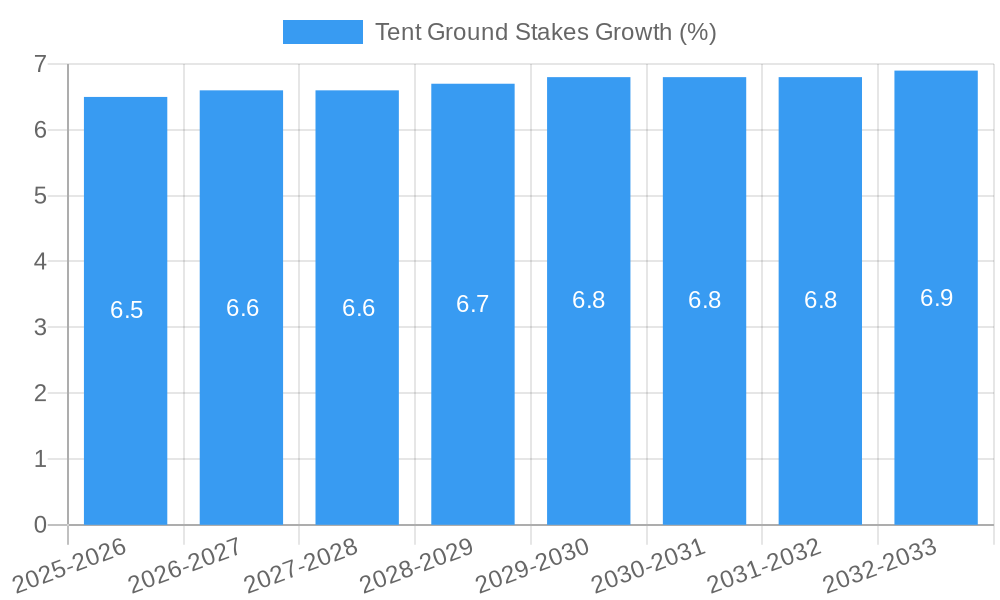

The global market for tent ground stakes is experiencing robust growth, estimated to reach approximately USD 150 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is primarily driven by the surging popularity of outdoor recreational activities, including camping, hiking, and backpacking, fueled by a growing desire for nature-based experiences and a post-pandemic surge in domestic tourism. The increasing accessibility of camping gear, coupled with a wider variety of tent types and sizes to accommodate different needs, further bolsters market demand. Furthermore, advancements in material science are leading to the development of lighter, stronger, and more durable ground stakes made from materials like titanium alloys and carbon fiber, enhancing their appeal to outdoor enthusiasts seeking reliable and portable equipment. Innovations in stake design, such as improved anchoring mechanisms and reflective elements for nighttime visibility, are also contributing to market expansion.

The market is bifurcated between online and offline sales channels, with online platforms demonstrating a higher growth trajectory due to their convenience, wider selection, and competitive pricing. Offline sales, however, remain significant, supported by specialized outdoor gear retailers offering expert advice and hands-on product experience. Key players such as Coleman, MSR, and Big Agnes are actively engaged in product innovation and strategic marketing to capture a larger market share. The market's growth is also influenced by emerging economies in the Asia Pacific region, where outdoor recreation is gaining traction. While the market presents significant opportunities, potential restraints include the seasonality of outdoor activities in certain regions and the impact of adverse weather conditions, which can temporarily dampen consumer spending on camping equipment. Nevertheless, the overarching trend of consumers embracing outdoor lifestyles is expected to sustain the positive market trajectory.

Tent Ground Stakes Market Concentration & Dynamics

The global tent ground stakes market exhibits a moderate to high concentration, driven by a blend of established outdoor recreation brands and specialized manufacturers. Key players like Coleman, MSR, Big Agnes, Sierra Designs, NEMO, Vargo, and Sea To Summit command significant market share through extensive product portfolios and strong brand recognition. The innovation ecosystem is dynamic, with a continuous push towards lighter, stronger, and more durable materials such as titanium alloy and carbon fibre. Regulatory frameworks, while generally permissive for outdoor equipment, may indirectly influence product standards and safety certifications. Substitute products, including rocks, logs, and specialized anchoring systems, exist but offer less portability and reliability for dedicated tent setups. End-user trends favor lightweight, compact, and eco-friendly camping solutions, aligning with the growth of outdoor activities like backpacking and glamping. Mergers and acquisitions (M&A) activity is currently subdued, with a predicted count of 5-10 M&A deals annually, primarily involving smaller, innovative startups being acquired by larger entities seeking to enhance their product offerings or technological capabilities. The market share of leading companies is estimated to be between 45% and 60% collectively.

Tent Ground Stakes Industry Insights & Trends

The tent ground stakes market is poised for substantial growth, projected to reach a market size of approximately $800 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025–2033. This expansion is primarily fueled by the burgeoning global interest in outdoor recreation, including camping, hiking, and adventure tourism. The post-pandemic era has witnessed a surge in individuals seeking nature-based experiences, directly translating into increased demand for camping equipment, with tent ground stakes forming an essential component. Technological disruptions are playing a crucial role, with continuous advancements in material science leading to the development of ultralight yet incredibly strong stakes made from titanium alloy and carbon fibre. These materials offer superior corrosion resistance and tensile strength compared to traditional aluminum or steel stakes, appealing to serious outdoor enthusiasts who prioritize performance and weight savings. Evolving consumer behaviors are also shaping the industry. There is a growing preference for sustainable and eco-friendly products, prompting manufacturers to explore recycled materials and minimize their environmental footprint. Furthermore, the rise of e-commerce platforms has democratized access to a wider range of tent ground stakes, enabling smaller brands to reach a global audience and driving competitive pricing and product innovation. The online sales segment is expected to outpace offline sales due to convenience and broader selection. The historical period of 2019–2024 has already laid a strong foundation, with steady growth attributed to increasing disposable incomes and a growing middle class participating in outdoor activities across developed and emerging economies. The base year of 2025 sees the market at an estimated $550 million, with continued upward trajectory anticipated.

Key Markets & Segments Leading Tent Ground Stakes

The online sales segment is emerging as a dominant force in the tent ground stakes market, driven by unparalleled accessibility, wider product selection, and competitive pricing. E-commerce platforms have revolutionized how consumers purchase outdoor gear, allowing individuals to compare various aluminium section, titanium alloy, and carbon fibre options from brands like Coleman, MSR, Big Agnes, Sierra Designs, NEMO, Vargo, Sea To Summit, Swiss Piranha, Outwell, Hilleberg, Eurmax, All One Tech, Orange Screw, TOAKS, FANBX, AnyGear, Coghlan's, Alpkit, NGT, and Quechua without geographical limitations. This ease of purchase is particularly appealing to younger demographics and those in remote areas with limited access to brick-and-mortar stores.

- Drivers for Online Sales Dominance:

- Global Reach: Online platforms transcend geographical boundaries, allowing manufacturers to tap into international markets.

- Convenience: 24/7 shopping access and doorstep delivery cater to busy lifestyles.

- Price Transparency & Comparison: Consumers can easily compare prices and read reviews, leading to informed purchasing decisions.

- Niche Market Access: Online marketplaces facilitate the discovery and purchase of specialized or boutique tent ground stake products.

The titanium alloy segment is also experiencing significant growth, especially among serious backpackers and mountaineers who prioritize weight reduction and extreme durability. While more expensive than aluminium, titanium stakes offer a superior strength-to-weight ratio, exceptional corrosion resistance, and are less prone to bending or breaking in harsh conditions. This premium segment is driven by the pursuit of high-performance outdoor gear.

- Drivers for Titanium Alloy Segment Growth:

- Ultralight Backpacking Trend: The increasing popularity of minimalist camping and long-distance trekking emphasizes the need for lightweight gear.

- Extreme Durability Demands: Mountaineering, desert camping, and high-wind environments necessitate stakes that can withstand extreme forces.

- Technological Advancements: Improved manufacturing techniques are making titanium stakes more accessible and cost-effective.

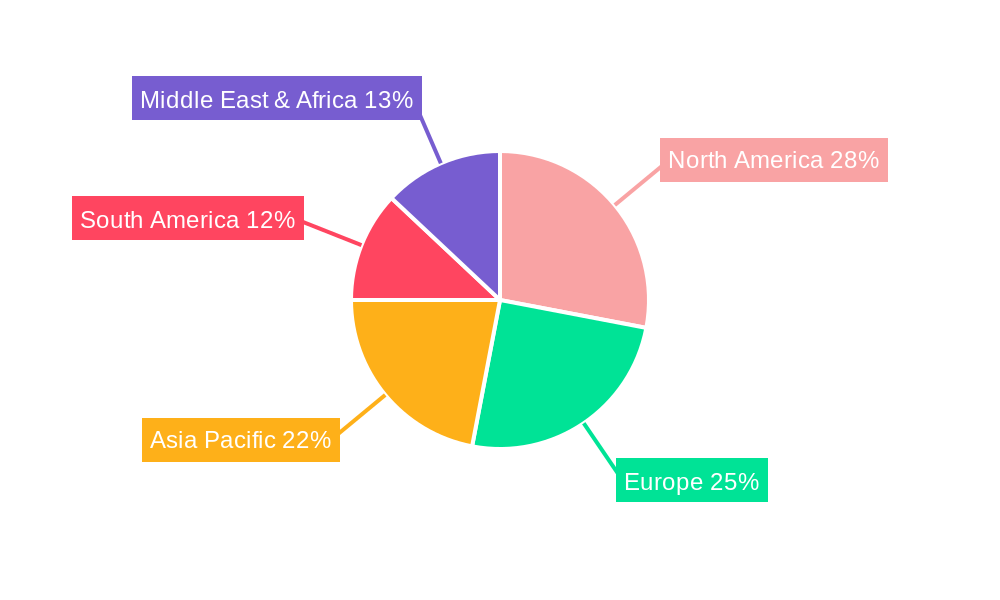

Geographically, North America and Europe continue to lead the market, owing to well-established outdoor recreation cultures, higher disposable incomes, and extensive national park systems that encourage camping. Emerging markets in Asia-Pacific are showing promising growth, fueled by increasing urbanization, a growing middle class, and a rising interest in adventure tourism.

Tent Ground Stakes Product Developments

Product innovations in tent ground stakes are predominantly focused on material science and design optimization. The introduction of ultra-lightweight carbon fibre stakes offers exceptional strength and flexibility, appealing to ultralight backpackers. Advancements in titanium alloy forging have resulted in stakes with superior tensile strength and corrosion resistance. Furthermore, innovative designs like integrated reflective elements for increased visibility, multi-directional anchoring capabilities, and ergonomic grips for easier insertion and removal are enhancing user experience. Market relevance is directly tied to performance in diverse environmental conditions, weight, durability, and ease of use, with companies like Vargo and Orange Screw leading in innovative designs.

Challenges in the Tent Ground Stakes Market

The tent ground stakes market faces several challenges that can hinder its growth. Supply chain disruptions, particularly for raw materials like titanium and specialized alloys, can lead to production delays and increased costs. Price sensitivity among casual campers can limit the adoption of premium materials like carbon fibre and titanium, creating a price-performance dilemma. Counterfeit products entering the market can dilute brand value and pose safety risks. Furthermore, environmental regulations regarding material sourcing and manufacturing processes may add compliance burdens. Quantifiable impacts include an estimated 10-15% increase in production costs due to material volatility and a 5-10% reduction in market penetration for premium products due to price barriers.

Forces Driving Tent Ground Stakes Growth

Several key forces are propelling the tent ground stakes market forward. The increasing global popularity of outdoor activities such as camping, hiking, and backpacking is the primary driver. Technological advancements in material science, leading to lighter, stronger, and more durable stakes made from titanium and carbon fibre, are enhancing product performance. Growing environmental consciousness is also influencing demand for sustainable and eco-friendly camping gear. Furthermore, government initiatives promoting tourism and outdoor recreation in various regions contribute to market expansion.

Challenges in the Tent Ground Stakes Market

Long-term growth catalysts for the tent ground stakes market lie in continuous innovation and strategic market expansion. The development of smart tent ground stakes with integrated sensors for ground condition monitoring or even small lighting capabilities presents a future opportunity. Partnerships between tent manufacturers and stake producers can lead to bundled offerings and enhanced brand synergy. Furthermore, penetrating emerging markets in Asia and South America, where outdoor recreation is gaining traction, offers significant long-term growth potential.

Emerging Opportunities in Tent Ground Stakes

Emerging opportunities in the tent ground stakes sector are multifaceted. The growing trend of glamping and luxury camping opens avenues for high-end, aesthetically pleasing, and feature-rich stakes. The development of biodegradable or recycled material stakes caters to the eco-conscious consumer base. Furthermore, exploring new applications beyond traditional tent anchoring, such as in agricultural or temporary outdoor structures, could unlock new market segments. The rental market for camping equipment also presents an opportunity for durable, high-quality stake manufacturers.

Leading Players in the Tent Ground Stakes Sector

- Coleman

- MSR

- Big Agnes

- Sierra Designs

- NEMO

- Vargo

- Sea To Summit

- Swiss Piranha

- Outwell

- Hilleberg

- Eurmax

- All One Tech

- Orange Screw

- TOAKS

- FANBX

- AnyGear

- Coghlan's

- Alpkit

- NGT

- Quechua

Key Milestones in Tent Ground Stakes Industry

- 2019: Introduction of advanced anodized aluminum stakes with improved grip and durability.

- 2020: Significant increase in demand driven by the global surge in outdoor activities and domestic travel.

- 2021: Enhanced focus on sustainable material sourcing and production by several key manufacturers.

- 2022: Emergence of ultralight carbon fiber stakes gaining traction among serious backpackers.

- 2023: Increased adoption of online sales channels, with a notable shift away from traditional retail for many consumers.

- 2024: Development of innovative stake designs featuring enhanced visibility and easier insertion mechanisms.

- 2025: Projected continued market growth driven by strong consumer engagement in outdoor pursuits.

- 2026-2033: Anticipated ongoing innovation in materials science and design, leading to specialized and high-performance tent ground stakes.

Strategic Outlook for Tent Ground Stakes Market

The strategic outlook for the tent ground stakes market is highly positive, with significant growth accelerators expected. Continued investment in research and development for advanced materials like graphene-infused composites will drive product innovation. Expanding distribution networks to include emerging markets and fostering partnerships with outdoor retailers and influencers will be crucial. The increasing demand for sustainable and eco-friendly solutions presents a prime opportunity for companies to differentiate themselves and capture market share. Strategic focus on enhancing online presence and e-commerce capabilities will also be vital for sustained growth and market leadership.

Tent Ground Stakes Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Aluminium Section

- 2.2. Titanium Alloy

- 2.3. Carbon Fibre

- 2.4. Others

Tent Ground Stakes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tent Ground Stakes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tent Ground Stakes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Aluminium Section

- 5.2.2. Titanium Alloy

- 5.2.3. Carbon Fibre

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tent Ground Stakes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Aluminium Section

- 6.2.2. Titanium Alloy

- 6.2.3. Carbon Fibre

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tent Ground Stakes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Aluminium Section

- 7.2.2. Titanium Alloy

- 7.2.3. Carbon Fibre

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tent Ground Stakes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Aluminium Section

- 8.2.2. Titanium Alloy

- 8.2.3. Carbon Fibre

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tent Ground Stakes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Aluminium Section

- 9.2.2. Titanium Alloy

- 9.2.3. Carbon Fibre

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tent Ground Stakes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Aluminium Section

- 10.2.2. Titanium Alloy

- 10.2.3. Carbon Fibre

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Coleman

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MSR

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Big Agnes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sierra Designs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NEMO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vargo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sea To Summit

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Swiss Piranha

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Outwell

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hilleberg

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eurmax

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 All One Tech

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Orange Screw

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TOAKS

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 FANBX

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AnyGear

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Coghlan's

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Alpkit

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 NGT

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Quechua

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Coleman

List of Figures

- Figure 1: Global Tent Ground Stakes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Tent Ground Stakes Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Tent Ground Stakes Revenue (million), by Application 2024 & 2032

- Figure 4: North America Tent Ground Stakes Volume (K), by Application 2024 & 2032

- Figure 5: North America Tent Ground Stakes Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Tent Ground Stakes Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Tent Ground Stakes Revenue (million), by Types 2024 & 2032

- Figure 8: North America Tent Ground Stakes Volume (K), by Types 2024 & 2032

- Figure 9: North America Tent Ground Stakes Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Tent Ground Stakes Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Tent Ground Stakes Revenue (million), by Country 2024 & 2032

- Figure 12: North America Tent Ground Stakes Volume (K), by Country 2024 & 2032

- Figure 13: North America Tent Ground Stakes Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Tent Ground Stakes Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Tent Ground Stakes Revenue (million), by Application 2024 & 2032

- Figure 16: South America Tent Ground Stakes Volume (K), by Application 2024 & 2032

- Figure 17: South America Tent Ground Stakes Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Tent Ground Stakes Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Tent Ground Stakes Revenue (million), by Types 2024 & 2032

- Figure 20: South America Tent Ground Stakes Volume (K), by Types 2024 & 2032

- Figure 21: South America Tent Ground Stakes Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Tent Ground Stakes Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Tent Ground Stakes Revenue (million), by Country 2024 & 2032

- Figure 24: South America Tent Ground Stakes Volume (K), by Country 2024 & 2032

- Figure 25: South America Tent Ground Stakes Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Tent Ground Stakes Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Tent Ground Stakes Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Tent Ground Stakes Volume (K), by Application 2024 & 2032

- Figure 29: Europe Tent Ground Stakes Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Tent Ground Stakes Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Tent Ground Stakes Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Tent Ground Stakes Volume (K), by Types 2024 & 2032

- Figure 33: Europe Tent Ground Stakes Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Tent Ground Stakes Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Tent Ground Stakes Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Tent Ground Stakes Volume (K), by Country 2024 & 2032

- Figure 37: Europe Tent Ground Stakes Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Tent Ground Stakes Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Tent Ground Stakes Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Tent Ground Stakes Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Tent Ground Stakes Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Tent Ground Stakes Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Tent Ground Stakes Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Tent Ground Stakes Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Tent Ground Stakes Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Tent Ground Stakes Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Tent Ground Stakes Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Tent Ground Stakes Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Tent Ground Stakes Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Tent Ground Stakes Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Tent Ground Stakes Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Tent Ground Stakes Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Tent Ground Stakes Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Tent Ground Stakes Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Tent Ground Stakes Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Tent Ground Stakes Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Tent Ground Stakes Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Tent Ground Stakes Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Tent Ground Stakes Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Tent Ground Stakes Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Tent Ground Stakes Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Tent Ground Stakes Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tent Ground Stakes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tent Ground Stakes Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Tent Ground Stakes Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Tent Ground Stakes Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Tent Ground Stakes Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Tent Ground Stakes Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Tent Ground Stakes Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Tent Ground Stakes Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Tent Ground Stakes Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Tent Ground Stakes Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Tent Ground Stakes Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Tent Ground Stakes Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Tent Ground Stakes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Tent Ground Stakes Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Tent Ground Stakes Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Tent Ground Stakes Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Tent Ground Stakes Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Tent Ground Stakes Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Tent Ground Stakes Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Tent Ground Stakes Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Tent Ground Stakes Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Tent Ground Stakes Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Tent Ground Stakes Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Tent Ground Stakes Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Tent Ground Stakes Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Tent Ground Stakes Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Tent Ground Stakes Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Tent Ground Stakes Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Tent Ground Stakes Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Tent Ground Stakes Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Tent Ground Stakes Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Tent Ground Stakes Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Tent Ground Stakes Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Tent Ground Stakes Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Tent Ground Stakes Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Tent Ground Stakes Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Tent Ground Stakes Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Tent Ground Stakes Volume K Forecast, by Country 2019 & 2032

- Table 81: China Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Tent Ground Stakes Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Tent Ground Stakes Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tent Ground Stakes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Tent Ground Stakes?

Key companies in the market include Coleman, MSR, Big Agnes, Sierra Designs, NEMO, Vargo, Sea To Summit, Swiss Piranha, Outwell, Hilleberg, Eurmax, All One Tech, Orange Screw, TOAKS, FANBX, AnyGear, Coghlan's, Alpkit, NGT, Quechua.

3. What are the main segments of the Tent Ground Stakes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tent Ground Stakes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tent Ground Stakes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tent Ground Stakes?

To stay informed about further developments, trends, and reports in the Tent Ground Stakes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence