Key Insights

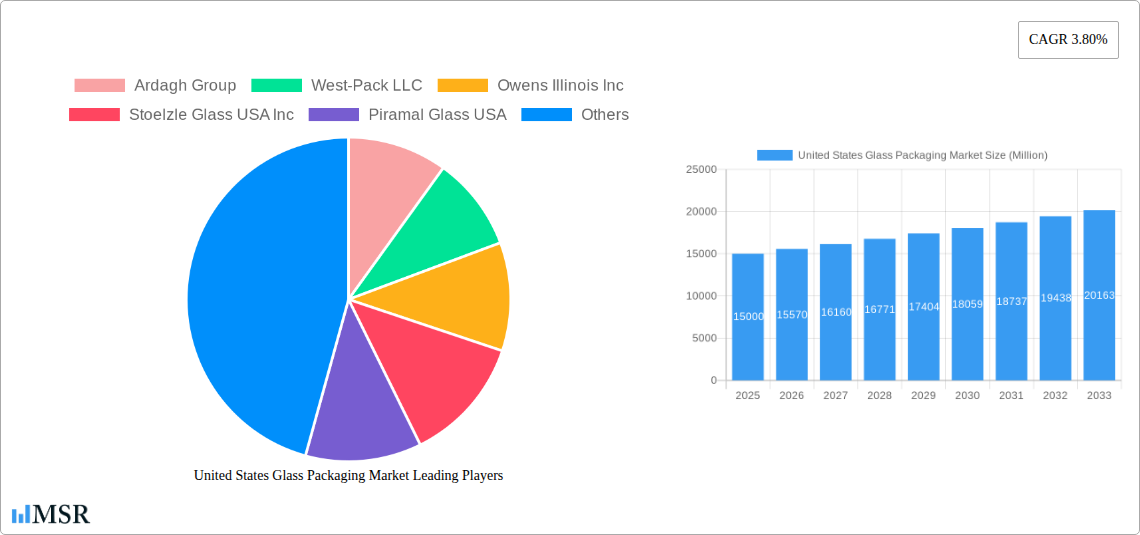

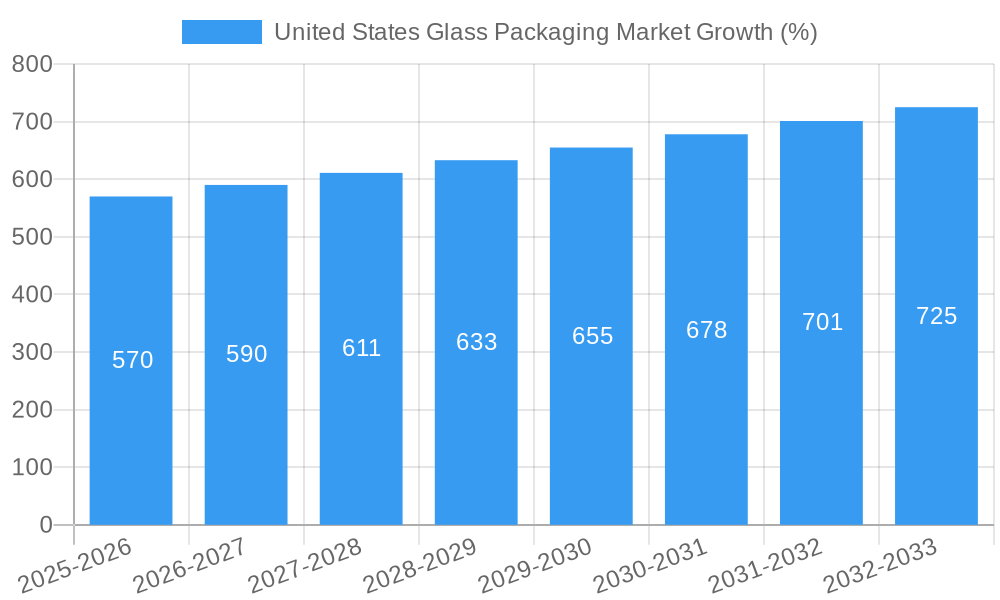

The United States glass packaging market, valued at approximately $15 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for sustainable and eco-friendly packaging solutions is a significant driver, as glass is infinitely recyclable and perceived as a healthier alternative to plastics, particularly within the food and beverage sectors. Growth in the e-commerce sector and the consequent rise in demand for convenient and safe product packaging also contribute significantly to market expansion. The personal care and healthcare industries are major consumers of glass packaging, further bolstering market demand. Specific product segments like bottles and jars dominate the market due to their versatility and suitability across diverse applications. However, the market faces challenges such as fluctuating raw material prices (namely silica sand and soda ash) and the potential for increased competition from alternative packaging materials like lightweight plastics and sustainable alternatives. While these restraints exist, the strong emphasis on environmental sustainability and the inherent qualities of glass packaging suggest a positive outlook for the market's continued growth in the coming years.

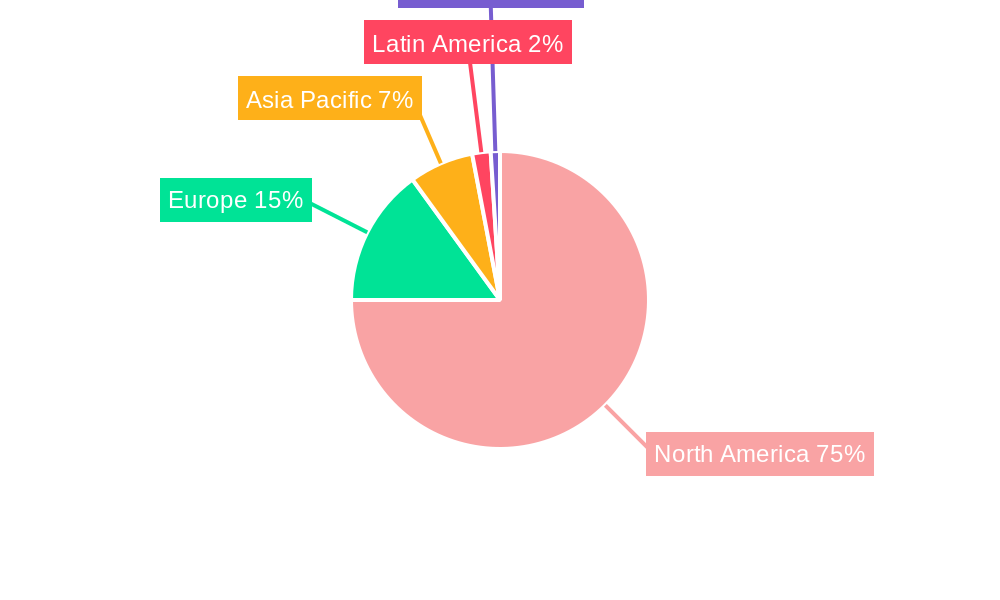

Despite challenges from competing materials, the robust CAGR of 3.80% indicates consistent expansion through 2033. This growth is expected to be propelled by innovation within the glass packaging industry itself, focusing on lighter weight designs to reduce transportation costs and environmental impact. Furthermore, ongoing advancements in glass manufacturing technologies will contribute to enhanced efficiency and potentially lower production costs. The geographic distribution of market share is likely skewed towards the North American region, reflecting the substantial domestic consumption within the United States. However, regional variations will exist, influenced by consumer preferences and regulatory landscapes. The forecast period of 2025-2033 presents significant opportunities for established players like Ardagh Group and Owens-Illinois Inc., as well as for emerging companies offering innovative glass packaging solutions.

United States Glass Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States glass packaging market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, key segments, leading players, and future growth opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United States Glass Packaging Market Market Concentration & Dynamics

The United States glass packaging market exhibits a moderately concentrated landscape, with key players like Ardagh Group, Owens Illinois Inc, and Gerresheimer AG holding significant market share. However, the presence of several smaller players and regional manufacturers contributes to competitive dynamics. Market share data for 2024 shows Ardagh Group holding approximately xx%, Owens Illinois Inc at xx%, and Gerresheimer AG at xx%. The remaining market share is distributed among other companies, creating opportunities for both established and emerging players.

Innovation within the sector focuses on sustainable packaging solutions, lightweighting technologies, and enhanced design aesthetics to meet evolving consumer preferences. Stringent regulatory frameworks concerning recyclability and material sourcing are shaping industry practices, incentivizing the adoption of eco-friendly manufacturing processes. Substitute materials, such as plastic and aluminum, present ongoing competitive pressure. However, the increasing consumer preference for sustainable packaging options is driving demand for glass, mitigating this pressure.

Mergers and acquisitions (M&A) activity in the recent years (2019-2024) has seen approximately xx deals, mostly focused on expanding production capacity, broadening product portfolios, and securing strategic partnerships. These activities signal consolidation within the market and a push towards economies of scale and diversification.

- Market Concentration: Moderately concentrated, with a few major players dominating

- Innovation: Sustainable solutions, lightweighting, and design enhancements

- Regulation: Stricter rules on recyclability and material sourcing

- Substitute Products: Plastic and aluminum packaging pose competitive threats

- End-User Trends: Growing demand for sustainable and aesthetically pleasing packaging

- M&A Activity: xx deals from 2019-2024, indicating consolidation and growth strategies.

United States Glass Packaging Market Industry Insights & Trends

The United States glass packaging market has witnessed consistent growth driven by several factors. The rising demand for packaged food and beverages, coupled with the increasing consumer preference for environmentally friendly packaging, fuels market expansion. Technological advancements in glass manufacturing, such as the introduction of lighter-weight bottles and jars, are improving efficiency and lowering production costs. The shift towards e-commerce and online retail has further boosted the demand for glass packaging, particularly for food and personal care products. These trends contribute to a robust growth trajectory, with a market size of xx Million in 2025 expected to grow to xx Million by 2033. This translates to a projected CAGR of xx% during the forecast period. Evolving consumer behaviors, with an increasing awareness of environmental sustainability and product safety, are directly influencing packaging choices, driving preference towards glass.

Key Markets & Segments Leading United States Glass Packaging Market

The Beverage segment dominates the end-user industry, accounting for approximately xx% of the market in 2025, followed by the Food segment at approximately xx%. Within product categories, Bottles constitute the largest segment, capturing a market share of approximately xx% in 2025. The Northeast region shows the highest market share, driven by a dense population and robust food and beverage industries.

- Dominant Segment (End-User): Beverage

- Dominant Segment (Product): Bottles

- Dominant Region: Northeast

- Drivers:

- Growing Food & Beverage Industry

- Increasing Consumer Preference for Sustainable Packaging

- Strong Economic Growth in Key Regions

- Well-developed Infrastructure supporting production and distribution.

United States Glass Packaging Market Product Developments

Recent product developments focus heavily on lightweighting technologies to reduce material usage and transportation costs. Innovations include the development of new glass formulations with improved strength and durability, and the introduction of enhanced surface treatments for improved printability and aesthetics. These advancements cater to the increasing demand for sustainable, efficient, and visually appealing packaging solutions, offering manufacturers a significant competitive edge.

Challenges in the United States Glass Packaging Market Market

The industry faces challenges from fluctuating raw material prices, particularly silica sand and natural gas, impacting production costs. Supply chain disruptions, exacerbated by global events, can lead to production delays and increased costs. Intense competition from substitute packaging materials like plastic and aluminum poses a significant threat. Additionally, stricter environmental regulations continuously raise the cost of compliance for manufacturers. For example, recent increases in energy costs have impacted production costs by approximately xx%, affecting profitability.

Forces Driving United States Glass Packaging Market Growth

Technological advancements in glass manufacturing and lightweighting contribute to cost optimization and enhanced performance. The increasing demand for sustainable and recyclable packaging solutions fuels market growth. Government regulations and incentives supporting environmentally conscious products further drive market expansion. For example, tax breaks for companies using recycled glass in their production process drive more eco-friendly practices.

Long-Term Growth Catalysts in the United States Glass Packaging Market

Long-term growth is fueled by the continuous innovation in glass production technologies, leading to lighter, stronger, and more sustainable packaging options. Strategic partnerships and collaborations between packaging manufacturers and brand owners are driving the development of bespoke solutions. Expanding into new markets and product segments, such as specialized pharmaceutical packaging, creates further growth potential.

Emerging Opportunities in United States Glass Packaging Market

The growing demand for premium and customized glass packaging, particularly in niche segments like craft beverages and cosmetics, presents significant opportunities. The incorporation of smart packaging technologies, such as sensors for tracking product freshness, is a promising area. The increasing popularity of reusable glass containers also opens a new avenue for growth and contributes to increased market sustainability.

Leading Players in the United States Glass Packaging Market Sector

- Ardagh Group

- West-Pack LLC

- Owens Illinois Inc

- Stoelzle Glass USA Inc

- Piramal Glass USA

- Heinz Glas USA Inc

- Gerresheimer AG

- Vitro SAB de CV

Key Milestones in United States Glass Packaging Market Industry

April 2022: Ardagh Glass Packaging partnered with Kansas City Bier Company, highlighting the growing demand for sustainable glass beer bottles in the US market. This partnership solidified Ardagh's position as a key supplier in the craft beer segment.

January 2022: Gerresheimer's expansion of glass vial capacity demonstrates the increasing demand for pharmaceutical packaging, impacting the overall market growth and enhancing Gerresheimer's market position. The 150 Million vial increase per year is a significant contribution to the industry's production capacity.

Strategic Outlook for United States Glass Packaging Market Market

The United States glass packaging market is poised for continued growth, driven by strong demand from various end-user industries and a growing focus on sustainability. Strategic opportunities lie in investing in innovative technologies, expanding production capacity to meet the rising demand, and developing strategic partnerships to capture new market segments. Focusing on eco-friendly practices and catering to the ever-evolving consumer preferences will be crucial for long-term success in this dynamic market.

United States Glass Packaging Market Segmentation

-

1. Products

- 1.1. Bottles

- 1.2. Jars

- 1.3. Vials

- 1.4. Others

-

2. End-User Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal care

- 2.4. Healthcare

- 2.5. Household care

- 2.6. Other End-user Industries

United States Glass Packaging Market Segmentation By Geography

- 1. United States

United States Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market

- 3.3. Market Restrains

- 3.3.1. ; Recycling Concerns and Dependence on End-user Uptake

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Food and Beverage Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Bottles

- 5.1.2. Jars

- 5.1.3. Vials

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal care

- 5.2.4. Healthcare

- 5.2.5. Household care

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America United States Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 7. Europe United States Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Germany

- 7.1.3 France

- 7.1.4 Rest of Europe

- 8. Asia Pacific United States Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 India

- 8.1.3 Japan

- 8.1.4 Rest of Asia Pacific

- 9. Latin America United States Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ardagh Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 West-Pack LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Owens Illinois Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stoelzle Glass USA Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Piramal Glass USA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Heinz Glas USA Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gerresheimer AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vitro SAB de CV*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Ardagh Group

List of Figures

- Figure 1: United States Glass Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Glass Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: United States Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Glass Packaging Market Revenue Million Forecast, by Products 2019 & 2032

- Table 3: United States Glass Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: United States Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United States Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United States Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States Glass Packaging Market Revenue Million Forecast, by Products 2019 & 2032

- Table 23: United States Glass Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 24: United States Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Glass Packaging Market?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the United States Glass Packaging Market?

Key companies in the market include Ardagh Group, West-Pack LLC, Owens Illinois Inc, Stoelzle Glass USA Inc, Piramal Glass USA, Heinz Glas USA Inc, Gerresheimer AG, Vitro SAB de CV*List Not Exhaustive.

3. What are the main segments of the United States Glass Packaging Market?

The market segments include Products, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market.

6. What are the notable trends driving market growth?

Rising Demand from the Food and Beverage Driving the Market.

7. Are there any restraints impacting market growth?

; Recycling Concerns and Dependence on End-user Uptake.

8. Can you provide examples of recent developments in the market?

April 2022: Ardagh Glass Packaging partnered with Kansas City Bier Company to supply all the brewery's glass beer bottles. Kansas City Bier exclusively packages its beer in 100% and endlessly recyclable glass bottles, and all are manufactured in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Glass Packaging Market?

To stay informed about further developments, trends, and reports in the United States Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence