Key Insights

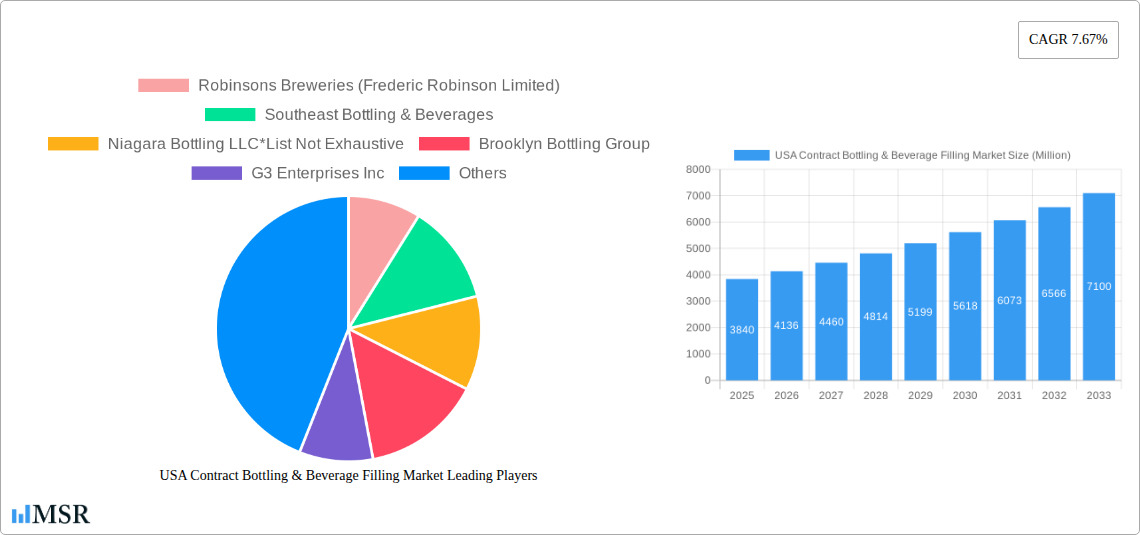

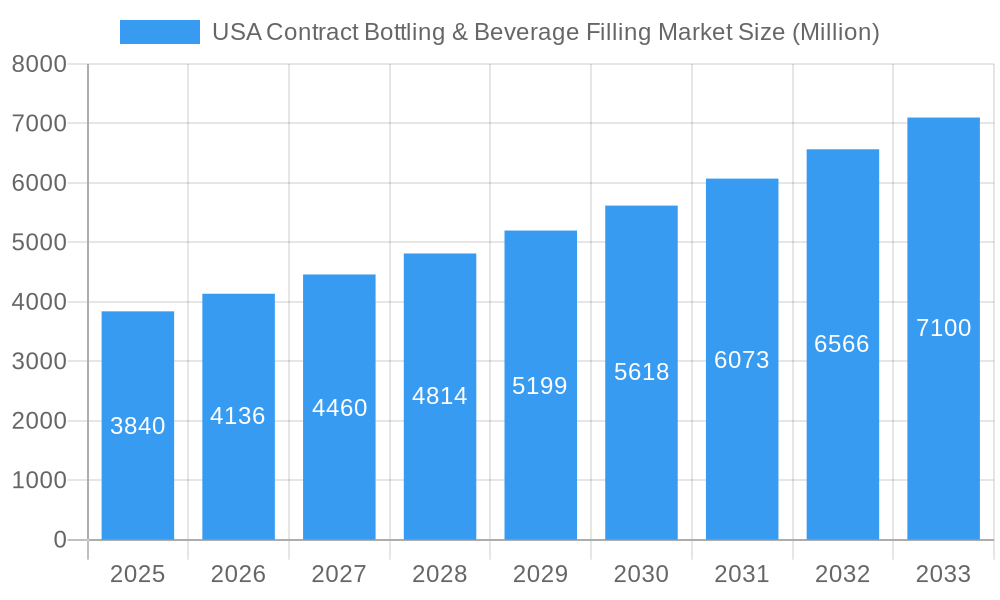

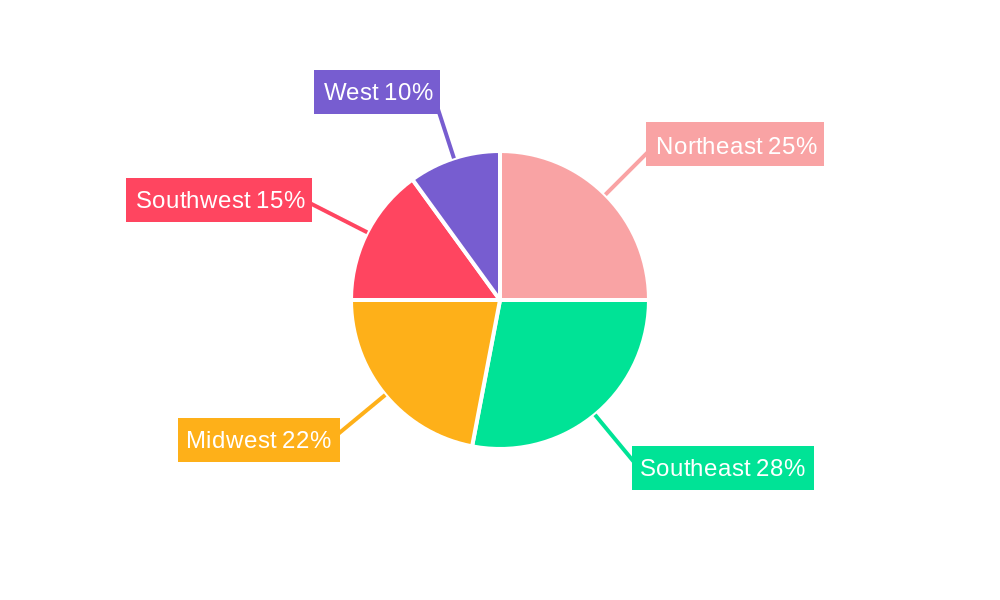

The US contract bottling and beverage filling market, valued at $3.84 billion in 2025, is projected to experience robust growth, driven by increasing demand for packaged beverages, particularly in the convenience-focused modern lifestyle. The market's Compound Annual Growth Rate (CAGR) of 7.67% from 2025 to 2033 indicates a significant expansion opportunity. Key drivers include the rising popularity of ready-to-drink beverages, growth in the food service industry requiring efficient bottling solutions, and the increasing preference for customized beverage offerings. The market is segmented by beverage type, with bottled water, carbonated drinks & fruit-based beverages, and beer holding significant market shares. The Northeast, Southeast, and West regions of the US are expected to contribute substantially to the market's growth, fueled by higher population densities and increased consumer spending. However, factors like fluctuating raw material prices and stringent regulatory compliance could pose challenges. Leading players like Robinsons Breweries, Southeast Bottling & Beverages, and Niagara Bottling are actively shaping market dynamics through strategic investments in advanced technologies and capacity expansion. The market's future prospects are bright, promising substantial returns for investors and sustained opportunities for industry players.

USA Contract Bottling & Beverage Filling Market Market Size (In Billion)

The competitive landscape is characterized by both large established players and smaller regional businesses. The presence of numerous contract bottlers provides diverse choices for beverage producers, while simultaneously driving competition and fostering innovation. This competitive environment ensures that pricing remains relatively competitive, and that beverage producers have access to various cost-effective and efficient solutions. Future growth will likely be influenced by consumer preferences, shifting beverage trends (e.g., functional beverages, plant-based options), and advancements in sustainable packaging solutions. The market's success will be determined by the ability of contract bottlers to meet the evolving demands of beverage producers, adapting their technology and operations to meet the changing market landscape.

USA Contract Bottling & Beverage Filling Market Company Market Share

USA Contract Bottling & Beverage Filling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the USA contract bottling and beverage filling market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report dissects market dynamics, trends, and opportunities, revealing the potential for significant growth. The market is projected to reach xx Million by 2033, showcasing a robust CAGR of xx%.

USA Contract Bottling & Beverage Filling Market Market Concentration & Dynamics

The USA contract bottling and beverage filling market exhibits a moderately concentrated landscape, with a handful of major players commanding significant market share. However, a considerable number of smaller, specialized contract bottlers and fillers also contribute to the overall market. Innovation is crucial, driven by advancements in automation, sustainable packaging solutions, and efficient filling technologies. Regulatory frameworks, including FDA guidelines and environmental regulations, significantly impact operational practices. Substitute products, such as single-serve beverage packs and ready-to-drink options, pose competitive challenges. End-user trends, notably the increasing demand for healthier beverages and personalized options, further shape market dynamics. Mergers and acquisitions (M&A) activity has been moderate, reflecting consolidation efforts and expansion strategies within the industry.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Deal Count: An average of xx deals per year were observed during the historical period (2019-2024).

- Innovation Focus: Automation, sustainable packaging, and efficient filling technologies.

- Regulatory Landscape: FDA compliance, environmental regulations.

- Substitute Products: Single-serve packs, RTD beverages.

USA Contract Bottling & Beverage Filling Market Industry Insights & Trends

The USA contract bottling and beverage filling market is experiencing robust growth fueled by several key factors. The rising demand for bottled beverages, particularly bottled water and ready-to-drink (RTD) options, significantly contributes to market expansion. Technological advancements, including automated filling lines and high-speed packaging systems, enhance efficiency and output, while reducing labor costs. Evolving consumer preferences, such as a preference for healthier beverages and convenient packaging, further propel growth. The market size is estimated at xx Million in 2025, with an anticipated CAGR of xx% throughout the forecast period. The increasing adoption of sustainable packaging materials, like recycled plastic and aluminum, is a significant trend influencing the market. Furthermore, the growing popularity of craft beverages and artisanal products provides opportunities for specialized contract bottlers.

Key Markets & Segments Leading USA Contract Bottling & Beverage Filling Market

The bottled water segment holds a dominant position in the USA contract bottling and beverage filling market. This dominance is primarily driven by increased consumer awareness of hydration and health, coupled with the convenient and readily available nature of bottled water. The carbonated drinks and fruit-based beverages segment also contributes significantly, propelled by the ongoing popularity of soft drinks and fruit juices.

- Bottled Water Segment Drivers:

- Rising health consciousness.

- Convenience and availability.

- Increasing disposable incomes.

- Carbonated Drinks & Fruit-based Beverages Segment Drivers:

- Persistent demand for soft drinks.

- Innovation in flavors and functional beverages.

- Expanding distribution channels.

The geographic distribution of the market is relatively diverse, with significant activity across various regions of the USA, reflecting the widespread distribution networks of major beverage companies.

USA Contract Bottling & Beverage Filling Market Product Developments

Recent product innovations focus on enhancing filling line efficiency, integrating advanced automation, and adopting sustainable packaging materials. These advancements aim to reduce production costs, minimize environmental impact, and offer greater flexibility to meet diverse beverage types and packaging requirements. The development of aseptic filling technologies ensures the preservation of product quality and extends shelf life. These developments are crucial for maintaining a competitive edge in the market.

Challenges in the USA Contract Bottling & Beverage Filling Market Market

The USA contract bottling and beverage filling market faces several challenges. Stringent regulatory compliance requirements, particularly regarding food safety and environmental regulations, increase operational costs. Fluctuations in raw material prices, such as plastic resin and aluminum, impact profitability. Intense competition from established players and emerging contract bottlers necessitates continuous innovation and efficiency improvements. Supply chain disruptions, particularly regarding packaging materials, can lead to production delays and increased costs. These challenges necessitate proactive risk management and strategic adaptation to maintain competitiveness.

Forces Driving USA Contract Bottling & Beverage Filling Market Growth

Several factors contribute to the growth of the USA contract bottling and beverage filling market. Technological advancements in automation and high-speed filling lines enhance efficiency and output. The rising demand for bottled beverages, fueled by changing consumer preferences and lifestyle trends, creates significant growth opportunities. Government initiatives promoting sustainability and reducing environmental impact drive the adoption of eco-friendly packaging materials, further boosting market expansion.

Challenges in the USA Contract Bottling & Beverage Filling Market Market

Long-term growth relies on several factors. Strategic partnerships between contract bottlers and beverage brands facilitate market expansion and access to new product lines. Technological innovation in aseptic filling and sustainable packaging enhances product quality and reduces environmental impact. Continuous improvement in operational efficiency and supply chain management optimizes costs and ensures timely delivery, thereby supporting long-term growth.

Emerging Opportunities in USA Contract Bottling & Beverage Filling Market

Emerging trends such as the growing demand for functional beverages, personalized drinks, and innovative packaging formats present significant opportunities. The increasing adoption of e-commerce and direct-to-consumer (DTC) models necessitates specialized packaging and logistical solutions. Contract bottlers focusing on niche beverage categories and sustainable practices are poised for significant growth.

Leading Players in the USA Contract Bottling & Beverage Filling Market Sector

- Robinsons Breweries (Frederic Robinson Limited)

- Southeast Bottling & Beverages

- Niagara Bottling LLC

- Brooklyn Bottling Group

- G3 Enterprises Inc

- CSD Co-Packers Inc

- Western Innovations Inc

Key Milestones in USA Contract Bottling & Beverage Filling Market Industry

- October 2021: MSI Express acquires Power Packaging, expanding its capabilities in aseptic beverage filling.

- January 2022: Encore Consumer Capital acquires Lion Beverages, boosting Lion's growth potential.

- April 2022: G3 Enterprises introduces a dedicated aluminum can supply, addressing the can shortage impacting craft brewers.

Strategic Outlook for USA Contract Bottling & Beverage Filling Market Market

The future of the USA contract bottling and beverage filling market appears promising, driven by sustained demand, technological advancements, and a focus on sustainability. Strategic partnerships, operational efficiency improvements, and innovative product offerings will be crucial for success. Contract bottlers adept at adapting to evolving consumer preferences and leveraging emerging technologies will be well-positioned for significant market share gains.

USA Contract Bottling & Beverage Filling Market Segmentation

-

1. Beverage Type

- 1.1. Beer

- 1.2. Carbonated Drinks and Fruit-based Beverages

- 1.3. Bottled Water

- 1.4. Other Beverage Types (Sport Drinks)

USA Contract Bottling & Beverage Filling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Contract Bottling & Beverage Filling Market Regional Market Share

Geographic Coverage of USA Contract Bottling & Beverage Filling Market

USA Contract Bottling & Beverage Filling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement

- 3.3. Market Restrains

- 3.3.1. Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending

- 3.4. Market Trends

- 3.4.1. Beer is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 5.1.1. Beer

- 5.1.2. Carbonated Drinks and Fruit-based Beverages

- 5.1.3. Bottled Water

- 5.1.4. Other Beverage Types (Sport Drinks)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6. North America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6.1.1. Beer

- 6.1.2. Carbonated Drinks and Fruit-based Beverages

- 6.1.3. Bottled Water

- 6.1.4. Other Beverage Types (Sport Drinks)

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7. South America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7.1.1. Beer

- 7.1.2. Carbonated Drinks and Fruit-based Beverages

- 7.1.3. Bottled Water

- 7.1.4. Other Beverage Types (Sport Drinks)

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8. Europe USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8.1.1. Beer

- 8.1.2. Carbonated Drinks and Fruit-based Beverages

- 8.1.3. Bottled Water

- 8.1.4. Other Beverage Types (Sport Drinks)

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9. Middle East & Africa USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9.1.1. Beer

- 9.1.2. Carbonated Drinks and Fruit-based Beverages

- 9.1.3. Bottled Water

- 9.1.4. Other Beverage Types (Sport Drinks)

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10. Asia Pacific USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10.1.1. Beer

- 10.1.2. Carbonated Drinks and Fruit-based Beverages

- 10.1.3. Bottled Water

- 10.1.4. Other Beverage Types (Sport Drinks)

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Southeast Bottling & Beverages

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Niagara Bottling LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brooklyn Bottling Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G3 Enterprises Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CSD Co-Packers Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Western Innovations Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

List of Figures

- Figure 1: Global USA Contract Bottling & Beverage Filling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 3: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 4: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 7: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 8: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 11: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 12: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 15: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 16: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 19: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 20: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 2: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 4: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 9: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 14: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 25: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 33: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Contract Bottling & Beverage Filling Market?

The projected CAGR is approximately 7.67%.

2. Which companies are prominent players in the USA Contract Bottling & Beverage Filling Market?

Key companies in the market include Robinsons Breweries (Frederic Robinson Limited), Southeast Bottling & Beverages, Niagara Bottling LLC*List Not Exhaustive, Brooklyn Bottling Group, G3 Enterprises Inc, CSD Co-Packers Inc, Western Innovations Inc.

3. What are the main segments of the USA Contract Bottling & Beverage Filling Market?

The market segments include Beverage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.84 Million as of 2022.

5. What are some drivers contributing to market growth?

CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement.

6. What are the notable trends driving market growth?

Beer is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending.

8. Can you provide examples of recent developments in the market?

April 2022 - G3 Enterprises introduces a new; dedicated aluminum can supply to craft brewers, RTD cocktail producers, and beverage companies. The recent aluminum can shortage has questioned this pastime, particularly for small beer companies, forced to pay more for aluminum cans if they can find them.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Contract Bottling & Beverage Filling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Contract Bottling & Beverage Filling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Contract Bottling & Beverage Filling Market?

To stay informed about further developments, trends, and reports in the USA Contract Bottling & Beverage Filling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence