Key Insights

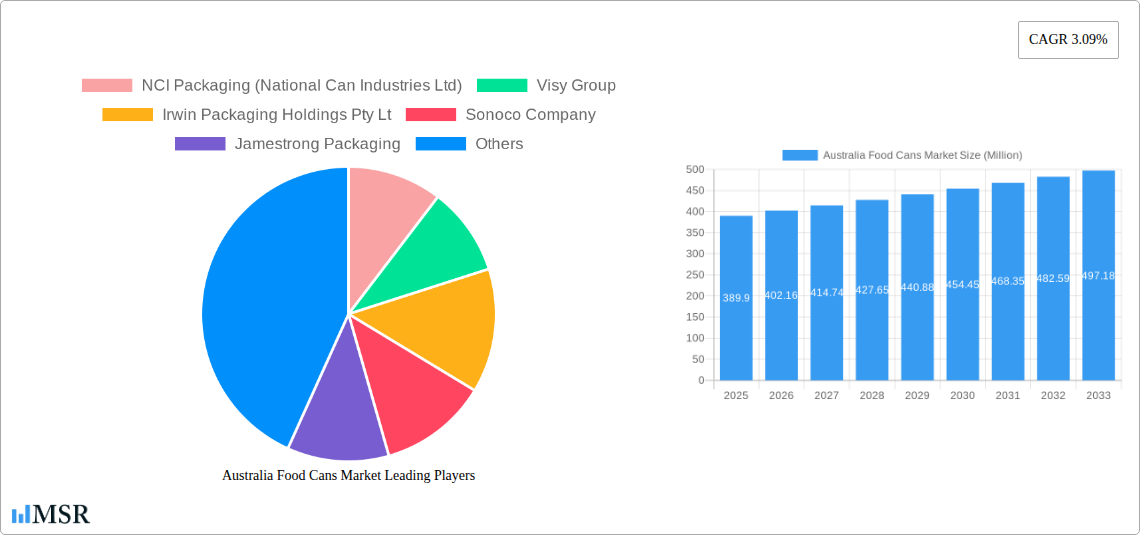

The Australian food cans market, valued at $389.90 million in 2025, is projected to experience steady growth, driven primarily by the increasing demand for convenient and shelf-stable food products. This growth is fueled by evolving consumer lifestyles, with a preference for ready-to-eat meals and on-the-go consumption. The rising popularity of pet food, particularly canned dog food, also contributes significantly to market expansion. Furthermore, advancements in can manufacturing technologies, such as improved coatings and lighter-weight materials, are enhancing the sustainability and cost-effectiveness of food cans. Steel and tin remain dominant materials, although aluminum cans are gaining traction due to their recyclability and lightweight properties. The two-piece can format holds the larger market share due to its efficient manufacturing process and lower cost. While the processed food segment currently leads in application, the fish and seafood, and fruits and vegetables segments are expected to show promising growth driven by increasing health consciousness and demand for convenient options. Key players like NCI Packaging, Visy Group, and Sonoco Company are competing based on their manufacturing capabilities, supply chain efficiency, and ability to meet diverse customer needs. Competitive pressures are expected to remain moderate throughout the forecast period, leading to strategic partnerships and investments in innovation.

Australia Food Cans Market Market Size (In Million)

The market's 3.09% CAGR from 2025 to 2033 suggests a consistent, albeit moderate, expansion. However, potential restraints include fluctuating raw material prices, particularly for steel and aluminum, and increasing environmental concerns related to waste management. Companies are proactively addressing these challenges by investing in sustainable practices and exploring innovative packaging solutions. The market's segmentation by material type, can type, and application allows for a granular understanding of consumer preferences and evolving industry trends. Regional concentration within Australia makes the market particularly susceptible to localized economic shifts and consumer behavior changes. Future market performance will depend on consumer spending patterns, technological advancements in can manufacturing, and the success of sustainability initiatives within the industry.

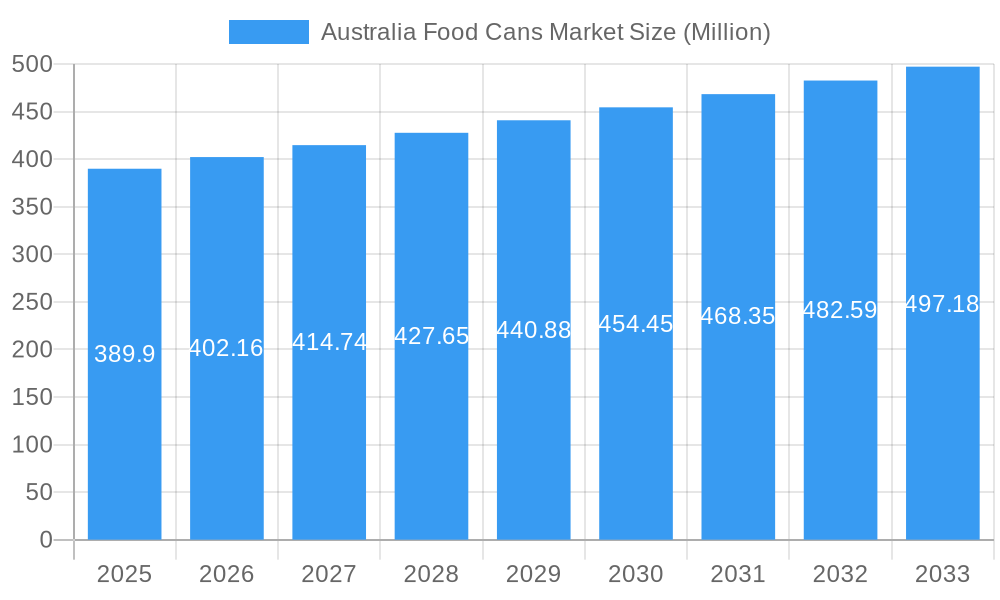

Australia Food Cans Market Company Market Share

Australia Food Cans Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian food cans market, covering market size, segmentation, key players, industry trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is invaluable for industry stakeholders, investors, and anyone seeking to understand the dynamics of this vital sector. The market is projected to reach xx Million by 2033.

Australia Food Cans Market Market Concentration & Dynamics

The Australian food cans market exhibits a moderately concentrated structure, with a handful of major players commanding significant market share. NCI Packaging (National Can Industries Ltd), Visy Group, and Sonoco Company are amongst the leading players, showcasing robust vertical integration and established supply chains. Market share data reveals that these companies collectively hold approximately xx% of the market, indicating a degree of oligopolistic competition.

- Market Concentration: xx% market share held by top 3 players.

- Innovation Ecosystem: Moderate level of R&D investment focused on sustainable packaging solutions and enhanced can designs.

- Regulatory Framework: Stringent food safety regulations and environmental standards influence packaging choices.

- Substitute Products: Plastic and other flexible packaging options pose a competitive threat, although canned food's perceived advantages in preservation and shelf life remain significant.

- End-User Trends: Growing consumer preference for convenience and sustainable packaging is driving demand for innovative can designs and materials.

- M&A Activities: The past five years have witnessed xx M&A deals, mostly focused on enhancing supply chain capabilities and expanding product portfolios. These deals highlight a trend of consolidation within the industry.

Australia Food Cans Market Industry Insights & Trends

The Australian food cans market is experiencing steady growth, driven by factors such as the increasing demand for convenient and shelf-stable food products. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements in can manufacturing, such as lightweighting and improved coating technologies, are enhancing efficiency and sustainability. Changing consumer preferences toward healthier food options and a rise in demand for pet food are also contributing to market expansion. However, fluctuations in raw material prices and environmental concerns related to metal waste management pose challenges.

Key Markets & Segments Leading Australia Food Cans Market

The Australian food cans market is segmented by material type (Steel/Tin, Aluminum), can type (2-piece, 3-piece), and application (Fish and Seafood, Fruits and Vegetables, Processed Food, Pet Food, Other Applications). While the Steel/Tin segment currently dominates, Aluminum cans are gaining traction due to their lightweight nature and recyclability. The 2-piece can type holds a larger market share due to its cost-effectiveness and ease of production. The Processed Food segment is the largest application area, followed by Fruits and Vegetables and Pet Food.

- Dominant Segment: Processed Food, driven by the high demand for convenience and long shelf life.

- Steel/Tin Segment Drivers: Cost-effectiveness and established infrastructure.

- Aluminum Segment Drivers: Lightweight, recyclability, and suitability for premium products.

- 2-Piece Can Drivers: Cost efficiency and faster production times.

- 3-Piece Can Drivers: Suitability for certain food types requiring higher pressure resistance.

- Pet Food Segment Growth Drivers: Increasing pet ownership and rising demand for premium pet food.

Australia Food Cans Market Product Developments

Recent product developments focus on sustainable packaging materials, improved can designs for enhanced functionality, and innovative coatings to extend shelf life and enhance product presentation. The industry is witnessing a shift towards lightweight cans and the incorporation of recycled content, driven by consumer demand for environmentally friendly packaging.

Challenges in the Australia Food Cans Market Market

The Australian food cans market faces challenges such as fluctuating raw material prices (e.g., steel and aluminum), intense competition from alternative packaging materials, and environmental concerns related to metal waste management. Supply chain disruptions and rising transportation costs also impact profitability. These factors contribute to price volatility and necessitate continuous cost optimization strategies.

Forces Driving Australia Food Cans Market Growth

Key growth drivers include rising demand for convenient and shelf-stable food products, increasing pet ownership, and a growing preference for sustainable packaging options. Technological advancements in can manufacturing, coupled with favorable government regulations promoting sustainable practices, further stimulate market expansion. The rising disposable income of Australian consumers also contributes to increased demand for processed and packaged foods.

Challenges in the Australia Food Cans Market Market (Long-Term Growth Catalysts)

Long-term growth hinges on continuous innovation in can design and material science, focusing on lightweighting and enhanced recyclability. Strategic partnerships with food manufacturers and retailers will be crucial for expanding market reach and enhancing product offerings. Moreover, proactive efforts in addressing environmental concerns and promoting sustainable practices will ensure the long-term viability and success of the industry.

Emerging Opportunities in Australia Food Cans Market

Emerging opportunities lie in developing innovative can designs that enhance consumer experience, adopting sustainable manufacturing practices, and expanding into niche markets like ready-to-eat meals and premium pet food. Exploring new materials and coatings to extend shelf life and improve product preservation offers significant potential for growth.

Leading Players in the Australia Food Cans Market Sector

- NCI Packaging (National Can Industries Ltd)

- Visy Group

- Irwin Packaging Holdings Pty Lt

- Sonoco Company

- Jamestrong Packaging

- CCL Industries Inc

- Perennial Packaging

- Morris McMahon & Co Pvt Ltd

- PrimePac

Key Milestones in Australia Food Cans Market Industry

- October 2023: TasFoods launched its Isle & Sky pet food brand, expanding its presence in the Australian pet food market. This highlights growing demand within the pet food segment.

- January 2024: Rising vegetable prices increase the relative affordability of canned goods, boosting demand for canned food products. This underscores the resilience of the market against inflationary pressures.

Strategic Outlook for Australia Food Cans Market Market

The Australian food cans market presents significant growth potential, driven by evolving consumer preferences, technological advancements, and rising demand for convenient and sustainable packaging. Companies that prioritize innovation, sustainability, and strategic partnerships will be best positioned to capitalize on future market opportunities and achieve sustained growth.

Australia Food Cans Market Segmentation

-

1. Material Type

- 1.1. Steel/Tin

- 1.2. Aluminum

-

2. Can Type

- 2.1. 2-piece

- 2.2. 3-piece

-

3. Application

- 3.1. Fish and Seafood

- 3.2. Fruits and Vegetables

- 3.3. Processed Food

- 3.4. Pet Food - Includes Dog Food

- 3.5. Other Applications

Australia Food Cans Market Segmentation By Geography

- 1. Australia

Australia Food Cans Market Regional Market Share

Geographic Coverage of Australia Food Cans Market

Australia Food Cans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Constant Initiatives of Recyclability and Recovery Rates of Metal Cans in Australia

- 3.3. Market Restrains

- 3.3.1. Increased Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Steel/Tin Material Type Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Steel/Tin

- 5.1.2. Aluminum

- 5.2. Market Analysis, Insights and Forecast - by Can Type

- 5.2.1. 2-piece

- 5.2.2. 3-piece

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fish and Seafood

- 5.3.2. Fruits and Vegetables

- 5.3.3. Processed Food

- 5.3.4. Pet Food - Includes Dog Food

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NCI Packaging (National Can Industries Ltd)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Visy Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Irwin Packaging Holdings Pty Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jamestrong Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CCL Industries Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Perennial Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Morris McMahon & Co Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PrimePac

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NCI Packaging (National Can Industries Ltd)

List of Figures

- Figure 1: Australia Food Cans Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Food Cans Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Australia Food Cans Market Revenue Million Forecast, by Can Type 2020 & 2033

- Table 3: Australia Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Australia Food Cans Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Australia Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Australia Food Cans Market Revenue Million Forecast, by Can Type 2020 & 2033

- Table 7: Australia Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Australia Food Cans Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Food Cans Market?

The projected CAGR is approximately 3.09%.

2. Which companies are prominent players in the Australia Food Cans Market?

Key companies in the market include NCI Packaging (National Can Industries Ltd), Visy Group, Irwin Packaging Holdings Pty Lt, Sonoco Company, Jamestrong Packaging, CCL Industries Inc, Perennial Packaging, Morris McMahon & Co Pvt Ltd, PrimePac.

3. What are the main segments of the Australia Food Cans Market?

The market segments include Material Type, Can Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 389.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Constant Initiatives of Recyclability and Recovery Rates of Metal Cans in Australia.

6. What are the notable trends driving market growth?

Steel/Tin Material Type Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increased Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

January 2024 - According to the news published by ABS Radio Brisbane, vegetables in the Australian market are getting more expensive than canned foods. As vegetables across the country experience a price increase, the affordability of canned foods remains a contrasting and attractive option for consumers. In the face of rising vegetable costs, the affordability of canned products provides a compelling incentive for consumers, emphasizing the resilience and market expansion of the Australian food can industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Food Cans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Food Cans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Food Cans Market?

To stay informed about further developments, trends, and reports in the Australia Food Cans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence