Key Insights

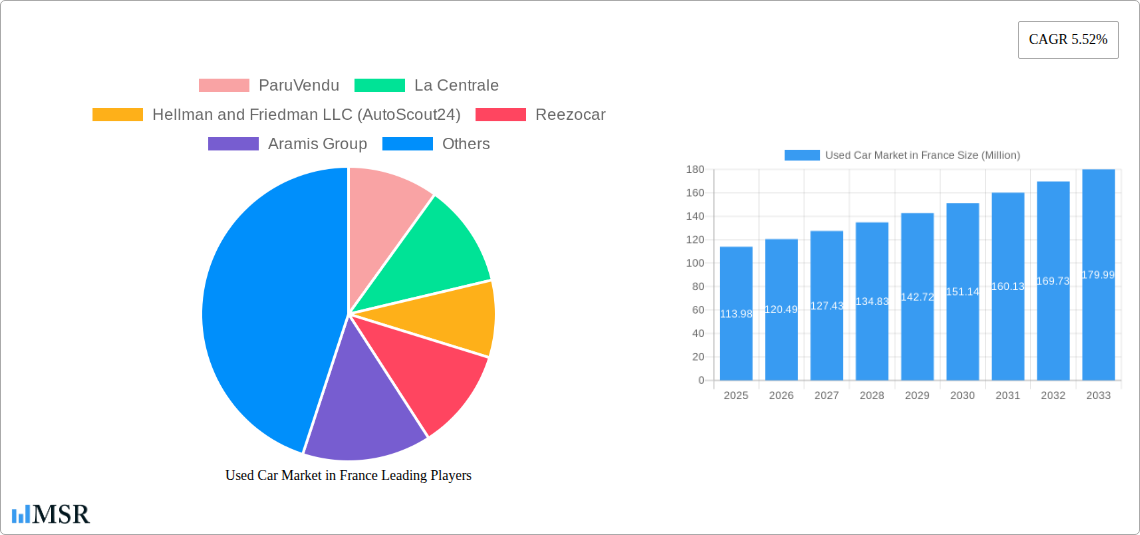

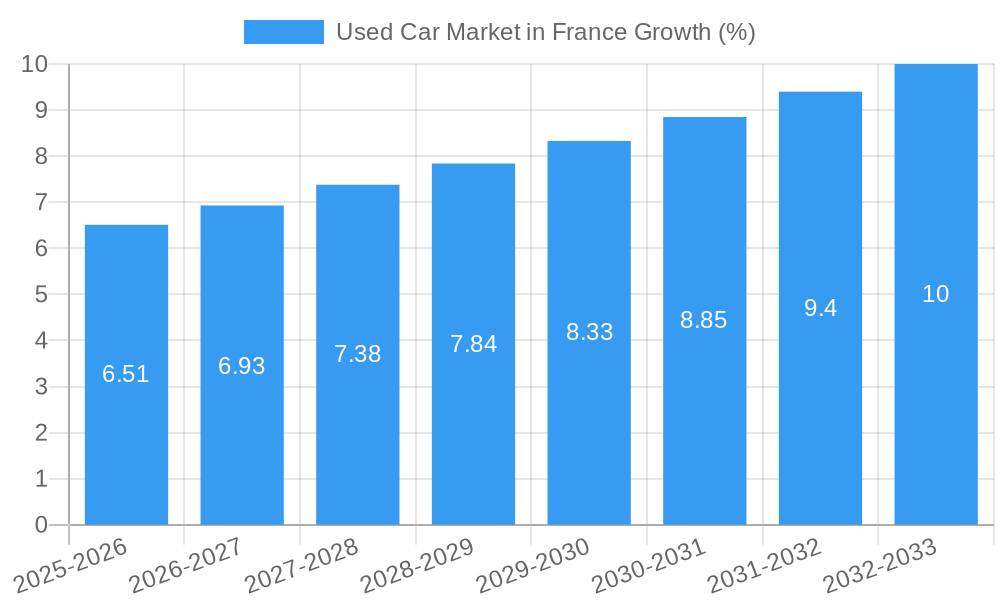

The French used car market, valued at €113.98 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing preference for cost-effective transportation options, coupled with the rising popularity of used electric vehicles (EVs) as battery technology matures and prices fall, significantly fuels market expansion. Furthermore, a strong pre-owned market is fostered by consistent vehicle turnover within the country, facilitated by efficient online and offline sales channels like those offered by major players like ParuVendu and La Centrale. The market segmentation reveals a diverse landscape, with SUVs and MPVs gaining traction among consumers, while the organized sector continues to dominate, benefiting from established infrastructure and consumer trust. However, challenges remain, including fluctuations in fuel prices impacting consumer choices, and the persistent presence of the unorganized sector leading to some market volatility. Government regulations concerning emissions and vehicle safety standards also shape market trends, creating both opportunities and constraints for businesses operating within this segment. The projected Compound Annual Growth Rate (CAGR) of 5.52% for the forecast period (2025-2033) suggests a considerable expansion in the market's overall value.

The competitive landscape is characterized by both established players and emerging online platforms, each vying for market share through innovative strategies. Established players like Aramis Group benefit from brand recognition and comprehensive services. Conversely, online marketplaces like Leboncoin and AutoScout24 capitalize on convenience and accessibility. The ongoing expansion of the electric vehicle segment presents a significant opportunity for market growth, but necessitates adaptation and investment in specialized services for these vehicles. The market's future success hinges on effective strategies to cater to evolving consumer preferences for fuel efficiency, technological advancements, and the increasing demand for seamless online transaction capabilities. The continued focus on sustainability, coupled with effective regulation, is also crucial for responsible market growth and consumer confidence.

Used Car Market in France: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the used car market in France, covering market dynamics, industry trends, key segments, and leading players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report utilizes data from the historical period (2019-2024) and estimated data for 2025 to project future market trends.

Used Car Market in France Market Concentration & Dynamics

The French used car market is characterized by a blend of established players and emerging online marketplaces. Market concentration is moderate, with a few dominant players holding significant shares, but a large number of smaller, independent dealers contributing significantly to the overall volume. Innovation is driven by online platforms improving transparency and customer experience, while regulatory frameworks, particularly concerning emissions and vehicle safety, significantly influence market dynamics. Substitute products, such as public transport and ride-sharing services, exert some pressure, but the overall demand for used cars remains robust. End-user trends indicate a preference for newer, well-maintained vehicles, particularly SUVs and hatchbacks.

- Market Share: The top three players (e.g., La Centrale, ParuVendu, Leboncoin) likely hold a combined market share of xx%, while the remaining players share the rest.

- M&A Activity: The market has witnessed xx M&A deals in the past five years, primarily driven by consolidation among online platforms and expansion into new segments. The acquisition of Cazoo’s Italian business by Aramis Group in November 2022 exemplifies this trend.

Used Car Market in France Industry Insights & Trends

The French used car market demonstrates consistent growth, driven by factors such as increasing vehicle affordability, a preference for shorter ownership cycles, and the ongoing expansion of the online sales channel. Technological disruptions, including the rise of online marketplaces and data-driven pricing models, are reshaping the industry landscape. Evolving consumer behaviors prioritize convenience, transparency, and digital interactions, demanding more user-friendly online platforms and comprehensive vehicle history reports. The market size in 2024 was estimated at €xx Million, and the CAGR from 2019 to 2024 was approximately xx%. Market projections for 2025 indicate a size of €xx Million, with a projected CAGR of xx% from 2025 to 2033. The increasing adoption of electric vehicles is also expected to influence the market in the coming years, albeit slowly.

Key Markets & Segments Leading Used Car Market in France

The French used car market is geographically dispersed, with significant activity across major cities and regions. However, detailed regional breakdowns require more precise data for each region.

By Vehicle Type:

- SUVs: Dominate the market due to their versatility and rising popularity.

- Hatchbacks: Maintain strong demand due to affordability and practicality.

- Sedans: Experience a relatively stable market share.

- MPVs: Show a declining trend due to the growing preference for SUVs.

By Vendor Type:

- Organized Dealers: Hold a larger share of the market, offering better warranties and financing options.

- Unorganized Dealers: Maintain a significant presence, particularly in smaller towns and cities, offering lower prices but often with less transparency.

By Fuel Type:

- Petrol: Still comprises a significant portion of the market, though its share is gradually decreasing.

- Diesel: Facing a decline due to environmental regulations and concerns.

- Electric: Show increasing market penetration, but adoption remains relatively low compared to petrol and diesel.

By Sales Channel:

- Online: Experiencing rapid growth driven by convenience and increased consumer trust.

- Offline: Maintains a substantial presence, particularly for those who prefer in-person vehicle inspections and interactions.

Drivers include stable economic growth in certain sectors within the French economy, along with an expanding middle class fostering increased demand.

Used Car Market in France Product Developments

Significant advancements in online platforms have improved the efficiency of the used car buying and selling process. Features like detailed vehicle history reports, virtual inspections, and online financing options have become increasingly common, enhancing transparency and buyer confidence. Companies are also focusing on providing better warranty and after-sales services. The integration of Artificial Intelligence and machine learning is streamlining inventory management and price optimization.

Challenges in the Used Car Market in France Market

The market faces challenges such as stringent emission regulations impacting the demand for older diesel vehicles, fluctuations in used car prices due to global supply chain issues, and increased competition from both established players and new entrants, including online platforms and innovative financing solutions. These factors, in combination, can potentially reduce profits and increase business costs for several key players and disrupt operations.

Forces Driving Used Car Market in France Growth

The market is driven by factors such as increasing consumer preference for used vehicles due to affordability and the economic benefits they provide, growing adoption of online platforms providing convenience and transparency, and government initiatives promoting sustainable mobility, including the shift towards electric vehicles.

Long-Term Growth Catalysts in the Used Car Market in France

Long-term growth will be fueled by the continued adoption of innovative technologies within the online marketplace improving user experiences, strategic partnerships between online and offline dealers, and expansion into new market segments including electric vehicles.

Emerging Opportunities in Used Car Market in France

Emerging opportunities lie in the growth of the electric used car market, the development of specialized services like subscription models and vehicle maintenance packages, and the increasing demand for data-driven solutions for pricing and risk management, particularly within the online sector.

Leading Players in the Used Car Market in France Sector

- ParuVendu

- La Centrale

- Hellman and Friedman LLC (AutoScout24)

- Reezocar

- Aramis Group

- OOYOO

- BYmyCAR Group

- Autospher

- Auto Beeb

- HeyCar

- Leboncoin

- BNP Paribas Fortis (Arval AutoSelect)

Key Milestones in Used Car Market in France Industry

- November 2022: Aramis Group acquires Cazoo's Italian business (Brumbrum), expanding its market reach and portfolio.

- October 2023: AutoScout24 reports a 27.07% market share for 2-5-year-old vehicles, alongside declining registrations for diesel and gasoline cars.

- January 2023: Heycar announces restructuring, reflecting challenges in maintaining profitability within the competitive online used car market.

Strategic Outlook for Used Car Market in France Market

The French used car market presents significant opportunities for growth, driven by technological innovation, evolving consumer preferences, and the increasing popularity of online marketplaces. Strategic partnerships, the development of value-added services, and investment in data-driven solutions will be crucial for success in this dynamic and competitive environment. The market exhibits strong potential for continued growth, particularly in the electric vehicle segment and the expansion of subscription-based models.

Used Car Market in France Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports Utility Vehicles (SUVs)

- 1.4. Multi-purpose Vehicles (MPVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Others (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Used Car Market in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing New Car Prices to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Presence of Various Used Car Dealerships Hampers the Market Growth

- 3.4. Market Trends

- 3.4.1. The Online Segment of the Market to Gain Traction During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports Utility Vehicles (SUVs)

- 5.1.4. Multi-purpose Vehicles (MPVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Others (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports Utility Vehicles (SUVs)

- 6.1.4. Multi-purpose Vehicles (MPVs)

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Petrol

- 6.3.2. Diesel

- 6.3.3. Electric

- 6.3.4. Others (LPG, CNG, etc.)

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. Online

- 6.4.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports Utility Vehicles (SUVs)

- 7.1.4. Multi-purpose Vehicles (MPVs)

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Petrol

- 7.3.2. Diesel

- 7.3.3. Electric

- 7.3.4. Others (LPG, CNG, etc.)

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. Online

- 7.4.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports Utility Vehicles (SUVs)

- 8.1.4. Multi-purpose Vehicles (MPVs)

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Petrol

- 8.3.2. Diesel

- 8.3.3. Electric

- 8.3.4. Others (LPG, CNG, etc.)

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. Online

- 8.4.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports Utility Vehicles (SUVs)

- 9.1.4. Multi-purpose Vehicles (MPVs)

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Petrol

- 9.3.2. Diesel

- 9.3.3. Electric

- 9.3.4. Others (LPG, CNG, etc.)

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. Online

- 9.4.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports Utility Vehicles (SUVs)

- 10.1.4. Multi-purpose Vehicles (MPVs)

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Petrol

- 10.3.2. Diesel

- 10.3.3. Electric

- 10.3.4. Others (LPG, CNG, etc.)

- 10.4. Market Analysis, Insights and Forecast - by Sales Channel

- 10.4.1. Online

- 10.4.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ParuVendu

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 La Centrale

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hellman and Friedman LLC (AutoScout24)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Reezocar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aramis Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OOYOO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BYmyCAR Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Autospher

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Auto Beeb

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HeyCar

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Leboncoin

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BNP Paribas Fortis (Arval AutoSelect)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ParuVendu

List of Figures

- Figure 1: Global Used Car Market in France Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: France Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 3: France Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 5: North America Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 6: North America Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 7: North America Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 8: North America Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 9: North America Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 10: North America Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 11: North America Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 12: North America Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: South America Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: South America Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 17: South America Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 18: South America Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 19: South America Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 20: South America Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 21: South America Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 22: South America Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Europe Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Europe Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 27: Europe Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 28: Europe Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 29: Europe Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 30: Europe Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 31: Europe Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 32: Europe Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Middle East & Africa Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Middle East & Africa Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 37: Middle East & Africa Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 38: Middle East & Africa Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 39: Middle East & Africa Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 40: Middle East & Africa Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 41: Middle East & Africa Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 42: Middle East & Africa Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 45: Asia Pacific Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 46: Asia Pacific Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 47: Asia Pacific Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 48: Asia Pacific Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 49: Asia Pacific Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 50: Asia Pacific Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 51: Asia Pacific Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 52: Asia Pacific Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Used Car Market in France Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Used Car Market in France Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Global Used Car Market in France Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 18: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 19: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 20: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 25: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 26: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 27: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 40: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 41: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 42: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 51: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 52: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 53: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market in France?

The projected CAGR is approximately 5.52%.

2. Which companies are prominent players in the Used Car Market in France?

Key companies in the market include ParuVendu, La Centrale, Hellman and Friedman LLC (AutoScout24), Reezocar, Aramis Group, OOYOO, BYmyCAR Group, Autospher, Auto Beeb, HeyCar, Leboncoin, BNP Paribas Fortis (Arval AutoSelect).

3. What are the main segments of the Used Car Market in France?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing New Car Prices to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The Online Segment of the Market to Gain Traction During the Forecast Period.

7. Are there any restraints impacting market growth?

Presence of Various Used Car Dealerships Hampers the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2023: Heycar, an online used car marketplace with operations in France, announced its restructuring strategy for its global business by reducing 16% of its 450 staff. The company stated that the restructuring aims to reduce expenditure to widen its profit margins, which have declined in recent years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market in France?

To stay informed about further developments, trends, and reports in the Used Car Market in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence