Key Insights

The Asia-Pacific casino gambling market is projected to reach $59.14 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.24%. This expansion is propelled by increasing disposable incomes and a growing middle class in key economies such as China, Japan, South Korea, and India, alongside the burgeoning popularity of online casino gaming, enhanced internet infrastructure, and widespread smartphone adoption. Innovations in game offerings, superior customer experiences driven by advanced technology, and strategic investments from major operators further fuel this growth. However, regulatory complexities, varying gambling laws across nations, and concerns regarding responsible gambling present significant challenges. Segments like live casino games, baccarat, and slots are anticipated to experience accelerated growth due to their broad appeal.

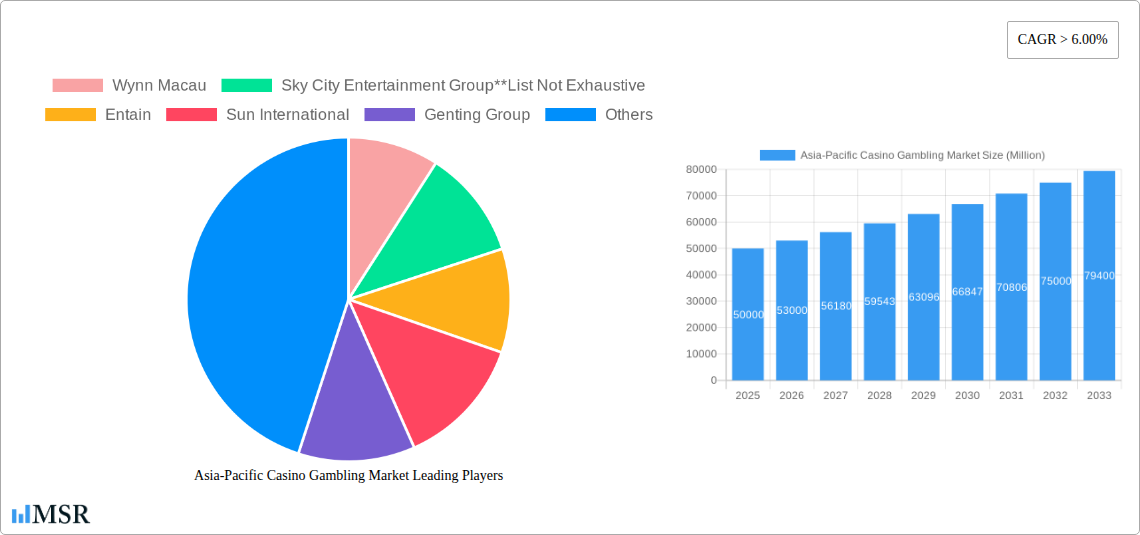

Asia-Pacific Casino Gambling Market Market Size (In Billion)

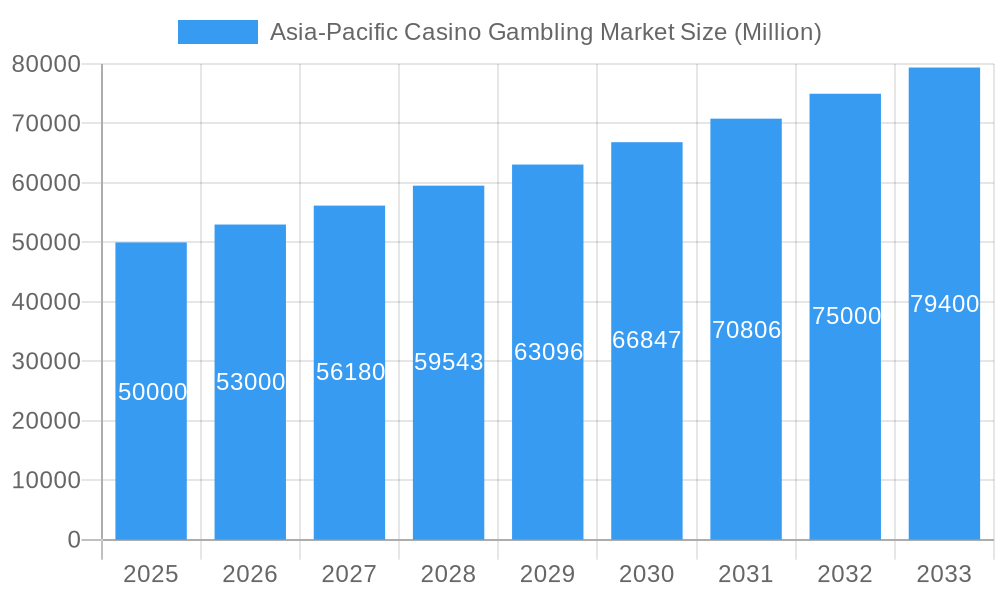

The market is segmented significantly by online platforms, aligning with global digital gaming trends. Leading players, including Wynn Macau, Sky City Entertainment Group, Entain, Sun International, and Genting Group, are actively influencing the competitive environment through technological advancements, market expansion, and game diversification. While Macau remains a dominant revenue hub, emerging markets across the region offer substantial growth potential, driving the overall market expansion. Regional regulatory frameworks and cultural perceptions of gambling will continue to shape individual country market dynamics within the Asia-Pacific region.

Asia-Pacific Casino Gambling Market Company Market Share

Asia-Pacific Casino Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific casino gambling market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The market is segmented by type (Live Casino, Baccarat, Blackjack, Poker, Slots, Other Types) and application (Online, Offline), revealing key trends and growth opportunities across the region. The report features data on market size (in Millions), CAGR, and market share, alongside detailed analysis of leading companies including Wynn Macau, Sky City Entertainment Group, Entain, Sun International, Genting Group, IGT, Melco, SJM, Crown Resorts, Galaxy Entertainment, Aristocrat, Light and Wonder, and Sands China.

Asia-Pacific Casino Gambling Market Market Concentration & Dynamics

The Asia-Pacific casino gambling market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller operators and the emergence of new entrants contribute to a dynamic competitive environment. Innovation in gaming technology, particularly in online platforms and virtual reality experiences, is driving market evolution. Regulatory frameworks vary significantly across the region, influencing market access and operational strategies. Substitute forms of entertainment, such as online gaming and esports, pose a challenge to traditional casinos. End-user trends lean towards personalized experiences, advanced technology, and responsible gaming initiatives. M&A activity has been robust in recent years, with xx major deals recorded in the past five years, reflecting consolidation efforts and expansion strategies.

- Market Share: Top 5 players account for approximately xx% of the market.

- M&A Deal Count (2019-2024): xx

- Key Regulatory Differences: Significant variations in licensing, taxation, and operational regulations across countries.

- Innovation Ecosystem: Strong focus on technological advancements, especially in online gaming and mobile platforms.

Asia-Pacific Casino Gambling Market Industry Insights & Trends

The Asia-Pacific casino gambling market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing tourism, and the expanding popularity of online gaming. The market size in 2025 is estimated at $xx Million, with a projected CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of blockchain technology and the rise of esports betting, are reshaping the industry landscape. Changing consumer behaviors, including a preference for personalized gaming experiences and a heightened awareness of responsible gaming practices, are influencing market dynamics. These trends are expected to continue to shape the industry over the next decade.

Key Markets & Segments Leading Asia-Pacific Casino Gambling Market

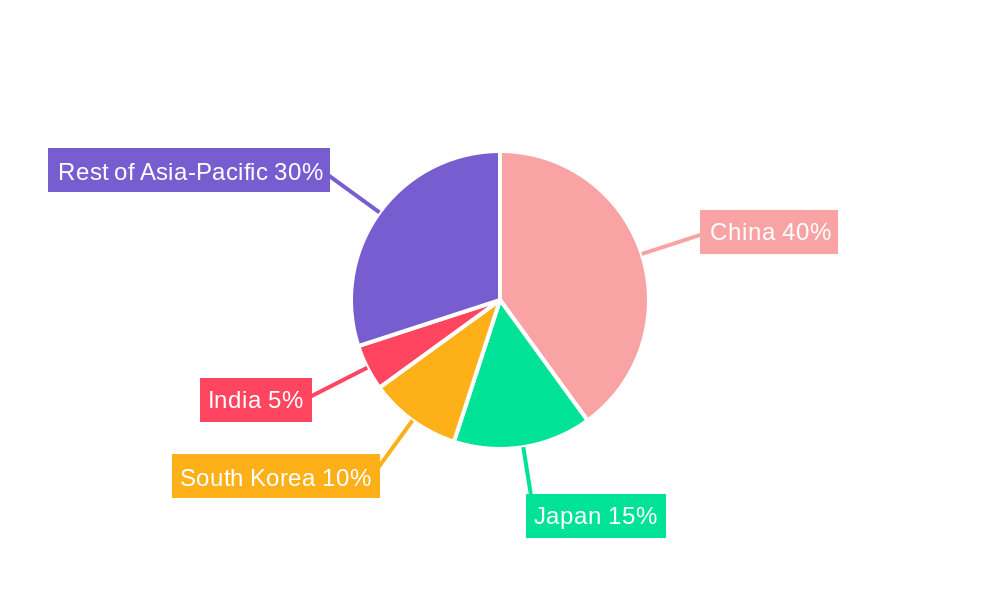

The market is geographically diverse, with significant variations in growth rates and segment dominance across countries. While specific country-level data requires a deeper dive into the full report, Macau and Singapore remain leading markets for offline casinos. Online gambling is showing rapid growth in several jurisdictions, notably in regulated markets in select countries.

By Type:

- Slots: This segment consistently holds the largest market share, driven by high demand and diverse game offerings.

- Baccarat: A highly popular game, particularly in Asian markets, contributing significantly to revenue generation.

- Live Casino: This segment is experiencing rapid growth, fueled by increasing technological advancements and the desire for an immersive gaming experience.

By Application:

- Offline Casinos: Offline casinos are the traditional backbone, though their dominance is gradually challenged by the rise of online platforms.

- Online Casinos: Online casinos are showing explosive growth, driven by technological advancements and regulatory changes in some regions.

Market Drivers:

- Economic Growth: Rising disposable incomes in several Asian countries fuel increased spending on leisure and entertainment.

- Tourism: Increased tourist arrivals to regions with established casino industries stimulate revenue.

- Technological Advancements: Innovations in gaming technology enhance player experience and attract new demographics.

- Regulatory Landscape: The gradual liberalization of online gambling in some markets opens significant new revenue streams.

Asia-Pacific Casino Gambling Market Product Developments

Recent product innovations focus on enhancing player experience through virtual reality, augmented reality, and immersive technology. The integration of mobile platforms and advanced payment systems is another key area of development. These innovations aim to create more engaging and convenient gaming experiences, leading to increased player retention and acquisition. Competitive edges are gained through unique game offerings, innovative technologies, and superior customer service.

Challenges in the Asia-Pacific Casino Gambling Market Market

The Asia-Pacific casino gambling market faces several challenges. Stringent regulatory frameworks and licensing requirements in some jurisdictions impose significant barriers to entry. Supply chain disruptions can affect the availability of gaming equipment and software. Intense competition from established players and the emergence of new entrants exert continuous pressure on profit margins. Estimates suggest that regulatory hurdles alone cost the industry $xx Million annually.

Forces Driving Asia-Pacific Casino Gambling Market Growth

Several factors fuel market growth. Technological advancements, like the integration of AI and big data analytics, enhance personalized gaming experiences. Economic growth and rising disposable incomes boost spending on entertainment. The gradual relaxation of regulations in some jurisdictions expands the market. Examples include the recent licensing of online gambling platforms in certain countries.

Challenges in the Asia-Pacific Casino Gambling Market Market

Long-term growth hinges on fostering innovation, strategic partnerships, and market expansion. Investment in research and development to develop new gaming technologies and create immersive experiences is crucial. Collaborations between gaming operators and technology companies will drive growth. Expansion into new markets and demographics requires a deep understanding of local regulations and consumer preferences.

Emerging Opportunities in Asia-Pacific Casino Gambling Market

The growing adoption of mobile gaming and the expansion of esports betting present lucrative opportunities. The integration of blockchain technology for enhanced security and transparency offers potential. Targeting underserved markets and demographic segments with tailored gaming experiences can unlock significant growth.

Leading Players in the Asia-Pacific Casino Gambling Market Sector

- Wynn Macau

- Sky City Entertainment Group

- Entain

- Sun International

- Genting Group

- IGT

- Melco

- SJM

- Crown Resorts

- Galaxy Entertainment

- Aristocrat

- Light and Wonder

- Sands China

Key Milestones in Asia-Pacific Casino Gambling Market Industry

- September 2023: Sands China Ltd partners with Emperor Entertainment Group to create 'residency shows' at the Londoner Macao, enhancing the resort's entertainment offerings and attracting a wider audience.

- July 2023: Novomatic secures distribution rights in the Philippines with Tecnet Asia, expanding its market reach and strengthening its presence in a key Asian market.

Strategic Outlook for Asia-Pacific Casino Gambling Market Market

The Asia-Pacific casino gambling market holds immense future potential. Strategic partnerships, technological innovation, and expansion into new markets are key growth accelerators. Operators who prioritize player experience, embrace responsible gaming practices, and adapt to evolving regulatory landscapes are poised for significant success. The projected market size by 2033 is estimated at $xx Million, indicating a substantial growth trajectory.

Asia-Pacific Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Other Types

-

2. Application

- 2.1. Online

- 2.2. Offline

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Japan

- 3.5. South Korea

- 3.6. Rest of Asia-Pacific

Asia-Pacific Casino Gambling Market Segmentation By Geography

- 1. China

- 2. India

- 3. Australia

- 4. Japan

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Casino Gambling Market Regional Market Share

Geographic Coverage of Asia-Pacific Casino Gambling Market

Asia-Pacific Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Online Gambling is Propelling the Market Growth across Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Australia

- 5.3.4. Japan

- 5.3.5. South Korea

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Australia

- 5.4.4. Japan

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Australia

- 6.3.4. Japan

- 6.3.5. South Korea

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Australia

- 7.3.4. Japan

- 7.3.5. South Korea

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Australia Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Australia

- 8.3.4. Japan

- 8.3.5. South Korea

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Japan Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Australia

- 9.3.4. Japan

- 9.3.5. South Korea

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Australia

- 10.3.4. Japan

- 10.3.5. South Korea

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Live Casino

- 11.1.2. Baccarat

- 11.1.3. Blackjack

- 11.1.4. Poker

- 11.1.5. Slots

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Online

- 11.2.2. Offline

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Australia

- 11.3.4. Japan

- 11.3.5. South Korea

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Wynn Macau

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sky City Entertainment Group**List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Entain

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sun International

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Genting Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 IGT

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Melco

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SJM

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Crown Resorts

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Galaxy Entertainment

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Aristocrat

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Light and Wonder

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Sands China

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Wynn Macau

List of Figures

- Figure 1: Asia-Pacific Casino Gambling Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Casino Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Casino Gambling Market?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the Asia-Pacific Casino Gambling Market?

Key companies in the market include Wynn Macau, Sky City Entertainment Group**List Not Exhaustive, Entain, Sun International, Genting Group, IGT, Melco, SJM, Crown Resorts, Galaxy Entertainment, Aristocrat, Light and Wonder, Sands China.

3. What are the main segments of the Asia-Pacific Casino Gambling Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Online Gambling is Propelling the Market Growth across Asia-Pacific.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Macau-based casino operator Sands China Ltd has partnered with Hong Kong's Emperor Entertainment Group to produce a gaming firm called 'residency shows' for the Londoner Macao resort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence