Key Insights

The Brazil Data Center Physical Security Market is experiencing robust growth, driven by the increasing adoption of cloud computing, the expanding digital economy, and stringent government regulations mandating robust data protection. The market size in 2025 is estimated at $40.40 million, reflecting a considerable expansion from its size in 2019. This growth trajectory is expected to continue throughout the forecast period (2025-2033), fueled by substantial investments in data center infrastructure and heightened concerns regarding cybersecurity threats. Key market segments include access control systems, video surveillance, intrusion detection, and perimeter security solutions. The demand for advanced security technologies, such as AI-powered video analytics and biometric authentication, is escalating as businesses seek to mitigate risks and ensure the integrity of their data assets. Furthermore, the growing adoption of colocation data centers and the expansion of hyperscale data centers are significant factors contributing to market expansion. Competition is intensifying, with both established players and emerging technology providers vying for market share. The market is characterized by a blend of local and international vendors offering a diverse range of solutions catering to varied customer needs and budgets.

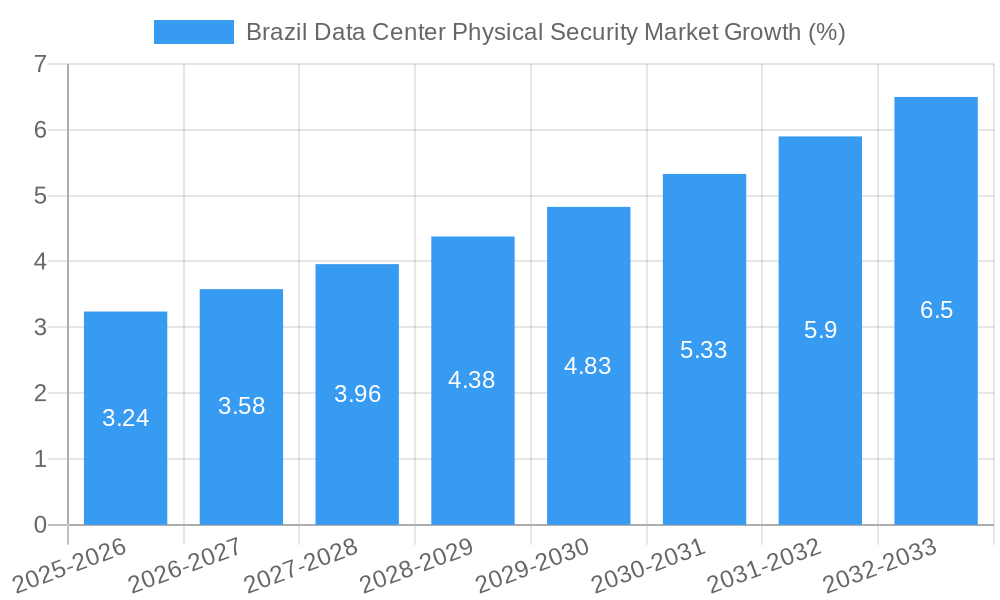

The CAGR for the period 2019-2033 provides a strong indication of sustained market growth. While the specific CAGR isn't provided, based on the 2025 market size and a reasonable assumption of market maturity, a projected CAGR of around 8-10% would align with industry trends for emerging markets like Brazil. This suggests substantial growth opportunities for businesses operating within this sector. The historical period (2019-2024) indicates a period of market development and foundational growth, leading to the accelerated expansion observed in and projected for the forecast period. This growth is expected to be particularly pronounced in regions with high concentrations of data centers and a growing digital infrastructure.

Brazil Data Center Physical Security Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil Data Center Physical Security Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to paint a clear picture of market dynamics, growth drivers, and future opportunities. The market size is estimated to reach xx Million in 2025, with a CAGR of xx% during the forecast period. This report meticulously examines key segments, leading players such as Axis Communications AB, ABB Ltd, Bosch Sicherheitssysteme GmbH, Johnson Controls, Honeywell International Inc, Siemens AG, Schneider Electric, Cisco Systems Inc, Hikvision, and Genetec (list not exhaustive), and emerging trends shaping this dynamic market.

Brazil Data Center Physical Security Market Market Concentration & Dynamics

The Brazil Data Center Physical Security Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is also witnessing increased competition from smaller, specialized vendors offering innovative solutions. The innovation ecosystem is vibrant, with ongoing R&D efforts focused on enhancing security features, improving efficiency, and integrating advanced technologies like AI and machine learning. Regulatory frameworks, while evolving, present both opportunities and challenges, impacting market growth and investment decisions. Substitute products, such as software-based security solutions, are gaining traction, while the market experiences considerable end-user demand driven by the rising adoption of cloud computing and data center modernization. Furthermore, mergers and acquisitions (M&A) activities are contributing to market consolidation and technological advancement.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals were concluded in the historical period (2019-2024).

- Innovation Ecosystem: Significant investment in R&D is driving innovation in areas such as biometrics, video analytics, and cybersecurity integration.

- Regulatory Landscape: The regulatory environment is evolving to address data privacy and security concerns, posing both challenges and opportunities.

Brazil Data Center Physical Security Market Industry Insights & Trends

The Brazil Data Center Physical Security Market is experiencing robust growth, fueled by the increasing adoption of cloud computing, the surge in data generation, and stringent data security regulations. Technological advancements such as AI-powered surveillance systems, biometric access control, and advanced intrusion detection systems are transforming the industry. Consumer behavior is shifting towards integrated and intelligent security solutions that offer enhanced visibility, efficiency, and cost-effectiveness. The market size is estimated to be xx Million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Growth is primarily driven by factors such as the expansion of data centers across various sectors and increasing investments in robust security infrastructure to mitigate risks associated with cyberattacks and data breaches. This substantial market growth necessitates a comprehensive understanding of the trends and drivers influencing the industry.

Key Markets & Segments Leading Brazil Data Center Physical Security Market

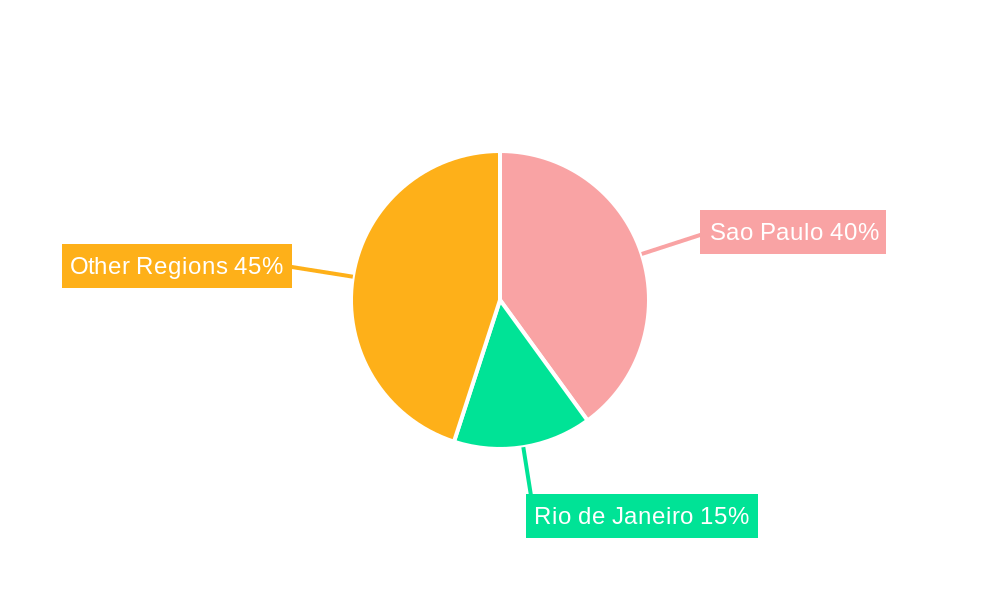

The São Paulo region is currently the dominant market for data center physical security in Brazil, driven by a high concentration of data centers and significant investments in IT infrastructure. However, other major metropolitan areas are experiencing rapid growth, presenting significant expansion opportunities.

- Drivers for São Paulo's Dominance:

- High concentration of data centers.

- Robust IT infrastructure.

- Strong economic activity.

- Growing adoption of cloud services.

- Favorable regulatory environment.

The market is segmented based on various factors such as security technology (access control, video surveillance, intrusion detection, perimeter security), deployment type (on-premise, cloud-based), and end-user industry (BFSI, IT & Telecom, government, healthcare). The access control systems segment holds the largest market share due to the rising demand for secure access management solutions in data centers.

Brazil Data Center Physical Security Market Product Developments

Recent product innovations include AI-powered video analytics for enhanced threat detection, biometrics-based access control for improved security, and integrated security platforms offering centralized management and monitoring. These advancements provide data centers with enhanced security capabilities, streamlined operations, and reduced costs. The integration of IoT devices and cloud-based solutions further enhances the effectiveness and scalability of physical security systems. Companies are actively competing by offering tailored solutions and superior customer support to maintain their market share.

Challenges in the Brazil Data Center Physical Security Market Market

The market faces challenges such as high initial investment costs for advanced security systems, concerns about data privacy and compliance with evolving regulations, and the complexity of integrating various security technologies. Supply chain disruptions can also impact the availability and cost of security equipment, creating a ripple effect throughout the market. Furthermore, intense competition and the emergence of innovative solutions continually pressure profit margins and market leadership. These constraints impact overall market growth and potential profitability.

Forces Driving Brazil Data Center Physical Security Market Growth

Several factors are driving market growth: The burgeoning adoption of cloud computing and the resulting increase in data center infrastructure necessitate stronger physical security measures. Rising cyber threats and data breaches are incentivizing investment in sophisticated security systems. Government regulations mandating enhanced data protection are further driving adoption. Technological advancements, such as AI-powered security and biometrics, improve security efficiency and effectiveness. The economic growth of Brazil also fuels the demand for advanced data center security solutions.

Challenges in the Brazil Data Center Physical Security Market Market

Long-term growth hinges on continued innovation in security technologies, such as the development of AI-driven threat prediction and autonomous security systems. Strategic partnerships between security vendors and data center operators are crucial for seamless integration and enhanced customer support. Expanding into new markets within Brazil and exploring opportunities in neighboring countries will further boost growth in the long run.

Emerging Opportunities in Brazil Data Center Physical Security Market

The market presents opportunities in emerging technologies like blockchain for enhanced security and data immutability, as well as the integration of AI and machine learning for predictive analytics and proactive threat mitigation. Growing demand from sectors like healthcare and finance presents substantial expansion potential. Furthermore, the increasing adoption of edge computing necessitates specialized security solutions for remote data centers. These developments shape future market trends and open avenues for new investments and product developments.

Leading Players in the Brazil Data Center Physical Security Market Sector

- Axis Communications AB

- ABB Ltd

- Bosch Sicherheitssysteme GmbH

- Johnson Controls

- Honeywell International Inc

- Siemens AG

- Schneider Electric

- Cisco Systems Inc

- Hikvision

- Genetec

Key Milestones in Brazil Data Center Physical Security Market Industry

October 2023: Zwipe partnered with Schneider Electric's Security Solutions Group to integrate Zwipe Access fingerprint-scanning smart cards into Schneider Electric's security platforms, expanding the reach of biometric access control in data centers and other sectors. This partnership signifies the growing adoption of advanced biometric security solutions.

March 2023: Quantum released version 5.0 of its unified surveillance platform (USP) software, featuring patented video data reduction techniques. This significantly reduces the storage and hardware needs for video surveillance, leading to cost savings and improved efficiency for data center security operations. The 80% reduction in data center footprint represents a substantial market impact.

Strategic Outlook for Brazil Data Center Physical Security Market Market

The Brazil Data Center Physical Security Market is poised for sustained growth, driven by the confluence of technological advancements, increasing data center deployments, and heightened security concerns. Strategic opportunities exist in developing integrated and AI-powered security solutions, expanding into underserved market segments, and capitalizing on the increasing adoption of cloud-based security services. Companies that can effectively navigate the evolving regulatory landscape and provide innovative, cost-effective solutions are well-positioned to capture significant market share in the years to come.

Brazil Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others (

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT and Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Brazil Data Center Physical Security Market Segmentation By Geography

- 1. Brazil

Brazil Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 21.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Cloud Computing Capabilities Drives Market Growth; Increase Security Concerns in the Market Drives Market Growth

- 3.3. Market Restrains

- 3.3.1. Increasing Demand of Cloud Computing Capabilities Drives Market Growth; Increase Security Concerns in the Market Drives Market Growth

- 3.4. Market Trends

- 3.4.1. The IT & Telecommunication Segment Holds the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others (

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT and Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bosch Sicherheitssysteme GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Controls

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honeywell International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hikvision

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Genetec*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: Brazil Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Data Center Physical Security Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 4: Brazil Data Center Physical Security Market Volume Million Forecast, by Solution Type 2019 & 2032

- Table 5: Brazil Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: Brazil Data Center Physical Security Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 7: Brazil Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Brazil Data Center Physical Security Market Volume Million Forecast, by End User 2019 & 2032

- Table 9: Brazil Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Data Center Physical Security Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Brazil Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 12: Brazil Data Center Physical Security Market Volume Million Forecast, by Solution Type 2019 & 2032

- Table 13: Brazil Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Brazil Data Center Physical Security Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 15: Brazil Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Brazil Data Center Physical Security Market Volume Million Forecast, by End User 2019 & 2032

- Table 17: Brazil Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Data Center Physical Security Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Data Center Physical Security Market?

The projected CAGR is approximately < 21.40%.

2. Which companies are prominent players in the Brazil Data Center Physical Security Market?

Key companies in the market include Axis Communications AB, ABB Ltd, Bosch Sicherheitssysteme GmbH, Johnson Controls, Honeywell International Inc, Siemens AG, Schneider Electric, Cisco Systems Inc, Hikvision, Genetec*List Not Exhaustive.

3. What are the main segments of the Brazil Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Cloud Computing Capabilities Drives Market Growth; Increase Security Concerns in the Market Drives Market Growth.

6. What are the notable trends driving market growth?

The IT & Telecommunication Segment Holds the Major Share.

7. Are there any restraints impacting market growth?

Increasing Demand of Cloud Computing Capabilities Drives Market Growth; Increase Security Concerns in the Market Drives Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: Zwipe partnered with Schneider Electric's Security Solutions Group. Schneider Electric plans to introduce the Zwipe Access fingerprint-scanning smart card to its clientele. This card will be integrated with Schneider Electric's Continuum and Security Expert platforms, serving a client base from airports, transportation, healthcare, data centers, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Brazil Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence