Key Insights

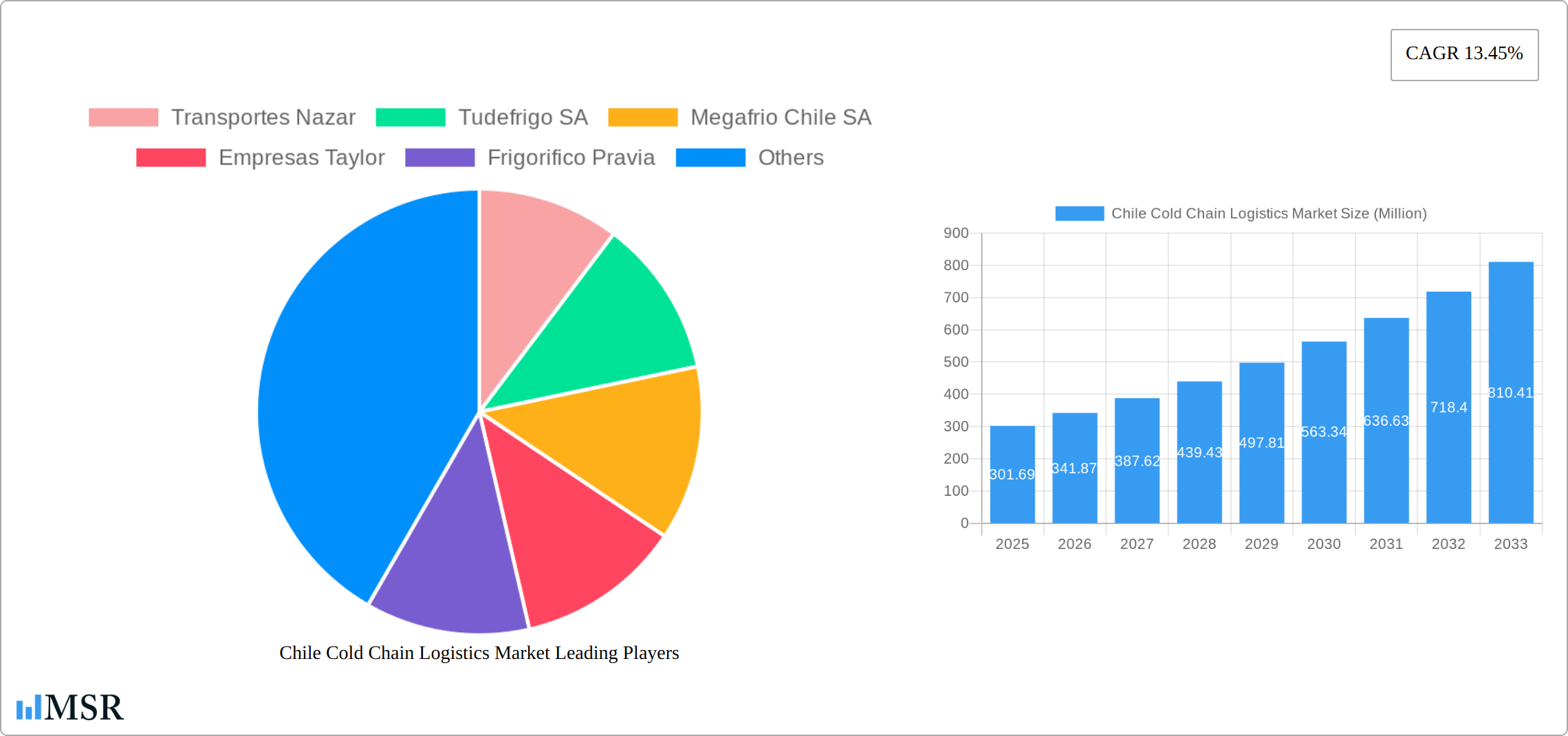

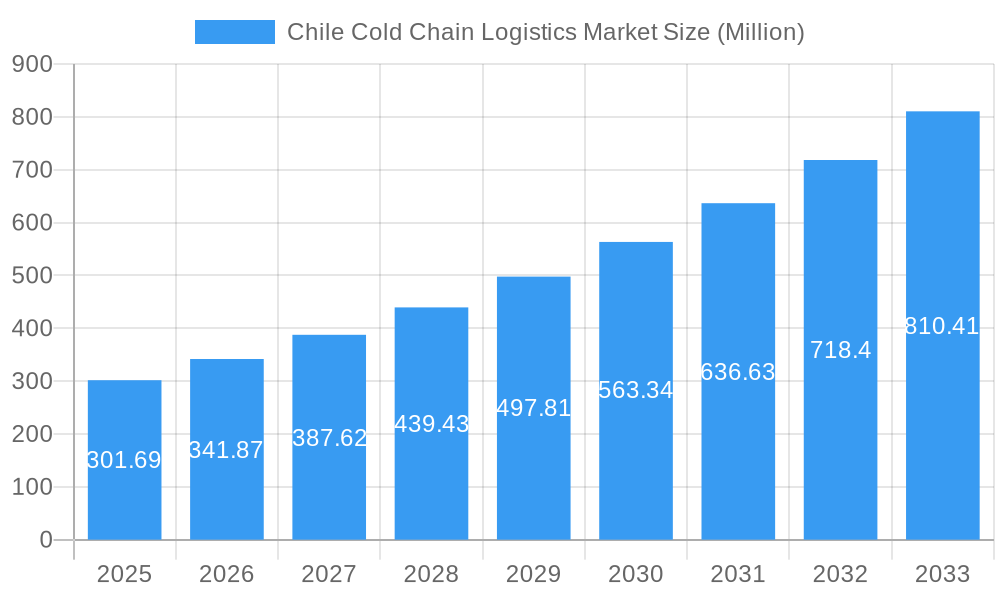

The Chilean cold chain logistics market, valued at $301.69 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 13.45% from 2025 to 2033. This surge is fueled by several key factors. The increasing demand for fresh produce, dairy products, and processed foods, particularly for export, is a primary driver. Chile's thriving horticulture sector, renowned for its high-quality fruits and vegetables, significantly contributes to this market expansion. Furthermore, the growing pharmaceutical and life sciences industries necessitate stringent temperature-controlled logistics, further boosting market demand. The increasing adoption of advanced technologies such as GPS tracking, temperature monitoring systems, and sophisticated warehousing solutions also contributes to market growth. However, challenges remain, including infrastructure limitations in certain regions and the need for continuous investment in cold storage facilities to maintain the cold chain integrity throughout the supply chain. The market is segmented by service type (storage, transportation, value-added services like blast freezing and inventory management), temperature control (chilled, frozen, ambient), and end-user industry (horticulture, dairy, meat, fish, poultry, processed foods, pharmaceuticals, life sciences, and chemicals). Key players include Transportes Nazar, Tudefrigo SA, and Megafrio Chile SA, among others, competing to provide efficient and reliable cold chain solutions. The market's future trajectory hinges on continuous infrastructure development, technological advancements, and sustained growth within key end-user sectors.

Chile Cold Chain Logistics Market Market Size (In Million)

The competitive landscape is characterized by a mix of large established players and smaller, specialized companies. While larger firms benefit from economies of scale and established networks, smaller companies often offer more specialized services catering to niche market segments. This dynamic creates opportunities for both established and emerging players to compete and innovate within the Chilean cold chain logistics market. The market's future success will depend on companies' ability to adapt to evolving customer needs, embrace technological advancements, and maintain high standards of quality and efficiency in their services. The continuing growth of e-commerce and the increasing emphasis on food safety regulations will also significantly impact the market in the coming years, creating both challenges and opportunities for growth. Sustainable practices and environmentally friendly solutions will also increasingly influence the market's trajectory.

Chile Cold Chain Logistics Market Company Market Share

Chile Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Chile Cold Chain Logistics Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, key players, growth drivers, and emerging opportunities for stakeholders in this rapidly evolving sector. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. With a focus on actionable intelligence, this report is essential for businesses seeking to navigate and capitalize on the potential of the Chilean cold chain logistics market. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Chile Cold Chain Logistics Market Market Concentration & Dynamics

The Chilean cold chain logistics market exhibits a moderately concentrated structure, with a few major players holding significant market share. Prominent entities such as Transportes Nazar, Tudefrigo SA, Megafrio Chile SA, Empresas Taylor, Frigorifico Pravia, Friofort SA, Frigorificos Puerto Montt, and Ceva Logistics are key contributors, collectively anticipated to represent a substantial portion of the total market share in the coming years. The market also thrives with the presence of numerous agile, regional operators who cater to specific local demands.

- Market Share Dynamics: While the top tier of players commands a considerable market share, indicating potential for further consolidation, there remains ample opportunity for emerging competitors to gain traction and innovate within specific niches.

- Mergers & Acquisitions (M&A) Activity: The past few years have seen a dynamic M&A landscape within the Chilean cold chain logistics sector. This trend is propelled by strategic imperatives such as geographic expansion, the integration of advanced service offerings, and the pursuit of operational efficiencies through economies of scale. This consolidation is expected to continue, shaping the market structure.

- Innovation Ecosystem: The market demonstrates a robust commitment to innovation, with significant investments directed towards enhancing operational efficiency and minimizing waste throughout the cold chain. Key technological advancements include the widespread adoption of GPS tracking for real-time visibility, sophisticated temperature monitoring systems for product integrity, and the implementation of advanced warehousing technologies to optimize storage and handling.

- Regulatory Framework: The regulatory environment in Chile is generally conducive to industry expansion, with a strong emphasis on upholding stringent food safety and quality standards. However, navigating certain regulatory intricacies, particularly those associated with complex import and export procedures, remains an area of ongoing development.

- Substitute Products & Technologies: Direct substitutes for comprehensive cold chain logistics services are limited. Nevertheless, advancements in food preservation technologies, such as modified atmosphere packaging and extended shelf-life innovations, could indirectly influence the demand patterns for traditional cold chain solutions.

- End-User Trends: The market is significantly propelled by robust demand from the expanding fresh produce and processed food sectors. Furthermore, the burgeoning pharmaceutical and life sciences industries, with their critical temperature-sensitive product requirements, are increasingly contributing to market growth.

Chile Cold Chain Logistics Market Industry Insights & Trends

The Chilean cold chain logistics market is experiencing robust growth, driven by factors such as increasing disposable incomes, changing consumer preferences for fresh and processed foods, and a rise in e-commerce. The market size in 2025 is estimated at xx Million, projecting significant expansion over the forecast period.

The market growth is primarily fueled by:

- Expanding Consumption of Fresh Produce: The increasing demand for fresh fruits, vegetables, and other perishable goods is significantly boosting the need for efficient cold chain solutions.

- Growth in the Processed Food Industry: The rise of the processed food sector necessitates specialized cold chain infrastructure for storage and transportation of processed products.

- E-commerce Boom: The accelerating adoption of e-commerce, particularly in grocery deliveries, is placing additional pressure on cold chain logistics to ensure timely and efficient delivery of perishable goods.

- Technological Advancements: Investments in technology, including IoT and AI, are streamlining operations and reducing waste.

- Government Initiatives: Regulatory changes aimed at improving food safety and quality standards indirectly support market expansion.

Key Markets & Segments Leading Chile Cold Chain Logistics Market

The Chilean cold chain logistics market is characterized by its geographical diversity, with significant operational hubs located in major urban centers and strategically important agricultural regions. The transportation of chilled and frozen products, with a particular emphasis on fresh produce and processed foods, represents the largest segment by volume.

-

Dominant Segments:

- Service: Transportation services currently hold the leading market share, closely followed by specialized cold storage solutions and a growing array of value-added services designed to enhance supply chain efficiency.

- Temperature: Frozen products constitute the largest segment in terms of volume, with chilled products representing a significant portion, followed by ambient temperature-controlled logistics.

- End-User: The horticulture sector, encompassing fresh fruits and vegetables, commands the largest market share. The dairy, meat, fish, and poultry sectors also represent substantial and growing segments within the market.

-

Growth Drivers:

- Economic Growth: Chile's sustained economic development directly translates into increased disposable incomes and a higher consumer demand for premium fresh and processed food products, thereby boosting cold chain requirements.

- Infrastructure Development: Ongoing investments in state-of-the-art cold chain infrastructure, including modern cold storage facilities and an optimized transportation network, are crucial in enhancing operational efficiency and expanding logistical capacity.

- Export Opportunities: The robust growth in Chile's agricultural exports, particularly in the fruit sector, creates a sustained demand for reliable and advanced cold chain solutions to maintain product quality during transit.

- Government Support: Favorable regulatory reforms and targeted government initiatives aimed at elevating food safety and quality standards provide a conducive environment for the continued expansion and modernization of the cold chain logistics sector.

Chile Cold Chain Logistics Market Product Developments

Recent product innovations focus on enhancing temperature control, traceability, and overall efficiency. This includes the adoption of IoT-enabled sensors for real-time monitoring, GPS tracking systems for precise location tracking, and advanced warehouse management systems for optimized inventory management. These advancements provide competitive edges by enhancing efficiency, reducing waste, and improving food safety.

Challenges in the Chile Cold Chain Logistics Market Market

The Chilean cold chain logistics market navigates a complex landscape of challenges, including the necessity for expanded cold storage infrastructure in underserved regions, the persistent issue of high transportation costs, and the ongoing need for refined food safety regulations. These factors collectively contribute to increased operational expenditures and can potentially affect the punctuality of delivering temperature-sensitive goods. Furthermore, the competitive intensity among established players, coupled with the strategic entry of new market participants, introduces additional layers of complexity. The scarcity of a skilled workforce also presents a significant impediment to the expansion ambitions of existing providers.

Forces Driving Chile Cold Chain Logistics Market Growth

Key growth drivers include rising consumer demand for fresh and processed foods, e-commerce growth, and government support for infrastructure development. Technological advancements, such as IoT-enabled monitoring and automated warehousing, are streamlining operations and improving efficiency, enhancing the overall attractiveness of the market. Furthermore, increased export opportunities for Chilean agricultural products are driving demand for specialized cold chain services.

Long-Term Growth Catalysts in the Chile Cold Chain Logistics Market

Long-term growth in the Chilean cold chain logistics market will be driven by continued investments in infrastructure, technological innovation, and strategic partnerships between logistics providers and food producers. Expansion into new market segments, such as pharmaceuticals and life sciences, will also play a crucial role in shaping future growth. The potential development of sustainable cold chain solutions will attract increasing investment and further propel market expansion.

Emerging Opportunities in Chile Cold Chain Logistics Market

Emerging opportunities include the growth of e-commerce grocery delivery services, expanding demand for specialized cold chain solutions in the pharmaceutical and life sciences sectors, and the increasing focus on sustainable and environmentally friendly logistics practices. The implementation of blockchain technology for enhanced traceability and supply chain transparency presents a significant area for innovation and market development.

Leading Players in the Chile Cold Chain Logistics Market Sector

- Transportes Nazar

- Tudefrigo SA

- Megafrio Chile SA

- Empresas Taylor

- Frigorifico Pravia

- Friofort SA

- Frigorificos Puerto Montt

- Ceva Logistics

- 6 Other Companies

- Emergent Cold LatAm

- TIBA Chile

Key Milestones in Chile Cold Chain Logistics Market Industry

- 2020: A notable surge in investments was observed in the development and expansion of cold storage facilities, particularly in key agricultural producing regions across Chile.

- 2022: The Chilean government enacted and implemented more stringent food safety regulations, raising the bar for quality and compliance across the cold chain.

- 2023: Several leading companies in the sector strategically launched comprehensive, integrated logistics solutions, seamlessly combining transportation and warehousing services to offer end-to-end supply chain management.

- 2024: A significant trend emerged with the widespread adoption of Internet of Things (IoT)-based temperature monitoring systems by a multitude of major players, enhancing real-time control and data analytics for product integrity.

Strategic Outlook for Chile Cold Chain Logistics Market Market

The Chilean cold chain logistics market presents significant growth potential driven by rising consumer demand, technological advancements, and supportive government policies. Strategic opportunities lie in investing in state-of-the-art infrastructure, embracing technological innovations to improve efficiency and transparency, and expanding into emerging market segments. Focus on sustainability and environmental responsibility will further enhance market competitiveness and attract investors seeking long-term growth prospects.

Chile Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 3.3. Meat, Fish, and Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Chile Cold Chain Logistics Market Segmentation By Geography

- 1. Chile

Chile Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Chile Cold Chain Logistics Market

Chile Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Fruit Exports

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges of First Mile Distribution in Chile

- 3.4. Market Trends

- 3.4.1. Growth Of E-commerce Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 5.3.3. Meat, Fish, and Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transportes Nazar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tudefrigo SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Megafrio Chile SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Empresas Taylor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frigorifico Pravia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Friofort SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frigorificos Puerto Montt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ceva Logistics**List Not Exhaustive 6 3 Other Companie

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emergent Cold LatAm

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TIBA Chile

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transportes Nazar

List of Figures

- Figure 1: Chile Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Chile Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Chile Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Cold Chain Logistics Market?

The projected CAGR is approximately 13.45%.

2. Which companies are prominent players in the Chile Cold Chain Logistics Market?

Key companies in the market include Transportes Nazar, Tudefrigo SA, Megafrio Chile SA, Empresas Taylor, Frigorifico Pravia, Friofort SA, Frigorificos Puerto Montt, Ceva Logistics**List Not Exhaustive 6 3 Other Companie, Emergent Cold LatAm, TIBA Chile.

3. What are the main segments of the Chile Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.69 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Fruit Exports.

6. What are the notable trends driving market growth?

Growth Of E-commerce Driving The Market.

7. Are there any restraints impacting market growth?

4.; Challenges of First Mile Distribution in Chile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Chile Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence