Key Insights

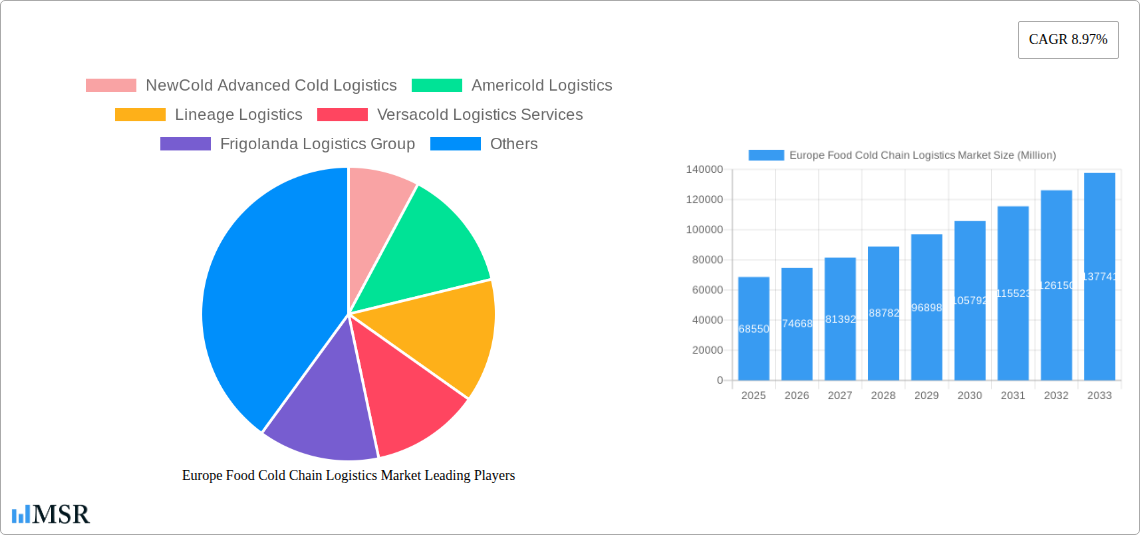

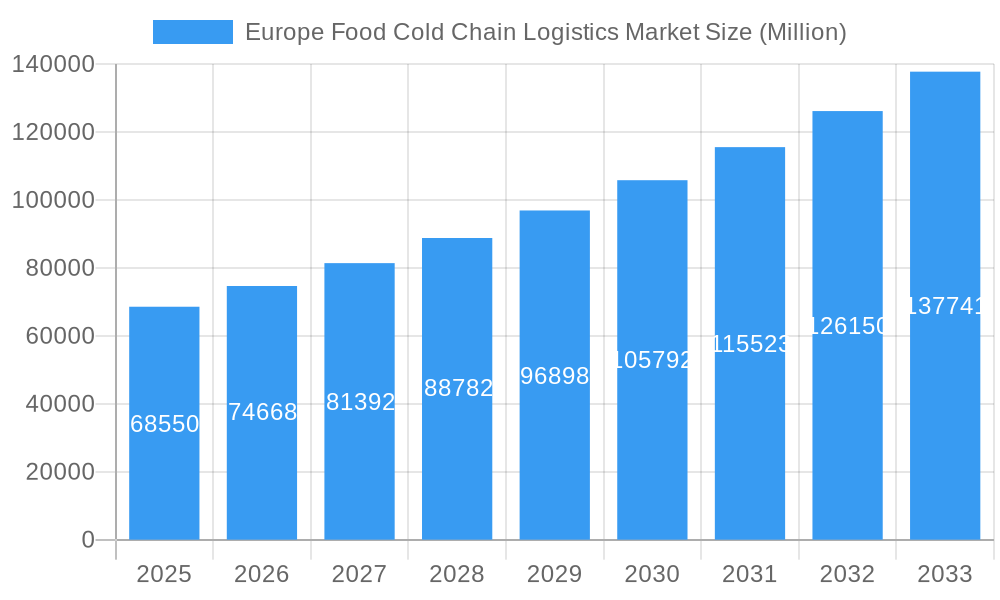

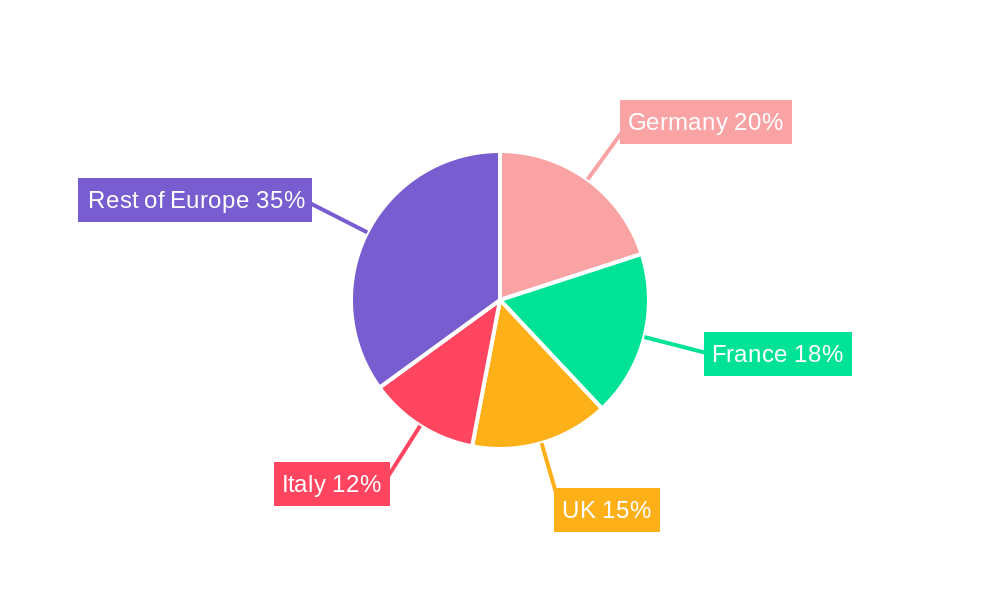

The European food cold chain logistics market is experiencing robust growth, projected to reach €68.55 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.97% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for fresh and processed food products across Europe, driven by changing consumer preferences towards healthier diets and convenience foods, is a significant driver. Furthermore, the rise of e-commerce and online grocery shopping necessitates efficient and reliable cold chain solutions to ensure product quality and safety during transportation and storage. Stringent food safety regulations and growing awareness of foodborne illnesses are also contributing to the market's growth by pushing for improved cold chain infrastructure and technology. The market is segmented by application (fruits and vegetables, meat and seafood, dairy, bakery, ready-to-eat meals, etc.) and service type (refrigerated storage, transport via airways, roadways, seaways, and railways). Germany, France, Italy, and the UK represent the largest national markets within Europe, benefiting from established infrastructure and high consumption levels.

Europe Food Cold Chain Logistics Market Market Size (In Billion)

Continued growth is expected due to ongoing investments in advanced cold chain technologies like temperature monitoring systems, automated warehousing, and improved transportation methods. The adoption of these technologies promises enhanced efficiency, reduced spoilage, and improved traceability throughout the supply chain. However, the market faces challenges such as fluctuating fuel prices, rising labor costs, and the need for continuous investment in infrastructure upgrades. Competition among established players like Americold Logistics, Lineage Logistics, and NewCold is fierce, driving innovation and service improvements. Nevertheless, the overall outlook for the European food cold chain logistics market remains positive, driven by consumer demand, technological advancements, and the imperative to ensure food safety and quality across the supply chain.

Europe Food Cold Chain Logistics Market Company Market Share

Europe Food Cold Chain Logistics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Food Cold Chain Logistics Market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is your essential guide to navigating the complexities and opportunities within this dynamic market. The market size in 2025 is estimated at xx Million and is expected to grow at a CAGR of xx% during the forecast period.

Europe Food Cold Chain Logistics Market Concentration & Dynamics

The European food cold chain logistics market exhibits a moderately concentrated structure, with several large multinational players holding significant market share. Key players like Lineage Logistics, Americold Logistics, and NewCold Advanced Cold Logistics dominate the refrigerated storage and transport segments. However, a diverse landscape of regional and specialized providers also contributes significantly. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market, indicating opportunities for both consolidation and niche market penetration.

The innovative ecosystem is vibrant, driven by technological advancements in temperature monitoring, automation, and data analytics. Regulatory frameworks, including stringent food safety standards and environmental regulations, significantly influence operational practices. Substitute products and services are limited, as the need for temperature-controlled transportation and storage is inherent to the food industry. End-user trends, such as the rising demand for fresh and convenient foods, fuel market growth. M&A activities are frequent, reflecting industry consolidation and expansion efforts. In the last 5 years, the market experienced approximately xx M&A deals, with a focus on expanding geographic reach and service capabilities.

- Market Share: Top 5 players - xx%

- M&A Deal Count (2019-2024): xx

Europe Food Cold Chain Logistics Market Industry Insights & Trends

The Europe Food Cold Chain Logistics market is experiencing robust growth, driven by several key factors. Increasing consumer demand for fresh produce and processed foods, coupled with the expansion of e-commerce grocery platforms, necessitates efficient cold chain solutions. Technological disruptions, such as the adoption of IoT-enabled sensors and advanced tracking systems, enhance supply chain visibility and reduce spoilage. Evolving consumer behaviors, including a preference for sustainable and ethically sourced products, further influence market dynamics. Growing focus on food safety and minimizing food waste also contribute to the market expansion. The market is expected to reach xx Million by 2033, driven by factors such as increased disposable incomes, growing urbanization, and evolving consumer preferences.

Key Markets & Segments Leading Europe Food Cold Chain Logistics Market

Geographically, Western Europe dominates the market due to higher per capita income and established cold chain infrastructure. Within this region, Germany, France, and the UK are leading markets. The Fruits and Vegetables segment holds the largest market share by application, followed by Meat and Seafood. Within service types, Refrigerated Storage and Refrigerated Transport are the most significant segments.

Drivers for Key Segments:

- Fruits and Vegetables: Growing consumer demand for fresh produce, increased imports and exports.

- Meat and Seafood: Stringent quality and safety requirements, rising demand for convenient protein sources.

- Refrigerated Storage: Increased need for warehousing capacity to meet growing demand.

- Refrigerated Transport: Expanding e-commerce, need for efficient and timely delivery of perishable goods.

Dominance Analysis:

Western Europe's dominance stems from strong consumer demand, well-developed logistics networks, and a mature regulatory environment. The Fruits and Vegetables segment leads due to higher perishability and need for temperature-controlled handling throughout the supply chain. Refrigerated storage and transport are crucial for maintaining product quality and extending shelf life, explaining their significant market share.

Europe Food Cold Chain Logistics Market Product Developments

Recent product innovations focus on enhancing efficiency, safety, and sustainability. This includes advancements in refrigerated transportation technologies, such as improved insulation and fuel-efficient vehicles, and the adoption of automated warehousing systems, enabling better inventory management and reducing labor costs. The integration of IoT and AI-powered solutions optimizes temperature control, reduces waste, and improves supply chain traceability. These advancements provide significant competitive advantages in terms of cost savings and operational efficiency.

Challenges in the Europe Food Cold Chain Logistics Market

The market faces several challenges including stringent regulatory compliance, which necessitates significant investments in infrastructure and technology. Supply chain disruptions, stemming from geopolitical instability and pandemics, impact operational efficiency and increase costs. Intense competition from established and emerging players also poses a challenge, requiring providers to differentiate through innovation and superior service delivery. The estimated financial impact of these challenges is xx Million annually.

Forces Driving Europe Food Cold Chain Logistics Market Growth

Technological advancements, including the integration of IoT, AI, and automation, are key drivers. Economic growth and rising disposable incomes contribute to increased demand for fresh and convenient food products. Favorable regulatory policies promoting food safety and sustainability further support market expansion. For instance, the EU's focus on reducing food waste encourages investments in efficient cold chain solutions.

Long-Term Growth Catalysts in Europe Food Cold Chain Logistics Market

Long-term growth will be fueled by continuous innovation in temperature control technologies, partnerships between logistics providers and food producers to optimize supply chains, and expansion into new markets with emerging demand for efficient cold chain logistics. The increasing adoption of sustainable practices within the cold chain will also drive growth.

Emerging Opportunities in Europe Food Cold Chain Logistics Market

Emerging opportunities include the growing adoption of sustainable and eco-friendly cold chain solutions, expansion into Eastern European markets, and the increasing use of data analytics to optimize supply chain operations. The rise of e-commerce and the demand for last-mile delivery of fresh food products also present significant growth potential.

Leading Players in the Europe Food Cold Chain Logistics Market Sector

- NewCold Advanced Cold Logistics

- Americold Logistics

- Lineage Logistics

- Versacold Logistics Services

- Frigolanda Logistics Group

- Agro Merchants Group

- Frigo Warehousing

- Nichirei Logistics Europe

- Magnavale Ltd

- Constellation Cold Logistics

- Gartner Kg

Key Milestones in Europe Food Cold Chain Logistics Market Industry

- March 2023: Lineage Logistics' acquisition of a new facility in Belgium expands its European presence and capacity for dairy and frozen products.

- February 2023: The EU-funded ICCEE project launched a capacity-building program to improve the knowledge and technological capabilities of European SMEs in cold chain efficiency.

Strategic Outlook for Europe Food Cold Chain Logistics Market

The future of the European food cold chain logistics market is bright, driven by technological innovation, sustainable practices, and increasing demand. Strategic opportunities lie in leveraging advanced technologies to enhance efficiency, transparency, and sustainability throughout the supply chain. Focusing on niche markets and developing strong partnerships within the food industry will be crucial for long-term success.

Europe Food Cold Chain Logistics Market Segmentation

-

1. Application

- 1.1. Fruits and Vegetables

- 1.2. Meat and Seafood

- 1.3. Dairy and Frozen Dessert

- 1.4. Bakery and Confectionery

- 1.5. Ready-to-Eat Meal

- 1.6. Other Applications

-

2. Service Type

- 2.1. Refrigerated Storage

- 2.2. Refrigerated Transport

- 2.3. Airways

- 2.4. Roadways

- 2.5. Seaways

- 2.6. Railways

Europe Food Cold Chain Logistics Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Russia

- 1.6. Spain

- 1.7. Rest of NA

Europe Food Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Europe Food Cold Chain Logistics Market

Europe Food Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The rising consumption of frozen food; Increasing Demand of Refrigerated Logistics from the Retail Industry

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs

- 3.4. Market Trends

- 3.4.1. Growth in penetration of the e-commerce industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fruits and Vegetables

- 5.1.2. Meat and Seafood

- 5.1.3. Dairy and Frozen Dessert

- 5.1.4. Bakery and Confectionery

- 5.1.5. Ready-to-Eat Meal

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Refrigerated Storage

- 5.2.2. Refrigerated Transport

- 5.2.3. Airways

- 5.2.4. Roadways

- 5.2.5. Seaways

- 5.2.6. Railways

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewCold Advanced Cold Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Americold Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lineage Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Versacold Logistics Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frigolanda Logistics Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agro Merchants Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frigo Warehousing

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nichirei Logistics Europe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Magnavale Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Constellation Cold Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gartner Kg**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 NewCold Advanced Cold Logistics

List of Figures

- Figure 1: Europe Food Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Food Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Food Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Europe Food Cold Chain Logistics Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Europe Food Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Food Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Europe Food Cold Chain Logistics Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Europe Food Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Kingdom Europe Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Russia Europe Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Spain Europe Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of NA Europe Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Cold Chain Logistics Market?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the Europe Food Cold Chain Logistics Market?

Key companies in the market include NewCold Advanced Cold Logistics, Americold Logistics, Lineage Logistics, Versacold Logistics Services, Frigolanda Logistics Group, Agro Merchants Group, Frigo Warehousing, Nichirei Logistics Europe, Magnavale Ltd, Constellation Cold Logistics, Gartner Kg**List Not Exhaustive.

3. What are the main segments of the Europe Food Cold Chain Logistics Market?

The market segments include Application, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.55 Million as of 2022.

5. What are some drivers contributing to market growth?

The rising consumption of frozen food; Increasing Demand of Refrigerated Logistics from the Retail Industry.

6. What are the notable trends driving market growth?

Growth in penetration of the e-commerce industry.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs.

8. Can you provide examples of recent developments in the market?

March 2023: Lineage Logistics announced the acquisition of a new facility in Belgium to expand its presence in the European market. This move is expected to increase the company's capacity for dairy and frozen products and improve its ability to serve customers across Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Food Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence