Key Insights

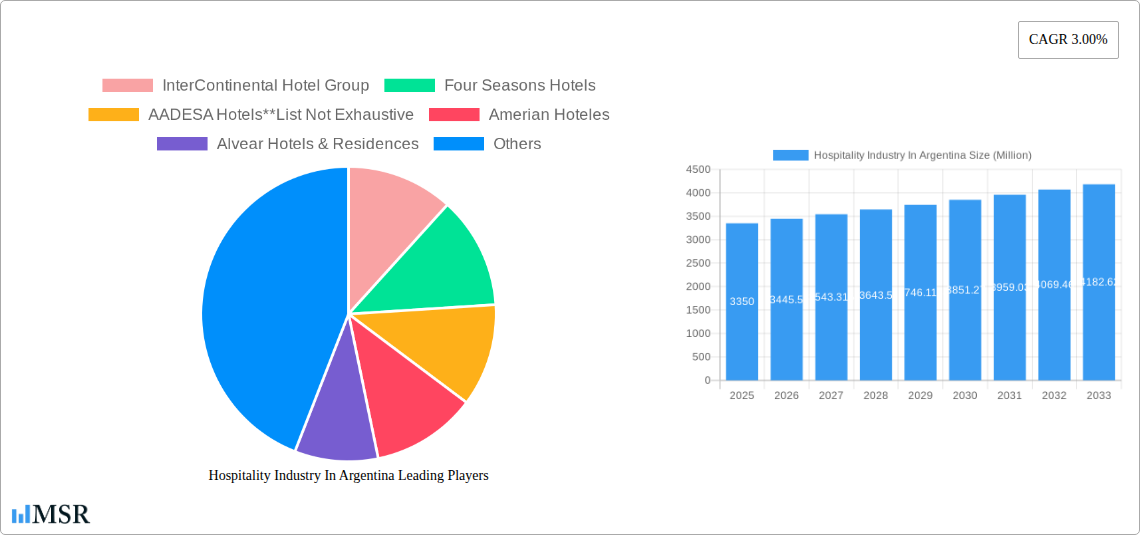

The Argentinian hospitality industry, valued at $3.35 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.00% from 2025 to 2033. This growth is fueled by several key factors. Increased tourism, driven by Argentina's diverse landscapes and cultural attractions, is a major contributor. The expanding middle class within Argentina also boosts domestic travel and hotel stays, particularly within the budget and mid-scale segments. Furthermore, government initiatives aimed at improving infrastructure and attracting foreign investment contribute positively to the sector's expansion. However, economic instability and fluctuations in the Argentinian Peso present significant challenges. Inflation and currency devaluation can impact both operational costs and consumer spending, potentially dampening growth. Competition within the market, particularly from international hotel chains, also plays a role. The industry is segmented by type (chain vs. independent hotels) and by hotel class (budget/economy, mid-scale, luxury, and service apartments). International chains like Marriott, Accor, and Wyndham are prominent players, competing with established local brands like Alvear Hotels & Residences and Amerian Hoteles. The ongoing evolution of the travel industry and technological advancements – particularly online booking platforms and the rise of the sharing economy – will continue to shape the competitive landscape in the coming years.

Hospitality Industry In Argentina Market Size (In Billion)

The forecast for the Argentinian hospitality industry indicates continued but moderate expansion. While the positive factors of increasing tourism and a growing middle class remain, careful management of macroeconomic risks is crucial. Strategic investments in infrastructure improvements and innovative marketing strategies will be essential for hotel operators to capitalize on growth opportunities and navigate the economic challenges. The diversification of offerings – encompassing budget-friendly options alongside luxury accommodations – is key to attracting a wider range of travelers. The successful players in the coming decade will be those who effectively balance operational efficiency, competitive pricing, and customer experience. The ongoing integration of technology will also be crucial for enhancing guest satisfaction and streamlining operations.

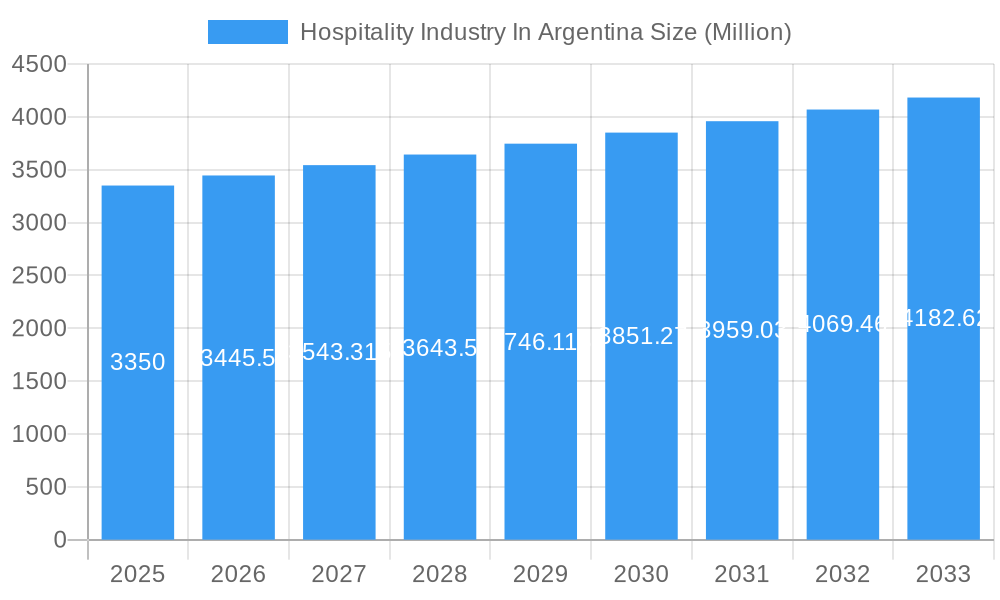

Hospitality Industry In Argentina Company Market Share

Argentina Hospitality Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Argentina hospitality market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and growth opportunities within Argentina's vibrant hospitality sector.

Hospitality Industry In Argentina Market Concentration & Dynamics

The Argentine hospitality market exhibits a moderately concentrated structure, with a mix of international chains and domestic players vying for market share. Key players such as InterContinental Hotel Group, Four Seasons Hotels, Wyndham Hotel Group LLC, NH Hotels Group SA, Marriott International Inc, and Accor SA compete alongside prominent local chains like AADESA Hotels, Amerian Hoteles, Alvear Hotels & Residences, Hoteles Panaamericano, Alvarez Argelles Hoteles, Hotel Madero, and Fierro Hotels. However, a significant portion of the market is occupied by independent hotels.

Market share data from 2024 suggests that international chains hold approximately xx% of the market, with the remaining xx% distributed amongst independent hotels and smaller domestic chains. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx M&A deals recorded between 2019 and 2024. This activity is largely driven by international chains seeking expansion into the Argentine market and domestic players consolidating their positions. The regulatory framework, while generally favorable to foreign investment, presents certain complexities related to labor laws and taxation, impacting investment decisions. Substitute products, such as Airbnb and other vacation rentals, exert increasing pressure, particularly within the budget and mid-scale segments. Evolving consumer preferences toward experiential travel and sustainability further influence the competitive landscape.

Hospitality Industry In Argentina Industry Insights & Trends

The Argentine hospitality industry is projected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of $xx Million by 2033. This growth is driven primarily by factors such as increasing inbound tourism, a burgeoning middle class with rising disposable incomes, and the government's focus on infrastructure development. Technological disruptions, including the rise of online travel agencies (OTAs), booking platforms like ReservAR AlojaMiento (launched June 2022 by FEHGRA), and the adoption of revenue management systems, are reshaping industry dynamics. Consumer behavior is also evolving, with a growing preference for personalized experiences, sustainable travel options, and seamless digital interactions. The rise of bleisure travel (blending business and leisure) presents another key trend shaping demand. The industry is witnessing an increased focus on wellness and health-centric offerings, catering to a health-conscious traveler segment.

Key Markets & Segments Leading Hospitality Industry In Argentina

While iconic tourist destinations across Argentina, from the glaciers of Patagonia to the vibrant vineyards of Mendoza, drive significant hospitality activity, the bustling capital of Buenos Aires continues to be the undisputed dominant market. It consistently accounts for a substantial portion, estimated at XX%, of the nation's total hospitality revenue, showcasing its unparalleled appeal to both domestic and international travelers.

Within the diverse segmentation of the Argentine hospitality landscape:

-

By Type: The luxury and upper-midscale segments are largely defined by the presence of established chain hotels, offering consistent quality and branding. Conversely, the budget and economy sectors are characterized by a prevalence of independent hotels, often providing a more localized and unique experience.

-

By Segment: The mid- and upper-midscale hotel segments are exhibiting the most dynamic growth potential. This surge is directly attributable to the steady rise in disposable incomes across Argentina, coupled with a discerning consumer preference for accommodations that offer a comfortable and appealing experience without compromising on affordability. Luxury hotels, while catering to a more specialized and affluent clientele, represent a highly lucrative niche, primarily drawing in high-spending international tourists seeking premium services and experiences. The budget and economy segments are facing considerable pressure and intense competition, not only from within their own ranks but increasingly from agile alternative accommodation providers such as Airbnb and other short-term rental platforms. Service apartments, while currently a niche segment, are steadily gaining traction by offering extended-stay flexibility and home-like amenities, appealing to business travelers and families on longer trips.

Key Drivers Fueling Segment Dominance and Growth:

- Robust Economic Growth & Rising Disposable Incomes: A sustained period of economic growth and the expanding middle class are directly translating into increased spending power, thereby fueling demand across all hospitality segments. This trend is particularly pronounced in the mid-scale and upper-midscale categories, where consumers are more inclined to upgrade their travel experiences.

- Strategic Infrastructure Development: Significant investments in improving and expanding Argentina's infrastructure, encompassing modern airports, enhanced public transportation networks, and better road connectivity, are crucial in boosting accessibility to various regions. This improved connectivity directly stimulates tourism, leading to higher occupancy rates and revenue generation throughout the entire hospitality sector.

- Proactive Tourism Promotion & Marketing Initiatives: Dedicated government initiatives and strategic campaigns aimed at promoting Argentina as a premier tourist destination, both domestically and internationally, are playing a pivotal role. These efforts are instrumental in attracting a wider range of visitors, thereby driving demand and bolstering occupancy rates across diverse hospitality segments.

Hospitality Industry In Argentina Product Developments

The Argentine hospitality industry is actively embracing innovation to elevate the guest experience. Recent product developments are heavily centered around technological advancements designed for seamless and personalized stays. This includes the widespread adoption of mobile check-in/check-out systems, sophisticated in-room entertainment platforms offering curated content, and the integration of smart room technology for enhanced comfort and control. Beyond technology, there's a palpable and growing emphasis on sustainable practices. Hotels are increasingly implementing eco-friendly initiatives, from energy-efficient operations to waste reduction programs, not only to appeal to the rising wave of environmentally conscious consumers but also to improve their competitive edge and operational efficiency.

Challenges in the Hospitality Industry In Argentina Market

The Argentine hospitality market navigates a landscape fraught with significant challenges. Economic volatility remains a persistent concern, directly impacting consumer discretionary spending and travel budgets. Fluctuating currency exchange rates introduce uncertainty and can deter international tourism, making it harder to predict revenue streams. Furthermore, supply chain disruptions can lead to unpredictable increases in operational costs, affecting everything from food and beverage supplies to maintenance. The industry also contends with a complex web of stringent regulations and labor laws, which contribute to higher operational expenses and administrative burdens. The landscape is further intensified by fierce competition, both from established domestic and international hotel chains, and the ever-expanding reach of alternative accommodation platforms like Airbnb, which exert considerable pressure on pricing and market share. The cumulative impact of these challenges resulted in an estimated XX Million loss in revenue for the sector in 2024.

Forces Driving Hospitality Industry In Argentina Growth

Several powerful forces are propelling the growth of the hospitality industry in Argentina. Technological advancements are a major catalyst, with improved online booking platforms and sophisticated revenue management systems significantly enhancing operational efficiency and optimizing pricing strategies. Complementing these are robust government initiatives focused on promoting tourism and investing in vital infrastructure development, making the country more accessible and attractive to visitors. On the consumer front, the notable increase in disposable incomes within the middle class is a critical driver, leading to a discernible rise in both domestic and international tourism, thereby boosting demand for hospitality services across the board.

Long-Term Growth Catalysts in the Hospitality Industry In Argentina

The Argentinian hospitality industry's long-term growth hinges on strategic partnerships to leverage global expertise and expand offerings. Continued investment in technological infrastructure is essential, along with a focus on sustainable and responsible tourism practices to meet the evolving expectations of the modern traveller.

Emerging Opportunities in Hospitality Industry In Argentina

The Argentine hospitality sector is ripe with emerging opportunities, particularly in the expansion of niche tourism segments. This includes catering to the growing demand for wellness tourism, offering rejuvenating retreats and health-focused experiences; the thrill of adventure tourism, leveraging Argentina's diverse natural landscapes for activities like trekking, rafting, and skiing; and the desire for authentic experiential travel, focusing on cultural immersion and unique local interactions. The strategic adoption of new technologies, such as AI-powered personalized guest services that anticipate needs and tailor recommendations, holds immense potential for enhancing the guest experience and unlocking new revenue streams. Furthermore, the burgeoning global demand for sustainable and eco-friendly options presents a significant opportunity for hotels that actively embrace and promote green practices, aligning with conscious consumer values and distinguishing themselves in the market.

Leading Players in the Hospitality Industry In Argentina Sector

- InterContinental Hotel Group

- Four Seasons Hotels

- AADESA Hotels

- Amerian Hoteles

- Alvear Hotels & Residences

- Hoteles Panaamericano

- Alvarez Argelles Hoteles

- Hotel Madero

- Fierro Hotels

- Wyndham Hotel Group LLC

- NH Hotels Group SA

- Marriott International Inc

- Accor SA

Key Milestones in Hospitality Industry In Argentina Industry

- June 2022: Launch of ReservAR AlojaMiento, a local booking platform promoting Argentine hospitality establishments. This initiative aims to boost local businesses and reduce reliance on international OTAs.

- August 2023: IHG Hotels and Resorts launches its Garner an IHG Hotel brand, targeting the midscale segment with value-driven offerings, potentially increasing competition within this segment and attracting new investors.

Strategic Outlook for Hospitality Industry In Argentina Market

The Argentine hospitality industry shows considerable promise, particularly within the mid-scale and upper-midscale segments. Strategic investments in technology, coupled with a focus on sustainable practices and tailored experiences, will be crucial for capturing market share and maximizing growth potential. The industry must adapt to evolving consumer preferences and navigate economic uncertainties to secure long-term success.

Hospitality Industry In Argentina Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry In Argentina Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry In Argentina Regional Market Share

Geographic Coverage of Hospitality Industry In Argentina

Hospitality Industry In Argentina REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism Sector is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs are Restraining the Market

- 3.4. Market Trends

- 3.4.1. The Buenos Aries is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 InterContinental Hotel Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Four Seasons Hotels

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AADESA Hotels**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amerian Hoteles

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alvear Hotels & Residences

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hoteles Panaamericano

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alvarez Argelles Hoteles

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hotel Madero

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fierro Hotels

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wyndham Hotel Group LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NH Hotels Group SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Marriott International Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Accor SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 InterContinental Hotel Group

List of Figures

- Figure 1: Global Hospitality Industry In Argentina Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry In Argentina Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry In Argentina?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Hospitality Industry In Argentina?

Key companies in the market include InterContinental Hotel Group, Four Seasons Hotels, AADESA Hotels**List Not Exhaustive, Amerian Hoteles, Alvear Hotels & Residences, Hoteles Panaamericano, Alvarez Argelles Hoteles, Hotel Madero, Fierro Hotels, Wyndham Hotel Group LLC, NH Hotels Group SA, Marriott International Inc, Accor SA.

3. What are the main segments of the Hospitality Industry In Argentina?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism Sector is Driving the Market.

6. What are the notable trends driving market growth?

The Buenos Aries is Dominating the Market.

7. Are there any restraints impacting market growth?

Rising Operational Costs are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Argentina’s hotel and restaurant federation sought to level the playing field in online distribution by debuting a homegrown booking website. Federación Empresaria Hotelera Gastronómica de la República Argentina (FEHGRA) has launched ReservAR AlojaMiento, which promotes local, licensed establishments and whether they are affiliated with the association or not.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry In Argentina," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry In Argentina report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry In Argentina?

To stay informed about further developments, trends, and reports in the Hospitality Industry In Argentina, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence