Key Insights

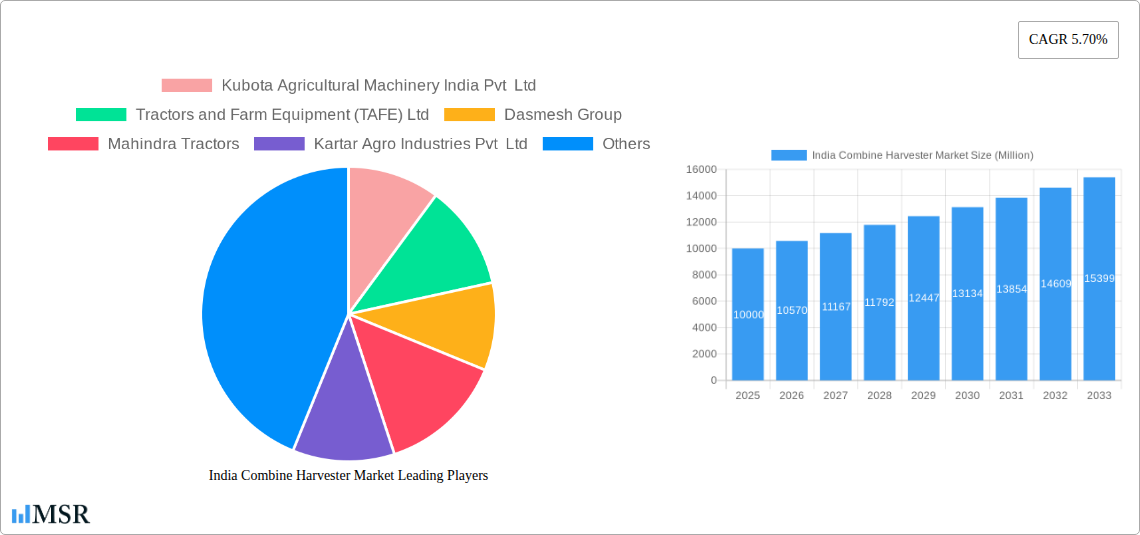

The Indian combine harvester market, projected at $275.4 million in 2025, is poised for substantial expansion, forecasting a Compound Annual Growth Rate (CAGR) of 5.7% between 2025 and 2033. This growth is propelled by increasing agricultural mechanization in India, driven by the imperative for enhanced operational efficiency and reduced labor expenditures. Government-backed initiatives promoting agricultural modernization, alongside infrastructure development such as improved transportation networks for crop logistics, are significant catalysts for market advancement. The growing demand for high-yield crop varieties also necessitates the adoption of sophisticated harvesting technologies, including combine harvesters. Furthermore, the trend towards large-scale farming operations, particularly in North and West India, is generating considerable opportunities for combine harvester manufacturers. Key challenges include high upfront investment costs, limited credit accessibility for smallholder farmers, and the requirement for improved after-sales support and maintenance infrastructure in select regions. Market segmentation highlights a strong preference for self-propelled combine harvesters, holding the largest market share, followed by track and tractor-powered variants. Prominent industry players, including Kubota, TAFE, Mahindra Tractors, and John Deere, are actively addressing this escalating demand through continuous innovation and the introduction of diverse models designed for India's varied agricultural landscapes.

India Combine Harvester Market Market Size (In Million)

The competitive environment features both established global and domestic manufacturers. International firms capitalize on their technological prowess and brand equity, while domestic companies leverage their deep understanding of local agricultural needs and cost-effective production capabilities. Future market growth will hinge on effective strategies that mitigate farmer constraints, such as tailored financing solutions, accessible training programs, and enhanced availability of spare parts and maintenance services. The development of fuel-efficient and technologically advanced models suited to various crop types and farm sizes will be critical for sustained market expansion. The projected growth trajectory signifies a positive outlook for the Indian combine harvester market, positioning it as a vital component of the nation's agricultural modernization agenda.

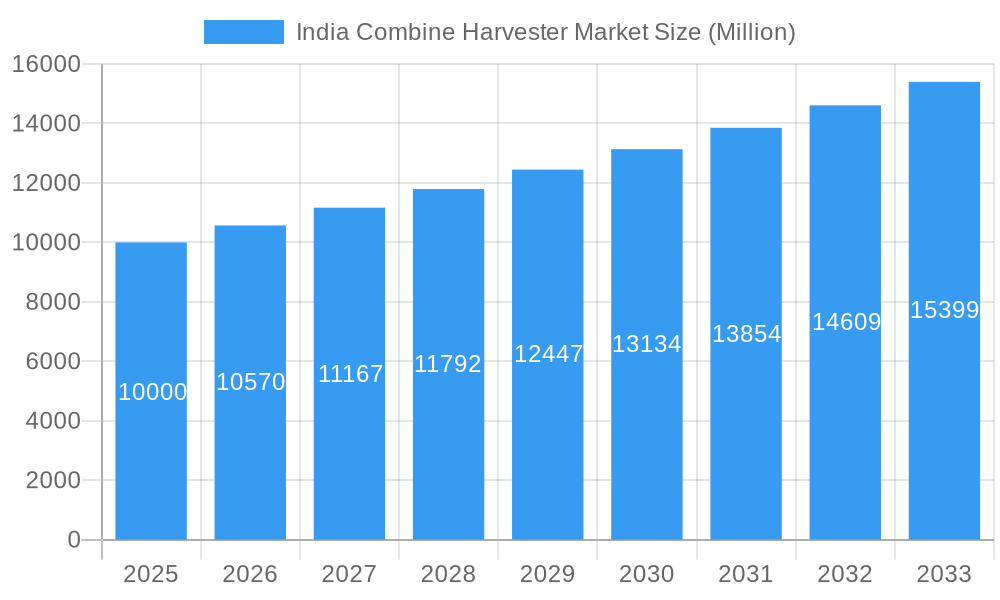

India Combine Harvester Market Company Market Share

India Combine Harvester Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India combine harvester market, offering valuable insights for industry stakeholders, investors, and market entrants. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, key players, technological advancements, and future growth prospects. The report leverages extensive research to provide actionable intelligence, enabling informed decision-making in this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

India Combine Harvester Market Concentration & Dynamics

The Indian combine harvester market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of several smaller, regional players contributes to a dynamic competitive environment. Innovation in this space is driven by technological advancements, particularly in automation and efficiency, as well as government initiatives promoting mechanization in agriculture. The regulatory framework, while supportive of agricultural modernization, presents some challenges related to import tariffs and emission norms. Substitute products like manual harvesting are declining in significance due to rising labor costs and the need for increased efficiency. End-user trends reveal a growing preference for self-propelled harvesters, especially among larger farms. M&A activity has been moderate, with a few notable acquisitions in recent years, reflecting consolidation trends within the sector.

- Market Share: Top 5 players account for approximately xx% of the market.

- M&A Deal Count: Approximately xx deals in the past 5 years.

- Key Innovation Areas: Automation, fuel efficiency, precision farming technologies.

- Regulatory Focus: Emission standards, safety regulations, import/export policies.

India Combine Harvester Market Industry Insights & Trends

The Indian combine harvester market has witnessed significant growth fueled by factors such as rising agricultural incomes, government support for mechanization, and increasing demand for efficient harvesting solutions. The market size in 2025 is estimated at xx Million. Technological advancements like GPS-guided harvesting and intelligent sensors are driving efficiency gains, while changing consumer preferences towards higher-capacity and technologically advanced machines are shaping market trends. The increasing adoption of precision farming techniques is further boosting demand for advanced combine harvesters. However, challenges remain, such as high initial investment costs, limited access to credit for smaller farmers, and uneven infrastructure development in certain regions. The market is expected to continue its growth trajectory, driven by increasing agricultural productivity and government initiatives aiming at modernizing the agricultural sector.

Key Markets & Segments Leading India Combine Harvester Market

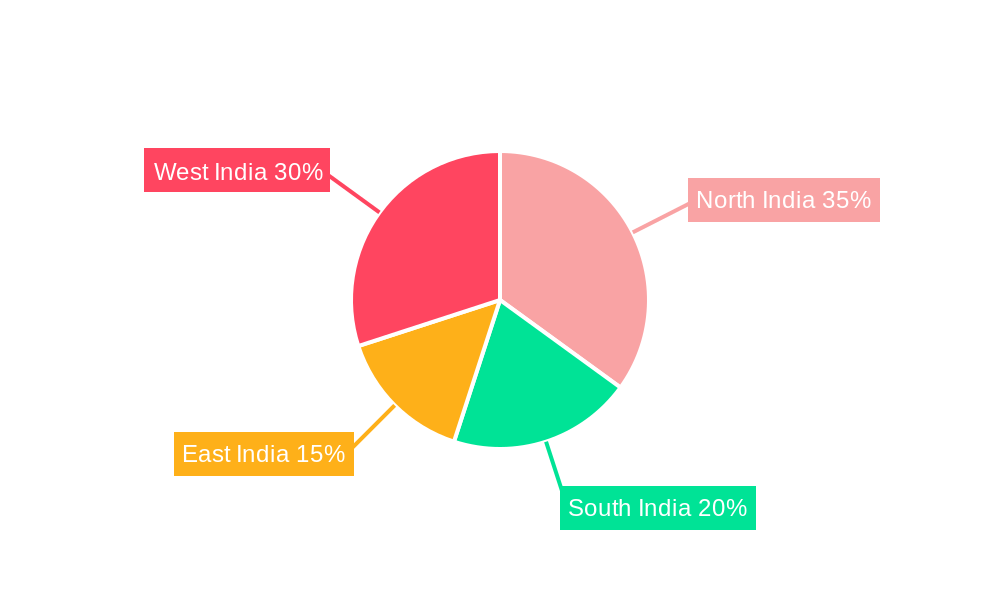

The North and West regions of India currently dominate the combine harvester market, driven by factors such as larger farm sizes, higher crop yields, and greater farmer awareness of the benefits of mechanization. Within the segment by type, self-propelled combine harvesters are experiencing the fastest growth, reflecting the increasing demand for higher efficiency and reduced reliance on tractors.

- Dominant Region: North and West India

- Fastest Growing Segment: Self-propelled Combine Harvester

- Growth Drivers:

- North & West: Larger farm sizes, higher yields, greater mechanization adoption.

- Self-propelled: Higher efficiency, reduced labor dependence, increased productivity.

- Track Combine Harvester: Better maneuverability in uneven terrains

- Tractor-powered Combine Harvester: Cost-effective option for smaller farms.

India Combine Harvester Market Product Developments

Recent product innovations focus on enhanced efficiency, improved fuel economy, and advanced features such as GPS integration for precision harvesting. Manufacturers are emphasizing user-friendly interfaces and robust designs to cater to diverse farming conditions. These advancements enhance productivity and reduce operational costs, providing a competitive edge in the market. The integration of smart technologies continues to be a key driver of product differentiation.

Challenges in the India Combine Harvester Market Market

The Indian combine harvester market faces challenges including high initial investment costs deterring small farmers, uneven infrastructure impacting accessibility in remote areas, and fierce competition among manufacturers leading to price pressures. Furthermore, fluctuations in raw material costs and the dependence on imports for some components contribute to market uncertainties. These factors influence the overall market growth and profitability.

Forces Driving India Combine Harvester Market Growth

Key growth drivers include government initiatives promoting agricultural mechanization, increasing farmer awareness of the benefits of mechanization, and the rising adoption of precision farming technologies. The expanding cultivated land area and favorable government policies further contribute to market expansion. The demand for improved crop yields and efficient harvesting methods is also fuelling market growth.

Challenges in the India Combine Harvester Market Market

Long-term growth is contingent upon sustained government support for agricultural mechanization, fostering technological innovation to reduce costs, and expanding access to credit for small farmers. Strategic partnerships between manufacturers and financial institutions can play a crucial role in mitigating the challenges faced by smallholder farmers.

Emerging Opportunities in India Combine Harvester Market

Emerging opportunities lie in the increasing adoption of technology in agriculture, the expanding demand for high-efficiency harvesters in newly cultivated areas, and the growing focus on sustainable farming practices. The development of customized solutions for specific crops and terrains represents significant potential. The government's push for sustainable agriculture also presents opportunities for eco-friendly combine harvester technologies.

Leading Players in the India Combine Harvester Market Sector

- Kubota Agricultural Machinery India Pvt Ltd

- Tractors and Farm Equipment (TAFE) Ltd

- Dasmesh Group

- Mahindra Tractors

- Kartar Agro Industries Pvt Ltd

- CLAAS India

- Balkar Combines

- John Deere India Pvt Ltd

- PREET Group

- Sonalika Group

- List Not Exhaustive

Key Milestones in India Combine Harvester Market Industry

- June 2022: The Andhra Pradesh government launched the YSR Yantra Seva Pathakam Scheme, distributing combine harvesters.

- November 2022: Mahindra & Mahindra inaugurated a new farm machinery plant capable of manufacturing 1200 combine harvesters annually.

- August 2023: Mahindra & Mahindra launched the Swaraj 8200 Wheel Harvester.

Strategic Outlook for India Combine Harvester Market Market

The India combine harvester market presents significant long-term growth potential, driven by increasing demand for efficient harvesting solutions and supportive government policies. Strategic focus should be on technological innovation, expanding market reach to smaller farms, and developing sustainable and affordable solutions. Partnerships and collaborations will be key to unlocking the full potential of this dynamic market.

India Combine Harvester Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Combine Harvester Market Segmentation By Geography

- 1. India

India Combine Harvester Market Regional Market Share

Geographic Coverage of India Combine Harvester Market

India Combine Harvester Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost of Farm Labors; Increasing Consumption of Grain Crops

- 3.3. Market Restrains

- 3.3.1. High Cost of Combine Harvesters; Small and Fragmented Land Holdings

- 3.4. Market Trends

- 3.4.1. High Cost of Farm Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Combine Harvester Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kubota Agricultural Machinery India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tractors and Farm Equipment (TAFE) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dasmesh Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahindra Tractors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kartar Agro Industries Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Balkar Combines

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 John Deere India Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PREET Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sonalika Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kubota Agricultural Machinery India Pvt Ltd

List of Figures

- Figure 1: India Combine Harvester Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Combine Harvester Market Share (%) by Company 2025

List of Tables

- Table 1: India Combine Harvester Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Combine Harvester Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Combine Harvester Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Combine Harvester Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Combine Harvester Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Combine Harvester Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: India Combine Harvester Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Combine Harvester Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Combine Harvester Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Combine Harvester Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Combine Harvester Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Combine Harvester Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Combine Harvester Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the India Combine Harvester Market?

Key companies in the market include Kubota Agricultural Machinery India Pvt Ltd, Tractors and Farm Equipment (TAFE) Ltd, Dasmesh Group, Mahindra Tractors, Kartar Agro Industries Pvt Ltd, CLAAS India, Balkar Combines, John Deere India Pvt Ltd, PREET Group, Sonalika Group*List Not Exhaustive.

3. What are the main segments of the India Combine Harvester Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 275.4 million as of 2022.

5. What are some drivers contributing to market growth?

High Cost of Farm Labors; Increasing Consumption of Grain Crops.

6. What are the notable trends driving market growth?

High Cost of Farm Labor.

7. Are there any restraints impacting market growth?

High Cost of Combine Harvesters; Small and Fragmented Land Holdings.

8. Can you provide examples of recent developments in the market?

August 2023: Mahindra & Mahindra Ltd (M&M Ltd) launched a new wheel harvester under the Swaraj brand in the domestic market. Swaraj 8200 Wheel Harvester provides maximum harvesting acreage in a year with best-in-class grain quality and maximum profit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Combine Harvester Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Combine Harvester Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Combine Harvester Market?

To stay informed about further developments, trends, and reports in the India Combine Harvester Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence