Key Insights

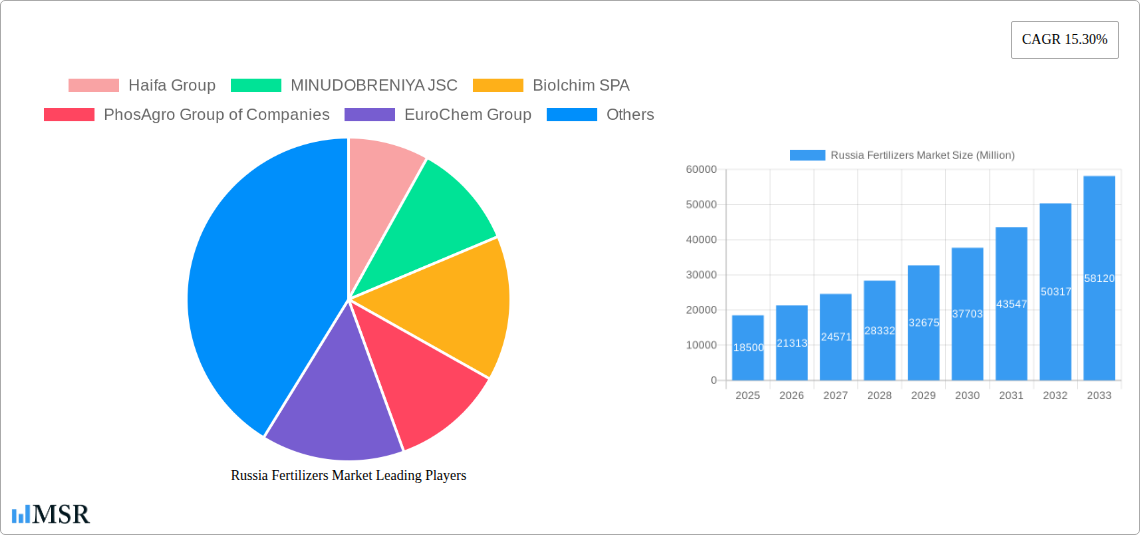

The Russian fertilizer market is poised for significant expansion, projecting a robust compound annual growth rate (CAGR) of 15.30% from 2025 to 2033. This growth is primarily fueled by increasing domestic demand for enhanced crop yields to ensure food security, coupled with Russia's strong position as a global exporter of key fertilizer types, particularly nitrogen-based products. The country's vast agricultural land and the continuous need for soil enrichment to optimize agricultural productivity are fundamental drivers. Furthermore, government initiatives aimed at boosting agricultural output and supporting domestic fertilizer manufacturers are expected to provide a favorable environment for market expansion. The market's value, estimated to reach approximately $18,500 million by 2025, is underpinned by these persistent factors.

Russia Fertilizers Market Market Size (In Billion)

While the market benefits from strong demand, several factors could temper its trajectory. Stricter environmental regulations concerning fertilizer production and usage, alongside potential fluctuations in global commodity prices for raw materials like natural gas (a key component in nitrogen fertilizer production), could present challenges. Geopolitical factors and evolving trade policies may also influence export volumes and market access. However, the inherent advantages of Russia's fertilizer industry, including its substantial production capacity and established export networks, are expected to largely offset these restraints. Key segments, including production, consumption, imports, exports, and price trends, will be crucial indicators of market health and evolution throughout the forecast period, with Russia itself being a significant regional player and contributor to the global fertilizer landscape.

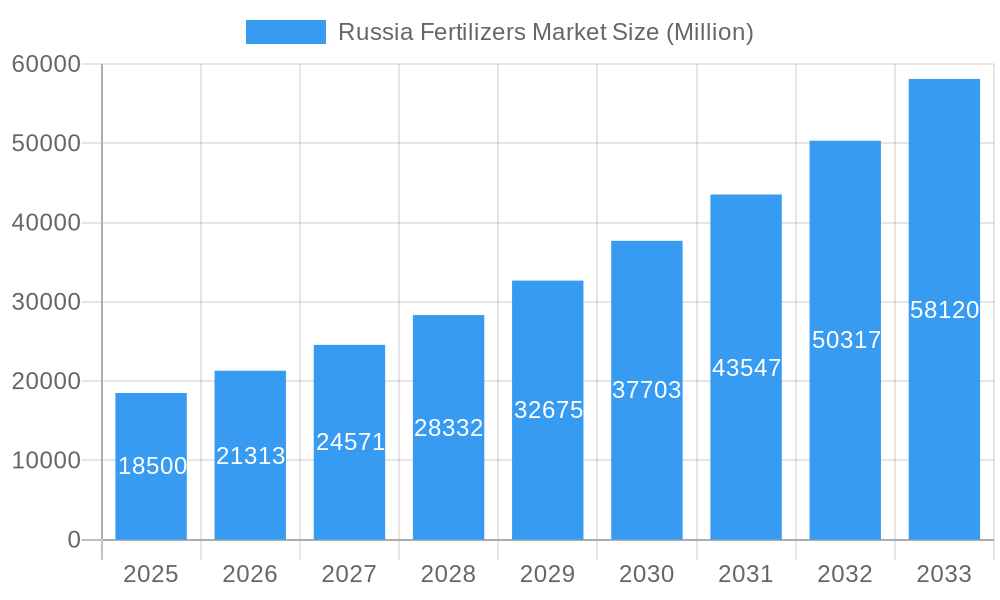

Russia Fertilizers Market Company Market Share

Russia Fertilizers Market Report: Unlocking Growth & Opportunities (2019-2033)

Gain unparalleled insights into the dynamic Russia Fertilizers Market with this comprehensive report. Covering the historical period of 2019-2024 and extending to a robust forecast period of 2025-2033, this analysis delves deep into production, consumption, import, export, and pricing dynamics. With a base and estimated year of 2025, this report leverages expert analysis and extensive data to equip industry stakeholders with actionable intelligence. Essential for fertilizer manufacturers, distributors, agricultural enterprises, and investors seeking to capitalize on the burgeoning Russian agricultural sector.

Russia Fertilizers Market Market Concentration & Dynamics

The Russia Fertilizers Market exhibits a moderately concentrated landscape, characterized by the significant presence of major global and domestic players. While a few large-scale producers dominate, there is still room for innovation and niche market penetration. Key companies like PhosAgro Group of Companies, EuroChem Group, and MINUDOBRENIYA JSC command substantial market share, influencing production volumes and export strategies. The innovation ecosystem is driven by advancements in nutrient efficiency, slow-release fertilizers, and specialized formulations to address specific soil deficiencies and crop requirements. Regulatory frameworks, primarily governed by government policies on agricultural subsidies, export duties, and environmental standards, play a crucial role in shaping market access and operational costs. Substitute products, such as organic fertilizers and bio-stimulants, are gaining traction, albeit slowly, driven by a growing consumer preference for sustainable agriculture. End-user trends are shifting towards precision agriculture, demanding higher-quality, customized fertilizer solutions that optimize crop yields while minimizing environmental impact. Merger and acquisition (M&A) activities, though not intensely frequent, have historically consolidated market power and expanded product portfolios. The market has witnessed a limited number of significant M&A deals in the historical period, primarily focused on vertical integration and market expansion by leading players.

Russia Fertilizers Market Industry Insights & Trends

The Russia Fertilizers Market is poised for significant expansion, driven by a confluence of robust growth drivers, technological disruptions, and evolving consumer behaviors. The estimated market size for 2025 is projected to be in the trillions of USD, with a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025-2033. This growth is underpinned by the critical need to enhance agricultural productivity to meet domestic food security demands and capitalize on export opportunities. Government initiatives aimed at modernizing the agricultural sector, coupled with increased investment in research and development, are fostering innovation in fertilizer production and application. Technological advancements, including the development of enhanced efficiency fertilizers (EEFs) and digital farming solutions, are revolutionizing nutrient management, leading to optimized resource utilization and reduced environmental footprint. Evolving consumer behaviors, influenced by a growing awareness of sustainable farming practices and the demand for high-quality produce, are pushing fertilizer manufacturers to develop environmentally friendly and specialized nutrient solutions. The increasing adoption of precision agriculture techniques, which leverage data analytics and sensor technology for targeted fertilizer application, is further stimulating demand for advanced fertilizer products. The market is also witnessing a trend towards bio-fertilizers and organic nutrient sources, reflecting a broader shift towards sustainable agricultural practices. Furthermore, the expansion of arable land and the continuous need to replenish soil nutrients for improved crop yields are fundamental drivers of market growth. The integration of advanced manufacturing technologies, such as AI-driven process optimization and automated production lines, is also contributing to enhanced efficiency and reduced production costs.

Key Markets & Segments Leading Russia Fertilizers Market

The Russia Fertilizers Market is characterized by strong leadership across various segments, primarily driven by the immense agricultural potential of the nation.

Production Analysis:

Russia stands as a global powerhouse in fertilizer production, particularly in nitrogenous and potash-based fertilizers. The country's abundant natural resources, including vast reserves of natural gas (essential for nitrogen fertilizer production) and potash, provide a significant competitive advantage. Key production hubs are concentrated in regions with access to these raw materials and well-developed logistical infrastructure. The dominant segment within production analysis is Nitrogen Fertilizers, due to their widespread application and high demand from diverse crops.

- Drivers of Dominance:

- Abundant natural gas reserves for ammonia production.

- Significant potash reserves for potash fertilizer production.

- Government support for domestic fertilizer production.

- Well-established chemical industry infrastructure.

Consumption Analysis:

Domestic consumption of fertilizers is on an upward trajectory, fueled by the need to improve crop yields and support the growing agricultural export sector. Cereals, oilseeds, and pulses are the primary crops driving fertilizer consumption. The dominant segment in consumption analysis is Nitrogen Fertilizers, reflecting their fundamental role in plant growth.

- Drivers of Dominance:

- Increasing demand for food security and agricultural exports.

- Government policies promoting agricultural modernization.

- Adoption of advanced farming techniques requiring optimized nutrient input.

- Expansion of cultivated land.

Import Market Analysis (Value & Volume):

While Russia is a major exporter, the import market for certain specialized fertilizers and nutrient blends remains significant. Imports cater to niche agricultural needs and specific crop requirements not fully met by domestic production. The value of imports is influenced by global pricing trends and the demand for high-margin, specialized products.

- Dominance Analysis: The import market is driven by demand for Specialty Fertilizers, such as micronutrient-enriched formulations and slow-release products, which offer specific advantages for high-value crops or challenging soil conditions. The volume of imports is relatively smaller compared to exports, but the value can be substantial due to the premium pricing of these products.

Export Market Analysis (Value & Volume):

Russia is a leading global exporter of fertilizers, contributing significantly to the international supply of nitrogen, phosphate, and potash fertilizers. The export market is crucial for the Russian economy, generating substantial foreign exchange earnings. The dominant segment in export analysis is Nitrogen and Potash Fertilizers, reflecting the country's resource advantages and production capacity.

- Drivers of Dominance:

- Competitive pricing due to abundant raw materials.

- Large-scale production facilities.

- Strategic geographical location for export to key agricultural markets in Asia, Europe, and Latin America.

- Government support for export promotion.

Price Trend Analysis:

Price trends in the Russian fertilizer market are influenced by global commodity prices, energy costs (particularly natural gas), supply and demand dynamics, government policies, and geopolitical factors. Fluctuations in international fertilizer benchmarks directly impact domestic pricing.

- Dominance Analysis: The price trend analysis is dominated by the impact of Global Commodity Prices and Energy Costs. Volatility in these factors directly translates to price fluctuations for both domestic and imported fertilizers. Periods of high energy prices can lead to increased production costs and, consequently, higher fertilizer prices.

Russia Fertilizers Market Product Developments

The Russian fertilizer market is witnessing a surge in product development focused on enhancing agricultural efficiency and sustainability. Innovations include the introduction of advanced NPK formulations with optimized trace element content, such as ICL's Solinure range, designed to boost crop yields. There's also a growing emphasis on specialty phosphate solutions, exemplified by ICL's strategic partnership with General Mills, aiming to deliver tailored nutrient solutions for global expansion. Furthermore, research is progressing into bio-fertilizers and slow-release technologies to minimize nutrient loss and environmental impact, aligning with global trends towards sustainable agriculture and precision farming practices.

Challenges in the Russia Fertilizers Market Market

The Russia Fertilizers Market faces several challenges that could impact its growth trajectory. Significant challenges include fluctuating global commodity prices and volatile energy costs, which directly affect production costs and market competitiveness. Stringent environmental regulations and evolving sustainability standards require continuous investment in eco-friendly production processes and product development. Logistical complexities, particularly in vast and remote agricultural regions, can lead to increased transportation costs and delays. Furthermore, geopolitical uncertainties and trade policy shifts can disrupt export markets and impact international trade flows, creating supply chain vulnerabilities.

Forces Driving Russia Fertilizers Market Growth

Several key forces are propelling the Russia Fertilizers Market forward. The imperative to enhance domestic food security and meet the growing global demand for agricultural products is a primary driver. Government support, through subsidies, tax incentives, and infrastructure development, plays a crucial role in fostering the industry. Technological advancements in fertilizer production, including enhanced efficiency fertilizers (EEFs) and precision agriculture technologies, are improving nutrient utilization and crop yields. The continuous need to replenish soil nutrients to maintain and improve agricultural productivity, coupled with an expanding cultivated land area, further fuels demand. The growing export potential, driven by Russia's competitive pricing and abundant raw material resources, also acts as a significant growth catalyst.

Challenges in the Russia Fertilizers Market Market

The long-term growth catalysts for the Russia Fertilizers Market are deeply intertwined with innovation and strategic market expansion. The development and widespread adoption of novel fertilizer formulations, such as controlled-release fertilizers and bio-stimulants, will be critical in addressing specific soil needs and environmental concerns. Strategic partnerships between domestic producers and international agricultural technology providers can accelerate the transfer of cutting-edge knowledge and product development. Furthermore, the exploration and penetration of new and emerging agricultural markets, particularly in regions with growing food demand, will offer substantial expansion opportunities. Continued investment in research and development to create climate-resilient and resource-efficient fertilizers will be paramount for sustained growth in a changing global agricultural landscape.

Emerging Opportunities in Russia Fertilizers Market

Emerging opportunities in the Russia Fertilizers Market are diverse and promising. There is a significant opportunity in the development and promotion of organic and bio-fertilizers, catering to the growing global demand for sustainable agriculture and organic produce. The increasing adoption of precision agriculture worldwide presents a demand for smart fertilizers and nutrient management solutions that can be precisely applied based on real-time crop needs. Furthermore, opportunities exist in expanding export markets, particularly in regions with rapidly developing agricultural sectors and increasing food import requirements. The development of specialty fertilizers for high-value crops and niche agricultural applications also offers lucrative avenues for growth and market differentiation. Russia's abundant natural resources present an ongoing opportunity for cost-effective production, a critical factor in a competitive global market.

Leading Players in the Russia Fertilizers Market Sector

- Haifa Group

- MINUDOBRENIYA JSC

- Biolchim SPA

- PhosAgro Group of Companies

- EuroChem Group

- Trade Corporation International

- Yara International AS

- KuibyshevAzot PJSC

- Mivena BV

- ICL Group Ltd

Key Milestones in Russia Fertilizers Market Industry

- January 2023: ICL entered into a strategic partnership agreement with General Mills, positioning itself as the supplier of strategic specialty phosphate solutions. This long-term agreement also focuses on international expansion, indicating a move towards diversified product offerings and global reach.

- May 2022: ICL launched three new NPK formulations under the Solinure product line, featuring increased trace elements to optimize crop yields. This product development highlights a focus on enhanced nutrient delivery and improved agricultural outcomes.

- May 2022: ICL signed agreements with customers in India and China to supply 600,000 and 700,000 metric tons of potash, respectively, in 2022 at USD 590 per ton. This demonstrates significant export activity and the company's role in fulfilling global potash demand, influencing international pricing and supply dynamics.

Strategic Outlook for Russia Fertilizers Market Market

The strategic outlook for the Russia Fertilizers Market is one of sustained growth and increasing sophistication. The market is expected to be driven by a combination of domestic demand for improved food security and robust export opportunities. Strategic investments in research and development for advanced, eco-friendly fertilizer solutions will be crucial for maintaining a competitive edge. Furthermore, forging strategic alliances and partnerships, both domestically and internationally, will foster innovation and market penetration. The focus on precision agriculture and the development of tailored nutrient management plans will unlock new market segments and enhance customer value. Ultimately, the market's future success will hinge on its ability to adapt to evolving environmental regulations, leverage technological advancements, and capitalize on global agricultural trends, ensuring long-term sustainability and profitability.

Russia Fertilizers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

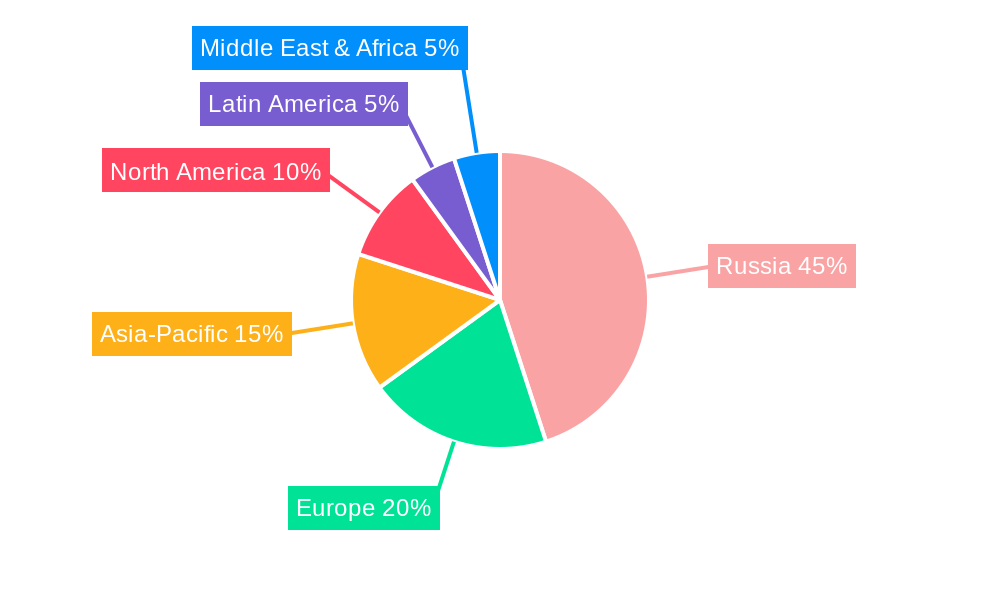

Russia Fertilizers Market Segmentation By Geography

- 1. Russia

Russia Fertilizers Market Regional Market Share

Geographic Coverage of Russia Fertilizers Market

Russia Fertilizers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Fertilizers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Haifa Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MINUDOBRENIYA JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biolchim SPA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PhosAgro Group of Companies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EuroChem Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trade Corporation International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yara International AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KuibyshevAzot PJSC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mivena BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ICL Group Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Haifa Group

List of Figures

- Figure 1: Russia Fertilizers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Russia Fertilizers Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Fertilizers Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Russia Fertilizers Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Russia Fertilizers Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Russia Fertilizers Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Russia Fertilizers Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Russia Fertilizers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Russia Fertilizers Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Russia Fertilizers Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Russia Fertilizers Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Russia Fertilizers Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Russia Fertilizers Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Russia Fertilizers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Fertilizers Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Russia Fertilizers Market?

Key companies in the market include Haifa Group, MINUDOBRENIYA JSC, Biolchim SPA, PhosAgro Group of Companies, EuroChem Group, Trade Corporation International, Yara International AS, KuibyshevAzot PJSC, Mivena BV, ICL Group Ltd.

3. What are the main segments of the Russia Fertilizers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.May 2022: ICL has launched three new NPK formulations of Solinure, a product with increased trace elements to optimise yieldsMay 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric tons of potash, respectively, in 2022 at USD 590 per ton.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Fertilizers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Fertilizers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Fertilizers Market?

To stay informed about further developments, trends, and reports in the Russia Fertilizers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence