Key Insights

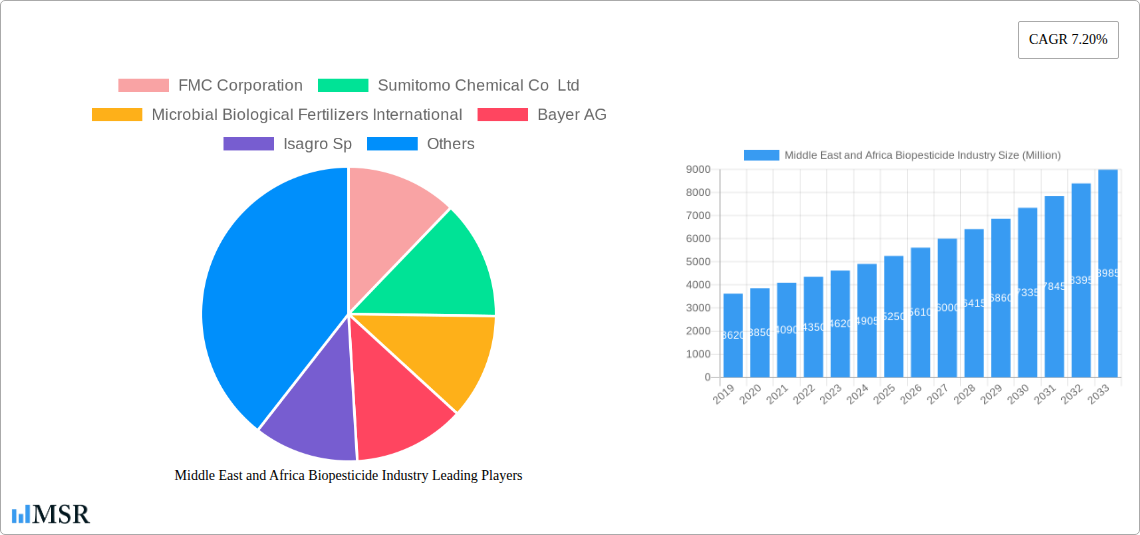

The Middle East and Africa (MEA) biopesticide market is poised for substantial expansion, projected to reach an estimated USD 5,250 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 7.20% through 2033. This robust growth is fueled by a confluence of factors, primarily the increasing demand for sustainable agricultural practices and a growing awareness of the environmental and health hazards associated with conventional chemical pesticides. Governments across the MEA region are actively promoting the adoption of biopesticides through various policies, incentives, and research initiatives, recognizing their role in achieving food security and safeguarding natural resources. Furthermore, the rising adoption of integrated pest management (IPM) strategies, which favor biological control agents, is a significant driver. Economic development in countries like Saudi Arabia and the UAE, coupled with a growing agricultural sector in nations such as South Africa and Egypt, creates a fertile ground for biopesticide market penetration. The trend towards organic farming and the increasing consumer preference for pesticide-free produce further bolster this demand, pushing the market beyond its current trajectory.

Middle East and Africa Biopesticide Industry Market Size (In Billion)

Despite the optimistic outlook, certain restraints may temper the growth rate. The relatively higher cost of some biopesticides compared to their chemical counterparts, coupled with challenges in distribution and farmer education regarding their effective application, present hurdles. Ensuring consistent product quality and efficacy across diverse climatic conditions prevalent in the MEA region is also a critical concern for manufacturers. However, ongoing research and development, leading to improved formulations and cost efficiencies, are expected to mitigate these challenges. The market is also witnessing innovation in product types, with a focus on microbial and botanical biopesticides, catering to specific pest and crop needs. Strategic partnerships and collaborations between leading global biopesticide companies and regional players are likely to accelerate market adoption and overcome infrastructural limitations. The commitment to sustainable agriculture and the burgeoning organic food movement within the MEA region firmly establish the biopesticide market as a critical component of future agricultural landscapes.

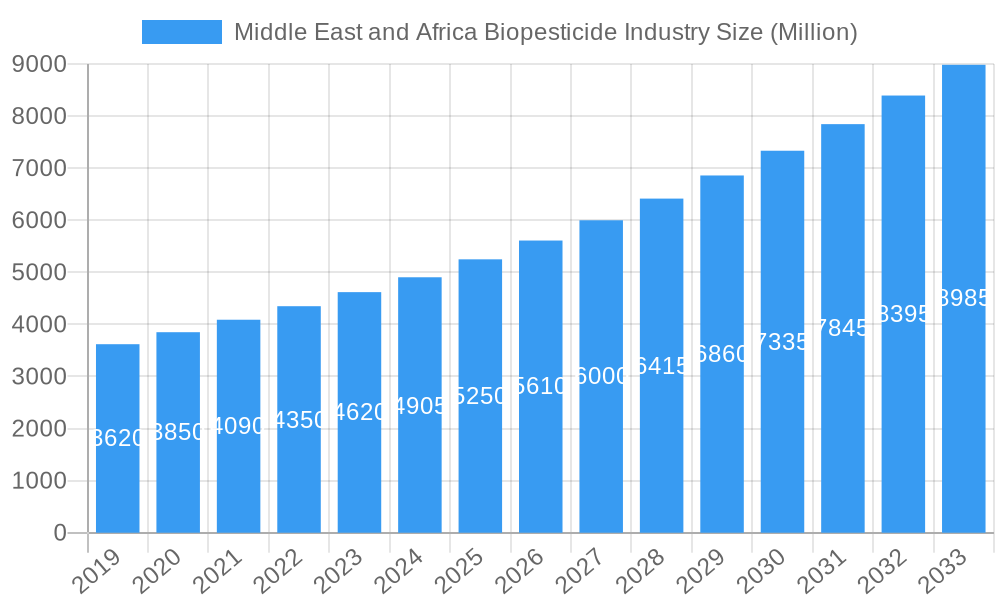

Middle East and Africa Biopesticide Industry Company Market Share

Middle East and Africa Biopesticide Industry Market Concentration & Dynamics

The Middle East and Africa (MEA) biopesticide market, valued at approximately $350 Million in 2025, is characterized by a moderate concentration with a few dominant players, including FMC Corporation, Sumitomo Chemical Co Ltd, Bayer AG, and BASF SE, holding significant market share. Innovation ecosystems are rapidly developing, driven by increasing research and development investments from both multinational corporations and emerging local enterprises like Microbial Biological Fertilizers International and Omnia Holdings Limited. Regulatory frameworks across MEA nations are progressively evolving, with some countries establishing more conducive policies for biopesticide registration and adoption. The presence of substitute conventional pesticides, though still prevalent, is facing increasing scrutiny due to environmental concerns, boosting the demand for biological alternatives. End-user trends indicate a growing preference for sustainable agricultural practices among farmers and consumers alike, spurred by awareness campaigns and a desire for healthier food products. Mergers and acquisitions (M&A) activity, while not yet at peak levels, is a growing trend, with an estimated XX M&A deals expected by 2028, indicating strategic consolidation and expansion by key players seeking to enhance their product portfolios and market reach.

Middle East and Africa Biopesticide Industry Industry Insights & Trends

The Middle East and Africa (MEA) biopesticide industry is poised for substantial growth, projected to expand from an estimated $350 Million in 2025 to over $1,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 14.5% during the forecast period (2025-2033). This robust expansion is fueled by a confluence of market growth drivers, technological disruptions, and evolving consumer behaviors that are reshaping the agricultural landscape.

Market Growth Drivers:

- Increasing Demand for Sustainable Agriculture: Growing environmental consciousness, coupled with concerns over the health impacts of chemical pesticides, is driving a significant shift towards sustainable farming practices across the MEA region. Governments and international organizations are actively promoting eco-friendly solutions, further bolstering the adoption of biopesticides.

- Favorable Government Policies and Initiatives: Several MEA countries are implementing supportive policies, including subsidies, tax incentives, and streamlined registration processes, to encourage the research, development, and commercialization of biopesticides. This regulatory push is a critical factor in market expansion.

- Rising Pest Resistance to Chemical Pesticides: The increasing prevalence of pest resistance to conventional chemical pesticides necessitates the development and adoption of alternative pest management strategies. Biopesticides offer a viable solution to overcome this challenge.

- Growth in the Organic Food Market: The expanding organic food sector, driven by increasing consumer demand for healthier and chemical-free produce, directly translates to a higher demand for biopesticides as essential inputs for organic farming.

- Technological Advancements in Biopesticide Production: Innovations in biotechnology, including advanced fermentation techniques and strain selection, are leading to the development of more effective, cost-efficient, and stable biopesticide formulations, thereby enhancing their market competitiveness.

Technological Disruptions: The biopesticide industry is witnessing significant technological advancements. The development of genetically modified microbial strains with enhanced efficacy, the use of nanotechnology for targeted delivery of biological agents, and the application of artificial intelligence in pest identification and management are key disruptive technologies. Furthermore, advancements in formulation technologies are improving the shelf-life and application efficiency of biopesticides, making them more practical for widespread use in diverse agricultural settings across the MEA. The integration of precision agriculture techniques with biopesticide application is also emerging, allowing for optimized and targeted pest control, reducing waste and maximizing effectiveness.

Evolving Consumer Behaviors: Consumers in the MEA region are increasingly prioritizing health and well-being, leading to a growing preference for organically produced food items. This heightened consumer awareness translates into a stronger demand for products grown using environmentally friendly methods, which inherently favors the use of biopesticides. Farmers, influenced by this demand and by the long-term benefits of soil health and biodiversity, are actively seeking sustainable alternatives to conventional pesticides. This shift in consumer perception and farmer adoption is a powerful catalyst for the biopesticide market's growth trajectory.

Key Markets & Segments Leading Middle East and Africa Biopesticide Industry

The Middle East and Africa (MEA) biopesticide industry exhibits distinct leadership across its various segments, driven by unique economic, environmental, and agricultural dynamics. In terms of Production Analysis, countries like South Africa and Egypt are emerging as significant production hubs, benefiting from favorable agricultural conditions, access to raw materials, and growing domestic demand. Their production strategies are increasingly focused on leveraging local microbial resources and adapting advanced biotechnological processes to cater to regional pest challenges.

For Consumption Analysis, the agricultural powerhouse of Egypt, followed by rapidly developing economies like Kenya and Nigeria, are leading the charge. These nations exhibit high consumption volumes due to their large agricultural sectors, diverse cropping patterns, and increasing adoption of integrated pest management (IPM) strategies. The demand is particularly robust for biopesticides targeting staple crops such as maize, wheat, and vegetables.

The Import Market Analysis for both Value and Volume is dominated by countries with significant agricultural import dependencies and a growing awareness of sustainable practices. South Africa, with its large commercial farming operations, and Saudi Arabia, looking to enhance food security through advanced agricultural techniques, are key importers. The import trends indicate a strong demand for established biopesticide formulations, as well as novel biological solutions for specific crop-disease complexes. The value of imports is projected to reach approximately $180 Million by 2025, with volumes estimated at around 45,000 metric tons.

Conversely, the Export Market Analysis, while still nascent, is showing promising growth. South Africa, with its established agricultural export base and access to advanced research, is a notable exporter. Emerging export markets include countries in the Gulf Cooperation Council (GCC) and North Africa, where demand for high-quality, sustainably produced agricultural goods is rising. The value of exports is predicted to reach around $70 Million by 2025, with volumes around 18,000 metric tons, showcasing a positive growth trajectory.

The Price Trend Analysis for MEA biopesticides reveals a gradual convergence with global pricing, driven by increased competition, economies of scale in production, and the development of more cost-effective manufacturing processes. While historically higher than conventional pesticides, the price gap is narrowing, making biopesticides a more economically viable option for a wider range of farmers. Factors influencing price include the cost of raw materials (microbial cultures, plant extracts), research and development expenditure, and regulatory compliance costs. Over the forecast period, prices are expected to see a steady increase of approximately 3-5% annually, primarily due to inflation and ongoing R&D investments.

Drivers for Dominance in Key Segments:

- Economic Growth and Agricultural Investment: Nations experiencing robust economic growth often allocate greater resources to their agricultural sectors, fostering the adoption of advanced technologies like biopesticides.

- Favorable Regulatory Environments: Governments that actively support biopesticide registration and market entry through streamlined processes and incentives drive both production and consumption.

- Presence of Leading Agribusiness Companies: The establishment and operations of major players like Bayer AG, BASF SE, and FMC Corporation in the region stimulate local production, import activity, and knowledge transfer.

- Farmer Education and Extension Services: Effective dissemination of information on the benefits and application of biopesticides through agricultural extension programs significantly influences farmer adoption and, consequently, consumption.

- Climate Change and Pest Pressure: Regions experiencing intensified pest outbreaks due to climate change are compelled to seek more sustainable and effective pest management solutions, driving demand for biopesticides.

Middle East and Africa Biopesticide Industry Product Developments

The MEA biopesticide market is witnessing a surge in product innovations focused on enhanced efficacy, broader spectrum control, and improved shelf-life. Companies are actively developing new microbial strains, botanical extracts, and pheromone-based solutions tailored to address the unique pest and disease challenges prevalent across the region's diverse agricultural landscapes. Key developments include formulations for controlling economically significant pests in staple crops like maize and wheat, as well as specialized products for high-value horticultural produce. Advancements in formulation technologies are also leading to more stable and easier-to-apply biopesticides, making them more accessible and attractive to a wider farmer base. The emphasis is increasingly on integrated pest management (IPM) compatible products that work synergistically with conventional methods, offering a sustainable path to crop protection.

Challenges in the Middle East and Africa Biopesticide Industry Market

Despite the promising growth, the MEA biopesticide market faces significant hurdles. Regulatory frameworks across many nations are still fragmented and underdeveloped, leading to lengthy and costly registration processes. This creates uncertainty for manufacturers and limits the availability of diverse products. Supply chain infrastructure for biopesticides, which often require specific storage and transportation conditions, is also lacking in many areas, hindering widespread distribution and accessibility for farmers. Furthermore, a lack of farmer awareness and education regarding the efficacy and application of biopesticides, coupled with the perceived higher initial cost compared to conventional alternatives, presents a substantial barrier to adoption. Limited access to financing for smallholder farmers also restricts their ability to invest in these newer technologies. The competitive pressure from established and cheaper conventional pesticides remains a significant challenge, requiring continuous efforts in demonstrating the long-term economic and environmental benefits of biopesticides.

Forces Driving Middle East and Africa Biopesticide Industry Growth

Several powerful forces are propelling the growth of the biopesticide industry in the Middle East and Africa. Foremost among these is the escalating global demand for sustainable and organic food, which is creating a ripple effect across agricultural markets. Governments across the MEA region are increasingly recognizing the environmental and health benefits of biopesticides and are implementing supportive policies, including subsidies and streamlined registration processes, to encourage their adoption. Technological advancements in biopesticide formulation and production are leading to more effective and cost-competitive products, addressing previous limitations. Furthermore, the growing issue of pest resistance to conventional chemical pesticides is compelling farmers to seek alternative, more sustainable solutions, making biopesticides an attractive proposition.

Challenges in the Middle East and Africa Biopesticide Industry Market

The long-term growth catalysts for the Middle East and Africa biopesticide industry lie in overcoming existing limitations and capitalizing on emerging opportunities. Continued investment in research and development by both established players like Novozymes AS and Koppert Biological Systems, and local R&D institutions, will be crucial for developing region-specific biopesticide solutions. Strategic partnerships between multinational corporations and local distributors will enhance market penetration and farmer outreach. Furthermore, government-led initiatives promoting integrated pest management (IPM) and sustainable agriculture, coupled with educational programs for farmers, will foster wider adoption. Expansion into underserved agricultural regions and diversification of product portfolios to address a broader range of crops and pest pressures will also contribute to sustained, long-term growth.

Emerging Opportunities in Middle East and Africa Biopesticide Industry

Emerging opportunities in the MEA biopesticide industry are abundant, driven by evolving market dynamics and a growing commitment to sustainable agriculture. The increasing adoption of precision agriculture technologies presents a significant opportunity for the development and deployment of highly targeted biopesticide applications. Furthermore, the growing demand for organic produce in both domestic and international markets creates a lucrative niche for biopesticide manufacturers. The development of novel biopesticides derived from indigenous microbial and plant resources specific to the MEA region offers a unique competitive advantage. Moreover, the expansion of protected cultivation (e.g., greenhouses) across the region necessitates the use of safe and effective pest control methods, a role perfectly suited for biopesticides. Finally, collaborations with local universities and research institutions can unlock new product development and accelerate market penetration.

Leading Players in the Middle East and Africa Biopesticide Industry Sector

- FMC Corporation

- Sumitomo Chemical Co Ltd

- Microbial Biological Fertilizers International

- Bayer AG

- Isagro Sp

- Marrone Bio Innovations

- Omnia Holdings Limited

- Novozymes AS

- Koppert Biological Systems

- BASF SE

Key Milestones in Middle East and Africa Biopesticide Industry Industry

- 2019: Launch of several new biofungicide formulations by Bayer AG in key African markets, targeting common crop diseases.

- 2020: FMC Corporation expands its biopesticide research and development center in South Africa, focusing on regional pest challenges.

- 2021: Microbial Biological Fertilizers International receives significant investment to scale up its production of biofertilizers and biopesticides in Egypt.

- 2022: Omnia Holdings Limited introduces a new range of microbial biopesticides in the South African market, enhancing crop protection solutions.

- 2023: Novozymes AS partners with a leading agricultural cooperative in Kenya to promote the adoption of its bioinsecticide products.

- 2024: Koppert Biological Systems establishes a new distribution network across North Africa to improve accessibility of its biological crop protection solutions.

- 2024: BASF SE announces a strategic collaboration with a regional research institute to develop novel biopesticide solutions for arid agricultural environments.

Strategic Outlook for Middle East and Africa Biopesticide Industry Market

The strategic outlook for the MEA biopesticide market is exceptionally positive, driven by a synergistic interplay of increasing demand for sustainable agriculture, supportive governmental policies, and continuous innovation. Key growth accelerators include strategic collaborations between global leaders and local players to leverage regional expertise and distribution networks. Investment in localized R&D for biopesticides tailored to specific MEA pest and disease profiles will be crucial. Furthermore, enhancing farmer education and providing access to financing for sustainable agricultural inputs will significantly boost market penetration. The ongoing expansion of organic farming initiatives and a rising consumer preference for healthy food products will continue to fuel demand, making the MEA biopesticide sector a vital contributor to food security and environmental sustainability in the region.

Middle East and Africa Biopesticide Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

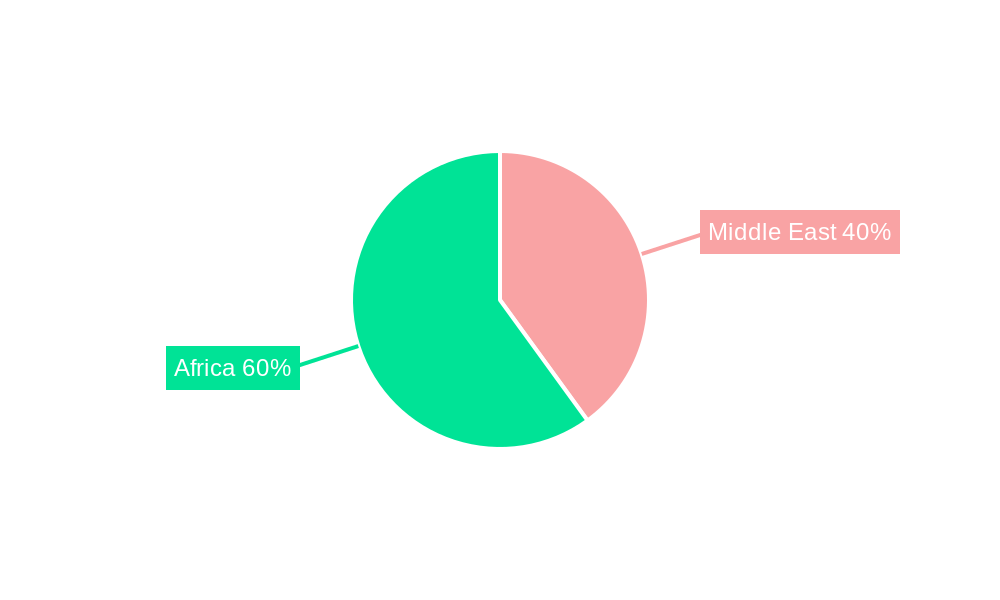

Middle East and Africa Biopesticide Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Biopesticide Industry Regional Market Share

Geographic Coverage of Middle East and Africa Biopesticide Industry

Middle East and Africa Biopesticide Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players

- 3.3. Market Restrains

- 3.3.1. High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming

- 3.4. Market Trends

- 3.4.1. Increase in Organic Farm Practises is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Biopesticide Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microbial Biological Fertilizers International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Isagro Sp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marrone Bio Innovations

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Omnia Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novozymes AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koppert Biological Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: Middle East and Africa Biopesticide Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Biopesticide Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East and Africa Biopesticide Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East and Africa Biopesticide Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Biopesticide Industry?

The projected CAGR is approximately 11.8%.

2. Which companies are prominent players in the Middle East and Africa Biopesticide Industry?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, Microbial Biological Fertilizers International, Bayer AG, Isagro Sp, Marrone Bio Innovations, Omnia Holdings Limited, Novozymes AS, Koppert Biological Systems, BASF SE.

3. What are the main segments of the Middle East and Africa Biopesticide Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players.

6. What are the notable trends driving market growth?

Increase in Organic Farm Practises is Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Biopesticide Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Biopesticide Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Biopesticide Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Biopesticide Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence