Key Insights

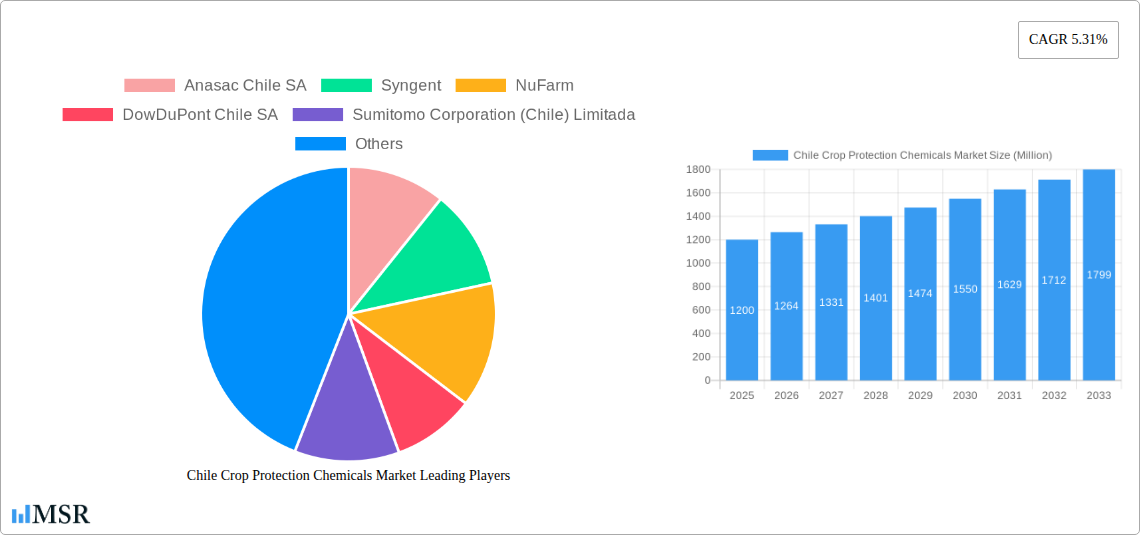

The Chile Crop Protection Chemicals Market is poised for robust expansion, projected to reach a substantial market size by 2033. Driven by a growing agricultural sector, increasing demand for higher crop yields, and the adoption of advanced farming practices, the market is expected to witness a Compound Annual Growth Rate (CAGR) of 5.31% throughout the forecast period. This growth is fueled by the critical need to safeguard crops from pests and diseases, ensuring food security and enhancing the profitability of agricultural operations. The Chilean government's supportive policies aimed at modernizing agriculture and promoting sustainable farming techniques further bolster this positive outlook. The market is segmented across synthetic and bio-based crop protection chemicals, with herbicides, insecticides, and fungicides representing the dominant product groups. The application of these chemicals spans a wide array of crops, including grains and cereals, oilseeds and pulses, and fruits and vegetables, underscoring their indispensable role in diverse agricultural landscapes.

Chile Crop Protection Chemicals Market Market Size (In Billion)

The market dynamics are further shaped by evolving trends such as the increasing preference for integrated pest management (IPM) strategies and the rising adoption of precision agriculture technologies. These trends are encouraging a more targeted and efficient application of crop protection solutions, leading to a reduction in environmental impact and improved sustainability. However, certain restraints, including stringent regulatory frameworks and the growing concern over the environmental impact of synthetic chemicals, necessitate a shift towards more eco-friendly alternatives. The burgeoning demand for bio-based crop protection chemicals presents a significant opportunity for innovation and market penetration, aligning with global sustainability goals. Companies operating in this space are focusing on research and development to introduce novel formulations and sustainable solutions to meet the evolving needs of Chilean agriculture.

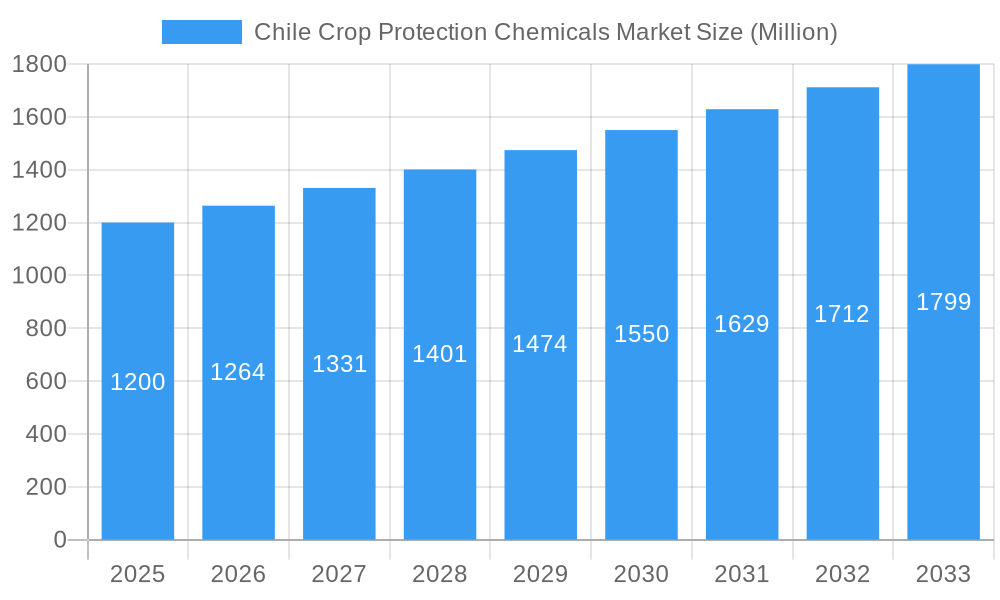

Chile Crop Protection Chemicals Market Company Market Share

This comprehensive report delves into the dynamic Chile Crop Protection Chemicals Market, providing in-depth analysis and actionable insights for stakeholders. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report examines market size, growth drivers, segmentation, competitive landscape, and future opportunities within Chile's vital agricultural sector. Discover how innovations in synthetic and bio-based crop protection chemicals, along with evolving product groups and application areas, are shaping the market.

Chile Crop Protection Chemicals Market Market Concentration & Dynamics

The Chile Crop Protection Chemicals Market exhibits a moderate to high concentration, characterized by the presence of major global players and a few significant domestic manufacturers. Innovation ecosystems are driven by ongoing research and development in both synthetic and bio-based crop protection chemicals, focusing on efficacy, environmental impact, and targeted pest control. The regulatory framework, overseen by entities like the Agricultural and Livestock Service (SAG), plays a crucial role in approving new active ingredients and formulations, influencing market entry and product lifecycle. Substitute products, including integrated pest management (IPM) strategies and advancements in agricultural biotechnology, are gaining traction, prompting chemical manufacturers to adapt their offerings. End-user trends are shifting towards sustainable agricultural practices, increasing demand for bio-based solutions and products with lower environmental footprints. Mergers and acquisitions (M&A) activities are sporadic but significant, aimed at consolidating market share, expanding product portfolios, and acquiring innovative technologies. Key M&A deal counts are estimated to be in the range of 2-5 significant transactions within the historical period, impacting market share distribution.

Chile Crop Protection Chemicals Market Industry Insights & Trends

The Chile Crop Protection Chemicals Market is projected to experience robust growth, driven by several key factors. The estimated market size for 2025 stands at approximately $XXX Million, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Increasing agricultural productivity demands, fueled by a growing global population and the need for enhanced food security, are primary market accelerators. Technological disruptions, including the development of precision agriculture techniques and the advent of digital farming solutions, are influencing the application and efficiency of crop protection chemicals. Farmers are increasingly adopting these technologies to optimize chemical usage, reduce waste, and improve crop yields. Evolving consumer behaviors, characterized by a rising preference for sustainably produced food and a greater awareness of the environmental impact of agricultural inputs, are also reshaping the market. This trend is fostering a significant increase in demand for bio-based crop protection chemicals, including biopesticides and biofungicides, which offer a more environmentally friendly alternative to conventional synthetic products. The Chilean government's focus on modernizing its agricultural sector and promoting export-oriented production further bolsters the market for effective crop protection solutions. Furthermore, the prevalence of specific agricultural challenges, such as the need to control invasive pests and diseases that threaten key export crops like fruits and vegetables, directly contributes to the sustained demand for a wide range of crop protection chemicals.

Key Markets & Segments Leading Chile Crop Protection Chemicals Market

The Synthetic Crop Protection Chemicals segment is currently the dominant force within the Chile Crop Protection Chemicals Market, accounting for an estimated XX% of the market share in the base year of 2025. This dominance is attributed to their established efficacy, broad-spectrum activity, and cost-effectiveness, particularly for large-scale agricultural operations. Within synthetic products, Herbicides represent the largest product group, driven by the extensive cultivation of grains and cereals, and oilseeds and pulses across the country. The need to manage weed infestations in these high-volume crops is a continuous requirement for effective herbicide solutions.

The Fruits and Vegetables application segment is another significant market leader, representing an estimated XX% of the overall market in 2025. Chile's strong export market for fruits like grapes, apples, and avocados, along with diverse vegetable production, necessitates a comprehensive range of crop protection chemicals, including insecticides and fungicides, to combat various pests and diseases that can impact quality and yield. The Turf and Ornamental Grass segment, while smaller in comparison, also contributes to the market, driven by landscaping needs in urban areas and golf courses.

However, the Bio-based Crop Protection Chemicals segment is experiencing substantial growth, with an anticipated CAGR of XX% during the forecast period. This rapid expansion is fueled by increasing environmental regulations, consumer demand for organic and sustainable produce, and advancements in biological control agents. As this segment matures, it is expected to capture a larger market share, particularly in high-value crop segments like fruits and vegetables where consumer perception plays a critical role.

Key drivers for the dominance of synthetic chemicals and specific segments include:

- Economic Growth: Overall economic prosperity supports investment in agricultural inputs, including crop protection chemicals.

- Infrastructure Development: Improved transportation and storage facilities facilitate the distribution of these chemicals across vast agricultural regions.

- Technological Advancements: Continued innovation in synthetic formulations leads to more effective and targeted solutions.

- Government Support for Agriculture: Policies promoting agricultural exports and productivity indirectly boost the demand for crop protection chemicals.

- Prevalence of Specific Pests and Diseases: Recurring and challenging pest and disease outbreaks in key crops necessitate robust chemical intervention.

Chile Crop Protection Chemicals Market Product Developments

Product development in the Chile Crop Protection Chemicals Market is intensely focused on enhancing efficacy, reducing environmental impact, and developing resistance management strategies. Innovations in synthetic formulations include the creation of novel active ingredients with improved toxicological profiles and reduced off-target effects. Simultaneously, significant advancements are being made in bio-based solutions, such as the development of highly specific microbial pesticides and biostimulants that boost plant immunity. The market relevance of these developments is high, as they address the dual demands of maximizing crop yields and adhering to stricter environmental regulations and consumer preferences for sustainable agriculture.

Challenges in the Chile Crop Protection Chemicals Market Market

The Chile Crop Protection Chemicals Market faces several significant challenges that can impact its growth trajectory. Stringent and evolving regulatory hurdles, including the approval processes for new chemical registrations and restrictions on certain active ingredients, can delay product launches and increase development costs. Supply chain disruptions, exacerbated by global events, can lead to price volatility and availability issues for key raw materials and finished products. Intense competitive pressures from both global giants and emerging domestic players also necessitate continuous innovation and strategic pricing. Quantifiable impacts include potential delays of 1-3 years for new product registrations and an estimated 5-10% increase in operational costs due to supply chain volatility.

Forces Driving Chile Crop Protection Chemicals Market Growth

Several powerful forces are propelling the growth of the Chile Crop Protection Chemicals Market. Technological advancements are a primary driver, with the development of more targeted, efficient, and environmentally friendly formulations, including precision application technologies. Economic factors, such as the increasing demand for agricultural commodities both domestically and internationally, and government initiatives aimed at boosting agricultural productivity and exports, provide a strong impetus for market expansion. Regulatory frameworks, while presenting challenges, also drive innovation towards safer and more sustainable products, thereby opening new market opportunities for bio-based solutions.

Challenges in the Chile Crop Protection Chemicals Market Market

Long-term growth catalysts for the Chile Crop Protection Chemicals Market are rooted in sustained innovation and strategic market adaptation. The ongoing research and development into novel active ingredients and advanced formulations, particularly those with enhanced biodegradability and reduced environmental persistence, will continue to be crucial. Strategic partnerships and collaborations between chemical manufacturers, research institutions, and agricultural technology providers are vital for accelerating the development and adoption of cutting-edge solutions. Furthermore, market expansions into underserved agricultural regions within Chile and exploring export opportunities for specialized crop protection chemicals will contribute to sustained growth.

Emerging Opportunities in Chile Crop Protection Chemicals Market

Emerging opportunities in the Chile Crop Protection Chemicals Market are abundant, primarily driven by the growing demand for sustainable agriculture and advanced farming practices. The significant growth potential of the bio-based crop protection chemicals segment presents a key opportunity, as farmers increasingly seek eco-friendly alternatives. The adoption of digital farming technologies, such as AI-powered pest detection and drone-based application systems, creates opportunities for specialized chemical products and integrated solutions. Furthermore, increasing consumer preference for locally sourced and sustainably produced food items is creating niche markets for organic and residue-free produce, driving demand for specific crop protection solutions.

Leading Players in the Chile Crop Protection Chemicals Market Sector

- Anasac Chile SA

- Syngent

- NuFarm

- DowDuPont Chile SA

- Sumitomo Corporation (Chile) Limitada

- Bayer SA

- Isagro SpA

- Cheminova SA

- Adama Chile SA

- BASF Chile SA

Key Milestones in Chile Crop Protection Chemicals Market Industry

- 2019: Launch of a new generation of broad-spectrum fungicides designed for high-value fruit crops.

- 2020: Significant investment in research and development for bio-based insecticides by a leading multinational corporation.

- 2021: Government initiative launched to promote sustainable agricultural practices and reduce chemical pesticide usage by XX%.

- 2022: Acquisition of a Chilean bio-pesticide startup by a major global agrochemical company, signaling a shift towards biologicals.

- 2023: Introduction of a digital platform offering precision application guidance for crop protection chemicals.

- 2024: Major player announces expansion of its herbicide portfolio with a focus on glyphosate-free alternatives.

Strategic Outlook for Chile Crop Protection Chemicals Market Market

The strategic outlook for the Chile Crop Protection Chemicals Market is positive, with continued growth anticipated. Key growth accelerators include the ongoing transition towards sustainable agricultural practices, driving demand for bio-based and low-impact synthetic solutions. The increasing adoption of digital farming technologies will create opportunities for integrated pest management solutions and precision application of crop protection chemicals. Strategic opportunities lie in fostering innovation through research and development, expanding product portfolios to include a wider range of bio-based alternatives, and investing in robust distribution networks. Companies that prioritize environmental stewardship, technological integration, and farmer education will be well-positioned to capitalize on the evolving market landscape.

Chile Crop Protection Chemicals Market Segmentation

-

1. Origin

- 1.1. Synthetic Crop Protection Chemicals

- 1.2. Bio-based Crop Protection Chemicals

-

2. Product Group

- 2.1. Herbicides

- 2.2. Insecticides

- 2.3. Fungicides

- 2.4. Other Crop Protection Chemicals

-

3. Application

- 3.1. Grains and Cereals

- 3.2. Oilseeds and Pulses

- 3.3. Fruits and Vegetables

- 3.4. Turf and Ornamental Grass

- 3.5. Other Applications

-

4. Origin

- 4.1. Synthetic Crop Protection Chemicals

- 4.2. Bio-based Crop Protection Chemicals

-

5. Product Group

- 5.1. Herbicides

- 5.2. Insecticides

- 5.3. Fungicides

- 5.4. Other Crop Protection Chemicals

-

6. Application

- 6.1. Grains and Cereals

- 6.2. Oilseeds and Pulses

- 6.3. Fruits and Vegetables

- 6.4. Turf and Ornamental Grass

- 6.5. Other Applications

Chile Crop Protection Chemicals Market Segmentation By Geography

- 1. Chile

Chile Crop Protection Chemicals Market Regional Market Share

Geographic Coverage of Chile Crop Protection Chemicals Market

Chile Crop Protection Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Technological Innovation in the Crop Protection Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Crop Protection Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 5.1.1. Synthetic Crop Protection Chemicals

- 5.1.2. Bio-based Crop Protection Chemicals

- 5.2. Market Analysis, Insights and Forecast - by Product Group

- 5.2.1. Herbicides

- 5.2.2. Insecticides

- 5.2.3. Fungicides

- 5.2.4. Other Crop Protection Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Grains and Cereals

- 5.3.2. Oilseeds and Pulses

- 5.3.3. Fruits and Vegetables

- 5.3.4. Turf and Ornamental Grass

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Origin

- 5.4.1. Synthetic Crop Protection Chemicals

- 5.4.2. Bio-based Crop Protection Chemicals

- 5.5. Market Analysis, Insights and Forecast - by Product Group

- 5.5.1. Herbicides

- 5.5.2. Insecticides

- 5.5.3. Fungicides

- 5.5.4. Other Crop Protection Chemicals

- 5.6. Market Analysis, Insights and Forecast - by Application

- 5.6.1. Grains and Cereals

- 5.6.2. Oilseeds and Pulses

- 5.6.3. Fruits and Vegetables

- 5.6.4. Turf and Ornamental Grass

- 5.6.5. Other Applications

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Anasac Chile SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Syngent

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NuFarm

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DowDuPont Chile SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sumitomo Corporation (Chile) Limitada

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Isagro SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cheminova SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adama Chile SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF Chile SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Anasac Chile SA

List of Figures

- Figure 1: Chile Crop Protection Chemicals Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Chile Crop Protection Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Origin 2020 & 2033

- Table 2: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Product Group 2020 & 2033

- Table 3: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Origin 2020 & 2033

- Table 5: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Product Group 2020 & 2033

- Table 6: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Origin 2020 & 2033

- Table 9: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Product Group 2020 & 2033

- Table 10: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Origin 2020 & 2033

- Table 12: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Product Group 2020 & 2033

- Table 13: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Chile Crop Protection Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Crop Protection Chemicals Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Chile Crop Protection Chemicals Market?

Key companies in the market include Anasac Chile SA, Syngent, NuFarm, DowDuPont Chile SA, Sumitomo Corporation (Chile) Limitada, Bayer SA, Isagro SpA, Cheminova SA, Adama Chile SA, BASF Chile SA.

3. What are the main segments of the Chile Crop Protection Chemicals Market?

The market segments include Origin, Product Group, Application, Origin, Product Group, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Technological Innovation in the Crop Protection Sector.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Crop Protection Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Crop Protection Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Crop Protection Chemicals Market?

To stay informed about further developments, trends, and reports in the Chile Crop Protection Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence