Key Insights

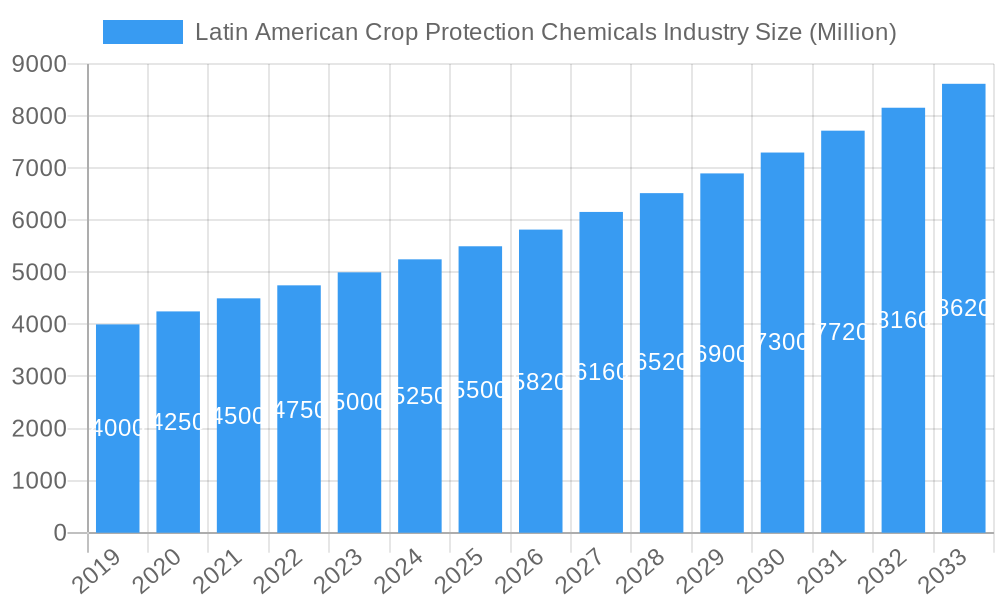

The Latin American crop protection chemicals market is poised for robust expansion, projected to reach a significant valuation of approximately USD 5,800 million by 2025, driven by a compound annual growth rate (CAGR) of 6.10% through 2033. This growth is fundamentally supported by an increasing demand for agricultural produce to feed a burgeoning global population and the critical need to enhance crop yields and quality in a region renowned for its agricultural prowess. Key drivers include the growing adoption of advanced farming practices, the introduction of innovative chemical formulations with improved efficacy and reduced environmental impact, and supportive government initiatives aimed at bolstering agricultural productivity. Furthermore, the rising prevalence of crop diseases and pest infestations, exacerbated by changing climatic conditions, necessitates consistent application of crop protection solutions. The market is witnessing a pronounced shift towards more sustainable and bio-based solutions, reflecting a growing environmental consciousness among farmers and consumers alike, alongside stringent regulatory frameworks that encourage the use of safer alternatives.

Latin American Crop Protection Chemicals Industry Market Size (In Billion)

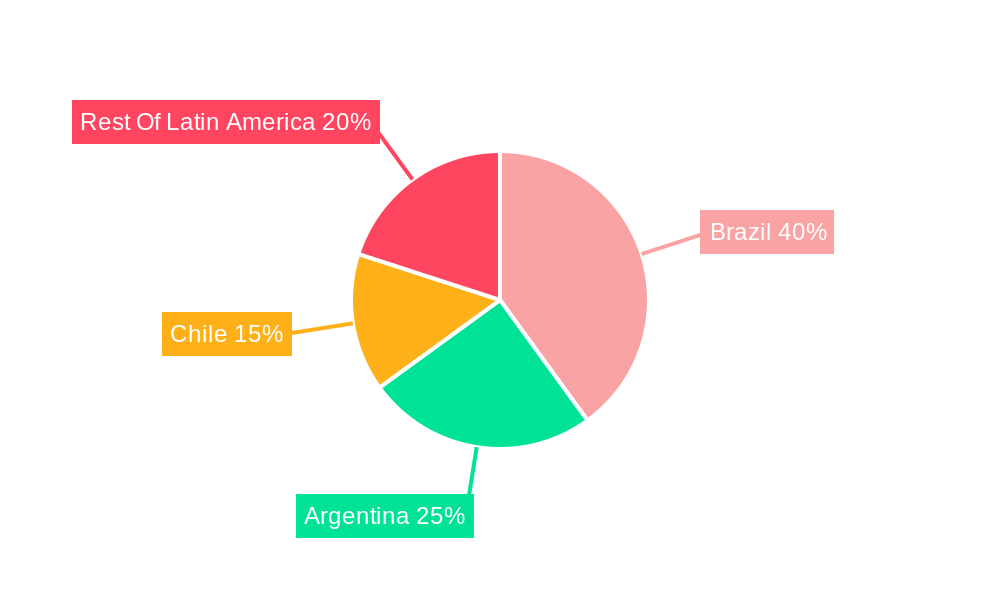

The market's segmentation reveals a dynamic landscape. Synthetic origins currently dominate the market due to their established efficacy and cost-effectiveness, but bio-based alternatives are rapidly gaining traction, driven by sustainability trends and consumer preferences. Herbicides represent the largest mode of action segment, reflecting the persistent challenge of weed management in diverse Latin American agricultural settings. Fungicides and insecticides also hold significant shares, addressing prevalent threats to crop health. The application segment is led by grains and cereals, followed closely by fruits and vegetables, indicating the core crops driving demand. Commercial crops, such as sugarcane and coffee, also contribute substantially. Geographically, Brazil emerges as the dominant market, accounting for a significant portion of the overall demand due to its vast agricultural land and production volumes. Argentina and Chile are also key contributors, with the Rest of Latin America showing promising growth potential. Leading companies like Bayer CropScience AG, Syngenta AG, and BASF SE are actively investing in research and development, expanding their product portfolios, and forging strategic partnerships to capitalize on these evolving market dynamics.

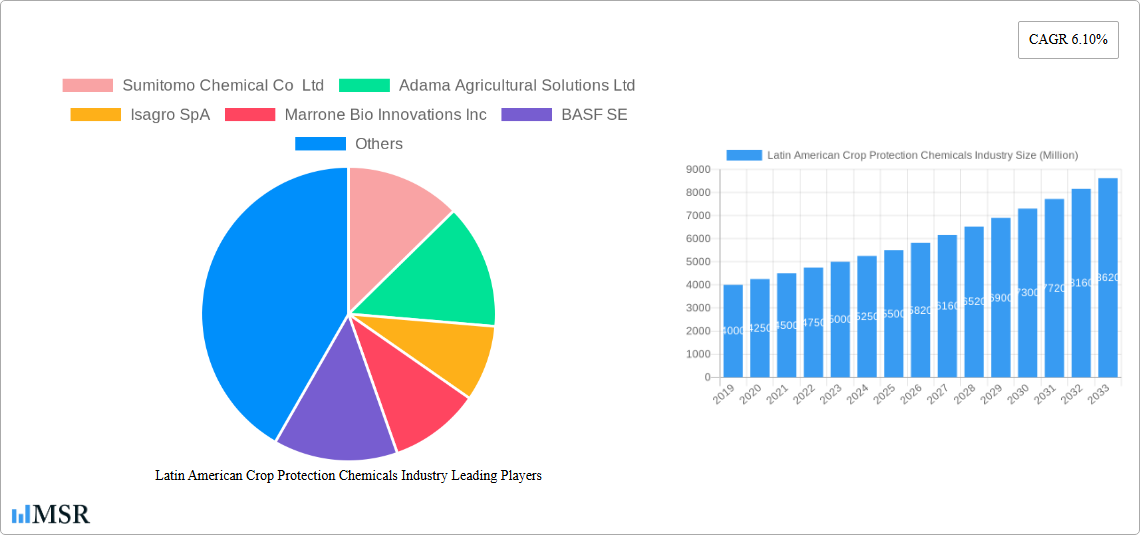

Latin American Crop Protection Chemicals Industry Company Market Share

Latin American Crop Protection Chemicals Industry: Market Forecast & Strategic Analysis (2019–2033)

This comprehensive report offers an in-depth analysis of the Latin American Crop Protection Chemicals Industry, providing critical insights into market dynamics, growth drivers, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this study delivers actionable intelligence for stakeholders navigating this vital sector. We examine the market across key segments including Synthetic and Bio Based origins, Herbicide, Fungicide, Insecticide, and Other Modes of Action, as well as applications in Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops, Turf and Ornamentals. Geographical deep dives into Brazil, Argentina, Chile, and the Rest of Latin America are also included. Gain a competitive edge with expert analysis on market concentration, industry trends, product developments, challenges, and emerging opportunities.

Latin American Crop Protection Chemicals Industry Market Concentration & Dynamics

The Latin American Crop Protection Chemicals Industry exhibits a moderate to high market concentration, with key players like BASF SE, Bayer CropScience AG, Syngenta AG, Corteva Agriscience, and FMC Corporation dominating the landscape. These multinational corporations, alongside regional specialists such as Adama Agricultural Solutions Ltd and Sumitomo Chemical Co Ltd, invest heavily in research and development, driving innovation and shaping market trends. The innovation ecosystem is characterized by a growing emphasis on sustainable and biological solutions, alongside the refinement of traditional synthetic chemistries. Regulatory frameworks across Latin America, while varying in stringency, are increasingly focused on environmental safety and residue limits, influencing product development and market access. The threat of substitute products, including advanced farming techniques and biopesticides, is a growing consideration. End-user trends are shifting towards integrated pest management (IPM) strategies and demand for products with a lower environmental footprint. Mergers and Acquisitions (M&A) activities remain a significant strategy for market consolidation and technology acquisition. For instance, the acquisition of Isagro SpA by Gowan Company highlights this trend, aiming to expand portfolios and geographic reach. Market share is dynamically distributed, with major players holding substantial portions, particularly in key crops like soybeans and corn.

Latin American Crop Protection Chemicals Industry Industry Insights & Trends

The Latin American Crop Protection Chemicals Industry is projected to experience robust growth, driven by several interconnected factors. The estimated market size for 2025 is XX Million, with a Compound Annual Growth Rate (CAGR) of XX% expected from 2025 to 2033. This expansion is primarily fueled by the region's significant agricultural output, increasing demand for food due to a growing population, and the persistent need to protect crops from pests and diseases to ensure yield security. Technological disruptions are at the forefront of industry evolution. The rise of biological crop protection solutions, offering environmentally friendly alternatives and complementary benefits to synthetic products, is a major trend. Companies are investing in research and development of biopesticides, biostimulants, and biofertilizers to meet the growing consumer and regulatory demand for sustainable agriculture. Furthermore, advancements in precision agriculture, including the use of drones, AI-powered monitoring systems, and data analytics, are enabling more targeted and efficient application of crop protection chemicals, reducing waste and environmental impact. Evolving consumer behaviors are also playing a crucial role. There is a palpable shift towards healthier, sustainably produced food, which indirectly drives the demand for crop protection solutions that minimize residues and environmental impact. Farmers are increasingly seeking integrated pest management (IPM) solutions that combine chemical and biological approaches for more effective and responsible crop protection. This necessitates a diverse product portfolio and innovative application technologies. The competitive landscape is intense, with established players continuously innovating and new entrants focusing on niche biological solutions. The Rest of Latin America region, encompassing countries beyond Brazil, Argentina, and Chile, presents significant untapped potential for growth due to ongoing agricultural modernization and increasing adoption of advanced crop protection practices. The demand for fungicides and herbicides remains high, driven by prevalent diseases and weed pressures in major crops. The market for insecticides is also substantial, crucial for safeguarding yields against a wide array of insect pests.

Key Markets & Segments Leading Latin American Crop Protection Chemicals Industry

The Latin American Crop Protection Chemicals Industry is significantly shaped by its diverse agricultural landscape and the specific needs of key crop segments and geographical regions. Brazil stands out as the largest and most influential market within Latin America. Its vast agricultural land, substantial production of commodities like soybeans, corn, and sugarcane, and advanced farming practices make it a focal point for crop protection chemical consumption. The dominance of synthetic origin products remains prevalent, driven by their efficacy and established use across large-scale operations. However, bio based solutions are rapidly gaining traction, particularly in Fruits and Vegetables and Commercial Crops, where consumer demand for residue-free produce is high and regulatory scrutiny is increasing.

Within the Mode of Action segmentation, Herbicides command the largest market share due to the pervasive challenge of weed competition in staple crops like grains and cereals. Insecticides follow closely, essential for managing the diverse pest pressures prevalent in the region’s warm climate. Fungicides are critical for protecting high-value crops such as fruits and vegetables from devastating diseases like late blight and mildew.

The Application segments of Grains and Cereals and Pulses and Oilseeds are the primary drivers of volume for crop protection chemicals, owing to their extensive cultivation areas. However, the Fruits and Vegetables segment, while smaller in volume, offers higher value and is experiencing accelerated growth due to increasing demand for quality produce and a shift towards specialty crops. Commercial Crops also represent a significant segment, encompassing plantations like coffee, cocoa, and cotton.

Geographically, Argentina and Chile are also key markets, with distinct agricultural profiles and regulatory environments. Argentina's strength in soybean and corn production mirrors Brazil's trends, while Chile’s significant fruit export industry fuels demand for specific crop protection solutions. The Rest of Latin America, comprising countries like Mexico, Colombia, and Peru, represents a growing frontier with expanding agricultural sectors and increasing adoption of modern crop protection technologies. The push towards bio based products is particularly pronounced in segments focusing on export markets with stringent residue limits.

- Dominant Geographical Market: Brazil's vast agricultural output and sophisticated farming practices solidify its leadership.

- Key Origin Segment: Synthetic origin products continue to hold a dominant share, supported by established use and efficacy.

- Leading Mode of Action: Herbicides are crucial due to significant weed pressures in staple crops.

- Primary Application Segments: Grains and Cereals, Pulses and Oilseeds drive volume, while Fruits and Vegetables and Commercial Crops offer high-value growth.

- Emerging Trends: Bio based solutions are gaining significant momentum across multiple application segments.

Latin American Crop Protection Chemicals Industry Product Developments

Recent product developments underscore the industry's commitment to innovation and addressing evolving agricultural needs. Bayer launched Adengo in November 2022, a pre-emergent herbicide featuring two active principles, isoxaflutole and thiencarbazone, offering broad-spectrum control for both broadleaf and narrow-leaf weeds. This dual-action approach enhances efficacy and combats herbicide resistance. In July 2022, BASF introduced Zampro (Ametoctradin + Dimethomorph) in Brazil, a potent fungicide targeting diseases like late blight and mildew in crops such as tomatoes, grapes, and potatoes. Furthermore, demonstrating a strategic entry into the biological segment, BASF presented Serifel in May 2022, a biological fungicide formulated with Bacillus amyloliquefaciens for use on fruits and vegetables, initially available for strawberries and raspberries in Argentina. These innovations highlight the dual focus on advanced synthetic chemistries and sustainable biological solutions, catering to diverse crop protection challenges and market demands.

Challenges in the Latin American Crop Protection Chemicals Industry Market

The Latin American Crop Protection Chemicals Industry faces several significant challenges. Regulatory hurdles and varying registration processes across different countries can impede market access and increase development costs. Supply chain disruptions, exacerbated by global events, can affect the availability and pricing of raw materials and finished products. Intense competition from both multinational corporations and local players, coupled with the threat of counterfeit products, puts pressure on profit margins. Pest and weed resistance to existing active ingredients necessitates continuous innovation and the development of new modes of action. The increasing demand for sustainable and environmentally friendly solutions requires substantial investment in R&D for biological alternatives. Furthermore, the economic volatility in some regional economies can impact farmer spending on crop protection inputs.

Forces Driving Latin American Crop Protection Chemicals Industry Growth

Several key forces are propelling the growth of the Latin American Crop Protection Chemicals Industry. The expanding agricultural sector in the region, driven by increasing global food demand, is a primary catalyst. Technological advancements in crop protection, including the development of novel active ingredients and the integration of digital farming tools, are enhancing efficacy and sustainability. Favorable government policies supporting agricultural modernization and increased investment in research and development further stimulate growth. The growing awareness and demand for sustainable agricultural practices are driving the adoption of bio based and integrated pest management solutions. Furthermore, the economic growth in many Latin American countries translates into increased farmer purchasing power and investment in crop protection.

Challenges in the Latin American Crop Protection Chemicals Industry Market

Long-term growth catalysts for the Latin American Crop Protection Chemicals Industry lie in continuous innovation and strategic market expansion. The development and adoption of next-generation crop protection solutions, including advanced biologicals, gene editing technologies for pest resistance, and smart delivery systems, will be crucial. Strategic partnerships and collaborations between chemical companies, biotech firms, and agricultural technology providers will foster synergistic growth. Market expansion into underserved regions within Latin America, coupled with tailoring product offerings to local needs and pest profiles, presents significant opportunities. Furthermore, investments in farmer education and training on best practices for integrated pest management and responsible chemical use will build trust and ensure sustainable market development.

Emerging Opportunities in Latin American Crop Protection Chemicals Industry

Emerging opportunities in the Latin American Crop Protection Chemicals Industry are abundant. The burgeoning market for biological crop protection offers substantial growth potential, driven by consumer demand for sustainable produce and increasing regulatory incentives. The adoption of digital agriculture and precision farming technologies presents a significant opportunity for differentiated service offerings and enhanced product application. There is also a growing demand for specialty crop protection solutions tailored to high-value niche markets, such as organic farming and the cultivation of exotic fruits and vegetables. Furthermore, the potential for export markets that demand stringent residue management and sustainable practices opens avenues for advanced and compliant product portfolios. The development of integrated crop management solutions that combine chemical, biological, and digital components will cater to the evolving needs of modern agriculture.

Leading Players in the Latin American Crop Protection Chemicals Industry Sector

- Sumitomo Chemical Co Ltd

- Adama Agricultural Solutions Ltd

- Isagro SpA

- Marrone Bio Innovations Inc

- BASF SE

- FMC Corporation

- Nutrien Ltd

- Syngenta AG

- Corteva Agriscience

- Bayer CropScience AG

Key Milestones in Latin American Crop Protection Chemicals Industry Industry

- November 2022: Bayer launched Adengo, a pre-emergent herbicide with two active principles (isoxaflutole and thiencarbazone), offering broad-spectrum control and advanced weed management.

- July 2022: BASF announced the launch of the fungicide Zampro (Ametoctradin + Dimethomorph) in Brazil, targeting diseases like late blight and mildew in tomatoes, grapes, and potatoes.

- May 2022: BASF presented Serifel, a new biological fungicide formulated with Bacillus amyloliquefaciens, marking its entry into the biological segment in Argentina for fruits and vegetables, initially for strawberries and raspberries.

Strategic Outlook for Latin American Crop Protection Chemicals Industry Market

The strategic outlook for the Latin American Crop Protection Chemicals Industry is exceptionally promising, characterized by a transition towards sustainable and technologically advanced solutions. Growth will be accelerated by the increasing adoption of bio based crop protection agents, driven by both consumer preference and regulatory mandates for reduced environmental impact. Furthermore, the integration of digital farming technologies and precision agriculture will optimize the application of both synthetic and biological products, leading to greater efficiency and cost-effectiveness for farmers. Strategic opportunities lie in developing comprehensive integrated pest management (IPM) programs that leverage a diverse portfolio of solutions. Companies that invest in robust R&D for novel active ingredients, advanced biological formulations, and precision application technologies will be well-positioned to capture market share. Continued focus on farmer education and support will be crucial for fostering sustainable practices and ensuring long-term market stability and growth in this dynamic sector.

Latin American Crop Protection Chemicals Industry Segmentation

-

1. Origin

- 1.1. Synthetic

- 1.2. Bio Based

-

2. Mode Of Action

- 2.1. Herbicide

- 2.2. Fungicide

- 2.3. Insecticide

- 2.4. Other Modes of Action

-

3. Application

- 3.1. Grains and Cereals

- 3.2. Pulses and Oilseeds

- 3.3. Fruits and Vegetables

- 3.4. Commercial Crops

- 3.5. Turf and Ornamentals

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Rest Of Latin America

-

5. Origin

- 5.1. Synthetic

- 5.2. Bio Based

-

6. Mode Of Action

- 6.1. Herbicide

- 6.2. Fungicide

- 6.3. Insecticide

- 6.4. Other Modes of Action

-

7. Application

- 7.1. Grains and Cereals

- 7.2. Pulses and Oilseeds

- 7.3. Fruits and Vegetables

- 7.4. Commercial Crops

- 7.5. Turf and Ornamentals

Latin American Crop Protection Chemicals Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Chile

- 4. Rest Of Latin America

Latin American Crop Protection Chemicals Industry Regional Market Share

Geographic Coverage of Latin American Crop Protection Chemicals Industry

Latin American Crop Protection Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Adoption of Genetically Modified (GM) Crops

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin American Crop Protection Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 5.1.1. Synthetic

- 5.1.2. Bio Based

- 5.2. Market Analysis, Insights and Forecast - by Mode Of Action

- 5.2.1. Herbicide

- 5.2.2. Fungicide

- 5.2.3. Insecticide

- 5.2.4. Other Modes of Action

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Grains and Cereals

- 5.3.2. Pulses and Oilseeds

- 5.3.3. Fruits and Vegetables

- 5.3.4. Commercial Crops

- 5.3.5. Turf and Ornamentals

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Chile

- 5.4.4. Rest Of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Origin

- 5.5.1. Synthetic

- 5.5.2. Bio Based

- 5.6. Market Analysis, Insights and Forecast - by Mode Of Action

- 5.6.1. Herbicide

- 5.6.2. Fungicide

- 5.6.3. Insecticide

- 5.6.4. Other Modes of Action

- 5.7. Market Analysis, Insights and Forecast - by Application

- 5.7.1. Grains and Cereals

- 5.7.2. Pulses and Oilseeds

- 5.7.3. Fruits and Vegetables

- 5.7.4. Commercial Crops

- 5.7.5. Turf and Ornamentals

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Brazil

- 5.8.2. Argentina

- 5.8.3. Chile

- 5.8.4. Rest Of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 6. Brazil Latin American Crop Protection Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 6.1.1. Synthetic

- 6.1.2. Bio Based

- 6.2. Market Analysis, Insights and Forecast - by Mode Of Action

- 6.2.1. Herbicide

- 6.2.2. Fungicide

- 6.2.3. Insecticide

- 6.2.4. Other Modes of Action

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Grains and Cereals

- 6.3.2. Pulses and Oilseeds

- 6.3.3. Fruits and Vegetables

- 6.3.4. Commercial Crops

- 6.3.5. Turf and Ornamentals

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Chile

- 6.4.4. Rest Of Latin America

- 6.5. Market Analysis, Insights and Forecast - by Origin

- 6.5.1. Synthetic

- 6.5.2. Bio Based

- 6.6. Market Analysis, Insights and Forecast - by Mode Of Action

- 6.6.1. Herbicide

- 6.6.2. Fungicide

- 6.6.3. Insecticide

- 6.6.4. Other Modes of Action

- 6.7. Market Analysis, Insights and Forecast - by Application

- 6.7.1. Grains and Cereals

- 6.7.2. Pulses and Oilseeds

- 6.7.3. Fruits and Vegetables

- 6.7.4. Commercial Crops

- 6.7.5. Turf and Ornamentals

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 7. Argentina Latin American Crop Protection Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 7.1.1. Synthetic

- 7.1.2. Bio Based

- 7.2. Market Analysis, Insights and Forecast - by Mode Of Action

- 7.2.1. Herbicide

- 7.2.2. Fungicide

- 7.2.3. Insecticide

- 7.2.4. Other Modes of Action

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Grains and Cereals

- 7.3.2. Pulses and Oilseeds

- 7.3.3. Fruits and Vegetables

- 7.3.4. Commercial Crops

- 7.3.5. Turf and Ornamentals

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Chile

- 7.4.4. Rest Of Latin America

- 7.5. Market Analysis, Insights and Forecast - by Origin

- 7.5.1. Synthetic

- 7.5.2. Bio Based

- 7.6. Market Analysis, Insights and Forecast - by Mode Of Action

- 7.6.1. Herbicide

- 7.6.2. Fungicide

- 7.6.3. Insecticide

- 7.6.4. Other Modes of Action

- 7.7. Market Analysis, Insights and Forecast - by Application

- 7.7.1. Grains and Cereals

- 7.7.2. Pulses and Oilseeds

- 7.7.3. Fruits and Vegetables

- 7.7.4. Commercial Crops

- 7.7.5. Turf and Ornamentals

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 8. Chile Latin American Crop Protection Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 8.1.1. Synthetic

- 8.1.2. Bio Based

- 8.2. Market Analysis, Insights and Forecast - by Mode Of Action

- 8.2.1. Herbicide

- 8.2.2. Fungicide

- 8.2.3. Insecticide

- 8.2.4. Other Modes of Action

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Grains and Cereals

- 8.3.2. Pulses and Oilseeds

- 8.3.3. Fruits and Vegetables

- 8.3.4. Commercial Crops

- 8.3.5. Turf and Ornamentals

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Chile

- 8.4.4. Rest Of Latin America

- 8.5. Market Analysis, Insights and Forecast - by Origin

- 8.5.1. Synthetic

- 8.5.2. Bio Based

- 8.6. Market Analysis, Insights and Forecast - by Mode Of Action

- 8.6.1. Herbicide

- 8.6.2. Fungicide

- 8.6.3. Insecticide

- 8.6.4. Other Modes of Action

- 8.7. Market Analysis, Insights and Forecast - by Application

- 8.7.1. Grains and Cereals

- 8.7.2. Pulses and Oilseeds

- 8.7.3. Fruits and Vegetables

- 8.7.4. Commercial Crops

- 8.7.5. Turf and Ornamentals

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 9. Rest Of Latin America Latin American Crop Protection Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Origin

- 9.1.1. Synthetic

- 9.1.2. Bio Based

- 9.2. Market Analysis, Insights and Forecast - by Mode Of Action

- 9.2.1. Herbicide

- 9.2.2. Fungicide

- 9.2.3. Insecticide

- 9.2.4. Other Modes of Action

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Grains and Cereals

- 9.3.2. Pulses and Oilseeds

- 9.3.3. Fruits and Vegetables

- 9.3.4. Commercial Crops

- 9.3.5. Turf and Ornamentals

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Argentina

- 9.4.3. Chile

- 9.4.4. Rest Of Latin America

- 9.5. Market Analysis, Insights and Forecast - by Origin

- 9.5.1. Synthetic

- 9.5.2. Bio Based

- 9.6. Market Analysis, Insights and Forecast - by Mode Of Action

- 9.6.1. Herbicide

- 9.6.2. Fungicide

- 9.6.3. Insecticide

- 9.6.4. Other Modes of Action

- 9.7. Market Analysis, Insights and Forecast - by Application

- 9.7.1. Grains and Cereals

- 9.7.2. Pulses and Oilseeds

- 9.7.3. Fruits and Vegetables

- 9.7.4. Commercial Crops

- 9.7.5. Turf and Ornamentals

- 9.1. Market Analysis, Insights and Forecast - by Origin

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sumitomo Chemical Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Adama Agricultural Solutions Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Isagro SpA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Marrone Bio Innovations Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BASF SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 FMC Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nutrien Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Syngenta AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Corteva Agriscience

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bayer CropScience AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: Latin American Crop Protection Chemicals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin American Crop Protection Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 2: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 3: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 6: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 7: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 9: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 10: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 11: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 13: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 14: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 15: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 18: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 19: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 22: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 23: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 26: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 27: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 29: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 30: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 31: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 34: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 35: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 37: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 38: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Mode Of Action 2020 & 2033

- Table 39: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Latin American Crop Protection Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin American Crop Protection Chemicals Industry?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Latin American Crop Protection Chemicals Industry?

Key companies in the market include Sumitomo Chemical Co Ltd, Adama Agricultural Solutions Ltd, Isagro SpA, Marrone Bio Innovations Inc, BASF SE, FMC Corporation, Nutrien Ltd, Syngenta AG, Corteva Agriscience, Bayer CropScience AG.

3. What are the main segments of the Latin American Crop Protection Chemicals Industry?

The market segments include Origin, Mode Of Action, Application, Geography, Origin, Mode Of Action, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Adoption of Genetically Modified (GM) Crops.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

November 2022: Bayer launched Adengo, a pre-emergent herbicide that has two active principles with different mechanisms of action: isoxaflutole and thiencarbazone, guaranteeing a broad spectrum of control and acting on both broad leaves and narrow sheets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin American Crop Protection Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin American Crop Protection Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin American Crop Protection Chemicals Industry?

To stay informed about further developments, trends, and reports in the Latin American Crop Protection Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence