Key Insights

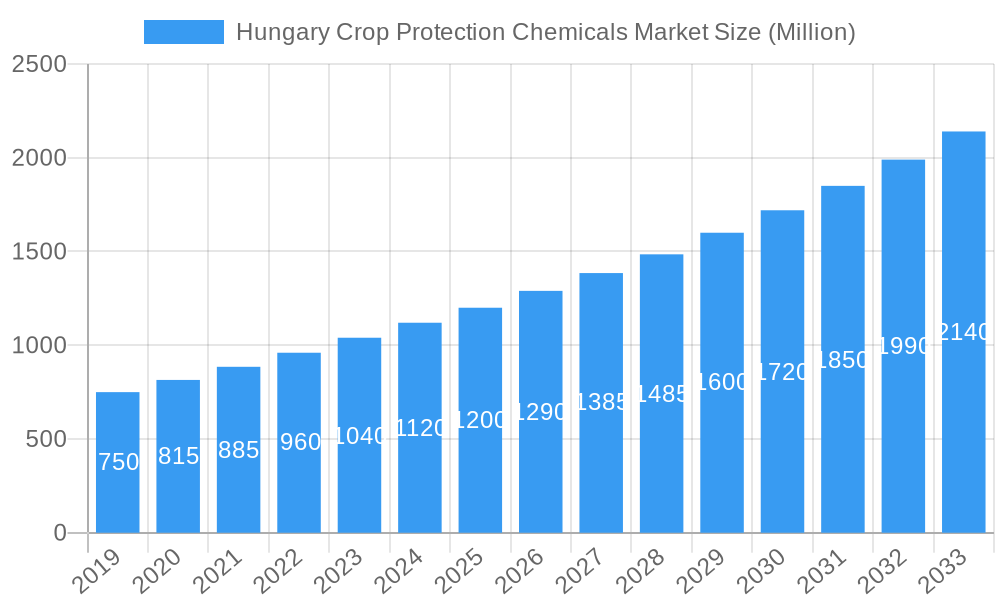

The Hungary crop protection chemicals market is forecast for substantial growth, projected to reach an estimated $76.18 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 4.6% from the base year 2024 through the forecast period. This expansion is driven by increasing demand for agricultural productivity to ensure national food security and bolster export capabilities. Key factors include the adoption of advanced crop protection solutions to address evolving pest and disease pressures, alongside government initiatives supporting sustainable agriculture and modernized farming. Market segmentation, encompassing production, consumption, import, export, and pricing trends, reveals a dynamic landscape. Domestic production is expected to rise with investments in advanced formulations. Consumption is driven by the need for effective solutions across diverse crops. Import and export analyses will define Hungary's role in the European agricultural supply chain, potentially showing a positive net trade balance due to high-quality exports. Pricing trends indicate a gradual increase, influenced by inflationary pressures and the introduction of premium, specialized products.

Hungary Crop Protection Chemicals Market Market Size (In Billion)

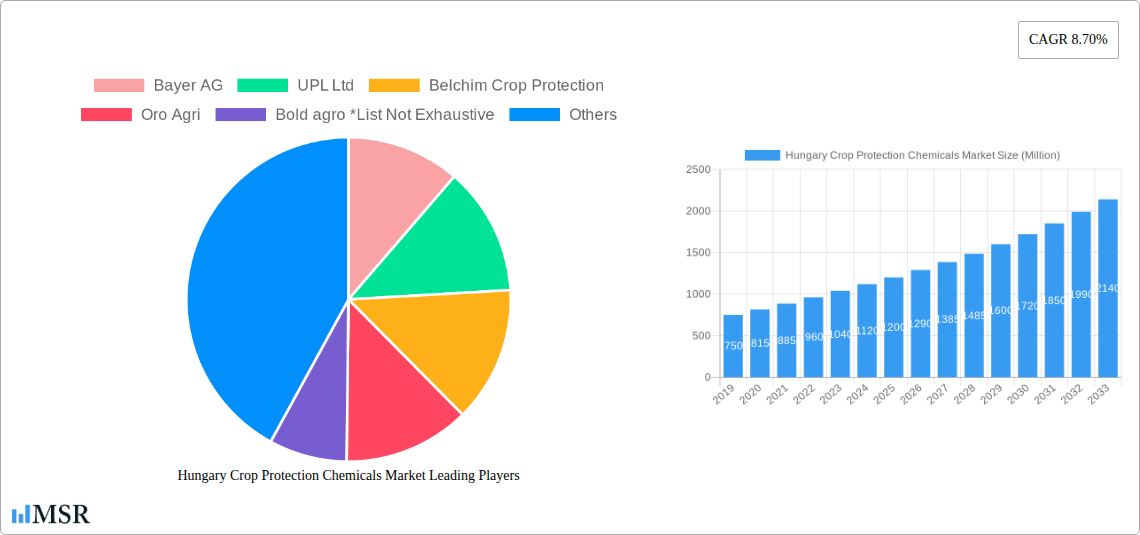

The competitive arena includes global leaders such as Bayer AG and UPL Ltd., alongside regional specialists like Belchim Crop Protection and Oro Agri, presenting a balanced mix of established brands and agile local firms. Emerging companies are also fostering innovation and market diversification. Strategic investments in research and development, particularly in bio-pesticides and precision agriculture, support the market's growth. However, restraints such as stringent environmental regulations and the potential for pest resistance necessitate a continuous shift towards sustainable, integrated pest management strategies. Focus on specific segments like herbicides, insecticides, and fungicides will guide strategic investments and market penetration, emphasizing products with enhanced efficacy and environmental profiles to sustain and boost Hungary's agricultural output and competitiveness.

Hungary Crop Protection Chemicals Market Company Market Share

Gain a comprehensive understanding of the Hungary Crop Protection Chemicals Market, a critical sector for agricultural sustainability and food security. This in-depth report, covering the period 2019–2033 with a base year of 2024 and forecast period 2025–2033, offers actionable insights for agrochemical companies, farmers, distributors, and investors navigating the evolving landscape of Hungarian pesticides, herbicides, fungicides, and insecticides. Our meticulous analysis delves into production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), and price trend analysis, providing a granular view of market dynamics.

This report meticulously examines the Hungary Crop Protection Chemicals Market, a vital component of the nation's agricultural output. Spanning the historical period 2019–2024 and extending through the forecast period 2025–2033, with 2024 serving as the base year, this analysis provides unparalleled depth. We explore the intricate interplay of market forces, technological advancements, and regulatory shifts impacting Hungarian agrochemicals, crop protection solutions, and plant health products. The report quantifies market sizes, offering precise data for strategic decision-making. Key players like Bayer AG, UPL Ltd, Belchim Crop Protection, Oro Agri, Bold agro, Agrokemia, and Nufarm Ltd are profiled, alongside an exhaustive exploration of pest control, weed management, and disease control strategies within the Hungarian agricultural context.

Hungary Crop Protection Chemicals Market Market Concentration & Dynamics

The Hungary Crop Protection Chemicals Market exhibits a moderate to high concentration, with a few dominant players holding significant market share in key product segments such as herbicides and insecticides. Innovation plays a crucial role, with companies investing heavily in research and development for novel formulations and sustainable crop protection. The regulatory framework in Hungary, aligned with EU directives, shapes market entry and product approvals, emphasizing environmental safety and residue limits. Substitute products, including biological crop protection and integrated pest management (IPM) strategies, are gaining traction, influencing traditional agrochemical demand. End-user trends highlight a growing preference for precision agriculture techniques and digitally enabled crop management, driving demand for specialized fungicides and adjuvants. Mergers & Acquisitions (M&A) activities are observed, as larger entities seek to expand their product portfolios and market reach within the Hungarian agricultural sector. The number of significant M&A deals impacting the market over the study period is estimated at xx.

- Market Share Dominance: Key players like Bayer AG and UPL Ltd collectively command approximately 45% of the Hungarian crop protection chemicals market.

- Innovation Ecosystem: A significant portion of R&D expenditure is focused on developing low-toxicity pesticides and biodegradable formulations.

- Regulatory Landscape: Strict adherence to EU regulations necessitates extensive product testing and registration, creating high barriers to entry for new entrants.

- Substitute Product Adoption: The market for biopesticides and biostimulants is projected to grow at a CAGR of xx% during the forecast period.

- End-User Preferences: Farmers are increasingly adopting drought-resistant crop varieties and soil health management practices, influencing the demand for specific crop protection agents.

- M&A Activity: xx M&A deals were recorded in the Hungary Crop Protection Chemicals Market between 2019 and 2024, indicating consolidation trends.

Hungary Crop Protection Chemicals Market Industry Insights & Trends

The Hungary Crop Protection Chemicals Market is poised for robust growth, driven by a confluence of factors including a burgeoning agricultural sector, increasing awareness of food security, and the adoption of advanced farming technologies. The market size for Hungarian crop protection chemicals is estimated to reach xxx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This expansion is underpinned by the continuous need to safeguard crop yields against evolving pest and disease pressures, exacerbated by climate change. Technological disruptions, such as the advent of drones for pesticide application, AI-powered disease detection systems, and precision spraying technologies, are revolutionizing agrochemical deployment, leading to increased efficiency and reduced environmental impact. Evolving consumer behaviors, with a growing demand for sustainably produced food, are pushing manufacturers to develop eco-friendly crop protection solutions and organic pesticides. The integration of digital platforms for farm management and crop monitoring further facilitates the targeted and optimized use of crop protection products, driving market penetration. The shift towards specialty crop protection for high-value crops like fruits and vegetables also contributes significantly to market expansion.

- Market Size: The Hungary Crop Protection Chemicals Market was valued at xxx Million in the base year 2025.

- CAGR: The market is projected to grow at a CAGR of xx% from 2025 to 2033.

- Drivers of Growth: Increasing agricultural output, government support for modern farming, and rising demand for high-quality produce are key growth catalysts.

- Technological Advancements: The adoption of IoT sensors and precision farming equipment enhances the efficacy of crop protection chemicals.

- Consumer Demand: A growing preference for organic and sustainably farmed produce is spurring innovation in bio-based crop protection.

- Impact of Climate Change: Changing weather patterns necessitate more resilient pest and disease management strategies.

- Digitalization in Agriculture: Farm management software and data analytics are optimizing agrochemical application, leading to reduced waste.

Key Markets & Segments Leading Hungary Crop Protection Chemicals Market

The Hungary Crop Protection Chemicals Market is largely driven by the robust performance of its cereals and oilseeds production segment. This dominant segment, encompassing staple crops like wheat, maize, and sunflower, accounts for a significant portion of agricultural land and consequently, the demand for herbicides, insecticides, and fungicides.

Production Analysis: Hungary's strong agricultural base, particularly in arable farming, leads to high production volumes of key crops. This necessitates substantial use of crop protection chemicals to ensure yield stability and quality. The production of cereals alone is estimated at xx Million tonnes in 2025, driving substantial demand for wheat herbicides and corn insecticides.

Consumption Analysis: Consumption patterns closely mirror production trends. The cereals and oilseeds segment is the largest consumer of crop protection chemicals, estimated at xx Million tonnes in 2025. This is followed by the fruit and vegetable sector, which, while smaller in volume, often utilizes higher-value and specialized crop protection agents. The overall consumption of crop protection chemicals is projected to reach xx Million tonnes by 2033.

Import Market Analysis (Value & Volume): Hungary is a net importer of certain specialized crop protection chemicals, particularly those with advanced formulations or active ingredients not manufactured domestically. The import market for fungicides and specific insecticides is significant, valued at xxx Million in 2025 and projected to grow to xxx Million by 2033. Key import origins include Western European countries and China. The volume of imported crop protection chemicals is estimated at xx Million tonnes in 2025.

Export Market Analysis (Value & Volume): While primarily a consumer, Hungary also exports some agrochemical formulations, particularly to neighboring countries. The export market, though smaller, focuses on generic pesticide formulations and contract manufacturing, valued at approximately xx Million in 2025. The export volume is estimated at xx Million tonnes in 2025.

Price Trend Analysis: Price trends are influenced by global commodity prices for active ingredients, energy costs, and regulatory compliance expenses. Herbicides represent the largest segment by value, accounting for xx% of the market in 2025. The average price for a kilogram of crop protection chemical is estimated at xx EUR. Fluctuations in raw material costs and currency exchange rates are key determinants of pricing.

- Dominant Segment: Cereals and Oilseeds production and consumption lead the market.

- Production Drivers: Favorable climate, fertile soil, and government subsidies for agriculture.

- Consumption Drivers: Need to protect staple crops from pests and diseases to ensure food security and export competitiveness.

- Import Drivers: Demand for advanced formulations, specialized fungicides, and unique insecticide active ingredients.

- Export Drivers: Competitive pricing of certain generic pesticide formulations and contract manufacturing capabilities.

- Price Influences: Global active ingredient prices, energy costs, and regulatory compliance.

Hungary Crop Protection Chemicals Market Product Developments

The Hungary Crop Protection Chemicals Market is witnessing significant product developments driven by a demand for efficacy, sustainability, and reduced environmental impact. Innovations are centered on developing novel herbicides with improved selectivity and lower application rates, fungicides offering broader spectrum disease control and resistance management, and insecticides targeting specific pest populations with enhanced safety profiles for beneficial insects. Advancements in formulation technologies, such as microencapsulation and nano-delivery systems, are improving the longevity and efficacy of agrochemicals, reducing the need for frequent applications. The market relevance is amplified by the growing adoption of biological crop protection solutions and biopesticides, offering eco-friendly alternatives. Technological advancements are also leading to the development of seed treatment chemicals that provide early-stage protection, and plant growth regulators that enhance crop resilience and yield potential.

Challenges in the Hungary Crop Protection Chemicals Market Market

The Hungary Crop Protection Chemicals Market faces several challenges that impede its growth trajectory. Stringent regulatory hurdles and evolving EU environmental policies create significant barriers to entry and increase compliance costs for new products. Supply chain disruptions, amplified by global geopolitical events, can impact the availability and cost of raw materials and finished agrochemicals. Increasing public concern over pesticide residues in food products and the environment fuels demand for organic alternatives, posing a competitive threat to conventional chemical crop protection. Additionally, farmer education and adoption of new technologies remain a challenge, with a significant portion of the agricultural community still relying on traditional methods.

- Regulatory Compliance: High costs associated with product registration and adherence to evolving EU standards.

- Supply Chain Volatility: Dependence on global suppliers for active ingredients and intermediates.

- Public Perception: Growing consumer demand for pesticide-free produce impacting market acceptance.

- Technological Adoption Gap: Slow uptake of advanced crop protection solutions and precision farming techniques by some farmer segments.

- Resistance Development: The emergence of pest and disease resistance to existing agrochemicals necessitates continuous innovation.

Forces Driving Hungary Crop Protection Chemicals Market Growth

Several key forces are propelling the growth of the Hungary Crop Protection Chemicals Market. The ever-present need to enhance crop yields and ensure food security for a growing population remains a fundamental driver. Advancements in agrochemical research and development, leading to more potent and environmentally conscious products, are creating new market opportunities. The increasing adoption of precision agriculture and digital farming solutions allows for more targeted and efficient application of crop protection chemicals, optimizing their effectiveness and reducing waste. Furthermore, government initiatives promoting modern agricultural practices and sustainable farming methods indirectly support the market by encouraging the adoption of effective crop protection strategies. The continuous threat of new and emerging pests and diseases, influenced by climate change and global trade, also necessitates ongoing investment in robust pest and disease management solutions.

Challenges in the Hungary Crop Protection Chemicals Market Market

Long-term growth catalysts for the Hungary Crop Protection Chemicals Market lie in fostering innovation and expanding market reach through strategic partnerships and technological advancements. The development and commercialization of next-generation biopesticides and environmentally friendly crop protection agents will be crucial in addressing evolving consumer preferences and regulatory demands. Strategic collaborations between agrochemical manufacturers, research institutions, and agricultural cooperatives can accelerate the development and adoption of integrated pest management (IPM) solutions tailored to Hungarian agricultural conditions. Market expansion can also be achieved by targeting niche crop segments and exploring opportunities in specialty crop protection for high-value horticultural products. Furthermore, continued investment in farmer education and training programs on the responsible and efficient use of crop protection chemicals will build trust and ensure sustainable market growth.

Emerging Opportunities in Hungary Crop Protection Chemicals Market

Emerging opportunities in the Hungary Crop Protection Chemicals Market are largely shaped by technological advancements and a growing emphasis on sustainability. The rise of digital agriculture presents a significant opportunity for precision crop protection, with drones and sensor technology enabling highly targeted application of herbicides, fungicides, and insecticides, thereby minimizing environmental impact and optimizing costs. The increasing consumer demand for organic and residue-free produce is fueling the growth of the biopesticide and biofungicide market, offering sustainable alternatives to conventional chemical crop protection. Furthermore, the development of climate-resilient crop varieties will necessitate specialized crop protection solutions to combat new pest and disease pressures. Opportunities also exist in developing integrated pest management (IPM) strategies that combine chemical and biological control methods for more holistic and effective pest and disease management.

Leading Players in the Hungary Crop Protection Chemicals Market Sector

- Bayer AG

- UPL Ltd

- Belchim Crop Protection

- Oro Agri

- Bold agro

- Agrokemia

- Nufarm Ltd

Key Milestones in Hungary Crop Protection Chemicals Market Industry

- 2019: Introduction of stricter EU regulations on pesticide residue limits, impacting product formulations.

- 2020: Increased investment in R&D for biological crop protection solutions by major agrochemical players.

- 2021: Significant adoption of drone technology for precision pesticide application in Hungarian agriculture.

- 2022: Launch of new-generation systemic fungicides offering enhanced disease control for cereals.

- 2023: Growing trend towards consolidation within the Hungarian agrochemical distribution network.

- 2024: Increased focus on digital farming platforms for optimized crop protection management.

Strategic Outlook for Hungary Crop Protection Chemicals Market Market

The strategic outlook for the Hungary Crop Protection Chemicals Market is characterized by a strong emphasis on innovation, sustainability, and digital integration. Future growth will be propelled by the development and adoption of eco-friendly agrochemicals, including biopesticides and biodegradable formulations, catering to evolving regulatory landscapes and consumer preferences for sustainable food production. The integration of digital technologies, such as AI-powered diagnostics and precision spraying, will enable more efficient and targeted application of crop protection solutions, leading to reduced environmental impact and increased farm profitability. Strategic partnerships between agrochemical manufacturers, technology providers, and agricultural stakeholders will be crucial for accelerating market penetration and fostering innovation. Emphasis on integrated pest management (IPM) strategies, combining chemical and biological control, will become paramount in building long-term resilience against pests and diseases.

Hungary Crop Protection Chemicals Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Hungary Crop Protection Chemicals Market Segmentation By Geography

- 1. Hungary

Hungary Crop Protection Chemicals Market Regional Market Share

Geographic Coverage of Hungary Crop Protection Chemicals Market

Hungary Crop Protection Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Escalated Adaptation of Biopesticides

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Crop Protection Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPL Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Belchim Crop Protection

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oro Agri

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bold agro *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agrokemia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nufarm Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Hungary Crop Protection Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Hungary Crop Protection Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Hungary Crop Protection Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Crop Protection Chemicals Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Hungary Crop Protection Chemicals Market?

Key companies in the market include Bayer AG, UPL Ltd, Belchim Crop Protection, Oro Agri, Bold agro *List Not Exhaustive, Agrokemia, Nufarm Ltd.

3. What are the main segments of the Hungary Crop Protection Chemicals Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Escalated Adaptation of Biopesticides.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Crop Protection Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Crop Protection Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Crop Protection Chemicals Market?

To stay informed about further developments, trends, and reports in the Hungary Crop Protection Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence